Estimate

Estimate

Uploaded by

ama kumar0 ratings0% found this document useful (0 votes)

5 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

5 views1 pageEstimate

Estimate

Uploaded by

ama kumarCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

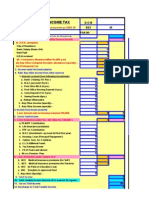

Basic Information

Assessment Year *

2024-25

Taxpayer Category

Individual

Residential Status *

RES (Resident)

Your Age

Below 60 years (Regular Between 60 - 79 years (Senior 80 and above (Super Senior

Citizen) Citizen) Citizen)

Due Date for Submission of Actual Date for Submission

Return * of Return *

31-Jul-2024 01-Apr-2024

Estimated Tax

View Comparison

Income Detail

(as per old Tax (as per new Tax

regime) regime)

Income under the head Salaries 1162040 1162040

Gross Salary 1212040 1212040

Exemption claimed u/s 10 N/A

Deduction u/s 16(ia) 50000 50000

Deduction u/s 16(ii) N/A

Deduction u/s 16(iii) N/A

Income under the head House Property 0 0

a. Income from self occupied house property 0 0

Interest on Borrowed Capital N/A

b. Income from Let-out Property

1. Annual Letable Value/ Rent Received or 0 0

Receivable

2. Less: Municipal Taxes Paid During the Year

3. Less:Unrealized Rent

Net Annual Value u/s 23 [1-(2+3)] 0 0

Less: Standard Deduction u/s 24(a) 0 0

Less: Interest Payable on Borrowed Capital u/s 24(b)

Income under the head Capital Gains 0 0

Short Term Capital Gains (Other than covered under 0 0

section 111A) Total

From 01-Apr to 15-Jun

From 16-Jun to 15-Sep

From 16-Sep to 15-Dec

From 16-Dec to 15-Mar

From 16-Mar to 31-Mar

Short Term Capital Gains (Covered under section 0 0

111A) Total

From 01-Apr to 15-Jun

From 16-Jun to 15-Sep

From 16-Sep to 15-Dec

From 16-Dec to 15-Mar

From 16-Mar to 31-Mar

Long Term Capital Gains (Charged to tax @ 20%) Total 0 0

From 01-Apr to 15-Jun

From 16-Jun to 15-Sep

From 16-Sep to 15-Dec

From 16-Dec to 15-Mar

From 16-Mar to 31-Mar

Long Term Capital Gains (Charged to tax @ 10%, other 0 0

than LTCG u/s 112A) Total

From 01-Apr to 15-Jun

From 16-Jun to 15-Sep

From 16-Sep to 15-Dec

From 16-Dec to 15-Mar

From 16-Mar to 31-Mar

Long Term Capital Gains u/s 112A(Charged to tax @ 0 0

10%) Total

From 01-Apr-to 15-Jun

From 16-Jun to 15-Sep

From 16-Sep to 15-Dec

From 16-Dec to 15-Mar

From 16-Mar to 31-Mar

Income under the head Business or Profession 0 0

Presumptive Income u/s 44AD,44ADA

Other income from Business or Profession. 0 0

Income under the head Other Sources 0 0

(i) Interest from Savings bank account

(ii) Other Interest Income 0 0

(iii) Winning from Lottery, crossword puzzles etc. 0 0

(iv) Any other income 0 0

Gross Total Income 1162040 1162040

Deduction Details

(as per old Tax (as per new Tax

regime) regime)

Deductions u/s 80C(LIC, PF, PPF, NSC, Repayment of 150000 N/A

Housing Loan, etc.)

Deduction u/s 80CCC(Payment in respect Pension N/A

Fund)

Deductions u/s 80CCD(1)(Employees / Self-employed N/A

contribution

Deductions u/s 80CCD (1B)(Additional Employees 50000 N/A

contribution towards NPS)

Deductions u/s 80CCD (2)(Employers contribution 141172 141172

towards NPS)

Total Deductions 341172 141172

Deductions u/s 80D(MediClaim Premium) 7800 N/A

Deductions u/s 80G(Donations) N/A

Deductions u/s 80E(Interest on Loan for Higher N/A

Education)

Deductions u/s 80EE(Interest on Loan taken for N/A

Residential House)

Deductions u/s 80TTA(Interest on Savings Bank N/A

Account)

Deductions u/s 80TTB(Interest on Deposits) 0 N/A

Any other deduction 0 N/A

Tax Details

(as per old Tax (as per new Tax

regime) regime)

Taxable Income 813068 1020868

1. Tax at Normal Rates 75113 63130

2. Tax at Special Rates (Capital Gains, Lottery, etc.) 0 0

Short Term Capital Gains (Covered u/s 111A) 0 0

Long Term Capital Gains (Charged to Tax @20%) 0 0

Long Term Capital Gains (Charged to tax @ 10%, 0 0

other than LTCG u/s 112A)

