SARS Income Tax

SARS Income Tax

Uploaded by

jamoneyzaCopyright:

Available Formats

SARS Income Tax

SARS Income Tax

Uploaded by

jamoneyzaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

SARS Income Tax

SARS Income Tax

Uploaded by

jamoneyzaCopyright:

Available Formats

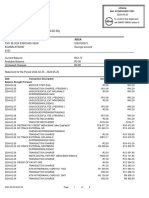

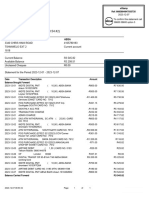

INCOME TAX

Notice of Registration

Enquiries should be addressed to SARS

Contact Detail

SARS 0800 00 7277

Alberton Website: www.sars.gov.za

ST SHANGASE 1528

M654 Mkhonzeni Street

Umlazi

Durban Details

4066 Taxpayer Reference No: 2372057196 Always quote this reference

number when contacting SARS

Date: 2024-04-02

2024-04-02

Dear Taxpayer

NOTICE OF REGISTRATION

The South African Revenue Service (SARS) confirms registration of the following taxpayer:

Name and Surname: SIPHELELE SHANGASE

ID number: 9608275342088

Taxpayer reference number: 2372057196

Date of Registration: 2024-04-02

Your tax obligation

Depending on your circumstances, you may be required to submit an annual income tax return. Should you be a provisional taxpayer,

returns and payments will be required every six months. More details can be obtained from the SARS website.

Any person who derives by way of income any amount which does not constitute remuneration or an allowance or advance

contemplated in section 8(1) of the Income Tax Act is regarded as a Provisional Taxpayer and may be required to submit provisional

returns.

Kindly notify SARS of any change to your registered particulars within 21 business days of such change.

Should you have any queries please call the SARS Contact Centre on 0800 00 7277. Remember to have your taxpayer reference

number at hand when you call to enable us to assist you promptly.

Sincerely

ISSUED ON BEHALF OF THE COMMISSIONER OF THE SOUTH AFRICAN REVENUE SERVICE

ST SHANGASE 8073497

2372057196 2024

RFDREG : 01/01

RFDREG

RFDREG

2024-04-2 2022.02.00 RFDREG_RO Page: 01/01

You might also like

- Bank Statement QNBDocument1 pageBank Statement QNBMalik AdufaniNo ratings yet

- SARS Confirmation LetterDocument1 pageSARS Confirmation Letterpmo41973No ratings yet

- Date Details (R) AMOUNT (Excl. Vat) (R) Vat (R) AMOUNT (Incl. Vat)Document2 pagesDate Details (R) AMOUNT (Excl. Vat) (R) Vat (R) AMOUNT (Incl. Vat)NinaNo ratings yet

- Bank Statement ABSADocument4 pagesBank Statement ABSApalesamokgotla3No ratings yet

- Capitec 1 Month Bank StatementDocument2 pagesCapitec 1 Month Bank Statementanitadlamini11No ratings yet

- Nondu Bank - Statement 11776543280Document8 pagesNondu Bank - Statement 11776543280stanley richiNo ratings yet

- Banking DetailsDocument1 pageBanking DetailsDon MadzivaNo ratings yet

- Tax Invoice Kolia Dawood-03-07-23Document2 pagesTax Invoice Kolia Dawood-03-07-23talha100% (1)

- Notice of RegistrationDocument1 pageNotice of Registrationbra9tee9tini100% (1)

- Gracefx Vix StrategyDocument10 pagesGracefx Vix StrategyPrince100% (1)

- Soal Pas B. Inggris Kelas 9Document3 pagesSoal Pas B. Inggris Kelas 9Rita Fauziah100% (6)

- SS EN 197-1-2008 - PreviewDocument10 pagesSS EN 197-1-2008 - PreviewNguyễn Thoại Bảo Tín0% (2)

- Uber Case StudyDocument2 pagesUber Case Studyapi-501556428100% (1)

