Cebu 350pts Mock No Answer

Cebu 350pts Mock No Answer

Uploaded by

restieulip.rebapqcCopyright:

Available Formats

Cebu 350pts Mock No Answer

Cebu 350pts Mock No Answer

Uploaded by

restieulip.rebapqcOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Cebu 350pts Mock No Answer

Cebu 350pts Mock No Answer

Uploaded by

restieulip.rebapqcCopyright:

Available Formats

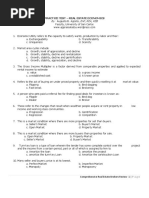

2014 Appraiser’s CRES Batch 5 Mock Examination Part 1 (100 items)

1. Scheduled rent (or contract rent) that is higher than market rent creates

a. Overage rent c. Excess rent

b. Gross rent d. Escalator rent

2. The amount paid over minimum base rent in a percentage lease is

a. Overage rent c. Excess rent

b. Gross rent d. Escalator rent

3. The lease under which the tenant pays a fixed rental and the landlord pays all expenses of ownership is the

a. Gross rate c. Net lease

b. Triple net lease d. Percentage lease

4. An index will be referred to in a(n)

a. Gross lease c. Escalator clause

b. Triple net lease d. Expense-stop clause

5. The interest of a sublessee is a

a. Leasehold c. Subleasehold

b. Lease fee d. Sandwich lease

6. In income property investments

a. Low risk = low cap rate = low value

b. Low risk = low cap rate = low value

c. High risk = high cap rate = low value

d. Low risk = high cap rate = high value

7. All other factors being equal, as the location of an income property becomes less desirable, the cap rate used

will be

a. Lower c. Less reliable

b. Higher d. Unaffected

8. Recapture generally applies to

a. Wasting assets, such as buildings c. Both a and b

b. Non-wasting assets, such as land d. Neither a nor b

9. In the land residual technique, the appraiser starts with an assumption of:

a. Replacement cost c. Net capitalization

b. Building value d. Land value

10. In the building residual technique, the appraiser starts with an assumption of:

a. Replacement cost c. Net capitalization

b. Building value d. Land value

11. The cash on cash rate is the same as the

a. Yield capitalization rate c. overall capitalization rate

b. Equity dividend rate d. break-even point

12. Name the two component rates that are inherent in every capitalization rate

a. Investors rate c. interest and recapture rates

b. Leased rate d. interest and depreciation rates

Cesar E. Santos Real Estate Academy Inc: 1

2014 Appraiser’s CRES Mock Examination

13. Under which method are the recapture installments lowest in the earlier years?

a. Annuity c. gross income multiplier method

b. Straight-line d. band of investment method

14. Under which method are the installments highest?

a. Annuity c. gross income multiplier method

b. Straight-line d. band of investment method

15. Which recapture method suggests the greatest reduction in risk?

a. Annuity c. gross income multiplier method

b. Straight-line d. band of investment method

16. Increase in maintenance costs are passed on to tenants under a(n)

a. Tax-stop clause c. Gross lease

b. Expense-stop clause d. Escalator clause

17. The average of all variates is the

a. Mean c. Median

b. Mode d. Range

18. The center of all variates is the

a. Mean c. Median

b. Mode d. Range

19. The difference between the highest and lowest variates is the

a. Mean c. Median

b. Mode d. Range

20. The mean of five house sales prices of P200,000, P150,000, P350,000, P400,000, and P300,000 is

a. P280,000 c. P700,000

b. P150,000 d. P175,000

21. The median of the house sales prices in question 20 is

a. P140,000 c. P700,000

b. P150,000 d. P175,000

22. The aggregate of the house sales prices in question 20 is

a. P140,000 c. P700,000

b. P150,000 d. P175,000

23. Geography is the scientific study of the location of people and activities across the earth’s surface and the

reason for their _________________.

a. Existence c. Planning

b. Distribution d. Space

24. The system used to transfer locations on the earth’s surface to locations on the map is ________________.

a. Plotting c. Projection

b. Mapping d. Survey

25. The Greek scholar who invented the word Geography is __________________.

a. Hipparchus c. Ptolemy

b. Eratosthenes d. Aristotle

Cesar E. Santos Real Estate Academy Inc: 2

2014 Appraiser’s CRES Mock Examination

26. The scientific study of population characteristic is ________________.

a. Migration c. Density

b. Ecumene d. Demography

27. In economic development, economic factor indicators are availability of consumer goods, worker productivity,

access to raw materials, economic structure and ______________.

a. Density c. Polulation

b. GNP d. Per capita income

28. In determining the Quality of Life (QOL), it is based on indicators of socioeconomic environment and

___________________.

a. Physical environment c. Population

b. Planning d. Migration

29. Urbanization is a process of becoming from a state of less concentration to a state of _________.

a. Threshold c. Calamity

b. More concentration d. Divisiveness

30. The two factors considered in relation to migration are _______________.

a. Push and pull c. Come and go

b. Push and push d. Pull and pull

31. Geography has relations to other disciplines and sciences such as biological, physical, social, mathematical and

_____________________.

a. Medical c. Arts and humanities

b. Cultural d. Botanical

32. ___________________ concerns with the relationship between humans and the physical environment.

a. Physical density c. Human geography

b. Physical geography d. Human density

33. A property has 25 apartment units, 15-units-two-bedroom unit renting for P5,000.00 per month each and 10

one-bedroom unit renting for P2,000.00 per month east.

There are 14 two-bedroom units occupied and 8 one-bedroom units occupied.

The potential gross income yearly is.

a. P1,000,000.00 c. P1,140,000.00

b. P1,120,000.00 d. P1,150,000.00

34. If houses in your area have increases in value 8% during the past year and the average price of houses sold last

year was P95,000.00. What is the average price of houses sold today?

a. P101,000.00 c. P102,600.00

b. P101,500.00 d. P103,000.00

35. An appraisal is to be made of a three-bedroom house. One comparable with two bedrooms sold for

P50,000.00. The appraiser makes an adjustment of P1,000.00 to the comparable to account for the difference

in the number of bedrooms. The adjustment sales price of the comparable is:

a. P49,000.00 c. P52,000.00

b. P51,000.00 d. P53,000.00

Cesar E. Santos Real Estate Academy Inc: 3

2014 Appraiser’s CRES Mock Examination

36. Which of the following estimates would result in a capitalization rate of 4 percent?

a. Potential gross income P200,000.00; value P5,000,000.00

b. Effective gross income P200,000.00; value P5,000,000.00

c. Net operating income P200,000.00; value P5,000,000.00

d. None of the above

37. In regard to zoning, which of the following statement is CORRECT?

a. Zoning ordinances are always more restrictive that deed restrictions

b. A nonconforming use and variance refer to the same thing

c. Zoning normally establishes land-use districts and provided for different restriction within each district

d. Exclusive zoning and spot zoning refer to the same thing

38. A comparable site sold a month ago @ P25,000.00 per square meter. Its location is considered 15% superior

and its shape and topography is 10% inferior to the subject site. The time adjustment is 12% per year.

Determine the adjustment sale price of the comparable site using straight plus and minus adjustment.

a. P18,250.00 per sqm. c. P25,750.00 per sqm.

b. P24,000.00 per sqm. d. P26,250.00 per sqm.

39. BR, 4 T&B and 4 car garage residential building was sold for P40,000,000.00. Using the rules of thumb of

building-to-land ratio of 3:2, what is the value of the building?

a. P10,000,000.00 c. P24,000,000.00

b. P11,000,000.00 d. P 8,000,000.00

40. An appraiser was asked to compute for the fair market rent per square meter of a P500.00 per square meter

vacant commercial lot using the following assumptions:

Fair market value of lot per sqm. - P24,000.00

Interest rate - 10% p.a.

