IFRS 15 (Solutions)

IFRS 15 (Solutions)

Uploaded by

adeelkacaCopyright:

Available Formats

IFRS 15 (Solutions)

IFRS 15 (Solutions)

Uploaded by

adeelkacaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

IFRS 15 (Solutions)

IFRS 15 (Solutions)

Uploaded by

adeelkacaCopyright:

Available Formats

IFRS 15 – SOLUTIONS (1)

SOLUTION TO QUESTION NO. 1

Nasir Abbas FCA

IFRS 15 – SOLUTIONS (2)

SOLUTION TO QUESTION NO. 2

SOLUTION TO QUESTION NO. 3

(a) Allocation of transaction price

(i)

Standalone Allocation of Allocation of

Product price Rs. 70,000 to E-2 and E-3 Rs. 90,000 to all

------------------------------ Rs. ---------------------------------

E-1 30,000 30,000 27,000

[90,000 x 30/100]

E-2 30,000 26,250 23,625

[70,000 x 30/80] [90,000 x 26.25/100]

E-3 50,000 43,750 39,375

[70,000 x 50/80] [90,000 x 43.75/100]

110,000 100,000 90,000

(ii)

Standalone Allocation of

Product price Rs. 104,000

--------------- Rs. -------------

E-1 30,000 24,000

[104,000 x 30/130]

E-3 100,000 80,000

[50,000 x 2] [104,000 x 100/130]

130,000 104,000

Nasir Abbas FCA

IFRS 15 – SOLUTIONS (3)

(c) Transaction price

The transaction price is the amount of consideration to which an entity expects to be entitled in exchange for transferring

promised goods or services to a customer, excluding amounts to be collected on behalf of third parties.

Factors affecting determination of the transaction price:

(i) Variable consideration

(ii) Constraints on variable consideration

(iii) Existence of a significant financing components (time value of money)

(iv) Non-cash consideration

(v) Consideration payable to a customer

SOLUTION TO QUESTION NO. 4

Trich Mir Limited

Correcting entries for the year ended 31 December 2019

S.No. Description Debit Credit

---- Rs. in million ----

(i) Revenues 25–20.66{25×(1.1)–2} 4.34

Receivable 4.34

Receivable 20.66×10%×(3÷12) 0.52

Interest income 0.52

Commission expense 1.60

Amortization expense 1.6÷2×3÷12 0.20

Contract cost 1.40

(ii) Cost of goods sold 15.00

Inventories 15.00

Receivable (30×60%)–11 7.00

Construction revenues 7.00

(iii) Revenues 12–12×16÷(12+8) 2.40

Receivable 2.40

Contract asset (12–2.4) 9.60

Receivable 9.60

Nasir Abbas FCA

IFRS 15 – SOLUTIONS (4)

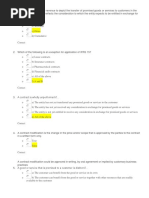

SOLUTION TO QUESTION NO. 5

Nasir Abbas FCA

IFRS 15 – SOLUTIONS (5)

SOLUTION TO QUESTION NO. 6

(a)

The general IFRS 15 model applies only when all of the following conditions are met:

▪ the parties to the contract have approved the contract.

▪ the entity can identify each party’s rights.

▪ the entity can identify the payment terms for the goods and services to be transferred.

▪ the contract has commercial substance.

▪ it is probable that the entity will collect the consideration.

(b)

(i) The contract contains two distinct performance obligations i.e. selling the machine and providing the maintenance

services as:

• the customer can separately benefit from the machine without the maintenance services from GW (or GW

sells maintenance services separately) and

• the machine and maintenance services are separately identifiable in the contract.

Thus GW will allocate the transaction price between the two performance obligations as follows:

Standalone price (Rs.) Proportion Transaction price (Rs.)

Machine 1,700,000 85% 1,530,000

Maintenance 300,000 15% 270,000

(Rs. 25,000 x 12) (Rs. 22,500 x 12)

2,000,000 100% 1,800,000

Revenue related to sale of machine would be recognized at a point in time i.e. upon delivery on 1 August 2018.

While revenue related to maintenance service would be recognized over time i.e. as the services are rendered. Till

31 December 2018, revenue would be recognized in respect of:

• Sale of machine Rs. 1,530,000

• Maintenance service Rs. 112,500 (i.e Rs. 22,500 for 5 months)

Remaining amount of Rs. 157,500 would appear in liabilities as deferred revenue.

(ii) The contract contains two distinct performance obligations i.e. selling the machine and providing the maintenance

services.