Long Term Capital Gains u/s 112A(Charged to tax @ 0 0

10%)

Winnings (from Lottery, Crossword Puzzles, etc.) 0 0

Total Tax before Rebate 75113 63130

Less: Tax Rebate u/s 87A 0 0

Total Tax before Rebate 75113 63130

Surcharge 0 0

Add: Health & Education Cess 3004 2525

Total Tax on Income 78117 65655

TDS/TCS 0 0

Self-Assessment Tax / Advance Tax 0 0

Balance Tax Payable / Refundable 78120 65660

Add: Interest u/s 234A 0 0

Add: Interest u/s 234B 781 656

Add: Interest u/s 234C 3940 3311

Add: Fees for late filing of return u/s 234F 0 0

Total Tax and Interest payable 82840 69620

You might also like

- Bus Math Grade 11 Q2 M2 W3Document12 pagesBus Math Grade 11 Q2 M2 W3Ronald AlmagroNo ratings yet

- Homework (AC 423) CHP 5&6 - Loh Yi ChengDocument12 pagesHomework (AC 423) CHP 5&6 - Loh Yi ChengDavid LohNo ratings yet

- Teleperformance Global Services Private Limited: Payslip For The Month of January 2022Document1 pageTeleperformance Global Services Private Limited: Payslip For The Month of January 2022gajala jamir67% (3)

- Certificate To Be Furnished by A Central Government Servant For Claiming House Rent AllowanceDocument1 pageCertificate To Be Furnished by A Central Government Servant For Claiming House Rent AllowanceTally AnuNo ratings yet

- Reference No. 13021416178: Hotel Ambrosia Sarovar ProticoDocument3 pagesReference No. 13021416178: Hotel Ambrosia Sarovar Proticokris_kcpNo ratings yet

- EstimateDocument1 pageEstimateHimali BarmanNo ratings yet

- EstimateDocument1 pageEstimateshrikrishnapunjabNo ratings yet

- EstimateDocument1 pageEstimatesandeep sandyNo ratings yet

- EstimateDocument1 pageEstimateAtulPalNo ratings yet

- EstimateDocument1 pageEstimateikan flyNo ratings yet

- Calculate Newtax 2024-25 21-04-2024Document6 pagesCalculate Newtax 2024-25 21-04-2024Nirmal KishorNo ratings yet

- Old Tax RegimeDocument6 pagesOld Tax RegimeTrumpNo ratings yet

- CalculateDocument1 pageCalculateanurag tiwariNo ratings yet

- CalculateDocument1 pageCalculateSneha dhakoliyaNo ratings yet

- Estimate - 2024-25 - 13-07-2024 INCOME TAXDocument6 pagesEstimate - 2024-25 - 13-07-2024 INCOME TAXashokjainwifeisrajanNo ratings yet

- Tax Calculator - Indian Income Tax 2008-09Document7 pagesTax Calculator - Indian Income Tax 2008-09Jayamohan100% (29)

- Income Tax Calculator Fy 2020 21 v2Document12 pagesIncome Tax Calculator Fy 2020 21 v2Anonymous Clm40C1No ratings yet

- Income Tax Calculator Fy 2020 21 v1Document8 pagesIncome Tax Calculator Fy 2020 21 v1Yogesh BajajNo ratings yet

- Latest Tax CalculatIor 3.3.2Document16 pagesLatest Tax CalculatIor 3.3.2Bijender Pal Choudhary100% (3)

- ITR-3 Excel SheetDocument8 pagesITR-3 Excel SheetRakesh CNo ratings yet

- Estimate - 2023 24 - 15 06 2024Document6 pagesEstimate - 2023 24 - 15 06 2024sk6222430No ratings yet

- IT Calculator 2018 LiteDocument6 pagesIT Calculator 2018 LiteHr PoonamNo ratings yet

- Tax Calculator Version 2Document4 pagesTax Calculator Version 2SoikotNo ratings yet

- Calculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10Document10 pagesCalculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10api-19754583No ratings yet

- 1701 P4.1Document2 pages1701 P4.1asteriaswan14No ratings yet

- Case Study 2Document2 pagesCase Study 2Anil NagarajNo ratings yet

- Page 4Document1 pagePage 4Carol MNo ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) 273151Document3 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 273151AVINASH TIWASKARNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNo ratings yet

- Income TaxDocument11 pagesIncome Taxci_balaNo ratings yet

- Income Tax Calculator FY 2016 17Document11 pagesIncome Tax Calculator FY 2016 17JITENDRA SHERKHANENo ratings yet

