74832bos60509 cp5

74832bos60509 cp5

Uploaded by

gangatharanassociatesCopyright:

Available Formats

74832bos60509 cp5

74832bos60509 cp5

Uploaded by

gangatharanassociatesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

74832bos60509 cp5

74832bos60509 cp5

Uploaded by

gangatharanassociatesCopyright:

Available Formats

CHAPTER 5

SECURITY VALUATION

LEARNING OUTCOMES

After reading this chapter student shall be able to understand:

Overview of Valuation

Return Concepts

Equity Risk Premium

Required Return on Equity

Discount Rate Selection in Relation to Cash Flows

Valuation of Equity Shares

Valuation of Preference Shares

Valuation of Debentures/ Bonds

Role and Responsibilities of Valuers

Precautions need to be taken by a Valuer before accepting any valuation

assignment.

1. OVERVIEW OF VALUATION

The definition of an Investment is – Investment involves commitment of funds with an objective to

obtain a return that would pay off the investor for the time during which the funds are invested or

locked, for the expected rate of inflation over the investment horizon, and for the risk involved. Most

investments are expected to have future cash flows and a stated market price (e.g., price of a

© The Institute of Chartered Accountants of India

2.2

5.2 ADVANCED FINANCIAL MANAGEMENT

common stock), and one must estimate a value for the investment to determine if its current market

price is consistent with his estimated intrinsic value. Investment returns can take many forms,

including earnings, cash flows, dividends, interest payments, interest on interest payments or capital

gains (increases in value) during an investment horizon.

Knowing what an asset is worth and what determines its value is a pre-requisite for making intelligent

investment decisions while choosing investments for a portfolio or in deciding an appropriate price

to pay or receive in a business takeover and in making investment, financing and dividend choices

when running a business. We can make reasonable estimates of value for most assets, and that the

fundamental principles determining the values of all types of assets whether real or financial, are

the same. Some assets may be easier to be valued than others and for different assets the details

of valuation and the uncertainty associated with their value estimates may vary. However, the core

principles of valuation always remain the same.

2. RETURN CONCEPTS

A sound investment decision depends on the correct use and evaluation of the rate of return. Some

of the different concepts of return are given as below:

2.1 Required Rate of Return

Required rate of return is the minimum rate of return that the investor is expected to receive while

making an investment in an asset over a specified period of time. This is also called Opportunity

Cost or Cost of Capital because it is the highest level of expected return forgone which is available

elsewhere from investment of similar risks. Many times required rate of return and expected return

are used interchangeably.

2.2 Discount Rate

Discount Rate is the rate used to calculate present value of future cash flows Discount rate depends

on the risk-free rate and risk premium of an investment. Actually, each cash flow stream coming

from different assets can be discounted at a different discount rate. This is because of variation in

risk premium which may be due to expected inflation rate, different maturity levels and probability of

defaults. This can be explained with the help of term structure of interest rates. For instance, in

upward sloping term structure of interest rates, interest rates increase with the maturity as longer

maturity may mean more inflation risk, more liquidity risk or more default risk.

Though future cash flows can be discounted at different discount rate, one may use the same

discount rate to get the same present value of a stream of cash flows. When a single discount rate

is applied instead of many discount rates, many individual discount rates can be replaced with an

equivalent single discount rate which eventually gives the same present value.

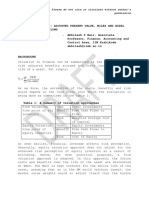

Example: Cash flows and discount rates for each year of cash flows at different maturities have

been given as below:-

© The Institute of Chartered Accountants of India

SECURITY VALUATION 2.3 5.3

1st year 2nd year 3rd year 4th year 5th year

Cash flows `100 `200 `300 `400 `500

Discount rates 2.0% 3.2% 3.6% 4.8% 5.0%

The present value of this stream of cash flows, by discounting each cash flow with the respective

discount rate, is ` 1,278.99.

The single discount rate that approximately equates the present value of the stream of cash flows

to `1278.99 is 4.4861% (any difference is due to rounding).

2.3 Internal Rate of Return

Internal Rate of Return is defined as that discount rate which equates the present value of future

cash flows of a security to its market price. The IRR is viewed as the average annual rate of return

that investors earn over their investment time period assuming that the cash flows are reinvested at

the IRR. This can be explained with the help of an example as follows:

Example

Suppose you are recommended to invest ` 20,000 now in an asset that offers a cash flow ` 3,000

one year from now and ` 23,000 two years from now. You want to estimate the IRR of the investment.

For this purpose you must find the discount rate that equates the present value of cash inflows to `

20,000, the value of the initial investment.

Time 0 1st year 2nd year

Cash flows (` 20,000) ` 3,000 ` 23,000

We solve the following equation for r which denotes IRR and get 15%.

20000 = 3000/(1+r) + 23000/(1+r)2

=> r = 15%

Thus, our IRR is 15%, which implies that we earn on an average 15% on the investment per annum.

Now let’s assume that when we receive ` 3,000, we reinvest it at 10% for one year and after one

year we receive total ` 26,300, ` 3,300 of which is attributable to reinvestment of ` 3,000. Since we

receive total cash `26300 we can estimate the IRR of the investment.

(26300/20000)1/2 – 1 = 0.1467 or 14.67%

Annual return is now at 14.67% if reinvested at 10%, which is actually less than what was expected

to be earned before investment. The reason is that the cash flow was reinvested at a rate (10%)

which is less than our expected IRR (15%).

If we had a chance to reinvest ` 3,000 at 15%, we would receive ` 26,450 at the end of 2nd year,

and the IRR of the investment would be equal to exactly 15% as calculated below:

(26450/20,000)1/2 – 1 = 0.15 or 15%

© The Institute of Chartered Accountants of India

2.4

5.4 ADVANCED FINANCIAL MANAGEMENT

3. EQUITY RISK PREMIUM

Equity risk premium is the excess return that an investment in equity shares provides over a risk

free rate, such as return from tax free government bonds. This excess return compensates investors

for taking on the higher risk of investing in equity shares of a company. The size of the premium will

change depending upon the level of risk in a particular portfolio and will also change over time as

market risk fluctuates. Generally, high-risk investments are compensated with a higher premium.

The equity risk premium is based on the idea of the risk-reward trade-off. However, equity risk

premium is a theoretical concept because it is difficult to predict that how a particular stock or the

stock market as a whole will perform in the future. It can only be estimated by observing stock market

and government bond market over a specified period of time, for instance from 1990 to the present

period. Further, estimates may vary depending on the time frame and method of calculation.

3.1 Explanation of Equity Risk Premium

Investment in equity shares of a company is a high risk investment. If an investor is investing in

equity shares of a company, he wants some risk premium over the risk-free investment avenues

such as government bonds. For example, if an investor could earn a 7% return on a Government

Bond (which is generally considered as risk free investment), a company’s share should earn 7%

return plus an additional return (the equity risk premium) in order to attract the investor.

Equity investors try to achieve a balance between risk and return. If a company wants to pursue

investors to put their money into its stock, it must provide a stimulus in the form of a premium to

attract the equity investors. If the stock gives a 15% return, in the example mentioned in the previous

paragraph, the equity risk premium would be 8% (15% - 7% risk free rate). However, practically, the

price of a stock, including the equity risk premium, moves with the market. Therefore, the investors

use the equity risk premium to look at historical values, risks, and returns on investments.

3.2 Calculating the Equity Risk Premium

To calculate the equity risk premium, we can use the Capital Asset Pricing Model (CAPM), which is

usually written:

Rx = Rf + βx (Rm - Rf)

Where:

Rx = expected return on equity investment in "x"(company x)

Rf = risk-free rate of return

βx = beta of "x"

Rm = expected return of market

Now, if we assume that x is identical to the Market Index, m, then Rx = Rm. Beta is a measure of a

stock's systematic risk ; and if x = m, then βx = βm = 1. Whereas Rm - Rf is known as the Market

© The Institute of Chartered Accountants of India

SECURITY VALUATION 2.5 5.5

Risk Premium; Rx - Rf is the risk premium of a particular stock. If x is an equity investment,

then Rx - Rf is the equity risk premium; if x = m, then the market premium and the equity risk

premium are the same.

