SCMA Unit - III Cost-Volume-Profit (CVP) Analysis and Activity-Based Costing (ABC)

SCMA Unit - III Cost-Volume-Profit (CVP) Analysis and Activity-Based Costing (ABC)

Uploaded by

22wj1e0050Copyright:

Available Formats

SCMA Unit - III Cost-Volume-Profit (CVP) Analysis and Activity-Based Costing (ABC)

SCMA Unit - III Cost-Volume-Profit (CVP) Analysis and Activity-Based Costing (ABC)

Uploaded by

22wj1e0050Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

SCMA Unit - III Cost-Volume-Profit (CVP) Analysis and Activity-Based Costing (ABC)

SCMA Unit - III Cost-Volume-Profit (CVP) Analysis and Activity-Based Costing (ABC)

Uploaded by

22wj1e0050Copyright:

Available Formats

UNIT – III:

Cost-Volume-Profit (CVP) Analysis and Activity-Based Costing

(ABC)

Syllabus : Essentials of CVP Analysis. The Breakeven Point using Equation Method,

Contribution Margin Method and Graph Method. Target Operating Income. Target Net

Income and Income Taxes. Breakeven Analysis for Decision making. Margin of Safety.

Application of BEP for various Business Problems. CVP analysis in Service and

Nonprofit Organizations.

Activity Based Cost (ABC) Systems: Comparison of Traditional and Activity Based Cost

Systems. Emergence of ABC Systems. Activity Hierarchies. Tracing Costs to Activities,

Tracing Costs from Activities to Products, Customer Profitability, Process Efficiency.

Activity Based Management. ABC Systems in Service Organizations. The Technological

Edge of using ABC Systems.

Essentials of CVPAnalysis:

Cost-Volume-Profit (CVP) analysis is a management accounting technique that helps

businesses understand the relationships between costs, volume, and profit. It is a valuable tool

for making informed decisions about pricing, production levels, and sales strategies. Here are

the essentials of CVP analysis:

1. Components of Cost-Volume-Profit Analysis:

Fixed Costs: These are costs that remain constant regardless of the level of

production or sales. Examples include rent, salaries, and insurance.

Variable Costs: These costs vary in direct proportion to the level of

production or sales. Examples include raw materials, direct labor, and sales

commissions.

Selling Price: The price at which a product is sold per unit.

2. Break-Even Point (BEP):

The break-even point is the level of sales at which total revenues equal total

costs (both fixed and variable). At this point, there is no profit or loss.

The break-even point can be calculated in units or sales dollars.

3. Contribution Margin:

Contribution margin is the difference between total sales revenue and total

variable costs. It represents the amount available to cover fixed costs and

contribute to profit.

Contribution Margin = Sales - Variable Costs

4. Contribution Margin Ratio:

The contribution margin ratio is the contribution margin expressed as a

percentage of total sales.

Contribution Margin Ratio = (Contribution Margin / Sales) * 100

5. Profit-Volume (P/V) Ratio:

Strategic Cost and Management Accounting MBA I Year IISem (R22)

Similar to the contribution margin ratio, the P/V ratio represents the proportion

of contribution margin to sales and is expressed as a percentage.

P/V Ratio = (Contribution Margin / Sales) * 100

6. Target Profit Analysis:

Businesses often have a target profit in mind. CVP analysis helps determine

the sales volume or revenue needed to achieve a specific profit level.

7. Margin of Safety:

The margin of safety is the excess of budgeted (or actual) sales over the break-

even sales. It represents the cushion or safety net before a business starts

incurring losses.

Margin of Safety = Actual (or Budgeted) Sales - Break-Even Sales

8. Sensitivity Analysis:

CVP analysis can be used to assess the impact of changes in variables such as

selling price, variable costs, or fixed costs on profits.

9. Assumptions of CVP Analysis:

CVP analysis assumes that the relationship between costs, volume, and profit

is linear and that all costs can be classified as either fixed or variable.

It also assumes that efficiency and productivity remain constant.

