Income Tax Deductions List - Section 80C To 80U Deductions FY 2023-24 (AY 2024-25) - Tax2win

Income Tax Deductions List - Section 80C To 80U Deductions FY 2023-24 (AY 2024-25) - Tax2win

Uploaded by

Saidas VengurlekarCopyright:

Available Formats

Income Tax Deductions List - Section 80C To 80U Deductions FY 2023-24 (AY 2024-25) - Tax2win

Income Tax Deductions List - Section 80C To 80U Deductions FY 2023-24 (AY 2024-25) - Tax2win

Uploaded by

Saidas VengurlekarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Income Tax Deductions List - Section 80C To 80U Deductions FY 2023-24 (AY 2024-25) - Tax2win

Income Tax Deductions List - Section 80C To 80U Deductions FY 2023-24 (AY 2024-25) - Tax2win

Uploaded by

Saidas VengurlekarCopyright:

Available Formats

Products Tools Knowledge Center Guides Pricing Contact Log In Sign Up

Maximize Your Income Tax Refund

File Your Taxes with the Experts

Start Today

Home Income Tax Income Tax Deductions Income Tax Deductions List - Section 80C to 80U Deductions FY 2023-24 (AY 2024-25)

Income Tax Deductions List:

Deductions on Section 80C,

80CCC, 80CCD & 80D - FY 2023-24

(AY 2024-25)

Updated on: 26 Jun, 2024 12:36 PM

deduction under chapter vi a, chapter vi a deductions, deductions under sec 80c to 80u,

income tax deduction list

The Income Tax Department, recognizing the significance of fostering savings and investments, has

incorporated a comprehensive set of income tax deductions under Chapter VI A of the Income Tax Act.

While deduction under 80C stands out as a widely known provision, several other deductions exist,

providing taxpayers with opportunities to strategically reduce their tax liabilities. These deductions

under section 80C to 80U serve as powerful incentives, allowing individuals to optimize their financial

planning and contribute to the nation's economic growth. In this article, we will present the 80C

deduction list as well as discuss in detail the chapter VI A deductions.

Contents

What is Income Tax Deduction under Chapter VI A of Income Tax Act?

Section 80 Deduction List - Who can Claim Income Tax Deductions?

Investments that Qualify for Deductions under Section 80C

Expenses that Qualify for Tax Deductions under Section 80C

Features of Income Tax Deduction u/s 80

FAQs on Deductions Under Sections 80C to 80U?

What is Income Tax Deduction under Chapter

VI A of Income Tax Act?

Income Tax Deduction under Chapter VIA of Income Tax Act refers to a reduction in the taxable income

of an individual or a business entity, which results in a lower tax liability. The Indian Income Tax Act

provides for various deductions under sections 80C to 80U, which can be claimed by an individual or a

business entity while calculating their taxable income.

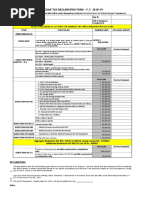

Let us take an example of tax saving for individuals with yearly salaries up to 20 lakhs.

Tax saving calculation for yearly income-20 lakhs

Gross Salary 2,000,000

Less:

HRA 200,000

LTA 40,000

Reimbursements 24,500

Children education and hostel allowance 9,600

Standard Deduction 50,000

Professional Tax 2400

Taxable Salary Income

Less: Deductions

80C (Refer Note below) 150,000

80D 50,000

80E 22,000

Net Taxable Income 14,51,500

Tax on the above income 2,57,868

Rebate u/s 87A Not applicable

Total Tax 2,57,868

Apart from this, you can also claim these tax deductions if eligible:

Interest on home loan EMIs under Section 24b -2,00,000

Principal amount of the home loan under section 80EEA -1,50,000

National Pension Scheme (NPS) investments u/s 80CCD(1B) -50,000

Section 80 Deduction List - Who can Claim

Income Tax Deductions?