Therefore, the equity risk premium can be calculated as follows:

Equity Risk Premium = Rx - Rf = βx (Rm - Rf)

4. REQUIRED RETURN ON EQUITY

If equity risk premium is calculated as indicated above, required rate of return can be easily

calculated with the help of Capital Asset Pricing Model (CAPM). The main insight of the model is

that the investors evaluate the risk of an asset in terms of the asset’s contribution to the systematic

risk (cannot be reduced by portfolio diversification) of their total portfolio. CAPM model provides a

relatively objective procedure for required return estimation; it has been widely used in valuation.

So, the required return on the share of particular company can be computed as below:

Return on share ‘A’ = Risk free return + β x Market Risk Premium

Example:

Risk free rate 5%,

β 1.5

and, Market risk premium 4.5%

Calculate Required return on equity.

Solution

Required return on share A = Risk free return + β x Market Risk Premium

= 0.05 + 1.5 (0.045)

= 0.1175 or 11.75%

5. DISCOUNT RATE SELECTION IN RELATION TO CASH

FLOWS

Cash flows are discounted at a suitable rate to arrive at the present value of future cash flows. Cash

flows are required by any organization to settle their debt claims and taxes. Whatever amount

remains are the cash flows available to equity shareholders. When cashflows to be available to

equity shareholders are discounted, the required rate of return on equity is an appropriate discount

rate. Further, when cash flows are available to meet the claims of all of company’s stakeholders,

then the cost of capital is the appropriate discount rate.

© The Institute of Chartered Accountants of India

2.6

5.6 ADVANCED FINANCIAL MANAGEMENT

5.1 Concept of Nominal Cash Flow and Real Cash Flow

Nominal cash flow is the amount of future revenues the company expects to receive and expenses

it expects to pay out, without any adjustments for inflation. For instance, a company which wants to

invest in a utility plant wants to forecast its future revenues and expenses it has to incur while earning

its income (i.e. wages to labour, electricity, water, gas pipeline etc.).

On the other hand, Real cash flow shows a company's cash flow with adjustments for inflation. Since

inflation reduces the spending power of money over time, the real cash flow shows the effects of

inflation on a company's cash flow.

In the short term and under conditions of low inflation, the nominal and real cash flows are almost

same. However, in conditions of high inflation rates, the nominal cash flows will be higher than the

real cash flows.

5.2 Discount rate selection in Equity Valuation

From the above discussion, it can be concluded that cash flows can be nominal or real. When cash

flows are stated in real terms, then they are adjusted for inflation. However, in case of nominal

cash flow, inflation is not adjusted.

For nominal cash flow, nominal rate of discount is used and for real cash flow, real rate of discount

is used. While valuing equity shares, only nominal cash flows are considered. Therefore, only

nominal discount rate is considered. The reason is that the tax applying to corporate earnings is

generally stated in nominal terms. Therefore, using nominal cash flow in equity valuation is the right

approach because it reflects taxes accurately.

Moreover, when the cash flows are available to equity shareholders only, nominal discount rate

applicable in case of equity is used. And, the nominal after tax weighted average cost of capital is

used when the cash flows are available to all the company’s capital providers.

6. VALUATION OF EQUITY SHARES

In order to undertake equity valuations, an analyst can use different approaches, some of which are

classified as follows:

(1) Dividend Based Models

(2) Earning Based Models

(3) Cash Flows Based Model

6.1 Dividend Based Models

As we know that dividend is the reward for the provider of equity capital, the same can be used to

value equity shares. Valuation of equity shares based on dividend are based on the following

assumptions:

© The Institute of Chartered Accountants of India

SECURITY VALUATION 2.7 5.7

a. Dividend to be paid annually.

b. Payment of first dividend shall occur at the end of first year.

c. Sale of equity shares occur at the end of a year and that to at ex-dividend price.

The value of any asset depends on the discounted value of cash streams expected from the same

asset. Accordingly, the value of equity shares can be determined on the basis of stream of dividend

expected at Required Rate of Return or Opportunity Cost i.e. Ke (Cost of Equity).

Value of equity share can be determined based on holding period as follows:

(1) Valuation Based holding period of One Year : If an investor holds the share for one year

then the value of equity share is computed as follows:

D1 P1 D+P

P0 = + = 1 11

(1 + K e ) (1 + K e ) (1 + K e )

1 1

Example: Share of X Ltd. is expected to be sold at ` 36 with a dividend of ` 6 after one year. If

required rate of return is 20% then what will be the share price?

Answer

The expected share price shall be computed as follows:

6 36

P0 = + = ` 35

(1+0.20) (1+0.20)1

1

(2) Valuation Based on Multi Holding Period: In this type of holding following three types of

dividend pattern can be analyzed.

(i) Zero Growth: Also, called as No Growth Model, as dividend amount remains same over the

years infinitely. The value of equity can be found as follows:

D

P0=

(K e )

(ii) Constant Growth: Constant Dividend assumption is quite an unrealistic assumption.

Accordingly, one very common model used is based on Constant Growth in dividend for infinitely

long period. In such situation, the value of equity shares can be found by using following formula:

D1 D0(1+g)

P0= or

Ke - g (K e - g)

It is important to observe that the above formula is based on Gordon Growth Model of Calculation

of Cost of Equity.

(iii) Variable Growth in Dividend: Just like no growth in dividend assumption, the constant growth

assumption also appears to be unrealistic. Accordingly, valuation of equity shares can be done on

© The Institute of Chartered Accountants of India

2.8

5.8 ADVANCED FINANCIAL MANAGEMENT

the basis of variable growth in dividends. It should however be noted that though we can assume

multiple growth rates but one growth rate should be assumed for infinity, only then we can find value

of equity shares.

Although stages of Company’s growth fall into following categories such as Growth, Transition and

Maturity Phase but for Valuation the multiple dividend growth can be divided into following two

categories.

(a) Two Stage Dividend Discount Model: While simple two stage model assumes extraordinary

growth (or supernormal growth) shall continue for finite number of years, the normal growth shall

prevail for infinite period. Accordingly, the formula for computation of Share Price or equity value

shall be as follows:

D0(1+g1) D0(1+g1)2 D0(1+g1)n Pn

P0 = + ...........+ n

+

(1+K e ) (1+K e ) (1+K e ) (1+K e )n

1 2

D0 (1+g1)n (1+g2)

Pn =

(K e - g2)

Where, D0 = Dividend Just Paid

g1 = Finite or Super Growth Rate

g2 = Normal Growth Rate

Ke = Required Rate of Return on Equity

Pn = Price of share at the end of Super Growth i.e. beginning of Normal Growth Period

(b) Three Stage Dividend Discount Model: As per one version there are three phases for valuations:

extraordinary growth period, transition period and stable growth period.

In the initial phase, a firm grows at an extraordinarily high rate, after which its advantage gets

depleted due to competition leading to a gradual decline in its growth rate. This phase is the

transition phase, which is followed by the phase of a stable growth rate.

Accordingly, the value of equity share shall be computed, as in case of two stage growth model by

adding discounted value of Dividends for two growth periods and finally discounted value of share

price at the beginning of sustainable or stable growth period.

There is another version of three stage growth model called H Model. In the first stage dividend

grows at high growth rate for a constant period, then in second stage it declines for some constant

period and finally grow at sustainable growth rate.

H Model is based on the assumption that before extraordinary growth rate reach to normal growth it

declines lineally for period 2H.

© The Institute of Chartered Accountants of India

SECURITY VALUATION 2.9 5.9

Though the situation is complex but the formula for calculation of equity share shall be as follows

which is sum of value on the normal growth rate and premium due to abnormal growth rate:

D0(1 + gn) D0H1(gc - gn)

P0 = +

r - gn r - gn

Where gn= Normal Growth Rate Long Run

gc= Current Growth Rate i.e. initial short term growth rate

H1= Half of duration of the transition growth period

These variants of models can also be applied to Free Cash Flow to Equity Model discussed later.

6.2 Earning Based Models

Above mentioned models are based on Dividends. However, nowadays an investor might be willing

to forego cash dividend in lieu of higher earnings on retained earning ultimately leading to higher

growth in dividend.