10. Limitations of CVP Analysis:

CVP analysis simplifies complex business realities and may not account for

factors like seasonality, changes in production efficiency, or market dynamics.

CVP analysis provides valuable insights into the financial implications of business decisions

and aids in planning and decision-making processes. It is particularly useful for managers in

setting prices, determining production levels, and understanding the impact of various factors

on profitability.

The Breakeven Point using Equation Method, Contribution Margin Method and Graph

Method:

The break-even point (BEP) can be calculated using three main methods: the Equation

Method, the Contribution Margin Method, and the Graphical Method. Let's explore each

method:

1. Equation Method:

The break-even point is the level of sales at which total revenues equal total

costs. The equation for calculating the break-even point in units is:

BEP (in units)=Fixed CostsSelling Price per Unit−Variable Cost per UnitBEP

(in units)=Selling Price per Unit−Variable Cost per UnitFixed Costs

The equation for calculating the break-even point in sales dollars is:

BEP (in dollars)=Fixed CostsContribution Margin RatioBEP (in dollars)=Cont

ribution Margin RatioFixed Costs

2. Contribution Margin Method:

The contribution margin method involves using the contribution margin to

determine the break-even point. The contribution margin is the selling price

per unit minus the variable cost per unit.

Strategic Cost and Management Accounting MBA I Year IISem (R22)

Contribution Margin=Selling Price per Unit−Variable Cost per UnitContributi

on Margin=Selling Price per Unit−Variable Cost per Unit

The break-even point in units can be calculated as:

BEP (in units)=Fixed CostsContribution Margin per UnitBEP (in units)=Contr

ibution Margin per UnitFixed Costs

The break-even point in sales dollars can be calculated as:

BEP (in dollars)=Fixed CostsContribution Margin RatioBEP (in dollars)=Cont

ribution Margin RatioFixed Costs

3. Graphical Method:

The graphical method involves plotting the total cost line and total revenue

line on a graph to identify the break-even point.

The total cost line starts at the level of fixed costs and increases linearly with

the level of activity (units sold).

The total revenue line starts at zero and increases linearly with the level of

activity based on the selling price per unit.

The break-even point is the intersection point of the total cost and total

revenue lines.

Target Operating Income:

Target operating income refers to the level of income or profit that a business aims to achieve

within a specific period. It is the desired amount of operating income that management sets as

a goal. This target is often used in the context of cost-volume-profit (CVP) analysis and is

instrumental in decision-making and planning processes.

To calculate the target operating income, you can use the following formula within the

framework of CVP analysis:

Target Operating Income=Fixed Costs+(Target Net IncomeContribution Margin Ratio)Target

Operating Income=Fixed Costs+(Contribution Margin RatioTarget Net Income)

Where:

Fixed CostsFixed Costs represent the total fixed costs that the business incurs.

Target Net IncomeTarget Net Income is the desired net income that the business

wants to achieve.

Contribution Margin RatioContribution Margin Ratio is the contribution margin

expressed as a percentage (Contribution MarginSales×100SalesContribution Margin

×100).

This formula is derived from the basic profit equation:

Profit=Sales−Variable Costs−Fixed CostsProfit=Sales−Variable Costs−Fixed Costs

By rearranging this equation and solving for the target operating income, you get the formula

mentioned earlier.

Here's a breakdown of the components:

1. Fixed Costs:

These are costs that do not change with the level of production or sales.

Examples include rent, salaries, and insurance.

2. Target Net Income:

Strategic Cost and Management Accounting MBA I Year IISem (R22)

This is the amount of profit the company wishes to achieve. It includes not

only operating income but also non-operating items such as interest and taxes.

3. Contribution Margin Ratio:

This represents the proportion of contribution margin to sales and is expressed

as a percentage.

The target operating income is crucial for businesses to set clear financial goals and plan their

operations accordingly. It helps in decision-making regarding pricing, cost management, and

sales strategies to achieve the desired level of profitability.

Target Net Income and Income Taxes:

Target net income is the specific level of profit that a business aims to achieve within a given

period. It is a crucial component of financial planning and goal-setting for companies. The

target net income is often determined based on various factors, including the company's

overall financial objectives, growth plans, and external market conditions.

