0 ratings0% found this document useful (0 votes)

4 viewsFinal QB

Final QB

Uploaded by

sreedatthapuvvalaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Final QB

Final QB

Uploaded by

sreedatthapuvvala0 ratings0% found this document useful (0 votes)

4 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

4 views2 pagesFinal QB

Final QB

Uploaded by

sreedatthapuvvalaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

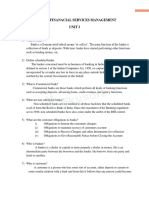

Questions

Unit 1 Mark 5 Marks

1 Define Cooperative bank. Discuss the structure of the Indian banking system.

1 List the services offered by the payment banks to their customers. What are the different types of Banks?

1 What is scheduled bank? Discuss the evolution of Indian Banks?

1 What is a key feature of cooperative banks? What are the main functions of commercial banks?

1 Define the Cash Reserve Ratio (CRR) in the context of banking. Explain briefly the major functions of the Reserve Bank of India (RBI)?

1 Which act th RBI was established? Describe the distinguishes between cooperative banks and commercial banks.

1 What is monetary policy? What are the tools of monetary control?

1 What is open market operations? What are the functions of RBI?

1 What is Cash Reserve Ratio (CRR)? What is Baking Regulation? Discuss in detail.

1 What is Retail Banking? What are the regulatroy restrictions on lending?

1 What is Wholesale banking? What are the different types of Banking?

1 What is International banking? What are the advantages and disadvantages of retail banking, as well as wholesale and international banking?

2 Define operational risk and give two examples. Discuss various steps involved in risk management for a retail bank.

2 What is credit risk? Identify the different risks faced by banks.

2 What do you mean by NPA? Critically analyze the major differences between Basel norms I, II and III.

2 What is CIBIL? What is the role and functions of CIBIL?

2 What is code for debt collection? Explain the fair practices for debt collection?

2 What is the objective of code for debt collection? Discuss the the fair practices for debt collection?

2 List the 5C's of credit that banks consider while assessing loan applications.Explain various principles of lending in detail.

2 What is bank guarantee? What are the cardinal principles?

2 What is principle of diversity? How do non-fund based facilities help the business in managing their cash flows?

2 What is primary objective of credit appraisal? What is the imprtance of Credit Apprisal?

2 What is ultimate goal of cash management? What are the credit apprisal techniques?

2 What is credit appraisal? What are modern methods of credit Appraisal?

3 How does a fixed deposit differ from a regular savings account? What are the different deposit products and services?

3 How do joint deposit works? What are the advantages and disadvantages of deposit products?

3 What factors should you consider before opening a deposit account? What are the different services provided by Banks?

3 Define digital banking. List various digital banking services provided to theWhat

customer

is KYC?

by a bank.

Explain the 4 key elements of KYC policies.

3 List various services offered to the customers by retail banks. What is KYC? When does it apply? Explain its advantages.

3 What is money laundering? What is money laundering? Discuss the popular activities through which money is laundered.

3 What is an overdraft facility? Analyze the different types of loans provided by banks and explain their significance in the financial system.

3 What is Mortagage? Discuss the process of discounting of bills and explain how it benefits businesses and banks. Provide examples.

3 What is Pledge? What are the different types of loans offered by Banks?

3 What is a supply bill? Evaluate the risks and benefits of using supply bills for financing

3 Distinguish the primary difference between a pledge and a mortgage. Explain financing book debts and supply bills?

3 Define book debts in the context of financing. Differentiate between pledge and mortgage with examples

4 What is Banking Ombudsman Scheme? Explain the powers of Banking Ombudsman.

4 What is COPRA? How COPRA is safeguarding consumer interests in Indian context?

4 What is the objective of COPRA? Differentiate between Consumer Protection Act 1986 and Consumer Protection Act 2019.

4 Define the term “Paying Banker”. Explain the process a paying banker follows to ensure the validity of a cheque before making a payment.

4 What is the primary duty of a collecting banker? Analyze the role of a collecting banker in the context of customer-agent relationships.

