December 2011.

December 2011.

Uploaded by

akshay kausaleCopyright:

Available Formats

December 2011.

December 2011.

Uploaded by

akshay kausaleCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

December 2011.

December 2011.

Uploaded by

akshay kausaleCopyright:

Available Formats

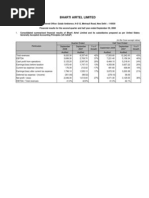

KANANI INDUSTRIES LIMITED

R.O. : G-6, PRASAD CHAMBERS, TATA ROAD NO.2, OPERA HOUSE, MUMBAI- 400 004.

UNAUDITED FINANCIAL RESULTS FOR THE QUARTER/YEAR ENDED 31ST DECEMBER, 2011

(` in lacs)

Year

Quarter Ended Nine Months Ended

Ended on

Particulars 31.12.2011 30.09.2011 31.12.2010 31.12.2011 31.12.2010 31.03.2011

Unaudited Unaudited Unaudited Unaudited Unaudited Audited

1. Income

a. Sales/ Income from Operation 5,420.10 2,059.98 3,827.69 10,853.39 12,257.94 15,166.70

b. Other Operating Income - - - - - -

c. Currency Fluctuation 222.91 (11.29) 9.34 211.62 26.13 26.13

Total Income 5,643.01 2,048.69 3,837.02 11,065.01 12,284.07 15,192.83

2. Expenditure

a. (Increase)/Decrease in Stock (52.67) (48.77) (0.16) 276.77 59.35 (318.70)

b. Raw Material Consumption & Purchases 5,376.18 2,082.48 3,507.77 10,412.88 10,336.95 13,695.17

c. Staff Cost 12.11 13.51 13.66 39.00 39.96 52.83

d. Depreciation 3.04 0.70 3.39 9.14 10.17 13.56

e. Other Expenses 7.64 6.41 55.09 23.45 76.49 84.18

Total Expenses 5,346.32 2,054.32 3,579.75 10,761.26 10,522.92 13,527.05

3. Profit from Operations before Other Income, Interest

and Exceptional Items 296.70 (5.64) 257.27 303.76 1,761.15 1,665.78

4. Other Income - - - - - -

5. Profit before Interest and Exceptional Items 296.70 (5.64) 257.27 303.76 1,761.15 1,665.78

6. Interest & Finance Charges 72.18 31.73 5.94 126.58 27.55 47.38

7. Profit after Interest but before Exceptional Items 224.51 (37.37) 251.33 177.17 1,733.60 1,618.41

8. Exceptional Items - - - - - -

9. Profit from Ordinary Activities before tax 224.51 (37.37) 251.33 177.17 1,733.60 1,618.41

10. Provision for Current tax - - - - - -

11. Profit after tax 224.51 (37.37) 251.33 177.17 1,733.60 1618.41

12. Paid up Equity Capital(Face Value of `5) 899.40 899.40 899.40 899.40 899.40 899.40

13. Reserves excluding revaluation reserves (As per Balance

Sheet of Previous accounting year) 3,079.53

14. Basic & Diluted EPS (Not annualised) 1.25 (0.21) 1.40 0.98 9.64 9.00

15. Public Shareholding

- No. of Shares 4,527,120 4,527,120 4,527,120 4,527,120 4,527,120 4,527,120

- % of Shares 25.17 25.17 25.17 25.17 25.17 25.17

16. Promoters and promoter group shareholding

a. Pledged / Encumbered

- Number of shares - - - - - -

- Percentage of shares as a % of total Promoter

and promoter group holding. - - - - - -

- Percentage of shares as a % of total Share

Capital of the company. - - - - - -

b. Non-Encumbered

- Number of shares 13,460,880 13,460,880 13,460,880 13,460,880 13,460,880 13,460,880

- Percentage of shares as a % of total Promoter

and promoter group holding. 100.00 100.00 100.00 100.00 100.00 100.00

- Percentage of shares as a % of total Share

Capital of the company. 74.83 74.83 74.83 74.83 74.83 74.83

NOTES :

1. Previous period figures have been regrouped/rearranged wherever necessary .

2. The National Stock Exchange of India Limited (NSE) approved and admitted the dealing in Equity Shares of the Company on its exchange

w.e.f. December 14, 2011.

