Handout-2 - Introduction To Financial Ratios

Handout-2 - Introduction To Financial Ratios

Uploaded by

Muhammad AhmedCopyright:

Available Formats

Handout-2 - Introduction To Financial Ratios

Handout-2 - Introduction To Financial Ratios

Uploaded by

Muhammad AhmedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Handout-2 - Introduction To Financial Ratios

Handout-2 - Introduction To Financial Ratios

Uploaded by

Muhammad AhmedCopyright:

Available Formats

Handout-2 Introduction to Financial Ratios Fall-2024

FINANCIAL ANALYSIS

INTRODUCTION TO FINANCIAL RATIOS

Various tools and techniques are used to convert financial statement data into formats that

facilitate analysis. These include ratio analysis, common-size analysis, graphical analysis, and

regression analysis.

Ratio Analysis

Ratios are useful tools for expressing relationships among data that can be used for internal

comparisons and comparisons across firms. They are often most useful in identifying

questions that need to be answered, rather than answering questions directly. Specifically,

ratios can be used to do the following:

Project future earnings and cash flow.

Evaluate a firm’s flexibility (the ability to grow and meet obligations even when

unexpected circumstances arise).

Assess management’s performance.

Evaluate changes in the firm and industry over time.

Compare the firm with industry competitors.

Analysts must also be aware of the limitations of ratios, including the following:

Financial ratios are not useful when viewed in isolation. They are only informative

when compared to those of other firms or to the company’s historical performance.

Comparisons with other companies are made more difficult by different accounting

treatments. This is particularly important when comparing U.S. firms to non-U.S.

firms.

It is difficult to find comparable industry ratios when analyzing companies that operate

in multiple industries.

Conclusions cannot be made by calculating a single ratio. All ratios must be viewed

relative to one another.

Determining the target or comparison value for a ratio is difficult, requiring some range

of acceptable values.

It is important to understand that the definitions of ratios can vary widely among the

analytical community. For example, some analysts use all liabilities when measuring

leverage, while other analysts only use interest-bearing obligations. Consistency is

paramount. Analysts must also understand that reasonable values of ratios can differ among

industries.

Financial Analysis UCP-Business School

Handout-2 Introduction to Financial Ratios Fall-2024

Common-Size Analysis

Common-size statements normalize balance sheets and income statements and allow the

analyst to more easily compare performance across firms and for a single firm over time.

A vertical common-size balance sheet expresses all balance sheet accounts as a

percentage of total assets.

A vertical common-size income statement expresses all income statement items as a

percentage of sales.

In addition to comparisons of financial data across firms and time, common-size analysis is

appropriate for quickly viewing certain financial ratios. For example, the gross profit margin,

operating profit margin, and net profit margin are all clearly indicated within a common-size

income statement. Vertical common-size income statement ratios are especially useful for

studying trends in costs and profit margins.

income statement account

vertical common-size income statement ratios =

sales

Balance sheet accounts can also be converted to common-size ratios by dividing each balance

sheet item by total assets.

balance sheet account

vertical common-size balance-sheet ratios = total assets

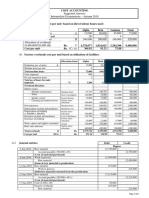

Vertical Common-Size Balance Sheet and Income Statement

Financial Analysis UCP-Business School

Handout-2 Introduction to Financial Ratios Fall-2024

Vertical Common-Size Balance Sheet and Income Statement (continued)

Beginning at the bottom, we can see that the profitability of the company has increased nicely

in 20X6 after falling slightly in 20X5. We can examine the 20X6 income statement values to

find the source of this greatly improved profitability. Cost of goods sold seems to be stable,

with an improvement (decrease) in 20X6 of only 0.48%. SG&A was down approximately

one-half percent as well.

These improvements from (relative) cost reduction, however, only begin to explain the 5%

increase in the net profit margin for 20X6. Improvements in two items, “amortization” and

“interest and other debt expense,” appear to be the most significant factors in the firm’s

improved profitability in 20X6. Clearly the analyst must investigate further in both areas to

learn whether these improvements represent permanent improvements or whether these items

can be expected to return to previous percentage-of-sales levels in the future.

