Mock Test - 2023

Mock Test - 2023

Uploaded by

Phuoc TruongCopyright:

Available Formats

Mock Test - 2023

Mock Test - 2023

Uploaded by

Phuoc TruongOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Mock Test - 2023

Mock Test - 2023

Uploaded by

Phuoc TruongCopyright:

Available Formats

MOCK TEST

1.5 hours 10 minutes

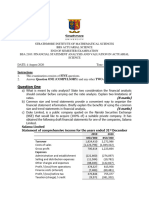

Question 1 (30 marks): Key figures have been extracted from the published

accounts of SunCo, and are summarised below.

Income Statements for the year ending 31 December

2020 2019

£m £m

Turnover 6,980 6,590

Cost of sales 5,475 5,145

Gross Profit 1,505 1,445

Administration and Distribution Expenses 1,105 990

Profit before Interest and Tax 400 455

Interest 60 35

Profit before tax 340 420

Tax 68 84

Profit after tax 272 336

Dividends 110 134

Retained Profit 162 202

Statements of Financial Position as at 31 December

2020 2019

£m £m

Non-current assets 3,507 3,222

Current assets 588 542

Inventories 338 296

Trade receivables 161 142

Cash and cash equivalents 89 104

Current Liabilities 1,250 1,309

Trade Payables 656 595

Overdrafts@ 12% 69 199

Other current Liabilities 525 515

Long term Loans @ 15% 838 568

Net assets 2,007 1,887

Equity 2,007 1,887

Share Capital @ £ 0.5 per share 1,000 1,000

Reserves 1,007 887

Share Price £ 1.7 £ 1.9

Required:

a) Evaluate SunCo’s financial performance in 2020 by comparing to 2019

with the following ratios (25 marks):

i) Profitability ratios - ROCE, Gross profit margin, Operating profit margin;

ii) Liquidity ratios - Current ratio, Quick ratio;

iii) Debt ratios – Gearing ratio, Interest cover;

iv) Investment ratios - EPS, P/E ratio, DPS.

(You are not expected to discuss working capital management as part of your

answer here; Calculation of ratio s= 1.5 marks x 10 ratios = 1 5 marks; Analysis of

performance = 10 marks)

(b) On the assumption that the Central Bank makes a substantial interest rate

increase, discuss the possible impact on cost of capital for SunCo. (5 marks)

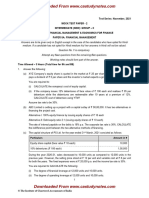

Question 3 (20 marks)

MoonCo is going to start trading on 1st Jul 2021. During the first 6 months of

trading, the monthly sales, production and overheads (including depreciation) are

expected as follows:

Sale Production Overheads

(Units) (Units) (Including

Depreciation)

(£ )

Jul 16,000 20,000 20,000

Aug 18,000 20,000 20,000

Sep 20,000 30,000 20,000

Oct 30,000 30,000 30,000

Nov 40,000 40,000 30,000

Dec 45,000 40,000 30,000

Extra information includes:

(i) The company is expected to have £500,000 cash at bank on 1st July 2021.

(ii)A machine was purchased for £130,000 and is to be paid in cash on 1st Jul

2021. The machine will have a useful life of 10 years and a residual value of

£10,000 at the end.

(iii) The selling price of the product will be £18 per unit. The sales are expected to

be 40% in cash and 60% in 1 -month credit. A 2% discount is given to the

customers who paid in cash.

(iv) Purchases of raw materials will be £ 5 per unit on 2-month credit.

(v) The labour cost will be £4 per unit, to be paid in the month concerned.

(vi) Overheads are planned to be paid 80% in the month of production and

20% in the following month.

