0 ratings0% found this document useful (0 votes)

34 viewsPLOT NO. 2-74 - GIDC Halol

PLOT NO. 2-74 - GIDC Halol

Uploaded by

rcvbrd06This document is a status letter from the Gujarat Industrial Development Corporation to Spring Well Industries regarding an industrial plot in Halol, Gujarat. It summarizes the outstanding dues as of October 11, 2023 totaling Rs. 46668, which includes charges for service, infrastructure fund, interest on revenue, and more. It provides instructions that in case of payment discrepancies to submit the transaction receipt number and date, and that interest on outstanding revenue charges is 1% per month.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

PLOT NO. 2-74 - GIDC Halol

PLOT NO. 2-74 - GIDC Halol

Uploaded by

rcvbrd060 ratings0% found this document useful (0 votes)

34 views1 pageThis document is a status letter from the Gujarat Industrial Development Corporation to Spring Well Industries regarding an industrial plot in Halol, Gujarat. It summarizes the outstanding dues as of October 11, 2023 totaling Rs. 46668, which includes charges for service, infrastructure fund, interest on revenue, and more. It provides instructions that in case of payment discrepancies to submit the transaction receipt number and date, and that interest on outstanding revenue charges is 1% per month.

Original Title

PLOT NO. 2-74_GIDC Halol

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

This document is a status letter from the Gujarat Industrial Development Corporation to Spring Well Industries regarding an industrial plot in Halol, Gujarat. It summarizes the outstanding dues as of October 11, 2023 totaling Rs. 46668, which includes charges for service, infrastructure fund, interest on revenue, and more. It provides instructions that in case of payment discrepancies to submit the transaction receipt number and date, and that interest on outstanding revenue charges is 1% per month.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

34 views1 pagePLOT NO. 2-74 - GIDC Halol

PLOT NO. 2-74 - GIDC Halol

Uploaded by

rcvbrd06This document is a status letter from the Gujarat Industrial Development Corporation to Spring Well Industries regarding an industrial plot in Halol, Gujarat. It summarizes the outstanding dues as of October 11, 2023 totaling Rs. 46668, which includes charges for service, infrastructure fund, interest on revenue, and more. It provides instructions that in case of payment discrepancies to submit the transaction receipt number and date, and that interest on outstanding revenue charges is 1% per month.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

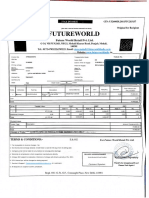

GUJARAT INDUSTRIAL DEVELOPMENT CORPORATION

Unique Trade Centre, 5,6 Floor, Hotel Kansar, Sayaji Ganj,

Vadodara 390005

Summary Letter As On 11/10/2023 Status : FULL-PAYMENT

Estate : H006 HALOL Area : 500

Party Name : H060 SPRING WELL INDUSTRIES Dt. Of Allotment : 31/07/2008

Plot No : 2/74 Asset Type : Industrial Plot

Address : PLOT NO. 2/74, GIDC ESTATE, PHASE-III, CHANDRAPURA, HALOL-389350 HALOL

Dues as on 11-10-2023 13:20:11

1. Installment Rs. 0

2. Int. On Delayed payment Including Penal Interest Rs. 0

3. Service Charge Rs. 30840

4. Service Charge(ST) Rs. 0

5. Service Charge(EC) Rs. 0

6. Service Charge(SBC) Rs. 0

7. Service Charge(KKC) Rs. 0

8. Service Charge(CGST) Rs. 2810

9. Service Charge(SGST) Rs. 2810

10. NAA Rs. 1890

11. NAA(ST) Rs. 0

12. NAA(EC) Rs. 0

13. NAA(SBC) Rs. 0

14. NAA(KKC) Rs. 0

15. NAA(CGST) Rs. 174

16. NAA(SGST) Rs. 174

17. LR Rs. 6

18. LR(ST) Rs. 0

19. LR(EC) Rs. 0

20. LR(SBC) Rs. 0

21. LR(KKC) Rs. 0

22. LR(CGST) Rs. 6

23. LR(SGST) Rs. 6

24. Interest On Revenue Charges Rs. 6736

25. Interest On Revenue Charges(CGST) Rs. 608

26. Interest On Revenue Charges(SGST) Rs. 608

27. Infrastructure Fund Rs. 0

28. Infrastructure Fund (ST) Rs. 0

29. Infrastructure Fund (EC) Rs. 0

30. Additional Capital Rs. 0

31. Additional Int of Capital Rs. 0

Total Rs. 46668

Can be Waived as per circuler 50% O/S(IDP-Portion) Rs. 0

Dated 20-06-2020 till 31-12-2020

100% O/S(PI-Portion) Rs. 0

Net To be Recovered Rs. 46668

PAN NUMBER OF GIDC : AABCG8033D GSTIN No of GIDC. 24AABCG8033D1Z2

SERV. TAX NO. OF REGIONAL OFFICE :AABCG8033DSD012 E.&.O.E

--> In case of any discrepancy in the accounts, you are requested to send the T.R No,

& Date through which the Payment is made.

