Ms9107a - Financial Statements Analysis

Ms9107a - Financial Statements Analysis

Uploaded by

Celestaire LeeCopyright:

Available Formats

Ms9107a - Financial Statements Analysis

Ms9107a - Financial Statements Analysis

Uploaded by

Celestaire LeeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Ms9107a - Financial Statements Analysis

Ms9107a - Financial Statements Analysis

Uploaded by

Celestaire LeeCopyright:

Available Formats

CPAR:MS 9107A_FINANCIAL STATEMENTS ANALYSIS BATCH MAY 2022

MS9107A – FINANCIAL STATEMENTS ANALYSIS

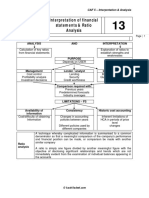

TOPIC OUTLINE

Definition

Basic

Objectives

Concepts

Problems and

FINANCIAL Limitations

STATEMENTS

ANALYSIS Horizontal Liquidity

Analysis Ratios

Techniques in Vertical Activity

FS Analysis Analysis Ratios

Financial Solvency

Ratios Ratios

Profitability

Ratios

Market-test

Ratios

LECTURE NOTES

BASIC CONCEPTS

Definition

FS Analysis involves careful selection of data from financial statements in order to assess and

evaluate the firm’s past performance, its present condition and future business potentials.

Objectives of FS Analysis

The primary objective of FS Analysis is to determine the extent of firm’s success in attaining its

financial goals in the following areas:

(1) Maximizing profitability

(2) Ability of the firm to pay its obligations

(3) Safety of the investment in the business

(4) Effectiveness and efficiency of management in utilizing the resources entrusted to them

(5) Attain stability in operations.

Problems and Limitations of FS Analysis

(1) The nature of the information

(a) The use of estimates in allocating costs to each period.

(b) Financial data is not adjusted for price changes or inflation/deflation because of cost principle.

(c) Companies have a choice of accounting methods. These differences impact ratios and make it

difficult to compare companies using different methods.

(d) Companies may have different fiscal year ends making comparison difficult if the industry is

cyclical.

(2) The need to look beyond ratios

Ratios or any information generated by FS analysis are not the ultimate goal. The company must

interpret and look beyond this results for a more proper evaluation.

TECHNIQUES IN FS ANALYSIS

(1) HORIZONTAL ANALYSIS

It is the process of analyzing the firms’ financial data across two or more consecutive periods. This is

done through either:

(a) Comparative FS (b) Trend Analysis

TREND PERCENTAGES – are index numbers showing relative changes in financial data resulting to

passage of time.

Management Advisory Services by Karim G. Abitago, CPA Page 1 of 7

CPAR:MS 9107A_FINANCIAL STATEMENTS ANALYSIS BATCH MAY 2022

In horizontal analysis, the amount of change and percentage of change should be shown.

PERCENTAGE CHANGE (%) = AMOUNT OF CHANGE / BASE

CAUTION ABOUT THE BASE:

(1) The base may be last year’s or earlier period data, average industry data or even chief

competitors’ data.

(2) The percentage change is NOT computed if the base is ZERO or NEGATIVE.

(2) VERTICAL ANALYSIS

Vertical analysis is a method of financial statement analysis in which each line item is listed as a

percentage of a base figure within the statement. Vertical analysis is the process of comparing figures

in the FS of a single period only.

Proper application of vertical will generate a COMMON-SIZE FINANCIAL STATEMENTS. Common size

financial statements are financial statements that translate peso amounts to percentages in relation

to a chosen base.

NOTE: In vertical analysis, only percentages are shown.

What base to use?

Financial Statement Proper Base

Income Statement Net Sales

Balance Sheet Total Assets

Statement of Cash Flows Total Cash Available

(3) FINANCIAL RATIOS

It is a comparison in fraction, decimal or proportion of two significant figures taken from the financial

statements.

REMINDER IN USING FINANCIAL RATIOS: In comparing balance sheet items with income statement

items in a single ratio, the balance sheet items are being averaged if the beginning and ending

balances are available.

