A Global Air Conditioning and Engineering Services Company

A Global Air Conditioning and Engineering Services Company

Uploaded by

raj_mrecj6511Copyright:

Available Formats

A Global Air Conditioning and Engineering Services Company

A Global Air Conditioning and Engineering Services Company

Uploaded by

raj_mrecj6511Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

A Global Air Conditioning and Engineering Services Company

A Global Air Conditioning and Engineering Services Company

Uploaded by

raj_mrecj6511Copyright:

Available Formats

A global air conditioning and engineering services Company

Voltas Organization of businesses (around its 3 core competencies)

Segment A : Electro-mechanical Projects & Services Segment A : Electro-mechanical Projects & Services Domestic and international MEP solutions (including HVAC) in Domestic and international MEP solutions (including HVAC) in infrastructure, built and industrial environment. infrastructure, built and industrial environment. Water management and treatment Water management and treatment Segment B : Engineering Products & Services Segment B : Engineering Products & Services Mining and Construction Equipment, Materials Handling Mining and Construction Equipment, Materials Handling Machinery supply of equipment, maintenance service, Machinery supply of equipment, maintenance service, accessories. accessories. and Textile and Textile spares and spares and

Segment C : Unitary Cooling products for comfort and commercial use Segment C : Unitary Cooling products for comfort and commercial use Room air conditioners Room air conditioners Commercial refrigeration products Commercial refrigeration products

Voltas Key Subsidiaries/JVs

Segment A: Electro-mechanical Projects & Services

a company manufacturing ducts and allied products, based in Jebel Ali Free Trade Zone, UAE. (100%)

Weathermaker Ltd.

Rohini Industrial Electricals Ltd.

Mumbai, India (67.33%)

an electrical contracting company based in

Universal Voltas LLC

(49%)

an MEP contracting company based in Abu Dhabi, UAE

Universal Weathermaker Factory LLC a duct manufacturing company based in

Abu Dhabi, UAE (49%)

Segment C: Unitray Cooling Products for Comfort and Commercial Use

a company manufacturing Unitary airconditioners, both window and split units, with manufacturing facility based in Pant Nagar, India (100%)

Universal Comfort Products Ltd.

Voltas Key Achievements

Leading in India as a trusted air conditioning and engineering services company, with over 50 years of experience. Indias largest exporter of electro-mechanical projects having executed multi-million dollar projects in over 30 countries. No 2 brand in the Indian air conditioner market. No 1 brand in the Indian commercial refrigeration market Leading provider of textile machinery in India; with 65% MS in the spinning segment. Premier provider of mining & construction equipment in India One of the largest manufactures of forklifts in India

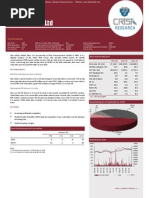

Voltas Limited FINANCIAL HIGHLIGHTS 2009-2010 (Consolidated

Rs. in Crores Sales & Services Operating Profit Profit/(Loss) After Tax Total Assets Net Worth Share Capital No.of Shareholders 4824 507 385 1134 1085 33 330884740 (US$ Mn) 1068 112 85 251 240 7 -

VOLTAS LIMITED FINANCIAL HIGHLIGHTS FY 02 - 10

6000

12000

Sales and Services - Rs.Crores (USD Mn)

5000

Number of Employees

10657

(107) 4830 (86)

4374 9627

10000

4000

7378

8000

(82)

3264 5747

3000

5390

5848

5096

5147 2598 4484

(60)

6000

(45) 2023

2000 4000

1342

1000

1438

1551

957

2000

0 2001-2002 2002-2003 2003-2004 2004-2005 2005-2006 2006-2007 2007-2008 2008-2009 2009-10

10

PAT % to Sales

7.53

5.63 5.04 5.30

3.37 1.30 2.19 2.80

3.64

0 2001-2002 2002-2003 2003-2004 2004-2005 2005-2006 2006-2007 2007-2008 2008-2009 2009-2010