The yearly market rent is:

a. P1,000,000.00 c. P1,500,000.00

b. P1,200,000.00 d. P800,000.00

41. If a commercial structure is a rectangle with sides of 65 meters and 135 meters and the current local cost to

built a similar structure id P5,000.00 per square meter, what is the estimate construction cost of the structure

using the square meter method:

a. P18,000.000.00 c. P43,875,000.00

b. P180,000,000.00 d. P36,450,000.00

42. A house and a lot are priced at P8,8000,000.00. The lot alone is values at P1,650,000.00. What percentage of

the total asking price is attributable to the value of the lot?

a. 18.8% c. 18 and ¾ %

b. 19.0% d. 18 and ¼%

43. R.A. 7279, Sec-18, specifies that developers of proposed subdivision projects shall be required to develop an

area for socialized housing equivalent to:

a. 25% of the total subdivision area

b. 20% of the net saleable area

c. 20% of the total subdivision area

d. 25%of the cost of development.

44. The basic formula for property valuation via income capitalization is:

a. Value = Income xRate c. Value = Rate / Income

b. Value = Income /Rate d. Value = Selling Price / Income

Cesar E. Santos Real Estate Academy Inc: 4

2014 Appraiser’s CRES Mock Examination

45. In a property residual capitalization approach what is the value of an improved property with a net income of

P80,000.00 a year, an interest rate of 8% and a recapture of 2%?

a. P1,000,000.00 c. P840,000.00

b. P800,000.00 d. P850,000.00

46. If houses in your area have increased in value 8% during the past year and the average price of houses sold

last year was P95,000.00. What is the average price houses sold today?

a. P101,000.00 c. P102,600.00

b. P101,500.00 d. P103,000.00

47. Assuming four different shapes of a 500 square meter house which would be the least expensive to built,

assuming the same materials and quality of construction?

a. A rectangle c. An H-shape

b. An L-shape d. A U-shape

48. Assume the following figures:

Annual net income form property -P100,000.00

Land Value -P200,000.00

Interest rate -8%

Recapture rate (based on the remaining economic life of 25 years) -4%

What is the property value indicated by the building residual technique?

a. P800,000.00 c. P960,000.00

b. P900,000.00 d. P980,000.00

49. Ideally, the appraiser of a residential property will collect data on comparable property sales that occurred

earlier than:

a. Six months prior to the date of appraisal

b. One year prior to the date of appraisal

c. 18 months prior to the date of appraisal

d. Two years prior to the date of appraisal

50. Which of the following is an advantage of two-storey house over a single-storey house?

a. Stairs

b. Lower construction cost per square meter

c. Easier to paint and maintain error

d. Less danger in case of fire

51. When a part of a building, or an obstruction physically intrudes, overlaps, or trespasses the property of

another, this is referred to as an:

a. Assemblage c. Easement

b. Escheat d. Encroachment

52. The term real estate is generally used to refer to the physical land and improvements, whereas the term real

property denotes:

a. Machinery and equipment c. Legal interest and rights inherent in

b. Surface rights only ownership

d. Air and subsurface rights

Cesar E. Santos Real Estate Academy Inc: 5

2014 Appraiser’s CRES Mock Examination

53. What is the distinction between the term market price and market value?

a. Market price is what the seller asks for, while market value is what the buyer actually pays

b. Market price is what the property sells for, while market value is what the sales price should be to

typical buyer

c. Market price is what is currently owned on the property, while market value is what is bought for

d. Market price is synonymous with replacement cost, while market value is the same as assessed value

54. The assessor’s Office is an agency where we inquire and conduct research on

a. Title verification c. Zonal value

b. Certified lot plan d. Cadastral map/tax map

55. An appraisal is best defined as:

a. An unbiased opinion of the nature, quality, value or utility of an interest in real estate and related

personality

b. An unbiased opinion of the most likely price for which a parcel of real estate would sell at a given

date

c. The process of studying the nature, quality, or utility of an interest in real estate in which a value

estimate is not necessarily required

d. The process of developing an opinion as to the market value or other defined value of a specified

interest in a specified point in time

56. Edwin owned a small farm of 1,500sqm.inAntipolo. When he died, he had no heirs, no friends, and no will.

a. The state will take the property and sell it

b. The land will be in Bob’s name forever because he died without heirs

c. The land will pass to the first person to occupy the land for seven years (i.e., squatter’s rights)

d. The land will pass to the adjacent owners equally

57. A 7-year old residence is currently valued at P720,000. What was the original value if it has appreciated by

60% since it as built?

a. P270,000 c. P378,000.00

b. P450,000 d. P1,152,000.00

58. In a soft market, a landlord accepted a new tenant with a 60-month lease at P5,000 per month but gave the

new tenant six months free rent. Using the average rent method, what is the effective monthly rent?

a. P5,555 c. P3,000

b. P4,500 d. P5,000

59. An office building recently sold for Php50,000,000. Given the following information:

Gross (potential) income : Php10,000,000

Vacancy factor : 8 percent

Expenses : 45 percent of effective gross income

Annual mortgage payment : Php4,125,000

Equity : Php12,500,000

What is the overall rate of return for the property? What is the pre-tax cash flow?

a. 8.3 percent c. 10.12%

b. 10 percent d. 9%

Cesar E. Santos Real Estate Academy Inc: 6

2014 Appraiser’s CRES Mock Examination

60. If the subject property is 10% superior to Comparable Sale no. 1 and the comparable sold for P1,000,000,

what is the indicated value of the subjects?

a. P1,000,000 x 0.90 = P900,000

b. P1,000,000 x 1.10 = P1,100,000

c. P1,000,000/ 1.10 = P909,090

d. P1,000,000/ 0.90 = P1,111,111

61. A tenant has a lease that states the base rent is P5,000 per month plus 3% of the sales above P50,000 in

gross sales per month. The tenant’s sales last year were P850,000. How much rent was paid last year?

a. P25,500 c. P60,000

b. P75,000 d. P67,500

62. If comparable sale #1 sold for Php2,000,000 and has two-car garage, adding Php100,000 to the value and the

subject property does not have a garage, the indicated value of the subject property would be found by:

a. Subtracting Php100,000 from the subject property

b. Adding Php100,000 to the comparable sale

c. Subtracting Php100,000 from the comparable sale

d. Adding Php100,000 to the subject property

63. A residence has been listed for sale for the last six months at a price of P1,249,000, and it has not sold, in this

market, the average marketing period is 45 days for this type for property.

a. The subject property’s market value could be higher than the list price

b. The subject property’s market value could be higher or lower than the list price

c. The subject property’s market value is less than the list price

d. The subject property’s market value could be lower than the list price

64. A property has an overhead garage door that is 13 years old. It cost P19,000 to replace. Because the

inclement weather comes out of the northwest, these doors typically last 15 years if they face the west and

25 years if they face east. This door faces east. What is the amount of value left in this item?

a. P9,120.00 c. P16,470.00

b. P9,880.00 d. P2,660.00

65. The area of rectangle with a base of 10 length and a length of 20 meters is

a. 250 sq.m. c. 300 sqm.

b. 200 sq.m. d. 400 sqm.

