STP and SWP Form

STP and SWP Form

Uploaded by

Hitesh MiskinCopyright:

Available Formats

STP and SWP Form

STP and SWP Form

Uploaded by

Hitesh MiskinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

STP and SWP Form

STP and SWP Form

Uploaded by

Hitesh MiskinCopyright:

Available Formats

SYSTEMATIC TRANSFER PLAN / SYSTEMATIC

WITHDRAWAL PLAN

Please read the Terms and Conditions carefully and strike off any sections that are not relevant or not applicable.

1. DISTRIBUTOR INFORMATION*

Broker Code/ Sub Broker /Agent's Internal Code for ISC Date Timestamp

Bank Branch Code EUIN*

ARN / RIA** / PMRN** Code ARN Code Sub - Agent / Employee Reference No.

** By mentioning RIA /PMRN code, I/We authorize you to share with the Investment Adviser/ Portfolio Manager the details of my/our transactions in the scheme(s) of Bajaj Finserv Mutual Fund.

(Please if applicable) *In case the EUIN box has been left blank, please refer the point related to EUIN in the Declaration & Signatures section overleaf. Commission “if any applicable” shall be paid

TOLL FREE NUMBER: 1800 309 3900 | EMAIL: service@bajajamc.com | WEBSITE: https://www.bajajamc.com

directly by the investor to the AMFI registered distributor, based on the investor's assessment of various factors, including the service rendered by the distributor.

2. EXISTING UNIT HOLDER INFORMATION

Investor Name Mr. Ms. M/s.

Folio No. PAN/PEKRN* Enclosed: KYC Compliance

3. SYSTEMATIC TRANSFER PLAN (STP) (To be submitted atleast 7 business days before the 1st due date for transfer) (Refer STP instructions)

From Scheme To Scheme

Plan Plan

Option (Please any one) Growth IDCW Payout IDCW Reinvestment Option (Please any one) Growth IDCW Payout IDCW Reinvestment

IDCW Frequency IDCW Frequency

(Please specify) (Please specify)

(In case of IDCW Option) (In case of IDCW Option)

STP Frequency: Daily Weekly (Any day from Monday to Friday) Monthly* (*Default) Quarterly

STP Date STP Start STP End

STP Amount: No. of Installments :

(You may select any date from 1st to 28th of the month)

4. SYSTEMATIC WITHDRAWAL PLAN (SWP ) (To be submitted atleast 7 business days before the due date for transfer) Refer SWP Instructions

Scheme Plan

Option (Please any one) Growth IDCW Payout IDCW Reinvestment *IDCW Frequency

(In case of IDCW Option)

SWP Instalment ` SWP Frequency: Monthly Quarterly Half Yearly Yearly

SWP Date: SWP Start: SWP End:

No. of Instalments

(You may select any date from 1st to 28th of the month)

5. DECLARATION AND SIGNATURE(S)

Having read and understood the content of the SID / SAI of the scheme, I/we hereby apply for units of the scheme. I have read and understood the terms, conditions, details, rules and

regulations governing the scheme.I/We hereby declare that the amount invested in the scheme is through legitimate source only and does not involve designed for the purpose of the

contravention of any Act, Rules, Regulations, Notifications or Directives of the provisions of the Income Tax Act, Anti Money Laundering Laws, Anti Corruption Laws or any other

applicable laws enacted by the Government of India from time to time. I/we have not received nor have been induced by any rebate or gifts, directly or indirectly in making this

investment. I/We confirm that the funds invested in the Scheme, legally belongs to me/us. In event “Know Your Customer” process is not completed by me/us to the satisfaction of the

Mutual Fund, (I/we hereby authorize the Mutual Fund, to redeem the funds invested in the Scheme, in favour of the applicant, at the applicable NAV prevailing on the date of such

redemption and undertake such other action with such funds that may be required by the law.) The ARN holder has disclosed to me/us all the commissions (trail commission or any

other mode), payable to him for the different competing Schemes of various Mutual Funds amongst which the Scheme is being recommended to me/ us. I/We confirm that I/We do not

have any existing Micro SIP/Lumpsum investments which together with the current application will result in aggregate investments exceeding `50,000 in a year (Applicable for Micro

investment only.) with your fund house. For NRIs only - I / We confirm that I am/ we are Non Residents of Indian nationality/origin and that I/We have remitted funds from abroad

Version 01: 04-07-23

through approved banking channels or from funds in my/ our Non Resident External / Non Resident Ordinary / FCNR account. I/We confirm that details provided by me/us are true and

correct.