3. The Impact of Income Tax on account of MAT, if any, shall be incorporated in the accounts at the end of the accounting year.

4. The above statement of unaudited financial results were taken on record at the meeting of the Board of Directors held on 31st January, 2012.

5. The Company has only one segment i.e. Studded Diamond Jewellery.

6. The Statutory Auditors have carried out Limited Review as required under Clause 41 of the Listing Agreement.

7. The Company has not received any Investor's Compliants during the period under review.

For & On behalf of Board of Directors

sd/-

Place : Mumbai (MR.HARSHIL P. KANANI)

Date : January 31, 2012 MANAGING DIRECTOR

You might also like

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- CSR PatanjaliDocument11 pagesCSR PatanjaliAshu Shaikh50% (4)

- BPI InterpretationDocument40 pagesBPI Interpretationportiadeportia100% (3)

- Problem Set #4Document2 pagesProblem Set #4Oxky Setiawan WibisonoNo ratings yet

- December1 2010Document1 pageDecember1 2010akshay kausaleNo ratings yet

- September 2011.Document1 pageSeptember 2011.akshay kausaleNo ratings yet

- Mar 12Document1 pageMar 12akshay kausaleNo ratings yet

- Result September 2012Document1 pageResult September 2012akshay kausaleNo ratings yet

- December 2009Document1 pageDecember 2009akshay kausaleNo ratings yet

- June 11Document1 pageJune 11akshay kausaleNo ratings yet

- Published Result Q-1-10 PrintDocument1 pagePublished Result Q-1-10 Prints natarajanNo ratings yet

- June 2010.Document1 pageJune 2010.akshay kausaleNo ratings yet

- $&C +$C CCCCCCCCCDocument4 pages$&C +$C CCCCCCCCCAlok SinghalNo ratings yet

- March29 AGMDocument4 pagesMarch29 AGMakshay kausaleNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Published Results 31 March 2010Document2 pagesPublished Results 31 March 2010Ravi ChaturvediNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- 634085163601250000financial Highlights0310-Correcte-1Document2 pages634085163601250000financial Highlights0310-Correcte-1arunnair1985No ratings yet

- Dec 2021Document2 pagesDec 2021akshay kausaleNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Balance Sheet of ZEE NETWORK (Rs in Crores)Document12 pagesBalance Sheet of ZEE NETWORK (Rs in Crores)abid ali khanNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Q2 09 ConsolidateDocument1 pageQ2 09 ConsolidatecayogeshguptaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results of Hardwyn India Sept 2023Document9 pagesFinancial Results of Hardwyn India Sept 2023prashant_natureNo ratings yet

- HBL FSAnnouncement 3Q2016Document9 pagesHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Resubmission of Standalone & Consolidated Financial Results For March 31, 2015 (Company Update)Document1 pageResubmission of Standalone & Consolidated Financial Results For March 31, 2015 (Company Update)Shyam SunderNo ratings yet

- q1 09 IOL Netcom ResultsDocument1 pageq1 09 IOL Netcom ResultsmixedbagNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- BOI_FR_300913Document4 pagesBOI_FR_300913ola moviessNo ratings yet

- Annual Results in BriefDocument8 pagesAnnual Results in BriefPrashanthDalawaiNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- FR 09112023Document10 pagesFR 09112023vikramgandhi89No ratings yet

- Standalone Financial Results, Auditors Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Auditors Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Industry Segment of Bajaj CompanyDocument4 pagesIndustry Segment of Bajaj CompanysantunusorenNo ratings yet

- Consolidated Q4Document6 pagesConsolidated Q4Qazi MudasirNo ratings yet

- Kci-Ufr Q3fy11Document1 pageKci-Ufr Q3fy11Shashi PandeyNo ratings yet

- Standalone Financial Results For December 31, 2016 (Result)Document2 pagesStandalone Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Britannia Industries: PrintDocument2 pagesBritannia Industries: PrintTanmoy BhuniaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- ACC Financial ResultsDocument12 pagesACC Financial ResultsKKVSBNo ratings yet