Only eligible taxpayers can claim these deductions in their income tax returns. Such eligible taxpayers

have been specified under various sections of the Act. It is pertinent to note that the taxpayers who opt

to pay tax under the new tax regime can claim only deductions under sections 80CCD(2) and 80JJAA.

Income tax deduction needs to be claimed at the time of filing your Income Tax Return, and no

separate disclosure compliances are required for claiming such deductions. The number of deductions

should be reduced from the gross income to reach the taxable amount.

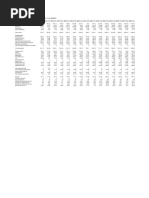

Sections Income Tax Deduction for FY Eligible person Maximum

2023-24(AY 2024-25) deduction

available for

FY 2023-24(AY

2024-25)

Section Investing into very common and Individual Upto Rs

80C popular investment options like Or 1,50,000

LIC, PPF, Sukanya Samriddhi HUF

Account, Mutual Funds, FD,

child tuition fee, ULIP, etc

Section Investment in Pension Funds Individuals

80CCC

Section Atal Pension Yojana and Individuals

80CCD (1) National Pension Scheme

Contribution

Section Atal Pension Yojana and Individuals Upto Rs 50,000

80CCD(1B) National Pension

SchemeContribution (additional

deduction)

Section National Pension Individuals Amount

80CCD(2) SchemeContribution by Contributed

Employer or

14% of Basic

Salary +

Dearness

Allowance (in

case the

employer is

Government)

10% of Basic

Salary+

Dearness

Allowance(in

case of any

other employer)

- Whichever is

lower

Section Medical Insurance Premium, Individual Upto Rs

80D preventive health checkup and Or 1,00,000

Medical Expenditure HUF

Section Medical Treatment of a Individual Normal

80DD Dependent with Disability Or Disability

HUF (atleast 40% or

more but less

than 80%): Rs

75000/-

Severe

Disability

(atleast 80% or

more) : Rs

125000/-

Section Medical expenditure for Individual Senior Citizens:

80DDB treatment of Specified Diseases Or Upto Rs

HUF 1,00,000

Others: Upto

Rs 40,000

Section Interest paid on Loan taken for Individual No limit (Any

80E Higher Education amount of

interest paid on

education

loan)upto 8

assessment

years

Section Interest paid on Housing Loan Individual Upto Rs 50,000

80EE subject to some

conditions

Section Interest Paid on Housing Loan Individual Upto Rs

80EEA 1,50,000/-

subject to some

conditions

Section Interest paid on Electric Vehicle Individual Upto Rs

80EEB Loan 1,50,000

subject to some

conditions

Section Donation to specified All Assessee 100% or 50% of

80G funds/institutions. Institutions (Individual, HUF, the Donated

Company, etc) amount or

Qualifying limit,

Allowed

donation in

cash upto

Rs.2000/-

Section Income Tax Deduction for Individual Rs. 5000 per

80GG House Rent Paid month

25% of

Adjusted Total

Income

Rent paid -

10% of

Adjusted Total

Income

- whichever is

lower

Section Donation to Scientific Research All assessees 100% of the

80GGA & Rural Development except those who amount

have an income donated.

(or loss) from a Allowed

business and/or a donations in

profession cash upto

Rs.10,000/-

Section Contribution to Political Parties Companies 100% of the

80GGB amount

contributed

No deduction

available for the

contribution

made in cash

Section Individuals on contribution to Individual 100% of the

80GGC Political Parties HUF amount

AOP contributed.

BOI No deduction

Firm available for the

contribution

made in cash

Section Royalty on Patents Individuals (Indian Rs.3,00,000/-

80RRB citizen or foreign Or

citizen being Specified

resident in India) Income

- whichever is

lower

Section Royalty Income of Authors Individuals (Indian Rs.3,00,000/-

80QQB citizen or foreign Or

citizen being Specified

resident in India) Income

- whichever is

lower

Section Interest earned on Savings Individual Upto Rs

80TTA Accounts Or 10,000/-

HUF (except

senior citizen)

Section Interest Income earned on Individual (60 yrs Upto Rs

80TTB deposits(Savings/ FDs) or above) 50,000/-

Section Disabled Individuals Individuals Normal

80U Disability: Rs.

