Computation of Tax - Nandish Mehta

Computation of Tax - Nandish Mehta

Uploaded by

Neeraj MishraCopyright:

Available Formats

Computation of Tax - Nandish Mehta

Computation of Tax - Nandish Mehta

Uploaded by

Neeraj MishraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Computation of Tax - Nandish Mehta

Computation of Tax - Nandish Mehta

Uploaded by

Neeraj MishraCopyright:

Available Formats

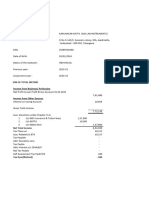

A.Y.

2024-25

Statement of Income

Rs. Rs. Rs.

n Income from Salary

Gross Salary

ADITYA BIRLA FINANCE LIMITED 945,663

KOTAK MAHINDRA BANK LIMITED 476,731 1,422,394

Less : Exempt Allowances u/s. 10

Sec 10(5) -LTA 62,500

Sec 10(13A) -HRA 465,000 527,500

Less : Deductions u/s 16

Standard deduction u/s 16(ia) 50,000

Professional tax u/s 16(iii) 2,500 52,500

Income chargeable under the head "Salaries" 842,394

n Profitsand Gains From Other Sources

Interest from Income Tax Refund 2,488

Interest Receied in Saving Bank Account 508

Income chargeable under the head "Other Souces" 2,996

n Gross Total Income 845,390

Deductions under Chapter VI-A

42,614

Total Deductions subject to Maximum Limit of Rs.150000/- 42,614

80D Mediclaim 12,845

80TTA : Deduction in respect of Interest Received in Saving Bank 508

n Total Income 789,423

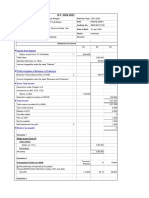

Calculation of Tax

Total income rounded off u/s 288A 789,420

Tax on total income 70,384

Less: Rebate u/s. 87A 0

70,384

Add: Education cess 2,815

Tax with cess 73,199

Less :TDS 112,234

n Balance Tax Refundable 39,035

You might also like

- Payslip For The Month of April 2022: Earnings DeductionsDocument2 pagesPayslip For The Month of April 2022: Earnings DeductionsPrateek KwatraNo ratings yet

- Razorpay Software P.L: Pay Slip For The Month of April 2021Document1 pageRazorpay Software P.L: Pay Slip For The Month of April 2021ARSHU . SNo ratings yet

- Aleg MergedDocument11 pagesAleg MergedSriram GovindaRajNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- Vinod Singh Computation Revised-3Document4 pagesVinod Singh Computation Revised-3vinodNo ratings yet

- Coi AmbekarDocument2 pagesCoi AmbekarCorman LimitedNo ratings yet

- Income Tax Calculation Worksheet: Thermax LTD Ascent PayrollDocument1 pageIncome Tax Calculation Worksheet: Thermax LTD Ascent PayrollAnuragNo ratings yet

- Computation - Vijay SharmaDocument2 pagesComputation - Vijay Sharmaankit sharmaNo ratings yet

- Computation of Income - Wajid 2021-22Document2 pagesComputation of Income - Wajid 2021-22casadegorrasfashionllp1No ratings yet

- Payslip July 2024Document1 pagePayslip July 2024hbcapital.banti1No ratings yet

- $RN8C7G2Document3 pages$RN8C7G2akxerox47No ratings yet

- Computation 2022-2023Document2 pagesComputation 2022-2023yiyirek783No ratings yet

- HTMLReportsDocument1 pageHTMLReportsRashmi Awanish PandeyNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- Vishal Thakkar ComputationDocument4 pagesVishal Thakkar ComputationHemant SurgicalNo ratings yet

- Computation 22-23 AyDocument2 pagesComputation 22-23 AysonuNo ratings yet

- TDS Calculation Sheet - Old RegimeDocument12 pagesTDS Calculation Sheet - Old RegimeABHISHEK SINGHNo ratings yet

- Financials - SignedDocument3 pagesFinancials - Signedsruthiconsultancy357No ratings yet

- Salary SlipDocument1 pageSalary Sliprichiek.mittraNo ratings yet

- Computation Sheet NewDocument3 pagesComputation Sheet New93zx6rNo ratings yet

- Profits and Gains of Business or ProfessionDocument3 pagesProfits and Gains of Business or ProfessionKumar GajulaNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument3 pagesIncome From Salaries: Rs. Rs. Rs. SCH - NoBilalNo ratings yet

