Financial Mathematics and Derivatives Chapter 6: Loans

Financial Mathematics and Derivatives Chapter 6: Loans

Uploaded by

Felicia PriskillaCopyright:

Available Formats

Financial Mathematics and Derivatives Chapter 6: Loans

Financial Mathematics and Derivatives Chapter 6: Loans

Uploaded by

Felicia PriskillaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Financial Mathematics and Derivatives Chapter 6: Loans

Financial Mathematics and Derivatives Chapter 6: Loans

Uploaded by

Felicia PriskillaCopyright:

Available Formats

SIQ2003

Financial Mathematics and Derivatives

Chapter 6: Loans

Lecturer: Nadiah Zabri

Institute of Mathematical Sciences

Faculty of Science

University Malaya

Outline

Amortizing a loan

1 Loan

Varying series of payments

Equal Principle repayments

Final Payments (Baloon and drop payments)

Sinking fund Method of loan repayment

Loan refinancing

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 2

• Loans can be paid by any payment schedule. It will still follow the

basic relationships for loan amortization

𝐼! = 𝑖𝐵!"# 𝑃! = 𝑅! − 𝐼! 𝐵4 = 𝐵456 − 𝑃4

𝐵"

𝐼! = 5%709.19 𝑃! = 200 − 35.46 = 709.19 − 164.54

= 35.46 = 164.54

=544.65

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 6

Another useful relationship:

Especially useful when 𝐵! is harder to compute and when you are given

the 𝑃! 𝑎𝑛𝑑 𝑅! info directly

• You can derive this by doing 𝑃! − 𝑃!"# :

𝑃! − 𝑃!"# = (𝑅! − 𝐵!"# 𝑖) − (𝑅!"# − 𝐵!"$ 𝑖)

= 𝑅! − 𝑅!"# + (𝐵!"$ − 𝐵!"# )i

= 𝑅! − 𝑅!"# + (𝑃!"# )i

𝑃! = (𝑅! − 𝑅!"# ) + 𝑃!"# (1 + 𝑖)

• So for the first repayment of RM200, the following is the

breakdown:

35.46 200

164.54

interest

principal Payment

payment,

repaid, 𝑃! in t=1, 𝑅!

𝐼!

• Over time, the proportion of interest and principle within the

RM200 level payment changes:

-Interest due, 𝐼! reduces

-Principle paid off, 𝑃! increases

Loan Amortizing a Loan

Outstanding balance

§ After some payment(s), there is 2 ways to compute outstanding

balance (OS) or principal at time t, 𝐵# , (after payment at time t is

made)

Ways of evaluating

Outstanding

balance

Retrospective Prospective

method method

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 10

1. Retrospective method. Looking backward considering all payments made

Loan=709.19

t=0 t=1 t=2 t=3 t=4

200 200 200 200

OS balance(t)

=Original principle− 𝐴𝑙𝑙 𝑝𝑟𝑖𝑛𝑐𝑖𝑝𝑙𝑒 𝑝𝑎𝑖𝑑 𝑢𝑝 𝑡𝑜 𝑡𝑖𝑚𝑒 𝑡

= 𝐴𝑉 𝑎𝑡 𝑡𝑖𝑚𝑒 𝑡 𝑜𝑓 𝑙𝑜𝑎𝑛 − 𝐴𝑉 𝑎𝑡 𝑡𝑖𝑚𝑒 𝑡 𝑜𝑓 𝑎𝑙𝑙 𝑝𝑎𝑦𝑚𝑒𝑛𝑡𝑠 𝑟𝑒𝑐𝑒𝑖𝑣𝑒𝑑 𝑏𝑒𝑓𝑜𝑟𝑒 𝑎𝑛𝑑 𝑎𝑡 𝑡.

OS balance(t=1)=709.19 − (200 − 709.19 ∗ 0.05) = 709.19 1.05 − 200 = 544.65,

If the periods involve varying interest rate, need to allow for the varying interest.

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 11

Loan Amortizing a Loan

2. Prospective method. Looking forward considering PV at time t of all

remaining payments

Loan=709.19

t=0 t=1 t=2 t=3 t=4

200 200 200 200

OS balance(t=1) = 200𝑎# ⃧ =544.65

If the period involve varying interest rate, need to allow as such

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 12

• Lets make sense of the convenient formula used for 𝐼# and 𝑃# when

loan payments are level:

• 𝐼# = 𝑖𝐵#%"

• If the retrospective method is used to compute 𝐵"$! :

!$' () *)+

𝐵"$! = 200𝑎#$("$!) ⃧ = 𝑅"

(

*n-(t-1) is the number of payments remaining at the beginning of the payment

period

!$' () *)+

So 𝐼" = 𝑖𝐵"$! = 𝑖 ∗ 𝑅" = 𝑅" 1 − 𝑣 #$ "$! .

(

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 13

• So here is an example. A loan is paid with 5 level payment of 1000,

interest rate is 5%.

t 𝐼! 𝑷!

