0 ratings0% found this document useful (0 votes)

11 viewsBusMath-LM7-Profit and Loss

BusMath-LM7-Profit and Loss

Uploaded by

CARLO ESTRELLACopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

BusMath-LM7-Profit and Loss

BusMath-LM7-Profit and Loss

Uploaded by

CARLO ESTRELLA0 ratings0% found this document useful (0 votes)

11 views31 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

11 views31 pagesBusMath-LM7-Profit and Loss

BusMath-LM7-Profit and Loss

Uploaded by

CARLO ESTRELLACopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 31

Ramona S.

Trillana High School

SENIOR HIGH DEPARTMENT

Business

Mathematics

for Accountancy, Business, and

Management (ABM) Learners

Mr. Carlo T. Estrella

Preliminary

How much will be the net price

and the trade discount availed

by a customer who purchases

a dozen of frozen products at a

unit price of ₱50.00 with a

discount rate of 5%?

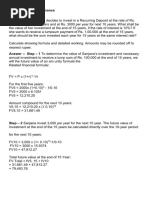

Preliminary To compute the trade discount

𝑇𝑟𝑎𝑑𝑒 𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡 = 𝑂𝑟𝑖𝑔𝑖𝑛𝑎𝑙 𝑃𝑟𝑖𝑐𝑒 ∗ 𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡 𝑟𝑎𝑡𝑒

How much will be 𝑇𝑟𝑎𝑑𝑒 𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡 = 50 ∗ 0.05

the net price and 𝑻𝒓𝒂𝒅𝒆 𝑫𝒊𝒔𝒄𝒐𝒖𝒏𝒕 = PHP 𝟐. 𝟓𝟎

the trade

The net price of the frozen product is

discount availed

𝑁𝑒𝑡 𝑃𝑟𝑖𝑐𝑒 = 𝑂𝑟𝑖𝑔𝑖𝑛𝑎𝑙 𝑃𝑟𝑖𝑐𝑒 − 𝑇𝑟𝑎𝑑𝑒 𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡

by a customer 𝑁𝑒𝑡 𝑃𝑟𝑖𝑐𝑒 = 50 − 2.50

who purchases a 𝑵𝒆𝒕 𝑷𝒓𝒊𝒄𝒆 = 𝑷𝑯𝑷 𝟒𝟕. 𝟓𝟎

dozen of frozen

products at a unit For 1 dozen of frozen products

price of ₱50.00 2.50𝑥12 = 𝑷𝑯𝑷 𝟑𝟎. 𝟎𝟎

with a discount

rate of 5%?

Objectives

Learning Competencies:

✓Differentiate profit from loss

✓Illustrate how profit is obtained

and how to avoid loss in a given

transaction.

Lesson

Analyze the 3 cases

Case 1 Case 2 Case 3

Net Sales: ₱ 1,000 Net Sales: ₱ 1,000 Net Sales: ₱ 1,000

Less: Cost 500 Less: Cost 1,200 Less: Cost 1,000

Profit ₱ 500 Profit (₱ 200) Profit ₱ 0

Profit Loss Break-even

situation situation situation

GROSS SALES

Refers to the total sales.

NET SALES

It is the amount collected from

the sale of goods after

deductions such as discounts

or refunds are made.

Income Statement Format

Net Sales ₱ xxxxx

Less: Variable xxx

Costs ₱ xxxx

Gross Profit xxxx

Less: Fixed Cost ₱ xxxx

Net Profit (Loss) ========

VARIABLE COSTS

It is the amount paid for raw

materials or ingredients

needed to produce a product

or a cost of a product

intended for resale.

FIXED COSTS

It is the other expenses that

might incur in opening a

business (rent, salary,

insurance, loan, office, store

supplies and etc.)

Example

Susan sells sacks of rice with free delivery to her

customers. She buys her supply of rice from a rice trader

at ₱ 2,000.00 per sack. She sells it to her customers at a

price with 20% mark-up based on cost. Susan rents a store

space (inclusive of water and light) near the public

market for ₱5,000 a month. During a month of operation,

she also incurs gasoline expenses of ₱2,000.00 and pays

wages of ₱3,000 to her driver. How much is the profit or

loss if during the month Susan was able to sell 50 sacks of

rice?