--> This Report and Other Account related reports are also available on our Website

www.gidc.gov.in .

--> GSTIN no is mandatory to avail the benefit of Input Tax Credit(ITC).

--> Interest On Outstanding dues of Revenue Charges as on 31-03-2023 will be charged

@ 1% per month upto date of payment received, Interest on revenue charges due during

the year will be charged @ 1% per month after 30-06-2023.

--> Rates of SC and NAA for the year 2023-24 will be fixed and recovered alongwith GST

applicable as per policy of the corporation.

Printed On: 11-10-2023

You might also like

- PTCL Bill New Format PDFDocument1 pagePTCL Bill New Format PDFmuneebNo ratings yet

- SWOT Analysis CandP HomesDocument5 pagesSWOT Analysis CandP HomesRowena CahintongNo ratings yet

- Future WorldDocument1 pageFuture WorldLavish SoodNo ratings yet

- Document 7 - OCRDocument1 pageDocument 7 - OCRLavish SoodNo ratings yet

- PTCL Bill New FormatDocument2 pagesPTCL Bill New Formatfarhad khanNo ratings yet

- Caparo Engg I PVT Ltd. - Gidc HalolDocument1 pageCaparo Engg I PVT Ltd. - Gidc Halolrcvbrd06No ratings yet

- 2 PH - (II) SUR-3 - GIDC HalolDocument1 page2 PH - (II) SUR-3 - GIDC Halolrcvbrd06No ratings yet

- Plot No. 2-60 - GIDC HalolDocument1 pagePlot No. 2-60 - GIDC Halolrcvbrd06No ratings yet

- Summary BillDocument1 pageSummary BillVipul RathodNo ratings yet

- ACFrOgBfcDc4ZkmRxDGfX36N bCUJVh - 6PwtZDXRz4ogV8C6WoSxUxvyYTthYmFqClgsElasl Q lzKNI92cfkyz0geGUBwq4L2Df23OEi1ME67J3fWfKFP7SuPF0RADocument1 pageACFrOgBfcDc4ZkmRxDGfX36N bCUJVh - 6PwtZDXRz4ogV8C6WoSxUxvyYTthYmFqClgsElasl Q lzKNI92cfkyz0geGUBwq4L2Df23OEi1ME67J3fWfKFP7SuPF0RAKishor HansoraNo ratings yet

- 507-1 - MKP As On 08-01-2021Document1 page507-1 - MKP As On 08-01-2021rajuNo ratings yet

- Dues As On 16-12-2020 15:46:13: 159.9 Full-Payment K019 KALOL (PMS) K002 Khyati Ceramics 12/12/2006 Housing-QuaterDocument1 pageDues As On 16-12-2020 15:46:13: 159.9 Full-Payment K019 KALOL (PMS) K002 Khyati Ceramics 12/12/2006 Housing-QuaterrajuNo ratings yet

- InvoiceDocument1 pageInvoiceawanish639No ratings yet

- BillCheck 30266 2024Document1 pageBillCheck 30266 2024kasayedgroupNo ratings yet

- Krishiv Infotech: Tax InvoiceDocument3 pagesKrishiv Infotech: Tax InvoiceRiviera SarkhejNo ratings yet

- Sales SES TI 24-25 201Document1 pageSales SES TI 24-25 201bhattshivam03012001No ratings yet

- PANEER CHICKEN - Merged (AJMER SATABDI 15.12.22)Document11 pagesPANEER CHICKEN - Merged (AJMER SATABDI 15.12.22)pradeep kumarNo ratings yet

- Fazal PTCL BillDocument1 pageFazal PTCL Billgajari gulNo ratings yet

- Sun Earth Painting - Proforma InvoiceDocument1 pageSun Earth Painting - Proforma Invoicebhikam jainNo ratings yet

- Degree Application 2018Document2 pagesDegree Application 2018ldineshkumarNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceKumar RohitNo ratings yet

- IOCL PRICE CIRCULAR 16-07-2024 Incl Bangalore & LSHS PDFDocument1 pageIOCL PRICE CIRCULAR 16-07-2024 Incl Bangalore & LSHS PDFskgiri3013No ratings yet