75,000/-

Severe

Disability: Rs.

1,25,000/-

If you want to know about more such tax-saving options and want to maximize your tax refund,

file your ITR with Tax2win’s tax experts and never fall prey to penalties.

Investments that Qualify for Deductions under

Section 80C

Tax saving options under Section 80C

There are several options you can choose to save tax under Section 80C of the Income Tax Act. The

Income Tax deduction list include:

1. Equity Linked Saving Scheme (ELSS)

2. National Pension Scheme (NPS)

3. Unit Linked Insurance Plan (ULIP)

4. Public Provident Fund (PPF)

5. Sukanya Samriddhi Yojana (SSY)

6. National Savings Certificate (NSC)

7. Fixed Deposit (FD)

8. Employee Provident Fund (EPF)

Please note that these benefits are available if you have chosen the “Old Tax Regime.”

Expenses that Qualify for Tax Deductions

under Section 80C

Life Insurance Premiums

Employee Provident Fund (EPF) contributions

Public Provident Fund (PPF) investments

National Savings Certificate (NSC) investments

Equity-Linked Savings Scheme (ELSS) investments

Sukanya Samriddhi Yojana (SSY) investments

5-Year Fixed Deposit with Banks

Senior Citizens Savings Scheme (SCSS) investments

Tuition Fees for up to two children

Home Loan Principal Repayment

Stamp Duty and Registration Charges for a Home

Features of Income Tax Deduction u/s 80

Section 80C: This section provides a deduction of up to Rs. 1.5

lakh for investments in specified instruments such as EPF, PPF,

NSC, ELSS, tax-saving fixed deposits, etc.

An income tax deduction list consisting of the investments that are eligible for deduction

under section 80 is given below -

1) Premium paid for life insurance policy Premium paid on insurance policies of self,

spouse, or child (minor or major). If you pay a premium for your parents, then you will

not be allowed to take a deduction under chapter vi a. If In the case of HUF, the

premium paid for any member. It can be either a life policy or an endowment policy.

2) Any amount invested in the Sukanya Samriddhi Scheme in the name of your

daughter or any girl child for whom you are a legal guardian.

3) Contribution to:

- Public Provident Fund

- Approved superannuation fund

- Unit-linked Insurance Plan, 1971

- Unit-linked Insurance Plan of LIC Mutual Fund

- Approved annuity plan of LIC

- Pension fund, which is set up by a mutual fund or by the administrator or the specified

company

- National Housing Bank Term Deposit Scheme, 2008

- additional account under NPS

- Senior Citizens Savings Scheme Rules, 2004

4) Subscription to:

- National Savings Certificates (VIII issues)

- units of any mutual fund or from the administrator or the specified company

- notified deposit scheme of a public sector company that provides long-term finance

for construction or purchase or construction of houses for the construction or purchase

or construction of houses for residential purposes in India or any other deposit scheme

concerned with housing accommodation or planning, improvement, or development of

cities, towns, and villages, or both.

- specified equity shares or debentures or units of mutual fund

- notified bonds issued by NABARD

5) Investment in a five-year fixed deposit (FD) of a Scheduled Bank or Post Office

6) Repayment of housing loan principal amount(including stamp duty, registration fee,

and other expenses)

7) Payment of tuition fees to any college, school, university, or other educational

institutions within India for full-time education for maximum 2 children

Check the detailed guide on section 80 C deduction.

Section 80CCC: This section provides a deduction for contributions

made to annuity plans of LIC or any other insurer for receiving

pension.