The contract includes a significant financing component in respect of sale of machine which is evident from the

difference between the amount of promised consideration of Rs. 1.95 million and the cash selling price of Rs. 1.7

million.

Revenue related to machine would be recognized upon delivery on 1 October 2018. Revenue related to

maintenance service would be recognized as the services are rendered each month. It is assumed that effective

rate of interest between promised consideration and cash selling price would reflect the borrowing rate in separate

financing transaction. Therefore, interest income would be recognized over two years using 7.1% [i.e. (1.95÷1.7) ½ –1].

Till 31 December 2018, revenue would be recognized in respect of:

▪ Sale of machine Rs. 1,700,000

▪ Maintenance service Rs. 75,000 i.e Rs. 25,000 for 3 months

▪ Interest revenue Rs. 30,175 (Rs. 1.7 million × 7.1% × 3/12)

SOLUTION TO QUESTION NO. 7

(a)

Step – 1: Identify the contract(s) with customers;

Step – 2: Identify the separate performance obligations

Step – 3: Determine the transaction price

Step – 4: Allocate the transaction price;

Step – 5: Recognition of revenue when an entity satisfies performance obligations.

(b)

(i)

Dr. Cr.

Rs. Rs.

1/6/18 Cash [500 x Rs. 200] 100,000

Sales [100,000 x 95%] 95,000

Refund liability [100,000 x 5%] 5,000

(To record sale of 500 units with 5% refund liability)

Nasir Abbas FCA

IFRS 15 – SOLUTIONS (6)

1/6/18 Cost of sale 71,250

Asset for right to recover products [75,000 x 5%] 3,750

Inventory [500 x Rs. 150] 75,000

(To record cost of sale and expected return)

30/6/18 Refund liability 5,000

Cash [Rs. 200 x 20] 4,000

Sales [Rs. 200 x 5] 1,000

(To record refund of units returned and sales)

30/6/18 Cost of sales [5 x Rs. 150] 750

Inventory [20 x Rs. 150] 3,000

Asset for right to recover products 3,750

(To record return of units and cost of sale)

(ii) Dr. Cr.

Rs. Rs.

1/6/18 Cash [500 x Rs. 200] 100,000

Refund liability 100,000

(To record upfront cash received for goods delivered)

1/6/18 Asset for right to recover products 75,000

Inventory [500 x Rs. 150] 75,000

(To record asset for right to recover products)

30/6/18 Refund liability 100,000

Cash [Rs. 200 x 20] 4,000

Sales [Rs. 200 x 480] 96,000

(To record refund of units returned and sales)

30/6/18 Cost of sales [480 x Rs. 150] 72,000

Inventory [20 x Rs. 150] 3,000

Asset for right to recover products 75,000

(To record cost of sale 7 return of units and cost of sale)

SOLUTION TO QUESTION NO. 8

(a) Performance obligation:

A performance obligation is a promise in a contract with a customer to transfer to the customer either:

• a good or service (or a bundle of goods or services) that is distinct; or

• a series of distinct goods or services that are substantially the same and that have the same pattern of

transfer to the customer.

Examples of promised goods and services

(i) Goods produced by an entity for sale

(ii) Resale of goods purchased by an entity

(iii) Resale of rights to goods or services purchased by an entity

(iv) Performing a contractually agreed-upon task for a customer

(v) Standing ready to provide goods or services

(vi) Providing a service of arranging for another party to transfer goods or services to the customer

(vii) Granting rights to goods or services to be provided in the future that a customer can resell

(viii) Constructing, manufacturing or developing an asset on behalf of a customer

(ix) Granting licences

(x) Granting options to purchase additional goods/services

Nasir Abbas FCA

IFRS 15 – SOLUTIONS (7)

(b)

Dr. Cr.

----- Rs. -----

31-12-17 Advance from customer 378,000

Revenue - mobile [15,750 (W-1) x 20] 315,000

Revenue - network usage [18,900 (W-1) x 20 x 2/12] 63,000

[To record revenue at year end]

W -1 Allocation of transaction price

Standalone prices: Rs.

Smart phone 18,000

Network usage for 1 year [1,800 x 12] 21,600

39,600

Allocation of transaction price:

Smart phone (34,650 x 18,000/39,600) 15,750

Net work usage (34,650 x 21,600/39,600) 18,900

34,650

SOLUTION TO QUESTION NO. 9

(a)

Journal entries - Option 1 (Lump sum payment)

Debit Credit

Date Description

Rs. Rs.