- Inv 2023 004501Document2 pagesInv 2023 004501yanakop167No ratings yet

- Invoice Kaynes 05Document2 pagesInvoice Kaynes 05Mohammed ZubairNo ratings yet

- Ar - Hardik Kakadiya & Associates Proforma Invoice 2024-55Document4 pagesAr - Hardik Kakadiya & Associates Proforma Invoice 2024-55notestomyself.12No ratings yet

- Tax Invoice: 638,616.00 Inr Six Lakh Thirtyeight Thousand Six Hundred Sixteen OnlyDocument1 pageTax Invoice: 638,616.00 Inr Six Lakh Thirtyeight Thousand Six Hundred Sixteen Onlysiva manikandanNo ratings yet

- Fin Tab 40201767 105426251Document1 pageFin Tab 40201767 105426251RAJPALNo ratings yet

- Pay Slip DDOWiseDocument1 pagePay Slip DDOWisekhushalrvarnotiNo ratings yet

- 8115674Document3 pages8115674sumit pandeyNo ratings yet

- Khandelwal Agencies PVT - LTD.: Sari Ganeshay Namah GST - Invoice Original For BuyerDocument1 pageKhandelwal Agencies PVT - LTD.: Sari Ganeshay Namah GST - Invoice Original For BuyerSabuj SarkarNo ratings yet

- Proforma Invoice - 31742Document2 pagesProforma Invoice - 31742Praveen TiwariNo ratings yet

- Proforma InvoiceDocument1 pageProforma InvoiceDeepak avinashNo ratings yet

- Group Invoice Template 13Document1 pageGroup Invoice Template 13sungavaresortsNo ratings yet

- Malhar - Materil For Rubber PlantDocument1 pageMalhar - Materil For Rubber Plantajit kadamNo ratings yet

- Accounting Voucher 40177 - 1Document1 pageAccounting Voucher 40177 - 1Amit SingNo ratings yet

- Folio Invoice 15Document1 pageFolio Invoice 15reddyvijaysimha771No ratings yet

- Credit Note (Balance Items)Document1 pageCredit Note (Balance Items)pradeep kumarNo ratings yet

- DDocument2 pagesDKedia FinanceNo ratings yet

- Bill SuryodayDocument1 pageBill SuryodaycakumawatprakashNo ratings yet

- Shree Balaji Oil Company: Tax InvoiceDocument1 pageShree Balaji Oil Company: Tax InvoiceSushant JainNo ratings yet

- Bill of Supply: (Figures in:INR)Document1 pageBill of Supply: (Figures in:INR)Swati MishraNo ratings yet

- Shah Tyres Pandhurna 58MTDocument1 pageShah Tyres Pandhurna 58MTliladharkhode2025No ratings yet

- Lexus Con NT 24 ThuDocument136 pagesLexus Con NT 24 ThuPranat BajajNo ratings yet

- PTCL Bill 283317954-Ptcl-Lbill - (1) .PDF - 1-1Document1 pagePTCL Bill 283317954-Ptcl-Lbill - (1) .PDF - 1-1ahmedkanewwiseNo ratings yet

- Bidasar, ChuruDocument2 pagesBidasar, ChuruNarendra kumar indoriaNo ratings yet

- Invoice 18 EmiratesDocument1 pageInvoice 18 Emiratessiva manikandanNo ratings yet

- AC Bill - MergedDocument7 pagesAC Bill - Mergedlakkireddy seshireddyNo ratings yet

- Ilovepdf MergedDocument2 pagesIlovepdf MergedCavella CHNo ratings yet

- Print07 05 2024 10 43 16Document1 pagePrint07 05 2024 10 43 16srjcbjobNo ratings yet

- Minati HardwareDocument1 pageMinati HardwarebiswaspranabghyNo ratings yet

- Bill 1Document1 pageBill 1Imraan IqbalNo ratings yet

- Xotic Bill - 28.02.2021Document1 pageXotic Bill - 28.02.2021Vanshaj SharmaNo ratings yet

- Nibco Asia: Tax InvoiceDocument1 pageNibco Asia: Tax InvoiceSHUBH LAXMI STONE INDUSTRIESNo ratings yet

- Tax Invoice: Description of Goods Amount Disc. % Per Rate Quantity GST Hsn/SacDocument1 pageTax Invoice: Description of Goods Amount Disc. % Per Rate Quantity GST Hsn/SacAashima sharmaNo ratings yet

- Thhxzxyrt052mktztgfxrgpln0llqt09 InvoiceDocument2 pagesThhxzxyrt052mktztgfxrgpln0llqt09 Invoicekapilks063No ratings yet

- Dipu BillDocument1 pageDipu BillNaresh KamlaniNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inGOKUL HD LIVE EVENTSNo ratings yet