75

PAT % to Shareholders' Funds

65 55

45

35

30.92 27.14 23.8

31.85 29.35

33.52

25

18.76 15.8 12.41

15

-5 2001-2002 2002-2003 2003-2004 2004-2005 2005-2006 2006-2007 2007-2008 2008-2009 2009-2010

0.9

Debt/Equity Ratio - %

0.63 0.64

0.8

0.7

0.6

0.5

0.5

0.5

0.4

0.37 0.28 0.24

0.3

0.2

0.13

0.1

0.03

0 2001-2002 2002-2003 2003-2004 2004-2005 2005-2006 2006-2007 2007-2008 2008-09 2009-2010

14 13 12 11 10 9 8 7 6 5 4 3 2

Earnings per Share

11.51

7.6 6.09 6.28

2.23 0.78 0.89 1.22 1.58

1 0 2001-2002 2002-2003 2003-2004 2004-2005 2005-2006 2006-2007 2007-2008 2008-09 2009-2010

220

200

Dividend % on Equity Capital

170

160 135

120

100

70

60 50 18 25 30

20

-30 2001-2002 2002-2003 2003-2004 2004-2005 2005-2006 2006-2007 2007-2008 2008-09 2009-2010

60

ROCE %

50

44.7 42.4

40

35.5 33.2

30

32.4

20

17.4 14.7 10.6 12.4

10

0 2001-2002 2002-2003 2003-2004 2004-2005 2005-2006 2006-2007 2007-2008 2008-2009 2009-2010

40.00

35.00

EVA %

30.00 24.50 24.54

30.00

* 25.00

19.00*

25.00

20.00

15.00

9.37

10.00

5.00

(0.33)

0.00

1.13

3.60

(5.00)

(10.00) 2001-2002 2002-2003 2003-2004 2004-2005 2005-2006 2006-2007 2007-2008 2008-2009 2009-2010

(*Consolidated Figures)

Profit before Tax and Exceptional Items Year 2005-06 - 2009-10

55000

50677

45000

34692

35000

33533 27767 15512 11788

R s. in L akh s

24864

25000

15000

11546 10297 7816 3280 2565

Jun 11546 10297 7816 3280 2565

19154 14744 6382 5477

Sep 24864 19154 14744 6382 5477 Cumulative Quarters

25146 20746 9553 8116

Dec 34692 25146 20746 9553 8116

5000

-5000

Mar 50677 33533 27767 15512 11788

2009-10 (Consol) 2008-09 2007-08 2006-07 2005-06

Note : Current year results are Consolidated. Previous period results are Stand-alone since there is no significant difference.

VOLTAS LIMITED FINANCIAL HIGHLIGHTS Results for year ended 31st March 2010

Highlights of Consolidated Results for year ended 31st March, 2010

Quarter PY CY

Increase in TO EBITDA Margin Increase in Profit before Exceptional Items Increase in PBT Increase in PAT Increase in Profit after Minority Interest and Share of Profit of Associate Taxation as percentage of PBT Positive EVA EPS (Re.) EPS before Exceptional items net of tax (Re.) Return on Net Worth (w/o Exceptional Items) Debt / Equity ratio 4% 10.7% 64% 82% 86% 87% 29% 21% 2.29 2.06 26% 0.04 NA 7.3% NA NA NA NA 30% 18% 1.23 1.23 22% 0.22

Cumulative PY CY

11% 11.4% 38% 31% 33% 32% 31% 21% 7.40 7.10 31% 0.04 NA 9.6% NA NA NA NA 32% 18% 5.59 5.08 28% 0.22

Electro-mechanical Projects & Services

ELECTRO-MECHANICAL PROJECTS & SERVICES

Performance Highlights

Contributes 61% to the Companys TO Segment Revenue grew by 13, Segment Results grew by 45% Domestic business contributes 22% of the Companys TO International business contributes 39% of the Companys TO. The consolidated order book stands at Rs 4700 Cr. ($1040mn) (As on March 2010) International business: Contributed significantly to the Companys profitability Won laurels for the Company's role in successfully completing: the Formula 1 Race Track, Abu Dhabi, a project of world-class quality, executed within demanding time-lines. Burj Kalifa, Dubai, the worlds tallest man-made structure. Won an order of Rs 800 Cr.($177mn): Central Market project, Abu Dhabi. The consolidated order book stands at Rs 3200 Cr.($709m)

