Porter Analysis: Threat of New Entrants

Porter Analysis: Threat of New Entrants

Uploaded by

Noopur ChoiwalCopyright:

Available Formats

Porter Analysis: Threat of New Entrants

Porter Analysis: Threat of New Entrants

Uploaded by

Noopur ChoiwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Porter Analysis: Threat of New Entrants

Porter Analysis: Threat of New Entrants

Uploaded by

Noopur ChoiwalCopyright:

Available Formats

Porter Analysis

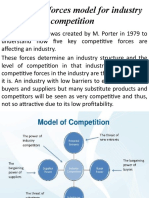

An industry is a group of firms that market products which are close substitutes for each other (e.g. the car industry, the travel industry). Some industries are more profitable than others. Why? The answer lies in understanding the dynamics of competitive structure in an industry. The most influential analytical model for assessing the nature of competition in an industry is Michael Porter's Five Forces Model, which is described below: Porter explains that there are five forces that determine industry attractiveness and long-run industry profitability. These five "competitive forces" are - The threat of entry of new competitors (new entrants) - The threat of substitutes - The bargaining power of buyers - The bargaining power of suppliers - The degree of rivalry between existing competitors Threat of New Entrants New entrants to an industry can raise the level of competition, thereby reducing its attractiveness. The threat of new entrants largely depends on the barriers to entry. High entry barriers exist in some industries (e.g. shipbuilding) whereas other industries are very easy to enter (e.g. estate agency, restaurants). Key barriers to entry include: - Economies of scale - Capital / investment requirements - Customer switching costs - Access to industry distribution channels - The likelihood of retaliation from existing industry players. Threat of Substitutes The presence of substitute products can lower industry attractiveness and profitability because they limit price levels. The threat of substitute products depends on: - Buyers' willingness to substitute - The relative price and performance of substitutes - The costs of switching to substitutes Bargaining Power of Suppliers The cost of items bought from suppliers (e.g. raw materials, components) can have a significant impact on a

company's profitability. If suppliers have high bargaining power over a company, then in theory the company's industry is less attractive. The bargaining power of suppliers will be high when: - There are many buyers and few dominant suppliers - There are undifferentiated, highly valued products - Suppliers threaten to integrate forward into the industry (e.g. brand manufacturers threatening to set up their own retail outlets) - Buyers do not threaten to integrate backwards into supply - The industry is not a key customer group to the suppliers Bargaining Power of Buyers Buyers are the people / organisations who create demand in an industry The bargaining power of buyers is greater when - There are few dominant buyers and many sellers in the industry - Products are standardised - Buyers threaten to integrate backward into the industry - Suppliers do not threaten to integrate forward into the buyer's industry - The industry is not a key supplying group for buyers Intensity of Rivalry The intensity of rivalry between competitors in an industry will depend on: - The structure of competition - for example, rivalry is more intense where there are many small or equally sized competitors; rivalry is less when an industry has a clear market leader- The structure of industry costs - for example, industries with high fixed costs encourage competitors to fill unused capacity by price cutting - Degree of differentiation - industries where products are commodities (e.g. steel, coal) have greater rivalry; industries where competitors can differentiate their products have less rivalry - Switching costs - rivalry is reduced where buyers have high switching costs - i.e. there is a significant cost associated with the decision to buy a product from an alternative supplier - Strategic objectives - when competitors are pursuing aggressive growth strategies, rivalry is more intense. Where competitors are "milking" profits in a mature industry, the degree of rivalry is less - Exit barriers - when barriers to leaving an industry are high (e.g. the cost of closing down factories) - then competitors tend to exhibit greater rivalry.

Case study on crisis management Johnson & Johnson and Tylenol

Companies in Crisis - What to do when it all goes wrong

Crisis need not strike a company purely as a result of its own negligence or misadventure. Often, a situation is created which cannot be blamed on the company - but the company finds out pretty quickly that it takes a huge amount of blame if it fumbles the ball in its response. One of the classic tales of how a company can get it right is that of Johnson & Johnson, and the company's response to the Tylenol poisoning.

What happened

In 1982, Johnson & Johnson's Tylenol medication commanded 35 per cent of the US overthe-counter analgesic market - representing something like 15 per cent of the company's profits.

Unfortunately, at that point one individual succeeded in lacing the drug with cyanide. Seven people died as a result, and a widespread panic ensued about how widespread the contamination might be. By the end of the episode, everyone knew that Tylenol was associated with the scare. The company's market value fell by $1bn as a result. When the same situation happened in 1986, the company had learned its lessons well. It acted quickly - ordering that Tylenol should be recalled from every outlet - not just those in the state where it had been tampered with. Not only that, but the company decided the product would not be re-established on the shelves until something had been done to provide better product protection. As a result, Johnson & Johnson developed the tamperproof packaging that would make it much more difficult for a similar incident to occur in future.