- Income Tax Calculator Fy 2019 20 v4Document9 pagesIncome Tax Calculator Fy 2019 20 v4Anil KesarkarNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument2 pages1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsrj aNo ratings yet

- CONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Document2 pagesCONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Akshay ShettyNo ratings yet

- F0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentDocument1 pageF0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentSourabhthakral_1No ratings yet

- Free Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Document16 pagesFree Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Bijender Pal ChoudharyNo ratings yet

- CFS - 18 Oct 2022Document11 pagesCFS - 18 Oct 2022Kartik SujanNo ratings yet

- Page 4 ItrDocument1 pagePage 4 ItrariannemungcalcpaNo ratings yet

- Old Vs New Income Tax CalculatorDocument14 pagesOld Vs New Income Tax Calculatorsebastianharry49No ratings yet

- Naveen 22-23 ComputationDocument2 pagesNaveen 22-23 Computationdeepkaler219No ratings yet

- Pravin Shinde-ARMS-01-TDS-FY 2019-20Document12 pagesPravin Shinde-ARMS-01-TDS-FY 2019-20Udaysinh PatilNo ratings yet

- CalculateDocument1 pageCalculateJaya Prakash ReddyNo ratings yet

- Income Tax CalculatorDocument9 pagesIncome Tax Calculatorchandu halwaeeNo ratings yet

- Summary 1689086671Document4 pagesSummary 1689086671Akshay SharmaNo ratings yet

- Faq'S & Guidlines On Income TaxDocument50 pagesFaq'S & Guidlines On Income TaxRavikarthik GurumurthyNo ratings yet

- Taxation Class Test 2Document5 pagesTaxation Class Test 2ap.quatrroNo ratings yet

- Res FormDocument1,320 pagesRes FormAnonymous pKsr5vNo ratings yet

- ACC2001 Lecture 4Document53 pagesACC2001 Lecture 4michael krueseiNo ratings yet

- Itr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 640703040090618 Assessment Year: 2018-19Document5 pagesItr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 640703040090618 Assessment Year: 2018-19Lokesh Ujjainia UjjainiaNo ratings yet

- Coi 23-24 Lalu YadavDocument2 pagesCoi 23-24 Lalu Yadavtejpalsinghyadav786No ratings yet

- Faq'S & Guidlines On Income TaxDocument50 pagesFaq'S & Guidlines On Income Taxvelpurimani19No ratings yet

- Income Tax Calculator 2018-19Document15 pagesIncome Tax Calculator 2018-19Raju Ranjan SinghNo ratings yet

- Calculation FormatDocument13 pagesCalculation FormatSahil Swaynshree SahooNo ratings yet

- Income Tax Calculator For FY 2022-23 & 2023-24 AY 2023-24 & 2024-25Document134 pagesIncome Tax Calculator For FY 2022-23 & 2023-24 AY 2023-24 & 2024-25Vipul SharmaNo ratings yet

- Transactions Assets Liabilities + Patent $120,000 + Cash 80,000 - Cash $2,500Document10 pagesTransactions Assets Liabilities + Patent $120,000 + Cash 80,000 - Cash $2,500abhishauryaNo ratings yet

- Old Vs New Tax Regime Calculator ExcelDocument8 pagesOld Vs New Tax Regime Calculator Excelkds1878521No ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21Raj KatochNo ratings yet

- Emailing Inter Full Book DT - Youtube - Prof - Aagam Dalal-3Document126 pagesEmailing Inter Full Book DT - Youtube - Prof - Aagam Dalal-3chalu account100% (2)

- Itr-1 Sahaj Individual Income Tax Return: Part A General InformationDocument5 pagesItr-1 Sahaj Individual Income Tax Return: Part A General InformationLala SachinNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document11 pagesIncome Tax Calculator Fy 2020 21 v1nach.nachiketNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- E801 - Org & Role of E8 (17 Files Merged)Document455 pagesE801 - Org & Role of E8 (17 Files Merged)ama kumarNo ratings yet

- Law-513 ShashwatDocument3 pagesLaw-513 Shashwatama kumarNo ratings yet

- Garvity Dam SKGDocument64 pagesGarvity Dam SKGama kumarNo ratings yet

- Earth Dam-Khare-Sep-2021-001Document140 pagesEarth Dam-Khare-Sep-2021-001ama kumarNo ratings yet

- Gravity Dam-Khare-Sep - 2021Document113 pagesGravity Dam-Khare-Sep - 2021ama kumarNo ratings yet

- Indian Institute of Technology: Dr. Deepak KhareDocument15 pagesIndian Institute of Technology: Dr. Deepak Khareama kumarNo ratings yet

