Govt. of India VAT Report-2

Govt. of India VAT Report-2

Uploaded by

thorat82Copyright:

Available Formats

Govt. of India VAT Report-2

Govt. of India VAT Report-2

Uploaded by

thorat82Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Govt. of India VAT Report-2

Govt. of India VAT Report-2

Uploaded by

thorat82Copyright:

Available Formats

REPORT ON CURRENT STATE REPO ASSESSMENT (AS ISPROCESS SSE SSM AS OCE DOCUMENTATION) OCUM NTA

Page 1 of 118

TABLE OF CONTENTS 1. 2. EXECUTIVE SUMMARY ........................................................................................................ 8 INTRODUCTION .................................................................................................................. .10 2.1. NATIONAL E-GOVERNANCE ACTION PLAN (NEGP) ...................................................................... 10 2.1.1. 2.1.2. 2.1.3. Key observations made by DIT and DAR&PG while endorsing the NeGP ............................ 10 Major activities proposed under the NeGP .......................................................................... 10 Framework for e-Governance under NeGP ......................................................................... 14 2.2. COMMERCIAL TAXES MISSION MODE PROGRAM (CT-MMP) ...................................................... 15 2.2.1. 2.2.2. 2.2.3. 2.2.4. Background to CT-MMP ..................................................................................................... 15 Vision of CT-MMP.............................................................................................................. 16 Overall game plan of CT-MMP ........................................................................................... 19 Key outcomes of CT-MMP .................................................................................................. 20 2.3. VALUE ADDED TAX (VAT) .......................................................................................................... 21 2.3.1. 2.3.2. 2.3.3. 2.3.4. 2.3.5. 3. 4. What is VAT?...................................................................................................................... 21 History of VAT .................................................................................................................... 22 History of VAT in India ....................................................................................................... 22 Self assessment and VAT ..................................................................................................... 23 Operational tasks within VAT.............................................................................................. 24

METHODOLOGY FOR CURRENT STATE ASSESSMENT .............................................. 27 SELECTION OF PROCESSES UNDER CT-MMP FOR BPR ............................................. 31 4.1. REGISTRATION OF DEALERS UNDER VAT ..................................................................................... 32 4.2. VAT RETURNS PROCESSING AND TAX COLLECTION ...................................................................... 34 4.3. PROCESSING OF VAT REFUNDS .................................................................................................... 35

4.4. TAX ACCOUNTING ...................................................................................................................... 37 4.5. INTER-STATE TRADE ................................................................................................................... 38 5. CURRENT STATE ASSESSMENT OF THE FOUR STATES ............................................. 41 5.1. PROCESS ARCHITECTURE ............................................................................................................ 41 5.1.1. 5.1.2. 5.1.3. 5.1.4. 5.1.5. Registration of dealers under VAT....................................................................................... 42 Processing of VAT returns and tax collection ...................................................................... 57 Processing of VAT refunds .................................................................................................. 67 Tax accounting ................................................................................................................... 73 Inter-state trade .................................................................................................................. 76

5.2. TECHNOLOGY ARCHITECTURE ..................................................................................................... 84 5.3. PEOPLE ARCHITECTURE .............................................................................................................. 90 5.3.1. 5.3.2. 5.3.3. Delhi Organizational structure............................................................................................ 93 Andhra Pradesh Organizational structure ........................................................................... 95 West Bengal Organizational structure ................................................................................. 97 Page 2 of 118

5.3.4. 5.3.5.

Gujarat Organizational structure ........................................................................................ 99 Key observations on the As-Is organizational structure.................................................. 100

5.4. TAXPAYER SERVICES ................................................................................................................ 102 5.5. FEEDBACK FROM VAT DEALERS INTERACTED WITH ACROSS FOUR STATES .................................. 107 6. STAKEHOLDERS CONSULTED IN THE FOUR STATES .............................................. 109

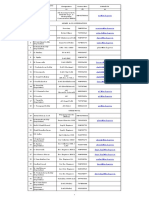

6.1. DELHI CTD OFFICIALS CONSULTED............................................................................................ 109 6.2. ANDHRA PRADESH CTD OFFICIALS CONSULTED ......................................................................... 110 6.2.1. Dealers interacted with in AP............................................................................................ 111 6.3. WEST BENGAL CTD OFFICIALS CONSULTED ............................................................................... 112 6.3.1. Dealers interacted with in West Bengal ............................................................................. 113 6.4. GUJARAT CTD OFFICIALS CONSULTED ....................................................................................... 114 6.4.1. 7. Dealers interacted with in Gujarat .................................................................................... 115

GLOSSARY OF TERMS ...................................................................................................... 116

Page 3 of 118

REFERENCE DOCUMENTS FOR INTERNAL USE

1: 2: 3: 4: 5: 6:

Delhi VAT Act, rules and schedules Delhi VAT Forms Delhi Checklist for returns scrutiny Delhi Organization structure Delhi Note on the computerization in the CTD Delhi SLA between Government of Delhi and Comat Technologies for data entry services

7:

Delhi Circular that had been circulated for reorganization and relocation of selective units under VAT regime

8: 9: 10 : 11 : 12 : 13 : 14 : 15 : 16 :

Delhi Select statistics related to Commercial Tax Administration AP VAT Act, rules and schedules AP VAT Forms AP VAT leaflets which have been prepared as ready reckoner on VAT AP Select statistics related to Commercial Tax Administration WB - VAT Act, rules and schedules WB VAT Forms WB Administrative report 2004-05 WB SLA between the office of commissioner, CT, WB and CMC Ltd. for data entry of endorsed waybills and transit declarations at 3 checkposts

17 :

WB- SLA between office of commissioner, CT, WB and Webel Technologies for hardware maintenance

18 : 19 : 20 : 21 : 22 :

WB Note on computerization in CCT WB Publication of Trade Circulars Gujarat VAT Act, rules and schedules Gujarat VAT Forms Gujarat Administrative organization at the division level

Page 4 of 118

23 : 24 : 25 : 26 : 27 :

Gujarat Proposed organizational structure to be adopted under VAT Gujarat MIS report on Input tax credit mismatch Gujarat Note on the checkpost activity Gujarat Select statistics related to Commercial tax Administration International case studies on successful implementation of Cross matching of invoices

Page 5 of 118

LIST OF FIGURES FIG 1: MAJOR ACTIVITIES PROPOSED UNDER NEGP AND BUDGET ALLOCATION .................................................. 13 FIG 2: OVERALL FRAMEWORK FOR E-GOVERNANCE .......................................................................................... 14 FIG 3: THE TRIPLE E OF COMMERCIAL TAX ADMINISTRATION SYSTEM ............................................................. 16 FIG 4: THE SEVEN DIMENSIONS OF EGOVERNANCE........................................................................................... 17 FIG 5: OVERALL GAME PLAN FOR CT-MMP ..................................................................................................... 19 FIG 6: METHODOLOGY ADOPTED FOR CURRENT STATE ASSESSMENT UNDER CT-MMP ..................................... 28 FIG 7: TAX ACCOUNTING SYSTEM.................................................................................................................... 37 FIG 8: FORMAT OF TAXPAYER IDENTIFICATION NUMBER (TIN) IN WEST BENGAL ............................................. 53 FIG 9: FORMAT OF TAXPAYER IDENTIFICATION NUMBER (TIN) IN GUJARAT...................................................... 54 FIG 10: ORGANIZATIONAL STRUCTURE OF AN OPERATIONS UNIT IN THE DELHI CTD ......................................... 93 FIG 11: ORGANIZATIONAL STRUCTURE OF THE DELHI COMMERCIAL TAX CTD.................................................. 94 FIG 12: ORGANIZATIONAL STRUCTURE OF THE AP CTD AT THE HEADQUARTERS ............................................... 95 FIG 14: ORGANIZATIONAL STRUCTURE OF THE WB CTD .................................................................................. 97 FIG 15: ORGANIZATIONAL STRUCTURE OF THE GUJARAT COMMERCIAL TAX CTD ............................................. 99

