MNCS Company Updates 1H23 SMGR 10 Aug 2023 - Buy TP Rp8,450

MNCS Company Updates 1H23 SMGR 10 Aug 2023 - Buy TP Rp8,450

Uploaded by

Jason SebastianCopyright:

Available Formats

MNCS Company Updates 1H23 SMGR 10 Aug 2023 - Buy TP Rp8,450

MNCS Company Updates 1H23 SMGR 10 Aug 2023 - Buy TP Rp8,450

Uploaded by

Jason SebastianOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

MNCS Company Updates 1H23 SMGR 10 Aug 2023 - Buy TP Rp8,450

MNCS Company Updates 1H23 SMGR 10 Aug 2023 - Buy TP Rp8,450

Uploaded by

Jason SebastianCopyright:

Available Formats

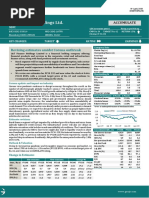

EQUITY RESEARCH - MNCS COMPANY UPDATES

Basic Materials – August 10, 2023

PT Semen Indonesia Tbk (SMGR IJ)

BUY I TP : IDR8,450 Expecting Better Performance in 2H23

1H23 results: growth still secured amid cost pressures

SMGR Stock Price Data

SMGR booked a revenue of IDR17.0tn in 1H23 or grew 2.0% YoY (vs IDR16.1tn in 1H22),

Last Price : IDR6,850 reflecting 44.2%/44.0% from MNCS/consensus targets. Sales volume was stable at 17.9mn

52wk High : IDR8,300 tons, bolstered by increased regional sales which improved 21.8% YoY. On the other

hand, domestic sales slowed down by -4.3% YoY on the back lower 2Q23 sales as there

52wk Low : IDR5,625

were fewer working days during that period (both Eid-al-Fitr and Eid-al-Adha fell on

Share Out : 5.9bn 2Q23). The cost of revenue jumped 5.9% YoY to IDR12.6tn (vs IDR11.9tn in 1H22), as a

Market Cap : IDR40.6tn result of inflated costs such as: 1) raw materials (+11.9% YoY); and 2) fuel and energy

(+7.0% YoY). Notwithstanding, SMGR was able to minimize their opex by -9.5% YoY down

to IDR2.8tn (vsIDR2.5tn in 1H22). Net profit came in at IDR866.2bn or increased 3.1% YoY

SMGR Stock Price Performance

(vs IDR840.1bn in 1H22), reflecting 32.3%/30.9% from MNCS target/consensus estimates.

1-Day : -2.92%

1-Week : +2.56%

Sales volume expected to improve in 2H23

We estimate SMGR’s sales volume to reach the level of ~38mn tons in FY23E, based on

1-Month : +1.53%

our assessment of the property sector which is to remain stable in FY23E, with properties’

3-Month : +11.76% marketing sales to at least match its FY22 levels. Within 10 months, the inflation rate has

Year-to-Date : +1.14%

subsided to 3.52% in Jun-23 (vs 5.95% in Sep-22) and this progression is viewed to induce

BI’s rate cutting soon from its current 5.75% 7DRR. This is likely to spark positive

sentiments for the bag market. Aside from that, the government’s target of the

Shareholders finalization of 58 strategic national projects (PSN) with a contract outstanding of IDR420tn

Government : 51.2%

up to FY24F acts as an insurance for SMGR’s bulk market demand. Furthermore, El Nino is

also poised to bring conducive climate for construction works, implying a much seamless

Public (<5%) : 48.8%

cement inventory turnover within the sector.

Prudent interest-bearing debt management

As of the 1H23, the total interest-bearing debt stood at IDR16.3tn, reflecting a decrease

of 3.1% when compared to the position in FY22. This reduction was a result of the

company's repayment of a portion of its long-term bank loan. The makeup of the total

interest-bearing debt consisted of 50.3% from bank loans, 30.4% from corporate bonds,

4.9% from lease liabilities, and 14.4% from temporary syirkah funds. The Net Debt to

Equity ratio experienced a slight uptick of 0.03x, while the Net Debt to EBITDA ratio saw a

reduction of -0.09x during the 1H23 in comparison to the FY22 position. This decrease

was aligned with the lower interest-bearing debt. Furthermore, the EBITDA to Interest

ratio increased by 0.36x, reflecting a correlation with the diminished interest expense -

8.1%.