Required:

(a)Prepare a monthly cash budget for the period July-December 2021. (15 marks)

(b)Discuss sources of finance for working capital. (5 marks)

You might also like

- Accounting and Management Exam - MancosaDocument11 pagesAccounting and Management Exam - MancosaFrancis Mtambo100% (1)

- Forecasting ProblemsDocument7 pagesForecasting ProblemsJoel Pangisban0% (3)

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- Workshop 2 Qs As Introduction To A FDocument18 pagesWorkshop 2 Qs As Introduction To A FYeoh Tze ShinNo ratings yet

- Tutorial 4Document4 pagesTutorial 4king kiang kongNo ratings yet

- SCALP Handout 040Document2 pagesSCALP Handout 040Cher NaNo ratings yet

- Example For Financial Statement AnalysisDocument2 pagesExample For Financial Statement AnalysisMobile Legends0% (1)

- SCALP Handout 040Document2 pagesSCALP Handout 040Cher NaNo ratings yet

- S 4Document53 pagesS 4Mia Ciobica0% (1)

- Mocktest 02Document4 pagesMocktest 02Nga LêNo ratings yet

- University of Bradford Financial Accounting, Afe5008-B Final ExaminationDocument9 pagesUniversity of Bradford Financial Accounting, Afe5008-B Final ExaminationDiana TuckerNo ratings yet

- Cash Flow QuestionDocument2 pagesCash Flow QuestionomairNo ratings yet

- Questions - Week 1Document5 pagesQuestions - Week 1Angela MonalisaNo ratings yet

- ACC2002 Practice 1Document9 pagesACC2002 Practice 1Đan LêNo ratings yet

- SunshineDocument3 pagesSunshinekgomotsomahloko11No ratings yet

- 03RATIO ANALYSIS MbaDocument18 pages03RATIO ANALYSIS MbaAbid XargarNo ratings yet

- Section A - Answer Question One (Compulsory Question)Document5 pagesSection A - Answer Question One (Compulsory Question)Adeel KhalidNo ratings yet

- AC123ASS1Document4 pagesAC123ASS1masiwakalonga28No ratings yet

- Audit Practice & Assurance Services: Professional 2 Examination - August 2017Document19 pagesAudit Practice & Assurance Services: Professional 2 Examination - August 2017Vitalis MbuyaNo ratings yet

- Fusen Pharmaceutical Company Limited 福 森 藥 業 有 限 公 司Document22 pagesFusen Pharmaceutical Company Limited 福 森 藥 業 有 限 公 司in resNo ratings yet

- Finc 301 2023 Tutorial Set 1 A.K. AngeloDocument9 pagesFinc 301 2023 Tutorial Set 1 A.K. AngeloObed AsamoahNo ratings yet

- Practice Questions For Final W Brick FinancialsDocument7 pagesPractice Questions For Final W Brick FinancialsJoana SilvaNo ratings yet

- Revision PaperDocument6 pagesRevision PaperBridget OlubayiNo ratings yet

- Acct1101 Final Examination SEMESTER 2, 2020Document13 pagesAcct1101 Final Examination SEMESTER 2, 2020Yahya ZafarNo ratings yet

- Accountancy FinancialDocument9 pagesAccountancy Financialverma.vineet.officialNo ratings yet

- 2020 Exam Question and Required FINALDocument10 pages2020 Exam Question and Required FINALkitalyac100No ratings yet

- FM&EconomicsQUESTIONPAPER MAY21Document6 pagesFM&EconomicsQUESTIONPAPER MAY21Harish Palani PalaniNo ratings yet

- Company AccountsDocument4 pagesCompany AccountsShlokNo ratings yet

- Online Assessment 1 EMNF2724Document11 pagesOnline Assessment 1 EMNF2724lehlohonoloronaldinhoNo ratings yet

- AFA IIP.L IIIQuestion June 2016Document4 pagesAFA IIP.L IIIQuestion June 2016HossainNo ratings yet

- FM-Cash Budget)Document9 pagesFM-Cash Budget)Aviona GregorioNo ratings yet

- 2.4 Test - W4Document2 pages2.4 Test - W4Mai PhươngNo ratings yet

- Financial Reporting Mcom 3 Semester: AssetsDocument2 pagesFinancial Reporting Mcom 3 Semester: AssetsYasir AminNo ratings yet

- Announcement of Results For The Year Ended 31 March 2020: Key HighlightsDocument27 pagesAnnouncement of Results For The Year Ended 31 March 2020: Key HighlightsJ. BangjakNo ratings yet