I /We hereby confirm that the EUIN box has been intentionally left blank by me/us as this is an “execution-only” transaction without any interaction or advice by the employee/rela-

tionship manager/sales person of the above distributor or notwithstanding the advice of in-appropriateness, if any, provided by the employee/relationship manager/sales person of

the distributor and the distributor has not charged any advisory fees on this transaction.

SIGNATURE(S)

Sign of 1st Applicant / Guardian / Sign of 2nd Applicant / Sign of 3rd Applicant /

Authorised Signatory / POA Authorised Signatory / POA Authorised Signatory / POA

ACKNOWLEDGMENT SLIP (To be filled in by the investor)

Application No.:

Folio No.

From

Scheme Plan

Amount Cheque No. Date Signature, Stamp & Date

TERMS AND CONDITIONS

SYSTEMATIC TRANSFER PLAN (STP)

• Systematic Transfer Plan (STP) is an option wherein Unit holders of Source Schemes can opt to transfer a fixed amount at regular intervals (and provide standing instructions to the AMC to switch the

same into the target schemes.

• The source schemes refer to all open-ended schemes and the target schemes refer to all open ended schemes where subscription is allowed.

• The amount transferred under STP from Source scheme to the Target Scheme shall be done by redeeming Units of Source scheme at Applicable NAV, subject to exit load, if any; and subscribing to the

Units of the Scheme at Applicable NAV as on specified date as given below:

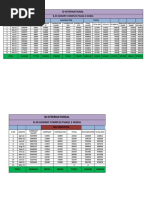

Systematic Transfer Plan (STP)

Default

Particulars Frequency

Daily Option All business day -

Weekly Option Any day from Monday to Friday Tuesday

10th of the

Monthly & Quarterly Option Any Date of every month month

In case these dates fall on a holiday or book closure period, the next Business Day will be considered for this purpose. In case of nil balance in the Source Scheme, STP for that particular due date will not

be processed.

• STP will cease to be active upon 3 consecutive unsuccessful transactions or if all units are pledged or upon receipt of intimation of death of Unit holder. All requests for registering or discontinuing

Systematic Transfer Plans shall be subject to an advance notice of 7 business days.

• The provision of “Minimum Redemption Amount” specified in Scheme Information Document (SID)(s) of the respective Source schemes and “Minimum Application Amount” applicable to the Target

Scheme as specified in this document will not be applicable for Systematic Transfer Plan.

• Daily, weekly, monthly and quarterly frequency: The minimum amount criteria will be Rs 1000/- per installment and any amount thereafter. The minimum number of installments required will be 6

installments.

In case frequency is not selected, default frequency shall be Monthly and the default date for STP shall be 10th of the month and in case of Weekly frequency, the default day will be Tuesday.

• Further, the minimum balance in the Unit holders account or the minimum amount of application at the time of enrolment for STP in the Transferor Scheme should be Rs. 12,000.

• There will be no maximum duration for STP enrolment.

• The amount transferred under the STP from the Transferor Scheme to the Transferee Scheme shall be effected by redeeming units of Transferor Scheme at Applicable NAV, after payment of Exit Load,

if any, and subscribing to the units of the Transferee Scheme at Applicable NAV in respect of each STP investment. In case the STP date falls on a Non-Business Day or falls during a book closure

period, the immediate next Business Day will be considered for the purpose of determining the applicability of NAV.

• Unit holders may change the amount (but not below the specified minimum) by giving written notice to any of the Official Point(s) of Acceptance. Unit holders will have the right to discontinue the STP

facility at any time by sending a written request to the OPA. Notice of such discontinuance should be received at least 7 business days prior to the due date of the next transfer date.

• On receipt of such request, the STP facility will be terminated. STP will be terminated automatically if all the Units are liquidated or withdrawn from the Transferor Scheme or pledged or upon the

Fund’s receipt of notification of death or incapacity of the Unit holder.

• Exit Load, if any, prevailing on the date of enrolment shall be levied in the Transferee Scheme.

• The AMC / Trustee reserve the right to change / modify load structure and other terms and conditions under the STP prospectively at a future date.

• The Fund reserves the right to include/remove any of its Schemes under the category of Source and Target Schemes available for STP from time to time by suitable display of notice on AMC's Website.

• The facility is available for both Source and Target Scheme.