Valuation and Recommendation: BUY with a TP IDR8,450

We believe demand for SMGR cement will increase moderately and the up-trend of ASP

will be limited, supported by higher infrastructure. However the main concern of

oversupply is still intact. Thus, we give a BUY recommendation with a target price (TP)

of Rp8,450 per share for the next 12 months, indicating +23.3% potential upside. Our

valuation implies 16.5x/14.3x of PE in FY23E/FY24F.

Key Financial Highlight FY20 FY21 FY22 FY23E FY24F

Revenue (IDR Bn) 35,171.7 36,702.3 36,378.6 38,565.4 39,739.5

EBITDA (IDR Bn) 10,062.4 8,465.4 7,790.6 8,768.7 8,974.8

EBITDA Margin (%) 28.6 23.1 21.4 22.7 22.6

Net Income (IDR Bn) 2,792.3 2,046.7 2,364.8 2,681.7 3,107.2

ROA (%) 3.4 2.5 2.9 3.3 3.9

ROE (%) 7.2 4.8 5.0 6.0 6.7

Research Analyst PE (x) 14.6 19.9 17.2 16.5 14.3

M. Rudy Setiawan PBV (x) 1.0 0.9 0.9 1.0 1.0

muhamad.setiawan@mncgroup.com

Sources : Bloomberg, MNCS Research

MNCS Research Division Page 1

EQUITY RESEARCH - MNCS COMPANY UPDATES

Automotive

Basic Materials – August

– August

Sector 10,

- June 01,

08,20232023

2023

Exhibit 01. SMGR’s 1H23 net income results was below MNCS/consensus estimates

1H23 1H22 YoY MNCS Cons. MNCS % Cons.%

Revenue 17,031.8 16,700.9 2.0% 38,565.4 38,679.4 44.2% 44.0%

COGS 12,615.9 11,916.5 5.9%

Op.Profit 1,877.3 2,066.7 -9.2% 4,875.0 4,935.6 38.5% 38.0%

Op. Margin 11.0% 12.4%

PBT 1,305.3 1,352.4 -3.5% 3,539.9 3,934.9 36.9% 33.2%

Net Income 866.2 840.1 3.1% 2,681.7 2,807.5 32.3% 30.9%

Net Margin 5.1% 5.0%

Sources : Company, Bloomberg, MNCS

Exhibit 02. SMGR sales volume, ASP and cost in FY21-FY24F

ASP (IDR k-lhs) Fuel and energy cost per ton (IDR k-lhs) Volume (mn tons-rhs)

1,200 43

42

1,000

41

800 40

39

600

38

400 37

36

200

35

- 34

FY21 FY22 FY23E FY24F

Sources : Company, MNCS

Exhibit 03. SMGR’s Currently Trading Near at -1 STD (5-Year Average) at 17.9x PE band

P/E Mean STD-1 STD-2 STD+1 STD+2

40

35

30

25

20

15

10

Sources : Bloomberg, MNCS

MNCS Research Division Page 2

EQUITY RESEARCH - MNCS COMPANY UPDATES

Basic Materials

Automotive – August

Sector - June10,

12,2023

2023

Exhibit 04. Financial Projections

Income Statement Balance Sheet

in Billion IDR FY20 FY21 FY22 FY23E FY24F in Billion IDR FY20 FY21 FY22 FY23E FY24F

Revenue 35,171.7 36,702.3 36,378.6 38,565.4 39,739.5 Cash & Equivalents 3,269.1 2,955.0 6,007.3 4,750.3 5,308.8

COGS (23,347.6) (24,975.6) (25,701.0) (27,119.8) (28,051.1) Trade Receivables 5,926.6 5,690.9 5,521.3 6,022.5 5,879.3

Gross Profit 11,824.0 11,726.7 10,677.6 11,445.6 11,688.4 Inventory 4,751.4 4,848.5 5,610.2 5,126.8 5,343.9

Others 2,344.0 2,691.1 1,740.1 1,808.3 1,823.5

Selling Expense (3,009.8) (3,297.0) (2,954.3) (3,149.9) (3,182.9) Current Assets 16,291.1 16,185.5 18,879.0 17,707.9 18,355.4

Fixed Assets - net 60,282.2 58,839.1 57,806.0 56,012.3 54,283.4

G&A Expense (3,161.6) (3,193.5) (3,154.2) (3,453.3) (3,294.8)