- Advanced Financial Reporting Supp 2018Document8 pagesAdvanced Financial Reporting Supp 2018smlingwaNo ratings yet

- Pre Test Winter 2024Document3 pagesPre Test Winter 2024Okuhle DondasheNo ratings yet

- 2.3 Seminar - W2+3Document5 pages2.3 Seminar - W2+3Mai PhươngNo ratings yet

- SCALP Handout 040Document2 pagesSCALP Handout 040Eren CuestaNo ratings yet

- FM Eco Q Mtp2 Inter Nov21Document7 pagesFM Eco Q Mtp2 Inter Nov21rridhigolchha15No ratings yet

- Ac 4052qa Coursework Augs24 Intake Assignment Brief 01Document2 pagesAc 4052qa Coursework Augs24 Intake Assignment Brief 01collojaiwhiteNo ratings yet

- Tutorial Questions Cac2101 2021Document13 pagesTutorial Questions Cac2101 2021chibireginabNo ratings yet

- FIA142 Cash Flows - Companies - Revision Exercise - 2024 Class SessionDocument11 pagesFIA142 Cash Flows - Companies - Revision Exercise - 2024 Class Sessionthimnabomvana3No ratings yet

- Final IFRS For SMEs Illustrator ExampleDocument30 pagesFinal IFRS For SMEs Illustrator ExampleleekosalNo ratings yet

- Business Accounting (LO 03,4,5) - Alternative AssessmentDocument7 pagesBusiness Accounting (LO 03,4,5) - Alternative Assessmentpiumi100% (1)

- Concepts of Financial Reporting Final OSADocument5 pagesConcepts of Financial Reporting Final OSAdamian.levendalNo ratings yet

- CBCS 3.3.3 Corporate Valuation and Restructuring 2020Document4 pagesCBCS 3.3.3 Corporate Valuation and Restructuring 2020Bharath MNo ratings yet

- UG1: Introduction To Financial and Management Accounting March 2021 AssignmentDocument8 pagesUG1: Introduction To Financial and Management Accounting March 2021 AssignmentAamirNo ratings yet

- Questions Business IncomeDocument8 pagesQuestions Business IncomeMbeiza MariamNo ratings yet

- Management Accounting - 1Document4 pagesManagement Accounting - 1amaljacobjogilinkedinNo ratings yet

- Name: Dao Mai Linh Class: F13B ID NUMBER: F13-127Document30 pagesName: Dao Mai Linh Class: F13B ID NUMBER: F13-127Linhzin LinhzinNo ratings yet

- Glencore PLC: ISIN: JE00B4T3BW64 WKN: B4T3BW6 Asset Class: StockDocument2 pagesGlencore PLC: ISIN: JE00B4T3BW64 WKN: B4T3BW6 Asset Class: StockDayu adisaputraNo ratings yet

- PDE4232 Individual Coursework - 2023-24 UpdatedDocument5 pagesPDE4232 Individual Coursework - 2023-24 UpdatedTariq KhanNo ratings yet

- Corporate ValuationDocument9 pagesCorporate ValuationPRACHI DASNo ratings yet

- Accf3114 1Document12 pagesAccf3114 1Krishna 11No ratings yet

- 301 AFA II PL III Question CMA June 2021 Exam.Document4 pages301 AFA II PL III Question CMA June 2021 Exam.rumelrashid_seuNo ratings yet

- ltn20110323207Document23 pagesltn20110323207Groupe MAP'SNo ratings yet

- ACC 401-2023 GA 2-EvenDocument3 pagesACC 401-2023 GA 2-EvenOhene Asare PogastyNo ratings yet

- Nov 2024 Fin Ratios - CRDocument26 pagesNov 2024 Fin Ratios - CRadetoun000No ratings yet

- 1.1+Acc+I+Nov+2020+Exam+Question+paper+with+comments+after+external+%281%29Document9 pages1.1+Acc+I+Nov+2020+Exam+Question+paper+with+comments+after+external+%281%29nonkonzovilakaziNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- Name of Group MembersDocument7 pagesName of Group Membersphelele488No ratings yet

