Professional Documents

Culture Documents

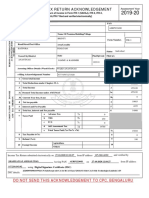

Abhishek - Provisional Form 16

Abhishek - Provisional Form 16

Uploaded by

hrrecruiter.vhtbsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Abhishek - Provisional Form 16

Abhishek - Provisional Form 16

Uploaded by

hrrecruiter.vhtbsCopyright:

Available Formats

Ref. No.

- EMP-137

Provisional Form No. 16

[See rule 31(1)(a)]

Certificate under section 203 of the Income-tax Act, 1961 for tax deducted at source from income

chargeable under the head " Salaries"

Name and address of the Employer Name and designation of the Employee

Samagra Development Associates Pvt. Ltd. Abhishek

,New Delhi,New Delhi

Emerging Leader

PAN / GIR No. TAN PAN / GIR No.

AASCS5052P DELS51192B CJKPA4180N

CIT (TDS) Assessment year Period

Address : From

2024-2025 To

City : PinCode :

12/06/2023 12/09/2023

Receipt Numbers of original Amount of tax deducted in Amount of tax

Quarter

statements of TDS under respect of employee deposited / remitted

sub-section in respect of

(3) of section 200. employee

Quarter 1 23805 0

Quarter 2 45654 0

Quarter 3 0 0

Quarter 4 0 0

Total 69459 0

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

1. Gross Salary

a) Salary as per provisions contained in sec.17(1) 563523

b) Value of perquisites u/s. 17(2) (as per Form No.12BA, 0

wherever applicable)

c) Profits in lieu of salary u/s 17(3)(as per Form No.12BA, 0

wherever applicable)

d) Total 563523

2. Less: Allowance to the extent exempt u/s. 10 :

a)

Total 0

3. Balance(1-2) 563523

4. Deductions :

a) Entertainment Allowance 0

b) Tax on Employment 0

5. Aggregate of 4(a) and (b) 50000

6. Income chargeable under the head 'Salaries'(3-5) 513523

7. Add: Any other income reported by the employee 0

8. Gross total income (6+7) 513523

Printed from Sensys EasyPAY.Web contact@sensysindia.com

Ref. No.- EMP-137

9. Deductions under Chapter VIA

(A) Sections 80C,80CCC and 80CCD Gross Amount Deductible Amoun

Provident Fund 13,740 13,740

Gross Amount Qualifying Amoun Deductible

Amount

(B) Other sections (for e.g.,80E,80G etc.) under chapter VIA

10.Aggregate of deductible amounts under Chapter VI-A 0

11. Total Income (8-10) 513523

12. Tax on total income 0

13. Education Cess (on tax at S.No. 12 surcharge at S. No.13) 0

14. Tax payable (12 + 13) 0

15. Relief under section 89 ( attach details ) 0

16. Tax payable (14-15) 0

I son/daughter of working in the capacity of (designation) do hereby certify that a sum of Rs. .[ (in words)]

has been deducted at source and paid to the credit of the Central Government. I further certify that the

information given above is true and correct based on the books of accounts, documents and other available

records.

Signature of the person responsible for deduction of tax

Place : Full Name :

Date 08/12/2023 Designation

ANNEXURE-B

DETAILS OF TAX DEDUCTED AND DEPOSITED INTO CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The Employer to provide payment wise details of tax deducted and deposited with respect to the employee)

DETAILS OF TAX DEDUCTED AND DEPOSITED INTO CENTRAL GOVERNMENT ACCOUNT

S Amount Challan identification number (CIN)

No.

BSR Code of Bank Date on which tax deposited Transfer Voucher / Challan

branch (dd/MM/yyyy) Identification No.

0

Total

Printed from Sensys EasyPAY.Web contact@sensysindia.com

You might also like

- Tata Consultancy Services PayslipDocument2 pagesTata Consultancy Services PayslipRahimaNo ratings yet

- PDF - 933662320220722.pdf ITR 22-23Document1 pagePDF - 933662320220722.pdf ITR 22-23smpNo ratings yet

- Form 16: Wipro LimitedDocument8 pagesForm 16: Wipro LimitedSekhar DashNo ratings yet

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDocument7 pagesSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavNo ratings yet

- Abhishek - Form 16Document2 pagesAbhishek - Form 16hrrecruiter.vhtbsNo ratings yet

- Ack 638167400230723Document1 pageAck 638167400230723gamers SatisfactionNo ratings yet

- PDF 169223670270722Document1 pagePDF 169223670270722adhya100% (1)

