Correction of Errors

Correction of Errors

Uploaded by

Nerissa BulagsakCopyright:

Available Formats

Correction of Errors

Correction of Errors

Uploaded by

Nerissa BulagsakCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Correction of Errors

Correction of Errors

Uploaded by

Nerissa BulagsakCopyright:

Available Formats

CORRECTION OF ERRORS Accruals & Deferrals (Failure to

record adjustments)

Assets (Debiting a capitalizable

The presence of error in the recorded

assets as nondepreciable assets or as

accounting data will have an effect in the

an expense)

measurement, determination, and

Revenues (Crediting revenues as

evaluation of performance and financial

some other forms of accounts with

status of an entity.

credit balance)

When errors are detected, an accountant

should be able to analyze these errors in

order to know what appropriate action

should be taken under the problem at Types of Errors Affecting Both BS

hand. and IS

Errors can be discovered during the Counterbalancing Error

accounting process itself or during the Non-counterbalancing Eroor

audit process.

COUNTERBALANCING ERRORS

CURRENT PERIOD ERRORS

Counterbalancing Errors are those which

Statement of Financial Position when not detected within the subsequent

Some errors made during the recording financial year in which the errors are

process can only affect balance sheet committed, are automatically corrected as a

accounts. natural part of the account process.

When these errors are detected, entries

can simply be made to correct the A correcting journal entry is necessary for

account balances. Since they are real any counterbalancing error that is detected

accounts, there are no implications on before it has counterbalanced.

accounts that close at the end of an

accounting period. Inventories (Overstatement and

Understatement)

Notes Receivable debited as Accounts Accruals and Deferrals (Omission or

Payable (Reclassification) failure to adjust)

Interest payable credited as salaries *Cash Basis, off-sets, RE of Year 2 is correct

payable (Reclassification)

Statement of Income

Although reclassification is required,

these kinds of errors do not affect the

amount of profit for the period in

consideration

Misclassification of items

Interest Revenue erroneously included

as sales revenue

Interest income being credited as

dividend income

However, if these misclassifications Non-counterbalancing Errors are errors

happened in a previous accounting that are not automatically corrected or offset

period would have to be corrected in the next accounting period.

through item reclassification.

A correcting journal entry is necessary for a

PRIOR PERIOD ERRORS non-counterbalancing error.

Most errors however, affect both BS and

IS items Erroneous Capital Expenditures

Inventory (Overstatement or Erroneous Revenue Recognition

Understatement) Omission of Depreciation Chargers

You might also like

- 8-m MasteryDocument3 pages8-m Masteryapi-3171855140% (2)

- Adjustments Quiz 2Document6 pagesAdjustments Quiz 2Loey ParkNo ratings yet

- 0129450730004260Document3 pages0129450730004260Deependra Singh100% (1)

- On December 31, 20x1, ABC Has Total Expenses of P1,000,000 Before Possible Adjustment For The FollowingDocument12 pagesOn December 31, 20x1, ABC Has Total Expenses of P1,000,000 Before Possible Adjustment For The FollowingKim Cristian MaañoNo ratings yet

- Transaction Cycles - Test of Controls and Substantive Tests of TransactionsDocument9 pagesTransaction Cycles - Test of Controls and Substantive Tests of TransactionsfeNo ratings yet

- Accounting CycleDocument21 pagesAccounting CycleJc GappiNo ratings yet

- CH 13Document33 pagesCH 13hamdanmakNo ratings yet

- Adjusting Entries Sample ProblemsDocument2 pagesAdjusting Entries Sample ProblemsReese KimNo ratings yet

- Pfrs 7 Financial Instruments DisclosuresDocument3 pagesPfrs 7 Financial Instruments DisclosuresR.A.No ratings yet

- FAR 44 ACCOUNTING PROCESS - Student 2Document11 pagesFAR 44 ACCOUNTING PROCESS - Student 2cherylsujede4No ratings yet

- Auditing and Assurance: Specialized Industries - Midterm ExaminationDocument14 pagesAuditing and Assurance: Specialized Industries - Midterm ExaminationHannah Sy100% (1)