- Bongani Mokitlane 2024-05-25 StampedDocument9 pagesBongani Mokitlane 2024-05-25 Stampedwfish8245100% (1)

- Screenshot 2022-12-11 at 18.17.13 PDFDocument1 pageScreenshot 2022-12-11 at 18.17.13 PDFLihle ShongweNo ratings yet

- Date Details (R) AMOUNT (Excl. Vat) (R) Vat (R) AMOUNT (Incl. Vat)Document2 pagesDate Details (R) AMOUNT (Excl. Vat) (R) Vat (R) AMOUNT (Incl. Vat)keorapetseNo ratings yet

- FNB Verified StatementDocument2 pagesFNB Verified Statementayandacriselda2No ratings yet

- Generate BillDocument3 pagesGenerate Billprintc231No ratings yet

- BO080 38230 MAKENA 1 HoldDocument1 pageBO080 38230 MAKENA 1 HoldSarie Jordaan FivazNo ratings yet

- Tax Invoice: Botes, Albertus Jacobus Petrus POSBUS 1105 Bela-Bela 0480Document1 pageTax Invoice: Botes, Albertus Jacobus Petrus POSBUS 1105 Bela-Bela 0480Benny BerniceNo ratings yet

- Pulana Martha Malatji - 2023 - 06 - 27Document2 pagesPulana Martha Malatji - 2023 - 06 - 27Vee-kay Vicky KatekaniNo ratings yet

- Devaksha Rampersadh Ftnqngi2 ArchivedDocument2 pagesDevaksha Rampersadh Ftnqngi2 ArchiveddevaksharamharakhNo ratings yet

- Live Better Savings Account Statement: Capitec B AnkDocument1 pageLive Better Savings Account Statement: Capitec B AnkManzini MlebogengNo ratings yet

- Account Statement 1 Feb 2024 To 28 May 2024Document2 pagesAccount Statement 1 Feb 2024 To 28 May 2024aneledupreeze92No ratings yet

- 05 Jun 2020 - (Free) ..Chcltf1zaws - Bg0fagocegb - Ewx-Bav3egdyd2yldqyjahfycmxxawkicneja3edcqh0cwegcaekdhvycgDocument5 pages05 Jun 2020 - (Free) ..Chcltf1zaws - Bg0fagocegb - Ewx-Bav3egdyd2yldqyjahfycmxxawkicneja3edcqh0cwegcaekdhvycgDanny WilsonNo ratings yet

- November 2022Document5 pagesNovember 2022aethr juniorNo ratings yet

- Tax Certificate MTSHALI IRP5Document3 pagesTax Certificate MTSHALI IRP5mariamoshahlama93No ratings yet

- 2bank StatementDocument1 page2bank Statementshaunmninzi2No ratings yet

- Mrs Nalini Rajdawu Savings Account 10 Coral Terrace Trenance Park 4339Document4 pagesMrs Nalini Rajdawu Savings Account 10 Coral Terrace Trenance Park 4339rajdawunaliniNo ratings yet

- ISU PDF GEN 1 EmailDocument2 pagesISU PDF GEN 1 EmailNotAuryan RahulNo ratings yet

- Transferee Fica Affidavit - Deborah Lonetta Anneline EsauDocument1 pageTransferee Fica Affidavit - Deborah Lonetta Anneline EsauDeborah EsauNo ratings yet

- CDB ReportDocument9 pagesCDB ReportBruce FerreiraNo ratings yet

- ETTIENNE HAYNES - 2024-05-25 - StampedDocument9 pagesETTIENNE HAYNES - 2024-05-25 - Stampedwfish8245No ratings yet

- Directors Rates and TaxesDocument3 pagesDirectors Rates and TaxesinfoNo ratings yet

- Laos LCNB Bank StatementDocument1 pageLaos LCNB Bank StatementTuấn Anh NguyễnNo ratings yet