Cautions in using ratios:

(1) Ratios have great disparities from one industry to another.

(2) Conservatism has a bias towards diminishing value of the firm.

(3) Historical cost principle may significantly contribute to a distorted FS Analysis.

Summary of Effect of Transactions in Ratios

Numerator + 0 - 0 + -

Denominator 0 + 0 - - +

Effect on Ratio + - - + + -

Based from the above table, we can say that movements on the numerator have a direct effect on the

ratio while movements on the denominator have an inverse effect on the ratio.

EXCEPTION:

Numerator + - + -

Denominator + - + -

Effect on Ratio + - - +

IF PROPER FRACTION IF IMPROPER FRACTION

LIST OF PROPER FRACTION AND IMPROPER FRACTION RATIOS

PROPER FRACTION IMPROPER FRACTION

Debt Ratio Current Ratio

Equity Ratio Quick Asset Ratio

Profit Margin AR Turnover Ratio

Gross Profit Margin Inventory Turnover Ratio

Return on Sales Asset Turnover Ratio

Return on Assets AP Turnover Ratio

Return on Equity Earnings per Share

Dividend Pay-out Ratio Book Value per Share

Dividend Yield Ratio Times Interest Earned

SUMMARY OF COMMONLY USED FINANCIAL RATIOS

(a) Liquidity ratios: are ratios used in measuring the ability of the firm to meet its currently

maturing obligations.

RATIO FORMULA

Total Current Assets

Current Ratio

Total Current Liabilities

Total Quick Assets*

Quick Ratio

Total Current Liabilities

*Cash + Marketable Securities + AR

Management Advisory Services by Karim G. Abitago, CPA Page 2 of 7

CPAR:MS 9107A_FINANCIAL STATEMENTS ANALYSIS BATCH MAY 2022

Total Current Assets - Total Current

Working Capital

Liabilities

(b) Activity ratios: are ratios that measure the liquidity of specific assets and efficiency in managing

assets.

RATIO FORMULA

Net Credit Sales*

AR Turnover

Average AR

* Net Sales if not available

360 days / 365 days

Days AR / Ave. Collection Period

AR Turnover

Cost of Goods Sold**

Inventory Turnover (For Merchandising)

Average Inventory

** Sales or Net Sales if not available

Cost of Goods Sold**

FG Inventory Turnover

Average FG Inventory

** Sales or Net Sales if not available

Cost of Goods Manufactured

WIP Inventory Turnover

Average WIP Inventory

Raw Materials Used

RM Inventory Turnover

Average RM Inventory

360 days / 365 days

Days Inventory / Ave. Conversion Period

Inventory Turnover

Net Credit Purchases***

AP Turnover

Ave. Accounts Payable

*** Net Purchases if not available

360 days / 365 days

Days AP / Ave. Payment Period

AP Turnover

Net Sales

Total Assets Turnover

Average Total Assets

Net Sales

Fixed Assets Turnover

Average Fixed Assets

(c) Solvency ratios: are ratios that measure the ability of the firm to pay its long-term financing

and the extent of a firm’s financing.

RATIO FORMULA

Total Liabilities

Debt Ratio

Total Assets

Total Equity

Equity Ratio

Total Assets

Total Liabilities

Debt to Equity Ratio

Total Equity

Total Assets

Total Equity

Leverage Ratio / Equity Multiplier or

1

Equity Ratio

Earnings Before Interest and Taxes (EBIT)

Times Interest Earned (TIE)

Annual Interest

Earnings Before Interest and Taxes (EBIT)

Basic Earnings Power

Total Assets

(d) Profitability ratios: are ratios that measure the overall performance of the firm.

