0 ratings0% found this document useful (0 votes)

34 viewsStarbucks 2020 Financial Info-1

Starbucks 2020 Financial Info-1

Uploaded by

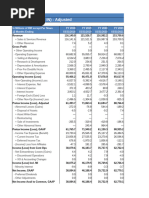

thehanimal74This document provides selected financial data for Starbucks from fiscal years 2016 to 2020. It shows that total net revenues declined from $26.5 billion in fiscal 2019 to $23.5 billion in fiscal 2020 as company-operated store revenues fell from $21.5 billion to $19.2 billion over that period. Net earnings attributable to Starbucks declined from $3.6 billion in fiscal 2019 to $928 million in fiscal 2020, while diluted earnings per share fell from $2.92 to $0.79 over the same period. Total assets increased from $19.2 billion in fiscal 2019 to $29.4 billion in fiscal 2020, while long-term debt rose from $11.2 billion to $15.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Starbucks 2020 Financial Info-1

Starbucks 2020 Financial Info-1

Uploaded by

thehanimal740 ratings0% found this document useful (0 votes)

34 views1 pageThis document provides selected financial data for Starbucks from fiscal years 2016 to 2020. It shows that total net revenues declined from $26.5 billion in fiscal 2019 to $23.5 billion in fiscal 2020 as company-operated store revenues fell from $21.5 billion to $19.2 billion over that period. Net earnings attributable to Starbucks declined from $3.6 billion in fiscal 2019 to $928 million in fiscal 2020, while diluted earnings per share fell from $2.92 to $0.79 over the same period. Total assets increased from $19.2 billion in fiscal 2019 to $29.4 billion in fiscal 2020, while long-term debt rose from $11.2 billion to $15.

Original Description:

Starbucks 2021 Annual Report

Original Title

Starbucks_2020_Financial_Info-1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

This document provides selected financial data for Starbucks from fiscal years 2016 to 2020. It shows that total net revenues declined from $26.5 billion in fiscal 2019 to $23.5 billion in fiscal 2020 as company-operated store revenues fell from $21.5 billion to $19.2 billion over that period. Net earnings attributable to Starbucks declined from $3.6 billion in fiscal 2019 to $928 million in fiscal 2020, while diluted earnings per share fell from $2.92 to $0.79 over the same period. Total assets increased from $19.2 billion in fiscal 2019 to $29.4 billion in fiscal 2020, while long-term debt rose from $11.2 billion to $15.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

34 views1 pageStarbucks 2020 Financial Info-1

Starbucks 2020 Financial Info-1

Uploaded by

thehanimal74This document provides selected financial data for Starbucks from fiscal years 2016 to 2020. It shows that total net revenues declined from $26.5 billion in fiscal 2019 to $23.5 billion in fiscal 2020 as company-operated store revenues fell from $21.5 billion to $19.2 billion over that period. Net earnings attributable to Starbucks declined from $3.6 billion in fiscal 2019 to $928 million in fiscal 2020, while diluted earnings per share fell from $2.92 to $0.79 over the same period. Total assets increased from $19.2 billion in fiscal 2019 to $29.4 billion in fiscal 2020, while long-term debt rose from $11.2 billion to $15.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Item 6.

Selected Financial Data

The following selected financial data is derived from the consolidated financial statements. The data below should be read in conjunction with “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” “Risk Factors,” and the consolidated financial statements and notes.

