ExamFM 2018

ExamFM 2018

Uploaded by

nargizireCopyright:

Available Formats

ExamFM 2018

ExamFM 2018

Uploaded by

nargizireOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

ExamFM 2018

ExamFM 2018

Uploaded by

nargizireCopyright:

Available Formats

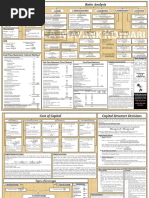

Exam FM

Adapt to Your Exam

INTERESTINTEREST

MEASUREMENT

MEASUREMENT Perpetuity YIELD RATES YIELD RATES

Effective Rate of Interest • Perpetuity-immediate:

1 Two methods for comparing investments:

𝐴𝐴(𝑡𝑡) − 𝐴𝐴(𝑡𝑡 − 1) 𝑃𝑃𝑃𝑃 = 𝑎𝑎N| = 𝑣𝑣 + 𝑣𝑣 ; + ⋯ =

𝑖𝑖" = • Net Present Value (NPV): Sum the present value

𝐴𝐴(𝑡𝑡 − 1) 𝑖𝑖

• Perpetuity-due: of cash inflows and cash outflows. Choose

Effective Rate of Discount 1 investment with greatest positive NPV.

𝐴𝐴(𝑡𝑡) − 𝐴𝐴(𝑡𝑡 − 1) 𝑃𝑃𝑃𝑃 = 𝑎𝑎̈ ∞| = 1 + 𝑣𝑣 + 𝑣𝑣 ; + ⋯ = • Internal Rate of Return (IRR): The rate such that

𝑑𝑑" = 𝑑𝑑

𝐴𝐴(𝑡𝑡) 𝑎𝑎̈ N| = 1 + 𝑎𝑎N| the present value of cash inflows is equal to the

Accumulation Function and Amount Function present value of cash outflows. Choose

𝐴𝐴(𝑡𝑡) = 𝐴𝐴(0) ∙ 𝑎𝑎(𝑡𝑡) investment with greatest IRR.

All-in-One Relationship Formula MORE GENERAL

MORE ANNUITIES

GENERAL ANNUITIES

0" 30"

𝑖𝑖 (0) 𝑑𝑑 (0)

(1 + 𝑖𝑖)" = /1 + 2 = (1 − 𝑑𝑑)3" = /1 − 2 = 𝑒𝑒 5" j-effective method is used when payments are more LOAN AMORTIZATION

𝑚𝑚 𝑚𝑚 LOAN AMORTIZATION

or less frequent than the interest period.

Simple Interest Outstanding Balance Calculation

𝑎𝑎(𝑡𝑡) = 1 + 𝑖𝑖𝑖𝑖 “j-effective” Method • Prospective: 𝐵𝐵" = 𝑅𝑅𝑎𝑎G3"| , 𝑅𝑅 = level payments

Convert the given interest rate to the equivalent

Variable Force of Interest Present value of future payments.

𝑎𝑎7 (𝑡𝑡) effective interest rate for the period between

• Retrospective: 𝐵𝐵" = 𝐿𝐿(1 + 𝑖𝑖) " − 𝑅𝑅𝑠𝑠"|

𝛿𝛿" = each payment.

𝑎𝑎(𝑡𝑡) Accumulated value of original loan amount L

Accumulate 1 from time 𝑡𝑡8 𝑡𝑡𝑡𝑡 𝑡𝑡𝑡𝑡𝑡𝑡𝑡𝑡 𝑡𝑡;: Example: To find the present value of 𝑛𝑛 monthly

"C payments given annual effective rate of i, define 𝑗𝑗 minus accumulated value of all past payments.

𝐴𝐴𝐴𝐴 = exp /@ 𝛿𝛿A 𝑑𝑑𝑑𝑑 2 as the monthly effective rate where

"D Retrospective Prospective

𝑗𝑗 = (1 + 𝑖𝑖) 8⁄8; − 1. Then apply 𝑃𝑃𝑃𝑃 = 𝑎𝑎G| using j.