Under section 80CCC income tax deduction for the contributions made in specified pension

plans can be claimed. The tax deduction can be claimed by individuals (whether resident or

non-resident). Maximum permissible deduction under sections 80C, 80CCC, and 80CCD(1) put

together is Rs. 1,50,000

Section 80CCD(1): An income tax deduction for contributions made

by individuals to eligible NPS

The contribution made to eligible NPS account is tax-deductible up to Rs 1.5 lakhs under

section 80CCD(1). The deductions shall be restricted to the amount contributed or the below-

given percentage, whichever is less. However, this tax benefit is within the overall ceiling limits

of section 80CCE, i.e., Rs. 1,50,000. To know the computation of the exempt amount, eligibility,

and much more. Read more

Section 80CCD(1B): Additional Income tax deduction for

contributions made by individuals to eligible NPS

Section 80CCD(1B) gives you the additional tax saving benefit of up to Rs 50,000 for

contributions to the NPS account. It is over and above the limits of section 80C,i.e., It shall not

be subjected to the ceiling limit of Rs. 1,50,000. This section 80CCD has gained so much

attention as you can invest up to Rs. 2 lakh in an NPS account and claim a deduction of the full

amount, i.e., Rs. 1.50 lakh under Sec 80CCD(1) and Rs. 50,000 under Section 80CCD(1B). Click

to know more.

Section 80CCD(2): An income tax deduction for contributions by an

employer to eligible NPS

The contribution to NPS is deductible under 80CCD(1), and 80CCD(1B), and the amount

contributed by your employer towards your NPS account is also tax-deductible under section

80CCD(2). Read to know more details. The deduction amount shall be restricted to 14% of

salary(Basic salary + DA) in the case of Govt. employees and 10% in case of any other

employees.

Section 80D: Income Tax benefit for medical insurance premium

Section 80D is amongst the most popular tax-saving options. Under this tax, the benefit is

admissible for

. Medical Insurance Premiums

. Expenditure on Preventive Health Check-up

. Other Medical Expenditure

The admissible deductions under this section are as under:

In

In the

the case

case of

of an

an individual

individual

. Case I – If your self/spouse or dependent children are below 60 Years of age, then

the maximum deduction is Rs. 25,000, and if your parents are also below 60 years of

age, then the maximum deduction is Rs. 25,000. Therefore, the aggregate deduction

shall be a maximum of Rs. 50,000.

. Case II – If your self/spouse or dependent children are below 60 Years of age, then

the maximum deduction is Rs. 25,000. If parents are 60 years or above, the maximum

deduction is Rs. 50,000. Therefore, the aggregate deduction shall be a maximum of

Rs. 75,000.

. Case III – If your self/spouse or dependent children are 60 years or above, then the

maximum deduction is Rs. 50,000. If your parents are also 60 years or older, the

maximum deduction is Rs. 50,000. Therefore, the aggregate deduction shall be a

maximum of Rs. 1,00,000.

. Deduction up to Rs. 5,000 shall be allowed for payment made towards preventive

health check-ups of self, spouse, dependent children, or dependent parents made

during the previous year. However, the said deduction of Rs. 5,000 shall be within the

overall limit of Rs. 25,000 or Rs. 50,000 specified above.

In

In the

the case

case of

of HUF,

HUF,

The maximum deduction available to a HUF in respect of premium paid to insure the health of

any member of the family would be Rs. 25,000, and in case any member is a senior citizen,

then Rs. 50,000.

Notes:

Notes:

. You can also claim a deduction of upto Rs. 50,000 under section 80D even if you do

not have any health insurance policy, provided any amount is incurred towards:

- medical treatment expenditure of self, spouse, and dependent children (who is of

the age of sixty years or more and not having medical insurance cover)

- medical treatment expenditure of any parent(s) (who is of the age of sixty years or

more and not having medical insurance cover)

. Deduction where the health insurance premium is paid in lump sum: Deduction shall

be apportioned towards all the years for which the premium is paid.