Financial Information (in millions, except per share data):

Sept 27, Sept 29, Sept 30, Oct 1, Oct 2,

2020 2019 2018 2017 2016

As of and for the Fiscal Year Ended(1) (52 Wks) (52 Wks) (52 Wks) (52 Wks) (53 Wks)

Results of Operations

Net revenues:

Company-operated stores $ 19,164.6 $ 21,544.4 $ 19,690.3 $ 17,650.7 $ 16,844.1

Licensed stores 2,327.1 2,875.0 2,652.2 2,355.0 2,154.2

Other 2,026.3 2,089.2 2,377.0 2,381.1 2,317.6

Total net revenues $ 23,518.0 $ 26,508.6 $ 24,719.5 $ 22,386.8 $ 21,315.9

Operating income $ 1,561.7 $ 4,077.9 $ 3,883.3 $ 4,134.7 $ 4,171.9

Net earnings including noncontrolling interests(2) 924.7 3,594.6 4,518.0 2,884.9 2,818.9

Net earnings/(loss) attributable to noncontrolling interests (3.6) (4.6) (0.3) 0.2 1.2

Net earnings attributable to Starbucks(2) 928.3 3,599.2 4,518.3 2,884.7 2,817.7

EPS — diluted(2) 0.79 2.92 3.24 1.97 1.90

Cash dividends declared per share(3) 1.23 1.49 1.32 1.05 0.85

Net cash provided by operating activities(4) 1,597.8 5,047.0 11,937.8 4,251.8 4,697.9

Capital expenditures (additions to property, plant and equipment) 1,483.6 1,806.6 1,976.4 1,519.4 1,440.3

Balance Sheet

Total assets $ 29,374.5 $ 19,219.6 $ 24,156.4 $ 14,365.6 $ 14,312.5

Long-term debt (including current portion) 15,909.5 11,167.0 9,440.1 3,932.6 3,585.2

Shareholders’ equity/(deficit) (7,805.1) (6,232.2) 1,169.5 5,450.1 5,884.0

(1) Our fiscal year ends on the Sunday closest to September 30. The fiscal year ending on October 2, 2016 included 53 weeks, with the 53rd week falling in our

fourth fiscal quarter.

(2) Fiscal 2018 results include a gain not subject to income tax of $1.4 billion resulting from the acquisition of our East China joint venture. The impact of the

gain to our diluted EPS was $0.99.

(3) Subsequent to our year-end, on September 30, 2020, we declared a cash dividend of $0.45 per share payable on November 27, 2020 to shareholders of record

on November 12, 2020.

(4) Net cash provided by operating activities for fiscal 2016 and fiscal 2017 has been adjusted for the adoption of new accounting guidance related to excess tax

benefits as discussed in Note 1, Summary of Significant Accounting Policies.

Starbucks Corporation 2020 Form 10-K 22

You might also like

- Case 29 Gainesboro Machine Tools CorporationDocument33 pagesCase 29 Gainesboro Machine Tools CorporationUshna100% (1)

- Trend Analysis, Horizontal Analysis, Vertical Analysis, Balance Sheet, Income Statement, Ratio AnalysisDocument4 pagesTrend Analysis, Horizontal Analysis, Vertical Analysis, Balance Sheet, Income Statement, Ratio Analysisnaimenim100% (1)

- Tutorial 2 QuestionsDocument4 pagesTutorial 2 Questionsguan junyanNo ratings yet

- Compensation LetterDocument2 pagesCompensation LetterJohn SmithNo ratings yet

- Registering A Company in Kenya and Summary of The New ACTDocument22 pagesRegistering A Company in Kenya and Summary of The New ACTmercy kNo ratings yet

- Lecture Note: Chapter 1 Introduction To Corporate FinanceDocument10 pagesLecture Note: Chapter 1 Introduction To Corporate FinanceKamrul HasanNo ratings yet

- 2018-Annual-Report Selected PagesDocument11 pages2018-Annual-Report Selected PagesLuis David BriceñoNo ratings yet

- Starbucks Fiscal 2021 Annual ReportDocument1 pageStarbucks Fiscal 2021 Annual ReportLeslie GuillermoNo ratings yet

- NMDCDocument50 pagesNMDChrithikjindal01No ratings yet

- FY2023 SGX Format-FINALDocument35 pagesFY2023 SGX Format-FINALjonathan.zy95No ratings yet