Example STEP 1. identify and label all the information

needed to solve the problem

Susan sells sacks of rice with free

delivery to her customers. She

buys her supply of rice from a 𝑉𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝑐𝑜𝑠𝑡 𝑝𝑒𝑟 𝑠𝑎𝑐𝑘 𝑜𝑓 𝑟𝑖𝑐𝑒 = ₱ 2,000

rice trader at ₱ 2,000.00 per sack.

She sells it to her customers at a

𝐹𝑖𝑥𝑒𝑑 Costs of Business=₱ 5, 000 (rent),

price with 20% mark-up based on ₱ 2, 000 (gasoline),

cost. Susan rents a store space

(inclusive of water and light) ₱ 3, 000 (wages),

near the public market for ₱5,000

a month. During a month of

operation, she also incurs

gasoline expenses of ₱2,000.00

and pays wages of ₱3,000 to her

driver. How much is the profit or

loss if during the month Susan

was able to sell 50 sacks of rice?

Example STEP 2. Compute the selling price of the

product.

Susan sells sacks of rice with free

delivery to her customers. She

buys her supply of rice from a 𝑀𝑎𝑟𝑘 − 𝑢𝑝 = 𝐶𝑜𝑠𝑡 𝑥 𝑑𝑒𝑠𝑖𝑟𝑒𝑑 𝑚𝑎𝑟𝑘 − 𝑢𝑝 𝑟𝑎𝑡𝑒

rice trader at ₱ 2,000.00 per sack. = ₱ 2,000 x 0.20

She sells it to her customers at a

price with 20% mark-up based on 𝑴𝒂𝒓𝒌 − 𝒖𝒑 = ₱ 400

cost. Susan rents a store space

(inclusive of water and light)

near the public market for ₱5,000 𝑆𝑒𝑙𝑙𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒 = 𝐶𝑜𝑠𝑡 + 𝑀𝑎𝑟𝑘 − 𝑢𝑝

a month. During a month of

operation, she also incurs

=₱ 2,000 + ₱ 400

gasoline expenses of ₱2,000.00 𝑺𝒆𝒍𝒍𝒊𝒏𝒈 𝑷𝒓𝒊𝒄𝒆 = ₱ 2,400

and pays wages of ₱3,000 to her

driver. How much is the profit or

loss if during the month Susan

was able to sell 50 sacks of rice?

Example STEP 3. Compute the net sales by multiplying

the quantity sold by its selling price.

Susan sells sacks of rice with free

delivery to her customers. She 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 = 𝑄𝑢𝑎𝑛𝑡𝑖𝑡𝑦 𝑠𝑜𝑙𝑑 ∗ 𝑆𝑒𝑙𝑙𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒

buys her supply of rice from a

rice trader at ₱ 2,000.00 per sack. = 50 𝑥 ₱2,400

She sells it to her customers at a

price with 20% mark-up based on

𝑵𝒆𝒕 𝑺𝒂𝒍𝒆𝒔 = ₱120,000

cost. Susan rents a store space

(inclusive of water and light) STEP 4. Identify and compute the variable

near the public market for ₱5,000

a month. During a month of cost f sales.

operation, she also incurs

gasoline expenses of ₱2,000.00 𝑉𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝐶𝑜𝑠𝑡 = 𝑄𝑢𝑎𝑛𝑡𝑖𝑡𝑦 𝑆𝑜𝑙𝑑 ∗ 𝑉𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝑐𝑜𝑠𝑡/𝑢𝑛𝑖𝑡

and pays wages of ₱3,000 to her

driver. How much is the profit or = 50 ∗ ₱2,000

loss if during the month Susan 𝑽𝒂𝒓𝒊𝒂𝒃𝒍𝒆 𝑪𝒐𝒔𝒕 = ₱𝟏𝟎𝟎, 𝟎𝟎𝟎

was able to sell 50 sacks of rice?

Example STEP 5. Identify and compute the total fixed

costs.

Susan sells sacks of rice with free

delivery to her customers. She

buys her supply of rice from a

rice trader at ₱ 2,000.00 per sack. ₱5,000 𝑟𝑒𝑛𝑡

She sells it to her customers at a +₱2,000 𝑔𝑎𝑠𝑜𝑙𝑖𝑛𝑒

price with 20% mark-up based on

cost. Susan rents a store space ₱3,000 𝑤𝑎𝑔𝑒𝑠

(inclusive of water and light)

near the public market for ₱5,000

𝑭𝒊𝒙𝒆𝒅 𝑪𝒐𝒔𝒕 = ₱𝟏𝟎, 𝟎𝟎𝟎

a month. During a month of

operation, she also incurs

gasoline expenses of ₱2,000.00

and pays wages of ₱3,000 to her

driver. How much is the profit or

loss if during the month Susan

was able to sell 50 sacks of rice?