Other 6,624.6 6,741.7 6,275.0 6,570.0 6,631.9

Operating Income 5,652.7 5,236.1 4,569.1 4,842.3 5,210.7

Non-Current Assets 66,906.8 65,580.8 64,081.0 62,582.2 60,915.3

TOTAL ASSETS 83,198.0 81,766.3 82,960.0 80,290.1 79,270.7

Finance Cost (Income) (2,106.7) (1,637.4) (1,329.0) (1,312.5) (1,116.1)

Other income Trade Payables 6,797.9 7,855.3 8,095.9 7,669.8 6,148.2

(Expense) (57.3) (61.1) 58.7 10.0 6.9

Short-term Debt 2,575.8 3,984.3 1,274.5 3,326.3 3,011.3

Other 2,975.3 2,792.6 3,690.6 3,742.1 3,753.6

Profit Before Tax 3,488.7 3,537.7 3,298.8 3,539.9 4,101.5

Current Liabilities 12,349.0 14,632.2 13,061.0 14,738.2 12,913.1

Tax Income (Expense) (814.3) (1,420.5) (799.8) (858.2) (994.3) Long-term Debt 24,887.8 16,388.3 15,526.9 13,681.9 12,386.2

Minority Interest 118.0 (70.5) (134.2) - - Other 7,217.0 7,870.8 7,132.7 7,378.7 7,398.3

Net Income 2,792.3 2,046.7 2,364.8 2,681.7 3,107.2 LT-Liabilities 32,104.8 24,259.1 22,659.6 21,060.5 19,784.5

Total Equity 38,744.1 42,875.0 47,239.4 44,491.3 46,573.1

EPS (IDR) 470.7 345.0 398.6 414.0 479.7 TOTAL LIA & EQUITY 83,198.0 81,766.3 82,960.0 80,290.1 79,270.7

Cash Flow Ratios

in Billion IDR FY20 FY21 FY22 FY23E FY24F FY20 FY21 FY22 FY23E FY24F

Net Income 2,792.3 2,046.7 2,364.8 2,681.7 3,107.2 Revenue Growth (%) (12.9) 4.4 (0.9) 6.0 3.0

D&A 4,414.2 3,257.6 3,165.1 3,893.7 3,728.9 Operating Profit Growth (%) (8.7) (7.8) (11.2) 5.4 7.6

Changes in WC 1,581.6 1,196.0 (351.5) (443.8) (1,595.5) Net Profit Growth (%) 16.7 (26.7) 15.5 13.4 15.9

Change in others (132.7) (551.1) 226.5 (16.7) (3.7)

Operating CF 8,655.4 5,949.2 5,404.9 6,114.8 5,236.8 Current Ratio (%) 131.9 110.6 144.5 120.1 142.1

Receivable Days (x) 61.5 56.6 44.0 57.0 54.0

Capex (8,094.7) (1,956.6) (2,133.1) (2,100.0) (2,000.0) Inventory Days (x) 74.3 70.9 64.0 69.0 69.5

Others (1,114.1) 10.9 1,896.8 (294.9) (61.9) Payable Days (x) 106.3 114.8 117.0 103.2 80.0

Investing CF (9,208.7) (1,945.6) (236.3) (2,394.9) (2,061.9) Net Gearing Ratio (x) 0.6 0.4 0.2 0.3 0.2

DER (x) 0.7 0.5 0.4 0.4 0.3

Dividend Paid (239.2) (1,116.9) (1,024.1) (938.6) (1,025.4) Interest Coverage (x) 2.4 2.9 3.2 3.1 3.9

Net Change in Debt (2,578.3) (7,091.0) (3,571.3) 206.8 (1,610.6)

Equity Fund Raised 587.0 2,159.4 4,970.6 (4,491.1) - Dividend Yield (%) 0.6 2.7 2.5 2.1 2.3

Others 2,102.5 1,730.7 (2,491.6) 245.9 19.6 Gross Profit Margin (%) 33.6 32.0 29.4 29.7 29.4

Financing CF (128.0) (4,317.8) (2,116.3) (4,977.0) (2,616.4) Operating Profit Margin (%) 16.1 14.2 12.7 12.6 13.2

EBITDA Margin (%) 28.6 23.1 21.4 22.7 22.6

Cash at Beginning 3,950.4 3,269.1 2,955.0 6,007.3 4,750.3 Net Income Margin (%) 7.9 5.6 6.5 7.0 7.8