- 2003 Financial StatementsDocument5 pages2003 Financial StatementsdjkapulkaNo ratings yet

- Intellipharmaceutics International Inc. q2 2021Document31 pagesIntellipharmaceutics International Inc. q2 2021Sandesh PatilNo ratings yet

- FSMDocument8 pagesFSMapi-482793475No ratings yet

- Financial Statement Fy 23 q 2Document34 pagesFinancial Statement Fy 23 q 2Singhal YashNo ratings yet

- Prospective Analysis 1Document5 pagesProspective Analysis 1MAYANK JAINNo ratings yet

- File 2 - Sbux Template With Historic ValuesDocument3 pagesFile 2 - Sbux Template With Historic ValuesChandrasekhar ThakurNo ratings yet

- Financials For Netflix and DisneyDocument9 pagesFinancials For Netflix and Disney7spamkevin3No ratings yet

- Unlock Assignment 05Document4 pagesUnlock Assignment 05mmakgabomnisi6No ratings yet

- MOIL LTDDocument48 pagesMOIL LTDhrithikjindal01No ratings yet

- Fin 4424 Sample ProjectDocument15 pagesFin 4424 Sample ProjectEduardo VillarrealNo ratings yet

- Current Assets: (See Accompanying Notes To Financial Statements)Document7 pagesCurrent Assets: (See Accompanying Notes To Financial Statements)Alicia NhsNo ratings yet

- Q4 20 - DhunseriDocument8 pagesQ4 20 - Dhunserica.anup.kNo ratings yet

- HomeDepot F22 SolutionDocument4 pagesHomeDepot F22 SolutionFalguni ShomeNo ratings yet

- Orth Annabis ORP: Condensed Interim Consolidated Financial Statements (Unaudited) As at March 31, 2020Document25 pagesOrth Annabis ORP: Condensed Interim Consolidated Financial Statements (Unaudited) As at March 31, 2020stonerhinoNo ratings yet

- Aspin Kemp - Associates Holding Corp. Consolidated FS 2017 PDFDocument25 pagesAspin Kemp - Associates Holding Corp. Consolidated FS 2017 PDFAnonymous nVXCkl0ANo ratings yet

- Coca-Cola 10-K Item 06Document1 pageCoca-Cola 10-K Item 06junerubinNo ratings yet

- TFR 2023 eDocument69 pagesTFR 2023 eAntwanNo ratings yet

- Microsoft Financial Data - FY19Q1Document26 pagesMicrosoft Financial Data - FY19Q1trisanka banikNo ratings yet

- Coal IndiaDocument52 pagesCoal Indiahrithikjindal01No ratings yet

- IS Deepak NitriteDocument4 pagesIS Deepak NitriteAditya KatareNo ratings yet

- HBL FSAnnouncement 3Q2016Document9 pagesHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNo ratings yet

- Ratio Analysis of Lanka Ashok Leyland PLCDocument6 pagesRatio Analysis of Lanka Ashok Leyland PLCThe MutantzNo ratings yet

- Condensed Consolidated Statements of Income: Weighted-Average Shares Outstanding (In Millions) 4,215 4,208 4,215 4,207Document10 pagesCondensed Consolidated Statements of Income: Weighted-Average Shares Outstanding (In Millions) 4,215 4,208 4,215 4,207patrickmen_86No ratings yet

- Announcement of Results For The Year Ended 31 DECEMBER 2010: (Incorporated in Bermuda With Limited Liability)Document25 pagesAnnouncement of Results For The Year Ended 31 DECEMBER 2010: (Incorporated in Bermuda With Limited Liability)shiyeegohNo ratings yet

- Nyse FFG 2005Document140 pagesNyse FFG 2005Bijoy AhmedNo ratings yet

- Pidilite Industries Limited BSE 500331 Financials Income StatementDocument4 pagesPidilite Industries Limited BSE 500331 Financials Income StatementRehan TyagiNo ratings yet