01-Jan-17 Cash 200,000

Contract liability 200,000

[Cash received]

31-Dec-17 Interest expense (W-2) 13,192

Contract liability (200,000 x 6.596%) 13,192

[Interest expense for 2017]

31-Dec-17 Contract liability (W-1) 110,000

Maintenance service revenue 110,000

[Revenue for 2017]

31-Dec-18 Interest expense (W-2) 6,808

Contract liability 6,808

[Interest expense for 2017]

31-Dec-18 Contract liability 110,000

Maintenance service revenue 110,000

[Revenue for 2018]

W-1 Annual service revenue

200,000

= [1−(1+6.596%)−2] = 110,000

6.596%

W-2 Revenue Interest Principal Balance

Date -------------------- Rs. ----------------------

200,000

31-Dec-17 110,000 13,192 96,808 103,192

31-Dec-18 110,000 6,808 103,192 -

Nasir Abbas FCA

IFRS 15 – SOLUTIONS (8)

Journal entries - Option 2 (Payment at end of each year)

Debit Credit

Date Description

Rs. Rs.

31-Dec-17 Cash 110,000

Maintenance service revenue 110,000

[Cash received for 1st year service]

31-Dec-18 Cash 110,000

Maintenance service revenue 110,000

[Cash received for 2nd year service]

(b) Calculation of Selling price to be allocated to each product

Rs.

Standalone price of product C - 1 100,000

Adjusted Standalone prices of:

C - 2 [170,000/200 x 90] 76,500

C - 3 [170,000/200 x 110] 93,500

270,000

Allocation of transaction price:

C - 1 [260,000/270 x 100] 96,296

C - 2 [260,000/270 x 76.5] 73,667

C - 3 [260,000/270 x 93.5] 90,037

260,000

(c)

Indications of transfer of control include the following:

• The entity has a present right to payment for the asset

• The customer has legal title

• The customer has physical possession (except in case of bill and hold, consignment sales and repos)

• The customer has significant risks and rewards of ownership of the asset

• The customer has accepted the asset

SOLUTION TO QUESTION NO. 10

(a)

Performance obligation is a promise in a contract with a customer to transfer to the customer either:

• a good or service (or a bundle of goods or services) that is distinct; or

• a series of distinct goods or services that are substantially the same and that have the same pattern of transfer to the

customer.

A good or service is distinct if both of the following criteria are met:

• the customer can benefit from the good or service either on its own or together with other resources that are readily

available to the customer; and

• the entity’s promise to transfer the good or service is separately identifiable from other promises in the contract.

Following factors may be considered to ascertain this condition:

- Entity is not using the good or service as an input to produce the combined output specified by customer.

- The good or service does not significantly modify or customize another good or service in contract

- The good or service is not highly dependent on or interrelated with other goods or services in contract.

(b)

(i) The different services being performed under the contract are not separately identifiable from each other

because all these services are used as an input to produce the combined output specified by customer.

Therefore, there is a single performance obligation i.e. construction of residential project.

(ii) Transfer of software license, software updates and support services are distinct. However, the software license is

delivered before the other services and remains functional without updates and technical support. Further, the

customer can benefit from each of the services either on their own or together with other services that are

readily available. Thus, the entity’s promise to transfer the good or service is separately identifiable from other

promises in the contract. Based on this, the contract should not be accounted for as a single performance

obligation.

Nasir Abbas FCA

IFRS 15 – SOLUTIONS (9)

SOLUTION TO QUESTION NO. 11

The transaction price should include management’s estimate of the amount of consideration to which the entity will be

entitled for the work performed.

Probability weighted average consideration

Rs. million

Contract price 20.00

Bonus:

[2m x 0.6] 1.20

[2m x 90% x 0.3] 0.54

[2m x 80% x 0.1] 0.16

1.90

21.90

The total transaction price is Rs. 21.90 million based on the probability-weighted estimate. DC will update its estimate at

each reporting date.

SOLUTION TO QUESTION NO. 12

It is appropriate for UC to use the most likely amount method to estimate the variable consideration as there is a binary

condition for bonus. The contract’s transaction price is therefore Rs. 275 million [Rs. 250 million + Rs. 25 million] because

it is more likely that UC will receive the bonus. This estimate should be updated each reporting date.

SOLUTION TO QUESTION NO. 13

It is appropriate for NC to use the most likely amount method to estimate the variable consideration as there is a binary

condition for penalty. The contract’s transaction price is therefore Rs. 100 million (i.e. ignoring penalty of Rs 10 million)

because it is more likely that penalty will not be deducted. This estimate should be updated each reporting date.

