Ilham Dwi L - 261

Ilham Dwi L - 261

Uploaded by

Via jyCopyright:

Available Formats

Ilham Dwi L - 261

Ilham Dwi L - 261

Uploaded by

Via jyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Ilham Dwi L - 261

Ilham Dwi L - 261

Uploaded by

Via jyCopyright:

Available Formats

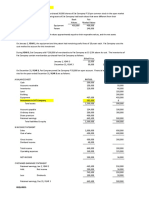

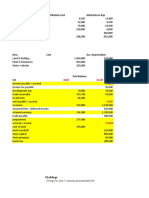

PT.

Puma dan Anak Perusahaan

Laporan Keuangan Konsolidasi

per 31 Desember 2013

(dalam ribuan)

Adjustment & Elimination

Accounts PT. Puma PT. Siaga Consolidated

Debit Credit

Income Statement

Sales 5,000,000 2,400,000 7,400,000

Dividend Income 280,000 280,000 -

Gain from Bargain Purchase 250,000 250,000

COGS 3,400,000 1,200,000 50,000 4,650,000

Depreciation Expense 300,000 200,000 80,000 580,000

Operating Expense 600,000 400,000 1,000,000

Other Operating Expense 120,000 100,000 220,000

NCI Share 186,000 (186,000)

Net Income 860,000 500,000 1,014,000

Retained Earnings, Begin 8,000,000 4,300,000 4,300,000 8,000,000

Dividend 600,000 400,000 400,000 600,000

Retained Earnings, End 8,260,000 4,400,000 8,414,000

Balance Sheet

Cash 500,000 500,000 1,000,000

Accounts Receivable 600,000 300,000 900,000

Dividend Receivable 70,000 70,000

Inventory 700,000 400,000 50,000 50,000 1,100,000

Supplies 160,000 50,000 210,000

Land 4,000,000 2,000,000 500,000 6,500,000

Building 2,000,000 5,000,000 7,000,000

Equipment 5,000,000 5,000,000 400,000 80,000 10,320,000

Investment in PT. Siaga 9,100,000 9,100,000 -

Goodwill 700,000 700,000 -

Total Assets 22,130,000 13,250,000 27,100,000

Accounts Payable 1,970,000 500,000 2,470,000

Dividend Payable 100,000 100,000

Other Liabilities 1,000,000 250,000 1,250,000

Capital Stock 9,000,000 5,000,000 5,000,000 9,000,000

Paid-In Capital 1,900,000 3,000,000 3,000,000 1,900,000

Retained Earnings 8,260,000 4,400,000 8,414,000

NCI 3,900,000

NCI 31 Dec 66,000 3,966,000

Total Liabilities and Equity 22,130,000 13,250,000 14,546,000 14,546,000 27,100,000

-

% of PT. Puma's ownership = 350,000 = 70

500,000

You might also like

- MIN-320 Topic 2 Spiritual Practices: Spiritual Discipline Biblical Support Real Life ApplicationDocument3 pagesMIN-320 Topic 2 Spiritual Practices: Spiritual Discipline Biblical Support Real Life ApplicationnadiaNo ratings yet

- 6 - Pat & Sat Co. - PALACIODocument7 pages6 - Pat & Sat Co. - PALACIOPinky DaisiesNo ratings yet

- Hinds County Detention Center Monitor ReportDocument13 pagesHinds County Detention Center Monitor ReportKayode CrownNo ratings yet

- Practice problems-EBIT-EPS, Debt Capacity, LeaseDocument3 pagesPractice problems-EBIT-EPS, Debt Capacity, LeasesabihaNo ratings yet

- Solusi Inventory Downstream-UpstreamDocument19 pagesSolusi Inventory Downstream-UpstreamKurrniadi AndiNo ratings yet

- Adv AssignmentDocument3 pagesAdv AssignmentBromanineNo ratings yet

- AFA ESE 2022 SolutionsDocument8 pagesAFA ESE 2022 Solutionssebastian mlingwaNo ratings yet

- Financial PlanDocument14 pagesFinancial Planagotevan0No ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditMichelle BabaNo ratings yet

- Problem16 5acctgDocument2 pagesProblem16 5acctgAleah kay BalontongNo ratings yet

- Tugas 5 - InventoryDocument11 pagesTugas 5 - InventoryMuhammad RochimNo ratings yet

- Advanced Accounting 3Document1 pageAdvanced Accounting 3Tax TrainingNo ratings yet

- AccountsDocument4 pagesAccountsVencint LaranNo ratings yet

- Strategic Corporate FinanceDocument21 pagesStrategic Corporate FinanceJustin MUNYAMAHORONo ratings yet

- Assets 2011 2012: Balance Sheet of Universal Learning Centerfor The Period 2011 To 2013Document10 pagesAssets 2011 2012: Balance Sheet of Universal Learning Centerfor The Period 2011 To 2013Jason RamsaranNo ratings yet

