Fundamentals of Partnership Questions

Fundamentals of Partnership Questions

Uploaded by

vandu.rekhiCopyright:

Available Formats

Fundamentals of Partnership Questions

Fundamentals of Partnership Questions

Uploaded by

vandu.rekhiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Fundamentals of Partnership Questions

Fundamentals of Partnership Questions

Uploaded by

vandu.rekhiCopyright:

Available Formats

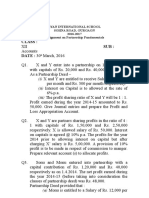

CA.

GAUTAM SETHI CLASSES

(Where your Quest for quality education ends)

ACCOUNTANCY Fundamentals of Partnership CLASS-12TH

Max Time : 1.30 hours Test Paper-II Max Marks: 35

Q1. L, M and N partners have omitted interest on capitals for three years ended on 31st December 2017. Their fixed

capitals in three years were L Rs. 40,000, M Rs. 25,000, N Rs. 15,000. Rate of interest on Capital is 12 % p.a. Their profit

sharing ratios were 2015 - 5 : 2 : 1, 2016 - 3: 2 : 1, 2017 - 2 : 1 : 1. Give the necessary adjusting entry. [3]

Q2. A, B and C are in partnership. A and B sharing profits in the ratio 3 : 1 and C receiving an annual salary of Rs.

32,000 plus 5 % of the profits after charging his salary and commission, or 1/4th of the profits of the firm whichever is

larger. Any excess of the latter over the former received by C is, under the partnership deed, to be borne by A and B in the

ratio 3 : 2. The profit for the year 2017 came to Rs.1,68,000 after charging C’s salary. Show the distribution of profits

among the partners. [5]

Q3. A, B, C and D are partners in a firm. Their Capital Accounts stood at Rs.80,000, Rs.50,000, Rs.50,000 & Rs.20,000

respectively on 1st January, 2016. They share profits and losses in the ratio of 4 : 3 : 3 : 2. D’s share of profits (excluding

interest on capital) is guaranteed by the firm to be not less than Rs. 30,000 p.a. C’s share of profit (including interest on

capital and salary) is guaranteed by A at a minimum of Rs.55,000 p.a. The profit for the year ended 31st Dec., 2016

amounted to Rs.1,58,000 before Considering interest on Capital @ 10 % p.a. and salary to C @ Rs.1,500 per month which

under the Partnership deed are allowable. Prepare Profit and Loss Adjustment Account. [5]

Q4. Mentions the items that may appear on the debit side of the Capital Account of a partner when the capitals are

fluctuating. [2]

Q5. X and Y are partners in a firm. They do not have any partnership deed. What should be done in the following

cases.(a). X has invested Rs. 1,00,000 and Y only Rs. 50,000 as capital. X wants interest on capital @ 12% p.a. (b) X

spends twice the time that Y devotes to the business. He wants a salary of Rs. 2,000 per month for the extra time spent by

him. (c) X wants to introduce his son Rajesh into the Business. Y objects it.(d) X has given a loan of Rs. 20,000 to the

firm. He wants interest on it @ 8% p.a. [4]

Q6. A, B and C are partners in a firm. They agree to distribute profit upto Rs. 10,000 as 50 %, 30 % and 20%

respectively and above it in equal proportions. If the divisible profit of the firm for the year 1998 was Rs. (I) 5,600 and (ii)

25,600. Distribute the profit. [4]

Q7. On Ist April, 2016 X,Y and Z started a business in partnership. X contributes Rs. 90,000 at first but withdraws

Rs.30,000 at the end of six months. Y introduces Rs.75,000 at first and increases it to Rs. 90,000 at the end of four

months. But withdraws Rs. 30,000 at the end of eight months. Z brings in Rs. 75,000 at the first but increases it by Rs.

60,000 at the end of seven months. During the year ended 31st March, 1997, they make a net profit of Rs.42,000. Show

how the partners should divide this Amount on the basis of effective capital employed by each partner. [4]

Q8. A and B are partners in a business sharing profits and losses in the ratio of 3:2 Their capital on 31st Dec. 1996,after

the adjustment of net profits and drawings amounted to Rs. 2,00,000 and Rs. 1,50,000. Later on, it was discovered that

interest on Capital at 8% p.a. as provided for in the partnership deed, had not been credited to the partners capital accounts

before the distribution of profits. The year’s net Profit amounted to Rs.75,000 and the partners had withdrawn Rs.24,000

each. Instead of altering the signed balance sheet, it was decided to make an adjustment entry at the beginning of the new

year. Give the necessary journal entry as also a statement of Details arriving at the amount of adjusting entry.