RATIO FORMULA

Gross Profit

Gross Profit Ratio

Net Sales

Net Income

Return on Sales / Profit Margin Ratio

Net Sales

Operating Income after Tax*

Average Total Assets

Return on Assets *Net income if cannot be determined

or

Profit Margin x Asset Turnover

Return on Equity Net Income

Average Total Equity

Management Advisory Services by Karim G. Abitago, CPA Page 3 of 7

CPAR:MS 9107A_FINANCIAL STATEMENTS ANALYSIS BATCH MAY 2022

or

Profit Margin x Asset Turnover x Leverage Ratio

Net Income - Preferred Dividends

Earnings per Share

Ave. Ordinary Shares Outstanding

Annual Dividends

Dividends per Share

Ave. Ordinary Shares Outstanding

Dividends per Share

Dividend Pay-out Ratio

Earnings per Share

Retention Ratio / Plowback Ratio 1 - Dividend Pay-out Ratio

Total Shareholders' Equity

Book Value per Share

Ave. Ordinary Shares Outstanding

NOTE: Operating income is synonymous to EBIT

(e) Market-test ratios: these ratios are concerned with the return on investment for shareholders, and

with the relationship between return and the value of an investment in company's shares.

RATIO FORMULA

Market Price

Price - Earnings Ratio

Earnings per Share

Dividends per Share

Dividend Yield Ratio

Market Price

Earnings per Share

Earnings Yield Ratio

Market Price

Management Advisory Services by Karim G. Abitago, CPA Page 4 of 7

CPAR:MS 9107A_FINANCIAL STATEMENTS ANALYSIS BATCH MAY 2022

DISCUSSION EXERCISES

STRAIGHT PROBLEMS:

HORIZONTAL ANALYSIS, VERTICAL ANALYSIS & RATIO ANALYSIS

1. Comparative data for LUZON CORP. for the two-year period 2019 and 2018 are as follows:

INCOME STATEMENT

2018 2019

Sales P1,500,000 P2,000,000

Cost of goods sold 900,000 1,200,000

Gross profit 600,000 800,000

Selling, general, and other expenses 100,000 150,000

Income tax expense 150,000 195,000

Net income 350,000 455,000

BALANCE SHEET

2018 2019

ASSETS

Cash P100,000 P150,000

Accounts Receivable 400,000 450,000

Inventory 300,000 400,000

Prepaid expenses - 50,000

Plant and Equipment, net 1,200,000 1,150,000

TOTAL ASSETS P2,000,000 P2,200,000

LIABILITIES & EQUITY

Accounts Payable 150,000 200,000

Short-term Notes Payable 350,000 400,000

Bonds Payable (10%) 500,000 500,000

Common Stock (P10 par) 400,000 400,000

Retained Earnings 600,000 700,000

TOTAL LIABILITIES & EQUITY 2,000,000 2,200,000

Additional information:

For the year 2018 and 2019, LUZON declared dividends amounting to P300,000 and P450,000,

respectively.

The market price of the share for the years 2018 and 2019 are P15 and P18.

REQUIREMENTS:

(a) Prepare a vertical and horizontal analysis for the year 2019.

(b) Prepare a ratio analysis for 2019 by computing the following ratios:

1. Current ratio. 16. Gross profit ratio

2. Acid-test ratio. 17. ROS

3. Accounts receivable turnover. 18. ROA

4. Inventory turnover. 19. ROE

5. Accounts payable turnover. 20. EPS

6. Days AR 21. DPS

7. Days Inventory 22. Dividend pay-out ratio

8. Days AP 23. Price-earnings ratio

9. Total asset turnover 24. Dividend yield ratio

10. Fixed asset turnover 25. Earnings yield ratio

11. Debt ratio

12. Equity ratio

13. Debt to equity ratio

14. Times interest earned

15. Basic earning power

EFFECTS OF TRANSACTIONS

2. Indicate the effects of each of the following transactions on the following ratios. There are three

possible answers: increase (+), decrease (-), and no effect (0). Before each transaction takes place,

the current ratio is greater than 1 to 1 and the acid-test ratio is less than 1 to 1.