- Rahul CompDocument2 pagesRahul CompCorman LimitedNo ratings yet

- Ay 22-23 Dattatri Kadam With Sign & StampDocument13 pagesAy 22-23 Dattatri Kadam With Sign & StampRAJESH DNo ratings yet

- Computation 2022 23Document2 pagesComputation 2022 23rohitaher294No ratings yet

- CompDocument4 pagesCompCorman LimitedNo ratings yet

- Direct Tax Solution PDFDocument8 pagesDirect Tax Solution PDFGaurav SoniNo ratings yet

- Oho Shop CoiDocument5 pagesOho Shop CoiJAY K SHAH & ASSOCIATESNo ratings yet

- Ay2022 23 Ujjawal Dhawan Apypd6567j ComputationDocument2 pagesAy2022 23 Ujjawal Dhawan Apypd6567j ComputationAkshat MittalNo ratings yet

- It Computation Sheet Fy 2020-21 - LopamudraDocument3 pagesIt Computation Sheet Fy 2020-21 - LopamudraGirija Prasad SwainNo ratings yet

- Salary Slip Format For HCLDocument1 pageSalary Slip Format For HCLgamersingh098123No ratings yet

- STEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Document1 pageSTEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Amaresh NayakNo ratings yet

- Ku Way Yik - Tax Booklet - DraftDocument19 pagesKu Way Yik - Tax Booklet - Draftestherkw940No ratings yet

- Problem & Solution - 5 - July 2018Document3 pagesProblem & Solution - 5 - July 2018Mohammed Shihab UddinNo ratings yet

- Profits and Gains of Business or Profession: Rs. Rs. Rs. SCH - NoDocument3 pagesProfits and Gains of Business or Profession: Rs. Rs. Rs. SCH - NoAkhil ThannikalNo ratings yet

- Adobe Scan 10 Mar 2022Document3 pagesAdobe Scan 10 Mar 2022LET'S SQUASH LET'S SQUASHNo ratings yet

- Dec Payslip - Rekrut IndiaDocument1 pageDec Payslip - Rekrut IndiafkadirNo ratings yet

- Upgrad PayslipDocument1 pageUpgrad PayslipSantanu SauNo ratings yet

- Computation 2023-2024Document2 pagesComputation 2023-2024yiyirek783No ratings yet

- $REGJV24Document2 pages$REGJV24akxerox47No ratings yet

- Ask Fy 2022-23 FNLDocument3 pagesAsk Fy 2022-23 FNLsgnvsureshNo ratings yet

- PDFReports PDFDocument1 pagePDFReports PDFTuhin ChakrabortyNo ratings yet

- Malarmangai 2021-2022Document10 pagesMalarmangai 2021-2022Karthick KumarNo ratings yet

- Chennagiri Raviteja 2023-24Document3 pagesChennagiri Raviteja 2023-24ravi.ramana64No ratings yet

- Ageeta AY 2018-2019: Computation of Income (ITR4)Document50 pagesAgeeta AY 2018-2019: Computation of Income (ITR4)pmcmbharat264No ratings yet

- Income From SalariesDocument2 pagesIncome From Salariesrangaswamy8194No ratings yet

- Revision TXDocument26 pagesRevision TXFatemah MohamedaliNo ratings yet

- Salary Slip MayDocument1 pageSalary Slip MaynikitachaudharyworldNo ratings yet

- COMPUTATIONDocument2 pagesCOMPUTATIONramakrishna6469No ratings yet

- Book 1Document1 pageBook 1gras2007No ratings yet

- CompDocument3 pagesCompchalukrcNo ratings yet

- Book 1Document2 pagesBook 1NandhakumarNo ratings yet

- ComputationDocument2 pagesComputationBike World BangaloreNo ratings yet

- Sep 2024Document1 pageSep 2024tomaraditya720No ratings yet

- Salary For Sep - 2022Document1 pageSalary For Sep - 2022narottam.ojhaNo ratings yet

- Salary Slip - Quess)Document1 pageSalary Slip - Quess)gamersingh098123No ratings yet

- BS 31.03.09Document11 pagesBS 31.03.09Leslie FlemingNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet