0 ratings0% found this document useful (0 votes)

11 viewsFinancial Accounting and Analysis

The document contains multiple examples of financial accounting entries including transactions for investing capital, purchasing furniture partially on credit, purchasing and selling goods, and paying expenses. It also defines the key components that contribute to a profit and loss account including revenue, tax rates, depreciation, cost of goods sold, and operating expenses. Additionally, it provides a current assets and liabilities statement and calculates the current ratio to analyze liquidity.

Uploaded by

fluxfusionmarket10362Copyright

© © All Rights Reserved

Available Formats

Download as PDF, TXT or read online on Scribd

0 ratings0% found this document useful (0 votes)

11 viewsFinancial Accounting and Analysis

The document contains multiple examples of financial accounting entries including transactions for investing capital, purchasing furniture partially on credit, purchasing and selling goods, and paying expenses. It also defines the key components that contribute to a profit and loss account including revenue, tax rates, depreciation, cost of goods sold, and operating expenses. Additionally, it provides a current assets and liabilities statement and calculates the current ratio to analyze liquidity.

Uploaded by

fluxfusionmarket10362Copyright

© © All Rights Reserved

Available Formats

Download as PDF, TXT or read online on Scribd

You are on page 1/ 2

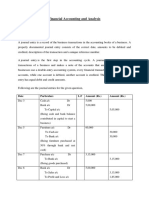

Financial Accounting & Analysis

Answer 1 =

Date Particular Debit Credit

3 – Dec Cash A/c 5,000

Bank A/c 5,00,000

To Capital A/c 5,05,000

(Being amount invested in

Mrs.Veena Business)

5 – Dec Furniture A/c 60,000

To Bank A/c 30,000

To Account Payable A/c 30,000

(Being furniture purchased and

50% amount payable)

7 – Dec Purchase A/c 3,15,000

To Bank A/c 3,15,000

(Being Goods purchased)

8 – Dec Cash A/c 5,00,000

To Sale A/c 5,00,000

(Being good sold off )

10 – Dec Electricity Bill A/c 10,000

Salary A/c 10,000

Rent A/c 10,000

To Bank A/c

(Being amount paid for 30,000

Expenses)

Answer 2 = The Five component which contribute in profit and loss account are:-

Depreciation

Revenue Tax rate and financial

charges

cost of good Operating

sold Expenses

1) Revenue = It is the total amount of income or money generated from sale of good or by

lending services to customer.

2) Tax Rate = It is rate which levied on income generated . In profit and loss account when

you subtract all expenses from the income, then you get profit before tax and tax

expenses are calculated on profit before tax.

3) Depreciation and financial charge = Depreciation is a charged which deduction from

fixed assets on the account of wear and tear or obsolescence. Similarly, financial charges

like interest on loans are a charge on profits paid to debtors of the company.

4) Cost of Good Sold = It says that total cost incurred in production of a good that can be

sold.We deduct Gross profit from Cost of good sold to incurred revenue.

5) Operating Expenses = Operating Expenses include all the expenses involved in the

normal course of operation like rent, salaries, insurance, maintenance etc.

Answer 3 a =

Liabilities Amount Assets Amount

Account payable 540 Account receivable 250

Salaries payable 150 Equipment 1500

Unearned revenue 200 Supplies 150

Retained earnings 860 Cash 550

Common stock 1000 Prepaid Insurance 300

Total 2750 2750

Answer b = # Current Ratio = Current Assets / Current Liabilities

= 1250 / 890

=1.4044

# Current Ratio = The ratio is the liquidity ratio that indicates a company’s capacity to repay

short-term loan dues by the next year

# It explains to investors and analysts how a business can use its present assets to the fullest

extent possible to pay down its current liabilities and other payables.