[5]

Q9. From the following Balance sheet of P and Q, calculate interest on capital at 10% p.a. for the year ending 31st

December, 2017:- During the year 2017, P’s drawings were Rs.8,000 and Q,s drawings Rs.24,000. Profit during the year

2017 was Rs. 48,000. BALANCE SHEET (as on 31st dec., 2017)

Rs. Rs.

P’s Capital 80,000 Sundry Assets 1,68,000

Q’s Capital 64,000 Drawings-P 8,000

P and l appropriation A/c-2017 32,000

1,76,000 1,76,000

[3]

SSP Janak Puri, Uttam Nagar, Ramesh Nagar, Laxmi Nagar 9811749975, 8505989141, 01141433366

You might also like

- SAE Network FundamentalDocument74 pagesSAE Network FundamentalMohammed ShafeeQueNo ratings yet

- Exh. 034 Affidavit of Niko Quinn 6-30-14Document4 pagesExh. 034 Affidavit of Niko Quinn 6-30-14Injustice WatchNo ratings yet

- Unity of Muslim UmmahDocument6 pagesUnity of Muslim UmmahsabikazaidiNo ratings yet

- FundamentalsDocument2 pagesFundamentalsyvs12311No ratings yet

- Partnership QuestionsDocument11 pagesPartnership QuestionsTRIPTI GUPTANo ratings yet

- Worksheet On Profit and Loss AppropriationDocument66 pagesWorksheet On Profit and Loss AppropriationAditya ShrivastavaNo ratings yet

- Screenshot 2023-03-11 at 12.52.38 PM PDFDocument56 pagesScreenshot 2023-03-11 at 12.52.38 PM PDFpalak sanghviNo ratings yet

- 12 Account SP 01 PDFDocument24 pages12 Account SP 01 PDFJanvi KushwahaNo ratings yet

- CBSE Class 12 Accountancy Accounting For Partnership Firms Sure Shot QuestionsDocument6 pagesCBSE Class 12 Accountancy Accounting For Partnership Firms Sure Shot Questionsdakshrwt06No ratings yet

- APS Class 12th Accountancy ExamDocument5 pagesAPS Class 12th Accountancy Exammmt05No ratings yet

- Class 12Document33 pagesClass 12vaibhav dangiNo ratings yet

- Partnership Fundamentals WorksheetDocument7 pagesPartnership Fundamentals Worksheetmpsaj1177b9No ratings yet

- What Are The Essential Features of A PartnershipDocument5 pagesWhat Are The Essential Features of A Partnershipfreefire668668No ratings yet

- Accounting For Partnership Firms Fundamental PDFDocument10 pagesAccounting For Partnership Firms Fundamental PDFMarivisiasNo ratings yet

- Worksheet 1-Fundamentals of PartnershipDocument6 pagesWorksheet 1-Fundamentals of Partnershipshakir surtiNo ratings yet

- Fundamentals Class Test 2023 1Document2 pagesFundamentals Class Test 2023 1roz.kandulnaNo ratings yet

- Long Answer Type QuestionDocument75 pagesLong Answer Type Questionincome taxNo ratings yet

- 01 Sample PaperDocument24 pages01 Sample Papergaming loverNo ratings yet

- Monthly Test - Acc. Aug 2020Document5 pagesMonthly Test - Acc. Aug 2020akash debbarmaNo ratings yet

- Assignment - 02 (Past Adjustments)Document2 pagesAssignment - 02 (Past Adjustments)vaastav169No ratings yet

- Kvs Senior Secondary Summer Holiday HW Final Class Xii 1525165274Document13 pagesKvs Senior Secondary Summer Holiday HW Final Class Xii 1525165274ADITHYA DAVID MNo ratings yet

- SUMMER HOLILDAYS HomeworkDocument33 pagesSUMMER HOLILDAYS HomeworkLorem LoremNo ratings yet

- Delhi Public School: ACCOUNTANCY - (Subject Code: 055)Document4 pagesDelhi Public School: ACCOUNTANCY - (Subject Code: 055)AbhishekNo ratings yet

- Fundamentals of Partnership (Past Adjustments)Document2 pagesFundamentals of Partnership (Past Adjustments)niraj jainNo ratings yet

- Accounts XiiDocument12 pagesAccounts XiiTanya JainNo ratings yet

- Accountancy Focus and Non Focus Questions-2Document28 pagesAccountancy Focus and Non Focus Questions-2Angelin GraceNo ratings yet

- UT 1 PAPER Class 12 SET A 2024-2025Document5 pagesUT 1 PAPER Class 12 SET A 2024-2025deshrajsharma488No ratings yet

- Test-chapter-1-Accountancy 12Document5 pagesTest-chapter-1-Accountancy 12Umesh JaiswalNo ratings yet