4 Defie the term "Collecting Banker" Evaluate the importance of confidentiality in the duties of a paying banker.

4 What is an endorsement under the Negotiable Instrument Act? What is cheques bounce? What are the impliations of cheque bounce?

4 Define a forged instrument as per the Negotiable Instrument Act. Discuss the legal consequences for a bank in handling forged instruments under the Negotiable Instruments Act 1881.

4 What is the legal implication of cheque bouncing under the Negotiable Instruments

What areAct?

the consequences of cheque bounce?

4 What is savings account? What are the different operational aspects of opening and maintaining various types of account holders?

4 Who is called as nominee? What are the ancillary services provided by the Banks?

4 What is joint account? Explain the opening and maintaing different account types in Banks.

5 Explain any three advantages of LAN in Bnaks. How banks can leverage LAN and WAN technologies to improve operations efficiency of the banks?

5 Explain the use of WAN in banks. Evaluate the challenges faced by the banks in implementing effective data warehousing and data mining solutions.

5 What is the purpose of data warehousing in banking? Discuss the security challenges associated with LAN and WAN in banking.

5 What is a prepaid payment instrument (PPI)? Discuss the different types of cards issued by banks and explain the roles of card networks in facilitating electronic transactions.

5 What is ATM? Analyze the growth of mobile wallets and prepaid payment instruments (PPI) in the financial sector. How do they differ from traditional banking products?

5 What is SWIFT? Evaluate the benefits and challenges of Internet and mobile banking for both customers and financial institutions.

5 What is e-wallet? What are the different types of cards offered by banks? Explain the features.

5 What is internat banking? What are the diffent types of electronic banking types?

5 What is electronic banking? What are the advantages and disadvantages of different types of cards provided by Banks?

5 Write the Benefits of Electronic Payment Systems. what is the difference between NEFT and RTGS?

5 Write about NPCI. What are the trends in communication networks for fund transfer in banks?

5 What are the drawbacks of Electronic Payment Systems. What are the diffent types communication networks for funds transfer in banks?

You might also like

- HSBC London Corporate Refund Undertaking LetterDocument1 pageHSBC London Corporate Refund Undertaking LetterHelge Sandoy100% (5)

- Interest Rate Lock AgreementDocument2 pagesInterest Rate Lock AgreementSarahi AlvarengaNo ratings yet

- 1.1 R - Old Edition - Dra-HandbookDocument97 pages1.1 R - Old Edition - Dra-HandbookRAJALAKSHMI HARIHARAN100% (1)

- Gap Analysis of Services Offered in Retail BankingDocument92 pagesGap Analysis of Services Offered in Retail Bankingjignay100% (18)

- Question PaperDocument6 pagesQuestion PaperAminul Haque RusselNo ratings yet

- Probable Ques3 &4Document3 pagesProbable Ques3 &4avikumar001No ratings yet

- Credit Operations QuestionDocument2 pagesCredit Operations QuestionSumon AhmedNo ratings yet

- MFI IndexDocument2 pagesMFI Indexaurisha008No ratings yet

- BLP AssignmentDocument2 pagesBLP AssignmentSekar MuruganNo ratings yet

- Banking & Its Operation: Finance SpecialisationDocument4 pagesBanking & Its Operation: Finance SpecialisationManojkumar HegdeNo ratings yet

- FSBI Important QuestioinsDocument6 pagesFSBI Important QuestioinsNagarjuna SunkaraNo ratings yet

- Banking Law Long QuestionsDocument4 pagesBanking Law Long QuestionsDEEPAKNo ratings yet

- Class Xii Money BankingDocument2 pagesClass Xii Money BankingAnujNo ratings yet

- Banking and Financial ServicesDocument3 pagesBanking and Financial Serviceskausarbagwan234No ratings yet

- Banking Important Exam Question and TermsDocument3 pagesBanking Important Exam Question and TermsAnkit JajalNo ratings yet

- SuggestionDocument6 pagesSuggestionMeheraf ShamimNo ratings yet

- Merchant BankingDocument23 pagesMerchant Bankingmukeshdilse100% (1)