SOLUTION TO QUESTION NO. 14

It is appropriate for AC to use the most likely amount method to estimate the variable consideration as there is a binary

condition for bonus. The contract’s transaction price is therefore Rs. 5.5 million [Rs. 5 million + Rs. 0.5 million] because it

is highly likely that AC will receive the bonus.

SOLUTION TO QUESTION NO. 15

Dr. Cr.

--------- Rs. --------

01-01-18 Cash [100 x Rs. 500] 50,000

Sales [92 x Rs. 500] 46,000

Refund liability [8 x Rs. 500] 4,000

[Cash received against sale]

01-01-18 Cost of sales [92 x Rs. 300] 27,600

Asset for right to recover product [8 x Rs. 300] 2,400

Inventory [100 x Rs. 300] 30,000

[Goods delivered to customers]

(a) Dr. Cr.

--------- Rs. --------

30-01-18 Refund liability 4,000

Sales 4,000

[Refund liability expires and revenue recognized]

Nasir Abbas FCA

IFRS 15 – SOLUTIONS (10)

30-01-18 Cost of sales 2,400

Asset for right to recover product 2,400

[Cost of goods recognized]

(b)

30-01-18 Refund liability 4,000

Cash [5 x Rs. 500] 2,500

Sales [3 x Rs. 500] 1,500

[Refund made and remaining recognized as revenue]

30-01-18 Cost of sales [3 x Rs. 300] 900

Inventory [5 x Rs. 300] 1,500

Asset for right to recover product 2,400

[Goods returned and remained recognized as cost]

(c)

30-01-18 Refund liability 4,000

Sale return [2 x Rs. 500] 1,000

Cash [10 x Rs. 500] 5,000

[Refund actually made]

30-01-18 Inventory [10 x Rs. 300] 3,000

Cost of sales [2 x Rs. 300] 600

Asset for right to recover product 2,400

[Goods returned by customers]

SOLUTION TO QUESTION NO. 16

Dr. Cr.

--------- Rs. --------

Cash [130 x Rs. 5,000] 650,000

Sales [130 x Rs. 4,000] 520,000

Refund liability [130 x Rs. 1,000] 130,000

[Cash received against sale]

SOLUTION TO QUESTION NO. 17

Dr. Cr.

--------- Rs. --------

Cash [300 x Rs. 5,000] 1,500,000

Sales [300 x Rs. 3,500 – 130 x Rs. 500] 985,000

Refund liability (balancing) 515,000

[Cash received against sale]

Nasir Abbas FCA

IFRS 15 – SOLUTIONS (11)

SOLUTION TO QUESTION NO. 18

Dr. Cr.

--------- Rs. --------

01-01-18 Receivable 785,124

Sales [W-1] 785,124

[Machine sold]

01-01-18 Cost of sales 400,000

Inventory 400,000

[Cost of machine recognized]

31-12-18 Receivable 78,512

Interest income [785,124 x 10%] 78,512

[Interest income for 2018]

31-12-19 Receivable 86,364

Interest income [785,124 x 1.1 x 10%] 86,364

[Interest income for 2019]

31-12-19 Cash 950,000

Receivable 950,000

[Cash received]

W-1

950,000

Present value of sale price = = Rs. 785,124

(1+10%)2

SOLUTION TO QUESTION NO. 19

(a) Option I Dr. Cr.

--------- Rs. --------

01-01-18 Cash 800,000

Contract liability 800,000

[100% advance received]

31-12-18 Interest expense [800,000 x 9%] 72,000

Contract liability 72,000

[Interest expense for 2018]

31-12-19 Interest expense [800,000 x 1.09 x 9%] 78,480

Contract liability 78,480

[Interest expense for 2019]

31-12-19 Contract liability 950,480

Sales 950,480

[Equipment delivered and sale recognized]

(b) Option II

31-12-19 Cash 1,000,000

Sales 1,000,000

[Equipment delivered and sale recognized]

Nasir Abbas FCA

IFRS 15 – SOLUTIONS (12)

SOLUTION TO QUESTION NO. 20

Product A Rs.

Up-front price 37,500

Year 1 Interest expense [37,500 x 6%] 2,250

39,750

Year 2 Interest expense [39,750 x 6%] 2,385

Year 2 Revenue for Product A 42,135

Product B

Up-front price 112,500

Year 1 Interest expense [112,500 x 6%] 6,750

119,250

Year 2 Interest expense [119,250 x 6%] 7,155

126,405

Year 3 Interest expense [126,405 x 6%] 7,584

133,989

Year 4 Interest expense [133,989 x 6%] 8,039

142,029

Year 5 Interest expense [142,029 x 6%] 8,522

Year 5 Revenue for Product B 150,550

SOLUTION TO QUESTION NO. 21

Dr. Cr.