We can also note that interest expense as a percentage of sales was approximately the same in

20X4 and 20X6. We must investigate the reasons for the higher interest costs in 20X5 to

determine whether the current level of 2.85% can be expected to continue into the next

period. In addition, more than 3% of the 5% increase in net profit margin in 20X6 is due to a

decrease in amortization expense. Since this is a noncash expense, the decrease may have no

implications for cash flows looking forward.

This discussion should make clear that common-size analysis doesn’t tell an analyst the

whole story about this company, but can certainly point the analyst in the right direction to

find out the circumstances that led to the increase in the net profit margin and to determine

the effects, if any, on firm cash flow going forward.

Another way to present financial statement data that is quite useful when analyzing trends

over time is a horizontal common-size balance sheet or income statement. The divisor

here is the first-year values, so they are all standardized to 1.0 by construction.

Financial Analysis UCP-Business School

Handout-2 Introduction to Financial Ratios Fall-2024

Horizontal Common-Size Balance Sheet Data

20X4 20X5 20X6

Inventory 1.0 1.1 1.4

Cash and marketable securities 1.0 1.3 1.2

Long-term debt 1.0 1.6 1.8

PP&E (net of depreciation) 1.0 0.9 0.8

Trends in the values of these items, as well as the relative growth in these items, are readily

apparent from a horizontal common-size balance sheet.

We can view the values in the common-size financial statements as ratios. Net income is

shown on the common-size income statement as net income/revenues, which is the net profit

margin, and tells the analyst the percentage of each dollar of sales that remains for

shareholders after all expenses related to the generation of those sales are deducted. One

measure of financial leverage, long-term debt to total assets, can be read directly from the

vertical common-size financial statements. Specific ratios commonly used in financial

analysis and interpretation of their values are covered in detail in this review.

Graphical Analysis

Graphs can be used to visually present performance comparisons and composition of

financial statement elements over time.

Financial Analysis UCP-Business School

Handout-2 Introduction to Financial Ratios Fall-2024

FINANCIAL RATIOS

Financial ratios can be segregated into different classifications by the type of information

about the company they provide. One such classification scheme is:

Activity ratios. This category includes several ratios also referred to asset utilization or

turnover ratios (e.g., inventory turnover, receivables turnover, and total assets

turnover). They often give indications of how well a firm utilizes various assets such as

inventory and fixed assets.

Liquidity ratios. Liquidity here refers to the ability to pay short-term obligations as

they come due.

Solvency ratios. Solvency ratios give the analyst information on the firm’s financial

leverage and ability to meet its longer-term obligations.

Profitability ratios. Profitability ratios provide information on how well the company

generates operating profits and net profits from its sales.

p ratios. Sales per share, pearnings

Valuation g per share, and price to cashpflow per share

are exam les of ratios used in com arin the relative valuation of com anies.

Profitability Ratios

Profitability ratios measure the overall performance of the firm relative to revenues, assets,

equity, and capital.

The net profit margin is the ratio of net income to revenue:

net income

net profit margin = revenue

Analysts should be concerned if this ratio is too low. The net profit margin should be

based on net income from continuing operations, because analysts should be primarily

concerned about future expectations, and below-the-line items such as discontinued

operations will not affect the company in the future.

Operating profitability ratios look at how good management is at turning their efforts

into profits. Operating ratios compare the top of the income statement (sales) to profits

The different ratios are designed to isolate specific costs.

Know these terms:

gross profits = net sales – COGS

operating profits = earnings before interest and taxes = EBIT

net income = earnings after taxes but before dividends

total capital = long-term debt + short-term debt + common and preferred equity

total capital = total assets

Financial Analysis UCP-Business School

Handout-2 Introduction to Financial Ratios Fall-2024

How they relate in the income statement:

The gross profit margin is the ratio of gross profit (sales less cost of goods sold) to

sales:

gross profit

gross profit margin = revenue

An analyst should be concerned if this ratio is too low. Gross profit can be increased by

raising prices or reducing costs. However, the ability to raise prices may be limited by

competition.