Hence, these investors may be interested in determination of value of equity share based on Earning

rather than Dividend. The different models based on earnings are as follows:

(a) Gordon’s Model: This model is based on following broad assumptions:

(i) Return on Retained earnings remains the same.

(ii) Retention Ratio remains the same.

Valuation as per this model shall be

EPS1(1 - b)

K e - br

Where, r = Return on Equity

b = Retention Ratio

(b) Walter’s Approach: This approach is based on Walter Model discussed at Intermediated Level

in the Financial Management Paper. As per this model, the value of equity share shall be:

r

D + (E - D)

Ke

Ke

(c) Price Earning Ratio or Multiplier Approach: This is one of the common valuation approaches

followed. Since, Price Earning (PE) Ration is based on the ratio of Share Price and EPS, with a

given PE Ratio and EPS, the share price or value can simply be determined as follows:

Value = EPS X PE Ratio

© The Institute of Chartered Accountants of India

2.10

5.10 ADVANCED FINANCIAL MANAGEMENT

Now, the question arises how to estimate the PE Ratio. This ratio can be estimated for a similar type

of company or of industry after making suitable adjustment in light of specific features pertaining to

the company under consideration. It should further be noted that EPS should be of equity shares.

Accordingly, it should be computed after payment of preference dividend as follows:

Profit after tax – Preference Dividend

EPS =

Number of Equity Shares

6.3 Cash Flow Based Models

In the case of Dividend Discounting Valuation model (DDM) the cash flows are dividend which are

to be distributed among equity shareholders. This cash flow does not take into consideration the

cash flows which can be utilised by the business to meet its long-term capital expenditure

requirements and short-term working capital requirement. Hence dividend discount model does not

reflect the true free cash flow available to a firm or the equity shareholders after adjusting for its

capex and working capital requirement.

Free cash flow valuation models discount the cash flows available to a firm and equity shareholders

after meeting its long term and short-term capital requirements. Based on the perspective from which

valuations are done, the free cash flow valuation models are classified as:

• Free Cash Flow to Firm Model (FCFF)

• Free Cash Flow to Equity Model (FCFE)

In the case of FCFF model, the discounting factor is the cost of capital (Ko) whereas in the case of

FCFE model the cost of equity (Ke) is used as the discounting factor.

FCFE along with DDM is used for valuation of the equity whereas FCFF model is used to find out

the overall value of the firm.

6.3.1 Calculation of Free Cash Flow to Firm (FCFF): FCFF can be calculated as follows:

(a) Based on its Net Income:

FCFF= Net Income + Interest expense *(1-tax) + Depreciation -/+ Capital Expenditure –/+

Change in Non-Cash Net Working Capital

(b) Based on Operating Income or Earnings Before Interest and Tax (EBIT):

FCFF= EBIT *(1 - tax rate) + Depreciation -/+ Capital Expenditure –/+ Change in Non-Cash

Net Working Capital

(c) Based on Earnings before Interest, Tax , Depreciation and Amortisation (EBITDA):

FCFF = EBITDA* (1-Tax) +Depreciation* (Tax Rate) -/+ Capital Expenditure – /+Change in

Non-Cash Net Working Capital

(d) Based on Free Cash Flow to Equity (FCFE):

FCFF = FCFE + Interest* (1-t) + Principal Prepaid – New Debt Issued + Preferred Dividend

© The Institute of Chartered Accountants of India

SECURITY VALUATION 2.11 5.11

(e) Based on Cash Flows:

FCFF = Cash Flow from Operations (CFO) + Interest (1-t) -/+ Capital Expenditure

Capital Expenditure or Capex for a single year is calculated as Purchase of Fixed Asset current

year - Sale of Fixed Asset current year taken from Cash Flow from Investing Activities.

Change in Non- Cash Working Capital is calculated as:

Step 1: Calculate Working Capital for the current year: Working Capital =Current Asset-Current

Liability

Step 2: Calculate Non-Cash Net Working Capital for the current year: Current Assets – Cash

and Bank Balance – Current Liabilities

Step 3: In a similar way calculate Working Capital for the previous year

Step 4: Calculate change in Non-Cash Working Capital as: Non-Cash Working Capital for the

current year- Non-Cash Working Capital for the previous year

Step 5: If change in Non-Cash Working Capital is positive, it means an increase in the working

capital requirement of a firm and hence is reduced to derive at free cash flow to a firm.

Based on the type of model discussed above the value of Firm can be calculated as follows:

(a) For one stage Model: Intrinsic Value = Present Value of Stable Period Free Cash Flows to

Firm

(b) For two stage Model: Intrinsic Value = Present value of Explicit Period Free Cash Flows to

Firm + Present Value of Stable Period Free Cash Flows to a Firm, or

Intrinsic Value = Present Value of Transition Period Free Cash Flows to Firm + Present Value

of Stable Period Free Cash Flows to a Firm

(c) For three stage Model: Intrinsic Value=Present value of Explicit Period Free Cash Flows to

Firm + Present Value of Transition Period Free Cash Flows to Firm + Present Value of Stable

Period Free Cash Flows to Firm

6.3.2 Calculation of Free Cash Flow to Equity (FCFE): Free Cash flow to equity is used for

measuring the intrinsic value of the stock for equity shareholders. The cash that is available for

equity shareholders after meeting all operating expenses, interest, net debt obligations and re-

investment requirements such as working capital and capital expenditure. It is computed as:

Free Cash Flow to Equity (FCFE) = Net Income - Capital Expenditures + Depreciation -/+ Change

in Non-cash Net Working Capital + New Debt Issued - Debt Repayments + Net issue of Preference

Shares – Preference Share Dividends

or

© The Institute of Chartered Accountants of India

2.12

5.12 ADVANCED FINANCIAL MANAGEMENT

FCFE = Net Profit + depreciation - ∆NWC - CAPEX + New Debt - Debt Repayment + Net issue of

Preference Shares – Preference Share Dividends

∆NWC = changes in Net Working Capital.

CAPEX = Addition in fixed assets to sustain the basis.

FCFE can also be used to value share as per Multistage Growth Model approach.

6.4 Dividend Discount Model versus Free Cash Flow to Equity Model

In the dividend discount model the analyst considers the stream of expected dividends to value the

company’s stock. It is assumed that the company follows a consistent dividend payout ratio which

can be less than the actual cash available with the firm.

Dividend discount model values a stock based on the cash paid to shareholders as dividend.

A stock’s intrinsic value based on the dividend discount model may not represent the fair value for

the shareholders because dividends are distributed in the form of cash from profits. In case the

company is maintaining healthy cash in its balance sheet then it means that dividend pay-outs is low

which could result in undervaluation of the stock.

In the case of free cash flow to equity model a stock is valued on the cash flow available for

distribution after all the reinvestment needs of capex and incremental working capital are met. Thus,

using the free cash flow to equity model provides a better measure for valuations in comparison to

the dividend discount model.

6.5 Enterprise Value

Enterprise Value is the true economic value of a company. It is calculated by adding market

capitalization, Long term Debt, Minority Interest minus cash and cash equivalents. (Also Minus like

Equity investments like affiliates, investment in any company and also Long term investments.)

© The Institute of Chartered Accountants of India

SECURITY VALUATION 2.13 5.13

Enterprise Value is of three types: Total, Operating and Core EV. Total Enterprise Value is the value

of all the business activities; it is the summation of market capitalization, Debt (Interest Bearing),

Minority Interest “minus “cash. The operating Enterprise value is the value of all operating activities,

and to get this we have to deduct “market value of non- operating assets” which includes Investments

and shares (in associates) from the total enterprise value.

Core enterprise value is the value which does not include the value of operations which are not the

part of core activities. To get this we deduct the value of non-core assets from the operating

enterprise value.

Enterprise value measures the business as a whole and gives its true economic value. It is more

comprehensive than equity multiples. Enterprise value considers both equity and debt in its valuation

of the firm and is least affected by its capital structure. Enterprise multiples are more reliable than

equity multiples because Equity multiples focus only on equity claim.