Read to know further details.

Section 80DD: Income Tax Deduction for Medical Treatment of a

Dependent with Disability

Section 80DD provides an income tax benefit to the extent of Rs 75,000 (Where disability is

40% or more but less than 80%) & Rs 1,25,000 (Where there is a severe disability (disability is

80% or more), respectively. The benefit can be availed for incurring medical expenditures for a

disabled dependent relative. For diseases covered, documents required, and other

information, please refer to the detailed guide.

Section 80DDB: Income Tax Deduction for Specified Diseases

The income tax deduction under section 80DDB serves as financial help for those suffering

from a severe disease or taking care of such dependent family members. The deduction is

allowed regarding the amount paid for the medical treatment of such disease or ailment of the

specified persons. The maximum deduction is summarized hereunder:

Dependant

Dependant Maximum

Maximum limit

limit (Rs.)

(Rs.)

A senior citizen (being a resident individual) 1,00,000

Other than a senior citizen 40,000

No such deduction shall be allowed unless a prescription is obtained for such medical

treatment from a neurologist, oncologist, urologist, hematologist, immunologist, or other

specialists, as may be prescribed. Read more to know the eligibility and other qualifying

criteria.

Section 80E: Income Tax Deduction for Interest paid on Higher

Education Loan

The interest paid on higher education loans taken for self, spouse, child, or student of whom

you are a legal guardian is eligible for income tax deduction under section 80E. The tax

benefit is available for the 8 Assessment Years. i.e., The current year and the next 7 years,

without maximum limits. Read to know more.

Section 80EE: Income Tax Deduction for Home Loan

Section 80EE provides an additional deduction of up to Rs. 50,000 in respect of the interest

on a loan taken by an individual to acquire residential house property from any financial

institution. Read insights here. 80EE deduction is in addition to the deduction available under

section 24 while computing ‘income from house property’. The conditions for availing

deduction of interest are: here.

Section 80EEA: Income Tax Deduction for first time home buyers

This section is Section 80EEA, which allows an additional deduction to taxpayers for paying

interest on a home loan availed by them. While Section 24 allowed for interest exemption on

home loans up to INR 2 lakhs, this section allows an additional exemption of Rs 1.5 lakhs to

home buyers who avail of a home loan and pay interest on the loan.

Other conditions for availing deduction of interest:

Section 80EEB: Income Tax Deduction for Repayment of Electronic

Vehicle Loan

This section was introduced to promote the purchase of electric vehicles among individuals by

giving them tax relief on the interest paid on loans taken to purchase such vehicles from any

financial institution from 01/04/2019 to 31/03/2023. The limit of deduction is up to Rs 1.5 lakhs.

Section 80G: Deduction in respect of donations made to specified

funds and charitable institutions etc

. Deduction under this section is available to all types of taxpayers (individual/ firm/ LLP

or any other person).

. The deduction amount is based on the category in which the fund falls, i.e., with or

without any qualifying limit.

Where the funds are subject to a qualifying limit, the formula for calculation of

deduction = Gross Qualifying Amount - Net Qualifying Amount

. The donation should be made in any mode of payment other than cash if it exceeds

Rs. 2,000. Donations in kind are not eligible for deduction under this section.

You might also like

- HSC Eco Essay PlansDocument65 pagesHSC Eco Essay Plansbmstf9hyfmNo ratings yet

- HCL PayslipDocument1 pageHCL PayslipkrishnaNo ratings yet

- Income Tax Deductions List - Deductions On Section 80C, 80CCC, 80CCD and 80D - FY 2022-23 (AY 2023-24) - Tax2winDocument26 pagesIncome Tax Deductions List - Deductions On Section 80C, 80CCC, 80CCD and 80D - FY 2022-23 (AY 2023-24) - Tax2winJaydeep DasadiyaNo ratings yet

