Invoice

Invoice

Uploaded by

Divya Prakash SharmaCopyright:

Available Formats

Invoice

Invoice

Uploaded by

Divya Prakash SharmaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Invoice

Invoice

Uploaded by

Divya Prakash SharmaCopyright:

Available Formats

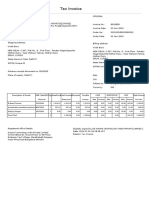

Tax Invoice

Supply Type B2B

Document Type Code Invoice Company PAN AAACX1645B

Seller Legal Name Xiaomi Technology India Private Limited Company CIN U72200KA2014FTC076704

Ground Floor, E-1/15, Sector -7, Rohini, New Delhi -

Seller Address 110085Ground Floor, E-1/15, Sector -7, Rohini, New Delhi -

110085

Seller Place NEW DELHI

Seller State 07

Seller PIN Code 110085 Dispatch State

Seller GSTIN 07AAACX1645B1ZQ Dispatch PIN Code

Tax Scheme GST Order Number SA1228242004957114

Currency INR Order Date 26-11-2022

Customer Support Email ID service.in@xiaomi.com

a384454d0d4719ea759b62b78dd2e7f0c524144ddac09d35a93

Customer Support Contact Number 18001036286 IRN

981be17136c86

Description

Invoice Number 22OM07IN00023944

Invoice Date 26-11-2022

Details Of Receiver (Billed To) Details Of Consignee (Shipped To)

Buyer Legal Name S S Associates Ship To Legal Name

Buyer GSTIN 07AYQPB5079E1ZA Ship To GSTIN

RZ-89B, Lane Number 6 and 7, Mohan Block West Sagarpur, West DelRZ-89B, Lane

Buyer Address Ship To Address

Number 6 and 7, Mohan Block West Sagarpur, West Del

Buyer Place NEW DELHI Ship To State

Buyer State 07 Ship To Place

Buyer PIN Code 110046 Ship To PIN Code

Billing POS 7 Contact Person Name

Contact Person Telephone

Total Assessable CGST IGST CGST SGST CESS

SI.NO Item Description SKU Goods ID HSN Code Is Service Quantity UOM Rate Discount IGST Rate SGST Rate CESS Rate Item Total

Amount Value Rate Amount Amount Amount Amount

Redmi 11 Prime 5G

Thunder Black

1 4GB+64GB SN:40002 MZB0BS6IN 40,002 85171300 no 1 Nos 11,863.56 11,863.56 0 11,863.56 0% 9% 9% 0% 0 1,067.72 1,067.72 0 13,999

/82XC00363 IMEI:

860825054996490

Xiaomi Smart Speaker

(IR Control) Black SN:

2 37407/A2RK61575 QBH4228IN 37,407 85182190 no 1 Nos 4,694.06 4,694.06 3,000 1,694.06 0% 9% 9% 0% 0 152.47 152.47 0 1,999

IMEI:37407

/A2RK61575

Total 2 16,557.62 3,000 13,557.62 0 1,220.19 1,220.19 0 15,998

TCS 0.00

Exchange Value 0

Gift Card Redemption 0

Grand Total 15998.00

Grand Total(in words) RUPEES FIFTEEN THOUSAND NINE HUNDRED NINETY EIGHT ONLY

Total CGST Amount 1220.19

Total SGST Amount 1220.19

Total IGST Amount 0.00

Total CESS Amount 0.00

Total Invoice Value 15998.00

TCS 0.00

Grand Total 15998.00

Note:

1.Tax Collected at Source (TCS) @ rate 0.1% is collected in terms of Section 206C(1H) of the Income-tax Act,1961, wherever applicable.

2.Reverse charge is not applicable for this supply

This is a computer generated invoice, so no signature is required

Xiaomi Technology India Private Limited

Xiaomi Technology India Private Limited, Embassy Tech Village, Devarabisanahalli, Bellandur, Bengaluru, Karnataka 560103

Terms and conditions:

1. Product once sold will not be returned or exchanged Under any circumstance.

2. Please visit nearby Authorised Service centre in case of DOA for authorization and replacement.

3. Keep a copy of this invoice to claim any future serve on the product at our service centers.

4. By making this purchase, you consent to the store sharing the information provided by you with Xiaomi Technology India Private Limited.

5. You consent to Xiaomi using this information to send you any promotional offers or benefits, to send you surveys or feedback requests, or for any

other reason related to your order.

6. It is also highlighted that only active GSTINs are accepted by IRP portal for IRN generation. Thus, in case status of your GSTIN is cancelled or

inactive at the time of issuance of invoice and your GSTIN is rejected by IRP portal, we shall not be able to issue B2B invoice with IRN and QR

Code. In such scenarios, B2C invoice would be raised by us basis which you would not be eligible to avail input tax credit.

(Xiaomi Technology India Private Limited is an authorized franchise holder of Mi products.)