--------- Rs. --------

01-01-18 Receivable 96,073

Sales [W-1] 96,073

[Equipment sold and revenue recognized]

01-01-18 Cost of sales 60,000

Inventory 60,000

[Cost of equipment recognized]

31-12-18 Cash 40,000

Receivable [W-2] 28,471

Interest income [W-2] 11,529

[1st installment received]

31-12-19 Cash 40,000

Receivable [W-2] 31,888

Interest income [W-2] 8,112

[2nd installment received]

31-12-20 Cash 40,000

Receivable [W-2] 35,714

Interest income [W-2] 4,286

[3rd installment received]

W-1

[1−(1+12%)−3 ]

Present value of installments = 40,000 x

12%

Nasir Abbas FCA

IFRS 15 – SOLUTIONS (13)

W-2

Installment Interest Principal Balance

Date -------------------- Rs. ----------------------

96,073

31-Dec-18 40,000 11,529 28,471 67,602

31-Dec-19 40,000 8,112 31,888 35,714

31-Dec-20 40,000 4,286 35,714 0

SOLUTION TO QUESTION NO. 22

Dr. Cr.

--------- Rs. --------

01-01-18 Cash 300,000

Contract liability 300,000

[100% upfront fees received]

31-12-18 Interest expense [W-2] 36,000

Contract liability 36,000

[Interest expense for 2018]

31-12-18 Contract liability 124,905

Maintenance service income [W-1] 124,905

[Revenue recognized for maintenance service]

31-12-19 Interest expense [W-2] 25,331

Contract liability 25,331

[Interest expense for 2019]

31-12-19 Contract liability 124,905

Maintenance service income [W-1] 124,905

[Revenue recognized for maintenance service]

31-12-20 Interest expense [W-2] 13,383

Contract liability 13,383

[Interest expense for 2020]

31-12-20 Contract liability 124,905

Maintenance service income [W-1] 124,905

[Revenue recognized for maintenance service]

W-1 Annual service revenue

300,000

= [1−(1+12%)−3] = 124,905

12%

Nasir Abbas FCA

IFRS 15 – SOLUTIONS (14)

W-2

Revenue Interest Principal Balance

Date -------------------- Rs. ----------------------

300,000

31-Dec-18 124,905 36,000 88,905 211,095

31-Dec-19 124,905 25,331 99,573 111,522

31-Dec-20 124,905 13,383 111,522 0

SOLUTION TO QUESTION NO. 23

Manufacture Co should include the fair value of the materials in the transaction price because it obtains control of them.

The transaction price of the arrangement is therefore Rs. 1.5 million.

SOLUTION TO QUESTION NO. 24

The payment made to the customer is not in exchange for a distinct good or service. Therefore, the Rs. 1m paid to the

customer must be treated as a reduction in the transaction price. The total transaction price is essentially being reduced

by 5% (Rs. 1m/ Rs. 20m). Therefore, Golden Gate reduces the price allocated to each good by 5% as it is transferred. By 31

December 2018, Golden Gate should have recognised revenue of Rs. 3.8m (Rs. 4m × 95%).

SOLUTION TO QUESTION NO. 25

Mobile Co should account for the payment to Retailer consistent with other purchases of advertising services. The

payment from Mobile Co to Retailer is consideration for a distinct service provided by Retailer and reflects fair value. The

advertising is distinct because Mobile Co could have engaged a third party who is not its customer to perform similar

services. The transaction price for the sale of the phones is Rs. 100,000 and is not affected by the payment made by

Retailer.

SOLUTION TO QUESTION NO. 26

Rs.

Stand-alone prices

Boat 300,000

Anchorage 50,000

350,000

Transaction price 325,000

Allocation of price:

Boat [325 x 300/350] 278,571

Anchorage [325 x 50/350] 46,429

325,000

SOLUTION TO QUESTION NO. 27

Rs.

Stand-alone prices

Boiler 360,000

Services [50,000 x 1.2] 60,000

420,000

Transaction price 400,000

Allocation of price:

Boiler [400 x 360/420] 342,857

Services [400 x 60/420] 57,143

400,000

Nasir Abbas FCA

IFRS 15 – SOLUTIONS (15)

SOLUTION TO QUESTION NO. 28

Seller can use the residual approach to estimate the standalone selling price of Product C because Seller has not

previously sold or established a price for Product C. Seller has observable evidence that Products A and B sell for Rs.

25,000 and Rs. 45,000, respectively, for a total of Rs. 70,000. The residual approach results in an estimated standalone

selling price of Rs. 30,000 for Product C (Rs. 100,000 total transaction price less Rs. 70,000).

