Agreement 0001015350001282938

Agreement 0001015350001282938

Uploaded by

Chagaleru RohiniCopyright:

Available Formats

Agreement 0001015350001282938

Agreement 0001015350001282938

Uploaded by

Chagaleru RohiniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Agreement 0001015350001282938

Agreement 0001015350001282938

Uploaded by

Chagaleru RohiniCopyright:

Available Formats

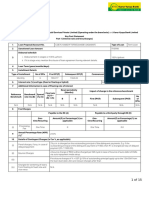

Annex A

Key Fact Statement

Part 1 (Interest Rate and fees/charges)

HDFC BANK LTD

DATE - 14/9/2024

Applicant Name - CHAGALERU ROHINI

1 Loan proposal /account Number WU2582411590 Type of Loan Insta Loan

Sanctioned Loan amount (In

2 Rs 70,000

Rupees)

3 Disbursement schedule

Disbursement in stages or 100%

(i) 100% Upfront

upfront

If it is stage wise mention the

(ii) clause of loan agreement having Not applicable

relevant details

4 Loan Term (Year/Months/Days) 36 Months

5 Instalment Details

Commencement of

Type of Instalments Number of EPIs EPI(Rs) repayment, post

sanction

12/10/2024

Monthly 36 Rs 2,357.23 EMI amount is payable

as per due date

specified in monthly

Statement

Interest rate p.a.(%) and

6 12.96%, Fixed

type(Fixed or floating or hybrid)

7 Additional information in case of floating rate of interest

Impact of change in

Final Rest Periodicity (Months) the reference

Reference Benchmark

Spread(%)(S) Rate(%) benchmark

Benchmark RATE(%)(B)

R=(B)+(S) Number of

B S EPI(Rs)

EPIs

Not

Not Not Not Not Not Not

Not Applicable Applica

Applicable Applicable Applicable Applicable Applicable Applicable

ble

Application is submitted on-line by the customer on 14/9/2024 at 4:48

8 Fee/Charges

Payable to the RE(A) Payable to a third party through RE(B)

Amount (in Rs) or Amount (in Rs) or

One-

One- time/ Recurring percentage (%) as percentage (%) as

time/Recurring

applicable applicable

(i) Processing Fees One time Rs 999 Not Applicable Not Applicable

(ii) Insurance Charges - - Not Applicable Not Applicable

(iii) Valuation Fees - - Not Applicable Not Applicable

Any Other (Please

(iv) - - Not Applicable Not Applicable

specify)

9 Annual Percentage Rate (APR)(%) 13.97 %

10 Details of contingent charges (in Rs or %, as applicable)

Late payment

(i) Penal Charges , if any, in case of delayed payment Outstanding Balance

Charges(Excl. GST)

Less than ₹100 Nil

₹100 to ₹500 Rs 100/-

₹501 to ₹5,000 Rs 500/-

₹5,001 to ₹10,000 Rs 600/-

₹10,001 to ₹25,000 Rs 800/-

₹25,001 to ₹50,000 Rs 1100/-

More than ₹50,000 Rs 1300/-

Payment Return fees: 2% of the payment amount, min

(ii) Other penal charges, if any

Rs450, max Rs4999.

3% of principal outstanding + GST & Pro-rata interest

(iii) Foreclosure charges, if applicable

+GST

Charges for switching of loans from floating to fixed

(iv) Not Applicable

rate and vice versa

(v) Any other charges(Please specify) Not Applicable

Application is submitted on-line by the customer on 14/9/2024 at 4:48

Total Interest charged during the entire tenure of the Rs 14,858

11

loan (In Rupees)

Total amount to be paid by the borrower (Sum of

12 Rs 85,857

(2),8(i),11) (In Rupees)

https://www.hdfcbank.com/personal/useful-

13 Privacy policies of HDFC Bank

links/privacy

Part 2 (Other Qualitative Information)

In the event of default, the details of authorized associate to

approach for recovery of dues will be intimated to you through a

Clause of Loan agreement relating to payment reminder communication and any change in details

1

engagement of recovery agents would be intimated to you thereon. List of authorized associates

empaneled for handling collections are updated on the bank’s

website for reference.