You might also like

- Customer Satisfaction Towards Canon ProductsDocument43 pagesCustomer Satisfaction Towards Canon ProductsAbhi Shinde80% (5)

- Business PlanDocument9 pagesBusiness PlanLeanne BallonNo ratings yet

- Tally ERP AssignmentDocument44 pagesTally ERP Assignmentvipin baidNo ratings yet

- Trends Networks Module 1Document65 pagesTrends Networks Module 1Manelyn Taga83% (6)

- Sa1215692148646210 - S080010032100227 - Nisha Goyal - 11-03-2021 2Document2 pagesSa1215692148646210 - S080010032100227 - Nisha Goyal - 11-03-2021 2nisha goyalNo ratings yet

- 522091330300079101Document2 pages522091330300079101Unique TechnicalNo ratings yet

- 522101443301961001Document2 pages522101443301961001SatyabrataNo ratings yet

- 521011660052221501Document2 pages521011660052221501Adaita Kumar RoutNo ratings yet

- 1Document2 pages1SINGHNo ratings yet

- Sa1227342006378315 - 22om27in00019015 - Jigna Parekh - 26-08-2022Document2 pagesSa1227342006378315 - 22om27in00019015 - Jigna Parekh - 26-08-2022meet AshishNo ratings yet

- d42c5b75415a4ad89dd8013c181b74afDocument2 pagesd42c5b75415a4ad89dd8013c181b74afSINGHNo ratings yet

- 522072966251135001 (2)Document2 pages522072966251135001 (2)arbazsid4No ratings yet

- MI InvoiceDocument1 pageMI InvoiceMOBILE WORLDNo ratings yet

- Mi Phone InvoiceDocument2 pagesMi Phone InvoicePrakash MuthusamyNo ratings yet

- 522092363704404601Document2 pages522092363704404601vatsal3576No ratings yet

- 24by09in00002376 - Sky Ventureszdup - 27-07-2024Document2 pages24by09in00002376 - Sky Ventureszdup - 27-07-2024skyventures.sumitNo ratings yet

- MI TV 43 InchDocument2 pagesMI TV 43 Inchharry tharunNo ratings yet

- 522102166855455201Document2 pages522102166855455201Narayana NarayanaNo ratings yet

- 522072348752678201Document2 pages522072348752678201Sanyasi JiNo ratings yet

- 523110694551223601Document2 pages523110694551223601lalitbhalla658No ratings yet

- 521033095854008301Document2 pages521033095854008301sitabehera12345678No ratings yet

- FileDocument2 pagesFilepardeep.pk89No ratings yet

- UntitledDocument2 pagesUntitledsharukNo ratings yet

- 524020641604114601Document2 pages524020641604114601sagarbhande218No ratings yet

- Sa1235552001930606 22om33in00020348 Gnanaprakasu 25-02-2023Document2 pagesSa1235552001930606 22om33in00020348 Gnanaprakasu 25-02-2023Gnanaprakasu MNo ratings yet

- Mi TrimmerDocument2 pagesMi TrimmerAmritansh SinghNo ratings yet

- 522032423512041601Document2 pages522032423512041601RAHUL MANI SINGHNo ratings yet

- 523042624952598201Document2 pages523042624952598201Ayush YadavNo ratings yet

- Mi Led TV InvoiceDocument2 pagesMi Led TV InvoiceRakesh KumarNo ratings yet

- 524012798349164001Document2 pages524012798349164001testpay6397No ratings yet

- 520120834100019101Document2 pages520120834100019101Abhishek AgarwalNo ratings yet

- Xiaomi Pad 6 DetailsDocument2 pagesXiaomi Pad 6 Detailswattefun0% (1)

- Sa1208592086840112 - S290009122001325 - Narendrababu C R - 26-12-2020Document2 pagesSa1208592086840112 - S290009122001325 - Narendrababu C R - 26-12-2020Sumithra ReddyNo ratings yet

- 1Document2 pages1Sushree sangita BarikNo ratings yet

- 523050657510169601Document2 pages523050657510169601vishalyadav5656No ratings yet

- 3Document2 pages3alvaano35No ratings yet

- 1Document2 pages1gayathri1996ganesanNo ratings yet

- InvoiceDocument1 pageInvoiceshonkusingh9211No ratings yet

- invoiceDocument1 pageinvoicesandeep.saagar05No ratings yet

- Siliguri 4Document3 pagesSiliguri 4bergerindustrial063No ratings yet

- Sa1228022004399324 - MH00862200002616 - Paramhans Stone Kala Kendra - 30-10-2022Document2 pagesSa1228022004399324 - MH00862200002616 - Paramhans Stone Kala Kendra - 30-10-2022badboyNo ratings yet

- Siliguri 3Document3 pagesSiliguri 3bergerindustrial063No ratings yet

- 522122811103146301Document2 pages522122811103146301Isha dattaniNo ratings yet

- Power BankDocument1 pagePower BankPaRtHiNo ratings yet

- Amazon 1Document1 pageAmazon 1Shivam GaneshiaNo ratings yet

- Vendor Master Registration Form: Creditor Name Payee NameDocument1 pageVendor Master Registration Form: Creditor Name Payee NameArun EthirajNo ratings yet

