IUFM - Lecture 4 - Homework Handouts

Uploaded by

thaitram22012004IUFM - Lecture 4 - Homework Handouts

Uploaded by

thaitram22012004FUNDAMENTALS OF FINANCIAL MANAGEMENT

TUTORIAL – Lecture 4

1. Textbook, Chapter 8: 12, 19, 25, 28, 30, 31, 36, 38

2. Textbook, Chapter 9: 2, 3, 9, 14, 16, 20, 22

3. You have been considering going into business for some time and have been on the look-out for

opportunities. You decide that West End is desperately in need of a gourmet pizza shop. You have

made a series of enquiries, obtained relevant quotes, and compiled the following data:

A shop can be leased for $800 per month payable in arrears. All fittings would have to be

purchased. These include:

A wood-fired pizza oven at a cost of $5,000,

An industrial fridge/freezer at a cost of $7,000,

A smoke/burglar alarm at a cost of $2,000,

Miscellaneous cooking utensils at a cost of $10,000.

All assets purchased will be depreciated (straight line) over a five-year useful life down to a

salvage value of zero.

The following data are relevant for estimating cash flows. All figures are on a monthly basis:

sales: 700 pizzas at an average price of $12,

sales: you anticipate that every second pizza buyer will also order a one-litre soft-drink.

Your profit on soft-drink is $1.50 per bottle.

costs: ingredients estimated at $3 per pizza,

advertising in letterboxes and newspapers, $500,

electricity and telephone, $800,

casual wages, 3,000.

Don't forget the lease cost!

Other miscellaneous items are:

You will offer free delivery of pizzas to surrounding suburbs. This will be done in your

own car, which was purchased (for private use) three years ago at a cost of $50,000.

The car is currently valued at $30,000 and has an estimated remaining life of five years.

You figure that business use of the car will amount to about 50% of the car's total use,

and that the business share of running expenses will amount to $3,000 per year

(including additional petrol). For tax purposes, you will depreciate the car to a zero

salvage value over its remaining life. If you decide not to start the pizza shop, you will

just continue using the car for personal use.

The above-mentioned advertising will only be conducted in the first two years of the

business. After that, you hope to have sufficient repeat business and word-of-mouth

to maintain your sales at forecasted levels.

To establish the business, you will inject working capital of $20,000. This money will

be recovered on closure of the business in five years.

You expect to pay tax at an average rate of 20%. Assume tax is paid at the end of each

year.

Prepared by: Dr. Tien Nguyen (Rei) 1

Since the equipment has a five-year useful life, you are looking at this being a five-year project, after

which you will move on to something else. Although many of the above estimates are on a monthly

basis, you will 'do the math' by aggregating all figures to get yearly estimates.

REQUIRED:

a. Calculate the expected annual after-tax cash flows over the five-year life of the business.

b. You are unsure of what discount rate to apply to these cash flows. Your forecasts of sales

and costs are pretty rough. Prepare an NPV profile to gauge the sensitivity of the NPV to the

discount rate.

c. Finally, you conclude that a 25% p.a. discount rate is applicable for this line of business.

Should you go ahead and establish the gourmet pizza shop?

4. The Outback Mining Company has constructed a town at Big Bore, near the site of a rich mineral

discovery in a remote part of Australia. The town will be abandoned when mining operations cease

after an estimated 10-year period. The following estimates of investment costs, sales and

operating expenses relate to a project to supply Big Bore with meat and agricultural produce over

the 10-year period by developing nearby land:

Investment in land is $1 million, farm buildings $200,000, and farm equipment $400,000.

The land is expected to have a realizable value of $1 million in 10 years' time. The salvage

value of the buildings after 10 years is expected to be $50,000. The farm equipment has an

estimated life of 10 years and a zero salvage value.

An investment of $250,000 in current assets is required at startup. This working capital will

be recovered at the termination of the venture.

Annual cash sales are estimated to be $2.48 million.

Annual cash operating costs are estimated to be $2.2 million.

Is this project profitable, given that the required rate of return is 10% p.a.? The applicable tax rate

is 30%. Note that investments in land and working capital are not depreciable. Assume that

buildings and equipment are depreciable straight line over their useful lives.