SOLUTION TO QUESTION NO. 29

Rs.

Adjusted Standalone prices of:

A [250 x 120/260] 115,385

B [250 x 140/260] 134,615

250,000

Revised stand-alone prices

A 115,385

B 134,615

C 130,000

D 150,000

530,000

Transaction price 500,000

Allocation of price

A [500 x 115.385/530] 108,853

B [500 x 134.615/530] 126,996

C [500 x 130/530] 122,642

D [500 x 150/530] 141,509

500,000

SOLUTION TO QUESTION NO. 30

The only costs that qualify as incremental costs of obtaining a contract are the commissions paid to the sales agents. The

commissions are costs to obtain a contract that Telecom would not have incurred if it had not obtained the contracts.

Telecom should record an asset for the costs, assuming they are recoverable.

All other costs are expensed as incurred. The sales agents’ salaries and the advertising expenses are expenses Telecom

would have incurred whether or not it obtained the customer contracts.

SOLUTION TO QUESTION NO. 31

TechCo should recognize the set-up costs incurred at the outset of the contract as an asset since they (1) relate directly to

the contract, (2) enhance the resources of the company to perform under the contract, and relate to future performance,

and (3) are expected to be recovered.

An asset is recognized and amortized on a systematic basis consistent with the pattern of transfer of the tracking and

monitoring services to the customer.

SOLUTION TO QUESTION NO 32

(a) For recognition of revenue five step model is followed:

- Identifying the contract: There is a contract duly identified as both parties agree to rights of each party

and payments terms. Collection is also probable as STML is regular customer.

- Identifying performance obligation: Performance obligation is the transfer of machine to customer.

- Determination of transaction price: The transaction price is the cash equivalent price net of trade

discount i.e. Rs. 4 million. [Assuming it is equal to present value of cash flow at financing rate]

Nasir Abbas FCA

IFRS 15 – SOLUTIONS (16)

- Allocation of transaction price: Since there is single performance obligation, entire price is attributable

to transfer of machine.

- Revenue recognition: Revenue of Rs. 4 million should be recognized when performance obligation is

satisfied on transfer of control to customer over machine. The excess amount of Rs. 1.6 million is

recognized as interest income over three years.

(b) For recognition of revenue five step model is followed:

- Identifying the contract: There is a contract duly identified as both parties agree to rights of each party

and payments terms. Collection is probable as FE is highly reputed multinational.

- Identifying performance obligation: Performance obligation is the re-plastering of 10 buildings.

- Determination of transaction price: The transaction price is the agreed contract price of Rs. 22 million.

- Allocation of transaction price: Since there is single performance obligation, entire price is attributable

to re-plastering.

- Revenue recognition: Performance obligation will be satisfied on transfer of control. Performance

obligation will be satisfied over time. Therefore revenue should be recognized over the period by

measuring the progress towards complete satisfaction of obligation. Various methods are used to

measure progress. Based on information given, cost incurred may be used as basis as well as units

completed basis may be used for progress measurement.

SOLUTION TO QUESTION NO 33

Application of the five-step process to TeleSouth

(i) Identify the contract with a customer. This is clear. TeleSouth has a twelve-month contract with Angelo.

(ii) Identify the separate performance obligations in the contract. In this case there are two distinct performance

obligations:

(1) The obligation to deliver a handset

(2) The obligation to provide network services for twelve months (The obligation to deliver a handset would

not be a distinct performance obligation if the handset could not be sold separately, but it is in this case

because the handsets are sold separately.)

(iii) Determine the transaction price. The transaction price is straightforward i.e. Rs. 2,400 [12 x Rs. 200]

(iv) Allocate the transaction price to the separate performance obligations in the contract. The transaction price is

allocated to each separate performance obligation in proportion to the standalone selling price at contract

inception of each performance obligation, that is the stand-alone price of the handset (Rs. 500 and the stand-

alone price of the network services (Rs. 175 × 12 = Rs. 2,100)

Rs.

Stand-alone prices

Handset 500

Services 2,100

2,600

Transaction price 2,400

Allocation of price:

Handset [2,400 x 500/2,600] 462

Services [2,400 x 2,100/2,600] 1,938

2,400

(v) Recognise revenue when (or as) the entity satisfies a performance obligation, that is when the entity transfers

a promised good or service to a customer. This applies to each of the performance obligations:

(1) When TeleSouth gives a handset to Angelo, it needs to recognize the revenue of Rs. 462.

(2) When TeleSouth provides network services to Angelo, it needs to recognize the total revenue of Rs.