66. All of the following statement are true except:

a. Real property refers to items that are not permanently fixed to a part of the real estate

b. Appraising is the art and science of estimating the value of asset

c. Assets value change with time

d. Market change with supply and demand

67. The principle of substitution holds that a purchaser will pay no more for a property than

a. The minimum he can afford

b. The cost of acquiring an equally desirable substitute

c. The price of a previously owned property

d. The price of a property with grater utility

68. Which of the following conditions is assumed in the normal definition of market value?

a. The estate value is as of a future date

b. The property will sell promptly

c. Payment will be made in cash or its equivalent

d. Only the buyer is knowledgeable as to the potential uses of the property

Cesar E. Santos Real Estate Academy Inc: 7

2014 Appraiser’s CRES Mock Examination

69. In which market are there many potential buyers but few properties available?

a. Demand c. Seller’s

b. Buyer’s d. Low-priced

70. To estimate market value, an appraisers follows the

a. Appraisal report c. Evaluation methodology

b. Valuation process d. Appraisal guidelines

71. An appraisal of real estate

a. Guarantees its value c. Determine its value

b. Assures its value d. Estimates its value

72. In which market is the direct sales comparison approach most applicable?

a. Seller’s c. Reasonable

b. Buyer’s d. Active

73. The legal right to move items such as topsoil or coal from another is known as a/an:

a. Easement c. Escheat

b. Profit d. Emblements

74. The process of changing the use of a building from an apartment complex to a condominium form of

ownership is normally referred to as a(n):

a. Conversion c. Interim use

b. Proration d. Variance

75. Which approach would be best when appraising a 15-to-20 years old house?

a. Cost c. Income capitalization

b. Sales comparison d. Replacement cost new less depreciation

76. Before reconciliation the appraiser should

a. Re-inspect the subject property

b. Evaluate the reliability of each approach to value

c. Review the over-all appraisal process and check for technical accuracy

d. Seek the property owner’s opinion

77. A large home built in an area of smell cottage is an example of:

a. Over-improvement c. Land regression

b. Under-improvement d. Functional obsolescence

78. The walls between two condominium units are NORMALLY considered to be:

a. Individual unit elements c. Limited common elements

b. Common elements d. Proprietary lease elements

79. What would be the indicated value of a property that rented for P7,500 per month, using a monthly gross

rent multiplier of 110, if the expenses attributable to the property were P1,250 per month?

a. P756,700.00 c. P687,500.00

b. P825,000.00 d. P611,250.00

80. A 7-year old residence is currently valued at P720,000. That is the original value if it has appreciated by 60

percent since it was built?

a. P270,000.00 c. P450,000.00

b. P378,000.00 d. P1,152,000.00

Cesar E. Santos Real Estate Academy Inc: 8

2014 Appraiser’s CRES Mock Examination

81. ________________ includes not only the ground or soil but everything which is attached to the earth

whether by bourse of nature or by man

a. Land c. Other land improvements

b. Building d. Real property

82. This evolution of value theory emphasized the relationship of market, price and value, normal value under

conditions of balanced supply and demand

a. Social theory of Mill c. Theories of Austrian School

b. Cost theory of Adam Smith d. Theories of Physiocrats

83. Under the international valuation standard (IVSC), two types of values are:

a. Fair market value and sound value

b. Market value and non-market value

c. Economic value and market value

d. Fair market value and liquidation value

84. Under the IVSC, the “C” stands for:

a. Corporation c. Conference

b. Committee d. Charter

85. A property with an annual net income of P382,500.00 was recently sold for P4,250,000.00. The remaining

economic life of the building is estimated to be 25 years. Land value is estimated to be P900,000.00. Based on

the data gathered.The overall rate of the property is:

a. 8% c. 10%

b. 9% d. 12%

86. There are various types of appraisal reports. Which of the following step would be the final one taken in the

appraisal process?

a. Narrative report `c. Personal letter of opinion

b. Bank form report d. Valuation report

87. A house and lot is period at P7,500,000.00. The lot alone is valued P2,531,250.00. What percentage of the

total asking price is attributed to the house?

a. 33 ¾% c. 66 ¼ %

b. 33 ¼% d. 66 ¾%

88. The value of the property with a monthly net income of P75,000.00 and with an overall capitalization rate of

9% is:

a. P833,333.00 c. P1,000,000.00

b. P10,000,000.00 d. P900,000.00 75K x 12 / .09

89. A regression gives the following information to estimate monthly rent for apartments:

Rent = 250 + (75 x Rooms) + (50 x students) + (25 x distance)

Where:

Rooms is the number of rooms in the apartment

Students is the percent of students in the apartment building (0 = 0 percent, 1.00 = 100 percent)

Distance is the distance from the periphery of the campus

The rent for an apartment with 3 rooms, 100 percent students and 50 meters from campus would be:

a. Php 1,500.00 c. Php2,500.00

b. Php 1,775.00 d. Php3,000.00

Cesar E. Santos Real Estate Academy Inc: 9

2014 Appraiser’s CRES Mock Examination

90. Building value : Php50,000,000.00

Net operating income : Php 8,350,000.00

Building capitalization rate : 14 percent

Land capitalization rate : 9 percent

What is the residual income to the land?

a. Php 1,350,000.00 c. Php4,500,000.00

b. Php 3,850,000.00 d. Php70,000,000.00

91. What is the present value of a 40-year net income of Php 10,000 per year if payments are in advance and the

net income is discounted at a rate of 12 percent?

(Factor = 8.233030)

a. Php 82,330.00 c. P92,210.00

b. Php 82,438.00 d. P92,330.0

92. Which of the following types of data is most likely to be derived from secondary data sources?

a. Building data

b. Site data

c. Neighborhood data

d. Regional data

93. Which of the following is NOT a regional value indicator

a. Economic base

b. Transportation systems

c. Neighborhood boundaries

d. Average household size

94. Neighborhood boundaries:

a. are determined by market influences

b. always correspond to physical barriers such as roads or streams

c. never correspond to physical barriers such as roads or streams

d. are the same as subdivision boundaries

95. Neighborhood data in an appraisal is used to:

a. identify comparable properties for analysis (sales comparison approach)

b. identify value influences that affect the subject property

c. support the appraiser’s estimate of value

d. all of the above

96. Off-site improvements that are relevant to a site description include:

a. streets

b. neighborhood utilities

c. storm sewers

d. all of the above

97. In an appraisal of residential property, building data would NOT be used to:

a. determine highest and best use of the land as if vacant

b. adjust the sales prices of comparable properties (sales comparison approach)

c. estimate reproduction cost or replacement cost in the cost approach to value

d. identify comparable properties for analysis

Cesar E. Santos Real Estate Academy Inc: 10

2014 Appraiser’s CRES Mock Examination

98.The most reliable building data for the subject property is acquired by:

a. reviewing the plans and specifications

b. interviewing the property owner

c. personal inspection

d. reviewing previous appraisal report on the property

99. The sales price of a comparable property may need to be adjusted to account for:

a. financing terms

b. date of sale

c. building size

d. all of the above

100. If market interest rates are 8%, and a comparable property is sold with seller financing at 6%, the price paid

for the comparable property is likely to be:

a. higher than market value

b. lower than market value

c. the same as market value

d. none of the above

Cesar E. Santos Real Estate Academy Inc: 11

2014 Appraiser’s CRES Mock Examination

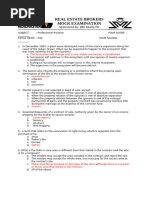

2014 Appraiser’s CRES Batch 5 Mock Examination Part 2 (200 items)

1. Which principle of value suggests that the maximum value of a property generally cannot exceed the cost of

its replacement?

a. Balance c. Anticipation

b. Substitution d. Opportunity cost

2. Which of the following statements is NOT true in regard to real estate markets?

a. Price is seldom equal to value

b. Supply and demand are seldom in balance

c. Supply adjusts more quickly than demand

d. There are many government regulations

3. The term absorption rate refers to:

a. An estimate of the expected annual sales or new occupancy of a particular type of land use.

b. An estimate of the rate at which a type of real estate space will be sold or occupied.

c. The rate at which the cash flows from a property will cover the initial investment in the property

d. The rate of return used to convert future payments into present cash values?