Example STEP 6. Use simple income statement to

compute the profit or loss.

Susan sells sacks of rice with free

delivery to her customers. She Net Sales ₱ 120,000

buys her supply of rice from a

rice trader at ₱ 2,000.00 per sack.

She sells it to her customers at a

Less: Variable Costs 100,000

price with 20% mark-up based on

cost. Susan rents a store space

Gross Profit ₱ 20,000

(inclusive of water and light)

near the public market for ₱5,000

Less: Fixed Profit 10,000

a month. During a month of

operation, she also incurs Net Profit ₱ 10,000

gasoline expenses of ₱2,000.00

and pays wages of ₱3,000 to her Conclusion: A net profit of ₱10,000 is

driver. How much is the profit or

loss if during the month Susan

gained in this period because the net

was able to sell 50 sacks of rice? sales made is greater than the costs

incurred in the business.

Example

Susan sells sacks of rice with free delivery to her

customers. She buys her supply of rice from a rice trader

at ₱ 2,000.00 per sack. She sells it to her customers at a

price with 20% mark-up based on cost. Susan rents a store

space (inclusive of water and light) near the public

market for ₱5,000 a month. During a month of operation,

she also incurs gasoline expenses of ₱2,000.00 and pays

wages of ₱3,000 to her driver. How much is profit or loss if

during the month, Susan was able to sell 20 sacks of rice?

Example STEP 1. identify and label all the information

needed to solve the problem

Susan sells sacks of rice with free

delivery to her customers. She

buys her supply of rice from a 𝑉𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝑐𝑜𝑠𝑡 𝑝𝑒𝑟 𝑠𝑎𝑐𝑘 𝑜𝑓 𝑟𝑖𝑐𝑒 = ₱ 2,000

rice trader at ₱ 2,000.00 per sack.

She sells it to her customers at a

𝐹𝑖𝑥𝑒𝑑 Costs of Business=₱ 5, 000 (rent),

price with 20% mark-up based on ₱ 2, 000 (gasoline),

cost. Susan rents a store space

(inclusive of water and light) ₱ 3, 000 (wages),

near the public market for ₱5,000

a month. During a month of

operation, she also incurs

gasoline expenses of ₱2,000.00

and pays wages of ₱3,000 to her

driver. How much is profit or loss if

during the month, Susan was

able to sell 20 sacks of rice?

Example STEP 2. Compute the selling price of the

product.

Susan sells sacks of rice with free

delivery to her customers. She

buys her supply of rice from a 𝑀𝑎𝑟𝑘 − 𝑢𝑝 = 𝐶𝑜𝑠𝑡 𝑥 𝑑𝑒𝑠𝑖𝑟𝑒𝑑 𝑚𝑎𝑟𝑘 − 𝑢𝑝 𝑟𝑎𝑡𝑒

rice trader at ₱ 2,000.00 per sack. = ₱ 2,000 x 0.20

She sells it to her customers at a

price with 20% mark-up based on 𝑴𝒂𝒓𝒌 − 𝒖𝒑 = ₱ 400

cost. Susan rents a store space

(inclusive of water and light)

near the public market for ₱5,000 𝑆𝑒𝑙𝑙𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒 = 𝐶𝑜𝑠𝑡 + 𝑀𝑎𝑟𝑘 − 𝑢𝑝

a month. During a month of

operation, she also incurs

=₱ 2,000 + ₱ 400

gasoline expenses of ₱2,000.00 𝑺𝒆𝒍𝒍𝒊𝒏𝒈 𝑷𝒓𝒊𝒄𝒆 = ₱ 2,400

and pays wages of ₱3,000 to her

driver. How much is profit or loss if

during the month, Susan was

able to sell 20 sacks of rice?

Example STEP 3. Compute the net sales by multiplying

the quantity sold by its selling price.