Page 6 of 118

LIST OF TABLES TABLE 1: LIST OF MISSION MODE PROJECTS UNDER NEGP ................................................................................ 12 TABLE 2: BASIS FOR IDENTIFICATION OF STATES FOR STUDY UNDER CT-MMP .................................................. 29 TABLE 3: LIST OF PROCESSES UNDER COMMERCIAL TAX ADMINISTRATION ....................................................... 31 TABLE 4: SNAPSHOT OF STATISTICS RELATED TO VAT REGISTRATION IN FOUR STATES ...................................... 32 TABLE 5: SNAPSHOT OF STATISTICS RELATED TO VAT RETURNS IN FOUR STATES .............................................. 34 TABLE 6: SNAPSHOT OF STATISTICS RELATED TO VAT REFUNDS IN FOUR STATES.............................................. 36 TABLE 7: SNAPSHOT OF STATISTICS RELATED TO INTER-STATE TRADE IN FOUR STATES ..................................... 38 TABLE 8: COMPARISON OF PROCESS OF VAT REGISTRATION ACROSS THE FOUR STATES ..................................... 52 TABLE 9: COMPARISON OF F VAT RETURNS PROCESSING AND TAX COLLECTION ACROSS THE FOUR STATES ........ 65 TABLE 10: COMPARISON OF PROCESS OF VAT REFUNDS ACROSS THE FOUR STATES ........................................... 70 TABLE 11: COMPARISON OF TAX ACCOUNTING ACROSS THE FOUR STATES ......................................................... 75 TABLE 12: COMPARISON OF PROCESS OF MONITORING INTER-STATE TRADE ACROSS THE FOUR STATES ............... 79 TABLE 13: COMPARISON OF EFFECTIVENESS OF VARIOUS CONTROLS RELATED TO INTERSTATE TRADE............... 81 TABLE 14: COMPARISON OF TECHNOLOGY ARCHITECTURE ACROSS THE FOUR STATES ........................................ 88 TABLE 15: COMPARISON OF ORGANIZATIONAL STRUCTURE ACROSS THE FOUR STATES ....................................... 92 TABLE 16: COMPARISON OF TAXPAYER SERVICES OFFERED BY THE CTDS ACROSS THE FOUR STATES ............... 106 TABLE 17: FEEDBACK FROM DEALERS ACROSS THE FOUR STATES .................................................................... 108

Page 7 of 118

1.

Executive Summary

National e-Governance Plan (NeGP) was conceptualized jointly by Department of Information Technology (DIT) with Department of Administrative Reforms & Public Grievances (DAR&PG) to lay the foundation and provide the impetus for long-term growth of e-Governance within the country. . The Commercial TaxesMission Mode Project (CT-MMP) has been initiated under the NeGP, spearheaded by the Department of Revenue (DoR), Ministry of Finance, Government of India. DoR has partnered with National institute for Smart Government (NISG) and Ernst & Young to play the role of strategic advisor in designing the MMP for introduction of e-Governance in area of Commercial Taxes in the States and Union Territories of India. This would include Conceptualization, Architecting and Defining the Mission Mode Program with respect to understanding the services to be provided to the citizens, designing of the architectures (functional, process, people, technology and resources) and design of a comprehensive and integrated Commercial Taxes MMP Model / Models. In order to study the complexities and ground realities associated with tax administration, four representative states of India, viz. Delhi, West Bengal, Andhra Pradesh and Gujarat were identified for study as well as for conducting discussions with stakeholders. After detailed study of various administrative procedures under Commercial Taxes, five core VAT administration processes were prioritized for re-design and infusion of various technology enabled solutions viz Registration of dealers under VAT, Processing of VAT returns and tax collection, Processing VAT refunds, Tax accounting and Inter-state trade. The current report is a detailed note on the findings of As-Is study of these five processes, the technology architecture and the organizational architecture across the four representative states. The study reveals significant variation across states both at the process concept/design level and implementation level. For each of the five processes, the parameter across which they vary and the impact it has on tax administration has been discussed in detail. Based on our study, feedback from dealers and understanding of the international leading practices, the following key areas have been identified to be considered during the re-design phase under CT-MMP: VAT Registration: Security deposit, Tin format, SIC code, pre-verification Versus postverification, time to grant registration and the steps involved therein Processing of VAT Returns and tax collection: Simplification of returns form with an objective to utilize the information captured for further processing ( scrutiny/ analysis), uniformity in period for filing of returns Processing of VAT Refunds: Stringent timelines for processing of refunds, cross matching of invoices Tax accounting: Simplification of reconciliation of tax payment Inter-state trade: Effectiveness of controls like checkposts, waybills, statutory forms in prevention of frauds related to inter-state trade

Page 8 of 118

Study of the technology reveals that the states differ significantly in the level of usage of technology as an enabler in increasing the effectiveness of service delivery to taxpayers. Based on the as-is study and the international leading practices following are some of the key e-Governance initiatives that have been identified for further discussion: Online registration Online filing of returns e-Payment of tax Electronic exchange of data between the CTD and banks, treasuries Electronic clearance of refunds Online tax profile for dealers Dematerialization of statutory forms

The study of organizational structures across the four states reveals that the structure is primarily geographic in nature and this causes problems like lack of specialization and focus, lack of economies of scale, possibility of collusion between dealer and officials etc. It is evident that there is a need for the CTDs to move toward a functional organizational structure. There is significant scope for improvement in Commercial Tax administration. It is desirable that the CTDs consider the possibility of incorporating international leading practices in their system, streamline and standardize the processes leading to Efficient, Effective and Equitable commercial tax administration system.

Page 9 of 118

2.

Introduction

2.1.National e-Governance Action Plan (NeGP) NeGP was conceptualized jointly by Department of Information Technology (DIT) with Department of Administrative Reforms & Public Grievances (DAR&PG) to lay the foundation and provide the impetus for long-term growth of e-Governance within the country. The Government of India has approved the National eGovernance Action Plan for implementation during the year 2003-2007. The plan seeks to create the right governance mechanisms, set up the core infrastructure and policies and implement Mission Mode Projects at the centre and state to create a citizen-centric and a business-centric environment for governance.

2.1.1. Key observations made by DIT and DAR&PG while endorsing the NeGP The ultimate goal of e-Governance is to make the delivery of government services and information to the citizens efficient, speedy and transparent using electronic means. For effective implementation of eGovernance, DIT and DAR&PG felt the necessity to incorporate the following key observations while endorsing the NeGP: Adequate weightage to be given for quality and speed of implementation in procurement procedures for IT services Incorporation of suitable system of incentivization of states to encourage adoption of eGovernance initiatives proposed under NeGP Trend of delivery of services to citizens through common service centers to be encouraged and promoted Services to be outsourced to competent entities if opportunity exists Full potential for private sector investment to be exploited Connectivity to be extended up to block level through NICNET/ SWANs

2.1.2. Major activities proposed under the NeGP The following is a list of major activities proposed under the NeGP: Development of Core Policies : This would involve development of overall vision, mission, strategy and approach for e-Governance; Policies relating to funding, human resources, integrated services, process reengineering etc Development of Core Projects / Mission mode projects : The following is the list of parameters based on which certain areas/ departments of the Government have been prioritized and Mission mode projects have been identified under those areas as a part of the NeGP : o o o Impact in terms of number of people likely to be affected by project Impact in terms of likely improvement of the quality of service Impact on the economy or economic environment in the country Page 10 of 118

o o o

Impact in terms of the likely cost-benefit of investments in the project Readiness and willingness of ministry/ CTD to position a National Mission Project Feasibility of implementing the project from a financial, administrative and political perspective within a reasonable time frame

The table presented below lists the Mission Mode projects identified under NeGP for implementation at the national level (Central government projects), state level (state government projects) and as integrated services.