ELECTRO-MECHANICAL PROJECTS & SERVICES

Performance Highlights

International business: Contd. Major current projects under execution Sidra Medical and Research Centre Barwa City Project (Doha, Qatar) Ferrari Experience (Abu Dhabi) Central Market Project T2 & T3 Towers (Abu Dhabi) Entered into a JV operation with Mustafa Sultan Group, Oman for execution of electro-mechanical projects in Oman. To shortly sign a JV agreement with a reputed company in SA, which will lead Voltas foray into SA market, which has the largest potential amongst the GCC countries.

ELECTRO-MECHANICAL PROJECTS & SERVICES Performance Highlights

International business: (contd.) Track record built on successful execution of iconic projects Hongkong International Airport Emirates Palace Hotel Mall of the Emirates Bahrain City Centre Sentosa Bay District Cooling Plant (Singapore) District Cooling Plant at the Dubai International Financial Centre Burj Khalifa (Dubai) Formula 1 Racing Track (Abu Dhabi) Etihad Towers (Abu Dhabi)

ELECTRO-MECHANICAL PROJECTS & SERVICES

Performance Highlights

Domestic business: Impacted by: The general economic uncertainty and slowdown Over-supply in commercial buildings sector, which resulted in reduced pace of implementation of projects To mitigate this impact the Company focused on: opportunities in the industrial sector, building up capabilities and technical pre-qualification. Completed the execution of the single largest VRF installation in India, with a capacity of 3000 TR, for TCS Kensington IT Park, at Powai Domestic order book has grown by 19% ($332m) as of 31st March 2010 and stands at Rs.1500 Cr

ELECTRO-MECHANICAL PROJECTS & SERVICES

Performance Highlights (contd)

Established the expanded scope of solutions offered as an EPC contractor in the domestic market, offering: HVAC, Integrated Building Management, Indoor Air Quality Electrical & Power management, Fire and Security Public Health Engineering including Water Treatment & Management Process refrigeration

ELECTRO-MECHANICAL PROJECTS & SERVICES Performance Megavol Years

2005-2006 Revenue Results Operating Margins ROCE 1175.12 68.28 5.8% 102% 2006-2007 1438.29 68.61 4.8% 43% 2007-2008 1744.86 116.99 6.7% NA 2008-2009 2766.79 213.42 7.7% 158% 2009-2010 3113.40 309.09 9.9% 148%

CAGR : Revenue: 27.6%; Results : 45.9%

ELECTRO-MECHANICAL PROJECTS & SERVICES

OUTLOOK INTERNATIONAL BUSINESS

Renewed investments and growth in major GCC countries from the 2nd half of last year. Abu Dhabi (with its large share of oil reserves), Qatar (with plentiful natural reserves) and Saudi Arabia (which has the largest economy within GCC) are territories of growth. Renewed investments in Oman, Singapore and HK The good consolidated order book yields visibility for the next 18 months

The Voltas Advantage Well-established track record of executing iconic & multi-million dollar projects A provider of choice in the Middle East for EPC electro-mechanical projects Known for quality and timely delivery of challenging/pioneering projects Proven Human Resources multi-cultural

ELECTRO-MECHANICAL PROJECTS & SERVICES

OUTLOOK DOMESTIC BUSINESS

Economic recovery to bring in renewed investments and growth in several

domestic markets Major opportunities lie in segments such as healthcare; urban infrastructure metro rail, airports and ports; Industry power, steel, and manufacturing sectors; education and research institutions New opportunities lie in the growing industrial focus on energy-efficiency, reduction of carbon footprint and on Green buildings in the commercial sector, as mandated by the Govt.