Cash at Ending 3,269.1 2,955.0 6,007.3 4,750.3 5,308.8 BVPS (IDR) 6,531.2 7,227.6 7,963.3 6,868.2 7,189.5

Sources : Company, MNCS

MNCS Research Division Page 3

EQUITY RESEARCH - MNCS COMPANY UPDATES

Basic Materials

Automotive – August

Sector - June10,

12,2023

2023

MNC Research Industry Ratings Guidance

OVERWEIGHT : Stock's total return is estimated to be above the average total return of our industry coverage

universe over next 6-12 months

NEUTRAL : Stock's total return is estimated to be in line with the average total return of our industry coverage

universe over next 6-12 months

UNDERWEIGHT : Stock's total return is estimated to be below the average total return of our industry coverage

universe over next 6-12 months

MNC Research Investment Ratings Guidance

BUY : Share price may exceed 10% over the next 12 months

HOLD : Share price may fall within the range of +/- 10% of the next 12 months

SELL : Share price may fall by more than 10% over the next 12 months

Not Rated : Stock is not within regular research coverage

PT MNC SEKURITAS

MNC Financial Center Lt. 14 – 16

Jl. Kebon Sirih No. 21 - 27, Jakarta Pusat 10340

Telp : (021) 2980 3111

Fax : (021) 3983 6899

Call Center : 1500 899

Disclaimer

This research report has been issued by PT MNC Sekuritas, It may not be reproduced or further distributed or published, in whole or in part, for any

purpose. PT MNC Sekuritas has based this document on information obtained from sources it believes to be reliable but which it has not

independently verified; PT MNC Sekuritas makes no guarantee, representation or warranty and accepts no responsibility to liability as to its accuracy

or completeness. Expression of opinion herein are those of the research department only and are subject to change without notice. This document is

not and should not be construed as an offer or the solicitation of an offer to purchase or subscribe or sell any investment. PT MNC Sekuritas and its

affiliates and/or their offices, director and employees may own or have positions in any investment mentioned herein or any investment related

thereto and may from time to time add to or dispose of any such investment. PT MNC Sekuritas and its affiliates may act as market maker or have

assumed an underwriting position in the securities of companies discusses herein (or investment related thereto) and may sell them to or buy them

from customers on a principal basis and may also perform or seek to perform investment banking or underwriting services for or relating to those

companies.

MNCS Research Division Page 4

You might also like

- U660 AtsgDocument63 pagesU660 Atsgevgeny91% (57)

- Fd60 2 Fd100 2 ServiceDocument114 pagesFd60 2 Fd100 2 ServicePyae Phyoe Aung78% (9)

- KUDA Draft Master Plan Zoning Regulations in Tabular FormDocument149 pagesKUDA Draft Master Plan Zoning Regulations in Tabular Formvish_sista100% (2)

- Anand Rural Electrification Corp Buy 25oct10Document2 pagesAnand Rural Electrification Corp Buy 25oct10bhunkus1327No ratings yet

- Bank Mandiri: Equity ResearchDocument5 pagesBank Mandiri: Equity ResearchAhmad SantosoNo ratings yet

- BUY TP: IDR1,700: Bank Tabungan NegaraDocument6 pagesBUY TP: IDR1,700: Bank Tabungan NegaraAl VengerNo ratings yet

- ITMGDocument5 pagesITMGjovalNo ratings yet

- Cams MoslDocument10 pagesCams MoslManish KalraNo ratings yet

- AmInv 95622347Document5 pagesAmInv 95622347Lim Chau LongNo ratings yet

- Research ReportsDocument10 pagesResearch Reportssrinath kNo ratings yet

- PTPP Targeting-National-Strategic-Project-PSN-Contracts 20211122 NHKSI Company ReportDocument6 pagesPTPP Targeting-National-Strategic-Project-PSN-Contracts 20211122 NHKSI Company ReportatanmasriNo ratings yet

- SMGR 111124 PtosDocument6 pagesSMGR 111124 PtosjenniferNo ratings yet

- Zensar Technologies (ZENT IN) : Q3FY19 Result UpdateDocument8 pagesZensar Technologies (ZENT IN) : Q3FY19 Result Updatesaran21No ratings yet

- ICICI Securities Kotak Bank Q3FY23 Results ReviewDocument21 pagesICICI Securities Kotak Bank Q3FY23 Results ReviewAmey WadajkarNo ratings yet

- Indopremier Sector Update 3Q23 Property 10 Nov 2023 Maintain OverweightDocument7 pagesIndopremier Sector Update 3Q23 Property 10 Nov 2023 Maintain Overweightbotoy26No ratings yet

- Investor Digest Pusat 28 Februari 2023Document10 pagesInvestor Digest Pusat 28 Februari 2023ALAMSYAH FormalNo ratings yet

- SAWAD230228RDocument8 pagesSAWAD230228RsozodaaaNo ratings yet

- ICICI_Securities_sees_2%_DOWNSIDE_in_Pidilite_Industries_In_lineDocument4 pagesICICI_Securities_sees_2%_DOWNSIDE_in_Pidilite_Industries_In_lineprashant PujariNo ratings yet

- Mirae Asset Sekuritas Indonesia Indocement Tunggal PrakarsaDocument7 pagesMirae Asset Sekuritas Indonesia Indocement Tunggal PrakarsaekaNo ratings yet

- Ramco Cement Q2FY24 ResultsDocument8 pagesRamco Cement Q2FY24 ResultseknathNo ratings yet

- Bajaj Finance Sell: Result UpdateDocument5 pagesBajaj Finance Sell: Result UpdateJeedula ManasaNo ratings yet

- ICICI - Piramal PharmaDocument4 pagesICICI - Piramal PharmasehgalgauravNo ratings yet

- 7204 D&O KENANGA 2023-08-24 SELL 2.30 DOGreenTechnologiesSluggishNewOrders - 167722211Document4 pages7204 D&O KENANGA 2023-08-24 SELL 2.30 DOGreenTechnologiesSluggishNewOrders - 167722211Nicholas ChehNo ratings yet

- BTPS Initiation Coverage Mirae Sekuritas - 230822 - 085823Document30 pagesBTPS Initiation Coverage Mirae Sekuritas - 230822 - 085823Ricky KurniawanNo ratings yet

- Can Fin Homes Ltd-4QFY23 Result UpdateDocument5 pagesCan Fin Homes Ltd-4QFY23 Result UpdateUjwal KumarNo ratings yet

- SMBR PDFDocument5 pagesSMBR PDFAulia Hamdani FeizalNo ratings yet

- ReportDocument10 pagesReportarun_algoNo ratings yet

- DRC 20230717 EarningsFlashDocument5 pagesDRC 20230717 EarningsFlashnguyenlonghaihcmutNo ratings yet

- Mirae Company Analysis 3Q23 KLBF 8 Nov 2023 Remain Hold Cut TP Rp1Document10 pagesMirae Company Analysis 3Q23 KLBF 8 Nov 2023 Remain Hold Cut TP Rp1Jason SebastianNo ratings yet

- PB Fintech Icici SecuritiesDocument33 pagesPB Fintech Icici SecuritieshamsNo ratings yet

- L&T Finance Holdings - GeojitDocument4 pagesL&T Finance Holdings - GeojitdarshanmadeNo ratings yet

- JSMR 17oct19 Rev.18 10 2019 - 02 53 53 - F45RbDocument31 pagesJSMR 17oct19 Rev.18 10 2019 - 02 53 53 - F45RbBovanantoo RuslanNo ratings yet

- ADRO IJ - MNC Sekuritas Update Report (13032023)Document5 pagesADRO IJ - MNC Sekuritas Update Report (13032023)Irwan SukmaNo ratings yet

- Pra Tinjau SahamDocument8 pagesPra Tinjau SahamADE CHANDRANo ratings yet

- Indofood Sukses Makmur TBK (INDF IJ) : Strong Performance From All SegmentsDocument6 pagesIndofood Sukses Makmur TBK (INDF IJ) : Strong Performance From All SegmentsPutu Chantika Putri DhammayantiNo ratings yet

- V Guard Industries Q3 FY22 Results PresentationDocument17 pagesV Guard Industries Q3 FY22 Results PresentationRATHINo ratings yet

- Vip 27 1 23 PLDocument6 pagesVip 27 1 23 PLJohn SukumarNo ratings yet

- Ambuja Cement (ACEM IN) : Q3CY20 Result UpdateDocument6 pagesAmbuja Cement (ACEM IN) : Q3CY20 Result Updatenani reddyNo ratings yet

- File 1686286056102Document14 pagesFile 1686286056102Tomar SahaabNo ratings yet

- Idfc (Idfc) : Strong Growth Ahead, Dilution ExpectedDocument7 pagesIdfc (Idfc) : Strong Growth Ahead, Dilution ExpectedKaushal KumarNo ratings yet

- GRUH-Finance-Limited 204 QuarterUpdateDocument10 pagesGRUH-Finance-Limited 204 QuarterUpdatevikasaggarwal01No ratings yet

- 3M India: Strong Recovery in Healthcare Safety & Industrials Continue To UnderperformDocument7 pages3M India: Strong Recovery in Healthcare Safety & Industrials Continue To UnderperformJayendra KulkarniNo ratings yet

- 3M India Q4FY21 ResultsDocument7 pages3M India Q4FY21 ResultsdarshanmaldeNo ratings yet

- 1.7. FABSecurities Lowerexpensesonadvertisementandpromotionaloffersboostedprofit Oct 13 2023Document5 pages1.7. FABSecurities Lowerexpensesonadvertisementandpromotionaloffersboostedprofit Oct 13 2023robynxjNo ratings yet

- Mirae Asset Sekuritas Indonesia INDF 2 Q23 Review A86140c7a2Document8 pagesMirae Asset Sekuritas Indonesia INDF 2 Q23 Review A86140c7a2Dhanny NuvriyantoNo ratings yet

- Press Release Results q3 2022-23Document5 pagesPress Release Results q3 2022-23ak4442679No ratings yet

- Verdhana_Banks_BTPS_4Q21Result_220214Document5 pagesVerdhana_Banks_BTPS_4Q21Result_220214sampahemailihNo ratings yet

- 7204 - D&O - PUBLIC BANK - 2023-08-24 - BUY - 4.37 - DOGreenTechnologiesExpectingaVShapeRecovery - 1840691060Document5 pages7204 - D&O - PUBLIC BANK - 2023-08-24 - BUY - 4.37 - DOGreenTechnologiesExpectingaVShapeRecovery - 1840691060Nicholas ChehNo ratings yet

- Q3 Fy20 BKTDocument14 pagesQ3 Fy20 BKTsam662223No ratings yet

- Press Release Arman Q3FY21Document5 pagesPress Release Arman Q3FY21Forall PainNo ratings yet

- Equity Research HDFCDocument7 pagesEquity Research HDFCKanika SohilNo ratings yet

- Slowing Growth: Results Review 3qfy17 13 FEB 2017Document10 pagesSlowing Growth: Results Review 3qfy17 13 FEB 2017arun_algoNo ratings yet

- ICICI Securities Suryoday Q2FY23 ResultsDocument10 pagesICICI Securities Suryoday Q2FY23 ResultsDivy JainNo ratings yet

- SMGR Ugrade - 4M17 Sales FinalDocument4 pagesSMGR Ugrade - 4M17 Sales FinalInna Rahmania d'RstNo ratings yet

- BNIS Short Notes: Under-Appreciated Gold AssetDocument4 pagesBNIS Short Notes: Under-Appreciated Gold AssetfirmanNo ratings yet

- Indsec ABFRL Q1 FY'21Document9 pagesIndsec ABFRL Q1 FY'21PriyankaNo ratings yet

- BVSC+-+Update+Report+DRC+10 2019Document12 pagesBVSC+-+Update+Report+DRC+10 2019acc1qhuyNo ratings yet

- Trimegah CF 20231124 ASII - A Mid-2024 PlayDocument12 pagesTrimegah CF 20231124 ASII - A Mid-2024 PlayMuhammad ErnandaNo ratings yet

- Suzlon Energy: Momentum Building UpDocument9 pagesSuzlon Energy: Momentum Building Uparun_algoNo ratings yet

- Bhansali Engineering Polymers - 34 AGM HighlightsDocument4 pagesBhansali Engineering Polymers - 34 AGM HighlightsAbhinav SrivastavaNo ratings yet

- BBNI Backed by Infrastructure Loan Disbursement - 20170718 - NHKS - Company Update 2Q17 (English)Document5 pagesBBNI Backed by Infrastructure Loan Disbursement - 20170718 - NHKS - Company Update 2Q17 (English)Anonymous XoUqrqyuNo ratings yet