When considering target net income, it's important to account for income taxes. Taxes are a

significant consideration because they represent a portion of the company's profits that must

be paid to the government. Here's how target net income and income taxes are related:

1. Calculating Target Net Income:

The formula for target net income is often expressed as:

Target Net Income=Target Operating Income−Target TaxesTarget Net Income

=Target Operating Income−Target Taxes

In this formula:

Target Operating Income: This is the desired level of operating profit

before taxes.

Target Taxes: This represents the income taxes that the company

expects to pay on its target operating income.

2. Accounting for Taxes:

The calculation of target taxes depends on the applicable tax rate. The tax rate

is typically expressed as a percentage of taxable income. The formula for

calculating taxes is:

Target Taxes=Tax Rate×Taxable IncomeTarget Taxes=Tax Rate×Taxable Inc

ome

The taxable income is the portion of the company's income that is subject to

taxation after considering various deductions and credits.

3. Tax Rate:

The tax rate used in these calculations is often the corporate income tax rate

applicable to the jurisdiction in which the company operates.

Breakeven Analysis for Decision making:

Break-even analysis is a valuable tool for decision-making in business. It helps companies

understand the minimum level of sales or production necessary to cover costs and avoid

losses. Here's how break-even analysis can be used for decision-making:

1. Setting Pricing Strategies:

Strategic Cost and Management Accounting MBA I Year IISem (R22)

Break-even analysis allows businesses to determine the minimum price at

which they should sell their products or services to cover costs. This helps in

setting competitive yet profitable pricing strategies.

2. Determining Sales Targets:

By knowing the break-even point, businesses can set realistic sales targets.

This information is essential for sales and marketing teams to align their

efforts with the company's financial goals.

3. Evaluating Cost Structure:

Break-even analysis provides insights into the fixed and variable costs

associated with production. This understanding helps management evaluate

the cost structure and identify opportunities for cost reduction or efficiency

improvements.

4. Capital Expenditure Decisions:

When considering investments in new equipment or facilities, break-even

analysis helps in assessing the impact on fixed costs and the level of sales

required to cover those costs. This is crucial in making informed capital

expenditure decisions.

5. Product Mix Decisions:

Companies often offer a range of products with different profit margins.

Break-even analysis helps in evaluating the contribution of each product to

overall profitability, guiding decisions on product mix and resource allocation.

6. Financial Planning:

Break-even analysis is an integral part of financial planning. It helps in

forecasting the financial performance of the company based on different

scenarios, enabling better preparation for potential changes in the business

environment.

7. Risk Management:

Understanding the break-even point helps in assessing financial risk.

Companies can evaluate the impact of uncertainties, such as changes in market

demand or cost fluctuations, on their ability to cover costs and make informed

decisions to mitigate risks.

8. Loan and Financing Decisions:

Lenders often assess a company's break-even point when considering loan

applications. A clear understanding of the break-even analysis can enhance the

company's credibility and increase the likelihood of obtaining financing.

9. Profit Planning:

Break-even analysis is a fundamental component of profit planning. It helps

businesses set realistic profit targets, understand the relationship between sales

volume and profitability, and make strategic decisions to achieve financial

goals.

10. Expansion or Contraction Decisions:

Break-even analysis is crucial when a company is considering expanding its

operations or, conversely, contracting certain activities. It provides insights

into the financial implications of such decisions.

Strategic Cost and Management Accounting MBA I Year IISem (R22)

Margin of Safety:

The margin of safety is a key financial metric that provides insight into how much a

company's actual or projected sales exceed its break-even point. It represents the cushion or

safety net a business has before it starts incurring losses. The margin of safety is expressed in

both percentage and monetary terms and is used for decision-making and risk assessment.