Susan sells sacks of rice with free

delivery to her customers. She 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 = 𝑄𝑢𝑎𝑛𝑡𝑖𝑡𝑦 𝑠𝑜𝑙𝑑 ∗ 𝑆𝑒𝑙𝑙𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒

buys her supply of rice from a

rice trader at ₱ 2,000.00 per sack. = 20 𝑥 ₱2,400

She sells it to her customers at a

price with 20% mark-up based on

𝑵𝒆𝒕 𝑺𝒂𝒍𝒆𝒔 = ₱𝟒𝟖, 𝟎𝟎𝟎

cost. Susan rents a store space

(inclusive of water and light) STEP 4. Identify and compute the variable

near the public market for ₱5,000

a month. During a month of cost f sales.

operation, she also incurs

gasoline expenses of ₱2,000.00 𝑉𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝐶𝑜𝑠𝑡 = 𝑄𝑢𝑎𝑛𝑡𝑖𝑡𝑦 𝑆𝑜𝑙𝑑 ∗ 𝑉𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝑐𝑜𝑠𝑡/𝑢𝑛𝑖𝑡

and pays wages of ₱3,000 to her

driver. How much is profit or loss if = 20 ∗ ₱2,000

during the month, Susan was

able to sell 20 sacks of rice?

𝑽𝒂𝒓𝒊𝒂𝒃𝒍𝒆 𝑪𝒐𝒔𝒕 = ₱𝟒𝟎, 𝟎𝟎𝟎

Example STEP 5. Identify and compute the total fixed

costs.

Susan sells sacks of rice with free

delivery to her customers. She

buys her supply of rice from a

rice trader at ₱ 2,000.00 per sack. ₱5,000 𝑟𝑒𝑛𝑡

She sells it to her customers at a +₱2,000 𝑔𝑎𝑠𝑜𝑙𝑖𝑛𝑒

price with 20% mark-up based on

cost. Susan rents a store space ₱3,000 𝑤𝑎𝑔𝑒𝑠

(inclusive of water and light)

near the public market for ₱5,000

𝑭𝒊𝒙𝒆𝒅 𝑪𝒐𝒔𝒕 = ₱𝟏𝟎, 𝟎𝟎𝟎

a month. During a month of

operation, she also incurs

gasoline expenses of ₱2,000.00

and pays wages of ₱3,000 to her

driver. How much is profit or loss if

during the month, Susan was

able to sell 20 sacks of rice?

Example STEP 6. Use simple income statement to

compute the profit or loss.

Susan sells sacks of rice with free

delivery to her customers. She Net Sales ₱ 48,000

buys her supply of rice from a

rice trader at ₱ 2,000.00 per sack.

She sells it to her customers at a

Less: Variable Costs 40,000

price with 20% mark-up based on

cost. Susan rents a store space

Gross Profit 8,000

(inclusive of water and light)

near the public market for ₱5,000

Less: Fixed Profit 10,000

a month. During a month of

operation, she also incurs Net Loss (₱ 2,000)

gasoline expenses of ₱2,000.00

and pays wages of ₱3,000 to her Conclusion: A net loss of ₱2,000 is

driver. How much is profit or loss if

during the month, Susan was

experienced in this period because the

able to sell 20 sacks of rice? net sales made is lesser than the costs

incurred in the business.

How to Effectively

Manage your

Profit and Loss

1. Do an initial assessment

Make a review of your past

profit and loss reports and

compare them to your current

one.

2. Use analytical tools

Your accounting team should

have proper analytical

financial tools to structure your

profit and loss statement based

on your business operations.

3. Take note of increase in

expenses.

Analyzing expense growth can

help you evaluate your

company’s use of resources.

4. Review company sales

A detailed analysis of the

company’s sales will allow your

understand if there has been an

increase or decrease in sales of

your product or service.

EXERCISE

Watch for Less

James buys a local brand of watch from a supplier at

₱1,000.00 each. He sells them in his store at a regular price of

₱1,500.00. In operating his watch store, he also incurred other

expenses like rent of space at ₱5,000.00 and salary of his

worker for ₱10,000.00 during the month.

Case 1 If during the month of August, James sells 25 units of

watches, what is the profit he gained or the loss he incurred in

this transaction?

Case 2 If during the month of August, in order to boost his sales,

James offers a 10 % discount for each watch and was able to

sell 90 units of watches. What is the profit he gained or loss he

incurred in this transaction?

