Business Financial Report - Oxyn Challenge August 2024 - Jesse Ekanem

Business Financial Report - Oxyn Challenge August 2024 - Jesse Ekanem

Uploaded by

Manoj GuddatiCopyright:

Available Formats

Business Financial Report - Oxyn Challenge August 2024 - Jesse Ekanem

Business Financial Report - Oxyn Challenge August 2024 - Jesse Ekanem

Uploaded by

Manoj GuddatiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Business Financial Report - Oxyn Challenge August 2024 - Jesse Ekanem

Business Financial Report - Oxyn Challenge August 2024 - Jesse Ekanem

Uploaded by

Manoj GuddatiCopyright:

Available Formats

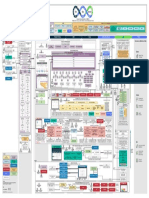

Power BI Desktop

Financial Report || FITNESS VENTURE - 2023 Evaluate the financial performance across three key business lines: Sports Equipment, Sportswear, and Nutrition & Food Supplements. Report created by : Jesse Ekanem

Key Focus Areas:

• Income Statement Review: Analyze revenues, expenses, and net income.

• Profit Margins Assessment: Examine gross, operating, and net profit margins.

• EBIT Margin Analysis: Assess Earnings Before Interest and Taxes (EBIT) for operational efficiency.

• Operating Expenses Ratio (OPEX): Determine operating expenses as a percentage of revenue.

Month Business Line

All All

Operating Expenses (OPEX): With an operating cost margin of 31.9% indicates that the operating expenses consume nearly one-

third of the revenue, which further suggests a high reasonable proportion of revenue is allocated to operational costs,

This is how much revenue generated for 2023... The expenses incurred against Revenue being A Net Margin percentage of 24.6% was

generated...indicates a healthy level of profitability. but focusing on cost efficiency could improve overall profitability. Business Line distributions

generated for 2023...

However.... (OPEX).

$15.83M $12.05M $3.78M Expense subgroup Opex scale M-o-M %

$17.56M $13.25M

$4.31M

PM revenue

$5.60M

PM expenses

PM net profit Payroll $1,790,000 9.28%

10.93% 9.95% 24.6% Equipment $1,333,000 10.26%

Total revenue generated M-o-M % revenue Total expenses incurred M-o-M % expenses Total Net Profit generated Net Margin Marketing $1,055,000 12.83%

10.59% 68.08% Rent $745,000 10.53%

The Nutrition and Food Supplements division R&D $540,000 9.09%

Drill down on revenue generated across Business Which Business line has the most expenses M-o-M % OPEX

experienced a substantial loss due to expenses Other $141,800 21.20%

Line... incurred in compare to revenue generated? OPEX margin

surpassing revenues.

Business Line Revenue's Business Line Expenses Business Line Total Profit Profit %

Sports equipment $8,908,500 $6,618,300 Sportswear $2,736,800 40.2%

Sports equipment

Sportswear $6,807,700 $4,070,900 Sports equipment $2,290,200 25.7%

Sportswear

Nutrition and Food Supplements $1,843,620 $2,556,500 Nutrition and Food Supplements ($712,880) -38.7%

Nutrition and Food Supplements

...and the trends of revenue (2023)... ...and the trends of expenses (2023)... ...and the trends of Net Profit (2023)... Gross Profit EBIT COGS Interest & Tax

$10.85M $5.24M $6.71M $929.40K

Consulting &

Gross Margin Other Income Total Sales

Professional Service

61.78% $966.19K $13.78M $2.82M

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Cash Flow Trend (2023) || Revenue & Expenses & Profit (Currency in USD) || Yearly & Quarterly Review. Profits. Revenue. Expenses. COGS distributions across Subgroup expenses... This is how the revenue and expenses splits by

departments over the year (2023)...