- Form No. 16: Part ADocument6 pagesForm No. 16: Part Asamir royNo ratings yet

- Itr 2018-19 PDFDocument1 pageItr 2018-19 PDFMalik MuzafferNo ratings yet

- November Pay SlipDocument2 pagesNovember Pay SlipanakinpowersNo ratings yet

- ITR-3 Computation of TaxDocument25 pagesITR-3 Computation of TaxsharathNo ratings yet

- Tech Mahindra Business Services Limited: Tax Return E-Filing ServiceDocument5 pagesTech Mahindra Business Services Limited: Tax Return E-Filing ServiceDavidroy MunimNo ratings yet

- Aug Salary SlipDocument1 pageAug Salary SlipDeepak AcsNo ratings yet

- Salary Slip (31692031 April, 2019) PDFDocument1 pageSalary Slip (31692031 April, 2019) PDFMuhammad AdnanNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSwapna BahaddurNo ratings yet

- Form 16Document4 pagesForm 16ramprashannaNo ratings yet

- PDF 990850220061221Document1 pagePDF 990850220061221Olympia FitnessNo ratings yet

- Payslip 4 2021Document1 pagePayslip 4 2021Mehraj PashaNo ratings yet

- 31 Aug 2023Document1 page31 Aug 2023Ashish MishraNo ratings yet

- Form No. 16: Part ADocument7 pagesForm No. 16: Part AFuture ArtistNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearvikas guptaNo ratings yet

- Itr-V FKTPM7864L 2023-24 756976760270723Document1 pageItr-V FKTPM7864L 2023-24 756976760270723Samrat AseshNo ratings yet

- June 24-July 24 StatementDocument3 pagesJune 24-July 24 StatementBishalNo ratings yet

- Form16 2022 2023Document8 pagesForm16 2022 2023arun poojariNo ratings yet

- F86407Document2 pagesF86407Abhishek PawarNo ratings yet

- Form 16: Wipro LimitedDocument8 pagesForm 16: Wipro LimitedsaisindhuNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearSagar GargNo ratings yet

- Deve 60398Document7 pagesDeve 60398Devesh Pratap ChandNo ratings yet

- QUA05891 SepSalarySlipwithTaxDetailsDocument1 pageQUA05891 SepSalarySlipwithTaxDetailssrajput66No ratings yet

- 2020 07 21 14 18 51 966 - 1595321331966 - XXXPA5493X - Acknowledgement PDFDocument1 page2020 07 21 14 18 51 966 - 1595321331966 - XXXPA5493X - Acknowledgement PDFVasanth Kumar AllaNo ratings yet

- M/S Vrvs India Private Limited: Total 17124.54 Total Deductions 1434.54 Payable Amount Rs. 15690.00Document1 pageM/S Vrvs India Private Limited: Total 17124.54 Total Deductions 1434.54 Payable Amount Rs. 15690.00AnilNo ratings yet

- PDF 139527500310723Document1 pagePDF 139527500310723NithinNo ratings yet

- Ack 367661020050723Document1 pageAck 367661020050723Sivaram PopuriNo ratings yet

- FSRID11020Document8 pagesFSRID11020SaleemNo ratings yet

- 26as Ay 21-22Document4 pages26as Ay 21-22Madhu MohanNo ratings yet

- 2019 08 28 15 18 21 048 - 1566985701048 - XXXPL5235X - Acknowledgement PDFDocument1 page2019 08 28 15 18 21 048 - 1566985701048 - XXXPL5235X - Acknowledgement PDFmaxNo ratings yet

- Form16 Till 14 Dec 2019Document11 pagesForm16 Till 14 Dec 2019Aviral SankhyadharNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearVINAY verma100% (1)

- PDF 628846520240522Document1 pagePDF 628846520240522Narayana Rao GanapathyNo ratings yet

- Ashok S R 2021-22 AckDocument1 pageAshok S R 2021-22 AckSHIFAZ SULAIMANNo ratings yet

- Pay SlipDocument1 pagePay Slipanji.guvvalaNo ratings yet

- Form 16 ADocument2 pagesForm 16 ANitya NarayananNo ratings yet

- Itr 23-24Document1 pageItr 23-24addy01.0001No ratings yet

- GI Nov PayslipsDocument1 pageGI Nov PayslipsmahendraNo ratings yet

- Umesh ITR A.Y. 2023-2024Document1 pageUmesh ITR A.Y. 2023-2024swatigrv2004No ratings yet