4. Which of the following explanations would be the BEST definition of market value?

a. Value to a typical investor

b. Value to any investor who is willing to purchase the property in the open market

c. Value to a typical seller

d. Value to the user who pays market rent

5. The term market value is MOST closely associated with which of the following value concepts?

a. Highest sales price c. Value in use

b. Value in exchange d. Assessed value

6. Which of the following economic principles BEST explains the occurrence of locational obsolescence

resulting from a change in surrounding land use?

a. Anticipation c. Contribution

b. Conformity d. Substitution

7. What economic principle suggests that the value of property is created and maintained when there is

equilibrium in the supply, demand, and location of real estate?

a. Balance c. Substitution

b. Equilibrium d. Surplus productivity

8. Which of the following land uses would NOT be considered a single purpose property?

a. Nuclear power plant c. Golf course

b. Grain elevator d. Cemetery

9. Normally, the amount of money a lender will agree to lend against a specific parcel of real estate is based on

which of the following prices or values?

a. Contract price

b. Appraised value

c. Contract price or appraised value, whichever is less

d. Assessed value

Cesar E. Santos Real Estate Academy Inc: 12

2014 Appraiser’s CRES Mock Examination

10. The legal ownership rights in real estate are limited by all of the following conditions EXCEPT:

a. Private voluntary restrictions such as deed restrictions

b. The law of nuisance

c. Supply of real estate in the marketplace

d. Public limitations such as eminent domain

11. The real property in a condominium form of ownership in severalty is referred to as:

a. Unit c. Limited common area

b. Common area d. Cooperative

12. Property taxes levied by local governments are normally referred to as ad valorem taxes. The term ad

valorem means:

a. Ability to pay c. According to most likely sales price

b. According to value d. Ability to collect the tax

13. If a commercial use such as retail store is permitted to remain in business following a zoning change to

residential use, the owner is said to have received a:

a. Variance c. Local exception

b. Nonconforming use d. Buffer zone use

14. A hectare of land contains ___________ square meters

a. 10,000 c. 100,000

b. 1,000 d. 1,000,000

15. A fixture such as a permanent bookcase or wall-to-wall carpeting is legally treated as:

a. Personality c. Intangible property

b. Realty d. Personal property

16. When a real estate is put up as a collateral for a loan, the borrower is known as the ____________ and the

lender is known as the ___________

a. Mortgagor, mortgagee c. Mortgage, financial intermediary

b. Mortgage, mortgagor d. Agent, principal

17. The term fee simple estate refers to an estate that:

a. Has all leases at the market rate

b. Has been leased at a specified fee

c. Is not a subject to any leases

d. Is fully encumbered by leases

18. What term is used to identify recently sold or leased properties that are similar to a particular property

being evaluated and used to indicate the value for the property being appraised?

a. Subjects c. Relatives

b. Comparables d. Outliers

19. Reconciliation criteria used to estimate the final value in an appraisal include which of the following factors?

a. Appropriateness, accuracy, market evidence

b. Appropriateness, quantity of evidence, accuracy

c. Accuracy, differences in value, appropriateness

d. Quantity of evidence, accuracy, market value

Cesar E. Santos Real Estate Academy Inc: 13

2014 Appraiser’s CRES Mock Examination

20. In the valuation process, which of the following steps identifies the items that contribute to a concise

appraisal completed in a thorough and efficient manner?

a. Definition of the problem

b. Data collection and analysis

c. Highest and best use analysis

d. Reconciliation

21. A common phrase included in all real estate appraisal forms includes the use of the “as of” date. Normally,

the “as of” date in an appraisal report refers to the date:

a. The appraisal assignment was accepted

b. The appraisal assignment is to be delivered

c. Of the last inspection

d. The loan is to close

22. In using the sales comparison approach, the appraiser finds that one of the comparables is superior to the

subject property in terms of location. In this event what adjustment will be made?

a. The comparable will be adjusted upward

b. The comparable will be adjusted downward

c. The subject property will be adjusted upward

d. The subject property will be adjusted downward

23. Normally, the comparable sales approach would be considered the MOST reliable when which of the

following conditions exist?

a. The property is new and unoccupied

b. A high rate of inflation exists

c. Obsolescence must be measured

d. Access to reliable market data exists

24. Your appraisal assignment involves the estimation of value for a 10 meter by 18 meter parcel of land. You

have identified and examined 10 comparables that are similar to the subject property except for size

differentials. You have developed a simple linear regression equation in which sales price (expressed in

thousands of pesos) is the dependent variable and size (expressed in square meters) is the independent

variable. The equation you have developed is Y₍ = 180,000 + 1,000 (x). using this equation and the

information given, what is the indicated sales price for the subject property?

a. Php180,000 c. Php280,000

b. Php360,000 d. Php435,000 180K + (1000 x (10 x 18))

25. In appraising a property, the appraiser identifies a similar property that appears to be a very good

comparable. The appraiser finds that when the comparable sold, very favorable financing was part of the

sale. In regard to the comparable, what is the appropriate action?

a. Not use the sale under any condition

b. Give the sale less weight than any of the other comparables

c. Adjust the sales price for cash equivalency and explain

d. Do nothing because the comparable sold and thus represents normal market activity

26. The portion of land that is NOT necessary for the existing improvement is referred to as:

a. Over improved land c. Useless land

b. Excess land d. Under improved land

Cesar E. Santos Real Estate Academy Inc: 14

2014 Appraiser’s CRES Mock Examination

27. The term site refers to:

a. Land that has been improved

b. Land within a certain set of boundaries

c. A legal description of a plot of land

d. Raw land with no improvements

28. _____________ is the estimated cost at current price to construct an exact replica of the building using the

same standards, materials, design, and lay out and including any deficiencies, super adequacies, and

obsolescence as the subject building.

a. Replacement cost c. Reproduction cost

b. Unit-in-place cost d. Market cost

29. The cost approach to value is generally MOST accurate when which of the following situations exists?

a. The building is old and suffers from a great deal of depreciation

b. The building is new and is being used under its highest and best use

c. The building is old and reproduction or replacement cost is not known

d. A vacant tract of land is being appraised

30. In the appraisal of real estate, the necessary step taken by the appraiser of valuing the land as if vacant is

part of which approach to value?

a. Cost c. Income capitalization

b. Sales comparison d. Gross rent multiplier

31. Which of the following statement is CORRECT in regard to estimating the value of residential real estate?

a. The highest and best use of a site with a newly constructed house property located on the site is

always its present value

b. The total area of a single family residence for purpose of using the cost approach to value is

calculated by summing the interior and the exterior areas of the structure

c. A newly constructed house cannot suffer from any type of depreciation

d. Total accrued depreciation is a loss in value from all causes

32. Super adequacies that might exist in a structure would be recognized and included in which of the following

types of depreciation?

a. Physical deterioration c. Economic obsolescence

b. Functional obsolescence d. Locational obsolescence

33. A house being appraised has a total living area of 50 square meters. For a house of similar construction

quality, national cost service indicates a cost of Php15,000 per square meter. The locational multiplier is .95.

The cost figures are five months old and the appraiser estimates that construction costs have increased 5

percent during this period. What is the current estimated replacement cost of this house?

a. Php712,425 c. Php 784,500.00

b. Php748,125 d. Php 874,000.00

34. The method of estimating total replacement cost of a building that measures the total floor area and

multiplies this total by the current cost per square meter is referred to as which of the following methods?

a. Comparative unit method c. Unit in place method

b. Builder’s method d. Quantity survey method

35. The term amortization refers to:

a. An increase in value of the property

b. A decrease in value of the property

c. Periodic repayment of debt

d. Assessment of property for tax purposes

Cesar E. Santos Real Estate Academy Inc: 15

2014 Appraiser’s CRES Mock Examination

36. The amount of debt payment due on a loan is a function of the amount borrowed, the interest charged, and

the term of the loan. In regard to the term, which of the following statement is CORRECT?

a. The longer the term, the greater the periodic payment

b. The longer the term, the less the periodic payment

c. The longer the term, the higher the interest rate charged and thus the higher payment

d. The longer the term, the lower the interest rate charged and thus the higher the employment

37. You have collected the following data on a comparable property, which you plan to use in estimating the

gross rent multiplier for rental properties in a neighborhood: sales price is Php1,000,000, annual rent is

Php60,000, annual property taxes is Php9,000, monthly mortgage payment is Php7,150.