You might also like

- FCHM Rotation WriteupDocument21 pagesFCHM Rotation WriteupBey BlancoNo ratings yet

- Unlock PIN Code (Autosaved)Document26 pagesUnlock PIN Code (Autosaved)Ana Krisleen MartinezNo ratings yet

- ECO111 - Individual Assignment 03Document3 pagesECO111 - Individual Assignment 03Van Quang NguyenNo ratings yet

- Learning Activity Sheet ABM 11 Business Mathematics (Q2-WK1) CommissionDocument10 pagesLearning Activity Sheet ABM 11 Business Mathematics (Q2-WK1) CommissionArchimedes Arvie GarciaNo ratings yet

- ECO111 - Individual Assignment 03Document3 pagesECO111 - Individual Assignment 03Khánh LyNo ratings yet

- Reviewer - Business MathematicsDocument5 pagesReviewer - Business MathematicsJeff ToledoNo ratings yet

- ECON111 - Individual-Assignment-03 Nguyen Quang TruongHS186206Document3 pagesECON111 - Individual-Assignment-03 Nguyen Quang TruongHS186206nguyenquangtruong1717No ratings yet

- DISCOUNT-SERIESDocument37 pagesDISCOUNT-SERIESbryan tabuzoNo ratings yet

- Profit LossDocument26 pagesProfit LossanggiNo ratings yet

- Profit and LossesDocument17 pagesProfit and LossesFrezie Jaine84% (25)

- Commission ActivityDocument43 pagesCommission Activityarnelregaladojr76No ratings yet

- NGUYEN THi THUY LINH - ECON111 - Individual Assignment 03Document4 pagesNGUYEN THi THUY LINH - ECON111 - Individual Assignment 03linhntths180872No ratings yet

- Buying and SellingDocument54 pagesBuying and SellingAna Valenzuela75% (4)

- ECON111 - Individual Assignment 03Document4 pagesECON111 - Individual Assignment 03Chang HuyềnNo ratings yet

- Commission Rate 120,000Document4 pagesCommission Rate 120,000Emmanuel Villeja LaysonNo ratings yet

- Forecasting Revenues and Cost IncurredDocument30 pagesForecasting Revenues and Cost Incurredjenleihoneymagdua-stemNo ratings yet

- Entreprenuership: Input 7 The Business EnterpriseDocument7 pagesEntreprenuership: Input 7 The Business EnterpriseRhina MayNo ratings yet

- COMMISSIONDocument3 pagesCOMMISSIONitsmetins25No ratings yet

- NAME: - Score: - GRADE & SECTION - TeacherDocument2 pagesNAME: - Score: - GRADE & SECTION - TeacherJessel CarilloNo ratings yet

- Business Math - W2 - CommissionDocument5 pagesBusiness Math - W2 - Commissioncj100% (3)

- BusMath-LM8-Break-even Analysis and Problem Solving Involving Buying and SellingDocument37 pagesBusMath-LM8-Break-even Analysis and Problem Solving Involving Buying and SellingCARLO ESTRELLANo ratings yet

- Example:: A Bag Costing Rs.28 Sold For Rs.35. Find The Percentage ProfitDocument8 pagesExample:: A Bag Costing Rs.28 Sold For Rs.35. Find The Percentage ProfitAbdullahiNo ratings yet

- Module 4 MathDocument10 pagesModule 4 MathAlissa MayNo ratings yet

- Module 4 MathDocument10 pagesModule 4 MathAlissa MayNo ratings yet

- ECON111 - Individual Assignment 03Document3 pagesECON111 - Individual Assignment 03yenpthhs186138No ratings yet

- Business Mathematics: Activity 1Document4 pagesBusiness Mathematics: Activity 1Mary Manzano Nool100% (2)

- Name: Roll Number: Room No: Class:: Student InformationDocument3 pagesName: Roll Number: Room No: Class:: Student InformationHa raNo ratings yet

- Corporate FinanceDocument8 pagesCorporate FinancepragatipNo ratings yet

- Business Math Activity 1Document6 pagesBusiness Math Activity 1gabezarate071No ratings yet

- Math 11 ABM Business Math Q2-Week 1Document17 pagesMath 11 ABM Business Math Q2-Week 1JESSA FERNANDEZNo ratings yet

