Gmail - Payment of Final Dividend for the Financial Year 2023-24.

Gmail - Payment of Final Dividend for the Financial Year 2023-24.

Uploaded by

jaytravel7799Copyright:

Available Formats

Gmail - Payment of Final Dividend for the Financial Year 2023-24.

Gmail - Payment of Final Dividend for the Financial Year 2023-24.

Uploaded by

jaytravel7799Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Gmail - Payment of Final Dividend for the Financial Year 2023-24.

Gmail - Payment of Final Dividend for the Financial Year 2023-24.

Uploaded by

jaytravel7799Copyright:

Available Formats

Payment of Final Dividend for the Financial Year 2023-24.

1 message

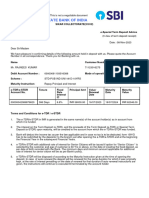

INDIAN RAILWAY FINANCE CORPORATION LIMITED <NOREPLY@beetalfinancial.com> Thu, Oct 24, 2024 at 2:53 PM

Reply-to: INDIAN RAILWAY FINANCE CORPORATION LIMITED <NOREPLY@beetalfinancial.com>

To: balachandrareddy96@gmail.com

DATE: 18/09/2024

Dear Shareholder,

Sub: Payment of Final Dividend for the Financial Year 2023-24.

This is to inform you that Final Dividend @7.0% i.e., Rs.0.70 per equity share of Rs.10/- each for the financial year 2023-24 was declared by

the shareholders of the Company in its Annual General Meeting held on 29th August, 2024.

The dividend has been paid to those Shareholders, whose name appeared in the statement of beneficial ownership furnished by National

Securities Depository Limited and Central Depository Services (India) Limited and in the Company’ s Register of Members maintained by

the Company’ s Registrar and Share Transfer Agent (‘RTA’), as on the record date i.e., 22nd August, 2024.

In respect of your shareholding and as per the mandate registered with the Depository Participants or with the Registrar & Share Transfer

Agent of the company, the company has paid the dividend amount to your bank account as per details given below:

01. Folio No. / DPID & Client ID No. 1208870288572268

02. Name of Shareholder MEKALA BALACHANDRAREDDY .

03. PAN NO ECZPB0467H

No. of Equity Share(s) held on Book Closure/Record

04. 5

Date

05. Dividend Per Share (Rs.) 0.70

06. Amount of Gross Dividend (Rs.) { a} 3.50

07. Tax Deducted (Rs.) { b} 0.00

08. Net Dividend Paid (Rs.) { a-b} 3.50

09. Bank Name STATE BANK OF INDIA

10. Bank Account No. 00000038241374005

11. MICR Code / IFS Code SBIN0021923

12. Mode of payment NACH

13. Electronic Credit Reference No. IR2208245391833

14. Date of Credit 18-09-2024

As per the provisions of the Income Tax Act, 1961 as amended by the Finance Act, 2020, tax at source (“TDS”) has been deducted

from the dividend, wherever applicable at the rates prescribed therein. The Company will file the TDS Return electronically as

prescribed in the Income Tax Rules, subsequent to this, shareholders can view the credit of TDS in Form 26AS, which can be

downloaded from their e-filing account at https://incometaxindia.gov.in.

Kindly verify with your bank statement/passbook for the dividend amount credited to your account. In case the dividend amount

has not been credited to your bank account or in case of any discrepancy/query, please take up the matter quoting your Folio No.

/ DPID & Client ID No. with RTA i.e., M/s Beetal Financial & Computer Services Pvt. Ltd., whose particulars are given below:

M/s Beetal Financial & Computer Services Private Limited (Unit: IRFC)

Beetal House, 3rd Floor, 99, Madangir,

Behind Local Shopping Centre, New Delhi-110062

Email : irfc@beetalfinancial.com

Tel. No.: 011-29961281-83

In case you would like to update Bank details, E-mail ID, Address and Contact Number, kindly update the same with your

Depository Participant (DP).

Thanking you,

Yours Sincerely,

For Indian Railway Finance Corporation Limited

Sd/-

Vijay Babulal Shirode

Company Secretary& Compliance Officer

--

Click Here to unsubscribe from this newsletter.

