PremiumRept MDS - Ramesh

PremiumRept MDS - Ramesh

Uploaded by

navengg521Copyright:

Available Formats

PremiumRept MDS - Ramesh

PremiumRept MDS - Ramesh

Uploaded by

navengg521Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

PremiumRept MDS - Ramesh

PremiumRept MDS - Ramesh

Uploaded by

navengg521Copyright:

Available Formats

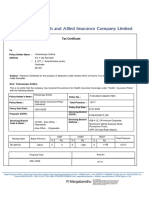

Premium Receipt

Dear MR. Pitta Ramesh Kumar

4-125/3 RAMALAYAM STREET,

PALURU,ATTILI MANDAL,

WEST GODAVARI

ANDHRA PRADESH -534134

We acknowledge the receipt of payment towards the premium of the following health insurance policy:

Policyholder Name Mr. Pitta Ramesh Kumar Policy Number 31507464202100

Product Name ReAssure Plan Opted Family Floater Base Sum Insured 5,00,000

Policy Commencement Date # 08/04/2022 Policy Expiry Date 07/04/2023

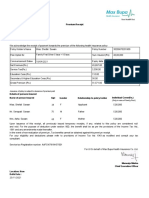

Premium Calculation:

(A) Premium (Rs.) – Base Product 23,865.00

(B) Premium (Rs.) – Personal Accident Cover 0.00

(C) Premium (Rs.) – Safeguard 0.00

(D) Premium (Rs.) – Hospital Cash 0.00

Underwriting Loading (Rs.) 0.00

Total Discount (Rs.) 0.00

Net Premium / Taxable value (Rs.) 23,865.00

Integrated Goods and Service Tax (18.00 %) 4,295.70

Central Goods and Service Tax (0.00 %) 0.00

State/UT Goods and Service Tax (0.00 %) 0.00

Gross Premium (Rs.) 28,161.00

#

Issuance of policy is subject to clearance of premium paid

Details of persons Insured:

Name of Person Insured Age Gender Relationship

Mr. Pitta Ramesh Kumar 30 Male Applicant

Upon issuance of this receipt, all previously issued temporary receipts, if any, related to this policy are considered null and void. For the

purpose of deduction under section 80D The benefit shall be as per the provisions of the Income Tax Act, 1961 and any amendments made

thereafter.

You may get tax benefits up to Rs. 28,161.00. subject to maximum permissible limits applicable under Income Tax Act 1961 as modified

from time to time. For more details, kindly consult your tax advisor. In the event of non-realization of premium, benefits cannot be obtained

against this premium receipt.

For your eligibility and deductions, please refer to provisions of Income Tax Act 1961 as modified and consult your tax consultant.

Product Name: ReAssure | Product UIN: MAXHLIP21060V012021

GSTI No.: 07AAFCM7916H1ZA SAC Code / Type of Service : 997133 / General Insurance Services

Max Bupa State Code: 7 Customer State Code / Customer GSTI No.: 37 /NA

Policy issuing office: Delhi, Consolidated Stamp Duty deposited as per the order of Government of National Capital Territory of Delhi.

Location: New Delhi Director - Operations & Customer Service

Date: 08/04/2022 For and on behalf of Max BupaHealth Insurance Company Limited

Product Name: ReAssure | Product UIN: MAXHLIP21060V012021

You might also like

- Education Loan - Interest Certificate FY23Document1 pageEducation Loan - Interest Certificate FY23Marzook SuhailNo ratings yet

- Premium ReceiptDocument1 pagePremium Receiptkarthink123100% (1)

- KasthuriDocument1 pageKasthuriYazh EnterpriseNo ratings yet

- Sistema Electrico Ford-Freestyle - 2006 - EN - Manual - de - Taller - Diagrama - Electrico - 132d5e7f2aDocument143 pagesSistema Electrico Ford-Freestyle - 2006 - EN - Manual - de - Taller - Diagrama - Electrico - 132d5e7f2aCarlos Ortega Martinez100% (1)