5. Pegasus Telecommunications Ltd (PTL) is considering rolling out a new cable Internet service. PTL is

a taxable, publicly listed corporation operating in Australia. PTL's management is in the process of

analysing the project using the NPV method, and as a junior analyst you have been asked to gather

the relevant information. For each of the following items explain briefly (no more than 1 sentence)

why that item is or is not relevant to the NPV computation:

a. Last month the marketing department ran a focus group to determine consumer interest in

the new service. An invoice for $2,500 has just arrived from the consultants involved in

running the focus group.

b. PTL headquarters allocates central company costs to departments at a rate of $5,000 per

employee per year.

c. PTL's bank will charge an interest rate of 12% p.a. compounded monthly on the loan required

to purchase the necessary hardware.

d. Equipment purchased will be depreciated straight line over 5 years.

Prepared by: Dr. Tien Nguyen (Rei) 2

e. The project will require the use of warehouse space already owned by PTL. The company

estimates that the warehouse is worth $450,000.

6. The Andy Aghastli Company (AAC) designs a range of eye-catching fluorescent tennis clothing. The

designers have always hand-drawn and painted their new fashion ranges. The owner, Mr Aghastli,

is considering purchasing a new computer-aided design (CAD) package to allow his designers to

create their designs on computers. The CAD project is expected to generate cost savings by

improving productivity. Also, AAC can submit electronic templates of its latest designs to the

manufacturers of its fashion ranges, which would also generate significant savings. The up-front

hardware and software cost to AAC is estimated at $300,000. The computers and software have a

5-year useful life. After that, the technology will be obsolete and will have no salvage value. The

CAD project is expected to save AAC approximately $88,000 (after tax) per annum.

REQUIRED:

Advise Mr Aghastli on the acceptability of the CAD proposal, applying the following capital

budgeting methods:

a. Net Present Value,

b. Internal Rate of Return.

Assume that all cash flows occur at the end of each period, with the exception of the up-front outlay,

which is paid at the commencement of the project. Assume that AAC's required rate of return on

this project is 10% p.a.

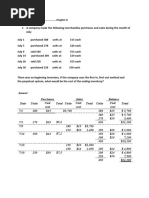

7. Your office is about to purchase a new machine at a cost of $64,000. You have forecast the

following data relating to the salvage value and maintenance costs over the next five years:

Salvage value at the end of Annual maintenance expense

Year

each year ($) ($)

1 50,000 11,000

2 40,000 13,000

3 30,000 18,000

4 23,000 24,000

5 3,500 28,000

Assume that the firm has a 28% tax rate and a 15% p.a. required return on this project, and use

straight-line depreciation. Should the office replace the machine every year, or every three years, or

every five years?

8. Kalorie Cola is considering buying a special-purpose bottling machine for $28,000. It is expected to

have a useful life of 7 years with a zero disposal price. The plant manager estimates the following

savings in cash-operating costs:

Prepared by: Dr. Tien Nguyen (Rei) 3

YEAR AM O UNT

1 $10,000

2 8,000

3 6,000

4 5,000

5 4,000

6 3,000

7 3,000

Total $39,000

The Plant Manager argues that, since the total cash savings ($39,000) exceed the outlay ($28,000),

Kalorie Cola should definitely purchase the machine.

REQUIRED:

a. Calculate whether the bottling machine should be purchased according to the following

methods: (i) net present value, and (ii) internal rate of return. Kalorie Cola's required rate of

return is 16% p.a.

b. Explain to the Plant Manager why his logic for purchasing the machine is flawed. Why can't

we compare the total cash savings with the machine cost?