- Statement 445Document4 pagesStatement 445yarec79954No ratings yet

- December StatementDocument3 pagesDecember StatementbashNo ratings yet

- DefaultDocument1 pageDefaultSahar SosoNo ratings yet

- Easy Account 37Document2 pagesEasy Account 37luvuyo.mali83No ratings yet

- Invoice DTW8810408751Document1 pageInvoice DTW8810408751denisdembskeyNo ratings yet

- Account Statement 1-Jun-2024 To 4-Sep-2024 2Document11 pagesAccount Statement 1-Jun-2024 To 4-Sep-2024 2DayleNo ratings yet

- GetNotice PDFDocument2 pagesGetNotice PDFMabeke NdlelaNo ratings yet

- Account Statement 1 Mar 2024 To 17 Apr 2024Document1 pageAccount Statement 1 Mar 2024 To 17 Apr 2024Lindo KuhleNo ratings yet

- Statement 20240403 132048Document3 pagesStatement 20240403 132048jaspreetsamana3456No ratings yet

- Statement For March5888568055871093156Document2 pagesStatement For March5888568055871093156Bullet KanyembaNo ratings yet

- THAPELO LEONARD MASHIANE - 2023-12-17 - 2024-01-17 - StampedDocument2 pagesTHAPELO LEONARD MASHIANE - 2023-12-17 - 2024-01-17 - Stampedsmitherasmus.agriNo ratings yet

- Manduleli Victor Bikitsha Nsualwjh ArchivedDocument10 pagesManduleli Victor Bikitsha Nsualwjh ArchivedManduleli Bikitsha100% (1)

- Account Statement 1 Mar 2024 To 18 Apr 2024Document3 pagesAccount Statement 1 Mar 2024 To 18 Apr 2024fredrickthanksNo ratings yet

- Manduleli Victor Bikitsha - Nsualwz1 - ArchivedDocument10 pagesManduleli Victor Bikitsha - Nsualwz1 - ArchivedManduleli BikitshaNo ratings yet

- Account Confirmation LetterDocument2 pagesAccount Confirmation LettercyrilpjoodNo ratings yet

- BANKconfirmationletterDocument1 pageBANKconfirmationletterdmaruping877No ratings yet

- PrintpdfDocument1 pagePrintpdfPancho G ReyesNo ratings yet

- Abdul Aleem Awubi AFRICAN BANK NEWDocument4 pagesAbdul Aleem Awubi AFRICAN BANK NEWDon MadzivaNo ratings yet

- Account For Stand No. Township DaysDocument2 pagesAccount For Stand No. Township DaysMandlakayise MabizelaNo ratings yet

- Savings Account Statement: Capitec B AnkDocument5 pagesSavings Account Statement: Capitec B AnkFikile EemNo ratings yet

- Invoice Format OWCDocument1 pageInvoice Format OWCzeeshan.arshadNo ratings yet

- Account Statement 221214 142227Document4 pagesAccount Statement 221214 142227Nomusa HlongoNo ratings yet

- Bank StatementDocument1 pageBank StatementMalik AdufaniNo ratings yet

- FNB Verified StatementDocument3 pagesFNB Verified StatementkvgaelesiweNo ratings yet

- Account StatementDocument5 pagesAccount StatementthabangsolteeNo ratings yet

- Customer Account Statement - TZDocument2 pagesCustomer Account Statement - TZGEAT MWAISWELONo ratings yet

- Your Bank Statement Is Ready 2Document53 pagesYour Bank Statement Is Ready 2mariakylie99No ratings yet

- Documents of Munyai KutelaniDocument1 pageDocuments of Munyai KutelaniKutelani MunyaiNo ratings yet

- eNotice of RegistrationDocument1 pageeNotice of Registrationlihle.jojiNo ratings yet

- Name: Lodymer A. Gasalao Problem #: Page #: 159 Self-Service Laundry General Journal Date Particulars P.R. DebitDocument12 pagesName: Lodymer A. Gasalao Problem #: Page #: 159 Self-Service Laundry General Journal Date Particulars P.R. DebitAnonnNo ratings yet