- GAR02 28 02 2024 FY2023 Results ReleaseDocument29 pagesGAR02 28 02 2024 FY2023 Results Releasedesifatimah87No ratings yet

- DuPont_case studyDocument4 pagesDuPont_case studyЛера ШульгинаNo ratings yet

- Prospective Analysis - FinalDocument7 pagesProspective Analysis - Finalsanjana jainNo ratings yet

- Q32023VZDocument17 pagesQ32023VZLuis DavidNo ratings yet

- MnA Financial Statement Analysis Group 4Document37 pagesMnA Financial Statement Analysis Group 4bennettuniversity.studentNo ratings yet

- Schedule 5.1 Projected Balance SheetDocument56 pagesSchedule 5.1 Projected Balance SheetMae CantalejoNo ratings yet

- Rezultate Financiare AppleDocument3 pagesRezultate Financiare AppleClaudiuNo ratings yet

- Costco Wholesale Corporation Reports Fourth Quarter and Fiscal Year 2021 Operating ResultsDocument3 pagesCostco Wholesale Corporation Reports Fourth Quarter and Fiscal Year 2021 Operating ResultsIfaz Mohammed Islam 1921237030No ratings yet

- MOD Technical Proposal 1.0Document23 pagesMOD Technical Proposal 1.0Scott TigerNo ratings yet

- Q4FY19 Press TableDocument9 pagesQ4FY19 Press TableSumit SharmaNo ratings yet

- Q1 20 - DhunseriDocument4 pagesQ1 20 - Dhunserica.anup.kNo ratings yet

- Sbux Model f1q2023 Review - After MeetingDocument25 pagesSbux Model f1q2023 Review - After MeetingChandrasekhar ThakurNo ratings yet

- CLISA - Consolidated - Financial Statements - Mar - 31-2022Document48 pagesCLISA - Consolidated - Financial Statements - Mar - 31-2022Evandro Maciel França MadeiraNo ratings yet

- Rainbow Paint LTD - Financial StatementsDocument25 pagesRainbow Paint LTD - Financial StatementsSamaksh VermaNo ratings yet

- Marel q3 2019 Condensed Consolidated Interim Financial Statements ExcelDocument5 pagesMarel q3 2019 Condensed Consolidated Interim Financial Statements ExcelAndre Laine AndreNo ratings yet

- Nasdaq Aaon 2018Document92 pagesNasdaq Aaon 2018gaja babaNo ratings yet

- 08 Sto.tomasLU2022 Part1 FSDocument8 pages08 Sto.tomasLU2022 Part1 FSJulie Ann GagucasNo ratings yet

- NALCODocument50 pagesNALCOhrithikjindal01No ratings yet

- Case 11-2 Alfi Dan Yessy AKT 18-MDocument4 pagesCase 11-2 Alfi Dan Yessy AKT 18-MAna KristianaNo ratings yet

- Att Ar 2012 ManagementDocument35 pagesAtt Ar 2012 ManagementDevandro MahendraNo ratings yet

- NISM-Series-XV-ResearchAnalyst-Workbook (Dragged) 6Document1 pageNISM-Series-XV-ResearchAnalyst-Workbook (Dragged) 6Shivam MiglaniNo ratings yet

- Condensed Consolidated Statements of Income: Weighted-Average Shares Outstanding (In Millions) 4,201 4,141 4,201 4,141Document10 pagesCondensed Consolidated Statements of Income: Weighted-Average Shares Outstanding (In Millions) 4,201 4,141 4,201 4,141Annemiek BlezerNo ratings yet

- Midterm_1_Financial_StatementsDocument6 pagesMidterm_1_Financial_StatementspussycatNo ratings yet

- NIKE Inc Ten Year Financial History FY19Document1 pageNIKE Inc Ten Year Financial History FY19Moisés Ríos RamosNo ratings yet