- Sample 00Document2 pagesSample 00advnishantbardoshiyaNo ratings yet

- 221700230274709001Document1 page221700230274709001BharathNo ratings yet

- Inalsa Garmwnt Steamer InvoiceDocument1 pageInalsa Garmwnt Steamer InvoicePawan YadavNo ratings yet

- BillDocument1 pageBillraj chopraNo ratings yet

- Amazon Mobile StandDocument1 pageAmazon Mobile Standcrownprince7263No ratings yet

- Naukri Proforma Invoice With TaxDocument2 pagesNaukri Proforma Invoice With TaxChetna AroraNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)1382aceNo ratings yet

- Tagg Verve Max IIDocument1 pageTagg Verve Max IIPixie DustNo ratings yet

- Note 10 Pro - Arjun BhallaDocument1 pageNote 10 Pro - Arjun BhallaRohan MarwahaNo ratings yet

- Tax Invoice: FromDocument1 pageTax Invoice: FromVivek BoraNo ratings yet

- POST661f9e308e987 1713348144Document1 pagePOST661f9e308e987 1713348144akass8878No ratings yet

- InvoiceDocument1 pageInvoiceSri watsa JiNo ratings yet

- 9019100097Document1 page9019100097ramanNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)akanshekNo ratings yet

- Razer Mouse InvoiceDocument1 pageRazer Mouse Invoiceaaron.gamer.3112No ratings yet

- PO-1620000792-UNL061 To Assam-Nagaland BorderDocument4 pagesPO-1620000792-UNL061 To Assam-Nagaland BorderbusinessvortexvaultNo ratings yet

- InvoiceDocument1 pageInvoicerajendrasahoo77777No ratings yet

- Unmatch Site Supplier Data - OU WiseDocument537 pagesUnmatch Site Supplier Data - OU Wiseshehzaib tariqNo ratings yet

- ArticleDocument21 pagesArticleMaykel Sanchez FloresNo ratings yet

- Article 1477Document1 pageArticle 1477MeriiiNo ratings yet

- Acc123 J&BPDocument20 pagesAcc123 J&BPCali SiobhanNo ratings yet

- Chapter 2 - Practice QuestionsDocument2 pagesChapter 2 - Practice QuestionsSiddhant AggarwalNo ratings yet

- Lect 3Document4 pagesLect 3ahmad arabiNo ratings yet

- Fi Co 1610 Fiori AppsDocument30 pagesFi Co 1610 Fiori AppsmaniaNo ratings yet

- 8 Management Accounting Practices in ManufacturingDocument69 pages8 Management Accounting Practices in ManufacturingAngel Rose Corales100% (1)

- Isc Report2a 1920Document153 pagesIsc Report2a 1920bharatgajjar0No ratings yet

- Determining The Cost of Plant Assets: 1) LANDDocument10 pagesDetermining The Cost of Plant Assets: 1) LANDShaheer KhurramNo ratings yet

- Literature Review CitationDocument3 pagesLiterature Review CitationashkNo ratings yet

- Liao v. Schedule A - ComplaintDocument13 pagesLiao v. Schedule A - ComplaintSarah BursteinNo ratings yet

- Company ProfileDocument21 pagesCompany ProfileCoping ForeverNo ratings yet

- Punyak SatishDocument1 pagePunyak Satish45Punyak SatishPGDM RMIIINo ratings yet

- BK Awb BH HPDocument6 pagesBK Awb BH HPqnhu5001No ratings yet

- Best Hashtag Guide For Your Instagram PDFDocument10 pagesBest Hashtag Guide For Your Instagram PDFhow toNo ratings yet

- A Synopsis: ON Summer Training Undertaken at Gujrani & CoDocument35 pagesA Synopsis: ON Summer Training Undertaken at Gujrani & CoRiddam SharmaNo ratings yet

- Ahmed Ramadhani DauDocument108 pagesAhmed Ramadhani DauTom JobNo ratings yet

- Plant and Equipment Wellness BookDocument118 pagesPlant and Equipment Wellness BookSushayan HunsasukNo ratings yet

- Bangladesh University of Professionals (BUP) : Research TopicDocument4 pagesBangladesh University of Professionals (BUP) : Research TopicsajibNo ratings yet

- Ugc Net Management: Unit SnapshotDocument60 pagesUgc Net Management: Unit SnapshotAbhishek gargNo ratings yet

- HPB Trafigura PRDocument2 pagesHPB Trafigura PRahmadhatakeNo ratings yet

- Report Format - OIP-2021 - Format-1Document46 pagesReport Format - OIP-2021 - Format-1Pranay Ikkurthy100% (1)

- Cover Letter IBMDocument2 pagesCover Letter IBMGautam SehgalNo ratings yet

- Bill24 06Document1 pageBill24 06DIGITAL INDIA SOLUTIONSNo ratings yet

- Rescissible Contract: Everything You Need To Know: Types of ContractsDocument17 pagesRescissible Contract: Everything You Need To Know: Types of ContractsStacy Pancho LumanogNo ratings yet