- Fin360 Autumn 2023Document7 pagesFin360 Autumn 2023hachimaai0511No ratings yet

- Gr9 EMS P2 ENG June 2022 Possible AnswersDocument6 pagesGr9 EMS P2 ENG June 2022 Possible Answers6lackzamokuhleNo ratings yet

- Intangibles ProblemDocument3 pagesIntangibles ProblemMarian RentoyNo ratings yet

- BSC and Strategic Decision Making 1Document13 pagesBSC and Strategic Decision Making 1Antony KimaniNo ratings yet

- Form Courier Bill of Entry - XIII (CBE-XIII) (See Regulation 5) Courier Bill of Entry For Dutiable Goods OriginalDocument2 pagesForm Courier Bill of Entry - XIII (CBE-XIII) (See Regulation 5) Courier Bill of Entry For Dutiable Goods OriginalMohammed jawedNo ratings yet

- Manual Balanca Ingenuity FolhaDocument36 pagesManual Balanca Ingenuity FolhaMaraysaNo ratings yet

- Central Bank Transparency PDFDocument27 pagesCentral Bank Transparency PDFChiou How TengNo ratings yet

- ABU RBC2024 Rulebook - AppendixDocument4 pagesABU RBC2024 Rulebook - AppendixAhmad IskandarNo ratings yet

- Managerial Econ Notes 1Document7 pagesManagerial Econ Notes 1Angelique CaliNo ratings yet

- Mathematical Literacy P1 May-June 2023 MG Afr & EngDocument19 pagesMathematical Literacy P1 May-June 2023 MG Afr & Engolwethumalinga081No ratings yet

- hdr2019 Technical NotesDocument16 pageshdr2019 Technical NotesfadmulNo ratings yet

- GyFTR Voucher List of Brands - 240709 - 214222Document1 pageGyFTR Voucher List of Brands - 240709 - 214222Aman SinghNo ratings yet

- Accounts Statement IiDocument51 pagesAccounts Statement Iiapi-19728905No ratings yet

- Curriculum For Certificate in Textile Machinery Repair & Maintenance (Weaving) (PDFDrive)Document41 pagesCurriculum For Certificate in Textile Machinery Repair & Maintenance (Weaving) (PDFDrive)sulzer texNo ratings yet

- MKT Leader, Follower, ChallengerDocument24 pagesMKT Leader, Follower, ChallengerAsad khan86% (14)

- KZN Accounting Grade 11 June 2023 P2 and MemoDocument30 pagesKZN Accounting Grade 11 June 2023 P2 and Memoac242297No ratings yet

- Welder Qualification ScheduleDocument1 pageWelder Qualification ScheduleFatih DemircanNo ratings yet

- Philips Norelco OneBlade Face QP1424 - 70 User ManualDocument2 pagesPhilips Norelco OneBlade Face QP1424 - 70 User ManualpablozpdNo ratings yet

- Final AnalysisDocument30 pagesFinal AnalysisHem GhimireNo ratings yet

- Ross - Chapter 9 - PowerPoint SlidesDocument39 pagesRoss - Chapter 9 - PowerPoint SlideszhousuyingNo ratings yet

- Patna To Bom TicketDocument3 pagesPatna To Bom TicketSharique AmanNo ratings yet

- ®e01-E18 ©M0240 RcuDocument18 pages®e01-E18 ©M0240 RcuTrung Trinh BaoNo ratings yet

- Saic M 1001Document8 pagesSaic M 1001noor mohamedazeezNo ratings yet

- Inego Techpack Pol708 - SS23 - Y. Dyed StripsDocument15 pagesInego Techpack Pol708 - SS23 - Y. Dyed Stripstariqul islamNo ratings yet

- Statistics 2 Formula Book Chapter 1Document6 pagesStatistics 2 Formula Book Chapter 1Vipin Mandyam Kadubi67% (6)