- InvoiceDocument2 pagesInvoiceHritesh HaldarNo ratings yet

- Bansilal Inv 1 1.3 PDFDocument1 pageBansilal Inv 1 1.3 PDFManya BhosaleNo ratings yet

- Engine, Turbine & Power Transmission Equipment World Summary: Market Values & Financials by CountryFrom EverandEngine, Turbine & Power Transmission Equipment World Summary: Market Values & Financials by CountryNo ratings yet

- Speed Changers, Drives & Gears World Summary: Market Values & Financials by CountryFrom EverandSpeed Changers, Drives & Gears World Summary: Market Values & Financials by CountryNo ratings yet

- BMAK Lectures III Part5Document52 pagesBMAK Lectures III Part5theodoreNo ratings yet

- Product Disclosure SheetDocument3 pagesProduct Disclosure SheetshamsulNo ratings yet

- Sulayman S. Al-Qudsi: Curriculum VitaeDocument23 pagesSulayman S. Al-Qudsi: Curriculum VitaeComputer GuruNo ratings yet

- Comprehensive Report On Indian Metal Cutting Machine Tool Industry - 2019Document73 pagesComprehensive Report On Indian Metal Cutting Machine Tool Industry - 2019Dr-Prashanth GowdaNo ratings yet

- Direct MaterialDocument12 pagesDirect Material200617No ratings yet

- Flight From CGP To MumbaiDocument2 pagesFlight From CGP To MumbaiPriyabrata MohantyNo ratings yet

- الادارة الهندسيةDocument7 pagesالادارة الهندسيةhassanien mohammedNo ratings yet

- Solution Manual For Microeconomics Canadian 15th Edition Ragan 0134378822 9780134378824Document37 pagesSolution Manual For Microeconomics Canadian 15th Edition Ragan 0134378822 9780134378824khasuoumueNo ratings yet

- Basic Accounting Procedures - Iii Ledger: Chapter - 5Document14 pagesBasic Accounting Procedures - Iii Ledger: Chapter - 5Aadhi RøckzŹźNo ratings yet

- 6inch Sensui Measuring WheelDocument2 pages6inch Sensui Measuring WheelCapt. KiddoNo ratings yet

- Ida PR 2010 Mar 2011Document3,228 pagesIda PR 2010 Mar 2011Choudhary SourabhNo ratings yet

- Fagor QVR-2Document28 pagesFagor QVR-2Ricardo Banegas ValleNo ratings yet

- GROUP DISCUSSION TOPICS: 1. Present State of Indian Cricket Team.Document12 pagesGROUP DISCUSSION TOPICS: 1. Present State of Indian Cricket Team.Aaron Merrill0% (1)

- ZENITH Four-In-One Mobile CrusherDocument14 pagesZENITH Four-In-One Mobile Crushergildemeister gerenciaNo ratings yet

- RFQ For: Supply of Ppe ItemsDocument17 pagesRFQ For: Supply of Ppe ItemsAZHAR AL-SULTANATE TRADINGNo ratings yet

- ExternalCodeSets 2Q2020 August2020 v1Document177 pagesExternalCodeSets 2Q2020 August2020 v1Warda YousafNo ratings yet

- ICAP Admit CardDocument1 pageICAP Admit CardWaseim KhanNo ratings yet

- Assignment Two Instructions S2 2021Document2 pagesAssignment Two Instructions S2 2021Dat HuynhNo ratings yet

- Game TheoryDocument7 pagesGame TheorypranshiNo ratings yet

- Profit Maximization: B-Pure MonopolyDocument11 pagesProfit Maximization: B-Pure MonopolyChadi AboukrrroumNo ratings yet

- Falcon FX Journal & Performance Analyser (V2)Document43 pagesFalcon FX Journal & Performance Analyser (V2)Villaca KeneteNo ratings yet

- CHAPTER 2.1 - Examples - StudentsDocument4 pagesCHAPTER 2.1 - Examples - Studentsirenep banhan21100% (1)

- WPR 001Document11 pagesWPR 001Vinay ShuklaNo ratings yet

- Cost Accumulation SystemDocument2 pagesCost Accumulation SystemOlga SîrbuNo ratings yet

- STP P High Impact PBT PC Safe T Pull BrochureDocument2 pagesSTP P High Impact PBT PC Safe T Pull BrochureDeni BagasNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 10Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 10Roshan RamkhalawonNo ratings yet

- Limit Switch Mounting PlateDocument1 pageLimit Switch Mounting PlateHimindra ChaaubeNo ratings yet

- Isc Eco ProjectDocument24 pagesIsc Eco Projectsunita singhaniaNo ratings yet

- ECC4 Example FormsDocument9 pagesECC4 Example FormsDavisNo ratings yet