You might also like

- Aditya Birla Foreclosure LetterDocument1 pageAditya Birla Foreclosure LetterShuvabrata Ganai100% (4)

- Trading GAPS Lazy Trader PDFDocument12 pagesTrading GAPS Lazy Trader PDFAnonymous LhmiGjO75% (16)

- Interest Certificate: Dharmendra Kumar SamtaniDocument1 pageInterest Certificate: Dharmendra Kumar SamtanideepNo ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Potu RavinderreddyNo ratings yet

- Revenue Cycle in Accounting Information Systems PDFDocument5 pagesRevenue Cycle in Accounting Information Systems PDFPrecious Ivy Fernandez100% (1)

- E Dividend FormDocument1 pageE Dividend FormWaleed SiddiquiNo ratings yet

- 5645474082123Document2 pages5645474082123kavin116No ratings yet

- Payment Details: Email: Investor - Relations@pidilite - Co.inDocument2 pagesPayment Details: Email: Investor - Relations@pidilite - Co.inOpenText DataNo ratings yet

- WirkDocument2 pagesWirkjiguvaniyaNo ratings yet

- IN30267933627262Document2 pagesIN30267933627262CLANCY GAMING COMUNITYNo ratings yet

- State Bank of Patiala: Rtgs/Neft/Application FormDocument2 pagesState Bank of Patiala: Rtgs/Neft/Application FormAnonymous wfgcPmJYNo ratings yet

- Summary of Accounts Held Under Customer Id: 523327962 As On 31-10-2012Document3 pagesSummary of Accounts Held Under Customer Id: 523327962 As On 31-10-2012skbansal1976No ratings yet

- Soa Drblbat00620030 09082024 1723182094158Document3 pagesSoa Drblbat00620030 09082024 1723182094158Ravinder singhNo ratings yet

- Girdhar51 1603693312542 PDFDocument2 pagesGirdhar51 1603693312542 PDFjignesh parmarNo ratings yet

- LTFSWelcomeKit_BL240221040100816Document3 pagesLTFSWelcomeKit_BL240221040100816praveenkotha.caNo ratings yet

- In 30302854036156Document2 pagesIn 30302854036156mallikaNo ratings yet

- LBTRU00005805276 IT Certificate 2021-22Document2 pagesLBTRU00005805276 IT Certificate 2021-22siva kumar reddy kNo ratings yet

- Power The Tata Power Company Limited: Payment DetailsDocument2 pagesPower The Tata Power Company Limited: Payment DetailschiragNo ratings yet

- Iw11750101 18082014075038Document1 pageIw11750101 18082014075038pankajmadhavNo ratings yet

- Annual Reports 2022-23Document82 pagesAnnual Reports 2022-23amit.bonhomiaNo ratings yet

- Sumit FD OF STATEBANKDocument2 pagesSumit FD OF STATEBANKrockkaindalNo ratings yet

- Registered Address: HDFC Bank Ltd. HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai-400013Document1 pageRegistered Address: HDFC Bank Ltd. HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai-400013margaj5552No ratings yet

- Bank Al Habib Director RemunerationDocument13 pagesBank Al Habib Director RemunerationARquam JamaliNo ratings yet

- Tata Steel Intimation LetterDocument2 pagesTata Steel Intimation LetterabhijitrathiNo ratings yet

- Aug2010Document4 pagesAug2010Mohd ShoaibNo ratings yet

- Calcutta Telephones: Anindya Mukherjee 1260/2 SURVEY PARK Santoshpur PIN-700075 Kolkata Kolkata WB 700075 P O StampDocument3 pagesCalcutta Telephones: Anindya Mukherjee 1260/2 SURVEY PARK Santoshpur PIN-700075 Kolkata Kolkata WB 700075 P O StampTaniya SarkerNo ratings yet

- Iw01220137 25022012025852Document1 pageIw01220137 25022012025852ishanarya00761No ratings yet

- Application FormDocument4 pagesApplication FormcrenjadNo ratings yet

- 121004_1002030000103369 (2)Document5 pages121004_1002030000103369 (2)AhnimeshNo ratings yet

- Maki1206 - Interest CertificateDocument1 pageMaki1206 - Interest CertificateAnil AneNo ratings yet

- TDS PresentationDocument16 pagesTDS Presentationgamers SatisfactionNo ratings yet