1,938. It would be reasonable to recognized service revenue on monthly basis.

Nasir Abbas FCA

IFRS 15 – SOLUTIONS (17)

Journal entries

Dr. Cr.

--------- Rs. --------

01-01-18 Receivable 462

Revenue 462

[Revenue from sale of handset recognized]

31-01-18 Cash 200

Revenue (1,938/12) 162

Receivable (462/12) 38

[Monthly bill received and service revenue recognized]

SOLUTION TO QUESTION NO. 34

Extracts – SOCI Rs. million

Revenue [500 x 80/400] 100

Costs 80

Extracts – SOFP

Current assets

Contract asset [100 – 75] 25

Receivable 75

SOLUTION TO QUESTION NO. 35

Journal entries Dr. Cr.

------- Rs. million -------

01-01-21 PPE 320.00

Cash 320.00

[Purchase of plant]

31-12-21 Contract cost WIP 101.00

Accumulated dep - Plant [320 ÷ 20] 16.00

Cash 85.00

[Construction costs incurred]

31-12-21 Contract asset [154 - 120] 34.00

Receivable 120.00 -

Construction revenue [700 x 22%] 154.00

[Revenue for the year recognized]

31-12-21 Cost of sales (W-1) 97.46

Contract asset WIP 97.46

[Cost of sales for the year recognized]

Extracts - SOCI

Rs. million

Revenue 154.00

Contract cost amortized 97.46

Nasir Abbas FCA

IFRS 15 – SOLUTIONS (18)

Extracts - SOFP

Non-current assets

PPE [320 - 16] 304.00

Current assets

Contract cost WIP (W-2) 3.54

Receivable 120.00

Contract asset 34.00

WORKINGS

W-1 Rs. million

Total estimated contract cost:

- Incurred to date (excluding dep) 85.00

- to be incurred (excluding dep) 310.00

- Plant dep [320 x 3/20] 48.00

443.00

Amortized [443 x 22%] 97.46

W-2

Cost incurred to date 101.00

Amortized (W-1) (97.46)

c/d balance 3.54

Nasir Abbas FCA

You might also like

- EY Applying Ifrs Presentation and Disclosure Requirements of Ifrs 15 October 2017No ratings yetEY Applying Ifrs Presentation and Disclosure Requirements of Ifrs 15 October 201751 pages

- IAS 17 Leases: Lease Finance Lease Operating LeaseNo ratings yetIAS 17 Leases: Lease Finance Lease Operating Lease13 pages

- Certificate in Big Data Analytics For Business and ManagementNo ratings yetCertificate in Big Data Analytics For Business and Management17 pages

- Chapter 1: The Financial Environment Multiple Choice: Answer: B Level: Medium Section: What Is Finance? 3No ratings yetChapter 1: The Financial Environment Multiple Choice: Answer: B Level: Medium Section: What Is Finance? 324 pages

- Capital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043100% (1)Capital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,04310 pages

- Financial Statement Analysis MCQs - Financial Statements MCQsNo ratings yetFinancial Statement Analysis MCQs - Financial Statements MCQs22 pages

- Managerial Economics in A Global Economy: Regulation and Antitrust: The Role of Government in The EconomyNo ratings yetManagerial Economics in A Global Economy: Regulation and Antitrust: The Role of Government in The Economy22 pages

- 07 Objective Type IAS 7 Statement of Cash Flows A35No ratings yet07 Objective Type IAS 7 Statement of Cash Flows A359 pages

- Advanced Financial Reporting: Module 4: Final Accounts of Insurance CompaniesNo ratings yetAdvanced Financial Reporting: Module 4: Final Accounts of Insurance Companies23 pages

- Ias 10 Events After The Reporting PeriodNo ratings yetIas 10 Events After The Reporting Period9 pages

- Qa Ca Zambia Programme December 2019 ExaminationNo ratings yetQa Ca Zambia Programme December 2019 Examination449 pages

- Review Questions On Financial Planning and ForecastingNo ratings yetReview Questions On Financial Planning and Forecasting5 pages

- ISA 320 Materiality in Planning and Performing An AuditNo ratings yetISA 320 Materiality in Planning and Performing An Audit8 pages

- Other Standards: 1 IAS 8 Accounting Policies, Changes in Accounting Estimates & ErrorsNo ratings yetOther Standards: 1 IAS 8 Accounting Policies, Changes in Accounting Estimates & Errors7 pages

- Coaf 4106 Risk Analysis Mock Exam Dec 2021No ratings yetCoaf 4106 Risk Analysis Mock Exam Dec 20215 pages