There are different Enterprise Value multiples which can be calculated as per the requirement (which

requirement). If we take the EV as numerator then the denominator must represent the claims of all

the claimholders on enterprise cash flow.

6.5.1 Enterprise Value to Sales: This multiple is suitable for the corporates who maintain negative

cash flows or negative earnings as cyclical firms. Corporate like technological firms generally use

this multiple. Sales are the least manipulative top line for any business and least affected by

accounting policies.

6.5.2 Enterprise Value to EBITDA: EBITDA, which is commonly known as the proxy of cash flow,

is the amount available to debt and equity holders of a company. This multiple is used for valuing

capital intensive companies, which generally have substantial depreciation and amortization

expenses. This multiple is used for acquisitions as it incorporates debts as well equity of the

business. An analyst prefers this multiple because it is not affected by depreciation policy and

changes in capital structure. The inverse of this multiple explains cash return on total investment.

6.6 Valuation of Rights

As we know that company offers right shares to the existing shareholders. Immediately after the

right issue, the price of share is called Ex Right Price or Theoretical Ex-Right Price (TERP) which is

computed as follows:

nP0 + S

n + n1

n = No. of existing equity shares

P0 = Price of Share Pre-Right Issue

S = Subscription amount raised from Right Issue

n1 = No. of new shares offered

© The Institute of Chartered Accountants of India

2.14

5.14 ADVANCED FINANCIAL MANAGEMENT

However, theoretical value of a right can be calculated as follows:

Ex- Right Price – Subscription Price

Ex-Right Price - Subscription Price

Value of Per Shareholding =

Exiting Number of Shares

7. VALUATION OF PREFERENCE SHARES

Preference shares, like debentures, are usually subject to fixed rate of dividend. In case of non-

redeemable preference shares, their valuation is similar to perpetual bonds.

Valuation of Redeemable preference share

The value of redeemable preference share is the present value of all the future expected dividend

payments and the maturity value, discounted at the required return on preference shares. Therefore,

Value of Redeemable Preference Share shall be:

=

Dividend1 Dividend2

+ + ..................+

(Dividendn + Maturity value )

(1+ r ) (1+ r ) (1+ r )

1 2 n

and Value of Non-Redeemable Preference Share shall be:

Dividend

Irredeemable Preference share value =

Required return on Preference share

Example

The face value of the preference share is ` 10,000 and the stated dividend rate is 10%. The shares

are redeemable after 3 years period. Calculate the value of preference shares if the required rate of

return is 12%.

Annual dividend = `10000 x 10% = `1000

Redeemable Preference share value

1,000 1,000 1,000 + 10,000

= + +

(1+ 0.12) (1+ 0.12) 2

(1+ 0.12)3

1,000 1,000 11,000

= + +

(1.12) (1.12)2 (1.12)3

= 892.86 + 797.19 + 7829.58

= 9519.63

Solving the above equation, we get the value of the preference shares as ` 9519.63

© The Institute of Chartered Accountants of India

SECURITY VALUATION 2.15 5.15

8. VALUATION OF DEBENTURES AND BONDS

8.1 Some Basics of a Bond

(a) Par Value: Value stated on the face of the bond of maturity.

(b) Coupon Rate and Frequency of Payment: A bond carries a specific interest rate known as

the Coupon Rate. The coupon can be paid monthly, quarterly, half-yearly or annually.

(c) Maturity Period: Total time till maturity.

(d) Redemption: Bullet i.e. one shot repayment of principal at par or premium.

8.2 Bond Valuation Model

The value of a bond is:

n

I F

V=∑ t

+

t =1 (1 + k )

d

(1 + k d )n

V = I ( PVIFAkd ,n ) + F ( PVIFkd ,n )

Where,

V = value of the bond

I = annual interest payable on the bond

F = principal amount (par value) of the bond repayable at the time of maturity

n = maturity period of the bond

kd = Yield to Maturity (YTM) or Required Rate of Return on same type of Bonds.

8.3 Bond Value Theorems

Some basic rules, which should be remembered with regard to bonds, are:

CAUSE EFFECT

Required rate of return or YTM = coupon Bond sells at par value

rate

Required rate of return or YTM > coupon Bond sells at a discount

rate

Required rate of return or YTM < coupon Bond sells at a premium

rate

Longer the maturity of a bond Greater the bond price change with a given change in

the required rate of return.

© The Institute of Chartered Accountants of India

2.16

5.16 ADVANCED FINANCIAL MANAGEMENT

8.4 Yield to Maturity (YTM)

The YTM is defined as that discount rate (“kd”) at which the present value of future cash flows from

a Bond equals its Market Price.

8.5 Bond Value with Semi-Annual Interest

The basic bond valuation equation thus becomes:

I

2n

2 + F

V= ∑ t 2n

t=1 kd kd

1+ 2 1+ 2

= I/2(PVIFAkd/2,2n) + F(PVIFkd/2,2n)

Where,

V = Value of the bond

I/2 = Semi-annual interest payment

Kd/2 = Discount rate applicable to a half-year period

F = Par value of the bond repayable at maturity

2n = Maturity period expressed in terms of half-yearly periods.

8.6 Price Yield Relationship

A basic property of a bond is that its price varies inversely with yield. The reason is - as the required

yield increases, the present value of the cash flow decreases; hence the price decreases and vice

versa.

8.7 Relationship between Bond Price and Time

The price of a bond must equal its par value at maturity (assuming that there is no risk of default),

because bond prices change with passage of time and they approach to the par value. It means that

if a bond is trading at premium, its price will decrease over time and if a bond is trading at a discount,

its price will increase over time.

8.8 Duration of Bond

Duration is the weighted average time within which an investor gets back the promised principal and

the promised YTM. Investment coupon bearing bond always has a duration which is lesser than its

maturity. Higher the coupon rate, lesser would be the duration and higher the yield-to-maturity, lower

will be the duration of a bond.

It measures how quickly a bond will repay its true cost. The longer the time it takes the greater

exposure the bond has to changes in the interest rate environment and hence, higher interest rate

risk. Duration is also a measure of interest rate risk – higher duration implies higher interest rate risk

© The Institute of Chartered Accountants of India

SECURITY VALUATION 2.17 5.17

and lower duration means lower interest rate risk. Following are some of factors that affect bond's

duration:

(i) Time to maturity: The shorter-maturity bond would have a lower duration and less interest

rate risk and vice versa.

(ii) Coupon rate: Coupon payment is a key factor in calculation of duration of bonds. The higher

the coupon, the lower is the duration and vice versa.

(iii) Yield-to-Maturity (YTM): Higher yield-to-maturity means lower duration and hence, lower

interest rate risk and vice versa.

Although there are many formulae to calculate the duration. However, following are commonly used

methods:

(a) Macaulay Duration: This formula measures the number of years required to recover the true

cost of a bond, considering the present value of all coupon and principal payments received in the

future. The formula for Macaulay duration is as follows:

n

t*c n*M

∑ (1+i) t

+

(1+i)n

Macaulay Duration = t=1

P

Where,

n = Time to maturity

C = Cash flows (Coupon Amount)

i = Required yield

M = Maturity (par) value

P = Bond price

(b) Modified Duration: This is a modified version of Macaulay duration which takes into account

the interest rate changes because the changes in interest rates affect duration as the yield gets

affected each time the interest rate varies.

The formula for modified duration is as follows:

Macaulay Duration in years

Modified Duration =

YTM

1 +

n

Where

n= Number of compounding periods per year

YTM = Yield to Maturity

© The Institute of Chartered Accountants of India

2.18

5.18 ADVANCED FINANCIAL MANAGEMENT

8.9 Immunization

We know that when interest rate goes up though the reinvestment income improves but the value of

bond falls and vice versa. Thus, the interest rate risk of a bond is subject to following two risks:

(a) Price Risk

(b) Reinvestment Risk

Further, with change in interest rates these two risks move in opposite direction. Through the process

of immunization, selection of bonds shall be in such a manner that the effect of above two risks shall

offset each other. It means that immunization takes place when the changes in the YTM in market

has no effect on the promised rate of return on a bond i.e., a portfolio of bond is said to be immunized

if the value of the portfolio at the end of a holding period is insensitive to interest rate changes. If

the duration of a bond is equal to its holding period, then we ensure immunization of the same and

hence, the bond is not having interest rate risk.