Discount Factor Accumulating Discounting

1 Past Payments Future Payments

𝑣𝑣 = = 1 − 𝑑𝑑 Payments in Arithmetic Progression

Bt

1 + 𝑖𝑖 • PV of n-year annuity-immediate with payments of

𝑖𝑖

𝑑𝑑 = = 𝑖𝑖𝑖𝑖 𝑃𝑃, 𝑃𝑃 + 𝑄𝑄, 𝑃𝑃 + 2𝑄𝑄, … , 𝑃𝑃 + (𝑛𝑛 − 1)𝑄𝑄

1 + 𝑖𝑖 𝑎𝑎G| G

VVV − 𝑛𝑛𝑣𝑣

𝑃𝑃𝑃𝑃 = 𝑃𝑃𝑎𝑎G| + 𝑄𝑄 0 n

𝑖𝑖 t

Calculator-friendly version: L

ANNUITIES ANNUITIES

𝑄𝑄 𝑄𝑄𝑄𝑄 G

Annuity-Immediate 𝑃𝑃𝑃𝑃 = W𝑃𝑃 + X 𝑎𝑎G| VVV + W− X 𝑣𝑣

𝑖𝑖 𝑖𝑖 Loan Amortization

1 − 𝑣𝑣 G 𝑄𝑄 𝑄𝑄𝑄𝑄

𝑃𝑃𝑃𝑃 = 𝑎𝑎G| = 𝑣𝑣 + 𝑣𝑣 ; + ⋯ + 𝑣𝑣 G = 𝑁𝑁 = 𝑛𝑛, 𝐼𝐼 ⁄𝑌𝑌 = 𝑖𝑖 (in %), 𝑃𝑃𝑃𝑃𝑃𝑃 = 𝑃𝑃 + , 𝐹𝐹𝐹𝐹 = − For a loan of 𝑎𝑎G| repaid with n payments of 1:

𝑖𝑖 𝑖𝑖 𝑖𝑖

𝐴𝐴𝐴𝐴 = 𝑠𝑠G| = 1 + (1 + 𝑖𝑖) + ⋯ + (1 + 𝑖𝑖)G38 Period 𝑡𝑡

(1 + 𝑖𝑖)G − 1 • PV of n-year annuity-immediate with payments of

Interest (𝐼𝐼" ) 1 − 𝑣𝑣 G3"L8

= 1, 2, 3, … , 𝑛𝑛

𝑖𝑖

k̈ l| 3Gm l

Principal repaid (𝑃𝑃" ) 𝑣𝑣 G3"L8

Unit increasing: (𝐼𝐼𝐼𝐼)G| =

a s n

Total 1

n n P&Q version: 𝑃𝑃 = 1, 𝑄𝑄 = 1, 𝑁𝑁 = 𝑛𝑛

$1 1 … 1 1 General Formulas for Amortized Loan with

• PV of n-year annuity-immediate with payments of

Level/Non-Level Payments

1 2 … n–1 n 𝑛𝑛, 𝑛𝑛 − 1, 𝑛𝑛 − 2, … , 1

G3kl| 𝐼𝐼" = 𝑖𝑖 ⋅ 𝐵𝐵"38

Unit decreasing: (𝐷𝐷𝐷𝐷)G| = 𝐵𝐵" = 𝐵𝐵"38(1 + 𝑖𝑖) − 𝑅𝑅" = 𝐵𝐵"38 − 𝑃𝑃"

n

Annuity-Due P&Q version: 𝑃𝑃 = 𝑛𝑛, 𝑄𝑄 = −1, 𝑁𝑁 = 𝑛𝑛 𝑃𝑃" = 𝑅𝑅" − 𝐼𝐼"

1 − 𝑣𝑣 G

𝑃𝑃𝑃𝑃 = 𝑎𝑎̈ G| = 1 + 𝑣𝑣 + 𝑣𝑣 ; + ⋯ + 𝑣𝑣 G38 = 𝑃𝑃"L} = 𝑃𝑃" (1 + 𝑖𝑖)} (only for Level Payments)

𝑑𝑑 • PV of perpetuity-immediate and perpetuity-due

𝐴𝐴𝐴𝐴 = 𝑠𝑠̈ G| = (1 + 𝑖𝑖) + (1 + 𝑖𝑖) ; + ⋯ + (1 + 𝑖𝑖)G with payments of 1, 2, 3, …

(1 + 𝑖𝑖)G − 1 1 1 1 1

= (𝐼𝐼𝐼𝐼)N| = = + ; (𝐼𝐼𝑎𝑎̈ )N| = ;