Here's how to calculate and interpret the margin of safety:

Formula for Margin of Safety:

1. In Units: Margin of Safety (in units)=Actual (or Budgeted) Sales−Break-

Even SalesMargin of Safety (in units)=Actual (or Budgeted) Sales−Break-Even Sales

2. In Sales Dollars: Margin of Safety (in dollars)=Actual (or Budgeted) Sales−Break-

Even SalesMargin of Safety (in dollars)=Actual (or Budgeted) Sales−Break-Even Sal

es

3. In Percentage:

Margin of Safety (percentage)=(Margin of Safety (in dollars)Actual (or Budgeted) Sal

es)×100Margin of Safety (percentage)=(Actual (or Budgeted) SalesMargin of Safety (

in dollars))×100

Interpretation:

Positive Margin of Safety:

A positive margin of safety indicates that the company's actual or projected

sales exceed the break-even point. The larger the margin, the more resilient the

business is to fluctuations in sales.

Negative Margin of Safety:

A negative margin of safety suggests that the company's actual or projected

sales are below the break-even point. This situation implies a risk of incurring

losses, and the business should carefully evaluate its cost structure and sales

strategies.

Significance and Use:

1. Risk Assessment:

A larger margin of safety provides a buffer against unexpected downturns in

sales or increases in costs, reducing the risk of financial distress.

2. Financial Planning:

Businesses use the margin of safety as a planning tool to set sales targets and

establish realistic expectations for financial performance.

3. Leverage and Financing:

Lenders and investors often consider the margin of safety when evaluating the

financial health and risk profile of a company. A higher margin of safety may

increase confidence in the company's ability to meet its financial obligations.

4. Operational Decision-Making:

Management can use the margin of safety to make informed decisions about

production levels, pricing strategies, and resource allocation.

5. Scenario Analysis:

Strategic Cost and Management Accounting MBA I Year IISem (R22)

By calculating the margin of safety under different scenarios, companies can

assess the impact of changes in sales volume or costs on their financial

position.

In summary, the margin of safety is a valuable metric for assessing a company's financial

resilience and risk exposure. It aids in decision-making and provides a practical measure for

businesses to navigate uncertain economic conditions.

Activity-Based Costing (ABC) Systems:

1. Comparison of Traditional and Activity-Based Cost Systems:

Traditional Costing:

Allocates overhead costs based on a single, volume-based cost driver (e.g.,

direct labor hours or machine hours).

May result in distorted product costs, especially in complex manufacturing

environments.

Activity-Based Costing (ABC):

Recognizes multiple cost drivers based on various activities that consume

resources.

Provides more accurate and detailed insights into the cost of products and

services.

2. Emergence of ABC Systems:

ABC systems emerged in response to the limitations of traditional costing methods,

especially in industries with diverse products and complex production processes.

ABC helps companies allocate costs more accurately by linking them to specific

activities that consume resources.

3. Activity Hierarchies:

ABC systems often use activity hierarchies to categorize activities based on their level

of complexity and impact on costs.

Hierarchies may include unit-level activities, batch-level activities, product-level

activities, and facility-level activities.

4. Tracing Costs to Activities:

In ABC, costs are traced to specific activities rather than being allocated based on a

single cost driver.

Identification of cost drivers is crucial to understand the factors influencing activity

costs.

5. Tracing Costs from Activities to Products:

Once costs are assigned to activities, they are then traced from activities to products

or services based on the actual consumption of those activities by each product.

6. Customer Profitability:

ABC systems allow for a more accurate assessment of customer profitability by

associating costs with specific customer-related activities.

This insight helps in strategic decision-making regarding customer segmentation and

pricing.

Strategic Cost and Management Accounting MBA I Year IISem (R22)

Strategic Cost and Management Accounting MBA I Year IISem (R22)

You might also like

- Rage Into Courage: Mindanao Under Martial Law (Volume 1), Activists Against The MarcosDocument2 pagesRage Into Courage: Mindanao Under Martial Law (Volume 1), Activists Against The MarcosPinky EclarinalNo ratings yet

- CVP SummaryDocument4 pagesCVP SummaryliaNo ratings yet

- Management Accounting RevisionDocument12 pagesManagement Accounting RevisionKelvin Maseko100% (2)