S. No.

Mission Mode project

Line ministries/ CTDs responsible

Mission mode projects under Central government 1 2 3 4 5 6 7 8 Income Tax Passport Visa & Immigration Project DCA21 Insurance National Citizen Database Central Excise Pensions Banking Ministry of Finance/Central Board of Direct Tax Ministry of External Affairs/Ministry of Home Affairs Department of Company Affairs Department Of Banking Ministry of Home Affairs/Registrar General of India (RGI ) Department of Revenue/Central Board of Excise & Custom Department Of Pensions & Pensioners welfare & CTD Of Expenditure Department of Banking Mission mode projects under State government 9 10 11 12 13 14 15 16 17 18 Land Records Road Transport Property Registration Agriculture Treasuries Municipalities Gram Panchayats Commercial Taxes Police (UTs initially) Employment Exchange * Ministry of Rural Development Ministry of Road Transport & Highway Department of Land Resources Department of Agriculture & Cooperation Ministry of Finance Ministry of Urban development and Poverty Alleviation Ministry of Panchayati Raj Ministry of Finance Ministry of Home affairs Ministry of Labor Page 11 of 118

Mission mode projects under Integrated services category 19 20 EDI (E-Commerce ) E-Biz Common Service Centres India Portal EG Gateway E-Courts* E-Procurement* Ministry of Commerce and Industry Department of Industrial Policy & Promotion / CTD of Information Technology Department of Information Technology Department of Information Technology and CTD of Administrative Reforms and Public Grievances Department of Information Technology Ministry of Justice/ Ministry of Home Affairs Ministry of Commerce and Supply

21

22 23 24 25

* Additional mission mode projects proposed Table 1: List of Mission mode projects under NeGP Development of Core Infrastructure: This involves development in areas like National eGovernment intranet, State wide intranets, National and state level data centers, security infrastructure. Development of Integrated Services Projects: This involves taking up initiatives related to the development of one stop national level and state level government portals, e-Business, e- Procurement. Development of Support Infrastructure: Support Infrastructure would cater to areas such as Service delivery infrastructure at State, District, Block and Village levels including Wireless infrastructure for last mile connectivity, e-Post, design, development and deployment of low cost technology solutions, Integrated Service Delivery Front ends. Human Resource Development/Training: This would comprise Training for e-Governance policy makers, Chief Information Officers, Project specific training, General IT Skills and Competencies, Special training programmes for specialists, Security, use of local language solutions, Advanced courses architecture, language technologies , Equipping National / State Institutions of Public Administration for EGovernance Training etc. Technical Assistance: The technical assistance under this Scheme may include Support for undertaking survey of needs and expectations, Benchmarking of interventions, Feasibility studies, Planning and design of various projects, Capacity building of institutions which would be involved in the implementation and monitoring of the projects . Awareness & Assessment: Some of the key initiatives under this activity are as follows : o o o Undertaking e-Readiness assessment of various States/ Departments Setting up of Virtual e-Governance Forums Assessment of e-Projects Page 12 of 118

o o o o o o Governance

Study of best practices for e-Governance Development of e-Governance National Resource Database Newsletters on e-Governance, workshops/ seminars/ Conferences, Setting up e-Governance forum for NGOs, Private Sector, Academicians Setting up of Training Institutions Create awareness through different media like films. such Board, as National Institute Electronic for Smart Council/ National Information Services National

Design and development of Organizational Structures

Government (NISG) , State Electronic Governance Councils/ State Information Services Board , Electronic Government Standards Institution, National Informatics Center (NIC). Research and development : Research and Development would need to be taken up in areas such as Architecture , Standards , Integration Strategies ,Language technologies , Electronic payment systems , Security and other areas related to E-Governance Figure 1 depicts the percentage allocation of the total budget proposed for NeGP to major activities identified under NeGP (listed above).

Core Policies 1% Inte grate d se r vices 2 % HRD and Tr aining 4 % Suppor t and Infr as tructure 5 % Cor e Infr astructure 10 %

Te chnical ass is tance 1 %

Or ganizational s tr uctues 1 %

Rese ar ch and De ve lopm e nt 1 % Aw ar e ness and Asses s m e nt 2 %

Core pr oje cts 73 %

Core projects HRD and Training Technical ass is tance

Core Infras tructure Integrated s ervices Organizational s tructues

Support and Infras tructure Core Policies Res earch and Developm ent

Awarenes s and Ass es s m ent Source: Website of Department of Information Technology Fig 1: Major activities proposed under NeGP and budget allocation

Page 13 of 118

2.1.3. Framework for e-Governance under NeGP Under NeGP, a framework/ overall architecture has been developed for the effective implementation of eGovernance initiatives. As depicted in Figure 2 below, the e-Governance framework includes the following main components Back-end: The e-Governance framework envisions the integration between databases of the different government agencies, service providers and state governments. An e-India portal would function as an interface between the back end, middle ware, GoI portals and the state government portals. Middleware: The Middleware comprises of communication and security infrastructure, gateways, central data banks and integrated services facilitating integration of inter-departmental services. Front-end delivery channels: The e-Governance envisions multiple delivery channels to citizens and businesses in form of home PCs, mobile phones, kiosks, integrated citizen service centers etc to increase the effectiveness of service delivery.

Middleware GOI Agencies GOI Portals Communication Infrastructure Central Data Banks Gateways Security Infrastructure Service Providers e-India Portal Front-end interface Integrated services enabled Citizen Portal State Portals State Agencies E-biz

Mobile

Citizens

Home PCs

Integrated CSC Kiosks

Businesses

DTV

Fig 2: Overall framework for e-Governance

Page 14 of 118

2.2. Commercial Taxes Mission Mode Program (CT-MMP) 2.2.1. Background to CT-MMP Commercial Taxes form the most important revenue base for the States and Union Territories in India, often accounting for 60% - 70% of the total internal resources generated. The Commercial Taxes departments are entrusted with the administration and enforcement of Tax Legislations as might be applicable. As the CT department mainly interfaces with businesses, its functioning can directly affect the attractiveness of the state as a business destination. Currently most States and Union Territories are aligning their processes with the new Value Added Tax (VAT) System adopted since 01-04-2005. A study of the Commercial Taxes administration across the states and union territories reveals significant variations both at the level of conceptualization/ design of processes and at the implementation level. One of the primary reasons for this variation being that VAT is a state subject and each state has developed its own act, rules and procedures for implementation of VAT. In many of the states, the previous sales tax act is still being administered. States are facing issues relating to the complete transition to VAT. The need for a Mission Mode Program (MMP) under Commercial Taxes was felt to establish a certain degree of standardization across states with respect to Commercial Tax administration and to come up with streamlined citizen-centric, service-oriented processes. The CT- MMP has been initiated under the National e-Governance Plan spearheaded by the Department of Revenue (DoR), Ministry of Finance, Government of India. DoR has partnered with National institute for Smart Government (NISG) to play the role of strategic advisor in designing the MMP. They are responsible for formulation and design of a MMP for introduction of e-Governance in area of Commercial Taxes in the States and Union Territories of India. This would include Conceptualization, Architecting and Defining the Mission Mode Program with respect to understanding the services to be provided to the citizens, designing of the architectures (function, process, people, technology and resources) and design of a comprehensive and integrated Commercial Taxes MMP. From the CT-MMP would emerge a comprehensive and integrated model for Commercial Taxes administration that can be adopted by all states by making suitable customizations specific to their state laws. The following are the key objectives of CT-MMP: Alignment with the NeGP goals of service orientation, centralized planning and de-centralized implementation. Design of e-Governance strategy and roadmap for Commercial Taxes (CT) Creation of a national mission-mode program for approval by Government of India Creation of a national infrastructure for o o o Facilitating inter-state trade Uniformity and standards in Commercial Tax administration Enabling free exchange of information Page 15 of 118