- Week 7 - Profit and Loss Week 8 - Break-Even Point: Business Math Leap - W7 & W8Document23 pagesWeek 7 - Profit and Loss Week 8 - Break-Even Point: Business Math Leap - W7 & W8david austriaNo ratings yet

- Pod HandlerDocument41 pagesPod HandlerWhite KrampNo ratings yet

- Commissions and InterestsDocument8 pagesCommissions and InterestsAxl Fitzgerald Bulawan100% (1)

- Marketing Metrics - Chapter 3Document28 pagesMarketing Metrics - Chapter 3Hoang Yen NhiNo ratings yet

- LP 2ND QUARTER Business Math 1Document59 pagesLP 2ND QUARTER Business Math 1Don't mind me100% (1)

- Business Mathematics Week 1Document24 pagesBusiness Mathematics Week 1Jewel Joy PudaNo ratings yet

- Holiday home-work IXDocument2 pagesHoliday home-work IXaditi.bhasinNo ratings yet

- Arithmetic QuestionsDocument2 pagesArithmetic QuestionsAmir KhanNo ratings yet

- BMATH-PROFIT-LOSTDocument21 pagesBMATH-PROFIT-LOSTEljine OchoaNo ratings yet

- Boardwork Profit or LossDocument8 pagesBoardwork Profit or LossDaniel Latiban GadorNo ratings yet

- Activity 2.Document3 pagesActivity 2.raquelmadolid10No ratings yet

- Solved ProblemsDocument32 pagesSolved ProblemsDeepshikha GoelNo ratings yet

- AQIB Break Even AnalysisDocument22 pagesAQIB Break Even AnalysisArmaghan BhattiNo ratings yet

- C. Cash DiscountsDocument17 pagesC. Cash DiscountsClarisse-joan Bumanglag GarmaNo ratings yet

- Break EvenDocument83 pagesBreak Evenavianne izra100% (1)

- Gross SalesDocument4 pagesGross SaleselijahrodsingueobetitaNo ratings yet

- 7 Profit & LossDocument7 pages7 Profit & LossManoj Swags7No ratings yet

- 6 Business ApplicationsDocument12 pages6 Business ApplicationsLianne Joy EsquierdaNo ratings yet

- Q2 1 BM CommissionDocument34 pagesQ2 1 BM CommissionAbbygail MatrizNo ratings yet

- Financial ManagementDocument6 pagesFinancial ManagementLiset van den BroekNo ratings yet

- Commission NotesDocument2 pagesCommission Notesivanjade627No ratings yet

- Business Math 11 Q1M5Document16 pagesBusiness Math 11 Q1M5Lalie ESCNo ratings yet

- q1 Business Math Module 5Document17 pagesq1 Business Math Module 5Reigi May100% (3)

- SOCIAL ArithmeticDocument5 pagesSOCIAL ArithmeticAdek Teguh Rachmawan Anar-qNo ratings yet

- Trading Profit Loss Discount and Shopping Upper Primary (0) 085527Document36 pagesTrading Profit Loss Discount and Shopping Upper Primary (0) 085527jamesremiraze4No ratings yet

- Finding Discount, Commission and InterestDocument17 pagesFinding Discount, Commission and InterestAiza MalondaNo ratings yet

- Lesson #2 (2nd QTR - 1st Sem) Trade DiscountDocument3 pagesLesson #2 (2nd QTR - 1st Sem) Trade Discountpaulinabeatrix10No ratings yet

- Profit and LossDocument23 pagesProfit and LossANDREA DEINLANo ratings yet

- budgeting small bussinessDocument2 pagesbudgeting small bussinessIZZATUL HAREESA BINTI ZAIDINo ratings yet

- Mark-Up Mark-On MarkdownDocument41 pagesMark-Up Mark-On MarkdownravenbaklasupotNo ratings yet

- MIL 1-Introduction to Media and Information LiteracyDocument52 pagesMIL 1-Introduction to Media and Information LiteracyCARLO ESTRELLANo ratings yet

- BusMath LM9 MortgagesDocument23 pagesBusMath LM9 MortgagesCARLO ESTRELLANo ratings yet

- BusMath-LM8-Break-even Analysis and Problem Solving Involving Buying and SellingDocument37 pagesBusMath-LM8-Break-even Analysis and Problem Solving Involving Buying and SellingCARLO ESTRELLANo ratings yet