Current Acid-test Debt ROS ROA EPS

Ratio Ratio Ratio

(a) Sell merchandise for cash

(b) Buy inventory for cash

(c) Pay an account payable

(d) Borrow cash on a short-term loan

(e) Purchase plant assets for cash

(f) Issue long-term bonds payable

(g) Collect an account receivable

(h) Record accrued expenses payable

(i) Sell a plant asset for cash at a profit

Management Advisory Services by Karim G. Abitago, CPA Page 5 of 7

CPAR:MS 9107A_FINANCIAL STATEMENTS ANALYSIS BATCH MAY 2022

(j) Sell a plant asset for cash at a loss

(k) Buy marketable securities for cash

(l) Declare and issue a stock dividend

(m) Purchase treasury stock for cash

(n) Acquire land by issuing common stock

(o) Write off an uncollectible account receivable

WORKING BACK AND COMPREHENSIVE PROBLEMS

3. Answer the questions for each of the following independent situations

(a) The current ratio is 2.5 to 1; the acid-test ratio is 0.9 to 1; cash and receivables are P270,000.

The only current assets are cash, receivables, and inventory. What are current liabilities? What

is inventory?

(b) A company had current assets of P600,000. It then paid a current liability of P90,000. After

the payment, the current ratio was 2 to 1. What were current liabilities before the payment was

made?

(c) A company has a debt ratio of 0.50, a total assets turnover of 0.25, and a profit margin of 10%.

The president is unhappy with the current return on equity, and he thinks it could be doubled.

This could be accomplished (1) by increasing the profit margin to 14% and (2) increasing debt

utilization. Total assets turnover will not change. What new debt ratio, along with the 14%

profit margin, is required to double the return on equity?

(d) The company has P1.6 million of accounts receivable on its balance sheet. The company’s DSO

is 40 (based on a 360-day year), its current assets are P2.5 million, and its current ratio is 1.5.

The company plans to reduce its DSO from 40 to the industry average of 30 without causing a

decline in sales. The resulting decrease in accounts receivable will free up cash that will be used

to reduce current liabilities. If the company succeeds in its plan, what will it’s new current ratio

be?

CONSTRUCTING FINANCIAL STATEMENTS FROM RATIOS

4. The following data are available for VISAYAS CORP. as of December 31, 2019 and for the year ended.

Current ratio 2.5 to 1

Days’ sales in account receivable 55 days

Inventory turnover 4 times

Debt ratio 40%

Current liabilities P450,000

Stockholders’ equity P1,500,000

Return on sales 10%

Return on common equity 20%

Gross profit ratio 40%

VISAYAS has no preferred stock, no marketable securities, and no prepaid expenses. Beginning-of-

year balance sheet figures are the same as end-of-year figures. The only noncurrent assets are plant

and equipment.

REQUIREMENT: Prepare a balance sheet as of December 31, 2019 and an income statement for 2019

in as much details as you can with the available information.

Management Advisory Services by Karim G. Abitago, CPA Page 6 of 7

CPAR:MS 9107A_FINANCIAL STATEMENTS ANALYSIS BATCH MAY 2022

MULTIPLE CHOICE (THEORIES)

1. Which one of the following is not a characteristic generally evaluated in analyzing financial

statements?

A. Liquidity C. Marketability

B. Profitability D. Solvency

2. In common size analysis,

A. a base amount is required.

B. a base amount is optional.

C. the same base is used across all financial statements analyzed.

D. the results of the horizontal analysis are necessary inputs for performing the analysis.

3. Which of the below statements is (are) incorrect?

A. In horizontal analysis both the amount of and percentage change is shown.

B. The base in horizontal analysis is the last year’s or earlier period data which can be used even if

it has a negative balance.

C. In comparing balance sheet items and income statement items using ratio analysis, ONLY

balance sheet items should be averaged.

D. Return on asset is computed as operating income after tax divided by average asset.

4. KGA Inc. has a current ratio of 0.50:1 before accounting for the following transactions

I. Payment of accounts payable worth P20,000

II. Retirement of bonds through issuance of equity securities P150,000.

III. Write-off of accounts receivable worth P15,000

Which of the following transactions above will increase the entity’s current ratio?

A. I and II D. III only

B. II and III E. None from I, II and III

C. I and III

5. A company has a current ratio of 2 to 1. The ratio will decrease if the company

A. Borrow cash on a six-month note.

B. Pays a large account payable which had been a current liability.

C. Receives a 5% stock dividend on one of its marketable securities.

D. Sells merchandise for more than cost and records the sale using the perpetual inventory

method.