- Preparing Cash Budgets 3: This Chapter Covers..No ratings yetPreparing Cash Budgets 3: This Chapter Covers..50 pages

- Strategic Management Accounting: Section A - Questions 1, 2 and 3 Are All Compulsory100% (1)Strategic Management Accounting: Section A - Questions 1, 2 and 3 Are All Compulsory21 pages

- Download Full Business Ethics: Ethical Decision Making & Cases 11th Edition – Ebook PDF Version PDF All Chapters100% (2)Download Full Business Ethics: Ethical Decision Making & Cases 11th Edition – Ebook PDF Version PDF All Chapters41 pages

- Ca Inter Accounting Full Test 1 Nov 2022 Unschedule Solution 1658223005No ratings yetCa Inter Accounting Full Test 1 Nov 2022 Unschedule Solution 165822300540 pages

- Topic 11 - XH-IFRS 15 - VN-Revenue From Contract With CustomersNo ratings yetTopic 11 - XH-IFRS 15 - VN-Revenue From Contract With Customers31 pages

- Long Term Construction Contracts Assignment100% (2)Long Term Construction Contracts Assignment10 pages

- IFRS 15 Revenue From Contracts With CustomersNo ratings yetIFRS 15 Revenue From Contracts With Customers47 pages

- CURRENT ISSUES IN ACCOUNTING Assignment 2No ratings yetCURRENT ISSUES IN ACCOUNTING Assignment 27 pages

- [ALEJO] Quizzer-Franchise and ConsignmentNo ratings yet[ALEJO] Quizzer-Franchise and Consignment5 pages

- Sponsor and Commercial Partner - Stadium Naming Rights: BackgroundNo ratings yetSponsor and Commercial Partner - Stadium Naming Rights: Background1 page

- Aafr Ifrs 15 Icap Past Papers With Solution0% (1)Aafr Ifrs 15 Icap Past Papers With Solution10 pages

- EY Applying Ifrs Presentation and Disclosure Requirements of Ifrs 15 October 2017EY Applying Ifrs Presentation and Disclosure Requirements of Ifrs 15 October 2017

- IAS 17 Leases: Lease Finance Lease Operating LeaseIAS 17 Leases: Lease Finance Lease Operating Lease

- Certificate in Big Data Analytics For Business and ManagementCertificate in Big Data Analytics For Business and Management

- Chapter 1: The Financial Environment Multiple Choice: Answer: B Level: Medium Section: What Is Finance? 3Chapter 1: The Financial Environment Multiple Choice: Answer: B Level: Medium Section: What Is Finance? 3

- Capital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043Capital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043

- Financial Statement Analysis MCQs - Financial Statements MCQsFinancial Statement Analysis MCQs - Financial Statements MCQs

- Managerial Economics in A Global Economy: Regulation and Antitrust: The Role of Government in The EconomyManagerial Economics in A Global Economy: Regulation and Antitrust: The Role of Government in The Economy

- 07 Objective Type IAS 7 Statement of Cash Flows A3507 Objective Type IAS 7 Statement of Cash Flows A35

- Advanced Financial Reporting: Module 4: Final Accounts of Insurance CompaniesAdvanced Financial Reporting: Module 4: Final Accounts of Insurance Companies

- Review Questions On Financial Planning and ForecastingReview Questions On Financial Planning and Forecasting

- ISA 320 Materiality in Planning and Performing An AuditISA 320 Materiality in Planning and Performing An Audit

- Other Standards: 1 IAS 8 Accounting Policies, Changes in Accounting Estimates & ErrorsOther Standards: 1 IAS 8 Accounting Policies, Changes in Accounting Estimates & Errors

- Strategic Management Accounting: Section A - Questions 1, 2 and 3 Are All CompulsoryStrategic Management Accounting: Section A - Questions 1, 2 and 3 Are All Compulsory

- Download Full Business Ethics: Ethical Decision Making & Cases 11th Edition – Ebook PDF Version PDF All ChaptersDownload Full Business Ethics: Ethical Decision Making & Cases 11th Edition – Ebook PDF Version PDF All Chapters

- Ca Inter Accounting Full Test 1 Nov 2022 Unschedule Solution 1658223005Ca Inter Accounting Full Test 1 Nov 2022 Unschedule Solution 1658223005

- Topic 11 - XH-IFRS 15 - VN-Revenue From Contract With CustomersTopic 11 - XH-IFRS 15 - VN-Revenue From Contract With Customers

- Sponsor and Commercial Partner - Stadium Naming Rights: BackgroundSponsor and Commercial Partner - Stadium Naming Rights: Background