- Income Tax NewDocument10 pagesIncome Tax Newmarketing.incand24No ratings yet

- Personal Income Tax Under The New Regime and Old RegimeDocument4 pagesPersonal Income Tax Under The New Regime and Old RegimeAiswarya BNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument8 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaGeetanjali BarejaNo ratings yet

- Income Tax Divyastra CH 13 Deductions From GTI RDocument22 pagesIncome Tax Divyastra CH 13 Deductions From GTI RN AparnaNo ratings yet

- Indian Institute of Technology Madras: CircularDocument5 pagesIndian Institute of Technology Madras: CircularAravinthram R am18m002No ratings yet

- SalaryDocument10 pagesSalaryMaanoj K SharmaaNo ratings yet

- Net Income How To Calculate Net Income in Income TaxDocument34 pagesNet Income How To Calculate Net Income in Income TaxSeetha SenthilNo ratings yet

- Faq'S & Guidlines On Income TaxDocument50 pagesFaq'S & Guidlines On Income TaxRavikarthik GurumurthyNo ratings yet

- Taxation CLass Test 1Document6 pagesTaxation CLass Test 1ap.quatrroNo ratings yet

- DeductionsDocument81 pagesDeductionsRaju DuttaNo ratings yet

- Form 16 - BLMPB2218K - 2019-20 - Part B PDFDocument6 pagesForm 16 - BLMPB2218K - 2019-20 - Part B PDFUmair BaigNo ratings yet

- Income Tax Planner FY 2020-21Document12 pagesIncome Tax Planner FY 2020-21RedNo ratings yet

- Employee Declaration Form 1Document4 pagesEmployee Declaration Form 1rifas caNo ratings yet

- 2021-2022 Shrikant Jadhav Form 16-Part B PDFDocument6 pages2021-2022 Shrikant Jadhav Form 16-Part B PDFVidya JadhavNo ratings yet

- Investment POI Guidance Notes (FY 23-24)Document33 pagesInvestment POI Guidance Notes (FY 23-24)Puneet GuptaNo ratings yet

- Employee Tax Declaration - FY 22-23-DBMPDocument3 pagesEmployee Tax Declaration - FY 22-23-DBMPthetrilight2023No ratings yet

- NMIMS Global Access School For Continuing Education (NGA-SCE) Course: Taxation-Direct and Indirect Internal Assignment Applicable For June 2020 ExaminationDocument10 pagesNMIMS Global Access School For Continuing Education (NGA-SCE) Course: Taxation-Direct and Indirect Internal Assignment Applicable For June 2020 ExaminationAnkit SharmaNo ratings yet

- F0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentDocument1 pageF0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentSourabhthakral_1No ratings yet

- Rebates and Releifs Page 415 To 418Document4 pagesRebates and Releifs Page 415 To 418Nitin RajNo ratings yet

- Final Tommorow YetDocument6 pagesFinal Tommorow YetGourav BathejaNo ratings yet

- Comparison of Old and New Tax Regime 04042023Document3 pagesComparison of Old and New Tax Regime 04042023VenkateshNo ratings yet

- Principles of Taxation - DeductionsDocument7 pagesPrinciples of Taxation - Deductions20047 BHAVANDEEP SINGHNo ratings yet

- DeductionsDocument81 pagesDeductionshitesh1601kukrejaNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inGOKUL HD LIVE EVENTSNo ratings yet

- Form 1614062023 173940Document3 pagesForm 1614062023 173940jrqvd9d5rnNo ratings yet

- CA FInal DT SampleDocument8 pagesCA FInal DT SampleprasannaNo ratings yet

- Income Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollDocument2 pagesIncome Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollShiva098No ratings yet

- Deductions Available Under Chapter VI of Income TaxDocument4 pagesDeductions Available Under Chapter VI of Income TaxDeepanjali NigamNo ratings yet

- Form-16-Excel-Format-AY-2024-25Document6 pagesForm-16-Excel-Format-AY-2024-25faijalrazakhanNo ratings yet