Overall Performance: The organization is facing challenges with maintaining profitability due to rising expenses and fluctuating revenue. Improving cost

Expense subgroup COGS scale

management and developing strategies to stabilize or increase revenue can help improve overall performance. It’s also beneficial to conduct a more detailed Sales $14M

analysis of specific cost drivers and revenue sources to make informed strategic decisions. Labor $4,492,000.00

Materials $1,065,000.00 Consulting and professional services $3M

Sales $447,000.00 Other income $1M

Q1 review Q2 review Q3 review Q4 review Shipping $345,600.00

Opex ($6M)

50% 35% 15% 50% 37% 13% 50% 42% 8% 50% 38% 12% Other $263,700.00

Packaging $98,200.00 COGS ($7M)

Rev. Exp. Profit Rev. Exp. Profit Rev. Exp. Profit Rev. Exp. Profit

$4.83M $3.35M $1.48M $4.57M $3.42M $1.15M $3.83M $3.18M $0.65M $4.33M $3.29M $1.04M

$92K | 8%

$193K | 17% $210K | 16% Month Revenue Net △M-o-M % △ scales

$289K | 21% $269K | 21% $295K | 22%

$303K | 23% $1,949,000

January

February $1,567,700 -19.56%

$479K | 31% $468K | 28% $493K | 29%

$531K | 31% March $1,313,350 -16.22%

April $1,156,100 -11.97%

$695K | 36%

May $1,698,500 46.92%

June $1,719,200 1.22%

July $1,400,050 -18.56%

August $1,304,850 -6.80%

September $1,120,890 -14.10%

October $1,322,475 17.98%

November $1,277,530 -3.40%

December $1,730,175 35.43%

$1.9M $1.6M $1.3M $1.2M $1.7M $1.7M $1.4M $1.3M $1.1M $1.3M $1.3M $1.7M

$1.25M $1.09M $1.01M $0.96M $1.23M $1.23M $1.11M $1.04M $1.03M $1.03M $1.07M $1.20M

With total sales of $13.78M and operating expenses of $5.6M, the operating cost margin is around 40.6%. This higher percentage

indicates that a significant portion of revenue is spent on operating costs, suggesting an urgent need to explore strategies to reduce

operational expenses in order to enhance profitability and operational efficiency.

Sales Revenue COGS Opex Profit Profit (%) EBIT

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan $1.36M $1.95M $0.66M $0.48M $0.69M 35.6% $0.81M

Feb $1.20M $1.57M $0.51M $0.48M $0.48M 30.5% $0.58M

Mar $1.05M $1.31M $0.51M $0.42M $0.30M 23.0% $0.38M

Apr $0.89M $1.16M $0.48M $0.42M $0.19M 16.7% $0.25M

Revenue : Expenses: Net Profit: May $1.30M $1.70M $0.64M $0.50M $0.47M 27.5% $0.55M

Expenses are rising as a percentage of revenue, peaking The decline in net profit percentage suggests that while Jun $1.33M $1.72M $0.63M $0.50M $0.49M 28.7% $0.58M

There is a need to focus on revenue growth strategies

in Q3. Consider evaluating cost control measures and revenue and expenses are fluctuating, profitability is Jul $1.16M $1.40M $0.58M $0.46M $0.29M 20.6% $0.36M

since there is a noticeable decline from Q1 to Q3.

improving operational efficiencies to reduce the getting squeezed. Efforts should be made to improve

Aug $1.05M $1.30M $0.55M $0.44M $0.27M 20.6% $0.32M

Ensuring consistent or growing revenue streams can

expense ratio. Analyzing which costs are increasing and Sep $0.93M $1.12M $0.54M $0.44M $0.09M 8.2% $0.14M

help stabilize profit margins. profit margins, possibly through cost reduction or

why could uncover areas for potential savings. Oct $1.08M $1.32M $0.52M $0.44M $0.30M 22.3% $0.36M

pricing strategies. Nov $1.07M $1.28M $0.54M $0.48M $0.21M 16.4% $0.26M

Dec $1.36M $1.73M $0.55M $0.54M $0.53M 30.7% $0.64M

Sports Equipment's Sportwear's

Revenue Leader : This category leads in revenue with $8.9 Nutrition & Food Sup.