- Bab III Buku Bu IinDocument14 pagesBab III Buku Bu IinAditya Agung SatrioNo ratings yet

- Bac 203 Cat 2Document3 pagesBac 203 Cat 2Brian MutuaNo ratings yet

- Afar-Chapter 3 AssignmentDocument38 pagesAfar-Chapter 3 AssignmentJeane Mae BooNo ratings yet

- Toko Kenanga Neraca Percobaan / Work Sheet Per 31 Desember 2016 No Keterangan Neraca Saldo Penyesuaian Debet Kredit Debet KreditDocument4 pagesToko Kenanga Neraca Percobaan / Work Sheet Per 31 Desember 2016 No Keterangan Neraca Saldo Penyesuaian Debet Kredit Debet KreditWasiah R MaharyNo ratings yet

- FSA Financial StatementsDocument4 pagesFSA Financial StatementsabidjaysNo ratings yet

- Latihan Intercompany Profit Transactions-Plant Assets WS 2Document5 pagesLatihan Intercompany Profit Transactions-Plant Assets WS 2Raihan SalehNo ratings yet

- Net Working Capital Current Assets - Current LiabilitiesDocument11 pagesNet Working Capital Current Assets - Current LiabilitiesRahul YadavNo ratings yet

- Karkits Corporation Excel Copy PasteDocument2 pagesKarkits Corporation Excel Copy PasteCoke Aidenry SaludoNo ratings yet

- Chapter 7 Up StreamDocument14 pagesChapter 7 Up StreamAditya Agung SatrioNo ratings yet

- UntitledDocument5 pagesUntitledm habiburrahman55No ratings yet

- Tugas AKL1Document4 pagesTugas AKL1Yandra Febriyanti0% (1)

- WorkshitDocument12 pagesWorkshitLukman ArimartaNo ratings yet

- Ricard PangabnDocument15 pagesRicard PangabnTey-yah Malumbres100% (5)

- Problem 5xDocument4 pagesProblem 5xMAXINE CLAIRE CUTINGNo ratings yet

- Johnson Turnaround (Appendices)Document13 pagesJohnson Turnaround (Appendices)RAVEENA DEVI A/P VENGADESWARA RAONo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- CFAS QUIZDocument2 pagesCFAS QUIZannediones182005No ratings yet

- 17769cash Flow Practice QuestionsDocument8 pages17769cash Flow Practice QuestionsirmaNo ratings yet

- 3 Months PlanDocument8 pages3 Months PlanWaleed ZakariaNo ratings yet

- Mabuhay CompanyDocument17 pagesMabuhay CompanygimenezdarylNo ratings yet

- Er Cla 2Document2 pagesEr Cla 2Sakshi ManotNo ratings yet

- Sharon PLC (Long Question)Document4 pagesSharon PLC (Long Question)Jimmy LimNo ratings yet

- Jawaban Latihan Soal AklDocument11 pagesJawaban Latihan Soal AklFauzi AbdillahNo ratings yet

- Chapter 1 Case 1 Net Asset AcquisitionDocument4 pagesChapter 1 Case 1 Net Asset AcquisitionANGELI GRACE GALVANNo ratings yet

- Prob1 Afar QuizDocument7 pagesProb1 Afar Quizryan rosalesNo ratings yet

- Cash Flow AnalysisDocument4 pagesCash Flow AnalysisMargin Pason RanjoNo ratings yet

- Assets AmountsDocument6 pagesAssets Amountsaashir chNo ratings yet

- FAR Prob 9 FinalDocument17 pagesFAR Prob 9 FinalRayno Chiu CimafrancaNo ratings yet

- FV Differential: Amortization TableDocument17 pagesFV Differential: Amortization TableBeenish JafriNo ratings yet

- Assignment 5Document17 pagesAssignment 5Beenish JafriNo ratings yet

- Entrepreneur JSDCHHCBCDocument3 pagesEntrepreneur JSDCHHCBCshayan.53260No ratings yet

- FINAL EXAM - Part 2Document4 pagesFINAL EXAM - Part 2Elton ArcenasNo ratings yet

- Intercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Document31 pagesIntercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Abegail LibreaNo ratings yet

- AE 120 Group Activity AnswersDocument5 pagesAE 120 Group Activity AnswersRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Sukoako Company Statement of Financial Position Current Assets Year 1 Year 2Document5 pagesSukoako Company Statement of Financial Position Current Assets Year 1 Year 2Kevin GarnettNo ratings yet

- Randall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Document5 pagesRandall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Diane MagnayeNo ratings yet

- 4-10 Consolidations SolDocument8 pages4-10 Consolidations Solericn5793No ratings yet