- College of Business and Management: Central Mindanao University Department of AccountancyDocument11 pagesCollege of Business and Management: Central Mindanao University Department of AccountancyErwin Dave M. DahaoNo ratings yet

- Audit Planning and MaterialityDocument11 pagesAudit Planning and MaterialityTigRao UlyMelNo ratings yet

- Chapter 5 Corporate Liquidation & ReorganizationDocument8 pagesChapter 5 Corporate Liquidation & ReorganizationMikaella BengcoNo ratings yet

- Sas Certified Accounting Technician Level 1 Module 2Document29 pagesSas Certified Accounting Technician Level 1 Module 2Plame GaseroNo ratings yet

- MAS 2 Prelim Exam To PrintDocument3 pagesMAS 2 Prelim Exam To PrintJuly LumantasNo ratings yet

- Materials Comprehensive AUd TheoryDocument15 pagesMaterials Comprehensive AUd TheoryAnonymous EgTu8E6O100% (1)

- c7 Review QuestionsDocument5 pagesc7 Review QuestionsPauline100% (1)

- Audit Rev. 3Document4 pagesAudit Rev. 3Charles PolidoNo ratings yet

- 2C. NPO Hospitals - PPTDocument18 pages2C. NPO Hospitals - PPTJSNo ratings yet

- FM 1 Assignment 1Document3 pagesFM 1 Assignment 1Jelly Ann AndresNo ratings yet

- Accounting Research EssayDocument4 pagesAccounting Research EssayInsatiable LifeNo ratings yet

- 03 - Partnership DissolutionDocument38 pages03 - Partnership DissolutionDonise Ronadel SantosNo ratings yet

- Pfrs 1 - First-Time Adoption of PfrssDocument14 pagesPfrs 1 - First-Time Adoption of PfrssAdrianIlaganNo ratings yet

- The Environment of Financial Accounting and ReportingDocument12 pagesThe Environment of Financial Accounting and ReportingJi Baltazar100% (1)

- Ia3 - Chapter 1Document8 pagesIa3 - Chapter 1chesca marie penarandaNo ratings yet

- Exercises On Closing Entries & Reversing EntriesDocument3 pagesExercises On Closing Entries & Reversing EntriesRoy BonitezNo ratings yet

- Substantive TestsDocument2 pagesSubstantive TestsLeny Lyn AnihayNo ratings yet

- BEP Sums QuestionsDocument7 pagesBEP Sums QuestionsPavan AcharyaNo ratings yet

- Sample Exam 2Document16 pagesSample Exam 2Zenni T XinNo ratings yet

- At.2503 Audit Evidence and Documentation The FrameworkDocument43 pagesAt.2503 Audit Evidence and Documentation The Frameworkawesome bloggersNo ratings yet

- A Case Study On TH Factors Influencing BS Accountancy Students Decision To Pursue Another Program Evidence in BPSU 2Document1 pageA Case Study On TH Factors Influencing BS Accountancy Students Decision To Pursue Another Program Evidence in BPSU 2Melanie AgustinNo ratings yet

- Fundamentals of Accounting MODULE 3Document31 pagesFundamentals of Accounting MODULE 3amnesia girlNo ratings yet

- Basic Accounting ExamDocument8 pagesBasic Accounting ExamMikaela SalvadorNo ratings yet

- Chapter 10 - Business Combinations: Review QuestionsDocument8 pagesChapter 10 - Business Combinations: Review QuestionsShek Kwun HeiNo ratings yet

- Level of Knowledge in Financial Recording and Reporting of Student Organizations' Treasurers in Saint Mary'S UniversityDocument25 pagesLevel of Knowledge in Financial Recording and Reporting of Student Organizations' Treasurers in Saint Mary'S UniversityJane GoodNo ratings yet

- Answers R41920 Acctg Varsity Basic Acctg Level 2Document12 pagesAnswers R41920 Acctg Varsity Basic Acctg Level 2John AceNo ratings yet

- STNR DecisionsDocument10 pagesSTNR DecisionsHassan AdamNo ratings yet

- Introduction To Transaction ProcessingDocument6 pagesIntroduction To Transaction ProcessingmafeNo ratings yet