- Banking Law Important QuestionDocument2 pagesBanking Law Important QuestionThrishul MaheshNo ratings yet

- Functions of Banks PDFDocument10 pagesFunctions of Banks PDFSumit K SankhlaNo ratings yet

- CHAPTER 1.1 - OVERVIEW OF BANKING - WHAT IS SPECIAL ABOUT BANKS - sv2.0Document22 pagesCHAPTER 1.1 - OVERVIEW OF BANKING - WHAT IS SPECIAL ABOUT BANKS - sv2.0Bích NgọcNo ratings yet

- 17Uco6Mc04 Modern Banking Pratices Question Bank Unit - 1: Introduction To BankingDocument4 pages17Uco6Mc04 Modern Banking Pratices Question Bank Unit - 1: Introduction To BankingSimon JosephNo ratings yet

- Banking Finanacial Services Management Unit I: Two Mark QuestionsDocument21 pagesBanking Finanacial Services Management Unit I: Two Mark QuestionsIndhuja MNo ratings yet

- B01028 - Chapter 1 - An Overview of The Changing Financial Services SectorDocument47 pagesB01028 - Chapter 1 - An Overview of The Changing Financial Services SectorNguyen GodyNo ratings yet

- BRO IMP QPDocument3 pagesBRO IMP QPshashank reddyNo ratings yet

- Merchant Banking 35889Document16 pagesMerchant Banking 35889Manish GargNo ratings yet

- Bank Audit - Opportunities and Concerns: 1) IntroductionDocument14 pagesBank Audit - Opportunities and Concerns: 1) IntroductionSURYA DEEPAK BEHERANo ratings yet

- Questions - Banking LawDocument5 pagesQuestions - Banking LawNitya DaryananiNo ratings yet

- Banking Law and Practice PDFDocument658 pagesBanking Law and Practice PDFshahidNo ratings yet

- important Questions for Banking principles and operationsDocument6 pagesimportant Questions for Banking principles and operationsmuhammedsafwan5622No ratings yet

- Banking Law and Practice-1Document5 pagesBanking Law and Practice-1udaymasssssNo ratings yet

- Dcom208 Banking Theory and Practice PDFDocument251 pagesDcom208 Banking Theory and Practice PDFLakshmanrao NayiniNo ratings yet

- Jaiib Demo NotesDocument16 pagesJaiib Demo Notesaditya_bb_sharmaNo ratings yet

- DescriptiveDocument3 pagesDescriptiveBikram BisaradNo ratings yet

- Banking Law Questions - 024016Document4 pagesBanking Law Questions - 024016Nanditha SwamyNo ratings yet

- 19351sm SFM Finalnew cp8 PDFDocument40 pages19351sm SFM Finalnew cp8 PDFtimirkantaNo ratings yet

- Naan MudhalvanDocument4 pagesNaan Mudhalvanharishguhan92No ratings yet

- Final Study of Internet Banking in IndiaDocument44 pagesFinal Study of Internet Banking in IndiaHemlatas RangoliNo ratings yet

- Functions of BanksDocument10 pagesFunctions of Banksz5bp8jgb2kNo ratings yet

- Main BodyDocument36 pagesMain Bodymd.jewel ranaNo ratings yet

- JAIIB Notes 2023 - PPB - Objective TypeDocument174 pagesJAIIB Notes 2023 - PPB - Objective TypeDevkinandan JharwalNo ratings yet

- Interview PreparationDocument17 pagesInterview PreparationAnmolDhillonNo ratings yet

- Money and Banking2Document2 pagesMoney and Banking2Mohammad Abdullah NabilNo ratings yet

- Unit 1.2Document7 pagesUnit 1.2demoid921No ratings yet

- MFS Previous Years QuestionsDocument6 pagesMFS Previous Years QuestionsNayana BaruahNo ratings yet

- Banking lawDocument4 pagesBanking lawTapan MandalNo ratings yet

- Question Bank For MfsDocument4 pagesQuestion Bank For MfsBALPREET_SVIETNo ratings yet