- 80D CertificateDocument2 pages80D CertificateYogy YNo ratings yet

- Received With Thanks ' 9,971.00 Through Payment Gateway Over The Internet FromDocument1 pageReceived With Thanks ' 9,971.00 Through Payment Gateway Over The Internet FromamitNo ratings yet

- NPS CertificateDocument2 pagesNPS CertificateSatish Tiwari100% (1)

- 80D.pdf-Piyush - Copy 3Document1 page80D.pdf-Piyush - Copy 3Saurabh RaghuvanshiNo ratings yet

- 80D Pdf-AnkitDocument1 page80D Pdf-AnkitSaurabh RaghuvanshiNo ratings yet

- ICICI Premium - HemavathyDocument2 pagesICICI Premium - HemavathyAshok SNo ratings yet

- HDFC Life Premium Receipts Nov 2022Document1 pageHDFC Life Premium Receipts Nov 2022kapsekunalNo ratings yet

- Bajaj Cash Assure Renewal Receipt PDFDocument1 pageBajaj Cash Assure Renewal Receipt PDFPawan KumarNo ratings yet

- Donation Detail Partner Ngo Program Donation Giveindia Retention TotalDocument1 pageDonation Detail Partner Ngo Program Donation Giveindia Retention TotalHarshit SinghNo ratings yet

- Reg No: Dl8Cav0116: Registration Certificate For VehicleDocument1 pageReg No: Dl8Cav0116: Registration Certificate For Vehicleh4ckerNo ratings yet

- PremiumRept FamilyDocument2 pagesPremiumRept Familynavengg521No ratings yet

- Parents Insurance PremiumDocument1 pageParents Insurance Premiumprajeesh.vijayanNo ratings yet

- Medical Premium Receipt SelfDocument1 pageMedical Premium Receipt SelfRakesh AggarwalNo ratings yet

- Aditya Life InsuranceDocument2 pagesAditya Life InsuranceMirzaNo ratings yet

- 80D SelfDocument1 page80D Selfnikhil nadakuditiNo ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuTrollstyleNo ratings yet

- Consolidated Premium Paid STMT 2020-2021 PDFDocument1 pageConsolidated Premium Paid STMT 2020-2021 PDFSHITESH KUMARNo ratings yet

- Birla Premium Paid Certificate 2020Document2 pagesBirla Premium Paid Certificate 2020SindhuNo ratings yet

- Tax Certificate - of Anjali Lalwani PDFDocument2 pagesTax Certificate - of Anjali Lalwani PDFBasant GakhrejaNo ratings yet

- Premium CertificateDocument2 pagesPremium CertificateKamsiddha KhandekarNo ratings yet

- LIC Aug 2020 PDFDocument1 pageLIC Aug 2020 PDFShantanu MetayNo ratings yet

- Individual Premium Paid STMTDocument1 pageIndividual Premium Paid STMTGanesh SlvNo ratings yet

- ELSS Investment ReceiptDocument2 pagesELSS Investment ReceiptAnindya SundarNo ratings yet

- Premium Paid Certificate: Date: 14-DEC-2017Document1 pagePremium Paid Certificate: Date: 14-DEC-2017zuhebNo ratings yet

- Preventive Health Check Up Receipt PDFDocument41 pagesPreventive Health Check Up Receipt PDFsan mohNo ratings yet

- HDFC ERGO General Insurance Company LimitedDocument3 pagesHDFC ERGO General Insurance Company LimitedAnish ShahNo ratings yet

- LIC Premium Jan 2023Document4 pagesLIC Premium Jan 2023Akriti SinghNo ratings yet

- PDFDocument3 pagesPDFKritarth KapoorNo ratings yet

- Renewal of Your Ican Essential Advanced Insurance PolicyDocument3 pagesRenewal of Your Ican Essential Advanced Insurance PolicySuganthi ChandrasekaranNo ratings yet

- Consolidated Premium Paid STMT 2012-2013Document1 pageConsolidated Premium Paid STMT 2012-2013jahmeddNo ratings yet