Transformation of key processes related to CT leading to improved service delivery Building capacities among all the stakeholders to enable people delivering the services to perform better Ensure balanced pace of implementation across all the states Exploit true revenue potential Use technology to alter the way services are delivered

2.2.2. Vision of CT-MMP The vision of the CT-MMP is to Create a modern state tax administration that is Efficient, Effective and Equitable and which is conducive to investment, economic growth and free flow of goods and services within the common market of India. An Efficient Commercial Tax administration would mean lower costs of administration for the department and lower costs of compliance for the taxpayer. It would minimize the negative impacts on investment and economic growth. It would also help to improve and regulate inter-state trade by bringing about uniformity in administrative procedures across states. An Effective Commercial Tax administration system would help improve revenue yield,

maximization of voluntary compliance and reduced revenue leakages, greater control over fraud and collusion and reduction in disputes with taxpayers and timely resolution of objections and appeals An Equitable Commercial Tax administration system would bring about greater transparency in tax administration, uniformity/consistency in application of tax to taxpayers in similar circumstances

Effective

Efficient

Equitable Fig 3: The Triple E of Commercial Tax Administration System

Page 16 of 118

The CT-MMP is designed to address each of the seven pillars of e-Governance as outlined below.

Program Management

Procurement Management

Expectation Management

Knowledge Management

Technology Management

Process reform Management Resource Management

Fig 4: The seven dimensions of e-Governance Knowledge management Knowledge sharing across states is critical so that states can learn from each others experience, best practices can be quickly replicated, mistakes and cost escalations are prevented. Simultaneously such a large scale change initiative requires rapid learning by functionaries at various levels across states for effective implementation. The CT-MMP would help in this regard as the model framework for Commercial Tax administration would incorporate the leading international practices as well as the learnings from visits to the four states identified for study Delhi, Andhra Pradesh, West Bengal and Gujarat. Program management Program management requires systems which help monitor and evaluate resources and progress of work across multiple areas of the mission mode program. Therefore much emphasis has been placed under the CT-MMP on the monitoring and evaluation framework to be used by the Department of Revenue and the states for assessing the progress of the mission mode program. Expectation management Under the CT MMP emphasis has been placed on understanding of the services that Commercial Tax departments wish to offer, the expectation of the various stakeholders and the service standards that citizens expect. Process reform management Process reforms require sensitization to various issues and also taking cognizance of the constraints that impact the reforms. Therefore, under the CT MMP a Page 17 of 118

participatory approach has been adopted to determine the reform initiatives required and what impact each reform would have on the tax organization and its performance. Resource management CT MMP has been designed to identify possibilities for public private partnerships and alternative channels for mobilizing new resources and improving utilization of existing resources. Technology management The pace with which technology landscape is changing necessitates redefinition of standards for technology procurement by the CTDs; ensure investment protection and optimal deployment of IT resources. In view of this in-depth analysis of various technology enabled options has been carried out. Procurement Management Migration to a new enterprise architecture based on a service delivery orientation would necessitate procurement of various kinds of resources. Therefore frameworks for procurement including sample RFPs, SLA frameworks and templates for public private partnerships are being developed as part of the CT MMP.

Page 18 of 118

2.2.3. Overall game plan of CT-MMP

Fig 5: Overall game plan for CT-MMP Subsequent to the design of MMP by DoR, a three-pronged strategy has been demarcated for roll out of the mission mode program. After approval of the MMP by Government of India, a monitoring and evaluation mechanism would be set up to oversee the establishment of core infrastructure for the MMP at national level. It would also monitor utilization of the technical and financial assistance rendered to the states as part of the MMP. In parallel, the MMP model would be shared with states for customization and implementation of the design. Industry and trade form a key stakeholder group and it would be important that they be aligned to the change initiatives planned under CT MMP and also participate in the capacity building exercise.

Page 19 of 118

2.2.4. Key outcomes of CT-MMP The following are the proposed key outcomes of CT-MMP: Roadmap for implementing the Commercial Taxes MMP with emphasis on vision, mission, service prioritization, program management and governance structure & mechanisms, stake holder expectations, risks and risk management guidelines, critical success factors International / National Best Practices along with their applicability and usability context in the CTMMP best practices for program management, governance, processes for management of Commercial Tax functions, technology architecture, service delivery, service delivery standards, channels for service delivery Portfolio of services to be targeted under the CT-MMP with description, breadth, depth, prioritization, service levels required to be achieved to meet stake holder expectations Reengineered Processes - process descriptions, process metrics, expected impacts of these processes on stake holders and on internal efficiencies, challenges in implementing them, governance structure for implementation, how the implementation plan has to be tied with IT infrastructure / applications Integrated o o o o o and comprehensive Commercial Taxes MMP Model/multiple models for

implementation, consisting of Functional Architecture - developing requirements of the functionality of the solution Process Architecture - defining the scope of BPR in selected core areas along with the BPR itself in those areas Technology Architecture - Technical solution, Information Security and Disaster Management Plan People Architecture - Capacity Building & Change Management Plan Resource Architecture - Business Model Options, including PPP models

Monitoring & Evaluation structure within the Ministry of Finance for Commercial Taxes MMP

The project seeks to bring significant improvements in area of Commercial Tax administration to increase the effectiveness of service delivery to citizens.

Page 20 of 118

2.3. Value added tax (VAT) 2.3.1. What is VAT? VAT is a multi-point Sales Tax system where the tax is levied as a proportion of value added (i.e. sales minus purchases).VAT is a consumption tax charged at every step of the value chain i.e. at each transaction in the production distribution system unlike previous Sales Tax systems concept of taxation at first/ last point. VAT helps to overcome certain problems and complexities associated with the Sales Tax structure. In the sales tax structure, there were problems of double taxation of commodities and multiplicity of taxes, resulting in a cascading tax burden. For instance, before a commodity is produced, inputs are first taxed, and then after the commodity is produced with input tax load, output is taxed again. This causes an unfair double taxation with cascading effects. Under VAT system, this problem is tackled by allowing dealers to claim a set-off on the input tax paid as well as the tax paid on previous purchases. Under the Sales Tax structure, there is also a multiplicity of taxes, such as turnover tax, surcharge on sales tax, additional surcharge, etc. With introduction of VAT, these taxes will be abolished. In addition, Central sales tax is also going to be phased out. The overall tax burden of a taxpayer will be rationalized, and prices in general will fall. VAT will replace the existing system of inspection by a system of built-in self-assessment by the dealers and auditing. The tax structure will become simple and more transparent. This will improve tax compliance and also augment revenue growth. To summarize, the introduction of VAT will result in the following key benefits: Prevention of double taxation with cascading effects by provision to dealers for claiming a set-off on input tax paid and tax paid on previous purchases Abolition of multiple taxes like turnover tax, surcharge, additional surcharge Rationalization of overall burden of taxpayer General fall in prices of goods over a period of time after stabilization of VAT system Shift from system of inspection of dealers by the CTD to system of self assessment by dealers Increase in transparency of taxation system Increased tax compliance and revenue growth

VAT will therefore help common people, traders, industrialists and also the Government. It is the right step in direction of a more efficient, effective and equitable taxation system.