𝑑𝑑 𝑖𝑖𝑖𝑖 𝑖𝑖 𝑖𝑖 𝑑𝑑

a!! s

!! Payments in Geometric Progression

n n PV of an n-year annuity-immediate with payments

$1 1 1 … 1 of 1, (1 + 𝑘𝑘), (1 + 𝑘𝑘); , … , (1 + 𝑘𝑘)G38

1 + 𝑘𝑘 G

1 2 … n–1 n 1−q r

1 + 𝑖𝑖 , 𝑖𝑖 ≠ 𝑘𝑘

𝑃𝑃𝑃𝑃 =

𝑖𝑖 − 𝑘𝑘

Immediate vs. Due Level and Increasing Continuous Annuity

𝑎𝑎̈ G| = 𝑎𝑎G|(1 + 𝑖𝑖) = 1 + 𝑎𝑎G38| G 1 − 𝑣𝑣 G 𝑖𝑖

𝑠𝑠̈ G| = 𝑠𝑠G| (1 + 𝑖𝑖) = 𝑠𝑠GL8| − 1 𝑎𝑎VG| = @ 𝑣𝑣 " 𝑑𝑑𝑑𝑑 = = 𝑎𝑎G|

t 𝛿𝛿 𝛿𝛿

Deferred Annuity G 𝑎𝑎VG| − 𝑛𝑛𝑣𝑣 G

̅ V)G| = @ 𝑡𝑡𝑡𝑡 " 𝑑𝑑𝑑𝑑 =

(𝐼𝐼 𝑎𝑎

m-year deferred n-year annuity-immediate: t 𝛿𝛿

𝑃𝑃𝑃𝑃 = 0|𝑎𝑎G| = 𝑣𝑣 0 ⋅ 𝑎𝑎G| = 𝑎𝑎0LG| − 𝑎𝑎0|

www.coachingactuaries.com Copyright © 2018 Coaching Actuaries. All Rights Reserved. 1

BONDS BONDS SPOT RATESRATES

SPOT AND FORWARD RATES

AND FORWARD RATES DETERMINANTS OF INTEREST

DETERMINANTS RATES

OF INTEREST RATES

Bond Pricing Formulas 𝑠𝑠" is the t-year spot rate • Interest rate can be viewed as the equilibrium

𝑃𝑃 Price of bond 𝑓𝑓["D,"C] is the forward rate from time 𝑡𝑡8 to time 𝑡𝑡;, price of money.

𝐹𝐹 Par value (face amount) of bond expressed annually. • Interest rate can be decomposed into five

(not a cash flow) 0 components:

(1 + 𝑠𝑠G )G ⋅ ã1 + 𝑓𝑓[G,GL0] å = (1 + 𝑠𝑠GL0 )GL0

𝑟𝑟 Coupon rate per payment period o Real risk-free rate (𝑟𝑟)

𝐹𝐹𝐹𝐹 Amount of each coupon payment o Maturity risk premium

(1+sn+m)n+m

𝐶𝐶 Redemption value of bond o Default risk premium (𝑠𝑠)

(𝐹𝐹 = 𝐶𝐶 unless otherwise stated) o Inflation premium (𝑖𝑖ë , 𝑖𝑖A , 𝑐𝑐, 𝑖𝑖k )

𝑖𝑖 Interest rate per payment period 0 n n+m o Liquidity premium

𝑛𝑛 Number of coupon payments • 𝑅𝑅 = 𝑟𝑟 + 𝑠𝑠 + 𝑖𝑖ë + 𝑖𝑖A − 𝑐𝑐 + 𝑖𝑖k

Basic Formula (1+sn)n (1+f[n,n+m])m o For loans with inflation protection, set 𝑖𝑖ë =

𝑃𝑃 = 𝐹𝐹𝐹𝐹𝑎𝑎G|n + 𝐶𝐶𝑣𝑣 G 𝑖𝑖A = 0. Then, 𝑅𝑅 is the real interest rate.

Premium/Discount Formula: (1 + 𝑠𝑠G )G = ã1 + 𝑓𝑓[t,8] å ⋅ ã1 + 𝑓𝑓[8,;] å ⋯ ã1 + 𝑓𝑓[G38,G] å o For loans without inflation protection, set

𝑃𝑃 = 𝐶𝐶 + (𝐹𝐹𝐹𝐹 − 𝐶𝐶𝐶𝐶)𝑎𝑎G|n 𝑖𝑖k = 𝑐𝑐 = 0. Then, 𝑅𝑅 is the nominal interest

(1+sn)n rate.

Premium vs. Discount • Four theories explaining why interest rates

Premium Discount differ by terms:

𝑃𝑃 > 𝐶𝐶 𝑃𝑃 < 𝐶𝐶 0 1 2 … n–1 n o Market segmentation theory

Condition or or o Preferred habitat theory

(1+f[0,1]) (1+f[1,2]) … (1+f[n–1,n]) o Liquidity preference theory/Opportunity cost

𝐹𝐹𝐹𝐹 > 𝐶𝐶𝐶𝐶 𝐹𝐹𝐹𝐹 < 𝐶𝐶𝐶𝐶

Amortization theory

Write-Down Write-Up o Expectations theory

Process

INTEREST RATE SWAP • Federal Reserve facilitates a country’s payment

|(𝐹𝐹𝐹𝐹 − 𝐶𝐶𝐶𝐶) ⋅ 𝑣𝑣 G3"L8 | INTEREST RATE SWAP

Amount operations and functions as a last resort lender

= |𝐵𝐵"38 − 𝐵𝐵" | = |𝐹𝐹𝐹𝐹 − 𝐼𝐼" |

An agreement between two parties in which both to commercial banks.