1 1000 1 − 𝑣 " . 1000 𝑣 !

2 1000 1 − 𝑣 # . 1000 𝑣 "

3 1000 1 − 𝑣 $ . 1000 𝑣 #

4 1000 1 − 𝑣 % . 1000 𝑣 $

5 1000 1 − 𝑣 & . 1000 𝑣 %

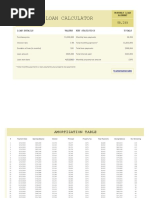

Loan Amortization schedule

1) Interest Content of

Payment at time t = OS

balance at time t-1*i

2) Capital repaid= payment

(1)- interest content of

payment

3) OS balance at time t

Garrett, S. J. (2013)

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 15

Loan for a mthly annuity

§ Loans can also be paid in mthly installments. It is very common

that loans is paid monthly like home /car loan etc.

§ The loan schedule is best derived using mthly effective interest

) (")

rate, j = * .

§ The schedule wont differ from annual schedule but now the time

unit is a portion of the year.

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 16

Varying series of Payments

§ Sometimes payment is less than interest due resulting in negative

amortization which will “capitalizes the interest shortfall”

§ A 3-year loan for $10,000 at 10% annual interest but the payments

are 600, 5000 and 7084. Build the amortization schedule:

Time, t Payment, 𝑹𝒕 Interest Paid, 𝑰𝒕 Principal repaid, 𝑷𝒕 Outstanding

Balance, 𝑩𝒕

0 10,000

1 600 1000 -400 10400

2 5,000 1040 3960 6440

3 7,084 644 6440 0

Total 12,684 2,684 10,000

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 18

Exercise

§ A loan is being repaid by a series of annual non-level payments at

10% effective. The t-th payment is $2,000 and the principal paid

from this payment is $1,000. The next payment is $3,000. How

much principal is contained in this payment?

𝐼# = 𝑅# − 𝑃# =2000-1000=1000

𝐵#%" 10% = 1000

𝐵#%" = 10,000

𝐵# = 𝐵#%" − 𝑃# = 10,000 − 1000 = 9000

Next Payment is

𝑅#+" = 𝐼#+" + 𝑃#+" =3000= 𝐵# ×10%+ 𝑃#+" =900+ 𝑃#+"

𝑃#+" = 3000 − 900 = 2100

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 19

Equal principal repayments (special case of

Varying payments)

When principle payments is level, how will the monthly payments

be?

Increasing Or Decreasing

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 20

Exercise

A loan of $10,000 is being repaid over 10 years by equal principal

payments plus interest on unpaid balance at an effective rate of i. If

the total interest paid in the 3rd to 8th years, inclusive is 2541,

determine i.

8000i+7000i+….3000i=2541

Arithmetic progression formula:

n(,$+ ,%) 6(.///)+ 0///))

= =33,000i=2541

- -

i=7.7%

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 21

Final Payment ( Baloon or drop payments)

§ For a level payment, usually the Payment is not a nice round number.

§ Common way is to choose a good round number as payment and then

adjust the final payment accordingly to settle the last OS balance.

1. A final payment larger than the

regular amount. This is called a balloon

payment.

2. A final payment smaller than the

regular amount. This is called a drop

payment.

§ To calculate the last payment, first need to: determine OS balance after

the last regular payment, then allow of interest earned between 2nd last

and last payment

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 22

Example

§ A loan of $10,000 is to be repaid at 5% effective by payments of

$1,000 at the end of each year until the loan is repaid.

n is supposed to be 14.2

Option 1: A final payment with larger than regular, at time 14

(balloon payment)

𝐵"! = 𝐴𝑉 𝑙𝑜𝑎𝑛 𝑎𝑡 𝑡𝑖𝑚𝑒 14 − 𝐴𝑉 𝑎𝑙𝑙 𝑝𝑎𝑦𝑚𝑒𝑛𝑡𝑠 𝑚𝑎𝑑𝑒 𝑎𝑡 𝑡𝑖𝑚𝑒 14

= 10,000*(1.05)"! − 1000 𝑠"! ⃧ =200.68

So payment at time 14 is 1000+200.68=1200.68

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 23

§ Option 2, A final payment smaller than regular at time 15.(drop

payment)

If the drop payment is paid following normal payment interval, then the

last payment will be:

AV of loan balance after last regular payment, to last payment time=

𝐵#, a(14,15)=200.68*(1.05)

As usual, last payment will include=

1) Interest= 𝐵!"# *i=200.68*0.05

2) Principle=200.68

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 24

You might also like

- Introduction To Corporate Finance 4th Edition Booth Test Bank Download100% (21)Introduction To Corporate Finance 4th Edition Booth Test Bank Download36 pages

- Lecture 8 Determinants of Interest RatesNo ratings yetLecture 8 Determinants of Interest Rates35 pages