Page 21 of 118

2.3.2. History of VAT Value Added Tax was first introduced in France in 1954 but initially it was not a complete system of VAT, since it applied only to transactions entered into by manufacturers and wholesalers. Later it was supplemented by a separate tax on services. A full-fledged VAT was initiated first in Brazil in mid 1960s, then in European countries in 1970s and subsequently introduced in about 130 countries, including several federal countries. VAT was extended to activities such as energy and construction during 1954 to 1963. In January 1968, reforms were initiated for generalizing VAT to all industrial, agricultural and commercial activities. It was extended to all transactions formerly subject to the local tax and to the tax on services, which were then abolished. Development of VAT in other countries has been gradual. Most of the countries had not adopted VAT till sixties. VAT has come to occupy an important place in the fiscal storage over the years in nearly all industrialized countries. This has led to many countries to adopt VAT as their major form of consumption tax. Thus, the augmentation of interest in VAT has been the most remarkable event in the evolution of commodity taxes in the present century. Over 120 countries worldwide have introduced VAT over the past three decades and India is amongst the last few to introduce it. 2.3.3. History of VAT in India In India, there has been a VAT system in respect of Central excise duties, introduced by the Government of India for approximately last ten years. The first preliminary discussion on State-level VAT took place in a meeting of Chief Ministers convened by Dr. Manmohan Singh, the then Union Finance Minister in 1995. In this meeting, the basic issues on VAT were discussed and this was followed up by periodic interactions of State Finance Ministers. Thereafter, in a significant meeting of all Chief Ministers, convened on November 16, 1999 by Shri Yashwant Sinha, the then Union Finance Minister, three important decisions were taken. Before the introduction of State-level VAT, the unhealthy sales tax rate war among the States would have to end and sales tax rates would need to be harmonized by implementing uniform floor rates of sales tax for different categories of commodities with effect from January 1, 2000. In the interest of harmonization of incidence of sales tax, the sales-tax-related industrial incentive schemes would also have to be discontinued with effect from January 1, 2000. On the basis of achievement of the first two objectives, steps would be taken by the States for introduction of State-level VAT after adequate preparation. For implementing these decisions, an Empowered Committee of State Finance Ministers was set- up. The Empowered Committee meets regularly, attended by the State Finance Ministers, and also by the Finance Secretaries and the Commissioners of Commercial Taxes of the State Governments as well as senior officials of the four Revenue CTD of the Ministry of Finance, Government of India. Through Page 22 of 118

repeated discussions and collective efforts in the Empowered Committee, it was possible within a period of about a year and a half to achieve nearly 98 per cent success in the first two objectives on harmonization of sales tax structure through implementation of uniform floor rates of sales tax and discontinuation of sales-taxrelated incentive schemes. As a part of regular monitoring, whenever any deviation is reported from the uniform floor rates of sales tax, or from decision on incentives, the Empowered Committee takes up the matter with the concerned State and also the Government of India for necessary rectification. Steps have been initiated by the EC for systematic preparation for the introduction of State-level VAT. In order to avoid competition among the states, attempts have been made from the beginning to harmonize the VAT design in the states keeping also in view the distinctive features of each state and the need for federal flexibility. Along with these measures at ensuring convergence on the basic issues on VAT, steps have also been taken for necessary training, computerization and interaction with trade and industry, particularly at the State levels. The Chief Ministers of all the states in an important meeting on State-level VAT convened by the Prime Minister on October 18, 2002, when Shri Jaswant Singh, the then Union Finance Minister was present, stated their intention of introducing VAT from April 1, 2003. Most of the states have joined VAT and implementation began on April 1, 2005 thus starting an era of the most significant tax-reform in indirect taxation. India is currently at a crucial stage in the introduction of a modern VAT. Some States have made excellent progress towards implementation, while others are at an early stage. Government of India wishes to see the development of a uniform set of VAT architecture and standards across all States regardless of their current stage of development.

2.3.4. Self assessment and VAT Modern tax administrations operate on the principle of self-assessment and the VAT proposed for India is ideally suited to that approach. In addition, India is already committed to formally adopting self- assessment across all revenues and therefore has a good basic experience in this approach. Self-assessment requires more than simply permitting the taxpayer to make the tax calculations and pay the amount calculated without notification from the tax administration. The concept is based on the understanding that a taxpayer is, because of the information known only to them, best placed to assess their tax liabilities and that the tax authorities efforts are best directed to identifying those taxpayers most likely to understate their tax liabilities, and focusing their scarce resources on the greatest areas of risk. Thus, the taxpayer effectively takes on responsibility for carrying out the assessment function otherwise carried out by the tax office. The following are some of the key responsibilities of taxpayers: Considering the facts relating to their own financial affairs Interpreting and applying the law to those facts Determining the amount of tax owing Page 23 of 118

Making that determination with an appropriate degree of finality Filing their return on time Paying the tax owing by the due date

This means that the tax administration pays little or no attention to the returns or affairs of the vast majority of taxpayers, other than to carry out automated checks for arithmetic accuracy and to ascertain that registered filers have in fact filed in a timely manner and paid the amounts they themselves have assessed. The declarations of most taxpayers are simply accepted. The modern tax management therefore relies heavily upon risk-assessment tools to determine which taxpayers' matters must be examined very closely, not merely at the audit level, but at all stages of the tax process, from registration to collection. In order for such a self-assessment system to be effective, the apparent freedom granted to taxpayers must be backed up with a supportive legislative framework and a comprehensive and integrated set of administrative processes, the main elements of which are: Simple and concise law Minimal discretion in hands of tax administrators Record-keeping rules appropriate to the nature and size of taxpayers business financial affairs Comprehensive and accessible taxpayer services A well-targeted audit system, leading to accurate reassessments with minimal disputes An effective and speedy disputes resolution service An appropriate and fairly applied penalty regime Well-designed processes to manage the recording of the receipt of returns and payments Identification of non-registrants, stop-filers and non-paying taxpayers Effective IT support across all functions

International experience has shown that this extensive reliance on self-assessment is the basic strategy that permits tax agencies to achieve high rates of voluntary compliance with ratios of 500 to 1000 or more taxpayers per tax official.

2.3.5. Operational tasks within VAT Decisions relating to policy and legislation, other state specific issues will have an impact on the way the tax is to be administered. However, international experience is that the main operational requirements of a modern VAT administration are: A registration program that facilitates registration for the vast majority of potential taxpayers while establishing proper controls for those registrants that are judged to have a high risk of fraudulent activities A comprehensive taxpayer services strategy and a strong taxpayer CTD to complement and support the service initiatives that have been included in the modernization program Page 24 of 118

Extensive use of technology including an aggressive and systematic campaign to promote electronic filing An audit program that relies on field audit presence and extensive reliance on risk assessment An arrears collection program that tailors the type and sequencing of enforcement actions to the degree of revenue risk posed by each arrears case

Following is a brief description of the key operational tasks under VAT administration: Registration: It has been an international experience that under VAT system a more dynamic approach to new taxpayer registration is required than under an income tax system. This flows from a number of features of the VAT, for example: o o o The pace with which arrears can accumulate if businesses are not registered immediately they commence The requirement for taxpayers to issue valid invoices to their customers from the day of commencement The compliance risks associated with false registration.