- RM - CVP AnalysisDocument5 pagesRM - CVP AnalysispamssyNo ratings yet

- CVP AnalysisDocument5 pagesCVP AnalysisRacheel SollezaNo ratings yet

- Cost Management AccountingDocument14 pagesCost Management AccountingdalveerchoudharyNo ratings yet

- Cost-Volume-Profit Analysis: A Managerial Planning Tool Break-Even Point in UnitsDocument3 pagesCost-Volume-Profit Analysis: A Managerial Planning Tool Break-Even Point in UnitsHafizh GalihNo ratings yet

- DocumentDocument1 pageDocumentjoeyrosario817No ratings yet

- Chapter 3 OM TQM Break Even AnalysisDocument22 pagesChapter 3 OM TQM Break Even AnalysisGelayieNo ratings yet

- Break-Even Analysis: The Relationship Between Fixed Costs, Variable Costs and ReturnsDocument5 pagesBreak-Even Analysis: The Relationship Between Fixed Costs, Variable Costs and ReturnsvianfulloflifeNo ratings yet

- Marginal Costing & Break Even Analysis (Unit 3)Document26 pagesMarginal Costing & Break Even Analysis (Unit 3)Varesh KapoorNo ratings yet

- Chapter 1Document14 pagesChapter 1Tariku KolchaNo ratings yet

- Unit 2 Acct312-UnlockedDocument16 pagesUnit 2 Acct312-UnlockedTilahun GirmaNo ratings yet

- Cost-Volume-Profit Analysis (CVP) : Names of Sub-UnitsDocument12 pagesCost-Volume-Profit Analysis (CVP) : Names of Sub-Unitsmakouapenda2000No ratings yet

- Cost Volume Profit AnalysisDocument4 pagesCost Volume Profit AnalysisDivina SalazarNo ratings yet

- CVP AnalysisDocument26 pagesCVP AnalysisChandan Jobanputra100% (1)

- FDM Unit IDocument23 pagesFDM Unit IthokatikrishnaveniNo ratings yet

- MODULE 2 - Profit Planning & Cost-Volume-Profit AnalysisDocument24 pagesMODULE 2 - Profit Planning & Cost-Volume-Profit AnalysisSugar TiuNo ratings yet

- Strategic Cost ManagementDocument14 pagesStrategic Cost Managementakshat khannaNo ratings yet

- Marginal CostingDocument25 pagesMarginal Costingsucheta_kanchiNo ratings yet

- Breakeven Analysis UnderstandingDocument12 pagesBreakeven Analysis UnderstandingSamreen LodhiNo ratings yet

- Chapter 3 Cost Valume Profit AnalysisDocument5 pagesChapter 3 Cost Valume Profit AnalysisAbdirazak MohamedNo ratings yet

- Module 2 Profit Planning and Cost-Volume-Profit AnalysisDocument25 pagesModule 2 Profit Planning and Cost-Volume-Profit AnalysisReianne RamosNo ratings yet

- Day 21 Marginal Costing M HSST CommerceDocument12 pagesDay 21 Marginal Costing M HSST Commerceprasasthan405No ratings yet

- Mod-6 Fina AccDocument7 pagesMod-6 Fina AccSujan MujawarNo ratings yet

- SMCCCD - Chapter 6 - Cost-Volume-Profit RelationshipsDocument8 pagesSMCCCD - Chapter 6 - Cost-Volume-Profit RelationshipsJames CrombezNo ratings yet

- Cost-Volume-Profit Analysis A Managerial Planning ToolDocument3 pagesCost-Volume-Profit Analysis A Managerial Planning Tooleskelapamudah enakNo ratings yet

- QAB Mod 4 Marginal CostingDocument7 pagesQAB Mod 4 Marginal CostingDr Rakesh ThakorNo ratings yet

- Unit 4Document22 pagesUnit 4placementNo ratings yet

- AC222 2023 2 Cost-Volume-ProfitDocument51 pagesAC222 2023 2 Cost-Volume-ProfitLloyd MasiNo ratings yet

- Cost Volume Profit (CVP) AnalysisDocument4 pagesCost Volume Profit (CVP) Analysisabhi kumarNo ratings yet