The Voltas Advantage One-stop-electro-mechanical shop one-window solution

Well-established track record of executing iconic projects A provider of choice for HVAC projects leader in HVAC High penetration in Indian industry A trusted Company that shares the Tata values Proven nation-wide sales and service network

ENGINEERING PRODUCTS & SERVICES

ENGINEERING PRODUCTS & SERVICES

Performance Highlights

Contributes 13% to the Company's TO. Has seen a pick-up in activity during the year in both Textile Machinery and Mining & Construction Equipment businesses.

The Materials Handling business was still under economic pressure Segment Revenues showed a 14% dip in TO. Segment Results improved by 40%, due to larger contribution from Agency businesses Agency business contributes to 25% of the segment Revenue compared to 20% last year.

Agency businesses are expected to grow faster than manufacturing-led businesses in the future.

ENGINEERING PRODUCTS & SERVICES Performance Megavol Years

2005-2006 Revenue Results Operating Margins ROCE 243.35 69.70 28.6% 249% 2006-2007 416.21 98.42 23.6% 121% 2007-2008 553.49 113.62 20.5% 144% 2008-2009 542.19 62.64 11.6% 49% 2009-2010 468.03 76.84 16.4% 80%

CAGR : Revenue: 17.8%; Results : 2.5.%

ENGINEERING PRODUCTS & SERVICES

Outlook

It is expected that investments in capital goods and engineering products will be sustained in the next few years as the Indian economy regains its growth path. Promoting investments in infrastructure projects such as airports, ports, and roads and manufacturing industries such as textiles Providing good opportunity and demand for mining and construction equipment, materials handling and textile machinery

Company has pending orders from large mining equipment from coal projects as well as ongoing parts and service contracts Demand for crushing and screening equipment and cranes is also expected to be strong for infrastructure and road projects

ENGINEERING PRODUCTS & SERVICES Outlook (contd.)

The market for materials handling equipment is beginning to revive with increased investment in manufacturing sectors, especially in two wheelers, automobiles, general engineering and power. - Leading to additional requirements in forklifts, cranes and warehousing equipment New projects are now being planned in the spinning sector yielding good demand for spinning machinery and services The post-spinning sector processing and finishing also has a number of projects on the anvil. Agency businesses is expected to grow faster than the manufacturing business, for the next few years, leading to improved profitability

UNITARY COOLING PRODUCTS

UNITARY COOLING PRODUCTS

Performance Highlights

Contributes 23% to the Company's TO Second best contributor to the Companys profitability Segment Revenues grew by 29%. Segment Results grew by 119% Cooling appliances sales grew by 30% in volume. Growth drivers were: Significant pick-up in the consumer durables sector AC industry grew by 25% per annum Change in consumer sentiments resumed spending Growth was fuelled by expansion of distribution channel improved supply chain management better product-mix aggressive advertising strategy

UNITARY COOLING PRODUCTS Performance Megavol Years

2005-2006 Revenue Results Operating Margins ROCE 459.58 (33.72) - ve - ve 2006-2007 595.73 2.58 0.4% 2% 2007-2008 825.94 55.31 6.7% 46% 2008-2009 922.28 55.03 6.0% 34% 2009-2010 1187.09 120.29 10.1% 85%

CAGR : Revenue: 26.8%; Results : 1014%

UNITARY COOLING PRODUCTS Outlook- room air conditioner business

Indian room air conditioner industry is expected to grow by 25-30% over the next few years driven by

-

air conditioners being a necessity due to rising middle-class aspirations and increasing impact of climate change low penetration levels growing disposable income affordability - initial and running costs health consciousness

Segments volume is expected to grow more than the market growth rate

UNITARY COOLING PRODUCTS Outlook - Commercial Refrigeration business

Indian Commercial Refrigeration industry is expected to grow by 35% over the next few years driven by - growing need for cold chain solutions in Indian - growing demand-gap in the user industries - retail, dairy, ice cream, and brewery - need for quality infrastructure