The operating profit margin is the ratio of operating profit (gross profit less selling,

general, and administrative expenses) to sales. Operating profit is also referred to as

earnings before interest and taxes (EBIT):

operating income EBIT

operating profit margin = revenue

or revenue

Strictly speaking, EBIT includes some nonoperating items, such as gains on

investment. The analyst, as with other ratios with various formulations, must be

consistent in his calculation method and know how published ratios are calculated.

Analysts should be concerned if this ratio is too low. Some analysts prefer to calculate

the operating profit margin by adding back depreciation and any amortization expense

to arrive at earnings before interest, taxes, depreciation, and amortization (EBITDA).

Sometimes profitability is measured using earnings before tax (EBT), which can be

calculated by subtracting interest from EBIT or from operating earnings. The pretax

margin is calculated as:

EBT

pretax margin = revenue

Financial Analysis UCP-Business School

Handout-2 Introduction to Financial Ratios Fall-2024

Another set of profitability ratios measure profitability relative to funds invested in the

company by common stockholders, preferred stockholders, and suppliers of debt

financing. The first of these measures is the return on assets (ROA). Typically, ROA is

calculated using net income:

net income

return on assets (ROA) = average total assets

This measure is a bit misleading, however, because interest is excluded from net

income but total assets include debt as well as equity. Adding interest adjusted for tax

back to net income puts the returns to both equity and debt holders in the numerator.

The interest expense that should be added back is gross interest expense, not net

interest expense (which is gross interest expense less interest income). This results in

an alternative calculation for ROA:

net income+ interest expense (1−tax rate)

return on assets (ROA) =

average total assets

A measure of return on assets that includes both taxes and interest in the numerator is

the operating return on assets:

operating income EBIT

operating return on assets = average total assets

or average total assets

The return on total capital (ROTC) is the ratio of net income before interest and taxes

to total capital:

EBIT

return on total capital = average total capital

Total capital includes short- and long-term debt, preferred equity, and common equity.

Analysts should be concerned if this ratio is too low.

An alternative method for computing ROTC is to include the present value of operating

leases on the balance sheet as a fixed asset and as a long-term liability. This adjustment

is especially important for firms that are dependent on operating leases as a major form

of financing.

The return on equity (ROE) is the ratio of net income to average total equity (including

preferred stock):

net income

return on equity = average total equity

Analysts should be concerned if this ratio is too low. It is sometimes called return on

total equity.

A similar ratio to the return on equity is the return on common equity:

net income – preferred dividends

return on common equity =

average common equity

net income available to common

= average common equity

This ratio differs from the return on total equity in that it only measures the accounting

profits available to, and the capital invested by, common stockholders, instead of

common and preferred stockholders. That is why preferred dividends are deducted

from net income in the numerator. Analysts should be concerned if this ratio is too low.

The return on common equity is often more thoroughly analyzed using the DuPont

decomposition, which is described later in this topic review.

Financial Analysis UCP-Business School

Handout-2 Introduction to Financial Ratios Fall-2024

EXAMPLE: Calculating ratios

A balance sheet and income statement for Sedgwick Company are shown in the following tables for this

year and the previous year.

Using the company information provided, calculate the following ratios for the current year: current ratio,

total asset turnover, net profit margin, return on common equity, and total debt to equity.

Sedgwick Company Balance Sheet

Year Current Year Previous Year

Assets

Cash and marketable securities $105 $95

Receivables 205 195

Inventories 310 290

Total current assets 620 580

Gross property, plant, and equipment 1,800 $1,700

Accumulated depreciation 360 340

Net property, plant, and equipment 1,440 1,360

Total assets $2,060 $1,940

Liabilities

Payables $110 $90

Short-term debt 160 140

Current portion of long-term debt 55 45

Current liabilities 325 $275

Long-term debt 610 $690

Deferred taxes 105 95

Common stock at par 300 300

Additional paid in capital 400 400

Retained earnings 320 180

Common shareholders equity 1,020 880

Total liabilities and equity $2,060 $1,940

Sedgwick Company Income Statement

Year Current Year

Sales $4,000

Cost of goods sold 3,000

Gross profit 1,000

Operating expenses 650

Operating profit 350

Interest expense 50

Earnings before taxes 300

Taxes 100

Net income 200

Common dividends 60

Financial Analysis UCP-Business School

You might also like

- Case Analysis - HP-Compaq The Merger DecisionDocument12 pagesCase Analysis - HP-Compaq The Merger DecisionSudheer Reddy Reddypalli100% (3)

