Week 13 - Soal

Week 13 - Soal

Uploaded by

Heidi ParamitaCopyright:

Available Formats

Week 13 - Soal

Week 13 - Soal

Uploaded by

Heidi ParamitaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Week 13 - Soal

Week 13 - Soal

Uploaded by

Heidi ParamitaCopyright:

Available Formats

ASISTENSI 13

STATEMENT OF CASH FLOW

PROBLEM 1

Barker Co. is a furniture company. The following information is the Barker Co. Profit / Loss Report.

for the period ended December 31, 2019.

Barker Co.

Income Statement

For the year ended December 31, 2019

Sales Revenue 28.350.000

COGS

Beginning inventory 8.457.000

Purchase 12.985.000

COGAS 21.442.000

Ending inventory (1.400.000)

Total COGS (20.042.000)

Gross Prrofit 8.308.000

Operating Expense (2.150.000)

Net Income 6.158.000

Additional information for Barker Co. financial condition are:

1. Accounts receivable decreased by $ 125,500 from the previous period.

2. Inventory increased by $ 315,000 from the previous period.

3. Prepaid expenses increased by $ 225,750 from the previous period.

4. Accounts payable decreased by $ 112,560 from the previous period.

5. Accrued expenses payable decreased by $ 100,000 from the previous period.

6. Operating expenses including a depreciation expense of $ 312,000.

Instruction:

Prepare a Statement of Cash Flows for Barker Co. for the period ending 31 December 2019 using

the indirect method!

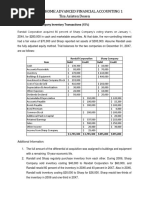

PROBLEM 2

The following is the ERIC Co. Comparative Balance Sheet for 31 December 2017 & 2018 and the

company's Profit / Loss Report for the year ended 31 December 2018.

ERIC Co

Comparative Balance Sheets

December 31

Assets 2018 2017

Cash and cash equivalents $21,000.00 $24,500.00

Accounts receivable $217,000.00 $178,500.00

Short Term Investments $122,500.00 $63,000.00

Inventory $140,000.00 $210,000.00

Prepaid rent $17,500.00 $14,000.00

Equipment $539,000.00 $455,000.00

Acc. Depreciation -equipment -$122,500.00 -$87,500.00

Copyrights $161,000.00 $175,000.00

Total Assets $1,095,500.00 $1,032,500.00

Liabilities and Stockholders'

Equity

Accounts payable $161,000.00 $140,000.00

Income Tax Payable $14,000.00 $21,000.00

Salary payable $28,000.00 $14,000.00

Short-term loans payable $28,000.00 $35,000.00

Long term loans payable $210,000.00 $241,500.00

Common Stock ($35) $350,000.00 $350,000.00

Paid in Capital in Excess of Par -

Common Stock $105,000.00 $105,000.00

Retained Eranings $199,500.00 $126,000.00

Total Liabilities and

Stockholders' Equity $1,095,500.00 $1,032,500.00

ERIC Co.

Income Statement

For the Year Ended December 31, 2018

Sales $1,183,525.00

Cost of Goods Sold $612,500.00

Gross Profit $571,025.00

Operating Expenses $420,000.00

Operating Profit $151,025.00

Interest Expenses $39,900.00

Gain on equipment sale $7,000.00 $32,900.00

Income before income tax $118,125.00

Income tax expense $23,625.00

Net Income $94,500.00

Additional Information:

Dividends are announced and paid in 2018. Operating expenses include depreciation and

amortization expenses. There are no gain/loss to investing in the current year. The equipment which

is valued at $ 70,000, has been depreciated 70% and sold in 2018.

Instruction:

a. Prepare an indirect cash flow statement method!

b. Prepare a direct cash flow statement method!

You might also like

- Draw Steel Rules Backer Packet FINALDocument125 pagesDraw Steel Rules Backer Packet FINALfragabore100% (1)

- Cash Flow Statements Study GuideDocument37 pagesCash Flow Statements Study GuideAshekin MahadiNo ratings yet

- Mini CaseDocument7 pagesMini CaseHarrisha Arumugam0% (1)

- Ch02 P14 Build A Model SolutionDocument6 pagesCh02 P14 Build A Model SolutionSeee OoonNo ratings yet

- Accounting Mock ExamDocument6 pagesAccounting Mock ExamKiran alex Challagiri100% (1)

- Task 4 - Consolidation: Patricia HarringtonDocument9 pagesTask 4 - Consolidation: Patricia HarringtonDewi Agus SukowatiNo ratings yet

- Chapter 23 Statement of Cash Flows Multiple Choice With SolutionsDocument10 pagesChapter 23 Statement of Cash Flows Multiple Choice With SolutionsHossein Parvardeh50% (2)

- Exercise 1: On December 31, Bryniuk's Company, The Accounting Records Showed The Following InformationDocument10 pagesExercise 1: On December 31, Bryniuk's Company, The Accounting Records Showed The Following InformationJohn Kenneth Bohol50% (2)

- In Class Excel - 825 - WorkingDocument98 pagesIn Class Excel - 825 - WorkingIanNo ratings yet

- Ch10-notes-templateDocument6 pagesCh10-notes-templatevinau1985No ratings yet

- Thumbs Up & ChemaliteDocument8 pagesThumbs Up & ChemaliteVaibhav MahajanNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- Problem 1: Cash Flow Statement (Class Practice)Document2 pagesProblem 1: Cash Flow Statement (Class Practice)ronamiNo ratings yet

- Tutorial 14 Introductory Accounting Teaching Assistant TeamDocument2 pagesTutorial 14 Introductory Accounting Teaching Assistant TeamAris KurniawanNo ratings yet

- ContDocument4 pagesContmrmts793No ratings yet

- FA I WORKSHEET cash flow(1)Document3 pagesFA I WORKSHEET cash flow(1)jundiahmedin46No ratings yet

- Activity Statement of Cash FlowsDocument2 pagesActivity Statement of Cash FlowsmabahosismartNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- CH23 - Transactional Approach and CFExercises and SolutionsDocument6 pagesCH23 - Transactional Approach and CFExercises and SolutionsHossein ParvardehNo ratings yet

- Latihan Soal Cash FlowDocument2 pagesLatihan Soal Cash FlowRuth AngeliaNo ratings yet

- Ch5 Additional Q OnlyDocument13 pagesCh5 Additional Q OnlynigaroNo ratings yet

- Session 11,12&13 AssignmentDocument3 pagesSession 11,12&13 AssignmentMardi SutiosoNo ratings yet

- Cashflow Exercise - RocastleDocument1 pageCashflow Exercise - RocastleAbrashi100% (1)

- Practice Questions and Answers: Financial AccountingDocument18 pagesPractice Questions and Answers: Financial AccountingFarah NazNo ratings yet

- Financial Statement Analysis QuestionsDocument4 pagesFinancial Statement Analysis QuestionsRisha OsfordNo ratings yet

- Statement of Cash Flows 4Document6 pagesStatement of Cash Flows 4Rashid W QureshiNo ratings yet

- Practice Exercise Ch18Document3 pagesPractice Exercise Ch18ngocanhhlee.11No ratings yet

- Acc310 7-1bDocument6 pagesAcc310 7-1bDestiny RolleNo ratings yet

- Class Problems CH 4Document9 pagesClass Problems CH 4Eduardo Negrete100% (2)

- Fa2 TutorialDocument59 pagesFa2 TutorialNam PhươngNo ratings yet

- Account AssignmentDocument4 pagesAccount AssignmentNavjeet SandhuNo ratings yet

- Acca110 Adorable Ac21 As03Document6 pagesAcca110 Adorable Ac21 As03Shaneen AdorableNo ratings yet

- Midterm Practice QuestionsDocument4 pagesMidterm Practice QuestionsGio RobakidzeNo ratings yet

- JadDocument10 pagesJaddomitiooNo ratings yet

- Chapter 17 Do It QuestionDocument3 pagesChapter 17 Do It QuestionMR. yoloNo ratings yet

- Exhibit 17. Goodwill Calculation and The Consolidated Balance SheetDocument4 pagesExhibit 17. Goodwill Calculation and The Consolidated Balance SheetЭниЭ.No ratings yet

- E22-6 (LO 2) Accounting Changes-DepreciationDocument6 pagesE22-6 (LO 2) Accounting Changes-DepreciationRiana DeztianiNo ratings yet

- Dispensers of California, Inc.Document7 pagesDispensers of California, Inc.Prashuk SethiNo ratings yet

- Cash Flow - Additional Exercises - SOLDocument5 pagesCash Flow - Additional Exercises - SOLMathieu HindyNo ratings yet

- Highlight Construction Company: Income StatementDocument9 pagesHighlight Construction Company: Income Statementthanh2141998No ratings yet

- Clarke Inc. HighlightedDocument4 pagesClarke Inc. HighlightedAdams BruinsNo ratings yet

- Financial statementsDocument4 pagesFinancial statementsnyxflrzzzzNo ratings yet

- Financial Statements EQUIPO 1Document14 pagesFinancial Statements EQUIPO 1David TorresNo ratings yet

- FS Consolidation at The Date of Acquisition v2Document16 pagesFS Consolidation at The Date of Acquisition v2Pagatpat, Apple Grace C.No ratings yet

- PepsiCo Financial StatementsDocument9 pagesPepsiCo Financial StatementsBorn TaylorNo ratings yet

- Unit 2 Module 3 Chapter SolutionsDocument6 pagesUnit 2 Module 3 Chapter SolutionsJimNo ratings yet

- Lecture Practice QuestionsDocument5 pagesLecture Practice QuestionsMariøn Lemonnier BruelNo ratings yet

- Assignment 1 Fall 2017Document3 pagesAssignment 1 Fall 2017YaseenTamerNo ratings yet

- Midterm Task PerformanceDocument7 pagesMidterm Task PerformanceSol Luna100% (1)

- (Quiz Uas Take Home) Akl-1 PDFDocument7 pages(Quiz Uas Take Home) Akl-1 PDFStephani ElvinaNo ratings yet

- Financial Management (Problems)Document12 pagesFinancial Management (Problems)Prasad GowdNo ratings yet

- 1 - Accounting Information Systems Problems With SolutionsDocument22 pages1 - Accounting Information Systems Problems With Solutionsbusiness docNo ratings yet

- Financial PlanDocument10 pagesFinancial Planmikasaackermann527No ratings yet

- Professor Office's Beach Cabana Balance Sheets As of December 31, 2014 and 2013Document3 pagesProfessor Office's Beach Cabana Balance Sheets As of December 31, 2014 and 2013Precious Uminga100% (1)

- TT10 QuestionDocument1 pageTT10 QuestionUyển Nhi TrầnNo ratings yet

- Movida CashtoaccrualDocument5 pagesMovida CashtoaccrualVivienne Rozenn LaytoNo ratings yet

- Group Activitity Bus FinDocument8 pagesGroup Activitity Bus FinDavon LopezNo ratings yet

- Chapter 7. Student CH 7-14 Build A Model: AssetsDocument5 pagesChapter 7. Student CH 7-14 Build A Model: Assetsseth litchfieldNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- an-introduction-to-dynamical-systems-continuous-and-discrete-coen7qeaa8Document6 pagesan-introduction-to-dynamical-systems-continuous-and-discrete-coen7qeaa8HonkiNo ratings yet

- Puma EnergyDocument17 pagesPuma EnergyPrashant SinghNo ratings yet

- The Gospel of LukeDocument3 pagesThe Gospel of LukeDavid JiménezNo ratings yet

- Tourismin India Editedv 2 Final VersionDocument10 pagesTourismin India Editedv 2 Final Versionjaswanthlalam2010No ratings yet