Clause of Loan agreement which details

2 Not applicable

grievance redressal mechanism

Mr. Kannan Ramaseshan (Grievance Redressal Officer)

Grievance Redressal Cell, HDFC Bank Limited,

1st Floor, Empire Plaza-1, Lal Bahadur Shastri Marg, Chandan

Nagar, Vikroli West, Mumbai-400083

Phone number and email id of the nodal Call: 18002664060

3

grievance redressal officer Monday to Saturday

9.30am to 5.30pm

This facility is not available on 2nd and 4th Saturdays, all

Sundays and Bank Holidays

4 Whether the loan is, or in future maybe,

subject to transfer to other Res or Not applicable

securitisation (Yes/No)

5 In case of lending under collaborative lending arrangements (e.g. co-lending/outsourcing), following additional

details may be furnished

Name of the originating RE, along with Name of the partner RE along with its

Blended rate of interest

its funding proportion proportion of funding

Not applicable Not applicable Not applicable

6 In case of digital loans, following specific disclosures may be furnished:

(i) Cooling off/look-up period, in terms of RE’s

board approved policy, during which

3 days

borrower shall not be charged any penalty

on prepayment of loan

https://www.hdfcbank.com/content/bbp/

(ii) Details of LSP acting as recovery agent and repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f/?

authorized to approach the borrower path=/Common%20Overlays/Feedback/PDFS/Banking%

20Ombudsman%20Scheme/Active-Collection-Vendor-List.pdf

Application is submitted on-line by the customer on 14/9/2024 at 4:48

Annex B

APR computation sheet

Number Parameter Details

1 Sanctioned Loan amount (in Rupees) Rs 70,000

2 Loan Term (in years/months/days) 36 Months

Number of instalments for payment of principal, in case of

a) Not Applicable

non-equated periodic loans

Type of EPI Monthly

b) Amount of each EPI(in Rupees) and Rs 2,357.23

Number of EPIs 36

Number of instalments for payment of capitalised interest,

c) Not applicable

if any

12/10/2024

d) Commencement of repayments, post sanction

EMI amount is payable as per due date

specified in monthly Statement

3 Interest rate type Fixed

4 Rate of interest p.a(%) 12.96 %

Total interest amount to be charged during the entire

5 tenor of the loan as per the rate prevailing on sanction Rs 14,858

date (in Rupees)

6 Fee/Charges payable (in Rupees)

A Payable to the RE Rs 999

B Payable to third-party routed through RE Not Applicable

7 Net disbursed amount (in Rupees) Rs 70,000

Total amount to be paid by the borrower (sum of 1 and 5

8 Rs 85,857

and 6A) (in Rupees)

Annual Percentage Rate- Effective annualised interest rate

9 13.97 %

(in percentage)

10 Schedule of disbursement as per terms and conditions 100% Upfront

12/10/2024

11 Due date of payment of instalment and interest EMI amount is payable as per due date

specified in monthly Statement

Application is submitted on-line by the customer on 14/9/2024 at 4:48

Annex C

Repayment Schedule

INSTALMENT OUTSTANDING PRINCIPAL (IN PRINCIPAL (IN INTEREST *EXCLUDING GST (IN INSTALMENT (IN

NO. RUPEES) RUPEES) RUPEES) RUPEES)

1 70000 1601.23 756 2357.23

2 68399 1618.23 739 2357.23

3 66781 1636.23 721 2357.23

4 65144 1653.23 704 2357.23

5 63491 1671.23 686 2357.23

6 61820 1689.23 668 2357.23

7 60131 1708.23 649 2357.23

8 58422 1726.23 631 2357.23

9 56696 1745.23 612 2357.23

10 54951 1764.23 593 2357.23

11 53187 1783.23 574 2357.23

12 51403 1802.23 555 2357.23

13 49601 1821.23 536 2357.23

14 47780 1841.23 516 2357.23

15 45939 1861.23 496 2357.23

16 44078 1881.23 476 2357.23

17 42196 1901.23 456 2357.23

18 40295 1922.23 435 2357.23

19 38373 1943.23 414 2357.23

20 36430 1964.23 393 2357.23

21 34465 1985.23 372 2357.23

22 32480 2006.23 351 2357.23

23 30474 2028.23 329 2357.23

24 28446 2050.23 307 2357.23

25 26396 2072.23 285 2357.23

26 24323 2094.23 263 2357.23

27 22229 2117.23 240 2357.23

28 20112 2140.23 217 2357.23

29 17972 2163.23 194 2357.23

30 15808 2186.23 171 2357.23

31 13622 2210.23 147 2357.23

32 11412 2234.23 123 2357.23

33 9178 2258.23 99 2357.23

34 6919 2282.23 75 2357.23

35 4637 2307.23 50 2357.23

36 2330 2330.01 25 2355

*GST is applicable on interest and charges.