High-Performing Revenue Driver : : With a revenue Declining Profitability : Although this segment realizes a gross

million, although it has a gross profit margin of 58.76% and a generation of $6.8 million, this segment demonstrates a profit margin of 44.82%, it is experiencing a Net loss of -38.67%.

Total Revenue net profit margin of 25.71%. Despite its lower profitability Total Revenue robust gross profit margin of 70.33% and a solid net profit Total Revenue This significant negative net margin suggests that operational

$8.91M

margins compared to other segments, its revenue potential

continues to be strong.

$6.81M margin of 40.20%, positioning it as the top-performing

$1.84M expenses are substantially undermining overall profitability.

category within the portfolio.

Total expenses Total expenses

Total Expenses

$6.62M 71.56% 58.76% $5.23M 25.7% $4.07M 75.38% 70.33% $4.79M 40.2%

$2.56M

Opex Margin Gross Margin Gross Profit Gross Profit Net Margin 24.32% 44.82% $826.32K -38.7%

Net Margin Opex Margin Gross Margin

Net Profit Net Profit Opex Margin Gross Margin Gross Profit Net Margin

Net Profit

$2.29M $2.74M ($712.88K)

More Focus on the profitable lines Sports Equipment and Sportswear lines Proper reviewing the cost structure for

(Sports Equipment and Sportswear) are driving profitability, while Nutrition & Nutrition & Food Supplements could

could sustain or increase overall Food Supplements need strategic help in identifying areas for cost

business profitability. improvements to reduce losses. reduction or efficiency improvements.

Operations Revenue Expenses Profit Operations Revenue Expenses Profit Operations Revenue Expenses Profit

COGS $3,674,200 ($3,674,200) COGS $2,020,000 ($2,020,000) COGS $1,017,300 ($1,017,300)

Consulting and professional $1,390,500 $1,390,500 Consulting and professional $1,170,000 $1,170,000 Consulting and professional $256,500 $256,500

services services services

Interest and tax $410,500 ($410,500) Interest and tax $374,900 ($374,900) Interest and tax $144,000 ($144,000)

Opex $2,533,600 ($2,533,600) Opex $1,676,000 ($1,676,000) Opex $1,395,200 ($1,395,200)

Other income $378,000 $378,000 Other income $532,600 $532,600 Other income $55,590 $55,590

Sales $7,140,000 $7,140,000 Sales $5,105,100 $5,105,100 Sales $1,531,530 $1,531,530

Total $8,908,500 $6,618,300 $2,290,200 Total $6,807,700 $4,070,900 $2,736,800 Total $1,843,620 $2,556,500 ($712,880)

REVENUE Qtr 1 Qtr 2 Qtr 3 Qtr 4 Quarterly Net Profit Business Line Net Profit

Consulting and professional services $982,500 $763,500 $517,500 $553,500

$2.74M

Other income $240,600 $296,500 $167,090 $262,000 $2.29M

Sales $3,606,950 $3,513,800 $3,141,200 $3,514,680

TOTAL REVENUE $4,830,050 $4,573,800 $3,825,790 $4,330,180

COGS Qtr 1 Qtr 2 Qtr 3 Qtr 4

Labor $1,035,000 $1,203,000 $1,174,000 $1,080,000

Materials $274,000 $283,000 $283,000 $225,000

Other $64,200 $67,800 $66,900 $64,800

($0.71M)

Packaging $27,600 $25,300 $18,600 $26,700

Sportswear Sports Nutrition and

Sales $102,700 $115,700 $75,000 $153,600 equipment Food

Supplements

Shipping $179,600 $64,600 $46,200 $55,200

TOTAL COGS $1,683,100 $1,759,400 $1,663,700 $1,605,300

CHALLENGES / INSIGHTS

OPERATING EXPENSES Qtr 1 Qtr 2 Qtr 3 Qtr 4

1. Negative Net Profit Margin for Nutrition & Food Supplements: The segment's negative net

Equipment $279,000 $328,600 $353,400 $372,000 profit margin of -38.67% reflects substantial profitability challenges and financial strain.

2. Low Gross Profit Margin for Nutrition & Food Supplements ; With a gross profit margin of

Marketing $305,000 $305,000 $195,000 $250,000

44.82%, this segment shows inefficiencies in converting sales revenue into gross profit.

Other $45,700 $31,000 $21,700 $43,400 3. High Cost of Goods Sold (COGS) for Sports Equipment: The $3.7 million COGS significantly

impacts the gross profit margin, indicating potential issues with cost management in this

Payroll $456,000 $456,000 $432,000 $446,000 category.

R&D $135,000 $135,000 $135,000 $135,000 4. High Labor Costs as a Percentage of COGS: Labor costs account for 66.93% of the $4.49

million COGS, which is notably high and negatively affects both gross and net profit

Rent $162,000 $171,000 $199,000 $213,000 margins.

TOTAL OPEX $1,382,700 $1,426,600 $1,336,100 $1,459,400 5. High Operating Expenses: Elevated operating costs in the Sports Equipment and Nutrition

& Food Supplements segments are adversely affecting overall profitability.

GROSS PROFIT Qtr 1 Qtr 2 Qtr 3 Qtr 4

COGS ($1,683,100) ($1,759,400) ($1,663,700) ($1,605,300)

Consulting and professional services $982,500 $763,500 $517,500 $553,500

Other income $240,600 $296,500 $167,090 $262,000 RECOMMENDATION / SOLUTIONS

Sales $3,606,950 $3,513,800 $3,141,200 $3,514,680 1. Implement Cost-Control Measures: Focus on reducing overall operating expenses

through cost-control and efficiency improvements.

TOTAL REVENUE $3,146,950 $2,814,400 $2,162,090 $2,724,880 2. Address Profitability Issues: Improve profitability by cutting costs, enhancing operations,

and exploring new revenue opportunities.

3. Boost Gross Profit Margin: Increase profitability by adjusting sales prices, lowering

M-o-M OPEX % Qtr 1 Qtr 2 Qtr 3 Qtr 4 production costs, or optimizing the product mix.

4. Reduce COGS: Implement strategies to lower the cost of goods sold for Sports Equipment

43.82% 5.93% -4.37% 7.10%

by negotiating better terms and improving production efficiency.

5. Revise Sales Strategies for Nutrition & Food Supplements: Reevaluate and enhance

NET PROFIT % Qtr 1 Qtr 2 Qtr 3 Qtr 4 strategies to improve sales and financial performance in this segment.

6. Invest in Automation and Marketing: Introduce automation to reduce labor costs and

30.6% 25.2% 17.0% 23.9%

increase investments in strategic marketing to drive revenue growth.

7. Revisit Business Processes and Marketing Strategies: Urgently re-evaluate and re-

EBIT Qtr 1 Qtr 2 Qtr 3 Qtr 4

strategize business processes and marketing approaches to enhance overall profitability.

$1,764,250 $1,387,800 $825,990 $1,265,480

You might also like

- Margin Concerns Should Take Precedence Over Improved OutlookDocument15 pagesMargin Concerns Should Take Precedence Over Improved Outlookashok yadavNo ratings yet

- Enterprise Value MapDocument1 pageEnterprise Value Mapkarimi.ahmad.89No ratings yet

- Fra 1Document1 pageFra 1khaipham7302No ratings yet

- Houston Industrial Market Quicktake: April 2020Document2 pagesHouston Industrial Market Quicktake: April 2020Kevin ParkerNo ratings yet

- 2018 Schindler Annual Report GR eDocument76 pages2018 Schindler Annual Report GR eTri NhanNo ratings yet

- Relatório de ContasDocument12 pagesRelatório de ContasirlandoNo ratings yet

- Acct503 Project CompletedDocument6 pagesAcct503 Project CompletedMark WafulaNo ratings yet