Prepared by: Dr. Tien Nguyen (Rei) 4

You might also like

- Producto Académico #02:: Ingeniería EconómicaNo ratings yetProducto Académico #02:: Ingeniería Económica4 pages

- Worksheet#3-MCQ-2018 .PDF Engineering Economy0% (1)Worksheet#3-MCQ-2018 .PDF Engineering Economy6 pages

- Engineering Economics and Finacial Management (HUM 3051)No ratings yetEngineering Economics and Finacial Management (HUM 3051)5 pages

- Tutorial 4 Capital Investment Decisions 1No ratings yetTutorial 4 Capital Investment Decisions 14 pages

- Theoretical and Conceptual Questions: (See Notes or Textbook)No ratings yetTheoretical and Conceptual Questions: (See Notes or Textbook)4 pages

- 3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsNo ratings yet3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real Options3 pages

- Theoretical and Conceptual Questions: (See Notes or Textbook)No ratings yetTheoretical and Conceptual Questions: (See Notes or Textbook)14 pages

- Sunday-Emma School of Accounting Class Test 5 - MANo ratings yetSunday-Emma School of Accounting Class Test 5 - MA4 pages

- Capital Investment Analysis Exercises - copyNo ratings yetCapital Investment Analysis Exercises - copy3 pages

- Jimma University Construction Economics (CEGN 6108)No ratings yetJimma University Construction Economics (CEGN 6108)7 pages

- Chapter 3 - Concepr Questions and ExercisesNo ratings yetChapter 3 - Concepr Questions and Exercises5 pages

- Capital Budgeting: Workshop Questions: Finance & Financial ManagementNo ratings yetCapital Budgeting: Workshop Questions: Finance & Financial Management12 pages

- Rental-Property Profits: A Financial Tool Kit for LandlordsFrom EverandRental-Property Profits: A Financial Tool Kit for LandlordsNo ratings yet

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- Toward a National Eco-compensation Regulation in the People's Republic of ChinaFrom EverandToward a National Eco-compensation Regulation in the People's Republic of ChinaNo ratings yet

- Exhibit 2 Product Class Cost Analysis (Normal Year) : Units UnitsNo ratings yetExhibit 2 Product Class Cost Analysis (Normal Year) : Units Units6 pages

- WK8 - Valuation Method - Relative ValuationNo ratings yetWK8 - Valuation Method - Relative Valuation17 pages

- Certified Accounting Technician ExaminationNo ratings yetCertified Accounting Technician Examination8 pages

- Sps. Gerry C. & Analiza B. Santig: Brgy. Bagumbayan, President Quirino, Sultan KudaratNo ratings yetSps. Gerry C. & Analiza B. Santig: Brgy. Bagumbayan, President Quirino, Sultan Kudarat1 page

- Accounting-Financial Statements of Companies-1653399167327513No ratings yetAccounting-Financial Statements of Companies-165339916732751337 pages

- Financial Model of Nestle India - 230819 - 233544No ratings yetFinancial Model of Nestle India - 230819 - 23354418 pages

- Engineering Economics and Finacial Management (HUM 3051)Engineering Economics and Finacial Management (HUM 3051)

- Theoretical and Conceptual Questions: (See Notes or Textbook)Theoretical and Conceptual Questions: (See Notes or Textbook)

- 3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real Options3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real Options

- Theoretical and Conceptual Questions: (See Notes or Textbook)Theoretical and Conceptual Questions: (See Notes or Textbook)

- Sunday-Emma School of Accounting Class Test 5 - MASunday-Emma School of Accounting Class Test 5 - MA

- Jimma University Construction Economics (CEGN 6108)Jimma University Construction Economics (CEGN 6108)

- Capital Budgeting: Workshop Questions: Finance & Financial ManagementCapital Budgeting: Workshop Questions: Finance & Financial Management

- Rental-Property Profits: A Financial Tool Kit for LandlordsFrom EverandRental-Property Profits: A Financial Tool Kit for Landlords

- Certified Cost Professional (CCP) Exam Practice TestFrom EverandCertified Cost Professional (CCP) Exam Practice Test

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric Results

- Toward a National Eco-compensation Regulation in the People's Republic of ChinaFrom EverandToward a National Eco-compensation Regulation in the People's Republic of China

- Exhibit 2 Product Class Cost Analysis (Normal Year) : Units UnitsExhibit 2 Product Class Cost Analysis (Normal Year) : Units Units

- Sps. Gerry C. & Analiza B. Santig: Brgy. Bagumbayan, President Quirino, Sultan KudaratSps. Gerry C. & Analiza B. Santig: Brgy. Bagumbayan, President Quirino, Sultan Kudarat

- Accounting-Financial Statements of Companies-1653399167327513Accounting-Financial Statements of Companies-1653399167327513