General Formulas for Bond Amortization parties agree to exchange a series of cash flows • U.S. T-bills are quoted:

• Book value: based on interest rates. 360 𝐼𝐼

𝐵𝐵" = 𝐹𝐹𝐹𝐹𝑎𝑎G3"|n + 𝐶𝐶𝑣𝑣 G3" = 𝐶𝐶 + (𝐹𝐹𝐹𝐹 − 𝐶𝐶𝐶𝐶)𝑎𝑎G3"|n Quoted Rate = ×

Swap Rate 𝑁𝑁 𝐶𝐶

• Interest earned = 𝑖𝑖𝐵𝐵"38 • Canadian T-bills are quoted:

The swap rate can be calculated by equating the

365 𝐼𝐼

Callable Bonds present value of swap payments with the present Quoted Rate = ×

𝑁𝑁 𝑃𝑃

Calculate the lowest price for all possible value of expected variable payments. where N is the number of days to maturity, I is the

redemption dates at a certain yield rate. This is the • If notional amount is not level: amount of interest, C is the maturity value and P is

highest price that guarantees this yield rate. 𝑋𝑋8 𝑅𝑅 𝑋𝑋; 𝑅𝑅 𝑋𝑋é 𝑅𝑅

+ +

1 + 𝑠𝑠8 (1 + 𝑠𝑠; ); (1 + 𝑠𝑠é )é

the price.

• Premium bond – call the bond on the FIRST 𝑋𝑋8 𝑓𝑓[t,8] 𝑋𝑋; 𝑓𝑓[8,;] 𝑋𝑋é 𝑓𝑓[;,é]

possible date. = + +

1 + 𝑠𝑠8 (1 + 𝑠𝑠; ); (1 + 𝑠𝑠é )é

• Discount bond – call the bond on the LAST • If notional amount is level: INTEREST MEASUREMENT

INTEREST OF A FUNDOF A FUND

MEASUREMENT

possible date. Since an interest rate swap is equivalent to

borrowing at a floating rate to buy a fixed-rate Dollar-weighted Interest Rate

bond, fixed swap rate is the coupon rate on a par The yield rate computation depends on the amount

STOCKS STOCKS coupon bond. invested.

𝑅𝑅 𝑅𝑅 𝑅𝑅 + 1 Method:

Price of Level Dividend-Paying Stock + +⋯+ =1 • Calculate amount of interest: 𝐼𝐼 = 𝐵𝐵 − 𝐴𝐴 − 𝐶𝐶

𝐹𝐹𝐹𝐹 1 + 𝑠𝑠8 (1 + 𝑠𝑠; ); (1 + 𝑠𝑠G )G

𝑃𝑃 = 1 − 𝑃𝑃G 𝐴𝐴: Amount at the beginning of period

𝑖𝑖 𝑅𝑅 = 𝐵𝐵: Amount at the end of period

𝐹𝐹 = par value, 𝑟𝑟 = fixed dividend rate 𝑃𝑃8 + 𝑃𝑃; + ⋯ + 𝑃𝑃G

𝐶𝐶: Deposit/withdrawal

Price of Increasing Dividend-Paying Stock Net Swap Payment • Calculate the dollar-weighted interest rate:

𝐷𝐷 The difference between the fixed interest payment 𝐼𝐼

𝑃𝑃 = and variable interest payment. 𝑖𝑖úù =

𝑖𝑖 − 𝑘𝑘 𝐴𝐴 + ∑ 𝐶𝐶" (1 − 𝑡𝑡)

𝐷𝐷 = expected first dividend, 𝑘𝑘 = growth rate

Net Interest Payment Time-weighted Interest Rate

The combination of the net swap payment and the The yield rate computation depends on successive

interest payment made by the borrower to the sub-intervals of the year each time a deposit or

lender. withdrawal is made.

Deferred Interest Rate Swap Method:

For an 𝑥𝑥-year deferred (𝑛𝑛 − 𝑥𝑥)-year swap with level 𝐴𝐴; 𝐴𝐴é 𝐴𝐴† 𝐴𝐴G

1 + 𝑖𝑖üù = W X ⋅ W X ⋅ W X ⋅ … ⋅ W X

notional amount: 𝐵𝐵8 𝐵𝐵; 𝐵𝐵é 𝐵𝐵G38

𝑃𝑃ê − 𝑃𝑃G Date 1 Date 2

𝑅𝑅 =

𝑃𝑃êL8 + 𝑃𝑃êL; + ⋯ + 𝑃𝑃G Account

where 𝑥𝑥 is the number of deferred years and 𝑛𝑛 is 𝐴𝐴8 𝐴𝐴;

Before CF

the term of the swap. Cash Flow

𝐶𝐶8 𝐶𝐶;

Market Value of a Swap (CF)

• The market value of a swap at time t is the Account

𝐵𝐵8 = 𝐴𝐴8 + 𝐶𝐶8 𝐵𝐵; = 𝐴𝐴; + 𝐶𝐶;

present value at time t of its expected future After CF

cash flows.