The Voltas Advantage Brand synonymous with air conditioners and refrigeration market in India

A trusted Tata Brand Brand hold an high ground on Value for Money proposition A flexible business model low on cost and high on return Growing dealer reach currently over a total of 3500 sales counters through distributors, dealers, retailers

Performance of Subsidiaries & JVs

For the year ended 31st March 2010

Revenue contribution to consolidated Revenue is Rs. 265crs ($58m)

Subsidiaries & JVs - OUTLOOK

Domestic: Total order book of 250 Cr.($55m) Universal Comfort Products Ltd. India Well placed to cater to growing demand for air conditioners and refrigeration

in India. AC and Commercial Refrigeration markets are expected to grow at 30% and 35%, respectively. Will also benefit from growing demand for locally manufactured ACs

Rohini Industrial Electricals, India Well placed (on its own and through Voltas) to cater to growing

needs/investments in Indian industry and infrastructure projects in electricals and instrumentation.

Subsidiaries & JVs OUTLOOK (contd)

International: Total order book of 200 Cr.($43mn) Weathermaker Ltd. UAE Pioneers in pre-fabricated duct manufacturing; well-placed to cater to demands in UAE Universal Voltas, Abu Dhabi Caters to the growing demand for pre-fabricated ducts and accessories in the Abu Dhabi market

Thank you.

Voltas Subsidiaries and Joint Ventures

Segment A : Electro-mechanical Projects & Services

Weathermaker Ltd., UAE, Rohini Industrial Electricals, India Saudi Ensas Co for Engg. Services KSA Naba Diganta Water Management Ltd., India Universal Weathermaker Factory, Abu Dhabi Universal Voltas, Abu Dhabi

Segment B :Engineering Products & Services

None

Segment C :Unitary Cooling products for comfort and commercial use

Universal Comfort Products Ltd.

Others

Lalbuksh Voltas Engg. Services and Trading, Oman

Unallocated

Investment Companies, viz., Simto, VIL Overseas Enterprises, Voice Antilles NV.

Sidra Medical and Research Centre, Doha, Qatar

Back

Barwa City Project, Doha, Qatar

Back

Ferrari Experience, Abu Dhabi

Back

Central Market Project T2 & T3 Towers, Abu Dhabi

Back

New Hong Kong International Airport

Back

Emirates Palace Hotel, Abu Dhabi

Back

Mall of the Emirates

Back

Bahrain City Centre

Back

Burj Khalifa, Dubai

Back

Formula 1 Racing Track, Abu Dhabi

Back

You might also like

- Order of Duties of Ophthalmic Assitants Under NPCB&VIDocument3 pagesOrder of Duties of Ophthalmic Assitants Under NPCB&VISathishNo ratings yet

- Company Presentation (Company Update)Document14 pagesCompany Presentation (Company Update)Shyam SunderNo ratings yet

- 1832 2011Document148 pages1832 2011William KaoNo ratings yet

- Cords Cable BaseDocument4 pagesCords Cable BaseSatishNo ratings yet

- TD Power Systems LTD: Company PresentationDocument32 pagesTD Power Systems LTD: Company Presentationzipotz3429No ratings yet

- SIEMENS Analysis of Financial StatementDocument16 pagesSIEMENS Analysis of Financial StatementNeelofar Saeed100% (1)

- Astra Microwave Products LTD: Exponential Growth On The Way!Document5 pagesAstra Microwave Products LTD: Exponential Growth On The Way!api-234474152No ratings yet

- Rakon Announcement 14 Feb 08Document6 pagesRakon Announcement 14 Feb 08Peter CorbanNo ratings yet