- Blue Cloud Softech Solutions Limited: Bse LTDDocument3 pagesBlue Cloud Softech Solutions Limited: Bse LTDShyam SunderNo ratings yet

- Reliance LtdDocument3 pagesReliance LtdKarthik RamNo ratings yet

- Profit Loss AccountDocument8 pagesProfit Loss AccountAbhishek JenaNo ratings yet

- ACAPL - Outcome of BM - Finnancials - Asset Cover CertificateDocument23 pagesACAPL - Outcome of BM - Finnancials - Asset Cover CertificateShashi Bhushan PrinceNo ratings yet

- Icici 2009Document4 pagesIcici 2009Anudeep ReddyNo ratings yet

- Balance Sheet of Tata Communications: - in Rs. Cr.Document24 pagesBalance Sheet of Tata Communications: - in Rs. Cr.ankush birlaNo ratings yet

- M&M Q1F24 Financial Results Pack 0Document12 pagesM&M Q1F24 Financial Results Pack 0piyushjii8750No ratings yet

- Financial Results 310324 PDFDocument14 pagesFinancial Results 310324 PDFvikramgandhi89No ratings yet

- Mar 09Document1 pageMar 09akshay kausaleNo ratings yet

- Eicher Motors Profit and Loss AccountDocument2 pagesEicher Motors Profit and Loss AccountVaishnav Sunil100% (1)

- P-H-O-E-N-I-X Petroleum Philippines, Inc. (PSE:PNX) Financials Income StatementDocument12 pagesP-H-O-E-N-I-X Petroleum Philippines, Inc. (PSE:PNX) Financials Income StatementDave Emmanuel SadunanNo ratings yet

- Dalmia Bharat Sugar and Industries Ltd.Document19 pagesDalmia Bharat Sugar and Industries Ltd.Shweta GargNo ratings yet

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Document3 pagesColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Upendra GuptaNo ratings yet

- Q3 201920 Results Steel CastDocument1 pageQ3 201920 Results Steel Castdarshilparekh19No ratings yet

- Time Watch Investments Limited Unaudited 2nd QTR 1HF2009 Financial Statement 090210Document13 pagesTime Watch Investments Limited Unaudited 2nd QTR 1HF2009 Financial Statement 090210WeR1 Consultants Pte LtdNo ratings yet

- KIL Result September 2021Document4 pagesKIL Result September 2021akshay kausaleNo ratings yet

- q209 - Airtel Published FinancialsDocument7 pagesq209 - Airtel Published Financialsmixedbag100% (2)

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- November12 AGMDocument4 pagesNovember12 AGMakshay kausaleNo ratings yet

- Dynamic Cables Limited: M F T An GDocument11 pagesDynamic Cables Limited: M F T An Gakshay kausaleNo ratings yet

- KIL Result June-2022Document3 pagesKIL Result June-2022akshay kausaleNo ratings yet

- March29 AGMDocument4 pagesMarch29 AGMakshay kausaleNo ratings yet

- December23 AGMDocument2 pagesDecember23 AGMakshay kausaleNo ratings yet

- December22 AGMDocument2 pagesDecember22 AGMakshay kausaleNo ratings yet

- Media Release RIL Q4 FY202324 Financial and Operational Performance - 0Document50 pagesMedia Release RIL Q4 FY202324 Financial and Operational Performance - 0akshay kausaleNo ratings yet

- Mar 09Document1 pageMar 09akshay kausaleNo ratings yet

- Thermax Subsidiary Annual Report 19 20Document417 pagesThermax Subsidiary Annual Report 19 20akshay kausaleNo ratings yet

- Investor Presentation - Q4FY23Document24 pagesInvestor Presentation - Q4FY23akshay kausaleNo ratings yet

- Thermax Subsidiary AR 2023 24 7 2023 FinalDocument676 pagesThermax Subsidiary AR 2023 24 7 2023 Finalakshay kausaleNo ratings yet

- 4 ॥महायाननित्यक्रमातिसंक्षेपः॥ With drawings PDFDocument5 pages4 ॥महायाननित्यक्रमातिसंक्षेपः॥ With drawings PDFMattia SalviniNo ratings yet