- WelcomeKit - T03180260922080808 - 6 Mar 2023Document3 pagesWelcomeKit - T03180260922080808 - 6 Mar 2023Roshan KumarNo ratings yet

- Statement of Axis Account No:921010039785984 For The Period (From: 26-02-2022 To: 04-03-2022)Document2 pagesStatement of Axis Account No:921010039785984 For The Period (From: 26-02-2022 To: 04-03-2022)Subham MeenaNo ratings yet

- StatementDocument10 pagesStatementchefrinkuNo ratings yet

- SBI ReceiptDocument1 pageSBI ReceiptVenkata Sujith ChNo ratings yet

- It 000159571758 2024 05Document1 pageIt 000159571758 2024 05dostm125No ratings yet

- Ad31812620 08112023095445Document1 pageAd31812620 08112023095445Rajneesh Khichar : MathematicsNo ratings yet

- PDF SubvaDocument1 pagePDF SubvaShakeel AbbasiNo ratings yet

- Soa LetterDocument2 pagesSoa LetterAnurag AnandNo ratings yet

- DiviDocument6 pagesDiviDeena dayalanNo ratings yet

- Graphite - India - LTD 509488 March 2003Document75 pagesGraphite - India - LTD 509488 March 2003mgn_mca943No ratings yet

- RTGSPaymetFromatDocument1 pageRTGSPaymetFromatjohnsondwayne881No ratings yet

- F230033317SFL F28003a7Document1 pageF230033317SFL F28003a7VisheshNo ratings yet

- Income Tax Payment Challan: PSID #: 183417668Document1 pageIncome Tax Payment Challan: PSID #: 183417668muhammadumerfarooq444No ratings yet

- B.A. Circular On Loan Repayment Dt. 12-04-2021Document2 pagesB.A. Circular On Loan Repayment Dt. 12-04-2021hazarataliNo ratings yet

- Registered Address: HDFC Bank Ltd. HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai-400013Document1 pageRegistered Address: HDFC Bank Ltd. HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai-400013preet2karamNo ratings yet

- It 000159572188 2024 04Document1 pageIt 000159572188 2024 04dostm125No ratings yet

- State Bank of IndiaDocument1 pageState Bank of IndiaBalaji MundheNo ratings yet

- Consumer Name & Address:: 34004000181 Ashokkumar Ravjibhai Vekaria Bus Stand Chowk I Shri KhodiyarDocument1 pageConsumer Name & Address:: 34004000181 Ashokkumar Ravjibhai Vekaria Bus Stand Chowk I Shri Khodiyarkrishna vekariya100% (1)

- 48249693_1714841804141Document1 page48249693_1714841804141Pmtbiology ClassesNo ratings yet

- Intcert - 20220927 - 01 04 2021 31 03 2022 - 35138734Document2 pagesIntcert - 20220927 - 01 04 2021 31 03 2022 - 35138734Mohan KumarNo ratings yet

- Receipt of Interest / Dividend Payments Through Electronic Payment Modes of (Necs/Neft/Rtgs)Document2 pagesReceipt of Interest / Dividend Payments Through Electronic Payment Modes of (Necs/Neft/Rtgs)Pawan Shyamsundar GadewadNo ratings yet

- Ad09025351 15092020022949Document1 pageAd09025351 15092020022949Anita MishraNo ratings yet

- Premium CertificateDocument1 pagePremium Certificatekeyurravaliya746No ratings yet

- RTGSFormat1709722636 45107024084Document1 pageRTGSFormat1709722636 45107024084thirupathiindustries22No ratings yet

- Interest Certificateev2024Document1 pageInterest Certificateev2024victskoolNo ratings yet

- Money View ApprovalDocument4 pagesMoney View Approvalnitinkumar575875No ratings yet

- Soa Abbhopl 000000681188 25062024 134570Document7 pagesSoa Abbhopl 000000681188 25062024 134570nikitachaudharyworldNo ratings yet

- CreditCardStatement PDFDocument3 pagesCreditCardStatement PDFSrinivasDukkaNo ratings yet

- Charge Slip - 1723043986645Document3 pagesCharge Slip - 1723043986645nsjio6946No ratings yet