8.10 Yield Curve

The term structure of interest rates, also known as Yield Curve, shows how yield to maturity is related

to term to maturity for bonds that are similar in all respects, except maturity.

Consider the following data for Government securities:

Face Value Coupon Rate (%) Maturity (years) Current Price Yield to Maturity (%)

10,000 12.40 1 9,987 12.546

10,000 12.75 2 9,937 13.128

10,000 13.50 3 10,035 13.351

10,000 13.50 4 9,971 13.599

10,000 13.75 5 9,948 13.901

The yield curve for the above bonds is shown in the diagram. It slopes upwards indicating that long-

term rates are greater than short-term rates.

Yield curves, however, do not have to necessarily slope upwards. They may follow different pattern.

Four patterns are depicted in the given diagram:

© The Institute of Chartered Accountants of India

SECURITY VALUATION 2.19 5.19

Types of Yield Curve

Another perspective on the term structure of interest rates is provided by the forward interest rates,

viz., the interest rates applicable to bonds in the future.

To get forward interest rates, begin with the one-year Zero Coupon Bond:

8,897 = 10,000 / (1 + r1)

Where,

r1 is the one-year spot rate i.e. the discount rate applicable to a risk less cash flow receivable

a year hence.

Solving for r1, we get r1 = 0.124.

Next, consider the two-year government security and split its benefits into two parts, the interest of

` 1,275 receivable at the end of year 1 and ` 11,275 (representing the interest and principal

repayment) receivable at the end of year 2. The present value of the first part is:

11,275 11,275

=

(1+r1 )(1+f2 ) 1.124(1+f2 )

To get the present value of the second year’s cash flow of ` 11,275, discount it twice at r1 (the

discount rate for year 1) and f2 (the discount rate for year 2) (please use f notation for the forward

rate so as to make a distinction between the spot rate and forward rate)

1,275 1,275

=

(1 + r1 )(1 + rf2 ) 1.124(1+ rf2 )

© The Institute of Chartered Accountants of India

2.20

5.20 ADVANCED FINANCIAL MANAGEMENT

f2 is called the ‘forward rate’ for after one for next one year i.e., the current expected estimate of the

next year’s one-year spot interest rate. Since r1, the market price of the bond, and the cash flow

associated with the bond are known the following equation can be set up:

1,275 11,275

9,937 = +

(1.124) (1.124)(I + r2 )

9,937(1.124)(1 + r2) = 1,275 (1 + r2) + 11,275

11,169 + 11,169 r2 = 1,275 + 1,275 r2 + 11,275

11,169 r2 – 1,275 r2 = 11,275 – 11,169 + 1,275

9,894 r2 = 1,381

1,381

r2 = 0.1396

=

9,894

Thus solving this equation we get r2 = 0.1396 say 14%

To get the forward rate for year 3(r3), set up the equation for the value of the three year bond:

1,350 1,350 11,350

10,035 = + +

(1 + r1 ) (1 + r1 )(1 + r2 ) (1 + r1 )(1 + r2 )(1 + r3 )

1,350 1,350 11,350

10,035 = + +

(1.124) (1.124)(1.140) (1.124)(1.140)(1+ r3 )

1,350 1,350 11,350

10,035 = + +

1.124 1.28136 1.28136(1+ r3 )

11,350

10,035 = 1,201+ 1,054 +

1.28136(1+ r3 )

11,350

7780 =

1.28136(1+r3 )

1 + r3 = 1.13853

r3 = 0.13853

Solving this equation we get r3=0.13853. This is the forward rate for year three. Continuing in a

similar fashion, set up the equation for the value of the four-year bond:

1,350 1,350 1,350 11,350

9,971 = + + +

(1+ r1 ) (1+ r1 )(1+ r2 ) (1+ r1 )(1+ r2 )(1+ r3 ) (1+ r1 )(1+ r2 )(1+ r3 )(1+ r4 )

Solving this equation we get r4 = 0.1462 (approx.). The following diagram plots the one-year spot

rate and forward rates f2, f3, f4. It can be noted that while the current spot rate and forward rates are

known, the future spot rates are not known – they will be revealed as the future unfolds.

© The Institute of Chartered Accountants of India

SECURITY VALUATION 2.21 5.21

Thus, on the basis of above it can be said that though YTM and Forward Rates are two distinct

measures but used equivalent way of evaluating a riskless cash flows.

CF( t)

Discount at the yield to maturity : (R t ) PV [CF(t)] =

(1+ R t ) t

Discount by the product of a spot rate plus the forward rates

CF( t)

PV [CF(t)] =

(1+ r1 )(1+ r2 )...(1+ rt )

8.11 Term Structure Theories

The term structure theories explain the relationship between interest rates or bond yields and

different terms or maturities. The different term structures theories are as follows:

(a) Expectation Theory: As per this theory the long-term interest rates can be used to forecast

short-term interest rates in the future as long-term interest rates are assumed to unbiased estimator

of the short term interest rate in future.

(b) Liquidity Preference Theory: As per this theory investors are risk averse and they want a

premium for taking risk. Long-term bonds have higher interest rate risk because of higher maturity,

hence, long-term interest rates should have a premium for such a risk. Further, people prefer liquidity

and if they are forced to sacrifice the same for a longer period, they need a higher compensation for

the same. Hence, as per this theory, the normal shape of a yield curve is Positive sloped one.

(c) Preferred Habitat Theory (Market Segmentation Theory): This theory states that though

different investors may be having different preference for shorter and longer maturity periods and

therefore, they have their own preferred habitat. Hence, the interest rate structure depends on the

© The Institute of Chartered Accountants of India

2.22

5.22 ADVANCED FINANCIAL MANAGEMENT

demand and supply of fund for different maturity periods for different market segments. In case there

is a mismatch between these forces, the players of a particular segment should be compensated at

a higher rate to pull them out from their preferred habitat; hence, that will determine the shape of the

yield curve. Accordingly, shape of yield curve will be determined which can be sloping upward, falling

or flat.

8.12 Convexity Adjustment

As mentioned above duration is a good approximation of the percentage change in price due to

percentage change for a small change in interest rate. However, the change cannot be estimated

so accurately due to convexity effect as duration base estimation assumes a linear relationship.

This estimation can be improved by adjustment to the duration formula on account of ‘convexity’ as

follows:

C* x (∆y)2 x100

V+ + V- - 2V0

C* =

2V0 (Δy)2

∆y = Change in Yield

V0 = Initial Price of bond

V+ = price of Bond if yield increases by ∆y

V- = price of Bond if yield decreases by ∆y

The convexity effect has been shown in the following diagram:

© The Institute of Chartered Accountants of India

SECURITY VALUATION 2.23 5.23

8.13 Convertible Debentures

Convertible Debentures are those debentures which are converted in equity shares after certain

period of time. The number of equity shares for each convertible debenture are called Conversion

Ratio and price paid for the equity share is called ‘Conversion Price’.

Further, conversion value of debenture is equal to Price per Equity Share x Converted No. of Shares

per Debenture.

8.14 Valuation of Warrants

A warrant is a right that entitles a holder to subscribe equity shares during a specific period at a

stated price. These are generally issued to sweeten the debenture issue.

Although both convertible Debentures and Warrants appeared to one and same thing but following

are major differences.

(i) In warrant, option of conversion is detachable while in convertible it is not so. Due to this

reason, warrants can be separately traded.

(ii) Warrants are exercisable for cash payment while convertible debenture does not involve any

such cash payment.

Theoretical value of warrant can be found as follows:

(MP – E) x n

MP = Current Market Price of Share

E = Exercise Price of Warrant

n = No. of equity shares convertible with one warrant

8.15 Zero Coupon Bond

As name indicates these bonds do not pay any coupon during the life of the bonds. Instead, Zero

Coupon Bonds (ZCBs) are issued at discounted price to their face value, which is the amount a bond

will be worth when it matures or comes due. When a ZCB matures, the investor will receive one

lump sum (face value) equal to the initial investment plus interest that has been accrued on the

investment made. The maturity dates on ZCBs are usually long term. These maturity dates allow an

investor for a long-range planning. ZCBs issued by banks, government and private sector

companies. However, bonds issued by corporate sector carry a potentially higher degree of risk,

depending on the financial strength of the issuer and longer maturity period, but they also provide

an opportunity to achieve a higher return.