- Management Advisory Services by Agamata Answer KeyDocument11 pagesManagement Advisory Services by Agamata Answer KeyLeon Genaro Naraga0% (1)

- Interim Financial ReportingDocument3 pagesInterim Financial ReportingHalina Valdez100% (1)

- Comprehensive Problem Master BudgetDocument1 pageComprehensive Problem Master BudgethdejnNo ratings yet

- Quiz No. 3 AFARDocument3 pagesQuiz No. 3 AFARPhilip LarozaNo ratings yet

- Assets Liabilities Owner'S Equity Income ExpensesDocument2 pagesAssets Liabilities Owner'S Equity Income ExpensesRalph Christer Maderazo0% (1)

- What Is AccountingDocument76 pagesWhat Is AccountingMa Jemaris Solis0% (1)

- Quiz On Chapter 13 Answer KeyDocument2 pagesQuiz On Chapter 13 Answer KeyCindy BitongNo ratings yet

- Operations Auditing: Audi26Document19 pagesOperations Auditing: Audi26Pricia AbellaNo ratings yet

- Cash and Accrual BasisDocument3 pagesCash and Accrual Basisattiva jade100% (1)

- CH 6 Audit of Conversion CycleDocument24 pagesCH 6 Audit of Conversion Cyclerogealyn100% (1)

- Objective: Ias 33 Earnings Per ShareDocument5 pagesObjective: Ias 33 Earnings Per ShareNadeem Sattar0% (1)

- Effectiveness of Internal Conrol Sysyems in Safeguarding InventoryDocument9 pagesEffectiveness of Internal Conrol Sysyems in Safeguarding Inventoryraymart copiarNo ratings yet

- 002 SHORT QUIZ - Code of Ethics - ACTG411 Assurance Principles, Professional Ethics & Good GovDocument1 page002 SHORT QUIZ - Code of Ethics - ACTG411 Assurance Principles, Professional Ethics & Good GovMarilou PanisalesNo ratings yet

- 4 Chap 1 Audit An Overview RevDocument29 pages4 Chap 1 Audit An Overview RevJoen SinamagNo ratings yet

- Far Chapter 1 8Document26 pagesFar Chapter 1 8Elijah Jian NaresNo ratings yet

- Management Advisory Services Antonio Jaramillo Dayag Management Accounting - Cost ConceptsDocument5 pagesManagement Advisory Services Antonio Jaramillo Dayag Management Accounting - Cost ConceptsNaddieNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document33 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- 2022-2023 INTACC3 PAS 1 HandoutsDocument9 pages2022-2023 INTACC3 PAS 1 HandoutsJefferson AlingasaNo ratings yet

- Multiple ChoiceDocument6 pagesMultiple Choicetough mamaNo ratings yet

- Trial Balance and Accounting Errors: ModuleDocument17 pagesTrial Balance and Accounting Errors: ModuleCharming MakaveliNo ratings yet

- Lesson 5.adjusting Entries and Adjusted Trial BalanceDocument5 pagesLesson 5.adjusting Entries and Adjusted Trial BalanceDacer, Rhycheall HeartNo ratings yet

- 320 Accountancy Eng Lesson12Document18 pages320 Accountancy Eng Lesson12Karen Joy RevadonaNo ratings yet

- Financial Statements Recognition Disclosure: Error CorrectionDocument9 pagesFinancial Statements Recognition Disclosure: Error CorrectionWild FlowerNo ratings yet

- 3 Recording Business TransactionsDocument8 pages3 Recording Business TransactionstinolasrflNo ratings yet

- Far ReviewerDocument2 pagesFar ReviewerNerissa BulagsakNo ratings yet

- Case Study 2Document1 pageCase Study 2Nerissa BulagsakNo ratings yet

- Case 1Document1 pageCase 1Nerissa BulagsakNo ratings yet

- ScriptDocument5 pagesScriptNerissa BulagsakNo ratings yet

- PFRS 16Document2 pagesPFRS 16Nerissa BulagsakNo ratings yet

- Hilton CH 6 Select SolutionsDocument19 pagesHilton CH 6 Select SolutionsRaymondSinegar100% (1)