6. Mabuhay Corp. has current assets of P180,000 and current liabilities of P360,000. Which of the

following transactions would improve Mabuhay’s current ratio?

A. Paying P40,000 of short-term accounts payable.

B. Collecting P20,000 of short-term accounts receivable.

C. Refinancing a P60,000 long-term mortgage with a short-term note.

D. Purchasing P100,000 of merchandise inventory with a short-term accounts payable.

7. Which of these ratios are measures of a company’s profitability?

1. Earnings per share 5. Return on assets

2. Current ratio 6. Inventory turnover

3. Return on sales 7. Receivables turnover

4. Debt-equity ratio 8. Price-earnings ratio

A. 1, 3, and 5 only C. 1, 3, 5, 6, 7, and 8 only.

B. 1, 3, 5, and 8 only. D. All eight ratios.

8. The ratio that measures a firm's ability to generate earnings from its resources is

A. Asset turnover. C. Days' sales in receivables.

B. Days' sales in inventory. D. Sales to working capital.

9. If a company is profitable and is effectively using leverage, which one of the following ratios is likely

to be the largest?

A. Return on total assets. C. Return on common stockholders' equity.

B. Return on total liabilities. D. Cannot be determined.

10. The current ratio is

A. calculated by dividing current liabilities by current assets.

B. used to evaluate a company's liquidity and short-term debt paying ability.

C. used to evaluate a company's solvency and long-term debt paying ability.

D. calculated by subtracting current liabilities from current assets.

- END OF HANDOUTS -

Management Advisory Services by Karim G. Abitago, CPA Page 7 of 7

You might also like

- Financial Planning & Analysis and Performance ManagementFrom EverandFinancial Planning & Analysis and Performance ManagementRating: 3 out of 5 stars3/5 (1)

- Report On Ratio Analysis (Reliance Infrastructure Limited)Document21 pagesReport On Ratio Analysis (Reliance Infrastructure Limited)SiddhiNo ratings yet

- Solved On November 4 Kim Contracted To Sell To Lynn 500Document1 pageSolved On November 4 Kim Contracted To Sell To Lynn 500Anbu jaromiaNo ratings yet

- Material No. 2 Financial Statement Analysis: Laguna State Polytechnic University-Los Baños Laguna (LSPU-LBC)Document5 pagesMaterial No. 2 Financial Statement Analysis: Laguna State Polytechnic University-Los Baños Laguna (LSPU-LBC)Kristine Joy NolloraNo ratings yet

- 04 Financial Statements Analysis: Management Advisory Services Online ReviewDocument16 pages04 Financial Statements Analysis: Management Advisory Services Online Reviewkarim abitagoNo ratings yet

- Basic Accounting RatiosDocument47 pagesBasic Accounting RatiosSUNYYRNo ratings yet

- ch15 - Financial Statement AnalysisDocument51 pagesch15 - Financial Statement AnalysisMd.Shadid Ur RahmanNo ratings yet

- Ratio Analysis - Unit 2Document8 pagesRatio Analysis - Unit 2T S Kumar Kumar100% (1)

- SBA01 FSAnalysisPart1Document4 pagesSBA01 FSAnalysisPart1Hazel VillanuevaNo ratings yet

- FM. Financial Analysis BookDocument31 pagesFM. Financial Analysis Bookahmedsoobi73No ratings yet

- Ratio Analysis Q&a MAFDocument23 pagesRatio Analysis Q&a MAFmohedNo ratings yet

- Financial Statement AnalysisDocument13 pagesFinancial Statement AnalysisKim EllaNo ratings yet

- Chapter 9 Ratio AnalysisDocument65 pagesChapter 9 Ratio AnalysisClara rdpNo ratings yet

- Ratio AnalysisDocument33 pagesRatio AnalysisSamNo ratings yet

- The Financial Statement AnalysisDocument25 pagesThe Financial Statement Analysisgk37765No ratings yet