- Breakeven AnalysisDocument4 pagesBreakeven AnalysisSaugata Shovan HaiderNo ratings yet

- chapter 1Document35 pageschapter 1abdifatahsheikhNo ratings yet

- Assignmnet 6. CHAPTER 4Document19 pagesAssignmnet 6. CHAPTER 4Regan Muammar NugrahaNo ratings yet

- CostDocument4 pagesCostjeevakumar03042005No ratings yet

- CVP Analysis: Shiri PaduriDocument9 pagesCVP Analysis: Shiri Padurivardha rajuNo ratings yet

- CVP Analysis 1Document20 pagesCVP Analysis 1divyansh sharmaNo ratings yet

- Cost II Chapter1Document9 pagesCost II Chapter1Dureti NiguseNo ratings yet

- CVP AnalysisDocument15 pagesCVP AnalysisAkhil JasrotiaNo ratings yet

- COST - VOLUME-PROFIT AnalysisDocument17 pagesCOST - VOLUME-PROFIT Analysisasa ravenNo ratings yet

- Profit Planning and Cost Volume Profit AnalysisDocument2 pagesProfit Planning and Cost Volume Profit AnalysisHalseeNo ratings yet

- Cost II-ch 1 - CVPDocument45 pagesCost II-ch 1 - CVPYitera SisayNo ratings yet

- Fn 5107- Topic6Document14 pagesFn 5107- Topic6wilbertmauya1No ratings yet

- Kinney 8e - CH 09Document17 pagesKinney 8e - CH 09Ashik Uz ZamanNo ratings yet

- CVP Sensitivity Analysis LmsDocument34 pagesCVP Sensitivity Analysis LmsnavalojiniravindranNo ratings yet

- Fixed Cost: Marginal CostingDocument6 pagesFixed Cost: Marginal CostingJebby VargheseNo ratings yet

- Operating and Financial LeverageDocument31 pagesOperating and Financial LeverageDan RyanNo ratings yet

- Marginal Costing CPZ6ADocument24 pagesMarginal Costing CPZ6AGauravsNo ratings yet

- Unit - 2 Marginal CostingDocument12 pagesUnit - 2 Marginal CostingAnkit GoelNo ratings yet

- Cost Management Accounting II, CVP AnalysisDocument17 pagesCost Management Accounting II, CVP AnalysisdiyarmynajiNo ratings yet

- Unit2 ModuleDocument29 pagesUnit2 ModuleJasper John NacuaNo ratings yet

- Cost Volume Profit AnalysisDocument9 pagesCost Volume Profit Analysisshorif4437No ratings yet

- Module 4 RMDocument8 pagesModule 4 RMDr Rakesh ThakorNo ratings yet

- Cost-Volume-Profit (CVP) AnalysisDocument2 pagesCost-Volume-Profit (CVP) AnalysisAsimsaNo ratings yet

- Strat CostDocument7 pagesStrat CostPsyche AzaleaNo ratings yet

- Profit Planning and Cost-Volume-Profit AnalysisDocument24 pagesProfit Planning and Cost-Volume-Profit AnalysisFallen Hieronymus50% (2)

- Cost-Volume-Profit (CVP) AnalysisDocument3 pagesCost-Volume-Profit (CVP) AnalysisAsimsaNo ratings yet

- Marginal Costing AND AnalysisDocument19 pagesMarginal Costing AND AnalysisRuchi BansalNo ratings yet

- Break-Even Analysis: (Cost-Volume-Profit Analysis)Document8 pagesBreak-Even Analysis: (Cost-Volume-Profit Analysis)Sachin SahooNo ratings yet

- Cost-Volume-Profit Relationships and AnalysisDocument9 pagesCost-Volume-Profit Relationships and Analysis마리레나No ratings yet

- Crucial Readings in Functional Grammar Matthew P. Anstey 2024 scribd downloadDocument50 pagesCrucial Readings in Functional Grammar Matthew P. Anstey 2024 scribd downloadmitallarco33100% (2)