8.16 Refunding of Bonds

Generally, Bonds issuer may refund bonds prior to its maturity date especially when interest rates

are falling. Under this scheme by issuing fresh bonds at lower coupon rates company can refund the

© The Institute of Chartered Accountants of India

2.24

5.24 ADVANCED FINANCIAL MANAGEMENT

existing bonds issued earlier at higher interest or coupon rate. Therefore, company prefers to issue

bonds with call features as it gives them the right or choice to redeem bonds before their due date

of maturity especially when market conditions are favourable to them, and new bonds can be issued

at lower interest rate. However, this call feature is not free of cost because companies are supposed

to repay higher amount than the face value of bonds which is called ‘Call Premium’.

It is a type of strategic financial decision, and the Capital Budgeting method is used to evaluate the

decision to refund the exiting bonds and issuing new bonds of an equivalent amount. Generally, the

Net Present Value (NPV) method is used to evaluate such types of Bond Refunding decisions. If the

Present Value of Cash Inflows (in form of net cash saving) exceeds the Present Value of cash outflow

(call premium, interest during transition period etc.) then exiting bonds can be refunded and new

bonds carrying lower coupon interest rate can be issued resulting in overall saving of cash outflows.

8.17 Money Market Instruments

Similar to Bonds, the money market instruments are important source of finance to industry, trade,

commerce and the government sector for meeting their short-term requirement for both national and

international trade. These financial instruments also provide an investment opportunity to the banks

and others to deploy their surplus funds so as to reduce their cost of liquidity and earn some income.

The instruments of money market are characterised by:

(a) Short duration.

(b) Large volume.

(c) De–regulated interest rates.

(d) The instruments are highly liquid.

(e) They are safe investments owing to issuers inherent financial strength.

The traditional short-term money market instruments consist of mainly call money and notice money

with limited players, treasury bills and commercial bills. The new money market instruments were

introduced giving a wider choice to short term holders of money to reap yield on funds even for a

day to earn a little more by parking funds through instruments for a few days more or until such time

till they need it for lending at a higher rate. The various types of instruments of money market are

discussed in the following paragraphs:

8.17.1 Call/Notice money: Call money market, or inter-bank call money market, is a segment of the

money market where scheduled commercial banks lend or borrow on call (i.e., overnight) or at short

notice (i.e., for periods upto 14 days) to manage the day-to-day surpluses and deficits in their cash-

flows.

When money is borrowed on overnight basis or for 1 day it is termed as ‘Call Money’. However,

under notice money market, funds are transacted for a period between two days and fourteen days.

These day-to-day surpluses and deficits arise due to the varying nature of their operations and the

peculiar nature of the portfolios of their assets and liabilities.

© The Institute of Chartered Accountants of India

SECURITY VALUATION 2.25 5.25

8.17.2 Treasury Bills (TBs): Among money market instruments TBs provide a temporary outlet for

short-term surplus as also provide financial instruments of varying short-term maturities to facilitate

a dynamic asset-liabilities management. The interest received on them is the discount which is the

difference between the price at which they are issued and their redemption value. They have assured

yield and negligible risk of default. The TBs are short-term promissory notes issued by Government

of India at a discount.

More relevant to the money market is the introduction of 14 days, 28 days, 91 days and 364 days

TBs on auction basis.

However, at present, the RBI issues Treasury Bills of three maturities i.e. 91 days, 182 days and

364 days.

TBs are issued at discount and their yields can be calculated with the help of the following formula:

F − P 365

Y= × × 100

P M

where Y = Yield,

F = Face Value,

P = Issue Price/Purchase Price,

M = Actual days to Maturity.

8.17.3 Commercial Bills: A commercial bill is one which arises out of a genuine trade transaction,

i.e. credit transaction. As soon as goods are sold on credit, the seller draws a bill on the buyer for

the amount due. The buyer accepts it immediately agreeing to pay amount mentioned therein after

a certain specified date. Thus, a bill of exchange contains a written order from the creditor to the

debtor, to pay a certain sum, to a certain person, after a creation period. A bill of exchange is a ‘self-

liquidating’ paper and negotiable; it is drawn always for a short period ranging between 3 months

and 6 months.

Bill financing is the core component of meeting working capital needs of corporates in developed

countries. Such a mode of financing facilitates an efficient payment system. The commercial bill is

instrument drawn by a seller of goods on a buyer of goods. RBI has pioneered its efforts in

developing bill culture in India, keeping in mind the distinct advantages of commercial bills, like, self-

liquidating in nature, recourse to two parties, knowing exact date transactions, transparency of

transactions etc.

Example

If a bank re-discounted a commercial bill with a face value of ` 100/- @ 15% for 2 months will fetch

` 97.50, on the basis of the following calculation.

15 2

Discount = 100 × × = ` 2.50

100 12

However, as the discount amount is paid at front-end.

© The Institute of Chartered Accountants of India

2.26

5.26 ADVANCED FINANCIAL MANAGEMENT

Example

The yield to the investor or cost to the borrower will be higher than the discount rate in view of the

fact that the discounter can deploy the amount of discount received for earning further income. This

can be calculated with the following formula:

FV - SV Days or months in a year

D= × × 100

SV M

where

D = Effective Discounting Rate

FV = Face Value

SV = Sale Value

M = Period of Discount

Accordingly, the Yield as per the data given in the example will be:

100 - 97.50 12

× × 100 = 15.385%

97.50 2

8.17.4 Certificate of Deposit: The Certificate of Deposits (CDs) are negotiable term-deposits

accepted by commercial bank from bulk depositors at market related rates. CDs are usually issued

in Demat form or as a Usance Promissory Note.

Just like Commercial Bills, Certificate of Deposit (CD) is a front–ended negotiable instrument, issued

at a discount and the face value is payable at maturity by the issuing bank.

Example

Amount of Issue – ` 100

Period - 6 months

Rate of discount – 20%

20 6

Discount = 100 × × = ` 10.00

100 12

Hence CD will be issued for ` 100 – 10 = ` 90.00. The effective rate to the bank will, however, be

calculated on the basis of the following formula:

FV - SV Days or months in a year

E= × × 100

SV M

where

E = Effective Yield

FV = Face Value

SV = Sale Value

M = Period of Discount

© The Institute of Chartered Accountants of India

SECURITY VALUATION 2.27 5.27

Accordingly, the Yield as per the data given in the example will be:

100 - 90 12

× × 100 = 22.22%

90 6

8.17.5 Commercial Paper: Commercial Paper (CP) has its origin in the financial markets of America

and Europe. The concept of CPs was originated in USA in early 19th century when commercial

banks monopolised and charged high rate of interest on loans and advances. In India, the CP was

introduced in January 1990 on the recommendation of Vaghul Committee subject to various

conditions. When the process of financial dis-intermediation started in India in 1990, RBI allowed

issue of two instruments, viz., the Commercial Paper (CP) and the Certificate of Deposit (CD) as a

part of reform in the financial sector. A notable feature of RBI Credit Policy announced on 16.10.1993

was the liberalisation of terms of issue of CP. At present it provides cheap source of funds for

corporate sector and has caught the fancy of corporate sector and banks. Its market has picked up

considerably in India due to interest rate differentials in the inter-bank and commercial lending rates.

CPs are unsecured and negotiable promissory notes issued by high rated corporate entities to raise

short-term funds for meeting working capital requirements directly from the market instead of

borrowing from banks. Its period ranges from 7 days to 1 year. CP is issued at discount to face value

The issue of CP seeks to by-pass the intermediary role of the banking system through the process

of securitisation.

It partly replaces the working capital limits enjoyed by companies with the commercial banks and

there will be no net increase in their borrowing by issue of CP. Generally, CP has to be issued at a

discount to face value. Yield on CP is freely determined by the market.

