AC GST Tax Invoice 1-3

AC GST Tax Invoice 1-3

Uploaded by

divyajeeva1325Copyright:

Available Formats

AC GST Tax Invoice 1-3

AC GST Tax Invoice 1-3

Uploaded by

divyajeeva1325Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

AC GST Tax Invoice 1-3

AC GST Tax Invoice 1-3

Uploaded by

divyajeeva1325Copyright:

Available Formats

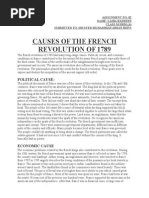

Tax Invoice

ORIGINAL FOR RECIPIENT

Invoice No. Date

RKL24-A000808557 25/01/2024

Transaction Detail : Transaction Category :

RG UnReg

Customer GSTIN No : Place of Supply : Document Type :

N/A Tamil Nadu INVOICE

Customer Name : TIN:

PB Jeevanandham TT2B1222562

Location : PNR No : HSN/SAC Code :

Tamil Nadu TS24010983158293824XRB 996422

Business Name :

N/A

Travel Information Payment Breakup

Bus Operator Name & Address : Bus Fare 1567.50

Si Sugam Travels

Other charges (toll + levies etc) N/A

Origin : Rescheduling charges N/A

Bangalore Rescheduling Excess fare N/A

Additional Services N/A

Operator discount 0.00

Destination : Total Taxable Value 1567.50

Chennai GST u/s 9(5)

IGST @ 5% 0.00

CGST @ 2.5% 41.25

SGST @ 2.5% 41.25

Total Invoice Value 1650.00

Whether Tax is payable under Reverse Charge Mechanism : No

This is a computer generated Invoice and does not require Signature/Stamp.

We hereby declare that though our aggregate turnover in any preceding financial year from 2017-18 onwards is more than the aggregate turnover notified

under sub-rule (4) of rule 48 , we are not required to prepare an invoice in terms of the provisions of the said sub-rule.

* Bus operator is the primary service provider of passenger transportation services. redBus acts only as an intermediary for passenger transportation services. GST on

passenger transportation services is collected and remitted by redBus in the capacity of E-commerce operator as per section 9(5) of the Central Goods and Services Act,

2017 and respective State GST Act. This invoice has been issued by redBus only with a limited purpose to comply with

legal obligations as an e-commerce operator under GST law.

PAN GST NUMBER

AAHCP1178L 33AAHCP1178L1Z7

CIN Service Description

U72900HR2012PTC090199 Passenger transport services

Redbus India Private Limited

Registered Office

(Formerly : Ibibo Group Private Limited)

Redbus 3, 1st floor,, RR Towers III, TVK Industrial Estate, 19th Floor, Epitome Building No. 5, DLF Cyber

Guindy, Chennai, Tamil Nadu, 600032 City, DLF Phase III Gurugram-122002, Haryana

You might also like

- Annex B-1 RR 11-2018 Sworn Statement of Declaration of Gross Sales and ReceiptsDocument1 pageAnnex B-1 RR 11-2018 Sworn Statement of Declaration of Gross Sales and ReceiptsEliza Corpuz Gadon86% (21)

- Carrefour UAE 2020Document1 pageCarrefour UAE 2020Genius icloud50% (2)

- Contract To Sell: (Note: Terms and Conditions Below Are Sample Only, Please Revise)Document3 pagesContract To Sell: (Note: Terms and Conditions Below Are Sample Only, Please Revise)Louie SupapoNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1prasannaNo ratings yet

- VLRTOCHDocument1 pageVLRTOCHakajay17641No ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1srr.vishnuvardhanNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1S.R.ANEESHNo ratings yet

- Ticket 2Document1 pageTicket 2prasannaNo ratings yet

- CHE To BLRDocument1 pageCHE To BLRprasannaNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1Magesh SNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1ml8084138No ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1mmmmmanmathanNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1mohamedansarimt15No ratings yet

- AC GST Tax Invoice 1 (1)Document1 pageAC GST Tax Invoice 1 (1)Padma SundaramNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1Thangam DuraiNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1us22cm085sakthiswariNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1SuriyaprakashNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1avarman85No ratings yet

- AC GST Tax Invoice 1 18.10.24 Emi Akka Team (Nagercoil To Chennai)Document1 pageAC GST Tax Invoice 1 18.10.24 Emi Akka Team (Nagercoil To Chennai)Davin JNo ratings yet

- GokulvlrDocument1 pageGokulvlrakajay17641No ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1Vikas SurveNo ratings yet

- Hosur Chennai 06.09.2024Document1 pageHosur Chennai 06.09.2024mail2prakashk007No ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1Saravanan SubramaniamNo ratings yet

- MuruganchDocument1 pageMuruganchakajay17641No ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1Selva VishnuNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1Indian Actor celebritiesNo ratings yet

- AC_GST_Tax_Invoice_1 (1)Document1 pageAC_GST_Tax_Invoice_1 (1)Vaibhav Verma RastogiNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1summathan3698No ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1bullet hameed khanNo ratings yet

- KKDI To Hosur 01.09.2024Document1 pageKKDI To Hosur 01.09.2024mail2prakashk007No ratings yet

- AC GST Tax InvoiceDocument1 pageAC GST Tax Invoiceanbu.jerome01No ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1venkateshsodisettyNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1dasari babuNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1sai7989821750No ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1smilyyriyasNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1blessingsam.rNo ratings yet