*GST is not added in the APR calculation.

The first EMI amount will include gap interest and will thus differ from what is mentioned in the above KFS table.

You might also like

- ACG3141 Chap 14 PDFDocument35 pagesACG3141 Chap 14 PDFLexter Dave C EstoqueNo ratings yet

- Agreement 0001010710000715698Document5 pagesAgreement 0001010710000715698nikhiltky1987No ratings yet

- Agreement 0001013880004495568Document5 pagesAgreement 0001013880004495568rakeshrohillaNo ratings yet

- Key Facts StatementDocument12 pagesKey Facts StatementdeepakNo ratings yet

- Disbursal DateDocument6 pagesDisbursal Datefnousheen12No ratings yet

- This Is A Confidential Document. This Is A Confidential DocumentDocument1 pageThis Is A Confidential Document. This Is A Confidential Documentbapan.dipNo ratings yet

- KeyFactsStatement GL34769980Document3 pagesKeyFactsStatement GL34769980vennelamangiNo ratings yet

- Sanction DlaDocument15 pagesSanction DlaJaydeep TeluguntlaNo ratings yet

- YES BANK Limited Customer Name: Jagjit Singh Date: October 19, 2024, 12:00Document5 pagesYES BANK Limited Customer Name: Jagjit Singh Date: October 19, 2024, 12:00jagjitsinghdhillon636No ratings yet

- SANCTION LETTER 001No00000IMWrtIAHDocument10 pagesSANCTION LETTER 001No00000IMWrtIAHJaggu TigerNo ratings yet

- KFS LBCL999092565946392024090851Document5 pagesKFS LBCL999092565946392024090851ersatishpalNo ratings yet

- Sanction Dla 10fee086 Ed45 4af5 9af5 B204ceb2fed5Document17 pagesSanction Dla 10fee086 Ed45 4af5 9af5 B204ceb2fed5Upendraa .SNo ratings yet

- Key Facts Statement: Monthly 59 14500 10-12-2024Document9 pagesKey Facts Statement: Monthly 59 14500 10-12-2024a21026398No ratings yet

- Sanction DlaDocument15 pagesSanction DlaAlle Pavan KumarNo ratings yet

- MalajanhaDocument17 pagesMalajanhanirmalbehera010203No ratings yet

- Sanction DlaDocument15 pagesSanction Dlafalakjani250No ratings yet

- RBI Key Facts StatementDocument2 pagesRBI Key Facts StatementShrinivas PuliNo ratings yet

- E-Stamp: Government of Tamil NaduDocument37 pagesE-Stamp: Government of Tamil Naduerd.vishnuNo ratings yet

- KFSDocument5 pagesKFSpoojabasesra007No ratings yet

- KFS FormDocument4 pagesKFS Formtiwarijnp1990No ratings yet

- TW KFS PageDocument6 pagesTW KFS PagechandanacamzoneNo ratings yet

- Loan DocumentsDocument26 pagesLoan DocumentsSoumodeep DasNo ratings yet

- estampDocument27 pagesestampshrushtidoodh121No ratings yet

- Hero Fincorp Limited: Key Fact StatementDocument4 pagesHero Fincorp Limited: Key Fact StatementammaapparajkumarNo ratings yet

- KB241014QKRJQ - KFS & Sanction LetterDocument12 pagesKB241014QKRJQ - KFS & Sanction LetterManojkumar RaajNo ratings yet

- Sanction Letter VFDocument8 pagesSanction Letter VFJatin ThakarNo ratings yet

- Disbursed KFSDocument24 pagesDisbursed KFSamulyabehera1976No ratings yet

- New KFS Template Apr - 24 - BACLDocument8 pagesNew KFS Template Apr - 24 - BACLandreshenrichsen1No ratings yet