- 141342112021251larsen Toubro Limited - 20210129Document5 pages141342112021251larsen Toubro Limited - 20210129Michelle CastelinoNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Design and Analysis of Gating System For SB-CNC Tail Stock Base CastingDocument5 pagesDesign and Analysis of Gating System For SB-CNC Tail Stock Base CastingtabibkarimNo ratings yet

- 2019 Performance Analysis and Optimization of Next Generation Wireless NetworksDocument201 pages2019 Performance Analysis and Optimization of Next Generation Wireless NetworksArun MozhiNo ratings yet

- KR 6 R900 Sixx: Workspace GraphicDocument1 pageKR 6 R900 Sixx: Workspace GraphicMarwa AlFaouriNo ratings yet

- Amber Coffee Shop MenuDocument7 pagesAmber Coffee Shop MenuRGiteya0% (1)

- SoPs Water Trucking V1 18 Dec 2024Document9 pagesSoPs Water Trucking V1 18 Dec 2024xb724No ratings yet

- Examination For The Private Pilot Licence Subject: Aerodynamics / Principle of FlightDocument4 pagesExamination For The Private Pilot Licence Subject: Aerodynamics / Principle of FlightFlorianus AdelNo ratings yet

- MCN Lect Module 2.5 Complications of Labor and Birth 4Document6 pagesMCN Lect Module 2.5 Complications of Labor and Birth 4AmethystNo ratings yet

- Mitosis Through Microscope Science 2003Document7 pagesMitosis Through Microscope Science 2003Fran IgarzabalNo ratings yet

- Report ModifiedDocument4 pagesReport ModifiedHARSH KUMARNo ratings yet

- Microsoft Word - Ma Loi Xe U CodeDocument14 pagesMicrosoft Word - Ma Loi Xe U CodeĐiện Ôtô TraiNingNo ratings yet

- About TellusDocument54 pagesAbout Tellusabeldiaz7No ratings yet

- Congruency Effect of Presentation Modality On False Recognition of Haptic and Visual ObjectsDocument9 pagesCongruency Effect of Presentation Modality On False Recognition of Haptic and Visual ObjectsKentNo ratings yet

- Ultra Mag Electromagnetic Flow Meter: Installation, Operation and Maintenance ManualDocument23 pagesUltra Mag Electromagnetic Flow Meter: Installation, Operation and Maintenance ManualSalvador HernándezNo ratings yet

- The Company of Fiends Tempting Monsters Book 2 by KathrynDocument475 pagesThe Company of Fiends Tempting Monsters Book 2 by KathrynCamila LunaNo ratings yet

- A Review of Monitoring in Mining Areas Current Status and FutureDocument14 pagesA Review of Monitoring in Mining Areas Current Status and FutureAlireza RastegarNo ratings yet

- 8000 Series XVR Quick Start GuideDocument16 pages8000 Series XVR Quick Start GuidearsanofficNo ratings yet

- GOWERS Trees and Family Trees in The Aeneid Ca - 2011 - 30 - 1 - 87Document32 pagesGOWERS Trees and Family Trees in The Aeneid Ca - 2011 - 30 - 1 - 87katzbandNo ratings yet

- Frialoc 3RDocument0 pagesFrialoc 3RThuc TruongNo ratings yet

- Math Paper Class 9Document4 pagesMath Paper Class 9Mantu DasNo ratings yet

- 'Rubber Material' Discovered That Could Lead To Scratch-Proof Paint For CarDocument2 pages'Rubber Material' Discovered That Could Lead To Scratch-Proof Paint For CarMatejŠarlijaNo ratings yet

- Chapter 6 Life Processes For Class 10 BiologyDocument15 pagesChapter 6 Life Processes For Class 10 BiologyKhushi RochwaniNo ratings yet

- FoodDocument10 pagesFoodminhthaonguyenNo ratings yet

- Utilities Size DistributionDocument3 pagesUtilities Size Distributionsnarf273No ratings yet

- The Manvantara DiagramDocument1 pageThe Manvantara DiagramAcharla SatyanarayanaNo ratings yet

- Anti-Slint 67500Document1 pageAnti-Slint 67500Shahrul Azmir ZamaniNo ratings yet

- PROJECT STANDARDS and SPECIFICATIONS Personnel Safety Protective Equipment Rev01Document14 pagesPROJECT STANDARDS and SPECIFICATIONS Personnel Safety Protective Equipment Rev01hiyeonNo ratings yet

- Ocean's BasinDocument31 pagesOcean's Basingene roy hernandezNo ratings yet