The yield on CP can be calculated as follows:

FV - SV Days or months in a year

Y= × × 100

SV M

where

Y = Yield

FV = Face Value

SV = Sale Value

M = Period of Discount

8.17.6 Repurchase Options (Repo.) and Reverse Repurchase Agreement (Reverse Repo): The

term Repurchase Agreement (Repo) and Reverse Repurchase Agreement (Reverse Repo) refer to

a type of transaction in which money market participant raises funds by selling securities and

simultaneously agreeing to repurchase the same after a specified time generally at a specified price,

which typically includes interest at an agreed upon rate. Sometimes it is also called Ready Forward

Contract as it involves funding by selling securities (held on Spot i.e. Ready Basis) and repurchasing

them on a forward basis.

© The Institute of Chartered Accountants of India

2.28

5.28 ADVANCED FINANCIAL MANAGEMENT

Following are major differences between Repo and Reverse Repo:

(a) Repo rate is the rate at which Reserve Bank of India (RBI) lends to Commercial Banks for a

short period of time against Government Securities. On the other hand, Reverse Repo is the

rate at which Commercial Banks lend to RBI.

(b) A transaction is called a Repo when viewed from the perspective of the seller of securities

(the party acquiring funds) and Reverse Repo when described from the point of view of the

supplier of funds. Thus, whether a given agreement is termed a Repo or a Reverse Repo

depends largely on which party initiated the transaction.

(c) The purpose of Repo is to fulfill the deficiency of funds. While the purpose of Reverse repo

is to reduce excess liquidity in the economy.

(d) The Repo rate is comparatively high in comparison to Reverse Repo rate.

(e) The Repo rate strives to contain inflation in the economy. The Reverse repo aims to control

money supply in the economy.

9. ROLE AND RESPONSIBILITIES OF VALUERS

9.1 Role of Valuers

The role of Valuers has increased a lot due to increased statutory and information requirements.

The valuations made by a Valuers are required statutorily for the following purposes: -

(a) Mergers/Acquisitions/ De-Mergers/Takeovers: Valuation is mandated in cases of Mergers/

Acquisitions/ De-Mergers/ Takeovers by the Income Tax Act, 1961 for the purpose of determining

the tax (if any) payable in such cases.

(b) Slump Sale/ Asset Sale/ IPR Sale: Valuation is required by Insolvency and Bankruptcy Code,

2016 in case of liquidation of company and sale of assets of corporate debtor for the purpose of

ascertaining fair value or liquidation value.

(c) Conversion of Debt/ Security: Valuation is a necessitated by RBI for Inbound Foreign

Investment, Outbound Foreign Investment and other business transactions.

(d) Capital Reduction: SEBI regulations such as ICDR/ LODR/ Preferential Allotment etc. also

require valuations to be made for listed securities for various purposes on a period basis.

(e) Strategic Financial Restructuring: Various statutes such as Companies Act, 2013, SARFAESI

Act, 2002, Arbitration and Conciliation Act 1996 etc., warrant valuations to be made for meeting

various statutory requirements. Valuation is also made for fulfilling IND AS purposes and may also

be made on Court Orders.

© The Institute of Chartered Accountants of India

SECURITY VALUATION 2.29 5.29

9.2 Responsibilities of Valuers

Under Rule 12(e) of the Companies (Registered Valuers and Valuation) Rules, 2017 the Model Code

of Conduct for Registered Valuers is as follows:

Integrity and Fairness

1. A valuer should in the conduct of his/its business follow high standards of integrity and fairness

in all his/its dealings with his/its clients and other valuers.

2. A valuer should maintain integrity by being honest, straightforward, and forthright in all

professional relationships.

3. A valuer should endeavour to ensure that he/it provides true and adequate information and shall

not misrepresent any facts or situations.

4. A valuer should refrain from being involved in any action that would bring disrepute to the

profession.

Professional Competence and Due Care

5. A valuer should render at all times high standards of service, exercise, due diligence, ensure

proper care and exercise independent professional judgment.

6. A valuer should carry out professional services in accordance with the relevant technical and

professional standards that may be specified from time to time

7. A valuer should continuously maintain professional knowledge and skill to provide competent

professional service based on up-to-date developments in practice, prevailing regulations/guidelines

and techniques.

8. In the preparation of a valuation report, the valuer should not disclaim liability for his/its expertise

or deny his/its duty of care, except to the extent that the assumptions are statements of fact provided

by the company and not generated by the valuer.

9. A valuer should have a duty to carry out with care and skill, the instructions of the client insofar

as they are compatible with the requirements of integrity, objectivity and independence.

Independence and Disclosure of Interest

10. A valuer should act with objectivity in his/its professional dealings by ensuring that his/its

decisions are made without the presence of any bias, conflict of interest, coercion, or undue

influence of any party, whether directly connected to the valuation assignment or not.

11. A valuer should not take up an assignment under the Act/Rules if he/it or any of his/its relatives

or associates is not independent in relation to the company and assets being valued.

12. A valuer should maintain complete independence in his/its professional relationships and shall

conduct the valuation independent of external influences.

© The Institute of Chartered Accountants of India

2.30

5.30 ADVANCED FINANCIAL MANAGEMENT

13. A valuer should wherever necessary disclose to the clients, possible sources of conflicts of duties

and interests, while providing unbiased services.

14. A valuer should not deal in securities of any subject company after any time when he/it first

becomes aware of the possibility of his/its association with the valuation, and in accordance with the

SEBI (Prohibition of Insider Trading) Regulations, 2015.

15. A valuer should not indulge in “mandate snatching” or “convenience valuations” in order to cater

to the company’s needs or client needs. A valuer should communicate in writing with a prior valuer

if there is knowledge of any prior valuer having been appointed before accepting the assignment.

16. As an independent valuer, the valuer should not charge success fee.

17. In any fairness opinion or independent expert opinion submitted by a valuer, if there has been a

prior engagement in an unconnected transaction, the valuer should declare the past association with

the company.

Confidentiality

18. A valuer should not use or divulge to other clients or any other party any confidential information

about the subject company, which has come to his/its knowledge without proper and specific

authority or unless there is a legal or professional right or duty to disclose.

Information Management

19. A valuer should ensure that he/ it maintains written contemporaneous records for any decision

taken, the reasons for taking the decision, and the information and evidence in support of such

decision. This should be maintained so as to sufficiently enable a reasonable person to take a view

on the appropriateness of his/its decisions and actions.

20. A valuer should appear, co-operate and be available for inspections and investigations carried

out by the Registration Authority, any person authorised by the Registration Authority, the Valuation

Professional Organisation with which he/it is registered or any other statutory regulatory body.

21. A valuer should provide all information and records as may be required by the Registration

Authority, the Tribunal, Appellate Tribunal, the Valuation Professional Organisation with which he/it

is registered, or any other statutory regulatory body.

22. A valuer while respecting the confidentiality of information acquired during the course of

performing professional services, should maintain proper working papers for a period of three years,

for production before a regulatory authority or for a peer review. In the event of a pending case

before the Tribunal or Appellate Tribunal, the record should be maintained till the disposal of the

case.

Gifts and hospitality

23. A valuer, or his/its relative should not accept gifts or hospitality which undermines or affects his

independence as a valuer.

© The Institute of Chartered Accountants of India

SECURITY VALUATION 2.31 5.31

24. A valuer should not offer gifts or hospitality or a financial or any other advantage to a public

servant or any other person, intending to obtain or retain work for himself/ itself, or to obtain or retain

an advantage in the conduct of profession for himself/ itself.

Remuneration and Costs

25. A valuer should provide services for remuneration which is charged in a transparent manner, is

a reasonable reflection of the work necessarily and properly undertaken and is not inconsistent with

the applicable rules.

26. A valuer should not accept any fees or charges other than those which are disclosed to and

approved by the persons fixing his/ its remuneration.

Occupation, employability and restrictions

27. A valuer should refrain from accepting too many assignments, if he/it is unlikely to be able to

devote adequate time to each of his/ its assignments.

28. A valuer should not engage in any employment, except when he has temporarily surrendered

his certificate of membership with the Valuation professional Organisation with which he is

registered.

29. A valuer should not conduct business which in the opinion of the Registration Authority is

inconsistent with the reputation of the profession.