• The market value of a swap is 0 at inception.

www.coachingactuaries.com Copyright © 2018 Coaching Actuaries. All Rights Reserved. 2

DURATION AND CONVEXITY

DURATION AND CONVEXITY IMMUNIZATION IMMUNIZATION BA-II PLUSPLUS

BA-II CALCULATOR GUIDELINE GUIDELINE

CALCULATOR

Duration Redington and Full Immunization Basic Operations

𝑃𝑃7 (𝛿𝛿) ∑G"°t 𝑡𝑡 ⋅ 𝑣𝑣 " ⋅ 𝐶𝐶𝐶𝐶" ENTER (SET) : Send value to a variable (option)

𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀 = − = Redington Full

𝑃𝑃(𝛿𝛿) ∑G"°t 𝑣𝑣 " ⋅ 𝐶𝐶𝐶𝐶"

↑ ↓ : Navigate through variables

7 (𝑖𝑖) ∑"°t 𝑡𝑡 ⋅ 𝑣𝑣 "L8 ⋅ 𝐶𝐶𝐶𝐶"

G

𝑃𝑃 𝑃𝑃𝑉𝑉ß®®ë"® = 𝑃𝑃𝑉𝑉©nk™n´n"në®

𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀 = − = 2ND : Access secondary functions (yellow)

𝑃𝑃(𝑖𝑖) ∑G"°t 𝑣𝑣 " ⋅ 𝐶𝐶𝐶𝐶"

𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀ß = 𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀© or 𝑃𝑃ß7 = 𝑃𝑃©7 STO + 0~9 : Send on-screen value into memory

𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀 = 𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀 ⋅ 𝑣𝑣

There has to be asset RCL + 0~9 : Recall value from a memory

𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀(𝑛𝑛-year zero-coupon bond) = 𝑛𝑛 𝐶𝐶ß > 𝐶𝐶©

cash flows before and

1 + 𝑖𝑖 or Time Value of Money (TVM)

𝑀𝑀𝑎𝑎𝑎𝑎𝑎𝑎 (geometrically increasing perpetuity) = after each liability

𝑖𝑖 − 𝑘𝑘 𝑃𝑃ß77 > 𝑃𝑃©77 Good for handling annuities, loans and bonds.

cash flow.

𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀(𝑛𝑛-year par bond) = 𝑎𝑎̈ G| Note: Be careful with signs of cash flows.

Immunizes against Immunizes against

First-order Modified Approximation small changes in 𝑖𝑖 any changes in 𝑖𝑖 N : Number of periods

𝑃𝑃(𝑖𝑖G ) ≈ 𝑃𝑃(𝑖𝑖£ ) ⋅ [1 − (𝑖𝑖G − 𝑖𝑖£ )(𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀)] I/Y : Effective interest rate per period (in %)

Immunization Shortcut

(works for immunization questions that have asset PV : Present value

First-order Macaulay Approximation

cash flows before and after the liability cash flow) PMT : Amount of each payment of an annuity

1 + 𝑖𝑖£ §k•ú

𝑃𝑃(𝑖𝑖G ) ≈ 𝑃𝑃(𝑖𝑖£ ) ⋅ W X FV : Future value

1 + 𝑖𝑖G 1. Identify the asset allocation at the time the

CPT + (one of above): Solve for unknown

Passage of Time liability occurs by equating face amounts

(prices) and durations. 2ND + BGN , 2ND + SET , 2ND + QUIT :

Given that the future cash flows are the same at

Switch between annuity immediate and annuity

time 𝑡𝑡8 and time 𝑡𝑡;: 𝑡𝑡8 Shorter bond duration

𝑀𝑀𝑀𝑀𝑀𝑀𝐷𝐷"C = 𝑀𝑀𝑀𝑀𝑀𝑀𝐷𝐷"D − (𝑡𝑡; − 𝑡𝑡8 ) due

𝑡𝑡; Longer bond duration

𝑀𝑀𝑀𝑀𝑀𝑀𝐷𝐷"C = 𝑀𝑀𝑀𝑀𝑀𝑀𝐷𝐷"D − 𝑣𝑣(𝑡𝑡; − 𝑡𝑡8) 2ND + P/Y : Please keep P/Y and C/Y as 1

𝑡𝑡© Liability duration

𝑤𝑤 Shorter bond's weight 2ND + CLR TVM : Clear TVM worksheet

Duration of a portfolio 2ND + AMORT : Amortization (See Below)

1 − 𝑤𝑤 Longer bond's weight

For a portfolio of m securities where invested

amount 𝑃𝑃 = 𝑃𝑃8 + 𝑃𝑃; + ⋯ + 𝑃𝑃0 at time 0, 𝑡𝑡; − 𝑡𝑡© For bonds ( 𝑃𝑃 = 𝐹𝐹𝐹𝐹𝑎𝑎G|n + 𝐶𝐶𝑣𝑣 G ):

𝑤𝑤 =

𝑃𝑃8 𝑃𝑃; 𝑃𝑃0 𝑡𝑡; − 𝑡𝑡8 N = 𝑛𝑛; I/Y = 𝑖𝑖; PV = −𝑃𝑃; PMT = 𝐹𝐹𝐹𝐹; FV = 𝐶𝐶.

𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀¶ = 𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀8 + 𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀; + ⋯ + 𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀0

𝑃𝑃 𝑃𝑃 𝑃𝑃

2. Adjust for interest to the asset maturity date.

Convexity Cash Flow Worksheet ( CF , NPV , IRR )

𝑃𝑃77 (𝑖𝑖) ∑G"°t 𝑡𝑡 ⋅ (𝑡𝑡 + 1) ⋅ 𝑣𝑣 "L; ⋅ 𝐶𝐶𝐶𝐶" Good for non-level series of payments.

𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀 = = Input ( CF )

𝑃𝑃(𝑖𝑖) ∑G"°t 𝑣𝑣 " ⋅ 𝐶𝐶𝐶𝐶"

𝑃𝑃 77 (𝛿𝛿) ∑"°t 𝑡𝑡 ⋅ 𝑣𝑣 " ⋅ 𝐶𝐶𝐶𝐶"

G ; CF0: Cash flow at time 0

𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀 = =

𝑃𝑃(𝛿𝛿) ∑G"°t 𝑣𝑣 " ⋅ 𝐶𝐶𝐶𝐶" Cn: nth cash flow

𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀 = 𝑣𝑣 ; (𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀 + 𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀) Fn: Frequency of the cash flow

𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀 (𝑛𝑛-year zero-coupon bond) = 𝑛𝑛 ;

Output ( NPV , IRR )

I: Effective interest rate (in %)

NPV + CPT : Solve for net present value

IRR + CPT : Solve for internal rate of return

Amortization Schedule ( 2ND + AMORT )

Good for finding outstanding balance of the loan and

interest/principal portion of certain payments.

Note: BA-II Plus requires computing the unknown

TVM variable before entering into AMORT

function.

P1: Starting period

P2: Ending period

BAL: Remaining balance of the loan after P2

PRN: Sum of the principal repaid from P1 to P2

INT: Sum of the interest paid from P1 to P2

Copyright © 2018 Coaching Actuaries. All Rights Reserved. 3

www.coachingactuaries.com

www.coachingactuaries.com Personal copies

Copyright permitted.

© 2018 Resale

Coaching or distribution

Actuaries. is prohibited.

All Rights Reserved. 3

You might also like

- FAR270 JULY 2022 SolutionDocument8 pagesFAR270 JULY 2022 SolutionNur Fatin Amirah100% (4)

- Financial Management Formula Sheet: Chapter 1: Nature, Significance and Scope of Financial ManagementDocument6 pagesFinancial Management Formula Sheet: Chapter 1: Nature, Significance and Scope of Financial ManagementEilen Joyce Bisnar100% (3)

- Accounting For Special Transactions Part 3 Course AssessmentDocument31 pagesAccounting For Special Transactions Part 3 Course AssessmentRAIN ALCANTARA ABUGAN100% (1)

- 2023-02-28 Luminar Provides Business Update With Q4 and Full 64Document13 pages2023-02-28 Luminar Provides Business Update With Q4 and Full 64Khairul ScNo ratings yet

- FM Formula Sheet 2022Document3 pagesFM Formula Sheet 2022Laura StephanieNo ratings yet

- Exam FM: You Have What It Takes To PassDocument5 pagesExam FM: You Have What It Takes To Passenquiry no100% (2)

- RSM430 Final Cheat SheetDocument1 pageRSM430 Final Cheat SheethappyNo ratings yet

- Finance Formula SheetDocument2 pagesFinance Formula SheetBrandon Rao100% (1)

- Finance 2017Document4 pagesFinance 2017Aamir0% (1)

- Mba Finance Placement ReadyDocument18 pagesMba Finance Placement Readyabhishek.abhishek1994No ratings yet

- FM Formula SheetDocument3 pagesFM Formula SheetPierre HazizaNo ratings yet

- Week 4Document16 pagesWeek 4kamleshmisra22No ratings yet

- Study Unit 2Document20 pagesStudy Unit 2pphelokazi54No ratings yet

- Level 1 2022 Formula SheetDocument16 pagesLevel 1 2022 Formula SheetxxNo ratings yet

- FM Formula SheetDocument5 pagesFM Formula SheetnargizireNo ratings yet

- Finance Mba PlacementDocument14 pagesFinance Mba Placementabhishek.abhishek1994No ratings yet

- FMSM FORMULA SHEET-Executive-RevisionDocument8 pagesFMSM FORMULA SHEET-Executive-RevisionHenrick Ian AmarlesNo ratings yet

- Study Unit 2Document19 pagesStudy Unit 2Irfaan CassimNo ratings yet

- FMSM Formula SheetDocument8 pagesFMSM Formula Sheetjacob michelNo ratings yet

- Accounting and Finance For Business Key Formulas: Statement of Financial PositionDocument3 pagesAccounting and Finance For Business Key Formulas: Statement of Financial PositionZOn YêuNo ratings yet

- L1 2024 Formula SheetDocument17 pagesL1 2024 Formula SheetfofyibaydoNo ratings yet

- Foundation of finance Formula Sheet for FinalDocument3 pagesFoundation of finance Formula Sheet for Finalricksun301No ratings yet

- Lecture Notes On Financial Mathematics 3Document20 pagesLecture Notes On Financial Mathematics 3olaifa TomisinNo ratings yet

- Total Dollar Return: Investment Portfolio Management WEEK 1: A Brief History of Risk and ReturnDocument43 pagesTotal Dollar Return: Investment Portfolio Management WEEK 1: A Brief History of Risk and ReturnVenessa Yong100% (1)

- MECH4403 LR Week04Document25 pagesMECH4403 LR Week04bobforlife001No ratings yet

- Section 4 - SummaryDocument4 pagesSection 4 - Summary8k4zw5kqpjNo ratings yet

- Basic_Financial_Calculation_Chapter_1_Part_2_Basic_Financial_CalculationsDocument8 pagesBasic_Financial_Calculation_Chapter_1_Part_2_Basic_Financial_CalculationsMewded DelelegnNo ratings yet

- Unit 1. Simple CapitalizationDocument13 pagesUnit 1. Simple CapitalizationbryanjahilNo ratings yet

- All Formulas MacroDocument3 pagesAll Formulas MacroInès ChougraniNo ratings yet

- To Find The Interest To Find The Principal To Find The Rate To Find The TimeDocument1 pageTo Find The Interest To Find The Principal To Find The Rate To Find The Timebonifacio gianga jrNo ratings yet

- FDN BUSM Quiz #2 FormulasDocument3 pagesFDN BUSM Quiz #2 FormulaserinlomioNo ratings yet

- Financial Mathematics Assignment 1 AliDocument8 pagesFinancial Mathematics Assignment 1 AliAli BarzamNo ratings yet

- 9B Cash Flow NPV and Portfolio Simulation ModelsDocument11 pages9B Cash Flow NPV and Portfolio Simulation ModelsChan AnsonNo ratings yet

- SUMMARY FMDocument25 pagesSUMMARY FMadventurineNo ratings yet

- FORMULA SHEET For Final - FMDocument1 pageFORMULA SHEET For Final - FMNajia SiddiquiNo ratings yet

- BUSINESS-MATH-FORMULA-CARDDocument1 pageBUSINESS-MATH-FORMULA-CARDyvesmartinez57No ratings yet

- FMSM Formula SheetDocument10 pagesFMSM Formula SheetRani LohiaNo ratings yet

- Signals and Systems NOTESDocument15 pagesSignals and Systems NOTESIoanaNo ratings yet

- Chapter 3 - SummaryDocument4 pagesChapter 3 - Summary8k4zw5kqpjNo ratings yet

- Formula Sheet (3)Document5 pagesFormula Sheet (3)Ebbe ReuterborgNo ratings yet

- Exponential FunctionDocument4 pagesExponential FunctionErica Mamauag100% (1)

- Lecture 2 - Economic DispatchDocument18 pagesLecture 2 - Economic DispatchhasinduNo ratings yet

- Cost of Capital-2021-Ppt (Encrypted)Document26 pagesCost of Capital-2021-Ppt (Encrypted)Prasad GharatNo ratings yet

- Formula CardDocument1 pageFormula CarddiditreachyouNo ratings yet

- Formula GenmathDocument2 pagesFormula Genmathearamos1030No ratings yet

- SEE705 Lecture Week 41Document31 pagesSEE705 Lecture Week 41永遠SobanNo ratings yet

- General AnnutiesDocument21 pagesGeneral Annutiesheartangelamores0No ratings yet

- FDP Day 1 Regression V 1Document29 pagesFDP Day 1 Regression V 1Ajay SharmaNo ratings yet

- FIN300 Midterm Tip SheetDocument1 pageFIN300 Midterm Tip Sheetsyrolin123No ratings yet

- Opera FormulaDocument4 pagesOpera FormulaWasyif AlshammariNo ratings yet

- Bonds and Their Valuation FormulasDocument1 pageBonds and Their Valuation FormulasGabrielle VaporNo ratings yet

- 22 Reinforcement LearningDocument18 pages22 Reinforcement Learningshahzad.darNo ratings yet

- InterestDocument8 pagesInterest1chandansoni1No ratings yet

- CA M K: Ayank OthariDocument4 pagesCA M K: Ayank Otharigagan vermaNo ratings yet

- HPGE Formulas - Soil and Geo HPGE4637_unlockedDocument3 pagesHPGE Formulas - Soil and Geo HPGE4637_unlockedjacobsantos054No ratings yet

- Chap 5Document9 pagesChap 5fleur scienceNo ratings yet

- Resumé EconomicsDocument2 pagesResumé EconomicsHala ItaniNo ratings yet

- Definition of Terms and FormulasDocument2 pagesDefinition of Terms and Formulascarladrian.cruz.abNo ratings yet

- Simple Annuity DueDocument28 pagesSimple Annuity DueNimrod CarolinoNo ratings yet

- Adjusting: Accounts điều chỉnh tài khoản AND PREPARING Financial StatementsDocument50 pagesAdjusting: Accounts điều chỉnh tài khoản AND PREPARING Financial StatementsPham Thi Hoa (K14 DN)No ratings yet

- Hou Et Al 15 Digesting Anomalies and Investment Approach - SlidesDocument43 pagesHou Et Al 15 Digesting Anomalies and Investment Approach - SlidesPeterParker1983No ratings yet

- Titman PPT CH12Document71 pagesTitman PPT CH12hanbutarbutar2901No ratings yet

- Financial Accounting Professional CertificateDocument2 pagesFinancial Accounting Professional CertificateSyed HusnainNo ratings yet

- Fin. Anal Rafael 3Document4 pagesFin. Anal Rafael 3MarjonNo ratings yet

- Trading and Profit and Loss Account Format: DR CRDocument14 pagesTrading and Profit and Loss Account Format: DR CRHarshini AkilandanNo ratings yet

- Comparative Balance SheetDocument5 pagesComparative Balance Sheetsatyamehta0% (1)

- Working Capital GapDocument10 pagesWorking Capital GapMilos StojakovicNo ratings yet

- Financial AnalysisDocument57 pagesFinancial Analysisv.gaurav0402No ratings yet

- RVI Unaudited Financials - 30 June 2013 - LPDocument11 pagesRVI Unaudited Financials - 30 June 2013 - LPseetzenNo ratings yet

- CH 05Document4 pagesCH 05vivienNo ratings yet

- Cost PDFDocument140 pagesCost PDFA. La NabiNo ratings yet

- Cost Accounting Foundations and EvolutionsDocument44 pagesCost Accounting Foundations and EvolutionsYus CeballosNo ratings yet

- 7 CMA FormatDocument30 pages7 CMA FormatSiddharth DasNo ratings yet

- Accounting For Share CapitalDocument10 pagesAccounting For Share CapitalShiraz MalhotraNo ratings yet

- Capex JSWE InitiateDocument13 pagesCapex JSWE InitiatemittleNo ratings yet

- FAR - Operating SegmentsDocument3 pagesFAR - Operating SegmentsDale JimenoNo ratings yet

- Black BookDocument77 pagesBlack Bookfh.nse209No ratings yet

- Exercise AFA1 For CH1-004-10!12!23Document12 pagesExercise AFA1 For CH1-004-10!12!23Srey NeangNo ratings yet

- Analysis of Financial StatementsDocument7 pagesAnalysis of Financial StatementsThakur Anmol RajputNo ratings yet

- Acc501 17feb2011 FinaltermDocument5 pagesAcc501 17feb2011 Finaltermshan aliNo ratings yet

- If I Would Like To Protect My Downside, How Would I Structure The Investment?Document6 pagesIf I Would Like To Protect My Downside, How Would I Structure The Investment?helloNo ratings yet

- Terminal Value Calculation in DCF Valuation Models: An Empirical VerificationDocument13 pagesTerminal Value Calculation in DCF Valuation Models: An Empirical Verificationpre.meh21No ratings yet

- Cma Esp Additional Practice Questions Part 2 FinalDocument175 pagesCma Esp Additional Practice Questions Part 2 FinalPattyNo ratings yet

- Class 12 Isc Accountancy Project 1Document19 pagesClass 12 Isc Accountancy Project 1manavpipaliya533No ratings yet

- Partnership Dissolution Name: Date: Professor: Section: Score: QuizDocument3 pagesPartnership Dissolution Name: Date: Professor: Section: Score: QuizPrincess Frean VillegasNo ratings yet

- 01 - Correction of ErrorsDocument4 pages01 - Correction of ErrorsMikaela SalvadorNo ratings yet