- Acccob3 HW5Document10 pagesAcccob3 HW5neovaldezNo ratings yet

- Science 37 (Site)Document28 pagesScience 37 (Site)Pro Business PlansNo ratings yet

- Comparative and Common Size Financial StatementsDocument24 pagesComparative and Common Size Financial StatementsTanish Bohra100% (10)

- Ratio AnalysisDocument24 pagesRatio Analysisrleo_19871982100% (1)

- Finance Project For McomDocument40 pagesFinance Project For McomSangeeta Rachkonda100% (1)

- Financial Statement AnalysisDocument33 pagesFinancial Statement Analysisfirst name100% (3)

- A Study On Ratio Analysis in Tata MotorsDocument63 pagesA Study On Ratio Analysis in Tata MotorsMeena Sivasubramanian100% (3)

- Ratio Analysis Project Shankar - NewDocument15 pagesRatio Analysis Project Shankar - NewShubham SinghalNo ratings yet

- Beatrice Peabody CaseDocument14 pagesBeatrice Peabody CaseSindhura Mahendran100% (9)

- Concepts and Review of LiteratureDocument40 pagesConcepts and Review of Literaturezeeshan shaikhNo ratings yet

- RatioAnalysis NotesDocument34 pagesRatioAnalysis Notesvrajshah3434No ratings yet

- Ratio AnalysisDocument21 pagesRatio Analysisindusunkari200No ratings yet

- Unit-2 Financial Statement Analysis ToolsDocument37 pagesUnit-2 Financial Statement Analysis Toolsbhargav.bhut112007No ratings yet

- FINANCIAL STATEMENT ANALYSISDocument34 pagesFINANCIAL STATEMENT ANALYSISyulakbey101No ratings yet

- Financial Statement Analysis (4)Document9 pagesFinancial Statement Analysis (4)jesjopjanNo ratings yet

- Financial Statement AnalysisDocument10 pagesFinancial Statement AnalysisElizabeth Espinosa ManilagNo ratings yet

- Chapter 1Document53 pagesChapter 1Prashob KoodathilNo ratings yet

- Financials RatiosDocument25 pagesFinancials RatiosSayan DattaNo ratings yet

- Theory On Financial Analysis - 240516 - 210216Document28 pagesTheory On Financial Analysis - 240516 - 210216manjubhaii12No ratings yet

- A Comparitive Study of FMCG Sector Financial Statements 2022Document42 pagesA Comparitive Study of FMCG Sector Financial Statements 2022Vikram SubramanyamNo ratings yet

- MEFA UNIT-VI 2024 Financial Statement AnalysisDocument20 pagesMEFA UNIT-VI 2024 Financial Statement Analysissajjavenkatasai566No ratings yet

- Accounts Project Isc (Mine)Document12 pagesAccounts Project Isc (Mine)Rahit Mitra67% (3)

- Kaushik Jain - 30 ProjectDocument45 pagesKaushik Jain - 30 ProjectKAUSHIK JAINNo ratings yet

- DIA-06-Block-02Document33 pagesDIA-06-Block-02sachindewangan45No ratings yet

- AccountsDocument4 pagesAccountsAnita YadavNo ratings yet

- Accounting A2Document15 pagesAccounting A2thngnNo ratings yet

- Acct 4102Document40 pagesAcct 4102Shimul HossainNo ratings yet

- 4.0 Financial Statement Analysis and Evaluation-1Document21 pages4.0 Financial Statement Analysis and Evaluation-1ronaldinhomwamasangulaNo ratings yet

- Cfa L1 Fsa CH6Document25 pagesCfa L1 Fsa CH6anarghanayakNo ratings yet

- My ProjectDocument72 pagesMy ProjectPrashob Koodathil0% (1)