Hence the key requirements of the registration system are: o o On commencement of the VAT to ensure that all existing businesses with turnover above the threshold are registered automatically To ensure that new businesses operating above the threshold are identified quickly by the VAT office the most effective administrations have put in place systems to ensure automatic registration where a new business is registered with an organization such as the companies office, business registration department etc. o Identify potential false registrations which are likely to be a precursor to attempted VAT fraud The registration process will generally include functions such as: o o o o Issuance and collection of registration forms The automated allocation of a taxpayer identification number Issue of a VAT registration certificate Issue of initial blank return and will also trigger a taxpayer service advisory contact.

Managing return filing can be seen as being an extension of the registration system in that any registered taxpayer failing to file a return by the due date will be followed up promptly with an automated reminder notice and the automatic imposition of appropriate penalties. Electronic filing: As far as possible, VAT taxpayers should be required to file their returns electronically. Countries with established VAT systems are moving taxpayers to electronic filing as quickly as they can, but countries currently considering the introduction of the tax are considering making electronic filing mandatory. Comprehensive strategies would be required to encourage taxpayers to file electronically such as accelerating the issuance of refunds, extending the filing Page 25 of 118

dates (possibly), free-use of filing software, on-line help facility, and mailing out promotional materials. Taxpayer services: In a functional structure, there will be little conceptual difference between the taxpayer services activity for the VAT and that required for other taxes. In the implementation phases it is most likely that a structured advisory service will be required so that taxpayers can receive intensive education in the new tax. On an ongoing basis VAT taxpayers might require a higher level of assistance because of the increased filing frequency, but this might be counterbalanced by the greater simplicity of the VAT when compared to income taxes. Modern technology is being used in many countries to minimize the level of direct contact between taxpayers and tax officers. Following are some of the key benefits ensued from the use of technology in rendering services to taxpayers: o o Reducing the level of face to face contact between taxpayer and CTD officials. Centralized service provision can increase the consistency of advice given to taxpayers Taxpayer audit: As with direct taxes, VAT can be evaded and a strong and effective audit program is therefore crucial to increase the risks for taxpayers of being detected, to identify discrepancies and to provide sanctions against those who do not comply. The most common methods of VAT evasion are broadly similar to those of traditional sales taxes and direct taxes including o o o o Non-registration of businesses Underreporting of gross receipts Abuse of multiple rates Failing to account for tax paid by customers

However, the credit mechanism and zero rating offer additional opportunities, and VAT-specific fraud will include o o o Use of fake invoices Classifying domestic sales as exports to benefit from zero rating Claim of VAT credits for ineligible purchases

Despite the apparent similarities, VAT and direct tax audit practices need to differ reflecting the differing nature and risks of the two taxes. A VAT liability generally arises monthly or quarterly and can be a significant liability even for a moderately sized business. Discrepancies can therefore grow rapidly over a year if defaults are not identified and addressed quickly. As a result, VAT audit activity must include short period-based checks during the year as well as some more comprehensive multi period, multi tax audits. By contrast, direct tax audit cannot take place until annual returns have been filed. Different cycles are therefore appropriate for VAT and direct taxes. Page 26 of 118

In addition, a VAT inevitably gives rise to a significant number of refund claims. Verification checks need to be made which balance the need to protect the revenue with the justified requirements of honest taxpayers to receive their refunds quickly. Specific risk based audit needs flow from this requirement, and generally require special treatment of established and trustworthy exporters. Payments and arrears collection: Fundamentally, there is no difference between the payment and debt collection activities for income taxes and the VAT. In both cases, the emphasis needs to be on making it as easy as possible for taxpayers to pay (using a range of methods including direct debiting, internet banking/payment etc) eliminating the need for the tax office to handle cash, and the speedy follow up of those who pay late. Because of the speed with which VAT debts can arise, it is necessary to commence debt follow up action even more quickly than might be traditional for income tax debt, but the collection measures themselves are essentially the same as for Income Tax.

3.

Methodology for Current state assessment

Figure 6 represents the methodology for Current State Assessment under CT-MMP Page 27 of 118

Identification of four states for study

Prioritization of processes for reengineering

Information Gathering Exercise

Research on International leading practices

Stakeholder Consultation

Consolidation & Analysis of info - rmation gathered

CURRENT STATE ASSESSMENT

Fig 6: Methodology adopted for Current State Assessment under CTMMP Phase 1: Identification of the four states for study Under CT-MMP, for conducting a dipstick study to understand the primary features of commercial tax administration in the country, it was decided to identify four states as representative states among the 28 states and 7 union territories in India. Some of the key parameters used for the selection of states are as follows: Status of development of tax administration in the state Complexity of economy and size of business activity in the state Trading and transaction patterns in the state Willingness and commitment to change on the part of the state Geographical representation and accessibility for study of the state VAT implementation and participation in TINXSYS (Tax Information Exchange System) by the state Level of computerization in the state States with relatively strong linkages to the rest of the economy

The following four states were identified based on the above listed parameters. State Gujarat Relevant Consideration West Bengal Andhra Pradesh Nascent state of VAT Implementation Open to reforms Large State Traditional (Evolving) tax administration Mix of manufacturing and trading activities

Advanced tax administration

Page 28 of 118

State Delhi

Relevant Consideration Ease of Implementation Test of concept Political commitment for improving administration Compact Diversity of trade transactions

Table 2: Basis for identification of states for study under CT-MMP Phase 2: Prioritization of processes for reengineering under CT-MMP The next phase was the prioritization of those processes, the reengineering of which would have the maximum impact on the commercial tax administration and result in an Effective, Efficient and Equitable system. Section 4 includes the complete list of processes, the parameters used for prioritization and the final list of prioritized processes for study and reengineering under CT-MMP. The following five processes were selected: Registration of dealers under VAT Processing of VAT returns and tax collection Processing of VAT refunds Tax accounting Inter-state trade

Phase 3: Information gathering exercise As a part of the Information gathering exercise, an attempt was made to gather the following documents for the four states from websites and other public domains: VAT act, rules and schedules VAT forms Organizational structures Statistics related to VAT Information about the state and CTD

Phase 4: Research on international leading practices As a part of Phase 4, research was conducted to study some of the leading international commercial tax administrations, particularly with respect to the five prioritized processes. This secondary research along with consultation with international experts was used to prepare the paper on international leading practices.

Page 29 of 118

Phase 5: Stakeholder Consultation This phase involved the following key steps: Visit to the four states identified o o o o Delhi West Bengal Gujarat : July 24 to July 27 , 2006 : August 28 to August 30, 2006 : August 31 to September 2 , 2006 Andhra Pradesh: August 22 to August 24 ,2006

Detailed discussions regarding the five prioritized processes with the concerned CTD officials Interaction with dealers to obtain their feedback with respect to the five prioritized processes Collection of relevant documents and statistics

Phase 6: Consolidation and analysis of the information gathered The final phase involved the consolidation and analysis of information gathered to understand the system of commercial tax administration in the four states and coming up with the current state assessment. The interaction with dealers provided significant insight into the drawbacks of the current system particularly with respect to the lack of citizen centricity and service orientation in process design. Also the research on leading practices helped benchmark the processes in the four states with international benchmarks and identify the existing gaps.

Page 30 of 118

4.