What is the monthly gross rent multiplier indicated by this property?

a. 100 c. 150

b. 125 d. 200

38. When payments on a loan are not sufficient to cover the interest on a loan, which of the following results is

applicable?

a. The loan has negative amortization

b. The loan will never get repaid

c. The loan has a debt coverage ratio less than one

d. The loan is a reverse annuity mortgage

39. A reversion can follow which of the following types of legal estates?

a. Leasehold c. Tenancy in common

b. Fee simple d. Fee simple absolute

40. Which of the following statements would be CORRECT if contract rent is likely to exceed market rent for the

term of the lease?

a. The leasehold estate is not likely to have any value

b. The leased fee estate is probably less valuable than a fee simple estate in the property

c. The leasehold interest will be greater than the fee simple value

d. The leasehold value is not affected by the contract rent

41. Which of the following terms refers to a lease used to sublease a property?

a. Blanket lease c. Sandwich lease

b. Subordinated lease d. Double lease

42. Which of the following reasons is often given as a weakness or disadvantage of using the sales comparison

approach?

a. The market may be too active

b. There may be so many sales that the appraiser cannot find comparables

c. The sales comparison approach is based on historical information or offerings in the market

d. A competitive and knowledgeable market may exist

43. Which principle of value suggests that the value of a property is equal to the present value of the property’s

projected-income?

a. Balance c. Opportunity cost

b. Anticipation d. Substitution

44. What term applies to the difference between the purchase price and the net proceeds from any mortgage

(s) used to purchase property?

a. Asset c. Capital gains tax

b. Reversion d. Equity

Cesar E. Santos Real Estate Academy Inc: 16

2014 Appraiser’s CRES Mock Examination

45. The relationship of a property to other properties in terms of time and distance preferences is referred to

as:

a. Linkage c. District

b. Externality d. Neighborhood

46. The demand for new homes in a market area is estimated to be 500 per year. Developer Abel’s new

subdivision, when completed, is expected to capture 10 percent of the market. Therefore Abel’s subdivision

has an expected absorption rate of:

a. 50 percent c. 50 homes per year

b. 5 percent d. 10 homes per year

47. The market value of a property and the selling price of that same property could be equal under which of

the following conditions?

a. They are always equal

b. They are never equal

c. They are sometimes equal

d. They are only equal with rental property

48. Which of the following economic principles is the underlying justification as to why the adjustment process

is used in the sales comparison (market) approach?

a. Anticipation c. Highest and best use

b. Contribution d. Opportunity cost

49. ____________ refers to that possible and legal use of land that will preserve the land’s utility and generate

a net income that forms, when capitalized, the greatest present value of the land.

a. Linkage c. Market value

b. Present value d. Highest and best-use

50. The primary difference between a straight-term (interest-only) mortgage and a fully amortized mortgage is

in the:

a. Loan-to-value ratio c. Length of the loan

b. Interest rate d. Method of principal repayment

51. In regard to an easement, which of the following statement is CORRECT?

a. An easement is a personal property right rather than a real property right

b. An easement must always be in writing

c. An easement, once created, becomes a life estate

d. An easement may be terminated once the purpose for which it was created no longer exists

52. An irregularly shaped lot is located in an area where the zoning setback requirement of 1.5 meters would

result in a planned building not properly fitting on the lot. To seek relief from the harshness of this

requirement, the owner may seek what type of adjustment from the local authority?

a. Nonconforming use c. Variance

b. Exception d. Special-use permit

53. In referring to various parties in a deed, the grantee is the:

a. Seller c. Broker

b. Buyer d. Escrow agent

54. The walls located between two condominium units are normally considered:

a. Individual unit elements c. Public elements

b. Limited common elements d. Proprietary lease elements

Cesar E. Santos Real Estate Academy Inc: 17

2014 Appraiser’s CRES Mock Examination

55. In determining whether an item is real property, which of the following test is NORMALLY considered?

a. Manner of attachment, intention of the party who made the attachment, purpose for which the

item is used

b. Manner of attachment, age of the item, cost of the item

c. Number of the items in question, current market value, purpose for which the item is used

d. Actual owner, cost of the item, current market value

56. The private rights and privileges of real property ownership are limited by what four powers of

government?

a. Police power, eminent domain, taxation, escheat

b. Police power, adverse possession, taxation, escheat

c. Eminent domain, zoning, condemnation, taxation

d. Zoning, police power, escheat, adverse possession

57. A written instrument, usually under seal, conveying some property interest from a grantor to a grantee is a

common definition of which of the following?

a. Mortgage c. Deed

b. Lease d. Sales contract

58. A current land use that existed prior to the establishment of a zoning district and is NOT consistent with the

current restrictions imposed on land uses in that district is called a(n):

a. Variance c. Illegal use

b. Nonconforming use d. Transitional use

59. In the valuation process, when does the reconciliation of value indications to a final value estimate take

place?

a. After completing of each approach

b. After completion of all three approaches

c. After the legal description is complete

d. Periodically during the appraisal process

60. Which of the following statement is CORRECT in regard to the range of value used in the final value

estimate?

a. There should be a single point estimate, not a range of values

b. A good range in values is plus or minus 5 percent

c. The range of value depends on the precision associated with the estimates and the confidence the

appraiser has in the value

d. The price should be given in whole numbers

61. Comparing the physical components of the subject property with those of comparable properties is part of

what step in the appraisal process?

a. Defining the problem

b. Collecting the data

c. Analyzing data via the sales comparison approach

d. Reconciling the value approaches

62. Which of the following guidelines is the PRIMARY one that should be followed by an appraiser in regard to

the collection and analysis of data used in the appraisal process?

a. They should be limited to public land record

b. They should be primary data only

c. They should be current

d. They should have a bearing or influence on the estimate of value

Cesar E. Santos Real Estate Academy Inc: 18

2014 Appraiser’s CRES Mock Examination

63. The valuation process has numerous steps that should be followed. Which of the following steps is NOT a

normally acceptable one undertaken by an appraiser in the appraisal process?

a. Definition of the problem

b. Collection and analysis of data

c. Averaging of the three approaches to value

d. Report of the defined value

64. Which of the following statements BEST describes how the adjustment process is used in the comparable

sales approach?

a. The subject property is adjusted to the comparables to make it as similar as possible

b. The comparables are adjusted to the subject property to make them as similar as possible

c. The subject property is valued using its highest and best use

d. Accrued depreciation is subtracted from replacement cost to estimate the value of the subject

property

65. Numerous elements of comparison are used by appraisers in the sales comparison approach. Which of the

following elements is NOT one that should be employed in this approach?

a. Conditions of sale c. Cost

b. Property rights being conveyed d. Location

66. For functional obsolescence to be curable, the:

a. Cost of replacing the feature must be less than the value of the feature

b. Feature as improved must contribute to the income of the property

c. Cost of replacing the feature must be the same as or less than the anticipated increase in value

d. Contribution of the improved feature to the income of the property must be greater than the cost to

install it

67. The term frontage refers to the:

a. Curb length along the perimeter of a property

b. Width of a site

c. Linear distance of a piece of land along a lake, river, street or highway

d. Distance between the front of a site and the back of the site

68. A residential neighborhood may suffer from economic obsolescence as a result of which of the following

conditions?

a. An increase in mortgage interest rates

b. Expansion of an airport runway on an adjoining property

c. Highest and best use of the surrounding land

d. A decrease in the millage rate used to calculate property taxes

69. A lot measuring 10 meters by 21 meters costs Php315,000. At the same rate per square meter, what would

a lot measuring 12.5 meters by 25 meter cost?