- Train Law ActDocument231 pagesTrain Law ActKristine Japitana100% (1)

- Break Even Point For Choosing Tax RegimeDocument9 pagesBreak Even Point For Choosing Tax RegimeSivasankariNo ratings yet

- Tax Report Jan 2024Document1 pageTax Report Jan 2024yashodhan.kadam30No ratings yet

- Tax Decalaration 2023-24Document3 pagesTax Decalaration 2023-24thetrilight2023No ratings yet

- Form 1602102023 160124Document3 pagesForm 1602102023 160124isantbasnet3561No ratings yet

- Form 1617082023 112227Document2 pagesForm 1617082023 112227rinsha.sherinNo ratings yet

- Income Tax Deductions ListDocument4 pagesIncome Tax Deductions Listamitks525No ratings yet

- Income Tax Deductions and Exemptions in India 2018: MenuDocument7 pagesIncome Tax Deductions and Exemptions in India 2018: MenusandeshNo ratings yet

- Tax Laws New Syllabus Mock Test 1 by VG SirDocument20 pagesTax Laws New Syllabus Mock Test 1 by VG Sirsharmaaryan1030No ratings yet

- S Income Tax Declaration April 2016Document2 pagesS Income Tax Declaration April 2016HanumanthNo ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- New Cals Case 14Document2 pagesNew Cals Case 14Rishi ChandakNo ratings yet

- Deductions From Gross Total Income: HapterDocument20 pagesDeductions From Gross Total Income: HapterJAWED MOHAMMADNo ratings yet

- Income Tax Calculator WarikooDocument10 pagesIncome Tax Calculator Warikoomehmood.aribNo ratings yet

- Section 80CCD (1B) Deduction - About NPS Scheme & Tax BenefitsDocument7 pagesSection 80CCD (1B) Deduction - About NPS Scheme & Tax BenefitsP B ChaudharyNo ratings yet

- R.A. 10963 (TRAIN) - Income Tax ProvisionsDocument50 pagesR.A. 10963 (TRAIN) - Income Tax ProvisionsKrishtineRapisoraBolivarNo ratings yet

- Principles of Taxation Law - (Week 8)Document56 pagesPrinciples of Taxation Law - (Week 8)Snigdha RohillaNo ratings yet

- S Income Tax Declaration April 2017Document2 pagesS Income Tax Declaration April 2017HanumanthNo ratings yet

- Employee Declaration FormDocument3 pagesEmployee Declaration Formmeshakjunior13No ratings yet

- DeductionsDocument7 pagesDeductionsAnurag BishtNo ratings yet

- Decoding Indian Union Budget Finance Bil PDFDocument7 pagesDecoding Indian Union Budget Finance Bil PDFkumarNo ratings yet

- Income Tax Calculation Worksheet: Thermax LTD Ascent PayrollDocument1 pageIncome Tax Calculation Worksheet: Thermax LTD Ascent PayrollAnuragNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inKATHI JAYANo ratings yet

- Summary Charts Deduction Chapter ViaDocument4 pagesSummary Charts Deduction Chapter ViaUttam Gagan18100% (1)

- TRAIN-LAWDocument49 pagesTRAIN-LAWAina AmainNo ratings yet

- Deductions From Gross Total Income: Learning OutcomesDocument86 pagesDeductions From Gross Total Income: Learning OutcomesNisha GuptaNo ratings yet

- How To Save Tax For Salary Above 20 LakhsDocument12 pagesHow To Save Tax For Salary Above 20 LakhsvijaytechskillupgradeNo ratings yet

- 1724015062-Old-Cals-Case-1Document2 pages1724015062-Old-Cals-Case-1nitikadogra207No ratings yet