Selection of processes under CT-MMP for BPR

The table below lists all the processes of a Commercial Tax administration grouped into core processes and support processes. Core processes Registration Return processing and tax payment Refunds processing Audits Tax accounting Taxpayer services Inter-state transactions Enforcement Mobile squads, Checkposts Debt collection/Recovery Support processes Personnel Development/Human Resources Administration Training Legal Policy Internal Audit Accounts Public Relations Information Technology

Table 3: List of processes under Commercial Tax Administration The potential processes for re-engineering were identified by collecting requisite data from the states identified for study and analyzing the impact of each process on effectiveness of service delivery through a mix of qualitative and quantitative parameters. Following are some of the indicative parameters used for measurement of impact: Extent of citizen interaction: According to NeGP, e-Governance is defined as giving taxpayers the choice of when and where they wish to access government information and services. NeGP emphasizes the importance of citizen centricity in the design of any initiative. Hence this is an important parameter for prioritization of processes. Increase in revenue collection: The ultimate objective of any tax administration is increased revenue collection. Hence this is an important parameter for prioritization of processes. Reduction in service delivery time: Since primarily citizen centricity is the underlying theme in design of any process under CT-MMP, taxpayer convenience becomes critical to an efficient and effective Commercial Tax administration system. Taxpayer convenience can in turn lead to increase compliance and increased revenue generation. Reduction in service delivery time has a direct impact on taxpayer convenience and hence is an important parameter in determining the effectiveness of service delivery. Possible reduction in paperwork: The rapid pace at which technology landscape is undergoing change makes it imperative that significant amount of work should be computerized by undertaking technology initiatives and minimize paperwork to extent possible. This would provide better maintenance, storage, access control and security of the data.

Page 31 of 118

Scope for standardization: There is significant amount of variation across the states in the processes both at the concept/ design level and the implementation level. It is necessary to bring about a certain degree of standardization in processes. From the taxpayers point of view, this would be helpful especially to those taxpayers who have their operations spread across multiple states. From the CTDs point of view, this would help in integration with other state CTDs for sharing of data relevant to Commercial Tax administration.

Scope for adoption of leading international practices: The objective of CT-MMP is to come up with a model framework for Commercial Tax administration incorporating some of the international leading practices. Hence we identify the processes where there is significant deviation from the international benchmarks and prioritize them for study under CT-MMP.

Possibility of revenue leakage: This is one of the primary areas of concern from the CTDs point of view. Hence it is necessary to prioritize those processes where there is potential for fraud leading to revenue leakage,

Following is a detailed discussion on how various processes were prioritized for re-engineering under CT-MMP. 4.1.Registration of dealers under VAT The table presented below is a snapshot of statistics related to VAT registration process across the four states. Parameters Number of dealers registered under VAT Number of times a dealer needs to visit the CTD to get the Registration Certificate issued Minimum of 2 visits Minimum of 1 visit Minimum of 2 visits Minimum of 3 visits Delhi 1,91,943 Andhra Pradesh 1,45,809 West Bengal 1,74,533 Gujarat 3,45,580

Average revenue generated per dealer per year (in INR) Average number of pages in the registration file of a single dealer (including supportings and annexures) Average wait time for a dealer to get the Registration Certificate ( in calendar days)

3,44,894

6,78,216

3,09,693

1,71,127

15 pages

10 pages

20 pages

20 pages

15 days

24 hours

7 days

30 days

Table 4: Snapshot of statistics related to VAT registration in four states Page 32 of 118

In conjunction with the statistics presented above, the following observations may be made with respect to the VAT registration process Extent of citizen interaction: Even though registration is a one time activity, it is the first customer touch point for new dealers and for existing dealers with good compliance history, there is an implicit expectation of an easier process. The registration process involves significant depth of interaction with dealer and therefore, it is essential that the process of registration be citizen friendly. The number of interactions of the taxpayer with the CTD to obtain Registration certificate varies across states. From taxpayer convenience point of view, ideally the number of visits required should be 1 or less and efforts should be made to achieve this. Registration as a process has an impact on both revenue generation and revenue protection. o o Revenue generation: The process of registration has a direct impact on revenue generated as higher the number of registered dealers, higher is the revenue generated Revenue protection: Registration is one of the processes where it is possible to control revenue leakage of the CTD by keeping the system free of bogus dealers who register to issue tax invoices but do not file returns The process of registration is primarily manual across states and this results in significant amount of paper work. This has a direct impact on issues related to storage space and security of the information stored. Hence registration process is an ideal candidate for reduction in paper work by process reengineering and using technology as an enabler. The service delivery time in a registration process is an important parameter since this is a citizen facing process and so it is necessary to minimize the turnaround time and make the process simple, fast and hassle free for the citizen. Scope for standardization: There is lack of standardization across states with respect to multiple parameters like TIN format, security deposit, pre-verification versus post verification, threshold for registration, types of registration, methods of collection and processing registration forms. There is a necessity to bring about a certain degree of standardization in the process across states so that dealers having operations in multiple states find it convenient to comply with the requirements. Scope for adoption of international leading practices: Some of the international benchmarks with respect to registration are as follows o o o o After initial implementation, all TIN to be issued within three (3) working days of the receipt of registration application TIN should be issued immediately for large business taxpayers provided all relevant documentation is provided with the application Ratio of active (operating regularly) to total registered taxpayers > 90% Ratio of taxpayers with more than one TIN to total registered taxpayers < 5%

In conjunction with the data pertaining to registration presented earlier, it can be seen that there is significant deviation from the international benchmarks with sufficient room for improvement.

Page 33 of 118

4.2. VAT Returns processing and tax collection The table presented below is a snapshot of statistics related to VAT returns and tax collection process across the four states. Parameters Number of VAT returns filed in financial year 2005-06 Number of times a dealer needs to visit the CTD in a year for filing of VAT returns Dependent on periodicity of filing of returns Monthly 12 Quarterly 4 Annual - 1 VAT tax collection for year 2005-06 (in INR crores) Average number of pages in the VAT returns filed by a single dealer (including supportings and annexures) 3 3 10 7 pages form + list of purchase and sales invoices and stock information Total Average =50 pages 6,620 9,889 5,405 5,913 12 times in a year for each dealer 4 System not yet stabilized Delhi 5,07,114 Andhra Pradesh 14,59,799 West Bengal 7,68,345 Gujarat 11,53,384

Table 5: Snapshot of statistics related to VAT returns in four states Based on the above statistics we can make the following observations with respect to VAT returns process Extent of citizen interaction: Return filing is a recurring periodic activity that a taxpayer must undertake and is the origin point for many other taxpayer related activities. The number of interactions of taxpayer with the CTD for filing of returns can be as high as 12 times in a year. Efforts should be made to minimize the number of visits of the taxpayer to the CTD by enabling electronic filing of returns. The process is primarily manual in the country across states resulting in a significant amount of paper work. This brings up issues related to storage space and security of the information stored. There is strong need for reduction in paper work by process reengineering and using technology as an enabler. Page 34 of 118

Scope for standardization: There is lack of standardization across states with respect to a multiple parameters like complexity of returns form design, periodicity of filing of returns and payment of tax, methods of collection and processing returns forms. This increases the compliance cost for dealers having operations across multiple states.

Average turnaround time for returns processing: The turnaround time for returns processing is a sum total of the time required for the following activities. The figures indicated are an average of the figures across the four states. o o o Forms collection ( 3- 5 mins) Data entry : 1 hour ( For Gujarat, the detailed entry can take upto 2-3 days depending on the length of annexures ) Scrutiny: The time required for scrutiny depends on whether it is performed manually / electronically. Only if performed manually it requires on an average a few hours time else the time required is insignificant. o Payment processing and reconciliation: This activity can be described as the bottleneck in the process. The time required varies across states. It also depends on whether the information is received from banks and treasuries in hard copy or electronically.