- Light EngineeringDocument50 pagesLight EngineeringAsif KhanNo ratings yet

- Fluidomat BSE CAREDocument5 pagesFluidomat BSE CAREayushidgr8No ratings yet

- Business CaseDocument11 pagesBusiness CasesomeshNo ratings yet

- Going For Growth: March 2006Document39 pagesGoing For Growth: March 2006Amish ChampanerkarNo ratings yet

- SPX Flow TechnologyDocument110 pagesSPX Flow TechnologySarah Perez100% (1)

- Strategic Review Plan Template - SampleDocument22 pagesStrategic Review Plan Template - SamplemhlgoswamyNo ratings yet

- KEC Result UpdatedDocument11 pagesKEC Result UpdatedAngel BrokingNo ratings yet

- TI India - PPT - Oct 12Document60 pagesTI India - PPT - Oct 12vishmittNo ratings yet

- KEC International: Key Management TakeawaysDocument8 pagesKEC International: Key Management TakeawaysAngel BrokingNo ratings yet

- FY 2013 Results: Philippe VANNIER, Chairman & CEO John Selman, CfoDocument22 pagesFY 2013 Results: Philippe VANNIER, Chairman & CEO John Selman, CfoNaokhaiz AfaquiNo ratings yet

- Automotive SystemsDocument30 pagesAutomotive SystemsTugui RazvanNo ratings yet

- Fie M Industries LimitedDocument4 pagesFie M Industries LimitedDavuluri OmprakashNo ratings yet

- Presentation - 4Q09 and 2009 ResultsDocument19 pagesPresentation - 4Q09 and 2009 ResultsLightRINo ratings yet

- Company Presentation September 2010 PDFDocument20 pagesCompany Presentation September 2010 PDFsonar_neelNo ratings yet

- Omax Annual ReprtDocument78 pagesOmax Annual ReprtSalini RajamohanNo ratings yet

- Voltage StabilizerDocument11 pagesVoltage StabilizerShreekant KashyapNo ratings yet

- Mind TreeDocument10 pagesMind TreeGaurav JainNo ratings yet

- ARKAN 13 06 x2011Document5 pagesARKAN 13 06 x2011Muhammad IlyasNo ratings yet

- For Global PA Project Team,: Energy Management Solution byDocument20 pagesFor Global PA Project Team,: Energy Management Solution byAndrew MaverickNo ratings yet

- Videocon Industries LTD: Key Financial IndicatorsDocument4 pagesVideocon Industries LTD: Key Financial IndicatorsryreddyNo ratings yet

- Pitch BookDocument80 pagesPitch Bookmmihai1100% (1)

- Eaton InvestorsDocument42 pagesEaton InvestorsZulfikar GadhiyaNo ratings yet

- Honeywell Automation 2009 ReportDocument4 pagesHoneywell Automation 2009 ReportmworahNo ratings yet

- Chasen Reverses Losses To Post FY2021 Profit Before Tax of S$4.6 Million Higher Revenue Driven by Specialist Relocation and Third Party LogisticsDocument4 pagesChasen Reverses Losses To Post FY2021 Profit Before Tax of S$4.6 Million Higher Revenue Driven by Specialist Relocation and Third Party LogisticsWeR1 Consultants Pte LtdNo ratings yet

- Idea Cellular LTD: Key Financial IndicatorsDocument4 pagesIdea Cellular LTD: Key Financial IndicatorsGanesh DeshiNo ratings yet

- Project Report On: Larsen & Toubro Limited (L&T)Document31 pagesProject Report On: Larsen & Toubro Limited (L&T)rohitghulepatilNo ratings yet

- Sun Microsystems Q107 Quarterly Results Release: Investor RelationsDocument39 pagesSun Microsystems Q107 Quarterly Results Release: Investor RelationsjohnachanNo ratings yet

- Bajaj Electrical Q1 FY2012Document4 pagesBajaj Electrical Q1 FY2012Tushar DasNo ratings yet

- Dialog2011 MainDocument73 pagesDialog2011 MainSopsky SalatNo ratings yet

- Exide Industries: Performance HighlightsDocument12 pagesExide Industries: Performance HighlightsAngel BrokingNo ratings yet