- Base Enterprise Value Map PDFDocument1 pageBase Enterprise Value Map PDFjvr001100% (1)

- All FrameworksDocument1 pageAll FrameworksArnav RoyNo ratings yet

- Monopolistic Competition: ConomicsDocument6 pagesMonopolistic Competition: ConomicsSushant BanjaraNo ratings yet

- Facts and Figures 2014.pdf - AssetinlineDocument2 pagesFacts and Figures 2014.pdf - Assetinlineعلي عبداللهNo ratings yet

- Danfoss at A Glance 2017 - EN - 300dpiDocument1 pageDanfoss at A Glance 2017 - EN - 300dpiAvronNo ratings yet

- Value Stream Improvement Plan TemplateDocument4 pagesValue Stream Improvement Plan TemplatemilandivacNo ratings yet

- AM Integrated Report 2020Document72 pagesAM Integrated Report 2020Lê Tố NhưNo ratings yet

- Financial Status Till March-2023 All ProjectsDocument1 pageFinancial Status Till March-2023 All ProjectsFAISAL Shahzad KhokharNo ratings yet

- Value-Map TM DeloitteDocument1 pageValue-Map TM DeloitteHugo SalazarNo ratings yet

- Lean Management: Business ExcellenceDocument68 pagesLean Management: Business Excellencesharma301100% (4)

- Etf Wealth RCH 0416fDocument2 pagesEtf Wealth RCH 0416fMatt EbrahimiNo ratings yet

- The Costing Cheat Sheet - Oana Labes, MBA, CPADocument1 pageThe Costing Cheat Sheet - Oana Labes, MBA, CPAYen HoangNo ratings yet

- Documents - Pub The Breakthrough Technology of Electric Marine Loading Morilhatthe BreakthroughDocument25 pagesDocuments - Pub The Breakthrough Technology of Electric Marine Loading Morilhatthe Breakthroughquoc khanh NgoNo ratings yet

- Séance 5 Le RIM - 230524 - 212726Document41 pagesSéance 5 Le RIM - 230524 - 212726Khadija HabibNo ratings yet

- October AccomplishmentDocument17 pagesOctober AccomplishmentReyma GalingganaNo ratings yet

- Pestle Analysis of IndiaDocument15 pagesPestle Analysis of IndiaRaghav PunjaniNo ratings yet

- Template WFP-Expenditure Form 2024Document22 pagesTemplate WFP-Expenditure Form 2024Joey Simba Jr.No ratings yet

- Pain Not Coming To An End Cut To Reduce: Bharti AirtelDocument17 pagesPain Not Coming To An End Cut To Reduce: Bharti AirtelAshokNo ratings yet

- WegnerTrevor 2020 FrontCover AppliedBusinessStatisDocument5 pagesWegnerTrevor 2020 FrontCover AppliedBusinessStatisPolitcioNo ratings yet

- DFDFDocument1 pageDFDFAmirSazzadSohanNo ratings yet

- Investor Day: 13 October 2009Document134 pagesInvestor Day: 13 October 2009tilak52No ratings yet

- Bangladesh S Intended Nationally Determined Contributions 'Document2 pagesBangladesh S Intended Nationally Determined Contributions 'Tahmina SultanaNo ratings yet

- Stadium of The Future Economic FrameworkDocument1 pageStadium of The Future Economic FrameworkActionNewsJaxNo ratings yet

- Brahmaputra Infrastructure LTD.: Subject: Key Financial Highlights of June-21 Quarter ResultsDocument5 pagesBrahmaputra Infrastructure LTD.: Subject: Key Financial Highlights of June-21 Quarter ResultsAmrut BhattNo ratings yet

- All English Editorials 13 - 1Document21 pagesAll English Editorials 13 - 1alifia 09No ratings yet

- Audi Quarterly Update q4 2021Document23 pagesAudi Quarterly Update q4 2021Hart layeNo ratings yet