- 80D CertificateDocument2 pages80D CertificateSiva KadaliNo ratings yet

- Group Activ Travel - Certificate of Insurance: Insured Person DetailsDocument2 pagesGroup Activ Travel - Certificate of Insurance: Insured Person Detailsabhinay anandNo ratings yet

- Medical InsuranceDocument1 pageMedical InsuranceMasood Ahmad100% (1)

- Max Health InsuranceDocument1 pageMax Health InsuranceanuNo ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuHAJARATHNo ratings yet

- 1865362Document1 page1865362Bhavesh ParekhNo ratings yet

- Sam Park DocumentDocument4 pagesSam Park DocumentShahadNo ratings yet

- Group Mediprime Certificate of Insurance: 380-Bsa-Dn188271Document4 pagesGroup Mediprime Certificate of Insurance: 380-Bsa-Dn188271Sangwan ParveshNo ratings yet

- PremiumReceipt PR0941870700012324Document2 pagesPremiumReceipt PR0941870700012324gjsivakumarNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2952 2007 9281 0602 001Document3 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2952 2007 9281 0602 001Deena DayalanNo ratings yet

- 40k Elss Mutual FundDocument1 page40k Elss Mutual FundSachin Khamitkar100% (1)

- 80D SelfDocument1 page80D Selfnikhil nadakuditiNo ratings yet

- Subject: Risk Assumption Letter: LAN Number: 19020618531140 Policy Number: 4111/EPP/164559158/00/000Document2 pagesSubject: Risk Assumption Letter: LAN Number: 19020618531140 Policy Number: 4111/EPP/164559158/00/000shekarNo ratings yet

- Your Renewal Premium Receipt (Provisional) : Receipt Number: OT007932427 Date: 02-03-2019Document2 pagesYour Renewal Premium Receipt (Provisional) : Receipt Number: OT007932427 Date: 02-03-2019Ritik Goyal100% (1)

- Statement of Public Provident Fund Account: Ms - Neha Raghubar YadavDocument2 pagesStatement of Public Provident Fund Account: Ms - Neha Raghubar YadavNeha100% (1)

- Abhay KumarDocument5 pagesAbhay KumarSunil SahNo ratings yet

- Discovery Fund Premium ReceiptsDocument1 pageDiscovery Fund Premium ReceiptsKartikNo ratings yet

- Star Health Cover NoteDocument3 pagesStar Health Cover NoteLakshya MittalNo ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance PolicyNikky KapoorNo ratings yet

- Backup of Gopal InsurenceDocument5 pagesBackup of Gopal Insurencemkm969No ratings yet

- Parents Insurance TaxDocument1 pageParents Insurance Taxdev77729100% (1)

- U200586078 New PDFDocument1 pageU200586078 New PDFKoushik DuttaNo ratings yet

- Max Bupa Premium Reeipt Parents PDFDocument1 pageMax Bupa Premium Reeipt Parents PDFSatyaNo ratings yet

- Krishna Sbi Life Policy Term InsuranceDocument36 pagesKrishna Sbi Life Policy Term Insurancekrishna_1238No ratings yet

- Intermediary Code CO0000000062 Akshaya Wealth Management PVT - LTD Phone No 080-26535701/02/8026535701 E-Mail Id Services@AkshayaweaDocument4 pagesIntermediary Code CO0000000062 Akshaya Wealth Management PVT - LTD Phone No 080-26535701/02/8026535701 E-Mail Id Services@Akshayaweapushpkant kumarNo ratings yet

- Medical Insurance Policy ParentsDocument1 pageMedical Insurance Policy Parentssivavm4No ratings yet

- Fri Sep 20 12 - 44 - 02 GMT+05 - 30 2024 - 33483899202300 - Tax - ReceiptDocument1 pageFri Sep 20 12 - 44 - 02 GMT+05 - 30 2024 - 33483899202300 - Tax - Receipthemarohi175No ratings yet