- Khare Dam Introduction Sep 2021 001Document60 pagesKhare Dam Introduction Sep 2021 001ama kumarNo ratings yet

- Tutorial 002 DWRS 2021Document1 pageTutorial 002 DWRS 2021ama kumarNo ratings yet

- Tutorial Consumptive UseDocument2 pagesTutorial Consumptive Useama kumarNo ratings yet

- L4 Hypothesis Tests 2021 FDocument27 pagesL4 Hypothesis Tests 2021 Fama kumarNo ratings yet

- Irrigation Water ReqDocument1 pageIrrigation Water Reqama kumarNo ratings yet

- Linear Programming Techniques - I M.L. KansalDocument30 pagesLinear Programming Techniques - I M.L. Kansalama kumarNo ratings yet

- L3 - Data Analysis - Central Tendency 20 - 21Document22 pagesL3 - Data Analysis - Central Tendency 20 - 21ama kumarNo ratings yet

- L2 - Simultaneous Equation SolutionDocument10 pagesL2 - Simultaneous Equation Solutionama kumarNo ratings yet

- Case StudyDocument3 pagesCase Studyama kumarNo ratings yet

- Ola BillDocument3 pagesOla Billmohamad chaudhariNo ratings yet

- Receipt: Sta. Rosa Schola MusicaDocument2 pagesReceipt: Sta. Rosa Schola MusicaJojimar Kenneth GonowonNo ratings yet

- Tax Exempt FormDocument1 pageTax Exempt Formjuan camaneyNo ratings yet

- Attendance Register Cum PayslipDocument13 pagesAttendance Register Cum PayslipHaider50% (2)

- Evaluating Front Office Financial ActivitiesDocument6 pagesEvaluating Front Office Financial Activitiesraymond trinidadNo ratings yet

- Baug CARP Beneficiaries Multi Purpose Cooperative (BCBMPC) : I. HistoryDocument5 pagesBaug CARP Beneficiaries Multi Purpose Cooperative (BCBMPC) : I. HistoryElla Louella LavadorNo ratings yet

- Non Exclusive Authority To SellDocument2 pagesNon Exclusive Authority To SellPat Dela CruzNo ratings yet

- Tax Lesson 3 Out of 3Document3 pagesTax Lesson 3 Out of 3api-492177450No ratings yet

- T3 Ans 1,2,4 (RA - DD)Document8 pagesT3 Ans 1,2,4 (RA - DD)MinWei1107No ratings yet

- Taxation - Vietnam (TX-VNM) : Syllabus and Study GuideDocument18 pagesTaxation - Vietnam (TX-VNM) : Syllabus and Study GuideNgo Phuong AnhNo ratings yet

- San Beda University: Department of Accountancy and TaxationDocument11 pagesSan Beda University: Department of Accountancy and TaxationOG FAMNo ratings yet

- DLCPM25314400000017730 2023Document2 pagesDLCPM25314400000017730 2023Shri MedhiniNo ratings yet

- E-Way Bill System PDFDocument1 pageE-Way Bill System PDFUtkarsh GuptaNo ratings yet

- Individual Income Taxation - IllustrationsDocument24 pagesIndividual Income Taxation - IllustrationsCharity Lumactod AlangcasNo ratings yet

- Statement 28-MAR-23 AC 23122263 02042716 - UnlockedDocument3 pagesStatement 28-MAR-23 AC 23122263 02042716 - Unlockedjonathangoodrick16No ratings yet

- E B BillDocument6 pagesE B Billheaughfrds1No ratings yet

- Contemporary Economic Issues Facing The Filipino EntrepreneurDocument16 pagesContemporary Economic Issues Facing The Filipino EntrepreneurNicole EnriquezNo ratings yet

- Process of Filing ITR-1 Under New Income Tax E-Filing Portal 2.0Document19 pagesProcess of Filing ITR-1 Under New Income Tax E-Filing Portal 2.0Narayanan RNo ratings yet

- RHB Islamic Credit Cards PDSDocument11 pagesRHB Islamic Credit Cards PDSDyana AmnaniNo ratings yet

- OnePlus 8 TC - SBI CardDocument3 pagesOnePlus 8 TC - SBI Cardanand.joshi095757No ratings yet

- Inter Tax FinalDocument4 pagesInter Tax FinalJil Macasaet0% (1)

- DG ReturnDocument3 pagesDG Returnkiaracecilia03No ratings yet

- NCR Cup 2 (Finals) TaxDocument63 pagesNCR Cup 2 (Finals) TaxIvan DorosanNo ratings yet

- Deferred TaxesDocument30 pagesDeferred TaxesVikasNo ratings yet

- Revolut Beyond BankingDocument41 pagesRevolut Beyond BankingVivekNo ratings yet