SYSTEMATIC WITHDRAWAL PLAN (SWP)

• This facility enables an investor to withdraw sums from their Unit accounts in the Scheme at periodic intervals through a one-time request. The withdrawals can be made as follows:

Frequency

Particulars Monthly Quarterly Half-Yearly Yearly

SWP Any date of every Any date of every Any date of every Any date of every

Transaction month (between 1st Quarter (between 1st & half- year (between year (between 1st &

Dates & 28th) 28th) 1st & 28th) 28th)

Minimum no. of 2 installments of Rs. 2 installments of Rs. 1000/- 2 installments of Rs. 2 installments of Rs.

installments and 1000/-each and in each and in multiples of Re. 1000/-each and in 1000/-each and in

Minimum amount multiples of Re. 1/- 1/- thereafter multiples of Re. 1/- multiples of Re. 1/-

of installment thereafter thereafter thereafter

• The withdrawals will commence from the start date mentioned by the investor in the SWP Application Form. The Units will be redeemed at the Applicable NAV of the respective dates on which such

withdrawals are sought.

• The request for enrollment / processing of SWP will only be on a Business Day at the applicable NAV.

• In case during the term of SWP processing date falls on a non-Business Day, then such request will be processed on the following Business Day’s applicable NAV.

• The request for enrollment of SWP in the prescribed form should be received at any OPA / ISC at least 7 Business Days in advance before the execution /commencement date.

• In case the balance in the scheme goes below the SWP installment amount, then the SWP shall be processed for the available balance.

• In case of 3 consecutive SWP installment on account of NIL balance in the scheme, the SWP in the scheme shall be discontinued.

• The request for discontinuation of SWP shall be given in writing and should be received at any official point of acceptance / Investor Service Center at least 7 Business Days in advance before the

execution / commencement date.

• A request for SWP will be treated as a request for Redemption from/Subscription into the respective Option(s)/Plan(s) of the Scheme(s) as opted by the Investor, at the applicable NAV.

BAJAJ FINSERV ASSET MANAGEMENT LIMITED (Investment Manager for Bajaj Finserv Mutual Fund)

8th floor, E-Core, Solitaire Business Park (formerly Marvel Edge), Viman Nagar, Pune 411014

TOLL FREE NUMBER: 1800 309 3900 | FAX: 020 - 6767 2550 | EMAIL: service@bajajamc.com | WEBSITE: https://www.bajajamc.com | CIN: U65990MH2017PLC294178

You might also like

- Competitive Strategy Techniques For Analyzing Industries and Competitors, Michael E. PorterDocument422 pagesCompetitive Strategy Techniques For Analyzing Industries and Competitors, Michael E. PorterTheonlyone0194% (31)

- GSOE9810 Assignment 1 Group 214Document18 pagesGSOE9810 Assignment 1 Group 214Heap Ke XinNo ratings yet

- Bandhan MF - STP FormDocument2 pagesBandhan MF - STP FormserviceNo ratings yet

- Systematic Transfer Plan Enrollement Form (Please Fill in Block Letters)Document3 pagesSystematic Transfer Plan Enrollement Form (Please Fill in Block Letters)Ankur KaushikNo ratings yet

- Systematic Withdrawal Plan - FormDocument2 pagesSystematic Withdrawal Plan - Formme19d012No ratings yet

- Bandhan SIPDocument2 pagesBandhan SIPmanikt1990No ratings yet

- Sip Enrolment FormDocument1 pageSip Enrolment FormYankit SoniNo ratings yet

- SIP DebitMandateNACH-FormDocument2 pagesSIP DebitMandateNACH-FormDevesh SinghNo ratings yet

- Iti CafDocument2 pagesIti CafreachoutrameshaNo ratings yet

- Systematic Investment Plan (SIP) / Micro SIP Form: 1. Applicant InformationDocument2 pagesSystematic Investment Plan (SIP) / Micro SIP Form: 1. Applicant InformationAnonymous MAQrYFQDzVNo ratings yet

- Transaction Slip ICICIDocument1 pageTransaction Slip ICICIVED singhNo ratings yet

- Transaction Form For Existing InvestorsDocument4 pagesTransaction Form For Existing InvestorsRRKNo ratings yet

- SIP1018 Kotak - CDRDocument1 pageSIP1018 Kotak - CDRNikesh MewaraNo ratings yet

- HDFC Sip Nach FormDocument6 pagesHDFC Sip Nach FormPraveen KumarNo ratings yet

- Mirae Sip FormDocument2 pagesMirae Sip Formitkahs120No ratings yet

- Transaction Form For STP & SWP: 1. Applicant InformationDocument2 pagesTransaction Form For STP & SWP: 1. Applicant InformationChintan JainNo ratings yet

- Family Solutions Transaction FormDocument2 pagesFamily Solutions Transaction FormSelva KumarNo ratings yet

- SIP Facility Appl Form V 1Document4 pagesSIP Facility Appl Form V 1DBCGNo ratings yet