- Lecture 9 Compounding Frequencies Amortization 14112024 015755pmNo ratings yetLecture 9 Compounding Frequencies Amortization 14112024 015755pm30 pages

- The Time Value of Money Lecture 3 and 4: Corporate Finance Ronald F. Singer Fall, 2010No ratings yetThe Time Value of Money Lecture 3 and 4: Corporate Finance Ronald F. Singer Fall, 201031 pages

- Chapter 6 - Amortization and Sinking FundsNo ratings yetChapter 6 - Amortization and Sinking Funds10 pages

- LM02 Fixed-Income Cash Flows and Types IFT NotesNo ratings yetLM02 Fixed-Income Cash Flows and Types IFT Notes13 pages

- Chapter 3 - Cash Flow, Interest and Equivalence100% (1)Chapter 3 - Cash Flow, Interest and Equivalence9 pages

- TAIFEX Interest Rate Derivatives Valuation in Modern World 20201204No ratings yetTAIFEX Interest Rate Derivatives Valuation in Modern World 2020120461 pages

- Financial Analyst - Real Estate Test & Case Study (2) (1) (1)-2No ratings yetFinancial Analyst - Real Estate Test & Case Study (2) (1) (1)-224 pages

- Topic 5. Time Value of Money (TVM) and its ApplicationsNo ratings yetTopic 5. Time Value of Money (TVM) and its Applications3 pages

- Quantitative Techniques For Management: Aditya K BiswasNo ratings yetQuantitative Techniques For Management: Aditya K Biswas31 pages

- Capital Investment Decisions - 2nd Dec 2023 (Session 01)No ratings yetCapital Investment Decisions - 2nd Dec 2023 (Session 01)3 pages

- Banking, Inflation and Exchange Rates Notes and QuestionsNo ratings yetBanking, Inflation and Exchange Rates Notes and Questions22 pages

- Key Concepts and Skills: Discounted Cash Flow ValuationNo ratings yetKey Concepts and Skills: Discounted Cash Flow Valuation4 pages

- BCO126 Mathematics of Finance: 3 Ects Spring Semester 2022No ratings yetBCO126 Mathematics of Finance: 3 Ects Spring Semester 202238 pages

- How Much Car Can I Afford Calculator_Gabrielle Talks MoneyNo ratings yetHow Much Car Can I Afford Calculator_Gabrielle Talks Money10 pages

- Home Loan EMI Calculator Amortization ScheduleNo ratings yetHome Loan EMI Calculator Amortization Schedule6 pages

- FAR.3418-Loans and Receivables – Long TermNo ratings yetFAR.3418-Loans and Receivables – Long Term4 pages

- 15 Development Bank of The Phils. v. Court of AppealsNo ratings yet15 Development Bank of The Phils. v. Court of Appeals16 pages

- SLF065 MultiPurposeLoanApplicationForm V06No ratings yetSLF065 MultiPurposeLoanApplicationForm V062 pages

- Chapter 3 Source of Capital - Handout - 404263880No ratings yetChapter 3 Source of Capital - Handout - 40426388022 pages

- Introduction To Corporate Finance 4th Edition Booth Test Bank DownloadIntroduction To Corporate Finance 4th Edition Booth Test Bank Download

- Lecture 9 Compounding Frequencies Amortization 14112024 015755pmLecture 9 Compounding Frequencies Amortization 14112024 015755pm

- The Time Value of Money Lecture 3 and 4: Corporate Finance Ronald F. Singer Fall, 2010The Time Value of Money Lecture 3 and 4: Corporate Finance Ronald F. Singer Fall, 2010

- TAIFEX Interest Rate Derivatives Valuation in Modern World 20201204TAIFEX Interest Rate Derivatives Valuation in Modern World 20201204

- Financial Analyst - Real Estate Test & Case Study (2) (1) (1)-2Financial Analyst - Real Estate Test & Case Study (2) (1) (1)-2

- Topic 5. Time Value of Money (TVM) and its ApplicationsTopic 5. Time Value of Money (TVM) and its Applications

- Quantitative Techniques For Management: Aditya K BiswasQuantitative Techniques For Management: Aditya K Biswas

- Capital Investment Decisions - 2nd Dec 2023 (Session 01)Capital Investment Decisions - 2nd Dec 2023 (Session 01)

- Banking, Inflation and Exchange Rates Notes and QuestionsBanking, Inflation and Exchange Rates Notes and Questions

- Key Concepts and Skills: Discounted Cash Flow ValuationKey Concepts and Skills: Discounted Cash Flow Valuation

- BCO126 Mathematics of Finance: 3 Ects Spring Semester 2022BCO126 Mathematics of Finance: 3 Ects Spring Semester 2022

- How Much Car Can I Afford Calculator_Gabrielle Talks MoneyHow Much Car Can I Afford Calculator_Gabrielle Talks Money

- 15 Development Bank of The Phils. v. Court of Appeals15 Development Bank of The Phils. v. Court of Appeals