- Ack 504547400170723Document1 pageAck 504547400170723varsha sardesaiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurumahesh bhorNo ratings yet

- 139468ga PDFDocument1 page139468ga PDFPugazhendhi PugazhNo ratings yet

- 110773Document6 pages110773asheesh kumarNo ratings yet

- Aaecc2134l 2023 PDFDocument4 pagesAaecc2134l 2023 PDFVineet KhuranaNo ratings yet

- Vamsi Krishna Velaga - ITDocument1 pageVamsi Krishna Velaga - ITvamsiNo ratings yet

- Salary SlipDocument3 pagesSalary SlipAmjad AliNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDipak Ranjan RathNo ratings yet

- PDF 463337980200624Document1 pagePDF 463337980200624paridarashmi12No ratings yet

- Abrpb4480f Partb 2020-21Document3 pagesAbrpb4480f Partb 2020-21Subray N BanaulikarNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormMahendra PatilNo ratings yet

- Form 16Document9 pagesForm 16KOKILA VIJAYAKUMARNo ratings yet

- 2020 10 17 15 39 31 472 - 1602929371472 - XXXPP3112X - Acknowledgement PDFDocument1 page2020 10 17 15 39 31 472 - 1602929371472 - XXXPP3112X - Acknowledgement PDFParmeshwar PrasadNo ratings yet

- Po8 11.10.21Document2 pagesPo8 11.10.21Amirtha ShreeNo ratings yet

- Form 1615052023 141937Document3 pagesForm 1615052023 141937Pawan KumarNo ratings yet

- Form16 1951051 17631 04570193K 2021 2022Document2 pagesForm16 1951051 17631 04570193K 2021 2022Ranjeet RajputNo ratings yet

- Form PDF 869004400261222Document10 pagesForm PDF 869004400261222mohilNo ratings yet

- TDS CertificateDocument2 pagesTDS CertificateJyoti MeenaNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Anandraj Sharadrao Pawar YedshiNo ratings yet

- Aaafz8016h 2022Document5 pagesAaafz8016h 2022yogiprathmeshNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)rafeekmek31No ratings yet

- Abxpb2604f 2022Document5 pagesAbxpb2604f 2022Vineet KhuranaNo ratings yet

- Itr1 PreviewDocument7 pagesItr1 PreviewKOUSHIK SAMINENINo ratings yet

- Form PDF 114320560260722Document9 pagesForm PDF 114320560260722DeepNo ratings yet

- BLSPM3354H Partb 2021-22Document3 pagesBLSPM3354H Partb 2021-22kumar reddyNo ratings yet

- Reduction in Rate of Tax Deduction at Source (TDS) & Tax Collection at Source (TCS)Document6 pagesReduction in Rate of Tax Deduction at Source (TDS) & Tax Collection at Source (TCS)Kranthi Kumar KatamreddyNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961ElvisPresliiNo ratings yet

- Itr4 PreviewDocument11 pagesItr4 Previewjasvendra3010No ratings yet

- 26ASDocument4 pages26ASAnubhav AsatiNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)shivam raiNo ratings yet

- Gourishankar - BihaniDocument5 pagesGourishankar - BihaniSunny MittalNo ratings yet

- Form PDF 736864730030722Document6 pagesForm PDF 736864730030722manuNo ratings yet

- Tax Deduction at Source (TDS)Document15 pagesTax Deduction at Source (TDS)yierbNo ratings yet

- Form16A - Amazon - AAJCA9880A - 2021-2022 - Q4Document3 pagesForm16A - Amazon - AAJCA9880A - 2021-2022 - Q4hello8434No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961anvi jainNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Director GGINo ratings yet

- Form PDF 648514400190719Document6 pagesForm PDF 648514400190719RebornNo ratings yet

- Geeta - Form 16 A 2022-23Document2 pagesGeeta - Form 16 A 2022-23Sourabh PunshiNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961NirajNo ratings yet

- (See Rule 31 (1) (B) ) : Form No. 16ADocument38 pages(See Rule 31 (1) (B) ) : Form No. 16AsamNo ratings yet

- Form No. 16: Part ADocument10 pagesForm No. 16: Part ARAJASHEKAR KYAROLLANo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToNanu PatelNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document8 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961heenaNo ratings yet

- FTRPS1276R 2020-21Document2 pagesFTRPS1276R 2020-21manasNo ratings yet

- Problems and Solutions On Advance Tax: Problem No. 1Document8 pagesProblems and Solutions On Advance Tax: Problem No. 1NishantNo ratings yet