- J.K. Lasser's Your Income Tax 2024, Professional EditionFrom EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNo ratings yet

- J.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnNo ratings yet

- Analysis of The Effect of Interest Rate On Stock Prices: A Case Study of Ghana Stock ExchangeDocument14 pagesAnalysis of The Effect of Interest Rate On Stock Prices: A Case Study of Ghana Stock ExchangeMaithili SUBRAMANIANNo ratings yet

- Chapter 1 Class 1Document47 pagesChapter 1 Class 1yzy9tkz22pNo ratings yet

- Learn All About Blockchain - Cryptocurrency - Binance AcademyDocument18 pagesLearn All About Blockchain - Cryptocurrency - Binance AcademyJavier BriceñoNo ratings yet

- openSAP s4h29 Unit 2 OVER PresentationDocument10 pagesopenSAP s4h29 Unit 2 OVER PresentationDavid RNo ratings yet

- Press Release For Tea Briefing Paper in English VersionDocument1 pagePress Release For Tea Briefing Paper in English VersionLet's Save MyanmarNo ratings yet

- RP v. City of DavaoDocument4 pagesRP v. City of Davaomodernelizabennet100% (1)

- Archive Copy: Booking AmendmentDocument2 pagesArchive Copy: Booking AmendmentNeiver PalaciosNo ratings yet

- PhilGEPS Certificate 2021-2022Document3 pagesPhilGEPS Certificate 2021-2022MARIEL REYESNo ratings yet

- 2.5 Tarea Business Task 2Document3 pages2.5 Tarea Business Task 2GABRIELA BUSTILLOSNo ratings yet

- Sox PDFDocument10 pagesSox PDFRajesh ChoudharyNo ratings yet

- Memorandum Copy FINALDocument19 pagesMemorandum Copy FINALTahirBajwaNo ratings yet

- FOCUS - Indofood Sukses Makmur: Saved by The GreenDocument10 pagesFOCUS - Indofood Sukses Makmur: Saved by The GreenriskaNo ratings yet

- Introduction To Economics and FinanceDocument2 pagesIntroduction To Economics and FinanceBablooNo ratings yet

- Supply Chain and Logistics Management: The Future of Same-Day Delivery: Same As The Past?Document12 pagesSupply Chain and Logistics Management: The Future of Same-Day Delivery: Same As The Past?Anindya BasuNo ratings yet

- Bain Southeast Asia Green Economy 2024 ReportDocument171 pagesBain Southeast Asia Green Economy 2024 ReportSanchita GuptaNo ratings yet

- Victoriano V Elizalde DigestDocument2 pagesVictoriano V Elizalde Digestalma navarro escuzarNo ratings yet

- UPSC Prelims Geography Free Material ResourcesDocument11 pagesUPSC Prelims Geography Free Material ResourcesChinmay JenaNo ratings yet

- Mine Manager: Contact DetailsDocument2 pagesMine Manager: Contact DetailsSudamBeheraNo ratings yet

- Concurrence and Preference of CreditDocument2 pagesConcurrence and Preference of CreditJapon, Jenn RossNo ratings yet

- Global Optical CaseletDocument1 pageGlobal Optical Caseletchandan tiwariNo ratings yet

- Muestra MASDocument132 pagesMuestra MASJohaderNo ratings yet

- EOS Web and Multimedia L3 & L4Document97 pagesEOS Web and Multimedia L3 & L4Habtamu Hailemariam Asfaw100% (1)

- Learn. Connect. ExploreDocument29 pagesLearn. Connect. Exploretodeneye100% (1)

- Exam Practise MathDocument4 pagesExam Practise MathSosmed RullyNo ratings yet

- Cat 2023 Sup06 enDocument2 pagesCat 2023 Sup06 enNAABOL-UNSANo ratings yet

- Asset Rotation Strategy With PythonDocument6 pagesAsset Rotation Strategy With PythonPeter SamualNo ratings yet

- TCW Midterm ReviewerDocument17 pagesTCW Midterm ReviewerDasha EthylNo ratings yet

- A Study On Consumer Buying Behaviour On Honda Two WheelersDocument5 pagesA Study On Consumer Buying Behaviour On Honda Two WheelersEditor IJTSRDNo ratings yet