- GEK 107568aDocument25 pagesGEK 107568aTina ValderuedaNo ratings yet

- Total ResultDocument29 pagesTotal Resultali aridiNo ratings yet

- Computer Network SolutionDocument2 pagesComputer Network SolutionAhmed KamalNo ratings yet

- Zip Password Is '123abc'. ReadmeDocument2 pagesZip Password Is '123abc'. Readmeوهيبه بكرNo ratings yet

- Q4 Health 7 Module 2 Week 4.BETA TESTEDDocument13 pagesQ4 Health 7 Module 2 Week 4.BETA TESTEDjoshendadoNo ratings yet

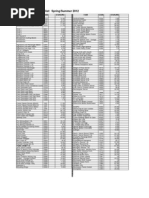

- Tupperware UK Price List: Spring/Summer 2012: Item Code Sterling Item CodeDocument1 pageTupperware UK Price List: Spring/Summer 2012: Item Code Sterling Item CodeAanju PurushothamanNo ratings yet

- Procedure For Stacking of Packed Shippers On Pallet.Document2 pagesProcedure For Stacking of Packed Shippers On Pallet.Rajender GoelNo ratings yet

- IEE Queries Muzammil PaperDocument2 pagesIEE Queries Muzammil PaperZaghum AbbasNo ratings yet

- Retail Management Marketing PlanDocument19 pagesRetail Management Marketing PlanKenneth Glenn SalongaNo ratings yet

- Fingerprint SensorDocument48 pagesFingerprint SensorPRITAM DASNo ratings yet

- TEST QuestiionsDocument1 pageTEST Questiionsipa.gdhmchNo ratings yet

- AnswersDocument3 pagesAnswersBaya Achourygghuuu9No ratings yet

- PCO Accreditation Application FormDocument3 pagesPCO Accreditation Application FormMenchie Ann Sabandal Salinas100% (1)

- Satvayur Corporate Profile EbrochureDocument6 pagesSatvayur Corporate Profile EbrochureKoushik SekharNo ratings yet

- 702 King Road, Burlington, On L7T3K4 House For Sale REMAX H4183155Document1 page702 King Road, Burlington, On L7T3K4 House For Sale REMAX H4183155boujjieb.tchNo ratings yet

- Sharvesh (Chemistry Project) - Study of The Purification of WaterDocument22 pagesSharvesh (Chemistry Project) - Study of The Purification of Waterkabirdas.srkNo ratings yet

- Weight Estimation - 002 PDFDocument12 pagesWeight Estimation - 002 PDFmurad_ashourNo ratings yet

- API 653 The Quality Guide PC Question BankDocument76 pagesAPI 653 The Quality Guide PC Question BankBabar Manzoor Ghauri100% (2)

- Azu TD Box706 1988 SMI WDocument71 pagesAzu TD Box706 1988 SMI WJoaco MartinNo ratings yet

- Acoustic PhoneticsDocument3 pagesAcoustic PhoneticsEspe PascualNo ratings yet

- T Mech PPR CatalogueDocument17 pagesT Mech PPR CatalogueDani DaniNo ratings yet

- 172 182 JMTR Jul17Document11 pages172 182 JMTR Jul17Mikel MichaelNo ratings yet

- Most Important Terms & Conditions: Schedule of ChargesDocument11 pagesMost Important Terms & Conditions: Schedule of ChargesRaghavan VenkatramanNo ratings yet

- Self Mastery and Fate With The Cycles of LifeDocument96 pagesSelf Mastery and Fate With The Cycles of LifeAl Siwel100% (1)

- 2 Bed 2 Bath Ship Container HomeDocument22 pages2 Bed 2 Bath Ship Container Homec8ar1970No ratings yet

- Soudokay Flux Cored Wires GBDocument8 pagesSoudokay Flux Cored Wires GBkamals55No ratings yet

- MSC Desta HailemariamDocument93 pagesMSC Desta HailemariamĐẠT NGUYỄN TUẤNNo ratings yet

- Journal of Anxiety DisordersDocument10 pagesJournal of Anxiety DisordersEstefania NavarroNo ratings yet