- UNIT 2 - Ratio AnalysisDocument16 pagesUNIT 2 - Ratio AnalysisVishika jainNo ratings yet

- Financial Statement AnalysisDocument56 pagesFinancial Statement AnalysisJade Berlyn AgcaoiliNo ratings yet

- Mahesh Total Project 1Document70 pagesMahesh Total Project 1Kaveti Madhu lathaNo ratings yet

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisCIPRIANO, Rodielyn L.No ratings yet

- Final Report Rachitha PDFDocument35 pagesFinal Report Rachitha PDFThanuja BhaskarNo ratings yet

- 4 Financial AnalysisDocument1 page4 Financial AnalysisHana DwiNo ratings yet

- Class 12 Accountancy Project (Specific) Ratio Analysis PidiliteDocument18 pagesClass 12 Accountancy Project (Specific) Ratio Analysis PidiliteAvirup Chakraborty55% (40)

- Class 12 Accountancy Project Specific Ratio Analysis PidiliteDocument18 pagesClass 12 Accountancy Project Specific Ratio Analysis Pidiliteyogesh kumarNo ratings yet

- Unit 5 MANAGEMENT ACCOUNTINGDocument25 pagesUnit 5 MANAGEMENT ACCOUNTINGSANDFORD MALULUNo ratings yet

- Ratio AnalysisDocument25 pagesRatio Analysismba departmentNo ratings yet

- Chapter 9 Ratio AnalysisDocument65 pagesChapter 9 Ratio AnalysisPoojaNo ratings yet

- Interpretation of Financial Statements & Ratio AnalysisDocument35 pagesInterpretation of Financial Statements & Ratio Analysisamitsinghslideshare67% (3)

- Introduction To Accounting: Financial Statements AnalysisDocument53 pagesIntroduction To Accounting: Financial Statements AnalysiskweeNo ratings yet

- Bafinmax Topic 2Document109 pagesBafinmax Topic 2airwaller rNo ratings yet

- Financial Statement Analysis LectureDocument71 pagesFinancial Statement Analysis Lecturephilippineball mapper100% (2)

- Vertical AnalysisDocument45 pagesVertical AnalysisArpit SidhuNo ratings yet

- AFMA Cha 4 MBA TT at 2020Document38 pagesAFMA Cha 4 MBA TT at 2020sheawNo ratings yet

- Financial Ratios: Research StartersDocument11 pagesFinancial Ratios: Research Starterszar.mx03No ratings yet

- 05 Ratios and Trend AnalysisDocument11 pages05 Ratios and Trend AnalysisHaris IshaqNo ratings yet

- Finalysis Reviewer Ver1Document2 pagesFinalysis Reviewer Ver1Eyvin AbleNo ratings yet

- FPA CHEATSHEET c6m74mDocument1 pageFPA CHEATSHEET c6m74mMaqbool ShahidNo ratings yet

- Report - Financial Statement AnalysisDocument43 pagesReport - Financial Statement AnalysisVijayNo ratings yet

- Class 12 Accountancy Projectspecific Ratio Analysis Pidilite PDF FreeDocument15 pagesClass 12 Accountancy Projectspecific Ratio Analysis Pidilite PDF Freeabu lilahNo ratings yet

- Financial RatiosDocument9 pagesFinancial RatiosDavid Isaias Jaimes ReyesNo ratings yet

- Pre Defense ReportDocument4 pagesPre Defense ReportKhayceePadillaNo ratings yet

- 1.1 Basic Financial Statement Analysis 2Document69 pages1.1 Basic Financial Statement Analysis 27rtqzp2fj8No ratings yet

- Financial RatiosDocument30 pagesFinancial RatiosSumitt AgrawalNo ratings yet

- Bcom Ratio Anlysis - Dr. S. M. VohraDocument18 pagesBcom Ratio Anlysis - Dr. S. M. Vohrankengbrandon7No ratings yet

- Module 01Document11 pagesModule 01VinDiesel Balag-eyNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument26 pagesFinancial Statement Analysis: K R Subramanyam John J WildichabooksNo ratings yet