- PDF Version Finalised InstructionsDocument2 pagesPDF Version Finalised Instructionsankit satpatiNo ratings yet

- Katalog Krushers 1.1Document8 pagesKatalog Krushers 1.1egasykesNo ratings yet

- MER331 - Lab 1: An Introduction To Uncertainty AnalysisDocument24 pagesMER331 - Lab 1: An Introduction To Uncertainty Analysischemist_tmaNo ratings yet

- MGT603 Strategic Management Solved Questions From Book by David (Chap 2) CDocument5 pagesMGT603 Strategic Management Solved Questions From Book by David (Chap 2) CFan CageNo ratings yet

- A1 - E1-1-to-E1-6 Database SystemDocument7 pagesA1 - E1-1-to-E1-6 Database Systemgebaboc615No ratings yet

- ETECH 2nd QuarterDocument39 pagesETECH 2nd QuarterReynalyn Guerrero0% (1)

- Susy Andriani, Wawan Halwany, Fajar Lestari, Sudin PanjaitanDocument6 pagesSusy Andriani, Wawan Halwany, Fajar Lestari, Sudin PanjaitanSyifaNo ratings yet

- LogDocument115 pagesLogomerkargin34No ratings yet

- PRF - SupplierDocument18 pagesPRF - Supplierdeanwolves16No ratings yet

- FDS Unit 5Document32 pagesFDS Unit 5priyamadan09No ratings yet

- Futures and Options Final TestDocument15 pagesFutures and Options Final TestCarolina SáNo ratings yet

- Estatement 11102024Document4 pagesEstatement 11102024Dek RitaNo ratings yet

- Kumpulan Soal SuggestionDocument19 pagesKumpulan Soal Suggestionsantosolexy100% (1)

- Renewable Energy Sources in FiguresDocument88 pagesRenewable Energy Sources in FiguresJayson LauNo ratings yet

- Sindh Text BookDocument27 pagesSindh Text BookSimren sadiqNo ratings yet

- Wireless LANSDocument3 pagesWireless LANSHOD-DIT PSG-PTCNo ratings yet

- CBLMDocument37 pagesCBLMDTVS Inc.No ratings yet

- Noise HandbookDocument284 pagesNoise HandbookrafieeNo ratings yet

- Is.13054.1991 0 PDFDocument8 pagesIs.13054.1991 0 PDFRakesh MishraNo ratings yet

- ATV NORM LIST Content - Edition - Ma Y20 2008Document6 pagesATV NORM LIST Content - Edition - Ma Y20 2008hamzadakmanNo ratings yet

- User Manual Pulse300Document58 pagesUser Manual Pulse300Kriss GalludNo ratings yet

- Lecture - Software Testing and ApplicationsDocument30 pagesLecture - Software Testing and ApplicationsKaran PatelNo ratings yet

- Chapter - 5 - c.MCQs On Workmen Compensation Act 1923Document4 pagesChapter - 5 - c.MCQs On Workmen Compensation Act 1923S M Mandar100% (1)

- AIRE Carrier48Tca04A12UsersManual310998.128173875Document107 pagesAIRE Carrier48Tca04A12UsersManual310998.128173875Elkin FernandezNo ratings yet

- Procure-to-Pay (Services) : Scenario OverviewDocument17 pagesProcure-to-Pay (Services) : Scenario OverviewYuri SeredaNo ratings yet

- CEHv6 1DayPrepPracticeQuestionsDocument127 pagesCEHv6 1DayPrepPracticeQuestionsElvis Garcia Reyes100% (1)

- Module 1 - Purpose, Scope and Limitation: - IntroductionDocument3 pagesModule 1 - Purpose, Scope and Limitation: - IntroductionCriselito EnigrihoNo ratings yet

- .Examination Hall and Seating Arrangement Application Using PHP PDFDocument7 pages.Examination Hall and Seating Arrangement Application Using PHP PDFhhNo ratings yet

- Employment AgreementDocument2 pagesEmployment Agreementakun cadanganNo ratings yet