- Part 1 (Interest Rate and Fees/charges) : Key Facts StatementDocument48 pagesPart 1 (Interest Rate and Fees/charges) : Key Facts Statementparthrathod161No ratings yet

- MKV8717674AID146752259 KeyFactStatementDocument6 pagesMKV8717674AID146752259 KeyFactStatementanmarpe62No ratings yet

- Sanction Letter VFDocument7 pagesSanction Letter VFJatin ThakarNo ratings yet

- Kfs DocumentcyuDocument4 pagesKfs Documentcyubhimrajgaikwad83No ratings yet

- PL 88007714169Document37 pagesPL 880077141698804puruNo ratings yet

- 24075238281058605_20241204155707Document11 pages24075238281058605_20241204155707chandan shahNo ratings yet

- Sanction_letter_INST1733496468126741_IDEP371396359651ITAD_3338438313333111_version-0 (1)Document9 pagesSanction_letter_INST1733496468126741_IDEP371396359651ITAD_3338438313333111_version-0 (1)prinshupatel822No ratings yet

- CD PageDocument4 pagesCD Pagesyedavez839No ratings yet

- Renewal JLG Loan PDD EnglishDocument12 pagesRenewal JLG Loan PDD EnglishViswa JoshNo ratings yet

- Agreement 0001014450001319648Document4 pagesAgreement 0001014450001319648bullbear240No ratings yet

- KFSDocument10 pagesKFSbhowmik1967No ratings yet

- KFS - Amortization Schedule - Personal Loan On Credit CardDocument7 pagesKFS - Amortization Schedule - Personal Loan On Credit Cardgowthami.nagaripuram8No ratings yet

- Transaction Slip - Debt Liquid Equity SchemesDocument1 pageTransaction Slip - Debt Liquid Equity SchemesMaster pratikNo ratings yet

- Applicant KFSPDF - 0Document6 pagesApplicant KFSPDF - 0warsiarshad99No ratings yet

- Loan Sanction-Letter With KfsDocument5 pagesLoan Sanction-Letter With KfsAshish tiwariNo ratings yet

- PKFS CashnGoldDocument3 pagesPKFS CashnGoldkhurram2201No ratings yet

- Key Facts Statement Part 1 (Interest Rate and Fees/charges) : General DetailsDocument7 pagesKey Facts Statement Part 1 (Interest Rate and Fees/charges) : General Detailsgamersingh098123No ratings yet

- Sanction Letter - Disbursement Documents - MRS. M J JAYANTHI MADHURIMA - S - 02082024 - 041521PMDocument8 pagesSanction Letter - Disbursement Documents - MRS. M J JAYANTHI MADHURIMA - S - 02082024 - 041521PMsrinivas rao kNo ratings yet

- Offer Letter AxisDocument2 pagesOffer Letter Axisgirimpatil123No ratings yet

- Loan Sanction-Letter With KfsDocument5 pagesLoan Sanction-Letter With Kfsas8286509No ratings yet

- Sanction Letter FAST7681730886144145 USER2171476524776NGM Version-0 PDFDocument9 pagesSanction Letter FAST7681730886144145 USER2171476524776NGM Version-0 PDFPatra enterprisesNo ratings yet

- Sanction Letter Disbursement Documents MR. SENDIL KUMAR S S 09052024 122245PMDocument8 pagesSanction Letter Disbursement Documents MR. SENDIL KUMAR S S 09052024 122245PMsendil kumarNo ratings yet

- KFS 2Document1 pageKFS 2amit.sharma4No ratings yet

- Sanction Letter INST7213133531474796 IDEP712313249181SXKD 1157777277521771 Version-0Document9 pagesSanction Letter INST7213133531474796 IDEP712313249181SXKD 1157777277521771 Version-0Ayush SinghNo ratings yet

- Annexure B: Common NotesDocument1 pageAnnexure B: Common Notesbapan.dipNo ratings yet

- Getdocument Bikkina Yesu Babu Sanction Letter PDFDocument10 pagesGetdocument Bikkina Yesu Babu Sanction Letter PDFRAKESH BABUNo ratings yet

- Personal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyFrom EverandPersonal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyNo ratings yet

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersFrom EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersNo ratings yet

- Right to Work?: Assessing India's Employment Guarantee Scheme in BiharFrom EverandRight to Work?: Assessing India's Employment Guarantee Scheme in BiharNo ratings yet

- Chapter.6 Financing - The.small - BusinessDocument66 pagesChapter.6 Financing - The.small - BusinesstyraNo ratings yet

- General Mathematics Quarter 2 ExaminationDocument6 pagesGeneral Mathematics Quarter 2 ExaminationDina Jean Sombrio100% (1)

- Key Facts Statement 4742588Document9 pagesKey Facts Statement 4742588jay20bdNo ratings yet

- Business Mathematics: For LearnersDocument13 pagesBusiness Mathematics: For LearnersJet Rollorata BacangNo ratings yet

- An Analysis of Non Performing Assets (NPA) On Punjab National BankDocument14 pagesAn Analysis of Non Performing Assets (NPA) On Punjab National BankRajni KumariNo ratings yet

- 4th Accounts Dec 2021Document2 pages4th Accounts Dec 2021KillingNo ratings yet

- Agreement of Leave and License Laram Base SDocument4 pagesAgreement of Leave and License Laram Base Svaibsaparadh407No ratings yet

- TarelcoDocument3 pagesTarelcoMargie GutierrezNo ratings yet

- Accountancy Class 11 Most Important Sample Paper 2023-2024Document12 pagesAccountancy Class 11 Most Important Sample Paper 2023-2024Hardik ChhabraNo ratings yet

- F2 Fintech - Company ProfileDocument11 pagesF2 Fintech - Company ProfileKamal SunarNo ratings yet

- Loan Syndication and Consortium Finance 1Document11 pagesLoan Syndication and Consortium Finance 1sarah x89% (9)

- Billwise ExerciseDocument2 pagesBillwise ExerciseRahul GoswamiNo ratings yet

- Microfinance PHD Thesis PDFDocument6 pagesMicrofinance PHD Thesis PDFh0nuvad1sif2100% (1)

- Wasta Edited 1Document3 pagesWasta Edited 1Gijoy GeorgeNo ratings yet

- KSFC Scheme For SC - ST K & E-pages-DeletedDocument3 pagesKSFC Scheme For SC - ST K & E-pages-DeletedVishwanath PatilNo ratings yet

- Nghe Chép Chính Tả - Intermediate - StudentDocument59 pagesNghe Chép Chính Tả - Intermediate - StudentThu PhạmNo ratings yet

- CGAP Appraisal Report For The Selection of MFIs Along The SNNP Region of Ethiopia.Document31 pagesCGAP Appraisal Report For The Selection of MFIs Along The SNNP Region of Ethiopia.Diana Nabukenya KattoNo ratings yet

- PW84PRP4819931 SoaDocument5 pagesPW84PRP4819931 Soasadhamba3No ratings yet

- Form 135Document4 pagesForm 135TechnetNo ratings yet

- Mint Delhi 13-12-2023Document21 pagesMint Delhi 13-12-2023deeksha vermaNo ratings yet

- 597009Document1 page597009Mahesh Babu MalepatiNo ratings yet

- BLG Part I Product and Process Overview Module Answer KeyDocument2 pagesBLG Part I Product and Process Overview Module Answer KeySusmita JakkinapalliNo ratings yet

- Bhagi Rathi Pandey: Page 1 of 3Document3 pagesBhagi Rathi Pandey: Page 1 of 3Bhagirathi PandeyNo ratings yet

- SPA Represent in Bank VehicleDocument2 pagesSPA Represent in Bank VehicleSherwin HermanoNo ratings yet

- Letter To Saraswat BankDocument3 pagesLetter To Saraswat BankSatishNo ratings yet

- Chart of Account With Old GLDocument37 pagesChart of Account With Old GLShivam pandeyNo ratings yet

- Personal Loan AgreementDocument5 pagesPersonal Loan AgreementedgeclosezimNo ratings yet

- Types of Loan Provided by Different BanksDocument43 pagesTypes of Loan Provided by Different Bankssurajchoudhari0204No ratings yet

- Additional Case - Urban Chic DesignersDocument2 pagesAdditional Case - Urban Chic DesignersNaman MantriNo ratings yet