- Digital Product Value Stream Management Architecture Blueprint v1 RC1Document1 pageDigital Product Value Stream Management Architecture Blueprint v1 RC1ofd86174No ratings yet

- Econs 2Document1 pageEcons 2khai.phamtien2002No ratings yet

- CF OPI ONLINE LIST - June 2019Document1 pageCF OPI ONLINE LIST - June 2019Tony CefaiNo ratings yet

- Ecommerce Committee - External CommunicationsDocument5 pagesEcommerce Committee - External Communicationsthiwa karanNo ratings yet

- Sample BM - BMDocument2 pagesSample BM - BMuddkor.salesNo ratings yet

- Airtel Malawi PLC H1 2023 FinancialsDocument1 pageAirtel Malawi PLC H1 2023 Financialsvjrbtmm7fm100% (1)

- Annual Report of IOCL 211Document1 pageAnnual Report of IOCL 211Nikunj ParmarNo ratings yet

- Annual Report of IOCL 211Document1 pageAnnual Report of IOCL 211NikunjNo ratings yet

- New Year Portfolio Portfolio Stock 2-2025Document5 pagesNew Year Portfolio Portfolio Stock 2-2025ajkNo ratings yet

- Pune-I CompaniesDocument9 pagesPune-I CompaniesTPO RCOEMNo ratings yet

- 2017 Yamaha AR All enDocument38 pages2017 Yamaha AR All enHarshitNo ratings yet

- Semiconductor Sector Update: Kick Starting The NKEA-15/10/2010Document2 pagesSemiconductor Sector Update: Kick Starting The NKEA-15/10/2010Rhb InvestNo ratings yet

- MT Logistics and Value Chain ManagementDocument30 pagesMT Logistics and Value Chain ManagementPawar ComputerNo ratings yet

- CompTIA IT Jobs ReportDocument3 pagesCompTIA IT Jobs ReportvcpmanNo ratings yet

- Fynergy IITMadrasDocument2 pagesFynergy IITMadrasfunnyguy080503No ratings yet

- Time TechnoplastDocument8 pagesTime Technoplastagrawal.minNo ratings yet

- SCHNEIDER DIA5ED1161001EN - v7.0Document20 pagesSCHNEIDER DIA5ED1161001EN - v7.0flaviosistemasNo ratings yet

- ShieldGruppe Dashboard Model Work Task 1Document1 pageShieldGruppe Dashboard Model Work Task 1Charielle Esthelin BacuganNo ratings yet

- AIP Consolidated 2024Document132 pagesAIP Consolidated 2024aeron antonioNo ratings yet

- FSM Islamic Managed Portfolio: ConservativeDocument1 pageFSM Islamic Managed Portfolio: ConservativePhua Kien HanNo ratings yet

- Wholesale Retail - Main PanelDocument1 pageWholesale Retail - Main PanelMuhammad Amri IdrisNo ratings yet

- Your Industry Challenges and How A Modern Can Help: Manufacturing Execution System (MES)Document1 pageYour Industry Challenges and How A Modern Can Help: Manufacturing Execution System (MES)ÆdzitØn EstradaNo ratings yet

- Wall Street Journal Monday October 12 2020 News Corp Ebook All Chapters PDFDocument62 pagesWall Street Journal Monday October 12 2020 News Corp Ebook All Chapters PDFkhllravuri100% (3)

- HFM IntroDocument27 pagesHFM IntroAmit SharmaNo ratings yet

- Valuable OSS - Delivering a Return on Your Investment in Operational Support Systems (OSS)From EverandValuable OSS - Delivering a Return on Your Investment in Operational Support Systems (OSS)No ratings yet

- Kpi DictionaryDocument18 pagesKpi DictionaryjbarbosaNo ratings yet

- Financial Management Literature Review PDFDocument8 pagesFinancial Management Literature Review PDFc5praq5p100% (1)