You might also like

- FINANCIAL ACCOUNTING AND ANALYSING Sem 1No ratings yetFINANCIAL ACCOUNTING AND ANALYSING Sem 14 pages

- Assignment Dec 2022 Financial AccountingNo ratings yetAssignment Dec 2022 Financial Accounting7 pages

- Accounting For Sole Proprietorship Problem3-6100% (1)Accounting For Sole Proprietorship Problem3-63 pages

- Financial Accounting and Analysis - Assignment Dec 2022No ratings yetFinancial Accounting and Analysis - Assignment Dec 20224 pages

- Taylor'S University American Degree Program Acct 201 - Test 1 Summer 2018 SemesterNo ratings yetTaylor'S University American Degree Program Acct 201 - Test 1 Summer 2018 Semester11 pages

- Question1 (B) Write Short Notes On Following I) Conservatism Principle II) Trail BalanceNo ratings yetQuestion1 (B) Write Short Notes On Following I) Conservatism Principle II) Trail Balance17 pages

- Tutorial 1 Introduction To Accounting (Q)No ratings yetTutorial 1 Introduction To Accounting (Q)11 pages

- CA-Foundation June 2023 Free Test - SUGGESTED ANSWERSNo ratings yetCA-Foundation June 2023 Free Test - SUGGESTED ANSWERS17 pages

- Merchandising - Adjusting To Reversing Entries - UpdatedNo ratings yetMerchandising - Adjusting To Reversing Entries - Updated36 pages

- SET 1. Q.1 Explain Any Two Accounting Concepts With Example? AnsNo ratings yetSET 1. Q.1 Explain Any Two Accounting Concepts With Example? Ans9 pages

- (Ust-Jpia) Quiz 1 Financial Accounting and Reporting Solution ManualNo ratings yet(Ust-Jpia) Quiz 1 Financial Accounting and Reporting Solution Manual9 pages

- Accounting For Service Businesses: The Islamic University, Gaza Faculty of Commerce Accounting DepartmentNo ratings yetAccounting For Service Businesses: The Islamic University, Gaza Faculty of Commerce Accounting Department6 pages

- Assignment - Financial Accounting & Analysis - Pratibha Bisht-77122102931-First Sem-MM MBANo ratings yetAssignment - Financial Accounting & Analysis - Pratibha Bisht-77122102931-First Sem-MM MBA12 pages

- Written Test (Accounting & Payroll Staff) - DoneNo ratings yetWritten Test (Accounting & Payroll Staff) - Done5 pages

- Financial Reporting and Analysis 7th Edition by Revsine Collins Mittelstaedt and Soffer ISBN Solution Manual100% (38)Financial Reporting and Analysis 7th Edition by Revsine Collins Mittelstaedt and Soffer ISBN Solution Manual108 pages

- Small Time Operator How To Start Your Own Business Keep Your Books Pay Your Taxes and Stay Out of Trouble 12th Edition Edition Bernard B. Kamoroff100% (2)Small Time Operator How To Start Your Own Business Keep Your Books Pay Your Taxes and Stay Out of Trouble 12th Edition Edition Bernard B. Kamoroff64 pages

- MODULE-3-REGULAR-INCOME-TAX-Regular-CorporationsNo ratings yetMODULE-3-REGULAR-INCOME-TAX-Regular-Corporations7 pages

- WM Unit 8 Retirement Planning 6th Jan 2022No ratings yetWM Unit 8 Retirement Planning 6th Jan 202232 pages

- Engineering Economy Lecture 6 With SW AsNo ratings yetEngineering Economy Lecture 6 With SW As2 pages

- Financial Statements and Analysis: Why This Chapter Matters To You Learning GoalsNo ratings yetFinancial Statements and Analysis: Why This Chapter Matters To You Learning Goals55 pages

- Model Exit Exam - Advanced Financial Accounting I100% (1)Model Exit Exam - Advanced Financial Accounting I8 pages

- Fundamentals of Accountancy Business and Management 1 11 3 Quarter100% (3)Fundamentals of Accountancy Business and Management 1 11 3 Quarter4 pages

- Rs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429No ratings yetRs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-242917 pages

- Income Taxation Tabag Summary Chapter 1 and Chapter 2No ratings yetIncome Taxation Tabag Summary Chapter 1 and Chapter 24 pages