- AC GST Tax InvoiceDocument1 pageAC GST Tax InvoiceMohan.vNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1rakxnachandran96No ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1thalapathytimes65No ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1mohanvinoNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1dhanushramesh89No ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1dasari babuNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1er.mohammadghouse4No ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1kaliraj5050No ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1srjyadav.7985No ratings yet

- AC_GST_Tax_Invoice_1Document1 pageAC_GST_Tax_Invoice_1Manoj SelvamNo ratings yet

- AC GST Tax InvoiceDocument1 pageAC GST Tax InvoicesriramNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1jaindrew1999No ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1secrethub07No ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1ashishshakya30nov1999No ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1satyanarayanakanakala1No ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1imabhayxzNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1sajjamalliswari0703No ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1RavisekharNo ratings yet

- AC GST Tax InvoiceDocument1 pageAC GST Tax InvoiceSonu SahaniNo ratings yet

- Bus TicketDocument1 pageBus TicketChelladurai ANo ratings yet

- AC GST Tax Invoice 1 Return KrishnarajDocument1 pageAC GST Tax Invoice 1 Return KrishnarajBharani VendhanNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1Kiran RNo ratings yet

- Ac GST Cancelled Tax Invoice 1Document1 pageAc GST Cancelled Tax Invoice 1rohithdespacitoNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1sreeharshanNo ratings yet

- BHAS_AC_GST_Tax_Invoice_MDocument1 pageBHAS_AC_GST_Tax_Invoice_MhemrdyNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1vighnarthaagency2255No ratings yet

- Endole - Eazy Insure LTD - Comprehensive ReportDocument17 pagesEndole - Eazy Insure LTD - Comprehensive ReportAgency Staff 1No ratings yet

- Winternitz Associates Insurance Brokers Corporation v. CIRDocument11 pagesWinternitz Associates Insurance Brokers Corporation v. CIRPrincess FaithNo ratings yet

- 2021.11.11 - ADB - LVC Final Report - V 8 - CompletedDocument212 pages2021.11.11 - ADB - LVC Final Report - V 8 - CompletedThelita Pelii100% (1)

- Assignment 2Document2 pagesAssignment 2labiangelNo ratings yet

- CGT Reliefs FA 20Document17 pagesCGT Reliefs FA 20Gayathri SudheerNo ratings yet

- (NR95129WM01) Ti 3352 2023 24Document1 page(NR95129WM01) Ti 3352 2023 24maneesh.bnlNo ratings yet

- CRPFDocument1 pageCRPFRaj MasterNo ratings yet

- Invoice CT-2232849Document3 pagesInvoice CT-2232849ABALUNo ratings yet

- Psba Topic OutlineDocument3 pagesPsba Topic OutlineRodmae VersonNo ratings yet

- Take Home Exercise No 4 - Salaries Tax Computation (2023S)Document3 pagesTake Home Exercise No 4 - Salaries Tax Computation (2023S)何健珩No ratings yet

- Epaper 31 August 2023Document32 pagesEpaper 31 August 2023gerald majoniNo ratings yet

- Huami Amazfit GTS AMOLED Smartwatch: Grand Total 5367.00Document1 pageHuami Amazfit GTS AMOLED Smartwatch: Grand Total 5367.00Mathi ShankarNo ratings yet

- Income Which Do Not Form Part of Total Income: HapterDocument33 pagesIncome Which Do Not Form Part of Total Income: HapterAleti NithishNo ratings yet

- Special Audit in Manufacturing Company: Internship ReportDocument44 pagesSpecial Audit in Manufacturing Company: Internship ReportAdnanNo ratings yet

- Analysis of Procter & Gamble Company's Business StrategyDocument7 pagesAnalysis of Procter & Gamble Company's Business StrategyAbid KhawajaNo ratings yet

- ENTRE 2 - Test ADocument3 pagesENTRE 2 - Test AQuinn De CastroNo ratings yet

- Input Tax Credits - VAT Canada!Document13 pagesInput Tax Credits - VAT Canada!Ali AyubNo ratings yet

- Tax Info - Au PairsDocument6 pagesTax Info - Au Pairsvitoriamodena556No ratings yet

- Liddell and Co. Vs The Collector of Internal RevenueDocument1 pageLiddell and Co. Vs The Collector of Internal RevenueEKANGNo ratings yet

- Land Purchase Tips From James Adhikaram MD REALUTIONZ - The No.1 Land Consultants in South India 9447464502Document58 pagesLand Purchase Tips From James Adhikaram MD REALUTIONZ - The No.1 Land Consultants in South India 9447464502James AdhikaramNo ratings yet

- Architectural Thesis Manual 003Document14 pagesArchitectural Thesis Manual 003bhavesh shettyNo ratings yet

- InvoiceDocument2 pagesInvoiceamalNo ratings yet

- Dictionary of American History 3rd Vol 08 PDFDocument603 pagesDictionary of American History 3rd Vol 08 PDFaNo ratings yet

- Summary of Audit & Assurance Application Level - Self Test With Immediate AnswerDocument72 pagesSummary of Audit & Assurance Application Level - Self Test With Immediate AnswerIQBAL MAHMUDNo ratings yet

- hrisPayrollSlip2.rpt 221013919 2301005406Document1 pagehrisPayrollSlip2.rpt 221013919 2301005406Leidegay AnicoyNo ratings yet

- OD430285905114666100Document4 pagesOD430285905114666100aritrapanja8No ratings yet

- LIC S Jeevan Akshay VII - Policy Document - WebsiteDocument22 pagesLIC S Jeevan Akshay VII - Policy Document - Websitechandra sekhar ANo ratings yet