- Av Birla Sip FormDocument1 pageAv Birla Sip FormVikas RaiNo ratings yet

- Distributor Information: Sign HereDocument2 pagesDistributor Information: Sign Herevabin muthirikundilNo ratings yet

- Sole / First Applicant Second Applicant Third ApplicantDocument2 pagesSole / First Applicant Second Applicant Third ApplicantAnkur KaushikNo ratings yet

- STP and SWP Form May17 FillPrintDocument2 pagesSTP and SWP Form May17 FillPrintRohan KapoorNo ratings yet

- Sip STP SWP Cancellation FormDocument2 pagesSip STP SWP Cancellation FormMahesh ChandranNo ratings yet

- Axis CTF FillableDocument1 pageAxis CTF FillablemayankNo ratings yet

- One Time Mandate FormDocument2 pagesOne Time Mandate FormJatin SinghNo ratings yet

- Transaction Slip - Debt Liquid Equity SchemesDocument1 pageTransaction Slip - Debt Liquid Equity SchemesMaster pratikNo ratings yet

- STP-Enrolment-(EUIN)-FormDocument2 pagesSTP-Enrolment-(EUIN)-FormAthulNo ratings yet

- Baroda BNP Paribas SIP Form 127Document2 pagesBaroda BNP Paribas SIP Form 127custodian.archiveNo ratings yet

- MahindraDocument2 pagesMahindravabin muthirikundilNo ratings yet

- STP FormDocument1 pageSTP FormLamar Wealth solutionsNo ratings yet

- CR Baf Smart STP To Nfo App Form v14 EditableDocument2 pagesCR Baf Smart STP To Nfo App Form v14 Editablesukanth30122004No ratings yet

- Application Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Document2 pagesApplication Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Gargi ShuklaNo ratings yet

- JM Finance MF - Sip NachDocument1 pageJM Finance MF - Sip NacharunimaapkNo ratings yet

- Common Transaction Form Financial Transaction Kk3i5z51Document8 pagesCommon Transaction Form Financial Transaction Kk3i5z51Balraj SinghNo ratings yet

- SBI stp-enrollment-formDocument3 pagesSBI stp-enrollment-formjanardhanreddy.kongaraNo ratings yet

- HDFC Sip CancellationDocument1 pageHDFC Sip CancellationMaluNo ratings yet

- STP FormDocument1 pageSTP FormLamar Wealth solutionsNo ratings yet

- SIP Form DebtDocument6 pagesSIP Form DebtNilesh MahajanNo ratings yet

- Redemtion Form DSPDocument2 pagesRedemtion Form DSPCubicle CoderNo ratings yet

- HDFC Dream SIP Application Form 270922Document6 pagesHDFC Dream SIP Application Form 270922pinak boradNo ratings yet

- UTI - Systematic Transfer Investment Plan UTI-STP New Editable Application FormDocument1 pageUTI - Systematic Transfer Investment Plan UTI-STP New Editable Application FormAnilmohan SreedharanNo ratings yet

- Application Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Document2 pagesApplication Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Chintan JainNo ratings yet

- Transaction SlipDocument2 pagesTransaction SlipCavikram JainNo ratings yet

- (Debit Mandate Form NACH/ ECS/ Direct Debit) : Request ForDocument2 pages(Debit Mandate Form NACH/ ECS/ Direct Debit) : Request Forssgentis100% (1)

- HDFC Sip FormDocument3 pagesHDFC Sip FormspeedenquiryNo ratings yet

- SIP Pause-Cancellation - Form PDFDocument1 pageSIP Pause-Cancellation - Form PDFdatadisk10No ratings yet

- SIP Pause Cancellation FormDocument1 pageSIP Pause Cancellation Formdatadisk10No ratings yet

- Enrolment Form For SIP/ Micro SIPDocument4 pagesEnrolment Form For SIP/ Micro SIPmeatulNo ratings yet

- Pip 1188230Document4 pagesPip 1188230anujgupta9278No ratings yet

- Dividend Sweep Option (DSO) : ISC's Signature & Time StampingDocument2 pagesDividend Sweep Option (DSO) : ISC's Signature & Time StampingAmit RajputNo ratings yet

- Transaction Slip: E-154428 ARN-110547Document1 pageTransaction Slip: E-154428 ARN-110547Money Manager OnlineNo ratings yet

- Defence Rase Day Performa 2024Document4 pagesDefence Rase Day Performa 2024motimama567No ratings yet

- Transaction Form: Sole/First Unit Holder PANDocument2 pagesTransaction Form: Sole/First Unit Holder PANSilparajaNo ratings yet

- Welcome Letter withEBT 24499583817621574647Document2 pagesWelcome Letter withEBT 24499583817621574647emaigalasNo ratings yet