- BusMath-LM5-Differentiating Mark-On, Markdown, and Mark-UpDocument57 pagesBusMath-LM5-Differentiating Mark-On, Markdown, and Mark-UpCARLO ESTRELLANo ratings yet

- mpd16 PDFDocument1 pagempd16 PDFVivek SinhaNo ratings yet

- Online Test Questions & AnswersDocument4 pagesOnline Test Questions & AnswerssurendraNo ratings yet

- Linear Regression Candles With OB and Target by LEODocument33 pagesLinear Regression Candles With OB and Target by LEObhargavboricha40% (1)

- Boom and Crash MethodDocument13 pagesBoom and Crash MethodMr.collageNo ratings yet

- Forfeiture Rate UpdateDocument7 pagesForfeiture Rate UpdateSeemaNo ratings yet

- Suggested Topics For SPEAKING TESTS. (Level A2.2)Document2 pagesSuggested Topics For SPEAKING TESTS. (Level A2.2)Hoàng ĐỗNo ratings yet

- Forms of Business Organization in NepalDocument10 pagesForms of Business Organization in Nepalsuraj banNo ratings yet

- Mark Lua - Resume 2fcover Letter 25 Points EachDocument1 pageMark Lua - Resume 2fcover Letter 25 Points Eachapi-460268921No ratings yet

- The Feedback Effect of Hedging in Illiquid MarketsDocument43 pagesThe Feedback Effect of Hedging in Illiquid MarketsSudeep SumanNo ratings yet

- Chapter 5 CPMDocument25 pagesChapter 5 CPMSahil MathurNo ratings yet

- Columbus Brewing Company Marketing Proposal: CM SquaredDocument11 pagesColumbus Brewing Company Marketing Proposal: CM SquaredMikayla McCormicNo ratings yet

- Swimming Pool Feasibility Study: Otto TownshipDocument55 pagesSwimming Pool Feasibility Study: Otto TownshiprajaNo ratings yet

- MD050s and Skills NeededDocument5 pagesMD050s and Skills NeededjayapavanNo ratings yet

- The Great PyramidDocument10 pagesThe Great PyramidRajendiraperasad ManiamNo ratings yet

- Standard Costing FormulasDocument3 pagesStandard Costing FormulassixcenzoNo ratings yet

- Bijapur 1Document10 pagesBijapur 1girish subhedarNo ratings yet

- MG University Syllabus MBA FIN and HRDocument13 pagesMG University Syllabus MBA FIN and HRcheriyettanNo ratings yet

- Pearson & George, (S.E. Asia), Inc. vs. NLRC G.R. No. 113928 February 1, 1996 FactsDocument1 pagePearson & George, (S.E. Asia), Inc. vs. NLRC G.R. No. 113928 February 1, 1996 Factscarlo_tabangcuraNo ratings yet

- ICCA Statistics: Country & City Rankings - Public AbstractDocument68 pagesICCA Statistics: Country & City Rankings - Public AbstractMelany CamaraNo ratings yet

- Chapter 16. Retail Trade Liberalization Act of 2000 and Related Provisions of The Anti-Dummy LawDocument10 pagesChapter 16. Retail Trade Liberalization Act of 2000 and Related Provisions of The Anti-Dummy LawRache GutierrezNo ratings yet

- Report 2020 State of Agility Procurement Supply R1.1Document12 pagesReport 2020 State of Agility Procurement Supply R1.1Joost van BoeschotenNo ratings yet

- Media ManagementDocument37 pagesMedia ManagementRizwan Khan100% (4)

- Investment in Sbi Mutual FundDocument63 pagesInvestment in Sbi Mutual FundNavneetNo ratings yet

- 17 Training CalendarDocument4 pages17 Training CalendarVijay GaikwadNo ratings yet

- IC Stock Inventory Control 8566Document9 pagesIC Stock Inventory Control 8566mayankNo ratings yet

- Conflict Management in An OrganisationDocument72 pagesConflict Management in An OrganisationVineet Tiwari80% (5)

- Ujjwal SharmaDocument2 pagesUjjwal SharmaMohit SharmaNo ratings yet

- AM Programs General ScheduleDocument20 pagesAM Programs General ScheduleFernando III PerezNo ratings yet

- Ar2012 Final PDFDocument53 pagesAr2012 Final PDFammendNo ratings yet