- Black Out PoetryDocument2 pagesBlack Out Poetryjoy villNo ratings yet

- Cell Preparation For Genomics FlyerDocument20 pagesCell Preparation For Genomics Flyersara samanianNo ratings yet

- Warfare Marketing Strategies (Offensive, Defensive, Flanking Strategies)Document6 pagesWarfare Marketing Strategies (Offensive, Defensive, Flanking Strategies)Yehualashet TeklemariamNo ratings yet

- DraglineDocument1 pageDraglinedeekshith gowdaNo ratings yet

- Present, Past and Future Continuous Tenses.Document2 pagesPresent, Past and Future Continuous Tenses.miss missy korinNo ratings yet

- Lapitan V ScandiaDocument3 pagesLapitan V ScandiaChoi ChoiNo ratings yet

- Semaphores: S S S0 + #V - #PDocument26 pagesSemaphores: S S S0 + #V - #PRebecca MathewsNo ratings yet

- 〈631〉 Color and AchromicityDocument8 pages〈631〉 Color and AchromicitySalimNo ratings yet

- The Cask of AmontilladoDocument43 pagesThe Cask of AmontilladoZechaina Udo100% (2)

- Citizen Report Card Survey On Free Education Services in Vavuniya and Mullaitivu Educational ZonesDocument64 pagesCitizen Report Card Survey On Free Education Services in Vavuniya and Mullaitivu Educational ZonesCentre for Poverty AnalysisNo ratings yet

- Entrepreneurship Development Institute of India (EDI)Document9 pagesEntrepreneurship Development Institute of India (EDI)apekshagoreNo ratings yet

- A and An With Key - 67319Document2 pagesA and An With Key - 67319RIEE50% (2)

- Full Offer: SoccerDocument14 pagesFull Offer: SoccerSamuel WagalukaNo ratings yet

- Monkey Pox Fact SheetDocument3 pagesMonkey Pox Fact SheetMalcolm M. LeeNo ratings yet

- Symbolic Interactionism PPT SHSDocument13 pagesSymbolic Interactionism PPT SHSJoan Doctor100% (1)

- Las Mapeh 9 Music Week 1Document4 pagesLas Mapeh 9 Music Week 1Joseph Eric NardoNo ratings yet

- 220089enb Generator DesignDocument58 pages220089enb Generator DesignMahmoud ElboraeNo ratings yet

- Class 11 Business Studies Sample Paper Set 13Document8 pagesClass 11 Business Studies Sample Paper Set 13Artham ResourcesNo ratings yet

- G11 12 Catch Up Fridays Peace Education Lesson Plan ExemplarDocument4 pagesG11 12 Catch Up Fridays Peace Education Lesson Plan ExemplarTrisha Mae BocaboNo ratings yet

- Wall SectionDocument43 pagesWall SectionrealdarossNo ratings yet

- Muayad T. Yousif: Compiled byDocument184 pagesMuayad T. Yousif: Compiled bySabah100% (5)

- Resume CritiqueDocument4 pagesResume CritiqueCynthia TranNo ratings yet

- MogoroDocument1 pageMogoroiraljonathanjr2002No ratings yet

- Template Consent FormDocument5 pagesTemplate Consent FormAlexandru ComanNo ratings yet

- SWOT Analysis For The Texas Southwest Council, BSA: Strengths WeaknessesDocument2 pagesSWOT Analysis For The Texas Southwest Council, BSA: Strengths WeaknessesRaquel GomezNo ratings yet

- Phulkian State GazzetterDocument409 pagesPhulkian State Gazzetteruday shardaNo ratings yet

- CSFP Sep 2019Document41 pagesCSFP Sep 2019ecomdigitalspaceNo ratings yet

- Gamelet Fostering Oral Reading Fluency With A Gamified Media Based ApproachDocument1 pageGamelet Fostering Oral Reading Fluency With A Gamified Media Based Approachtuxedo.usagi.84No ratings yet