- Grade-12 HHWDocument12 pagesGrade-12 HHWjanduharjinder65No ratings yet

- Assignment On Fundamentals of PartnershipDocument8 pagesAssignment On Fundamentals of Partnershipsainimanish170gmailc100% (1)

- Partnership AccountingDocument21 pagesPartnership AccountingTharun P.Mu.No ratings yet

- Xii Acc Worksheetss-1-29Document29 pagesXii Acc Worksheetss-1-29Unknown patelNo ratings yet

- Xii Acc WorksheetssDocument55 pagesXii Acc WorksheetssUnknown patelNo ratings yet

- 12 HW Commerce group 2024 FinDocument11 pages12 HW Commerce group 2024 Findassneha064No ratings yet

- Screenshot 2023-08-14 at 1.31.19 PMDocument4 pagesScreenshot 2023-08-14 at 1.31.19 PMEri ChaNo ratings yet

- ch1 fundamental acc ASSIGNMENT 2Document1 pagech1 fundamental acc ASSIGNMENT 2Swasti JainNo ratings yet

- REVISION 2022 Part A - CH. 2Document5 pagesREVISION 2022 Part A - CH. 2ADAM ABDUL RAZACKNo ratings yet

- Worksheet Partnership Fundamental 2Document3 pagesWorksheet Partnership Fundamental 2Harsh ShahNo ratings yet

- GR 12 Accountancy Sa 2024Document19 pagesGR 12 Accountancy Sa 2024bhumika motiyaniNo ratings yet

- Class Test Fundamentals and Goodwill Set A 01.05.2023 1Document2 pagesClass Test Fundamentals and Goodwill Set A 01.05.2023 1ANTECNo ratings yet

- GKJ Accounts Xii - Rs 68.00Document67 pagesGKJ Accounts Xii - Rs 68.00sintisharma67No ratings yet

- RKG Imp Q (CH 1 & 2) DoneDocument3 pagesRKG Imp Q (CH 1 & 2) Donepriyanshi.bansal25No ratings yet

- Accounts and Business Studies Question BankDocument5 pagesAccounts and Business Studies Question BankAkshat TiwariNo ratings yet

- Unit 2 Partmership Firms FundamentsDocument10 pagesUnit 2 Partmership Firms FundamentsSunlight SirSundeepNo ratings yet

- FundamentalDocument4 pagesFundamentalPainNo ratings yet

- Summer Holiday Homework Grade Xii CommerceDocument10 pagesSummer Holiday Homework Grade Xii CommerceJéévâNo ratings yet

- AssingmentDocument4 pagesAssingmentGarima LohanNo ratings yet

- Class XII Accountancy Unit Test 1 15.05.2021Document3 pagesClass XII Accountancy Unit Test 1 15.05.2021Mohm. Armaan MalikNo ratings yet

- Holiday Homework Accountancy Class 12Document15 pagesHoliday Homework Accountancy Class 12Sambhav GargNo ratings yet

- Chapter - 1 Fundamentals of Partnership (Only Question)Document12 pagesChapter - 1 Fundamentals of Partnership (Only Question)aryanparwani19No ratings yet

- Xii Comm Holiday Homework 2020 23Document44 pagesXii Comm Holiday Homework 2020 23Mohit SuryavanshiNo ratings yet

- Appropriation Account in PartnershipDocument3 pagesAppropriation Account in PartnershipumeshNo ratings yet

- +2 Accounts RTP 2023-24 Partnership Fundamental & Goodwill - 29089845Document9 pages+2 Accounts RTP 2023-24 Partnership Fundamental & Goodwill - 29089845vanshkapoorr3No ratings yet

- Question Bank Accountancy (055) Class XiiDocument5 pagesQuestion Bank Accountancy (055) Class XiiDHIRENDRA KUMARNo ratings yet

- Fundamentals Test (17!05!24)Document4 pagesFundamentals Test (17!05!24)MAHEE SHREE MITTALNo ratings yet

- Question BankDocument7 pagesQuestion BankAnkur MusharrafNo ratings yet

- Test Partner Ship 13-10-22Document2 pagesTest Partner Ship 13-10-22sanjanapurswani9No ratings yet

- ACCOUNTING FOR PARTNERSHIP FIRMS - WorksheetDocument2 pagesACCOUNTING FOR PARTNERSHIP FIRMS - WorksheetMAYOOKHA MADHU ATTIPPILNo ratings yet

- Chapter 1 XII WorksheetDocument2 pagesChapter 1 XII Worksheetlk.khushlani65No ratings yet

- Partnership Fundamental TestDocument2 pagesPartnership Fundamental TestHARSH SHAHNo ratings yet