- Systematic Withdrawal Plan SWP Application FormDocument1 pageSystematic Withdrawal Plan SWP Application Formsagar9985No ratings yet

- PPTSF Services OfferedDocument7 pagesPPTSF Services Offereddm.sgstechNo ratings yet

- Sip STP SWP Cancellation FormDocument1 pageSip STP SWP Cancellation FormamarNo ratings yet

- Sip Enrollment DetailsDocument2 pagesSip Enrollment DetailsDBCGNo ratings yet

- Commen Trasaction FormDocument1 pageCommen Trasaction Formsandip vishwakarmaNo ratings yet

- COM0004057712 REG Dist SIP ApplicationDocument1 pageCOM0004057712 REG Dist SIP Applicationraj tripathiNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703From EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No ratings yet

- A Strategic Management Plan by Analysing Macro and Micro EnvironmentsDocument20 pagesA Strategic Management Plan by Analysing Macro and Micro EnvironmentsIshraque HossainNo ratings yet

- Barangay TamblerDocument8 pagesBarangay TamblerpuzzleregineNo ratings yet

- FullReport AES2021Document108 pagesFullReport AES2021clement3176No ratings yet

- Kode Zoom Kelas Jadwal Kuliah Ganjil 2020-2021Document54 pagesKode Zoom Kelas Jadwal Kuliah Ganjil 2020-2021Daffa EnggarastraNo ratings yet

- Po PCitesDocument17 pagesPo PCitesjohn doeNo ratings yet

- Workbook - GRATYO Live Business Coaching With Coach Yohanes G. Pauly - 13 April 2023Document17 pagesWorkbook - GRATYO Live Business Coaching With Coach Yohanes G. Pauly - 13 April 2023Nidya LestariNo ratings yet

- Metro Manila, Philippines: by Junio M RagragioDocument21 pagesMetro Manila, Philippines: by Junio M RagragiofrancisNo ratings yet

- Smcbup Iec MaterialsDocument2 pagesSmcbup Iec MaterialsMark Kevin IIINo ratings yet

- RETRENCHMENT Labour NotesDocument16 pagesRETRENCHMENT Labour NotesNew NormalNo ratings yet

- Why Invest in TZDocument3 pagesWhy Invest in TZherman gervasNo ratings yet

- Faisal BankDocument130 pagesFaisal BankYusra JamilNo ratings yet

- Staxxon To Accept Pre-Order Deposits For Its 20-ft, 40-ft and 40-ft HC Folding ContainersDocument4 pagesStaxxon To Accept Pre-Order Deposits For Its 20-ft, 40-ft and 40-ft HC Folding ContainersPR.comNo ratings yet

- PIALEFDocument1 pagePIALEFEileen LauNo ratings yet

- Ch3ppt 1s CorrectedDocument26 pagesCh3ppt 1s CorrectedKoon Sing ChanNo ratings yet

- Account MCQDocument8 pagesAccount MCQRubina HannureNo ratings yet

- Tax 2 - DST, ExciseDocument11 pagesTax 2 - DST, ExciseDINARDO SANTOSNo ratings yet

- CPG PDFDocument20 pagesCPG PDFRehman MuzaffarNo ratings yet

- National Electrical Manufacturers AssociationDocument10 pagesNational Electrical Manufacturers AssociationKen SelorioNo ratings yet

- Coop Module 1Document64 pagesCoop Module 1Eldeen EscuadroNo ratings yet

- TallyDocument27 pagesTallyRonak JainNo ratings yet

- Finals - Attempt ReviewDocument10 pagesFinals - Attempt ReviewRony MaeaNo ratings yet

- CHAPTER 9 The Dynamics of The Franchisee Franchisor RelationshipDocument24 pagesCHAPTER 9 The Dynamics of The Franchisee Franchisor Relationshipmar bernardinoNo ratings yet

- GCR ReportDocument98 pagesGCR ReportPatel GautamNo ratings yet

- Capital Budgeting For Small Businesses - An Appropriate ModificatiDocument18 pagesCapital Budgeting For Small Businesses - An Appropriate Modificatimuhamaad.ali.javedNo ratings yet

- Id International: B-39 Hosiery Complex Phase-2 NoidaDocument3 pagesId International: B-39 Hosiery Complex Phase-2 Noidaid internationalNo ratings yet

- FM 101 SG 1Document4 pagesFM 101 SG 1Kezia Gwyneth100% (1)

- MarketingDocument2 pagesMarketingArianneCasulNo ratings yet

- Power Finance CorpDocument10 pagesPower Finance CorpdevrajkinjalNo ratings yet