There is a significant scope for improvement in average time required for returns processing. One of the key areas that need to be looked at is the time required for data entry. In states collecting invoice level purchase and sales details from every dealer registered under VAT, the time required may be as high as 3 days for a single return. Such data entry activities are a significant drain on the administrations resources and divert the managements attention from more important issues. It also increases expenditure levels without any visible impact on efficiency or effectiveness of the administration. 4.3. Processing of VAT refunds The table presented below is a snapshot of statistics related to VAT refunds process across the four states. Parameters Citizen base the refunds process caters to Number of refunds made in year financial 2005-06 Total refunds amount in year 2005-06 (in INR crores) 121.33 35.5 9.5 262.67 12,726 88 20 7,691 Delhi 1,91,943 Andhra Pradesh 1,45,809 West Bengal 1,74,533 Gujarat 3,45,580

Page 35 of 118

Parameters Average wait time for dealer for refunds process ( in calendar days)

Delhi 30 days

Andhra Pradesh 45 days for exporter, 90 days for others

West Bengal NA *

Gujarat NA *

* NA Not applicable. The system of VAT refunds is under development. Input tax credit due is carried forward and settlement is made at year end. Table 6: Snapshot of statistics related to VAT refunds in four states Based on the above statistics we can make the following observations with respect to VAT refunds process Extent of citizen interaction: Refund processing is a critical activity especially for exporters and dealers who incur heavy capital expenditures. In many cases taxpayers need to prove validity of refund claims. Given that a large population of dealers would belong to this category and would require frequent refunds the extent of citizen interaction for refund processing is very high. The turnaround time for refunds process is an important parameter because a slow refund process implies stagnation of the working capital of a large segment of dealers. This can significantly hamper the economy and countries across the world have stringent timelines for refund clearance. There is significant variant found across the four states with respect to the turn around time. Scope for standardization: There is lack of standardization across the four states with respect to a number of parameters like time taken to grant refunds, approval process, and modes for granting refunds. By developing a model framework for all states, it would be possible to bring about a certain degree of standardization in the process across states. Scope for adoption of leading international practices: Internationally as well, experience with VAT implementation in many countries shows that refund of credits to taxpayers has been the Achilles heel of the VAT. For an efficient VAT functioning, VAT refunds should be paid promptly following receipt by the tax authority of a VAT return giving rise to an excess credit. That is the practice of most developed countries, where refunds are generally paid within four weeks of a refund claim being made.

Page 36 of 118

4.4. Tax Accounting Tax accounting is the critical process in any tax administration system. The process deals with the accounting of all cash inflows and outflows of the CTD and thus has direct revenue implications. The process is primarily complicated as it involves multiple entities both internal and external. The Department needs to receive information from these entities at different points in time and reconcile the information to maintain an up-todate snapshot of every dealer profile and to be able to answer the two ultimate questions: How much does the dealer owe to the Department? How much does the Department owe to the dealer?

External

Internal 3 1 4

External

Banks designated by CTD

Deale r

2 Commercial Tax Departme nt 10 9 8 7 5

6 Treasur y

Circle Office 1 2 3 4 5 Information about tax paid VAT Refunds issued

Audit

Enforcement

Other Acts

6 7 8 9 10

Information about payment realized Information for adjustments related to other acts Information on interests and penalties due Information about assessments issued Carry forward information of dealers

Information on refunds for electronic clearance Summary scroll for payments received and challan scroll VAT Refunds issued to dealers

Fig 7: Tax Accounting System

Page 37 of 118

The process of tax accounting is primarily manual across states and this results in significant amount of paper work. Also if the process is manual, there will be a considerable lag before the information gets reflected in the dealers account. Hence tax accounting process is an ideal candidate for using technology as an enabler to make process streamlined and efficient.

Scope for adoption of international leading practices: All leading tax administrations provide an online access to the dealers account/ ledger maintained by the Department. Since designing of citizen centric processes is the underlying theme of CT-MMP, Tax accounting becomes one of the candidate processes for reengineering. This initiative will also help to increase the transparency in the system and this in turn will lead to reduction in number of disputes and effort needed for dispute resolution.

4.5. Inter-state Trade The table presented below is a snapshot of statistics of processes related to inter state trade across the four states. Parameters Number of dealers registered under CST act Number of CST returns filed in the financial year 2005-06 Amount of CST collected in year 2005-06 (in INR crores) Number of times a dealer needs to visit the CTD with inter-state trade The dealer has to visit the CTD four times a year for filing CST returns. For the application and issuance of statutory forms need based The dealer has to visit the CTD four times a year for filing CST returns. For the application and issuance of waybills/ statutory forms need based The dealer has to visit the CTD four times a year for filing CST returns. For the application and issuance of waybills/ statutory forms need based The dealer has to visit the CTD four times a year for filing CST returns. For the application and issuance of statutory forms need based NA * 1,037 713.97 2,002 4,91,656 3,79,079 2,32,508 5,01,389 Delhi 1,862 Andhra Pradesh 76,734 West Bengal 1,00,831 Gujarat 2,04,399

* Data not available Table 7: Snapshot of statistics related to Inter-state trade in four states Page 38 of 118

In conjunction with the statistics presented above, the following observations may be made with respect to the VAT registration process Extent of citizen interaction: The number of interactions of each taxpayer with the CTD is a minimum of four times as the CST returns are to be filed quarterly. The dealer also has to visit the CTD for obtaining statutory forms and waybills on need basis. From taxpayer convenience point of view, it is necessary to minimize the number of interactions. Inter-state trade is one of the areas where there is significant scope for fraud prevention and control revenue leakage. Some of the possible frauds related to statutory forms are as follows o o o Faked/ forged statutory forms Misutillization of statutory forms Misrepresentation of information content in forms (Understating of purchases in the form submitted to the CTD of the purchasing dealer and overstating of the same in the copy submitted to the CTD of the selling dealer ) The processes related to inter-state trade are primarily manual across states. o The process of application and issuance of waybills and statutory forms is manual. This results in significant amount of paper work for the department and the dealer. Based on the teams interaction with dealers, it is estimated that a large inter-state dealer on an average manages around two thousand waybills in a year. o o The existence of manual statutory forms gives scope for related frauds. The process of monitoring inter-state transactions is primarily manual which means real time sharing of information related to statutory forms across states is not possible and therefore monitoring of inter-state transactions cannot be effective. Scope for standardization: There is lack of standardization across states with respect to parameters like process of application and issuance of waybills and statutory forms. There is a necessity to bring about a certain degree of standardization in the process across states so that dealers having operations in multiple states find it convenient to comply with the requirements.

Page 39 of 118

Conclusion: As is evident from the above analysis, the selection of processes for study under CT- MMP has been done in alignment with the NeGP goal of citizen centricity and service orientation. As a result of the analysis the following five processes been selected for study and re-design under the CT- MMP: Registration of dealers under VAT VAT Return processing and tax collection VAT Refund processing Tax accounting and Inter-state trade processes

The approach for selection of processes is oriented towards creation of a national infrastructure that would bring about uniformity in taxpayer services across India and facilitate inter-state trade. It is widely recognized that a streamlined registration process, automated return processing, electronic clearance of refunds and extensive use of internet technologies for tax payment processing and accounting are the hallmarks of any leading VAT administration. Given the intensity of citizen interaction in the five processes identified above it is expected that transformation of these key processes would lead to improved service delivery and help in exploitation of the true revenue potential of commercial activity in the various states. These processes lend significant scope for infusion of technology for faster processing and for easier information flow.

Page 40 of 118

5.

Current State Assessment of the four states