a. Php312,500 c. Php393,750

b. Php315,000 d. Php468,750

Solution: 315K / 10 x 21 = 1500; 12.5 x 25 = 312.50 x 1500 = 468,750

70. Corner influence is MOST important to the appraiser under which of the following conditions?

a. Traffic flow on the road fronting the property is only one way

b. The property is zoned highway commercial

c. Access to the property is readily available

d. Investigation and analysis show concerns to be more valuable

Cesar E. Santos Real Estate Academy Inc: 19

2014 Appraiser’s CRES Mock Examination

71. A house with a total living area of 100 square meters would cost Php10,000 per square meter to reproduce

new. It has an expected economic life of 50 years and is estimated to have an effective age of five years. The

lot has a market value of Php2,500,000. What is the estimated value of the property using the cost

approach?

a. Php4,000,000 c. Php 3,400,000

b. Php2,600,000 d. Php 3,500,000

72. In regard to various statistical test undertaken by appraisers, which of the following statements is CORRECT

with respect to the median?

a. The median and the mode are always the same

b. The median is the most commonly occurring value in a group

c. The median is the middle value in a group

d. The median is always greater than the mean

73. The term ground lease applies to what type of lease?

a. A lease that applies to the ground floor of a structure

b. Any lease that includes land

c. A lease allowing something to be removed from the land

d. A lease that applies to the land only

74. A comparable property sold six months ago for Php1,250,000. Market investigation indicates the following:

Location adjustment: +5 percent

Time adjustment: +6 percent

Age adjustment: -7 percent

Given the above information, what is the indicated value based on the comparable property?

a. Php1,232,250 c. Php 1,300,000

b. Php1,293,860 d. Php 1,325,000

75. Data obtained from published sources are referred to as:

a. Primary data c. General data

b. Secondary data d. Specific data

76. Market rental rates tend to be set at the rate that prevails for equally desirable space. This is a reflection of

what appraisal principle?

a. Anticipation c. Substitution

b. Balance d. Competition

77. The process of identifying and analyzing submarkets of a larger market is known as:

a. Extraction c. Market segmentation

b. Market allocation d. Substitution

78. When a property’s highest and best use is in a stage of transition, which of the following action is required

of the appraiser?

a. Consider interim use

b. Ignore interim use

c. Consider interim use only if it results in a higher value

d. Consider interim use only if it results in a lower value

79. The common areas in a condominium project normally are owned by whom?

a. The developer

b. The homeowners association

c. Each individual unit owner

d. The board of directors of the homeowner’s association

Cesar E. Santos Real Estate Academy Inc: 20

2014 Appraiser’s CRES Mock Examination

80. A strip of land used to separate two adjoining parcels of land that have incompatible uses, such as a

residential subdivision and an industrial park, is referred to as a:

a. Buffer zone c. Nonconforming use

b. Planned unit development d. Variance

81. In appraising a condominium, an appraiser should consider the following approach(es) to value:

a. Cost approach c. Income comparison

b. Sales comparison approach d. All three approaches

82. Which of the following statements is CORRECT for the purpose of estimating vacancy rates in an appraisal

used to estimate the value of a fee simple estate?

a. Projects that are the highest and best use of the site normally would have no vacancy

b. The vacancy rate used in an appraisal normally should be the vacancy rate currently experiences by

the project

c. The vacancy rate used in an appraisal should reflect the typical vacancy rate for comparable

properties

d. The vacancy rate should never be zero

83. As the degree of risk and uncertainty associated with the income potential of property increases, the

income generated by that property may be capitalized at a higher rate. This action will bring about which of

the following results?

a. A higher capitalization rate will mean a higher value

b. A higher capitalization rate will mean a lower value

c. A change in the capitalization rate will have no bearing on the estimate of value

d. A change in the capitalization rate will have an effect on value only if the property is being used under

its highest and best use

84. An office building has 1,000 square meters of net leasable space. The owner has an annual mortgage

payment of Php750,000 and expects operating expenses to be Php250,000. If the owner wants a before-tax

cash flow of Php500,000, what should the gross rent per square meter be on a monthly basis?

a. Php100 c. Php 150

b. Php125 d. Php 1,500

85. Demand is one of the essential elements or characteristics of value, however, for demand to influence value

there must also be

a. Purchasing power c. An adequate supply

b. Need d. Good sales technique

86. Which of the following calculations is NOT a type of yield rate?

a. Internal rate of return c. Overall capitalization rate

b. Discount rate d. Interest rate

87. What information is NOT needed to apply the building residual technique?

a. Building value c. Net operating income

b. Land value d. Land and building capitalization rates

88. What term used to denote the difference, if any, between the present value of expected benefits, or

positive cash flows, and the present value of capital outlays, or negative cash flows?

a. Profitability index c. Internal rate of return

b. Net present value d. Net cash flow

Cesar E. Santos Real Estate Academy Inc: 21

2014 Appraiser’s CRES Mock Examination

89. Given the following information:

Building capitalization rate: 0.11

Land capitalization rate: 0.09

Land value as a percent of total value: 35 percent

What is the overall capitalization rate by using the band of investment approach?

a. 0.097 c. 0.103

b. 0.100 d. 0.110

90. Given the following information, what is the building capitalization rate for the subject property?

Land value: Php600,000 NOI - P250,000

Net operating income Php250,000 Inc. to land - 48,000

Land capitalization rate: 8 percent Inc. to bldg - P 202,000

Overall capitalization rate: 9 percent

a. 10.9 percent c. 8.4 percent

b. 9.3 percent d. 8.8 percent

91. If a property has a net income ratio of .75 and gross income multiplier of 9, what is the indicated overall

capitalization rate?

a. 2.78 percent c. 8.33 percent

b. 6.75 percent d. 12.00 percent

92. The term holding period usually refers to the:

a. Time span in which improvements continue to contribute to value

b. Period of time over which net income remains greater than operating expense

c. Time span of ownership

d. Period of time that has elapsed since construction of the improvements

93. Capitalization is the process of:

a. Forecasting future yields of a property

b. Calculating value from price

c. Deducting expenses to find net assets

d. Converting income into a value indication

94. Which of the following statements BEST describes the amount of adjustment an appraiser should make for

vacancy allowance in a property?

a. 5 percent of gross income

b. 1 percent for each year the property has been rented

c. Somewhere between 5 percent and 10 percent

d. The amount will vary with each property

95. Which of the following returns would be included in the capitalization rate established by the appraiser for a

property with a declining value and a constant land value?

a. Return on the land and building

b. Return on the land and building and recapture of the building

c. Return on the land and building and recapture of the land and building

d. Return on the land and building and recapture of the land

96. In addition to the income generated by rents, what else does the income approach always require the

appraiser to analyze?

a. Total debt service c. Operating expenses

b. Pretax cash flow d. After-tax cash flow

Cesar E. Santos Real Estate Academy Inc: 22

2014 Appraiser’s CRES Mock Examination

97. A 10-unit apartment complex has been purchased for Php25,000,000. A 75 percent loan has been obtained.

Vacancy allowance, operating expenses, reserve accounts, and debt service equal Php2,375,000 annually.