- Goodwill: ICM 12 Standard Gautam BeryDocument9 pagesGoodwill: ICM 12 Standard Gautam BeryGautam KhanwaniNo ratings yet

- 12 Ac CH 1+2 Test .1Document3 pages12 Ac CH 1+2 Test .1rohitmahto18158920No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Dictionary of Quotations LatinDocument603 pagesDictionary of Quotations LatinpstrlNo ratings yet

- United States v. Stukes, 4th Cir. (2007)Document4 pagesUnited States v. Stukes, 4th Cir. (2007)Scribd Government DocsNo ratings yet

- Demand Letter - Mattro Construction 27 October 2020Document2 pagesDemand Letter - Mattro Construction 27 October 2020Anne Lorraine DioknoNo ratings yet

- 1005 Judicial Notice To MagistrateDocument6 pages1005 Judicial Notice To MagistrateJosh Roark100% (2)

- Temenos 3Document8 pagesTemenos 3redetbelay055No ratings yet

- Maldives: Rules, Regulations & Formalities The New NormalDocument15 pagesMaldives: Rules, Regulations & Formalities The New NormalRishijit PanigrahiNo ratings yet

- RCAP Financial Management GuideDocument44 pagesRCAP Financial Management GuidededeteNo ratings yet

- Legal Manager - ResumeDocument2 pagesLegal Manager - Resumearun.soni.udaipur2No ratings yet

- Language-Rev-Key Intermediate Achievement Test 5 (Units 9-10) Speakout Pag1Document1 pageLanguage-Rev-Key Intermediate Achievement Test 5 (Units 9-10) Speakout Pag1Diego Fernando Barrios OsorioNo ratings yet

- MNL-147-AWRG-1.0 (Sec-B To ANO-147)Document18 pagesMNL-147-AWRG-1.0 (Sec-B To ANO-147)Ammar AhmedNo ratings yet

- Subscriber Cookie Statement-1Document4 pagesSubscriber Cookie Statement-1renieldionora05No ratings yet

- Hot Springs 07 CRPF Veer GathaDocument36 pagesHot Springs 07 CRPF Veer GathaAshyo MaanNo ratings yet

- Farid v. Bouey Et Al - Document No. 9Document5 pagesFarid v. Bouey Et Al - Document No. 9Justia.comNo ratings yet

- ssspvtltd1 1 20240122034105Document1 pagessspvtltd1 1 20240122034105Kesav ChandraNo ratings yet

- CH 13Document14 pagesCH 13Trang VânNo ratings yet

- Singson v. CA G.R. No. 119995. Nov. 18 1997Document16 pagesSingson v. CA G.R. No. 119995. Nov. 18 1997Ralf Vincent OcañadaNo ratings yet

- RA MEDTECH MANILA Mar2019 PDFDocument94 pagesRA MEDTECH MANILA Mar2019 PDFPhilBoardResultsNo ratings yet

- Brief History of Chinese in The PhilippinesDocument2 pagesBrief History of Chinese in The PhilippinesMitch Gatdula40% (5)

- James P. Kartell, M.D., and Grant v. Rodkey, M.D., Intervenor-Plaintiffs-Appellants v. Blue Shield of Massachusetts, Inc., 687 F.2d 543, 1st Cir. (1982)Document17 pagesJames P. Kartell, M.D., and Grant v. Rodkey, M.D., Intervenor-Plaintiffs-Appellants v. Blue Shield of Massachusetts, Inc., 687 F.2d 543, 1st Cir. (1982)Scribd Government DocsNo ratings yet

- 2001 01-17-2001 2 CLJ 1 Clara Tai Saw Lan V Kurnia Insurance Malaysia Berhad EdDocument11 pages2001 01-17-2001 2 CLJ 1 Clara Tai Saw Lan V Kurnia Insurance Malaysia Berhad EdBrandon ChanNo ratings yet

- The Work of The Labour Party's Governance and Legal Unit in Relation To Antisemitism, 2014 - 2019Document851 pagesThe Work of The Labour Party's Governance and Legal Unit in Relation To Antisemitism, 2014 - 2019fuckyeNo ratings yet

- PrimeFaces Showcase VideoDocument1 pagePrimeFaces Showcase VideojbsysatmNo ratings yet

- Career 1Document13 pagesCareer 1ARUNKUMAR SNo ratings yet

- College Managment SystemDocument4 pagesCollege Managment SystemPrakash SinghNo ratings yet

- Designation LetterDocument2 pagesDesignation LetterbabyroseNo ratings yet

- Lalwani V Lalwani - GD Final 24 4 17 PDFDocument39 pagesLalwani V Lalwani - GD Final 24 4 17 PDFEnoch LowNo ratings yet

- PA 131 EssayDocument3 pagesPA 131 EssayAllana NacinoNo ratings yet