10. PRECAUTIONS NEED TO BE TAKEN BY A VALUER

BEFORE ACCEPTING ANY VALUATION ASSIGNMENT

It should be evidently clear to the valuation professional as well as to the end consumer that a good

valuation is much more than just numbers. While it is critical to get the maths and application right-

however it is equally important to have a comprehensive understanding of the narrative behind the

valuation. Attention should be given to the following points while making a valuation:

1. A good valuation does not provide a precise estimate of value. A valuation by necessity involves

many assumptions and is a professional estimate of value. The quality and veracity of a good

valuation model does not depend just on number crunching. The quality of a valuation will be directly

proportional to the time spent in collecting the data and in understanding the firm being valued.

2. Valuing a company is much more than evaluating the financial statements of a company and

estimating an intrinsic value based on numbers. This concept is getting more and more critical in

today’s day and age where most emerging business are valued not on their historical performances

captured in the financial statement but rather on a narrative driven factors like scalability, ease of

replication, growth potential, cross sell opportunities etc.

© The Institute of Chartered Accountants of India

2.32

5.32 ADVANCED FINANCIAL MANAGEMENT

3. More often than not, investors/users tend to focus on either numbers or the story without

attempting to reach a middle ground. In both these cases, investors will fail to capture opportunities

that could have been unlocked had they been willing to reach some middle ground between the two

concepts.

4. While it is true that a robust intrinsic value calculation using financial statements data and an

error-free model makes investing a more technical subject, in reality, emotions play a massive role

in moving stocks higher or lower. Not accounting for this fact, therefore, could become an obstacle

in consistently getting the valuation right.

TEST YOUR KNOWLEDGE

Theoretical Questions

1. Why should the duration of a coupon carrying bond always be less than the time to its

maturity?

2. Write short notes on Zero Coupon Bonds.

Practical Questions

1. A company has a book value per share of ` 137.80. Its return on equity is 15% and it follows

a policy of retaining 60% of its earnings. If the Opportunity Cost of Capital is 18%, compute

is the price of the share today using both Dividend Growth Model and Walter’s Model.

2. ABC Limited’s shares are currently selling at ` 13 per share. There are 10,00,000 shares

outstanding. The firm is planning to raise ` 20 lakhs to Finance a new project.

Required:

What are the ex-right price of shares and the value of a right, if

(i) The firm offers one right share for every two shares held.

(ii) The firm offers one right share for every four shares held.

(iii) How does the shareholders’ wealth (holding 100 shares) change from (i) to (ii)? How

does right issue increases shareholders’ wealth?

3. MNP Ltd. has declared and paid annual dividend of ` 4 per share. It is expected to grow @

20% for the next two years and 10% thereafter. The required rate of return of equity investors

is 15%. Compute the current price at which equity shares should sell.

Note: Present Value Interest Factor (PVIF) @ 15%:

For year 1 = 0.8696;

For year 2 = 0.7561

© The Institute of Chartered Accountants of India

SECURITY VALUATION 2.33 5.33

4. On the basis of the following information:

Current dividend (Do) = ` 2.50

Discount rate (k) = 10.5%

Growth rate (g) = 2%

(i) Calculate the present value of stock of ABC Ltd.

(ii) Is its stock overvalued if stock price is ` 35, ROE = 9% and EPS = ` 2.25? Show

detailed calculation. Using PE Multiple Approach and Earning Growth Model.

5. X Limited, just declared a dividend of ` 14.00 per share. Mr. B is planning to purchase the

share of X Limited, anticipating increase in growth rate from 8% to 9%, which will continue

for three years. He also expects the market price of this share to be ` 360.00 after three

years.

You are required to determine:

(i) the maximum amount Mr. B should pay for shares, if he requires a rate of return of

13% per annum.

(ii) the maximum price Mr. B will be willing to pay for share, if he is of the opinion that

the 9% growth can be maintained indefinitely and require 13% rate of return per

annum.

(iii) the price of share at the end of three years, if 9% growth rate is achieved and

assuming other conditions remaining same as in (ii) above.

Calculate rupee amount up to two decimal points.

Year-1 Year-2 Year-3

FVIF @ 9% 1.090 1.188 1.295

FVIF @ 13% 1.130 1.277 1.443

PVIF @ 13% 0.885 0.783 0.693

6. Piyush Loonker and Associates presently pay a dividend of Re. 1.00 per share and has a

share price of ` 20.00.

(i) If this dividend were expected to grow at a rate of 12% per annum forever, what is the

firm’s expected or required return on equity using a dividend-discount model

approach?

(ii) Instead of this situation in part (i), suppose that the dividends were expected to grow

at a rate of 20% per annum for 5 years and 10% per year thereafter. Now what is the

firm’s expected, or required, return on equity?

© The Institute of Chartered Accountants of India

2.34

5.34 ADVANCED FINANCIAL MANAGEMENT

7. Capital structure of Sun Ltd., as at 31.3.2003 was as under:

(` in lakhs)

Equity share capital (` 100 each) 80

8% Preference share capital 40

12% Debentures 64

Reserves 32

Sun Ltd., earns a profit of ` 32 lakhs annually on an average before deduction of income-tax,

which works out to 35%, and interest on debentures.

Normal return on equity shares of companies similarly placed is 9.6% provided:

(a) Profit after tax covers fixed interest and fixed dividends at least 3 times.

(b) Capital gearing ratio is 0.75.

(c) Yield on share is calculated at 50% of profits distributed and at 5% on undistributed

profits.

Sun Ltd., has been regularly paying equity dividend of 8%.

Compute the value per equity share of the company assuming:

(i) 1% for every one time of difference for Interest and Fixed Dividend Coverage.

(ii) 2% for every one time of difference for Capital Gearing Ratio.

8. ABC Ltd. has been maintaining a growth rate of 10 percent in dividends. The company has

paid dividend @ ` 3 per share. The rate of return on market portfolio is 12 percent and the

risk free rate of return in the market has been observed as 8 percent. The Beta co-efficient of

company’s share is 1.5.

You are required to calculate the expected rate of return on company’s shares as per CAPM

model and equilibrium price per share by dividend growth model.

9. A Company pays a dividend of ` 2.00 per share with a growth rate of 7%. The risk free rate

is 9% and the market rate of return is 13%. The Company has a beta factor of 1.50. However,

due to a decision of the Finance Manager, beta is likely to increase to 1.75. Find out the

present as well as the likely value of the share after the decision.

10. Calculate the value of share from the following information:

Profit after tax of the company ` 290 crores

Equity capital of company ` 1,300 crores

Par value of share ` 40 each

© The Institute of Chartered Accountants of India

SECURITY VALUATION 2.35 5.35

Debt ratio of company (Debt/ Debt + Equity) 27%

Long run growth rate of the company 8%

Beta 0.1; risk free interest rate 8.7%

Market returns 10.3%

Capital expenditure per share ` 47

Depreciation per share ` 39

Change in Working capital ` 3.45 per share

11. Shares of Voyage Ltd. are being quoted at a price-earning ratio of 8 times. The company

retains ` 5 per share which is 45% of its Earning Per Share.

You are required to compute

(i) The cost of equity to the company if the market expects a growth rate of 15% p.a.

(ii) If the anticipated growth rate is 16% per annum, calculate the indicative market price

with the same cost of capital.

(iii) If the company's cost of capital is 20% p.a. & the anticipated growth rate is 19% p.a.,

calculate the market price per share.

12. Following Financial data are available for PQR Ltd. for the year 2008:

(` in lakh)

8% debentures 125

10% bonds (2007) 50

Equity shares (` 10 each) 100

Reserves and Surplus 300

Total Assets 600

Assets Turnovers ratio 1.1

Effective interest rate 8%

Effective tax rate 40%

Operating margin 10%

Dividend payout ratio 16.67%

Current market Price of Share ` 14

Required rate of return of investors 15%

© The Institute of Chartered Accountants of India

2.36

5.36 ADVANCED FINANCIAL MANAGEMENT

You are required to:

(i) Draw income statement for the year

(ii) Calculate its sustainable growth rate of earnings

(iii) Calculate the fair price of the Company's share using dividend discount model, and