- Faculty of Sport Science, Jakarta State University, IndonesiaDocument5 pagesFaculty of Sport Science, Jakarta State University, IndonesiaFansisca SiallaganNo ratings yet

- PDFDocument38 pagesPDFDuong Thuy NgacNo ratings yet

- GLG The Expert Interview BlueprintDocument17 pagesGLG The Expert Interview BlueprintGovind VenugopalanNo ratings yet

- Water Level & Rainfall 2024 1717908056Document2 pagesWater Level & Rainfall 2024 1717908056ALAM ENGINEERINGNo ratings yet

- Showbiz News ScriptDocument3 pagesShowbiz News ScriptFreedom DoctamaNo ratings yet

- Wildcat Family Network XXS: Important Dates Parent University SymposiumDocument3 pagesWildcat Family Network XXS: Important Dates Parent University SymposiumRicardo RecinosNo ratings yet

- SFAC - Value Chain Analysis Pages 91 96Document6 pagesSFAC - Value Chain Analysis Pages 91 96shubhram2014No ratings yet

- Read The Text. Taylor SwiftDocument2 pagesRead The Text. Taylor Swiftfajar sukmanaNo ratings yet

- Five Roses Cook BookDocument159 pagesFive Roses Cook BookShannel BachNo ratings yet

- Orcino Vs Gaspar, AC No. 3773, September 24, 1997Document3 pagesOrcino Vs Gaspar, AC No. 3773, September 24, 1997Nathalie TanNo ratings yet

- Synchronous AlternatorDocument18 pagesSynchronous AlternatorShaun HarrisonNo ratings yet

- Ignou mmpc001 Intro To MGT PPT - 1Document25 pagesIgnou mmpc001 Intro To MGT PPT - 1utkarshNo ratings yet

- Math (34 1 34) : Model Test 5Document12 pagesMath (34 1 34) : Model Test 5Sa KibNo ratings yet

- Learning Activity Sheet No: 2: English For Academic and Professional Purposes (Eapp)Document6 pagesLearning Activity Sheet No: 2: English For Academic and Professional Purposes (Eapp)YVONE MAE MAYORNo ratings yet

- Empire XXI Cinema Yogyakarta - Google SearchDocument1 pageEmpire XXI Cinema Yogyakarta - Google SearchTio Roby, S.Sn., M.Sn100% (1)

- Action Research For Sports (Athletics)Document6 pagesAction Research For Sports (Athletics)Jesse James NagorNo ratings yet

- 1663 - Jawaban Soal 2 Financial StatementsDocument2 pages1663 - Jawaban Soal 2 Financial StatementsRezekiro IrmNo ratings yet

- Twelve HousesDocument3 pagesTwelve HousesSandeep SinghNo ratings yet

- TLE10 Q3 Lesson1Document19 pagesTLE10 Q3 Lesson1Ella Cagadas PuzonNo ratings yet

- CTU Form No. 2B DETAILED RD Proposal 1.18.22 SDG GADDocument10 pagesCTU Form No. 2B DETAILED RD Proposal 1.18.22 SDG GADJay Lord EstilNo ratings yet

- Lyrics Jose Manuel Palomino Moya: EatlesDocument18 pagesLyrics Jose Manuel Palomino Moya: EatlescorreolphNo ratings yet

- Medical ImagingDocument12 pagesMedical ImagingKeanan WongsoNo ratings yet

- Operators in JavaDocument3 pagesOperators in JavaNurzafirah NasohaNo ratings yet

- BHIE-143 English Assignment 2021-22Document3 pagesBHIE-143 English Assignment 2021-22Iswara KhetiNo ratings yet

- Department of Architecture: College of Architecture, Design and The Built EnvironmentDocument25 pagesDepartment of Architecture: College of Architecture, Design and The Built EnvironmentNichole Angelo T. DeguzmanNo ratings yet