- AventDocument9 pagesAventLiigiia San YrafatsarNo ratings yet

- Regional Human Dev Report Asia-Pacific 2024 0Document144 pagesRegional Human Dev Report Asia-Pacific 2024 0Pontianak sampitNo ratings yet

- CH 7 Formal and Informal Networks of CommunicationsDocument27 pagesCH 7 Formal and Informal Networks of CommunicationsMiyamoto MusashiNo ratings yet

- 7715Law-Property Law 2 Case Analysis & Synthesis TRIMESTER 2, 2021Document3 pages7715Law-Property Law 2 Case Analysis & Synthesis TRIMESTER 2, 2021Bhavishya WadhawanNo ratings yet

- 32 Diet Recipes - Tamil MagazinesDocument11 pages32 Diet Recipes - Tamil MagazinesPandimadevi Selvakumar0% (1)

- Master Listing Jan 13 2018Document137 pagesMaster Listing Jan 13 2018Deden ChandraNo ratings yet

- United States v. Isaac Sturdivant, 4th Cir. (2012)Document4 pagesUnited States v. Isaac Sturdivant, 4th Cir. (2012)Scribd Government DocsNo ratings yet

- Speech AtikaDocument2 pagesSpeech AtikaNur SaidahNo ratings yet

- Meditation 17 Translation - FlattenedDocument2 pagesMeditation 17 Translation - FlattenedEmily HsiehNo ratings yet

- Durban Apartments v. Pioneer, G.R. No. 179419, January 12, 2011Document10 pagesDurban Apartments v. Pioneer, G.R. No. 179419, January 12, 2011Alan Vincent FontanosaNo ratings yet

- Blockchain Health CareDocument10 pagesBlockchain Health Careyounus hassaniNo ratings yet

- Theo 2 Activity 2Document2 pagesTheo 2 Activity 2parkjim446No ratings yet

- Anthony FranciosaDocument9 pagesAnthony FranciosaFrancisco Mistral Francisco LagardaNo ratings yet

- Homicide and InfanticideDocument54 pagesHomicide and InfanticideKuber JaishiNo ratings yet

- History of Sanitary WareDocument7 pagesHistory of Sanitary WareShreya Deochakke PanchalNo ratings yet

- WWW - Ignou.Ac - In: Frequently Asked Questions (Faqs)Document2 pagesWWW - Ignou.Ac - In: Frequently Asked Questions (Faqs)Wopensys systemNo ratings yet

- Contenido de Ejercicios NatgeoDocument23 pagesContenido de Ejercicios Natgeo21No ratings yet

- Walkthrough On Recent Regulatory Changes-Mirae Asset Mutual FundDocument38 pagesWalkthrough On Recent Regulatory Changes-Mirae Asset Mutual Fundsaurabh.shrivastavNo ratings yet

- One Flew Over The Cuckoo's NestDocument2 pagesOne Flew Over The Cuckoo's NestMikaela Ysabel CañaNo ratings yet

- Global Patent Holdings, LLC v. Panthers BRHC LLC - Document No. 1Document22 pagesGlobal Patent Holdings, LLC v. Panthers BRHC LLC - Document No. 1Justia.comNo ratings yet

- Poultry Feed Mills in PunjabDocument21 pagesPoultry Feed Mills in PunjabKazimNo ratings yet

- Compiled Insurance Digest Comrev Under Dean SundiangDocument36 pagesCompiled Insurance Digest Comrev Under Dean SundiangCessy Ciar KimNo ratings yet

- My Left Foot SummaryDocument3 pagesMy Left Foot SummaryCinaramaNo ratings yet

- Ilsw8 - Word FormDocument6 pagesIlsw8 - Word Formhaonb95100% (1)

- Affidavit of WitnessDocument2 pagesAffidavit of WitnessTom Ybanez100% (5)

- EHealth Glimpse Into The Future of Connected Care With MedTechsDocument20 pagesEHealth Glimpse Into The Future of Connected Care With MedTechsshabsprimalinkNo ratings yet