Cost and benefit

The cost was a high one. In addition to the impact on the company's share price when the crisis first hit, the lost production and destroyed goods as a result of the recall were considerable. However, the company won praise for its quick and appropriate action. Having sidestepped the position others have found themselves in - of having been slow to act in the face of consumer concern - they achieved the status of consumer champion. Within five months of the disaster, the company had recovered 70% of its market share for the drug - and the fact this went on to improve over time showed that the company had succeeded in preserving the long term value of the brand. Companies such as Perrier, who had been criticised for less adept handling of a crisis, found their reputation damaged for as long as five years after an incident. In fact, there is some evidence that it was rewarded by consumers who were so reassured by the steps taken that they switched from other painkillers to Tylenol. Conclusion The features that made Johnson & Johnson's handling of the crisis a success included the following:

They acted quickly, with complete openness about what had happened, and immediately sought to remove any source of danger based on the worst case scenario - not waiting for evidence to see whether the contamination might be more widespread Having acted quickly, they then sought to ensure that measures were taken which would prevent as far as possible a recurrence of the problem

They showed themselves to be prepared to bear the short term cost in the name of consumer safety. That more than anything else established a basis for trust with their customers

You might also like

- Porter's Five Forces: Understand competitive forces and stay ahead of the competitionFrom EverandPorter's Five Forces: Understand competitive forces and stay ahead of the competitionRating: 4 out of 5 stars4/5 (10)

- How Competitive Forces Shape StrategyDocument11 pagesHow Competitive Forces Shape StrategyErwinsyah RusliNo ratings yet

- Supermarket Industry PorterDocument5 pagesSupermarket Industry PorterMiklós BarnabásNo ratings yet

- Industry Analysis: Positioning The Firm Within The Specific EnvironmentDocument12 pagesIndustry Analysis: Positioning The Firm Within The Specific EnvironmentJann Aldrin Pula100% (1)

- Consulting Interview Case Preparation: Frameworks and Practice CasesFrom EverandConsulting Interview Case Preparation: Frameworks and Practice CasesNo ratings yet

- Competing Against Time: How Time-Based Competition is Reshaping Global MarFrom EverandCompeting Against Time: How Time-Based Competition is Reshaping Global MarRating: 4 out of 5 stars4/5 (9)

- Red Brand CannersDocument2 pagesRed Brand Cannersprateek_goyal20910% (1)

- Opportunities & Threats - Analyzing The External EnvironmentDocument4 pagesOpportunities & Threats - Analyzing The External EnvironmentMaeNo ratings yet

- External Analysis: The Identification of Opportunities and ThreatsDocument16 pagesExternal Analysis: The Identification of Opportunities and Threatsfaria tabassum anikaNo ratings yet

- Business EnvironmentDocument22 pagesBusiness Environmentgetcultured69No ratings yet

- Porter's 5 ForcesDocument15 pagesPorter's 5 ForcesGolan MehtaNo ratings yet

- The External EnvironmentDocument6 pagesThe External EnvironmentLovely De CastroNo ratings yet

- Reviewquestion Chapter5 Group5Document7 pagesReviewquestion Chapter5 Group5Linh Bảo BảoNo ratings yet

- Group 1Document16 pagesGroup 1priyanka srivastavaNo ratings yet

- Industry AnalysisDocument25 pagesIndustry AnalysisPrashant Tejwani100% (1)

- The Structural Analysis of IndustriesDocument6 pagesThe Structural Analysis of IndustriesAnonymous B59wYX4EhNo ratings yet

- Porter's 5 ForcesDocument16 pagesPorter's 5 ForcesSamir ParikhNo ratings yet

- Porter's 5 ForcesDocument16 pagesPorter's 5 ForcesAnjali SaigalNo ratings yet

- Porters Five Force ModelDocument13 pagesPorters Five Force Modelyuvaraj100% (1)

- Market AnalysisDocument6 pagesMarket AnalysisVincent NdaleNo ratings yet

- Threat of Entry: ReviewDocument4 pagesThreat of Entry: ReviewJerome NaronNo ratings yet

- SBM TSB GRP 6 - Porters 5 ForceDocument27 pagesSBM TSB GRP 6 - Porters 5 ForceShashank BhootraNo ratings yet

- Chapter 3-External AnalysisDocument18 pagesChapter 3-External AnalysisMd. Rashed Kamal 221-45-042No ratings yet

- Porters Five Forces Model For Industry CompetitionDocument15 pagesPorters Five Forces Model For Industry CompetitionShahid ChuhdryNo ratings yet

- Case Study: Competitive ForcesDocument3 pagesCase Study: Competitive ForcesArif QureshiNo ratings yet