- Chapter 6Document7 pagesChapter 6Its meh SushiNo ratings yet

- Entry For The AcquisitionDocument5 pagesEntry For The AcquisitionEnalem OtsuepmeNo ratings yet

- 8 4Document3 pages8 4FakerPlaymakerNo ratings yet

- H.W ch4q7 Acc418Document4 pagesH.W ch4q7 Acc418SARA ALKHODAIRNo ratings yet

- AFE3871 Assingment 2 Memo 1Document45 pagesAFE3871 Assingment 2 Memo 1SoblessedNo ratings yet

- WorksheetsDocument2 pagesWorksheetsSarifeMacawadibSaid100% (5)

- MI Worksheet Final LectureDocument3 pagesMI Worksheet Final Lecturethapa_bisNo ratings yet

- PERSIJADocument10 pagesPERSIJAricoananta10No ratings yet

- Financial Management Week 2 AssignmentDocument2 pagesFinancial Management Week 2 AssignmentAndrea Monique AlejagaNo ratings yet

- P 4-11Document10 pagesP 4-11owennoecker10No ratings yet

- Title ProposalDocument3 pagesTitle Proposal21-38010No ratings yet

- Business Law Term Paper ExampleDocument6 pagesBusiness Law Term Paper Examplec5qrar20100% (1)

- Q4 - MODULE 5 - Feasibility Study at Naratibong UlatDocument24 pagesQ4 - MODULE 5 - Feasibility Study at Naratibong UlatlostcraftrealNo ratings yet

- JA of JK AbarriDocument8 pagesJA of JK Abarrijan l.No ratings yet

- Cover Letter CowenDocument1 pageCover Letter CowenLuis TellezNo ratings yet

- Chapter 6 - Group 1Document18 pagesChapter 6 - Group 1truongvutramyNo ratings yet

- Resolution No. 10, S. 2019Document4 pagesResolution No. 10, S. 2019Aina Langcay Daligdig100% (1)

- Risk Management Concepts & PrinciplesDocument42 pagesRisk Management Concepts & PrinciplesJohn Jordan CalebagNo ratings yet

- Leadership Assignment One FinalDocument21 pagesLeadership Assignment One FinalJaswinder Kaur SainiNo ratings yet

- Guppy Moving Averages PDFDocument7 pagesGuppy Moving Averages PDFAlain LatourNo ratings yet

- Professional Ethics Two Mark With AnswerDocument25 pagesProfessional Ethics Two Mark With AnswerShashwarya ShashuNo ratings yet

- ADR in The CPCDocument3 pagesADR in The CPCwelcome.hdkNo ratings yet

- Episode 3 Class NotesDocument19 pagesEpisode 3 Class NotesmaqNo ratings yet

- Analysis of The Theme of Marriage in Jane Austen's Persuasion' Novel - Chanelle KatsidziraDocument35 pagesAnalysis of The Theme of Marriage in Jane Austen's Persuasion' Novel - Chanelle KatsidziraCocoachanie’s LyricsNo ratings yet

- ATIVA EM PriceListDocument1 pageATIVA EM PriceListDora ManumathewNo ratings yet

- Life Narrative Definitions and Distinctions - SidonieSmith and JuliaWatson - ReadingAutoBiographyDocument20 pagesLife Narrative Definitions and Distinctions - SidonieSmith and JuliaWatson - ReadingAutoBiographyAndresa MorenoNo ratings yet

- Formerly: San Nicolas Academy / Dominican School - Founded 1946Document8 pagesFormerly: San Nicolas Academy / Dominican School - Founded 1946Atasha Xd670No ratings yet

- Short Story COVID-19Document3 pagesShort Story COVID-19Kim SaysonNo ratings yet

- Shiva PoojaDocument108 pagesShiva PoojaKiran Kumar AbburuNo ratings yet

- Liquidated DamagesDocument25 pagesLiquidated Damagesvirfann01No ratings yet

- Most Common Irregular and Regular VerbsDocument7 pagesMost Common Irregular and Regular VerbsmariaNo ratings yet

- Introduction To SociologyDocument55 pagesIntroduction To SociologyRajalakshmi ANo ratings yet

- Physiology MCQsDocument7 pagesPhysiology MCQsshair adamNo ratings yet

- Opportunity Seeking, Screening, and SeizingDocument48 pagesOpportunity Seeking, Screening, and SeizingLeny Ann Tabac Rimpillo - Abella0% (1)

- Choice Multiple Questions - Docx.u1conflictDocument4 pagesChoice Multiple Questions - Docx.u1conflictAbdulaziz S.mNo ratings yet

- Belapur HousingDocument29 pagesBelapur HousingPRATHMESH KAPSENo ratings yet

- Listening ExercisesDocument5 pagesListening ExercisesCandelaria LuqueNo ratings yet