- Chap. II FSADocument37 pagesChap. II FSAKirubel SolomonNo ratings yet

- 4.0 Financial Statement Analysis and EvaluationDocument20 pages4.0 Financial Statement Analysis and Evaluationnbp7ry76vqNo ratings yet

- Week 011 - Module Analysis and Interpretation of Financial StatementsDocument7 pagesWeek 011 - Module Analysis and Interpretation of Financial StatementsJoana Marie100% (1)

- Ratio Kotak Mahindra BankDocument64 pagesRatio Kotak Mahindra Bankdk6666No ratings yet

- BHEL FinanceDocument44 pagesBHEL FinanceJayanth C VNo ratings yet

- Classification of RatiosDocument10 pagesClassification of Ratiosaym_6005100% (2)

- Accounting Ratios by AteeqDocument4 pagesAccounting Ratios by AteeqAteejuttNo ratings yet

- Ncert Solutions For Class 12 Accountancy 23 May Chapter 4 Analysis of Financial Statements 2Document23 pagesNcert Solutions For Class 12 Accountancy 23 May Chapter 4 Analysis of Financial Statements 2Priya SharmaNo ratings yet

- Module 2....Document15 pagesModule 2....AnimeliciousNo ratings yet

- FSs Analysis and Interpretation 5Document18 pagesFSs Analysis and Interpretation 5Shierwin Ebcas JavierNo ratings yet

- Chapter-Two Financial AnalysisDocument94 pagesChapter-Two Financial AnalysisDejene GurmesaNo ratings yet

- Financial RatiosDocument9 pagesFinancial RatiosDavid Isaias Jaimes ReyesNo ratings yet

- Ratio Analysis M&M and Maruti SuzukiDocument36 pagesRatio Analysis M&M and Maruti SuzukiSamiSherzai50% (2)

- Chapter 9 Ratio Analysis1Document65 pagesChapter 9 Ratio Analysis1niovaleyNo ratings yet

- Financial Statement AnalysisDocument10 pagesFinancial Statement AnalysisLeonilaEnriquezNo ratings yet

- Common Size Balance Sheet - Definition, Formula, ExampleDocument7 pagesCommon Size Balance Sheet - Definition, Formula, Examplenithya-mbaNo ratings yet

- Financial and Accounting Digital Assignment-2Document22 pagesFinancial and Accounting Digital Assignment-2Vignesh ShanmugamNo ratings yet

- Definition and Explanation of Financial Statement AnalysisDocument7 pagesDefinition and Explanation of Financial Statement Analysismedbest11No ratings yet

- Revised Chapter 2 Financial Statements and Corporate FinanceDocument17 pagesRevised Chapter 2 Financial Statements and Corporate FinanceLegend Game100% (1)

- NCERT Class 12 Accountancy Accounting RatiosDocument47 pagesNCERT Class 12 Accountancy Accounting RatiosKrish Pagani100% (1)

- Company ProfileDocument69 pagesCompany ProfileSemi StephenNo ratings yet

- Ratio AnalysisDocument9 pagesRatio Analysisbharti gupta100% (1)

- Ratio Analysis - PDFDocument17 pagesRatio Analysis - PDFMadhav AggarwalNo ratings yet

- Timbol, Kathlyn Mae V - Financial Analysis TechniquesDocument4 pagesTimbol, Kathlyn Mae V - Financial Analysis TechniquesMae TimbolNo ratings yet

- Definition and Explanation of Financial Statement Analysis:: Horizontal Analysis or Trend AnalysisDocument3 pagesDefinition and Explanation of Financial Statement Analysis:: Horizontal Analysis or Trend AnalysisrkumarkNo ratings yet

- IntroductionDocument5 pagesIntroductionDushyant ChouhanNo ratings yet

- Theoretical Framework: Interpretation of The RatiosDocument9 pagesTheoretical Framework: Interpretation of The Ratiosdurga deviNo ratings yet

- Financial Ratios: Research StartersDocument11 pagesFinancial Ratios: Research Starterszar.mx03No ratings yet