- Defining An Industry: Strategy: Porter's Five Forces Model: Analysing Industry StructureDocument3 pagesDefining An Industry: Strategy: Porter's Five Forces Model: Analysing Industry StructureSahera KhanNo ratings yet

- The Strategic Planning ProcessDocument39 pagesThe Strategic Planning Processakash0chattoorNo ratings yet

- Developing Strategy Through External AnalysisDocument8 pagesDeveloping Strategy Through External AnalysisDavid GreeneNo ratings yet

- 7bTHE STRATEGIC PLANNING PROCESS, PART 1 & 2Document22 pages7bTHE STRATEGIC PLANNING PROCESS, PART 1 & 2Sakura CnNo ratings yet

- Feb Chap 5Document13 pagesFeb Chap 5gx559953No ratings yet

- Hanger Industry Based On Porter's Five ForcesDocument4 pagesHanger Industry Based On Porter's Five ForcesMuktadirhasanNo ratings yet

- LSE CMC Exploring Strategy Industry and Sector AnalysisDocument32 pagesLSE CMC Exploring Strategy Industry and Sector AnalysisĐinh Hữu NamNo ratings yet

- Portel Five ModelDocument22 pagesPortel Five ModelMuhammad shahNo ratings yet

- Strategy - Chapter 3: Can A Firm Develop Strategies That Influence Industry Structure in Order To Moderate Competition?Document8 pagesStrategy - Chapter 3: Can A Firm Develop Strategies That Influence Industry Structure in Order To Moderate Competition?Tang WillyNo ratings yet

- Industry AnalysisDocument7 pagesIndustry AnalysisNethiyaaRajendranNo ratings yet

- Strama 2Document26 pagesStrama 2Ruby De GranoNo ratings yet

- Red Ocean and Blue Ocean StrategyDocument7 pagesRed Ocean and Blue Ocean StrategySeikh SadiNo ratings yet

- Ranbaxy PorterDocument4 pagesRanbaxy PorterBhanu GuptaNo ratings yet

- Module 2 BAV 30-05-2024Document89 pagesModule 2 BAV 30-05-2024f20210957No ratings yet

- 5 Chapter Industry and Competitor AnalysisDocument10 pages5 Chapter Industry and Competitor AnalysisSuman ChaudharyNo ratings yet

- Industry Life Cycle Analysis BCGDocument6 pagesIndustry Life Cycle Analysis BCGsabbir mahmud sakilNo ratings yet

- Module 3 - Industry AnalysisDocument28 pagesModule 3 - Industry AnalysisJohanna EkbladNo ratings yet

- Strategy: Porter's Five Forces Model: Analysing Industry StructureDocument19 pagesStrategy: Porter's Five Forces Model: Analysing Industry StructureMalsha KularathnaNo ratings yet

- Porter's Five Forces AnalysisDocument3 pagesPorter's Five Forces Analysisvidhit87No ratings yet

- Porter's Five Forces ModelDocument5 pagesPorter's Five Forces ModelPrajakta Gokhale100% (1)

- Chapter 2 The EnvironmentDocument15 pagesChapter 2 The Environmentelio achkarNo ratings yet

- Porter Five Forces PDFDocument9 pagesPorter Five Forces PDFMeepNo ratings yet

- Strategy: Porter's Five Forces Model: Analysing Industry StructureDocument3 pagesStrategy: Porter's Five Forces Model: Analysing Industry StructuresunnysunsationNo ratings yet

- Competitive Strategy: Lecture 2: External EnvironmentDocument22 pagesCompetitive Strategy: Lecture 2: External EnvironmenthrleenNo ratings yet

- Hec Group of Institutions, Haridwar Online Notes Topic:-Michael Porter's Five Forces ModelDocument4 pagesHec Group of Institutions, Haridwar Online Notes Topic:-Michael Porter's Five Forces ModelHarshit KumarNo ratings yet

- OligopolyDocument16 pagesOligopolygipaworldNo ratings yet

- CG SkriptaDocument41 pagesCG SkriptaInesNo ratings yet

- Industry Handbook: Porte: R's 5 Forces AnalysisDocument20 pagesIndustry Handbook: Porte: R's 5 Forces AnalysisAnitha GirigoudruNo ratings yet

- Analysis of The Competitive EnvironmentDocument46 pagesAnalysis of The Competitive Environmentshivbab1No ratings yet

- Porters Five ForcesDocument12 pagesPorters Five ForcesPrithvi AcharyaNo ratings yet

- Industry and Environmental Analysis ActivityDocument3 pagesIndustry and Environmental Analysis Activityrosalinda yapNo ratings yet

- Analisis PorterDocument2 pagesAnalisis PorterAlim AhmadNo ratings yet

- Lecture 3 Industry AnalysisDocument37 pagesLecture 3 Industry AnalysisAsmaa BaaboudNo ratings yet