- PDFDocument1 pagePDFAlex AlexNo ratings yet

- A/c #:1083851501004133 A/c #:1083851501004133 A/c #:1083851501004133Document1 pageA/c #:1083851501004133 A/c #:1083851501004133 A/c #:1083851501004133Faisal AminNo ratings yet

- Preview Copy Do MSTC Lko 24-25 1107Document2 pagesPreview Copy Do MSTC Lko 24-25 1107AshwaniSinghNo ratings yet

- ADB Annual Report 2006Document301 pagesADB Annual Report 2006Asian Development BankNo ratings yet

- Making Competition Work For You in ConstructionDocument28 pagesMaking Competition Work For You in ConstructionChris FindlayNo ratings yet

- Bar Questions in Negotiable InstrumentDocument21 pagesBar Questions in Negotiable InstrumentLIBEREIZ SUAREZNo ratings yet

- Checklist For Pro Gap StrategyDocument2 pagesChecklist For Pro Gap StrategyvivekNo ratings yet

- Rajat Gupta CaseDocument16 pagesRajat Gupta CaseGanesh Surve100% (1)

- February 21, 2014 Strathmore TimesDocument28 pagesFebruary 21, 2014 Strathmore TimesStrathmore TimesNo ratings yet

- AEZ Kesar Maharashtra StateDocument2 pagesAEZ Kesar Maharashtra StateAmol RautNo ratings yet

- Mirare Asset Emerging Bluechip FolioDocument4 pagesMirare Asset Emerging Bluechip FoliokarlNo ratings yet

- Biller Code: Ref-1: Ref-2: Jompay Online at Internet and Mobile Banking With YourDocument1 pageBiller Code: Ref-1: Ref-2: Jompay Online at Internet and Mobile Banking With YourDalila DyleaNo ratings yet

- A. General Information: Sherif - Samy@efsa - Gov.egDocument18 pagesA. General Information: Sherif - Samy@efsa - Gov.egCyrus SantosNo ratings yet

- IMF Article IV Report On ItalyDocument68 pagesIMF Article IV Report On ItalyYannis KoutsomitisNo ratings yet

- Lec 3 AFM Types of CorporationsDocument47 pagesLec 3 AFM Types of CorporationsJunaidNo ratings yet

- NCP 29Document18 pagesNCP 29aksNo ratings yet

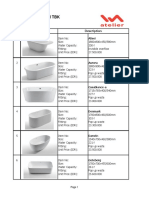

- Price List Acrylic Bathtub 01.02.23Document3 pagesPrice List Acrylic Bathtub 01.02.23Khansa AnastyaNo ratings yet

- GST Invoice Format No. 12Document1 pageGST Invoice Format No. 12Arindam ChandaNo ratings yet

- Saving, Spending, & BudgetingDocument32 pagesSaving, Spending, & BudgetingMa'am Katrina Marie MirandaNo ratings yet

- "An Analytical Study of Leverages of Tata Capital Financial Services LTD" (For The Period OF 2017-2020)Document11 pages"An Analytical Study of Leverages of Tata Capital Financial Services LTD" (For The Period OF 2017-2020)Prashant GAidhaneNo ratings yet

- Unit-1 Indian Partneship ActDocument8 pagesUnit-1 Indian Partneship Actagarwalpawan1No ratings yet

- Security Analysis & Portfolio ManagementDocument25 pagesSecurity Analysis & Portfolio ManagementKaneNo ratings yet

- Investor Presentation (Company Update)Document39 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- 05 - TMF Mauritius Limited - Ubo Information SheetDocument3 pages05 - TMF Mauritius Limited - Ubo Information Sheetchung elaineNo ratings yet

- Auditing Gray 2015 CH 15 Assurance Engagements Internal AuditDocument46 pagesAuditing Gray 2015 CH 15 Assurance Engagements Internal AuditAdzhana AprillaNo ratings yet

- A-Level Accounting PDFDocument11 pagesA-Level Accounting PDFTawanda B MatsokotereNo ratings yet