- Review of Literature2Document29 pagesReview of Literature2chaniyilkannanNo ratings yet

- Earnings Analysis for Stock Traders & Investors: Fundamental AnalysisFrom EverandEarnings Analysis for Stock Traders & Investors: Fundamental AnalysisNo ratings yet

- Financial Performance Measures and Value Creation: the State of the ArtFrom EverandFinancial Performance Measures and Value Creation: the State of the ArtNo ratings yet

- RM Mubarak Financial Statement Dikonversi Diedit PDFDocument1 pageRM Mubarak Financial Statement Dikonversi Diedit PDFAgil RosdianaNo ratings yet

- Trial Balance - Melvino YDocument4 pagesTrial Balance - Melvino YTrainingDigital Marketing BandungNo ratings yet

- Rich Angelie Muñez - Adjusting Entries and Promissory NotesDocument9 pagesRich Angelie Muñez - Adjusting Entries and Promissory NotesRich Angelie MuñezNo ratings yet

- HeinzDocument76 pagesHeinzGaurav SinghNo ratings yet

- What Are The Elements of Cost in Cost AccountingDocument6 pagesWhat Are The Elements of Cost in Cost AccountingSumit BainNo ratings yet

- Aec12 - Journal EntriesDocument3 pagesAec12 - Journal EntriesAlyanna Grace OhimanNo ratings yet

- Final Revisions aCCOUNTINGDocument15 pagesFinal Revisions aCCOUNTINGMiran HussienNo ratings yet

- Return On Capital EmployedDocument6 pagesReturn On Capital EmployedFrankie LamNo ratings yet

- Annual 07Document65 pagesAnnual 07Muhammad IsrarNo ratings yet

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 10Document26 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 10jasperkennedy083% (36)

- Final Exam PracticeDocument4 pagesFinal Exam Practiceqtra0033No ratings yet

- Cost Accounting: Allocation Basis Alpha Beta Gamma TotalDocument6 pagesCost Accounting: Allocation Basis Alpha Beta Gamma TotalShehrozSTNo ratings yet

- Fue Leung V IACDocument2 pagesFue Leung V IACd2015memberNo ratings yet

- Capital Structure and Leverages-ProblemsDocument7 pagesCapital Structure and Leverages-ProblemsUday GowdaNo ratings yet

- H.16 NPC Vs Presiding Judge GR No. 72477 10161990 PDFDocument3 pagesH.16 NPC Vs Presiding Judge GR No. 72477 10161990 PDFbabyclaire17No ratings yet

- Ic 01Document3 pagesIc 01gsm.nkl6049No ratings yet

- Illinois Tool Works Inc.: FORM 10-KDocument112 pagesIllinois Tool Works Inc.: FORM 10-KMark Francis CosingNo ratings yet

- Financial Performance Analysis - NBLDocument68 pagesFinancial Performance Analysis - NBLHimel paul0% (1)

- 518 Assignment FinalDocument12 pages518 Assignment FinalCarmel ThereseNo ratings yet

- Post-Closing Trial BalanceDocument4 pagesPost-Closing Trial Balanceapi-299265916100% (2)

- 38th Report of The Parliamentary Standing Committee On Finance - Tax Assessment and Exemptions and Related Matters Concerning IPL-BCCIDocument77 pages38th Report of The Parliamentary Standing Committee On Finance - Tax Assessment and Exemptions and Related Matters Concerning IPL-BCCIRaj A KapadiaNo ratings yet

- DUTALND AnnualReport2013Document134 pagesDUTALND AnnualReport2013Hèñry LimNo ratings yet

- Final Report of Inventory ManagementDocument61 pagesFinal Report of Inventory ManagementRefat Dedar100% (1)

- Labor RaibornDocument16 pagesLabor RaibornChristine Joy GalbanNo ratings yet

- Assignment Print ViewDocument103 pagesAssignment Print ViewHARISHPBSNo ratings yet

- Eng Econ - Cash - Flow - L3 - MME 4272Document55 pagesEng Econ - Cash - Flow - L3 - MME 4272Ayesha RalliyaNo ratings yet