- Graduation Thesis-Nguyen Nhu Ngoc (1760) 0305Document106 pagesGraduation Thesis-Nguyen Nhu Ngoc (1760) 0305Nguyên HồNo ratings yet

- Financial Statement and Ratio Analysis - ITFDocument6 pagesFinancial Statement and Ratio Analysis - ITFchaitanya paiNo ratings yet

- DavidDocument7 pagesDavidcleverngaka9No ratings yet

- 078 1Document34 pages078 1jesssamuelNo ratings yet

- PM BECKER Mock 1 Ans.Document15 pagesPM BECKER Mock 1 Ans.SHIVAM BARANWALNo ratings yet

- Balwin Properties Limited Long Form Announcement 29 February 2024Document34 pagesBalwin Properties Limited Long Form Announcement 29 February 2024lefifiprNo ratings yet

- FM I - Chapter Two NoteDocument16 pagesFM I - Chapter Two Notenatnaelsleshi3No ratings yet

- May 2023 1Document20 pagesMay 2023 1Mr. JCNo ratings yet

- StarbucksDocument19 pagesStarbucksPraveen KumarNo ratings yet

- UNIQLODocument26 pagesUNIQLOsondaravalliNo ratings yet

- Chapter 5Document23 pagesChapter 52t65xn9qqzNo ratings yet

- Name:-Bathija Jharna SonuDocument36 pagesName:-Bathija Jharna SonuJharnaNo ratings yet

- RenataDocument48 pagesRenataTheAgents107No ratings yet

- Company Profile 2Document26 pagesCompany Profile 2Vishal Singh PanwarNo ratings yet

- Edexcel A Level Business 2024 Revision Workshop-OutputDocument60 pagesEdexcel A Level Business 2024 Revision Workshop-Outputk.lauNo ratings yet

- FIN433 - Group ReportDocument86 pagesFIN433 - Group Reportsanjida.shahabuddinNo ratings yet

- PDF Financial Analysis, Ratios and InterpretationDocument7 pagesPDF Financial Analysis, Ratios and InterpretationAaliyah AndreaNo ratings yet

- Financial Performance Analysis of Abdul Monem Limited. Submitted ToDocument37 pagesFinancial Performance Analysis of Abdul Monem Limited. Submitted ToHarunur RashidNo ratings yet

- 2019 Analysis SAC Version 2 SolutionDocument6 pages2019 Analysis SAC Version 2 SolutionLachlan McFarlandNo ratings yet

- Proposal BBS 4th YearDocument12 pagesProposal BBS 4th YearSunita Mgr100% (1)

- Equity Research ReportDocument17 pagesEquity Research ReportDua jumaniNo ratings yet

- SFAD Final Term Report.Document14 pagesSFAD Final Term Report.Mansoor ArshadNo ratings yet

- Buy ebook Coin Laundries Road to Financial Independence A Complete Guide to Starting and Operating Profitable Self Service Laundries 2nd Edition Emerson G. Higdon. cheap priceDocument81 pagesBuy ebook Coin Laundries Road to Financial Independence A Complete Guide to Starting and Operating Profitable Self Service Laundries 2nd Edition Emerson G. Higdon. cheap pricewaldehcanu100% (1)

- 41920011-Ashish N Report 2024Document45 pages41920011-Ashish N Report 2024Krishna KumarNo ratings yet

- 2027 Specimen Paper 2 Mark SchemeDocument18 pages2027 Specimen Paper 2 Mark SchemeshujaitbukhariNo ratings yet

- Group 5 Accounting Term PaperDocument19 pagesGroup 5 Accounting Term PaperHM FarhanNo ratings yet

- Idly Batter Shop Business and Make Good Profits Every MonthDocument14 pagesIdly Batter Shop Business and Make Good Profits Every Monthmohandidymus.vNo ratings yet

- FM Question Bank by CA Amit Sharma (AIR 30)Document423 pagesFM Question Bank by CA Amit Sharma (AIR 30)adilansari200319No ratings yet