- Income Tax Declaration April 2017Document2 pagesIncome Tax Declaration April 2017HanumanthNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Fundamentals of Accountancy, Business and Management 2Document2 pagesFundamentals of Accountancy, Business and Management 2Sharlyn Marie An Noble-BadilloNo ratings yet

- Chapter 4Document28 pagesChapter 4april020718No ratings yet

- 12th Accountancy EM Quarterly Exam 2022 Original Question Paper Tenkasi District English Medium PDF DownloadDocument4 pages12th Accountancy EM Quarterly Exam 2022 Original Question Paper Tenkasi District English Medium PDF DownloadJansi ArulNo ratings yet

- Macroeconomics SummaryDocument3 pagesMacroeconomics Summaryzsarlie786No ratings yet

- Financial Statement AnalysisDocument42 pagesFinancial Statement AnalysisM RNo ratings yet

- Lecture 5eDocument38 pagesLecture 5eShedrine ButaliNo ratings yet

- F3 - ACCA Chapter-18-1Document40 pagesF3 - ACCA Chapter-18-1Nile NguyenNo ratings yet

- Nama Nama AkunDocument26 pagesNama Nama AkunTia YuliandiniNo ratings yet

- Break Even AnalysisDocument13 pagesBreak Even Analysissuchipatel100% (2)

- Compiled Econ Objective Type From Examveda-1Document38 pagesCompiled Econ Objective Type From Examveda-1Jeziel AtaNo ratings yet

- COMPANY/FINANCE/PROFIT AND LOSS/175/Nestle IndiaDocument1 pageCOMPANY/FINANCE/PROFIT AND LOSS/175/Nestle IndiabhuvaneshkmrsNo ratings yet

- LKTT SC - 30 Jun 2020Document146 pagesLKTT SC - 30 Jun 2020adjipramNo ratings yet

- Taylor NZ CaseDocument60 pagesTaylor NZ CaseSarthak ChaturvediNo ratings yet

- Nepal Budget 2076-77 (2019-20)Document38 pagesNepal Budget 2076-77 (2019-20)Menuka SiwaNo ratings yet

- Tugas AuditDocument11 pagesTugas AuditJihan Faradhilah326No ratings yet

- Research Essay Cs FinalDocument13 pagesResearch Essay Cs Finalapi-519794514No ratings yet

- Clubbing of Income Under Income Tax Act, 1961 - Section 60 To 64 - Taxguru - inDocument6 pagesClubbing of Income Under Income Tax Act, 1961 - Section 60 To 64 - Taxguru - inRISHITA RAJPUT SINGHNo ratings yet

- MODULE 9 MicroDocument7 pagesMODULE 9 MicroGladz De ChavezNo ratings yet

- Tally Chapter 3Document54 pagesTally Chapter 3bhavya gNo ratings yet

- Jat Holdings Limited: Sri LankaDocument3 pagesJat Holdings Limited: Sri Lankacpasl123No ratings yet

- Shopify Financial Worksheet Template: More Instructions On Cash Flow Management HereDocument6 pagesShopify Financial Worksheet Template: More Instructions On Cash Flow Management HereOLOMOSEDARA IFEOLUWANo ratings yet

- BE Mar 2020 Assignment SolutionDocument9 pagesBE Mar 2020 Assignment SolutionJATINNo ratings yet

- Lgu FSSDocument32 pagesLgu FSSAh MhiNo ratings yet

- Lesson 2 Sources of Family IncomeDocument22 pagesLesson 2 Sources of Family Incomeroel mabbayad83% (6)

- Advanced FA I Course OutlineDocument4 pagesAdvanced FA I Course Outlinebekelesolomon828No ratings yet

- CH 4 - The Economic Environments Facing BusinessDocument28 pagesCH 4 - The Economic Environments Facing BusinessSamarth Dargan100% (1)

- Case Competition GuideDocument49 pagesCase Competition GuidexxNo ratings yet

- Income Taxation-FinalsDocument14 pagesIncome Taxation-FinalsTheaNo ratings yet