- CF1 Lec3 Financial Analysis SVDocument31 pagesCF1 Lec3 Financial Analysis SVAnh Nguyễn MaiNo ratings yet

- Financial Statement Anlaysis Ratio Analysis - Session 17 To 19Document49 pagesFinancial Statement Anlaysis Ratio Analysis - Session 17 To 19shvm.shkla96No ratings yet

- Final Project Report On Financial Statement AnalysisDocument36 pagesFinal Project Report On Financial Statement AnalysisMercy Jacob100% (1)

- Chapter 9 Ratio Analysis1Document65 pagesChapter 9 Ratio Analysis1niovaleyNo ratings yet

- Ratio Analysis 08.04.2022Document15 pagesRatio Analysis 08.04.2022surangauorNo ratings yet

- Financial Performance Measures and Value Creation: the State of the ArtFrom EverandFinancial Performance Measures and Value Creation: the State of the ArtNo ratings yet

- Financial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesFrom EverandFinancial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)No ratings yet

- Financial Statement Analysis: Business Strategy & Competitive AdvantageFrom EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Financial Steering: Valuation, KPI Management and the Interaction with IFRSFrom EverandFinancial Steering: Valuation, KPI Management and the Interaction with IFRSNo ratings yet

- Implementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesFrom EverandImplementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesNo ratings yet

- Financial Management: Partner in Driving Performance and ValueFrom EverandFinancial Management: Partner in Driving Performance and ValueNo ratings yet

- 9114 - Process CostingDocument4 pages9114 - Process CostingCelestaire LeeNo ratings yet

- 9113 - Standard CostingDocument2 pages9113 - Standard CostingCelestaire LeeNo ratings yet

- 9112 - JIT and Backflush CostingDocument2 pages9112 - JIT and Backflush CostingCelestaire LeeNo ratings yet

- MS9111a - Self-Test AnswersDocument7 pagesMS9111a - Self-Test AnswersCelestaire LeeNo ratings yet

- ch09 1Document20 pagesch09 1Celestaire LeeNo ratings yet

- Chapter 5 Job Order CostingDocument19 pagesChapter 5 Job Order CostingCelestaire LeeNo ratings yet

- CPAR85 Auditing TheoryDocument10 pagesCPAR85 Auditing TheoryCelestaire LeeNo ratings yet

- Chapter 16 Managing Costs and UncertaintyDocument22 pagesChapter 16 Managing Costs and UncertaintyCelestaire LeeNo ratings yet

- Chapter 15 Capital BudgetingDocument16 pagesChapter 15 Capital BudgetingCelestaire LeeNo ratings yet

- Chapter 11 Allocation of Joint Costs and Accounting For by ProductDocument18 pagesChapter 11 Allocation of Joint Costs and Accounting For by ProductCelestaire LeeNo ratings yet

- Chapter 14 Performance Measurement, Balanced Scorecards and Performance RewardsDocument12 pagesChapter 14 Performance Measurement, Balanced Scorecards and Performance RewardsCelestaire LeeNo ratings yet

- GS Guide To Inflation-Linked BondsDocument8 pagesGS Guide To Inflation-Linked BondsOmer H.No ratings yet

- Excise, Taxation and Narcotics Control DepartmentDocument1 pageExcise, Taxation and Narcotics Control DepartmentabdulqadirjewlNo ratings yet

- Ee 4146 - Chapt. 4, 5, 6Document13 pagesEe 4146 - Chapt. 4, 5, 6Gian Carla C. NICOLASNo ratings yet

- Macroeconomics: Lection 2: Riccardo FranceschinDocument20 pagesMacroeconomics: Lection 2: Riccardo FranceschindurdyNo ratings yet

- Company Vinamilk PESTLE AnalyzeDocument2 pagesCompany Vinamilk PESTLE AnalyzeHiền ThảoNo ratings yet

- 1form No. IoccadDocument1 page1form No. Ioccadkinnari bhutaNo ratings yet

- Filing of Resolutions and Agreements To The Registrar Under Section 117Document14 pagesFiling of Resolutions and Agreements To The Registrar Under Section 117Prathap ChowdaryNo ratings yet