How much must each unit rent for monthly to generate a 10-percent dividend rate?

a. P23,750 c. P25,000.00

b. P24,000 d. P30,000.00

98. The mathematical process of converting investment inflows or an income stream into a present value is

commonly referred to as:

a. Compounding c. Amortization

b. Discounting d. Equity reduction

99. In analyzing the market by using a gross rent multiplier (GRM) technique, value is estimated by doing which

of the following?

a. Dividing market rent by gross rent multiplier

b. Dividing market rent by net income

c. Multiplying operating expenses by gross rent multiplier

d. Multiplying market rent by gross rent multiplier

100. Which of the following statement is MOST descriptive of what occurs with a capitalization rate used in the

income approach to value?

a. The capitalization rate increases when the risk increases

b. The capitalization rate decreases when the risk increases

c. The capitalization rate increases when the risk decreases

d. The capitalization rate remains the same as long as there is positive net income

101. A set of percentages indicating the proportion of site value attributable to each additional amount of depth

in the lot is referred to as:

a. Depth tables c. Plottage

b. Multiplication tables d. Grid

102. Risk due to the use of dept financing is referred to as:

a. Interest risk c. Leverage risk

b. Financial risk d. Equity risk

103. A large national tenant that occupies space in a shopping center is often referred to as a(n):

a. Discount tenant c. Department store

b. Anchor tenant d. Mall tenant

104. Which of the following conditions is NOT a basic assumption in the definition of market value?

a. The seller receives cash or its equivalent

b. Both the buyer and the seller are knowledgeable about current market conditions

c. The value will be as of a specific date

d. The property will sell promptly

105. Which of the following conditions is assumed in the normal definition of market value?

a. The stated value is a of a future date

b. The property will sell promptly

c. Payment will be made in cash or its equivalent

d. Only the buyer is knowledgeable as to the potential uses of the property.

Cesar E. Santos Real Estate Academy Inc: 23

2014 Appraiser’s CRES Mock Examination

106. In considering the highest and best use of a parcel of land to be improved with an office building, the

appraiser determines the optimal land to building ratio for the parcel. Which of the following economic

principles does this illustrate?

a. Anticipation c. Contribution

b. Balance d. Substitution

107. An existing site has an improvement on it such as a building. Which of the following statements BEST

describes the highest and best use of that site?

a. It cannot be determined

b. It is automatically the current use since the site is improved

c. It may be different from the current use

d. If the improvement is a residence, then the land does not have a highest and best use

108. A tax assessment is intended to accomplish which of the following results?

a. Set the maximum price paid at a foreclosure sale

b. Establish the asking price of property when listed for sale by the owner

c. Aid the determination of how much property tax is due

d. Determine market value

109. The process of changing the use of a building from an apartment complex to a condominium form of

ownership is normally referred to as a (n):

a. Conversion c. Interim use

b. Proration d. Variance

110. In regard to zoning, which of the following statement is CORRECT?

a. Zoning ordinances are always more restrictive than deed restrictions

b. A nonconforming use and a variance refer to the same thing

c. Zoning normally establishes land-use districts and provides for different restrictions within each

district

d. Exclusionary zoning and spot zoning refer to the same thing

111. The extension of some improvements or object, such as a building or driveway, across the legal boundary of

an adjoining tract of land is referred to as a (n):

a. Easement c. Encroachment

b. Emblements d. Profit

112. The legal right of the state to acquire property of a decedent who died without a will and without heirs is

referred to as what?

a. Eminent domain c. Dedication

b. Escheat d. Devise

113. Cost and value are MOST likely to be similar under which of the following conditions?

a. The property is new c. The property is special purpose

b. The property is small d. The property has no deferred maintenance

114. Highest and best use analysis is used to determine which of the following factors

a. The type of property to put on a site

b. The amount of capital to invest in a site for improvements

c. Whether any existing building on a site should be demolished

d. All of the above

Cesar E. Santos Real Estate Academy Inc: 24

2014 Appraiser’s CRES Mock Examination

115. Which of the following valuation concepts is indicative of special purpose properties, such as churches or

schools, when the continuation of the special use is assumed?

a. Value in exchange c. Value in perpetuity

b. Value in use d. Book value

116. Which of the following explanation BEST describes the term market place?

a. The amount of money actually paid in a transaction

b. The amount of the loan

c. The amount of money necessary to replace the property

d. Same term as market value

117. What economic principles is BEST illustrated when anappraiser concludes that modernization of the plumbing

system in the subject property will increase the value of the property by more than the cost of modernization?

a. Anticipation c. Contribution

b. Balance d. Substitution

118. Which of the following statements is CORRECT in regard to the highest and best use of a parcel of land?

a. Unimproved land does not have a highest and best use.

b. If the improvement to the land is a house, then the highest and best use is always residential.

c. The highest and best use can change over time.

d. Highest and best use is strictly an economic concept and is not influenced by physical and legal

considerations.

119. The total loan payment made on a parcel of real estate during any one year is generally referred to as:

a. Debt service c. Mortgage constant

b. Equity d. Cash flow

120. The test used to determine whether or not an article is a fixture depends on all of the followingconditions

EXCEPT:

a. Reasonable intent of the party attaching the object.

b. Adaptation of the object

c. Cost of the item being attached

d. Method of attachment

121. The legal estate in land that provides the highest degree or extent of ownership rights recognized by law may

be referred to by which of the following terms?

a. Fee c. Fee simple absolute

b. Fee simple d. All of the above

122. Which of the following actions is an example of the legal right of government based on police power?

a. Taxation c. Eminent domain

b. Escheat d. Zoning

123. In avoluntary conveyance of real estate, the _____________conveys the title to the property and

the______________receives the title.

a. Grantor, grantee c. Owner, seller

b. Grantee, grantor d. Grantee, grantor

125. All legal rights, such as riparianrights or easements, that “go with the land” when title to the land is

transferred are known as:

a. Encroachments c. Appurtenances

b. Seizings d. Easements

Cesar E. Santos Real Estate Academy Inc: 25

2014 Appraiser’s CRES Mock Examination

126. Numerous public andprivate limitations are placed on real property. Some are voluntary and others are

involuntary. Which of the following limitations is NOT an example of a private involuntary limitation?

a. Encroachment c. Mechanics lien

b. Adverse possession d. Deed restriction

127. Reference to a plat map would be made in which of the following legal description

methods?

a. Lot and block c. Street address

b. Rectangular survey d. Monuments

128. Which of the following terms refers to the right of a person who owns a property free and clear of any

leases?

a. Leased fee estate c. Fee simple estate

b. Leasehold estate d. Lessee’s estate

129. When a building, a part of a building, or an obstruction physically intrudes, overlaps, or trespasses the

property of another, this is referred to as an:

a. Escheat c. Encroachment

b. Easement d. Assemblage

130. An appraisal is best defined as:

a. An unbiased opinion of the most likely price for which a parcel of real estate would sell at a given date.

b. An unbiased opinion of the nature, quality, value or utility of an interest in real estate and related

personally

c. The process of developing an opinion as to market value or other defined value of a specified interest

in a specified point in time.

d. The process of studying the nature, quality, or utility of an interest in real estate in which a value

estimate is not necessarily required.

131. In the appraisal process, the property being appraised is referred to as the:

a. Comparable property c. Subject property

b. Assessed property d. Appraised property

132. The appraisal process undertaken by an appraiser consists of many steps. What is the correct first step

in the appraisal process?

a. Definition of the problem

b. Collection and analysis of data

c. Analysis of highest and best use

d. Initial estimate of value

133. The objective of undertaking an appraisal of real estate is to:

a. Determine asking price

b. Estimate value

c. Establish loan value

d. Identify legal rights and interest that may exist

134. When an appraiser is using the sales comparison approach, one of the elements of comparison that may

have to be adjusted is often referred to as a time adjustment. What does the time adjustment provide?

a. An adjustment for the period of time between when a listing is taken on property and when the

property actually sells.