- Tirathai Public Company Limited: Opportunity Day On 23 May 2013Document26 pagesTirathai Public Company Limited: Opportunity Day On 23 May 2013Vishan SharmaNo ratings yet

- BluestarDocument11 pagesBluestaramol1928No ratings yet

- Reliance Communication: Performance HighlightsDocument10 pagesReliance Communication: Performance HighlightsAngel BrokingNo ratings yet

- Global StrategyDocument14 pagesGlobal StrategyclareNo ratings yet

- Japan Top RunnerDocument26 pagesJapan Top RunnerRidvan AydinliNo ratings yet

- Submitted BY: Jatin Arora Mohit Gupta Mukul GuptaDocument38 pagesSubmitted BY: Jatin Arora Mohit Gupta Mukul GuptaJatin AroraNo ratings yet

- Strategy Group9 Section F QualcommDocument14 pagesStrategy Group9 Section F QualcommNaveen DhayapuleNo ratings yet

- Electric Vehicle Industry RoadmapDocument88 pagesElectric Vehicle Industry RoadmapJenny Bascuna100% (4)

- Sub: Accounting and Financial Management IVRCL and Infrastructure PVT LTD Submitted To: Dr. D.R.Patel By: Shaikh Adnan Cp1812Document15 pagesSub: Accounting and Financial Management IVRCL and Infrastructure PVT LTD Submitted To: Dr. D.R.Patel By: Shaikh Adnan Cp1812Adnan ShaikhNo ratings yet

- Summer Training ReportDocument70 pagesSummer Training Reportbuliya10No ratings yet

- Rs.661 MN Rs. 281 MN Rs. 202 MN: Arrow Greentech LTD Reports Robust Results For Q1 FY25 With 95% Y-o-Y Growth in EBITDADocument2 pagesRs.661 MN Rs. 281 MN Rs. 202 MN: Arrow Greentech LTD Reports Robust Results For Q1 FY25 With 95% Y-o-Y Growth in EBITDAguy fawkesNo ratings yet

- Operating Profit Analysis: Tata Consultancy Services (TCS)Document43 pagesOperating Profit Analysis: Tata Consultancy Services (TCS)manju_chandelNo ratings yet

- Unido Full Report EbookDocument259 pagesUnido Full Report EbookDayat LaodengkoweNo ratings yet

- Challenges To Indian GrowthDocument40 pagesChallenges To Indian GrowthVarsha BhutraNo ratings yet

- ABB Integrated Report 2023Document112 pagesABB Integrated Report 2023nikhil.uk010No ratings yet

- BGF ChiSong RollsRoyceDocument69 pagesBGF ChiSong RollsRoyceMatt Taylor100% (1)

- Deviation&Decision Report Group Pink R3Document4 pagesDeviation&Decision Report Group Pink R3Sai KiranNo ratings yet

- Aes Corporation AES Sonel Business ReviewDocument20 pagesAes Corporation AES Sonel Business ReviewOkoye PeculiarNo ratings yet

- National Institute of Textile Engineering and Researc2Document15 pagesNational Institute of Textile Engineering and Researc2aemon05No ratings yet

- Engineering Service Revenues World Summary: Market Values & Financials by CountryFrom EverandEngineering Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Industrial Machinery World Summary: Market Values & Financials by CountryFrom EverandIndustrial Machinery World Summary: Market Values & Financials by CountryNo ratings yet

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Psalms and Prayers Becking All Chapter Instant DownloadDocument84 pagesPsalms and Prayers Becking All Chapter Instant Downloadbijevaraadom85100% (3)

- Tabel Besi SniDocument57 pagesTabel Besi SniHusein SyarifNo ratings yet

- QinetiQ Sustainable Procurement GuideDocument32 pagesQinetiQ Sustainable Procurement GuideanhthutangocNo ratings yet