- Industry AnalysisDocument3 pagesIndustry AnalysisYuvraj MinawalaNo ratings yet

- Chapter 3 StrategicDocument9 pagesChapter 3 StrategicShewit DestaNo ratings yet

- The Competitive Power of the Product Lifecycle: Revolutionise the way you sell your productsFrom EverandThe Competitive Power of the Product Lifecycle: Revolutionise the way you sell your productsNo ratings yet

- BMA 12e SM CH 26 Final PDFDocument14 pagesBMA 12e SM CH 26 Final PDFNikhil ChadhaNo ratings yet

- TBCH 16Document19 pagesTBCH 16Bill Benntt100% (1)

- Forex MarketDocument33 pagesForex Marketaniket7gNo ratings yet

- Brunn 2002Document13 pagesBrunn 2002Aggna NiawanNo ratings yet

- CA Foundation BookDocument341 pagesCA Foundation Bookpmritunjay219No ratings yet

- Divergence (BraveFx Academy)Document12 pagesDivergence (BraveFx Academy)Mikail AdedejiNo ratings yet

- Dr. Ram Manohar Lohiya National Lawuniversity 2018-2019: Project OnDocument21 pagesDr. Ram Manohar Lohiya National Lawuniversity 2018-2019: Project OnHariank GuptaNo ratings yet

- Volume and Divergence by Gail MerceDocument7 pagesVolume and Divergence by Gail MerceCryptoFX80% (5)

- De Mar's Product Strategy Case Study: Group ThreeDocument11 pagesDe Mar's Product Strategy Case Study: Group ThreeDeepak UpadhyayNo ratings yet

- Marketing MyopiaDocument29 pagesMarketing MyopiaMuzammil MuzammilNo ratings yet

- Dividend Policy: Financial Management Theory and PracticeDocument33 pagesDividend Policy: Financial Management Theory and PracticeSamar KhanzadaNo ratings yet

- Strategy Formulation - Group 4Document41 pagesStrategy Formulation - Group 4Angeline de Sagun100% (1)

- ABM Applied Economics Module 5 Evaluating The Viability and Impacts of Business On The CommunityDocument90 pagesABM Applied Economics Module 5 Evaluating The Viability and Impacts of Business On The Communitymara ellyn lacson100% (1)

- (English) Why Do Competitors Open Their Stores Next To One Another? - Jac de Haan (DownSub - Com)Document4 pages(English) Why Do Competitors Open Their Stores Next To One Another? - Jac de Haan (DownSub - Com)FlorencedNo ratings yet

- Fundamental Inflexibility Assumptions:: W - Inflexible P - InflexibleDocument18 pagesFundamental Inflexibility Assumptions:: W - Inflexible P - InflexibleCedric PinNo ratings yet

- Marketing Management ReviewerDocument6 pagesMarketing Management ReviewerGrace MarasiganNo ratings yet

- Warwick Economics Summer School 2016 Problem Set 1 AnswersDocument9 pagesWarwick Economics Summer School 2016 Problem Set 1 AnswersAndrew NormandNo ratings yet

- Money Market Vs Capital MarketDocument53 pagesMoney Market Vs Capital MarketrajNo ratings yet

- The Expert'S Guide: To Building A GTM Strategy That WorksDocument22 pagesThe Expert'S Guide: To Building A GTM Strategy That WorksRony James100% (2)

- Physical DistributionDocument2 pagesPhysical DistributionKeshav ShankarNo ratings yet

- Parkin Econ SM CH06Document21 pagesParkin Econ SM CH06Quang VinhNo ratings yet

- Reading 6 The Arbitrage Pricing Theory and Multifactor Models of Risk and ReturnDocument5 pagesReading 6 The Arbitrage Pricing Theory and Multifactor Models of Risk and ReturnPriyadarshini SealNo ratings yet

- Exploring The Difference Between Micro and Macro EconomicsDocument5 pagesExploring The Difference Between Micro and Macro EconomicsExport ImbdNo ratings yet

- Employee ManagementDocument18 pagesEmployee ManagementTina BrutsNo ratings yet

- Supply, Demand and Government PoliciesDocument7 pagesSupply, Demand and Government PoliciesLý ĐinhNo ratings yet

- Addons Retail Private Limited Was Incorporated in 2006 (Autosaved)Document7 pagesAddons Retail Private Limited Was Incorporated in 2006 (Autosaved)Rajat RajoriyaNo ratings yet

- Noc18 mg35 Assignment5Document4 pagesNoc18 mg35 Assignment5ANADI BANCHHORNo ratings yet

- Introduction To Macroeconomics: IS-LM ModelDocument45 pagesIntroduction To Macroeconomics: IS-LM ModelAlbert Eka SaputraNo ratings yet

- Soneri Bank Limited Balance SheetDocument3 pagesSoneri Bank Limited Balance SheetSaad Ur RehmanNo ratings yet