- Advanced Info Service PCL (ADVANC TB) - AdjustedDocument12 pagesAdvanced Info Service PCL (ADVANC TB) - AdjustedYounG TerKNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Genting Plantations BerhadDocument11 pagesGenting Plantations Berhadboyuan XDNo ratings yet

- MBS CF ProjectDocument4 pagesMBS CF ProjectShadow MoonNo ratings yet

- ACM C A08 Construction Equipment Management Assignment 2: Submission Deadline: 2 September, 10amDocument2 pagesACM C A08 Construction Equipment Management Assignment 2: Submission Deadline: 2 September, 10amRushikesh ChevaleNo ratings yet

- Submission NI Act and Artha Rin 13.03.2018Document21 pagesSubmission NI Act and Artha Rin 13.03.2018Shah Fakhrul Islam AlokNo ratings yet

- GR 255470 2023Document12 pagesGR 255470 2023licenselessriderNo ratings yet

- Co 1815Document4 pagesCo 1815Josh JosephNo ratings yet

- Immidiate Annuity Options Business Line June 25, 2023Document1 pageImmidiate Annuity Options Business Line June 25, 2023Madhupam KrishnaNo ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 IndexRahul RanjanNo ratings yet

- Ratio Analysis Toyota Indus Motors Company Limited: Lquidity RatiosDocument9 pagesRatio Analysis Toyota Indus Motors Company Limited: Lquidity RatiosArsl331No ratings yet

- Print Money ReceiptDocument2 pagesPrint Money ReceiptUPcoming GamerNo ratings yet

- ECO 213B Statistics For Business and Economics Group Homework 2Document3 pagesECO 213B Statistics For Business and Economics Group Homework 2testing440No ratings yet

- What Are The Functions of Commercial Banks?Document8 pagesWhat Are The Functions of Commercial Banks?Anusha RaoNo ratings yet

- Chapter 3 The Machinery of Government MMLSDocument32 pagesChapter 3 The Machinery of Government MMLSpremsuwaatiiNo ratings yet

- Progressive Development v. QC - 172 SCRA 629 (1989)Document6 pagesProgressive Development v. QC - 172 SCRA 629 (1989)Nikki Estores GonzalesNo ratings yet

- Bond Valuation NotesDocument3 pagesBond Valuation NotesChristine LealNo ratings yet

- Haldia Refinery Project Appraisal ReportDocument43 pagesHaldia Refinery Project Appraisal Reportaravind_k104No ratings yet

- SalunkeDocument10 pagesSalunkevikaspawar462No ratings yet

- Global FinanceDocument28 pagesGlobal FinanceRen Ren GutierrezNo ratings yet

- Tax Case LawsDocument6 pagesTax Case LawsHandikatare Bruce TNo ratings yet

- Bajaj Auto - SM AnalysisDocument8 pagesBajaj Auto - SM AnalysisDavidNo ratings yet

- Personal Loan - Governement emDocument2 pagesPersonal Loan - Governement emrajesh.dhawan74No ratings yet

- Ethical Issues in Business ValuationDocument111 pagesEthical Issues in Business ValuationMeeta Murarka100% (1)

- Siraj BakeryDocument27 pagesSiraj BakeryOnnatan Dinka100% (3)

- CBSE Class 11 Accountancy - Journal EntriesDocument1 pageCBSE Class 11 Accountancy - Journal EntriesIbt Malda67% (3)

- Basilan Estates Vs CIRDocument2 pagesBasilan Estates Vs CIRKim Lorenzo Calatrava100% (1)

- Unit 6: Bank Reconciliation StatementDocument10 pagesUnit 6: Bank Reconciliation StatementJohnnySaviourNo ratings yet

- Foundations in Accountancy: December 2011: Relevant Dates Examination History DetailsDocument2 pagesFoundations in Accountancy: December 2011: Relevant Dates Examination History DetailsSarmad Sadiq E4 420% (1)