- CORDOCENTESISDocument4 pagesCORDOCENTESISDaily DoseNo ratings yet

- Win8 GuideDocument20 pagesWin8 GuidePurush ThamanNo ratings yet

- Arduino Talking RepeaterV1.6 PDFDocument1 pageArduino Talking RepeaterV1.6 PDFRusselguide Electronics100% (1)

- Control of Hotel Real EstateDocument109 pagesControl of Hotel Real EstateASAD AhmadNo ratings yet

- Case Solutions For Case Studies in Finance Managing For Corporate Value Creation 6th Edition by BrunerDocument12 pagesCase Solutions For Case Studies in Finance Managing For Corporate Value Creation 6th Edition by Brunerbiwithse7en0% (1)

- Financing of International TradeDocument59 pagesFinancing of International TradeBinod Raj SubediNo ratings yet

- 112 Prone PositioningDocument6 pages112 Prone PositioningMade Septyana Parama AdiNo ratings yet

- Workers Wages and BenefitsDocument66 pagesWorkers Wages and BenefitsmichaelalangcasNo ratings yet

- EntrepBusiness Plan PartVVISAMPLEDocument2 pagesEntrepBusiness Plan PartVVISAMPLEleii xxuNo ratings yet

- Mvaj101 - Trip RelayDocument2 pagesMvaj101 - Trip Relayratheeshkumard100% (1)

- Bermuda Triangle RamayanaDocument11 pagesBermuda Triangle RamayanaT Sampath KumaranNo ratings yet

- Chapter 3 DsuDocument17 pagesChapter 3 Dsusasane sachinNo ratings yet

- Integrating Microsoft Active Directory and Oracle Internet Directory With Database Logins: Enterprise User SecurityDocument37 pagesIntegrating Microsoft Active Directory and Oracle Internet Directory With Database Logins: Enterprise User SecurityDiego Cruz CastañedaNo ratings yet

- HTML Cheat SheetDocument3 pagesHTML Cheat SheetmeraTechStuffNo ratings yet

- 01 - PSM Intro - Students - A4Document34 pages01 - PSM Intro - Students - A4Hachem NbiliNo ratings yet

- 1N2N EngineSDL P2Document4 pages1N2N EngineSDL P2Enrique ChalcoNo ratings yet

- Schumann Op15 No1 PsuDocument1 pageSchumann Op15 No1 PsuCedric TutosNo ratings yet

- Optical Power Debugging in The DWDM SystemDocument31 pagesOptical Power Debugging in The DWDM SystemWubie NegaNo ratings yet

- Renault Megane2 PDFDocument14 pagesRenault Megane2 PDFMelinte Lucian GeorgeNo ratings yet

- Guide D'Installation - HP LaserJet 1018Document2 pagesGuide D'Installation - HP LaserJet 1018Koko Yves BeugreNo ratings yet

- Wiley Journal APCs Open AccessDocument44 pagesWiley Journal APCs Open Accesstoyibatul hidayatiNo ratings yet

- Bi-Radial® Studio Monitor: High-Frequency Horn and DriverDocument4 pagesBi-Radial® Studio Monitor: High-Frequency Horn and DriverMarc GavageNo ratings yet

- Final Exam Flashcards - Easy NotecardsDocument41 pagesFinal Exam Flashcards - Easy NotecardsTalo MjNo ratings yet

- Punch-Through Analysis of Jack-Up Rig at A Site Off The East Coast of India - A Case StudyDocument4 pagesPunch-Through Analysis of Jack-Up Rig at A Site Off The East Coast of India - A Case StudyAtul KumarNo ratings yet

- Maritime Graduate Student Facing Difficulty Getting Employed in Maritime Companies (Chapter 1)Document13 pagesMaritime Graduate Student Facing Difficulty Getting Employed in Maritime Companies (Chapter 1)Xzie HighlightsNo ratings yet

- Garcia V Executive SecretaryDocument4 pagesGarcia V Executive SecretaryJMVNo ratings yet