b. An adjustment between the date of sale of a comparable and the date of the appraisal to allow for

any changes over time

Cesar E. Santos Real Estate Academy Inc: 26

2014 Appraiser’s CRES Mock Examination

c. An adjustment between the listing date of a comparable sale and the date the subject property is

actually appraised

d. An adjustment for the period of time between the actual sale of a comparable for the appraisal

assignment

135. Deferred maintenance usually results in which of the following losses in value?

a. Incurable physical depreciation

b. Curable physical depreciation

c. Curable functional obsolescence

d. Curable external obsolescence

136. What terms applies to the effect on value of location or proximity to the intersection of two streets?

a. Corner influence c. Externality

b. Amenity d. Plottage

137. Functional obsolescence could be caused by which of the following?

a. A ceiling that is to high c. A poor location

b. Deferred maintenance d. A worn-out roof

138. The building cost estimate method that replicates the contractor’s development of abid, and is the

most comprehensive way to estimate building costs, is known as the:

a. Unit-in-place method c. Breakdown method

b. Quantity survey method d. Comparative unit method

139. Included in the cost approach to value is all of the following components EXCEPT:

a. Replacement cost c. Acquisition cost

b. Highest and best use of the land d. Accrued depreciation

140. In regard to accrued depreciation , which of the following terms does NOT belong together?

a. Physical deterioration-curable

b. Functional obsolescence-incurable

c. Economic obsolescence-curable

d. Functional obsolescence-curable

141. The combining of two or more into a single ownership with the value of the assembled lots being

more than the sum of the values of the individual lots is referred to as:

a. Highest and best use c. Escheat

b. Economic rent d. Plottage

142. Another term used to denote the actual age of a building is

a. Chronological age c. Economic age

b. Effective age d. Depreciated age

143. The basic capitalization formula used in the income approach to value contains three components.

Those three components are:

a. Market, cost, income c. Physical, functional, economic

b. Value, rate, income d. Potential, gross, net income

144. What is the gross income multiplier for a property with a current market value of

Php570,000 and rents for Php5,000 per month?

a. 9 c. 10

b. 9.5 d. 10.5

Cesar E. Santos Real Estate Academy Inc: 27

2014 Appraiser’s CRES Mock Examination

145.The peso amount of rent received from a parcel of real estate when rented in an open, competitive

market is referred to as:

a. Economic rent c. Ground rent

b. Contract rent d. Gross rent

146. A mortgage loan for Php300,000 at 9 percent per annum for 30 years has been made. What is the

amount of interest for the first month?

a. Php163.90 c. P2,250.00

b. Php900.00 d. P2,413.90

147. What does the range of a group of variables indicate to the appraiser?

a. The value of the highest sample

b. The difference between the lowest and the highest values

c. The average for the group

d. The percentage variation from the mean

148. Which of the following types of lease does NOT provide at least some protection to the lessor

against inflation?

a. Flat lease c. Reappraisal lease

b. Index lease d. Graduated lease

149. Which of the following statements is CORRECT in regard to assessed value?

a. The assessed value must equal the market value

b. The assessed value is used primarily to calculate property taxes

c. The assessed value is used primarily to calculate property insurance

d. The assessed value will never exceed cost

150. A father sells his home to his daughter and her husband. Such a sale would NORMALLY be

described as which of the following sales?

a. Arm’s-length sale c. Distorted sale

b. Illegal sale d. Forced sale

151. Which of the following actions is NOT characteristic of market value?

a. Sale as soon as possible c. Typical financing

b. Well informed buyers d. Typically motivated sellers

152. Which of the following factors is NOT normally considered to affect the supply of real estate?

a. Volume of new construction c. Land use and city growth

b. Standing stock d. Competition

153. What term best describes the effect of a power plant on the value of a nearby home?

a. Balance c. Contribution

b. Externalities d. Conformity

154. Which of the following appraisal principles holds that market value is indicated by the value of

another property with similar utility?

a. Supply and demand c. Competition

b. Substitution d. Balance

155. The specific use of a parcel of land that gives that land the greatest residual of income is referred

to as the land’s:

a. Intrinsic use c. Income producing use

b. Highest and best use d. Efficient use

Cesar E. Santos Real Estate Academy Inc: 28

2014 Appraiser’s CRES Mock Examination

156. The proper or most correct placement of an improvement to land, such as the construction of a

house, is normally strongly influenced by the application of which of the following economic principles?

a. Conformity c. Escheat

b. Encroachment d. Substitution

157. The term lenders often use to refer to the relative amount of money they will lend on a specific

parcel of property is known as:

a. Gross rent multiplier c. Value to loan ratio

b. Debt-to-equity ration d. Loan to value ratio

158. Effective demand in the marketplace for housing varies MOST directly with which of the following

conditions?

a. Purchasing power c. Building codes

b. Interest rates d. Building cycles

159. A worn path crosses an owner’s property. What legal doctrine would require a potential purchaser

to take note of the fact that there may be an unrecorded prescriptive easement against that property?

a. Actual notice c. Lispendens

b. Constructive notice d. Escheat

160. An individual owner of a condominium unit is in default on payment of the property taxes to the

local government. Of thefollowing choices, which is the only one legally available to the taxing authority?

a. Levy the tax on the entire condominium project

b. Foreclose against the individual unit

c. Place a lien on the common areas

d. Foreclose against the homeowners’ association

161. The legal right of government to acquire private property for a public use or purpose with just compensation

is known as:

a. Police power c. Condemnation

b. Eminent domain d. Escheat

162. In regard to the legal concept of land, what is a landowner entitled to in addition to the surface rights?

a. Nothing

b. Air rights only

c. Everything below the surface only

d. Everything above and below the surface

163. The term real estate is generally

a. Air and subsurface rights

b. Surface rights only

c. Machinery and equipment

d. Legal interests and rights inherent in ownership

164. Which of the following activities is NOT a public limitation on real estate?

a. Building codes c. Adverse possession

b. Zoning d. Fire codes

Cesar E. Santos Real Estate Academy Inc: 29

2014 Appraiser’s CRES Mock Examination

165. If the metes-and-bounds method of legally describing land is being used, which of the following statement is

CORRECT?

a. The starting point must be a natural benchmark

b. There must be a definite point of beginning

c. Monuments cannot be used as part of the description

d. No other method, such as lot-and-block, can be used as part of the description

166. Which of the following terms refer to the legal interest belonging to a person who is leasing property from

someone else?

a. Leased fee estate c. Fee simple estate

b. Leasehold estate d. Lessee’s estate

167. Which of the following terms refers to the stages that a neighborhood goes through over time?

a. Revitalization c. Life cycle

b. Growth cycle d. Change

168. The term appraisal refers to:

a. The process of estimating the market value of a property

b. The valuation of a market and how it affects property values

c. The process of estimating the most likely sales price of a property

d. The act or process of developing an opinion of value

169. The date of valuation for an appraisal is determined by which of the following?

a. The actual date the appraisal is signed

b. The date the appraisal assignment is accepted

c. The date the property is actually inspected

d. Whatever date is specified in the appraisal report

170. What is the PRIMARY purpose of economic base analysis?

a. To forecast future economic growth in an area and divide that growth between basic and

non-basic industries

b. To forecast changes in local zoning ordinances

c. To determine property tax rates and the likely amount of taxes due on property

d. To forecast inflation rates

171. In using the sales comparison approach, the appraiser finds that in terms of location, sale #1 is superior to

the subject property but is inferior to sale #2. The correct procedure would be to adjust:

a. Both sales down to the subject property

b. Both sales up to the subject property

c. Sale #1 down and sale#2 up

d. Sale#1 up and sale #2 down

172. The adjustment in the sales comparison approach that involves comparing two properties with similar

features and characteristics but different dates of sale is referred to as the:

a. Loan closing adjustment

b. Time adjustment (market conditions)

c. Appreciation in value adjustment

d. Time value of money adjustment

173. The building cost method that finds the cost of the component parts of a building through standard cost

estimates and then adjusts for the condition of the component, time and location is known as the:

a. Unit-in-place method c. Break-down method

b. Quantity survey method d. Comparative unit method

Cesar E. Santos Real Estate Academy Inc: 30

2014 Appraiser’s CRES Mock Examination

174. Maria’s house was built 12 years ago. Because he keeps it in excellent condition, it shows only as much wear