- PARAGMILK StockReport 20230828 1022Document12 pagesPARAGMILK StockReport 20230828 1022Chetan ChouguleNo ratings yet

- Projections 20.11.20Document7 pagesProjections 20.11.20Pawan GuptaNo ratings yet

- Copy4-Mr. Ramashankar Yadav Confirmation Letter Ind 1Document2 pagesCopy4-Mr. Ramashankar Yadav Confirmation Letter Ind 1farhanNo ratings yet

- Each Question Carries Mark: Objective TypeDocument10 pagesEach Question Carries Mark: Objective TypeSyed Fawad MarwatNo ratings yet

- Chak # 111/15-L, Post Office Mohsinwal, Tehsil Mian Channu, Khanewal, Mian Channu. Abbas AliDocument3 pagesChak # 111/15-L, Post Office Mohsinwal, Tehsil Mian Channu, Khanewal, Mian Channu. Abbas AliZeeshan Haider RizviNo ratings yet

- (Updated) List of IFRS and IAS 2021 - WikiaccountingDocument4 pages(Updated) List of IFRS and IAS 2021 - WikiaccountingAli KhanNo ratings yet

- CA Final DT Q MTP 2 Nov23 Castudynotes ComDocument10 pagesCA Final DT Q MTP 2 Nov23 Castudynotes ComRajdeep GuptaNo ratings yet

- Powell and Zwolinski The Ethical and Economic Case Against Sweatshop LaborDocument24 pagesPowell and Zwolinski The Ethical and Economic Case Against Sweatshop LaborEngr Gaddafi Kabiru MarafaNo ratings yet

- Thi Online 1 Phân TDocument3 pagesThi Online 1 Phân TnguyenanhthushinNo ratings yet

- CONTROLLING. Your TRADES, MONEY& EMOTIONS. by Chris VermeulenDocument11 pagesCONTROLLING. Your TRADES, MONEY& EMOTIONS. by Chris VermeulenfrankkinunghiNo ratings yet

- Ay - of - IKEA - in - The - Case - of - Internationalisation Title: Strategic Drivers & Barriers Essay of IKEA in The Case of InternationalisationDocument12 pagesAy - of - IKEA - in - The - Case - of - Internationalisation Title: Strategic Drivers & Barriers Essay of IKEA in The Case of InternationalisationgayaNo ratings yet

- Case Study On MilkyMistDocument10 pagesCase Study On MilkyMistHarshit MistryNo ratings yet

- Qnet Full Magazine NewDocument94 pagesQnet Full Magazine NewNishad MishraNo ratings yet

- CASE DIGEST Commissioner of Lnternal Revenue (CIR) vs. Algue, Inc. (158 SCRA 9), G.R. No. L-28896, February 17, 1988 - Batas FiDocument1 pageCASE DIGEST Commissioner of Lnternal Revenue (CIR) vs. Algue, Inc. (158 SCRA 9), G.R. No. L-28896, February 17, 1988 - Batas FisundaeicecreamNo ratings yet

- 3443 Daiwa 20221027 PDFDocument8 pages3443 Daiwa 20221027 PDFVinaNo ratings yet

- QB Income TaxesDocument6 pagesQB Income TaxesSarthak MalhotraNo ratings yet

- 2.3.4 Marketing PlanDocument9 pages2.3.4 Marketing PlanKumar DiwakarNo ratings yet

- Emilio P. Callelero Ii: Putatan, Muntinlupa CityDocument3 pagesEmilio P. Callelero Ii: Putatan, Muntinlupa CityYuan Joseph YuloNo ratings yet

- FMT 14Document8 pagesFMT 14Armel AbarracosoNo ratings yet

- Inventory SystemsDocument3 pagesInventory SystemsAllen Carl33% (3)

- Net Capital Outflow: Trade BalanceDocument3 pagesNet Capital Outflow: Trade Balancehnin scarletNo ratings yet

- Honda MotorsDocument68 pagesHonda MotorsCyber VirginNo ratings yet