- Questions With AnswersDocument2 pagesQuestions With AnswersshilpakulliNo ratings yet

- Money Question PDFDocument4 pagesMoney Question PDFgopalNo ratings yet

- A Manual On Non Banking Financial Institutions: 9. Anti Money Laundering StandardsDocument143 pagesA Manual On Non Banking Financial Institutions: 9. Anti Money Laundering StandardsRahul JagwaniNo ratings yet

- Ba 7026 BFSMDocument4 pagesBa 7026 BFSMRamalingam ChandrasekharanNo ratings yet

- Chatper 2 Merchant Banking PPT 1Document23 pagesChatper 2 Merchant Banking PPT 1Madhavi Pulluru100% (1)

- Indian Banking Sector ReportDocument59 pagesIndian Banking Sector Reportraviawade100% (2)

- Important Questions in Banking Insurance.Document3 pagesImportant Questions in Banking Insurance.Chandra sekhar VallepuNo ratings yet

- Bank, CPC and BnssDocument18 pagesBank, CPC and BnssshakthiNo ratings yet

- Frequently Asked Bank Clerical & Po Interview Questionswith AnswersDocument2 pagesFrequently Asked Bank Clerical & Po Interview Questionswith AnswersUdit YadavNo ratings yet

- Project On Merchant BankingDocument66 pagesProject On Merchant BankingNiket DattaniNo ratings yet

- QB 030030610Document41 pagesQB 030030610shamsudeen mahmudNo ratings yet

- Merchant Banking 35889Document19 pagesMerchant Banking 35889nfitnesshubNo ratings yet

- Module 4 Eco Sem 3Document18 pagesModule 4 Eco Sem 3sruthikadug22No ratings yet

- Non-Collateral Personal Loan - Google SearchDocument13 pagesNon-Collateral Personal Loan - Google SearchPolarNo ratings yet

- Finance British English TeacherDocument10 pagesFinance British English TeacherSorana Paleu100% (1)

- Triple Zest LNS - 2023 - 1 - 102Document26 pagesTriple Zest LNS - 2023 - 1 - 102yusehaiNo ratings yet

- Project Spring - Forward FlowDocument64 pagesProject Spring - Forward FlowJasmeet BhatiaNo ratings yet

- AF208 - Revision Package - Test 1 - S1 2021 - SolutionDocument5 pagesAF208 - Revision Package - Test 1 - S1 2021 - SolutionRossie VeremaitoNo ratings yet

- Synonym For BANK-22.01.2020Document28 pagesSynonym For BANK-22.01.2020Shoive AhmedNo ratings yet

- Total: (We Will Overdraw Rs.500 From Bank Account)Document6 pagesTotal: (We Will Overdraw Rs.500 From Bank Account)Daxhing RajaNo ratings yet

- Resolution - Corporation For A Loan02Document2 pagesResolution - Corporation For A Loan02Elrikki Mira NautanNo ratings yet

- Budget ProjectDocument6 pagesBudget Projectapi-703306744No ratings yet

- SME Business Loan - Application FormDocument2 pagesSME Business Loan - Application FormChiqu Lending Corp.No ratings yet

- Fillable - Business Loan Application FormDocument1 pageFillable - Business Loan Application FormMARKOI SHOWNo ratings yet

- Halliburton EFT Vendor Request FormDocument4 pagesHalliburton EFT Vendor Request FormOmariwiris MnDzNo ratings yet

- P ROPOSALDocument14 pagesP ROPOSALabceritreaNo ratings yet

- Hai 01 2024 Housing Affordability Index 2024 03 08Document1 pageHai 01 2024 Housing Affordability Index 2024 03 08api-737532809No ratings yet

- Presentation On MCB BankDocument35 pagesPresentation On MCB BankMuhammad Shakeel Ijaz DhuddiNo ratings yet

- Application Form Account Opening 24011715551501951901Document5 pagesApplication Form Account Opening 24011715551501951901sri.rajaboina1983No ratings yet

- Balance SheetDocument2 pagesBalance SheetUDAYTRSNo ratings yet

- Calculator: Terms & Conditions - Insta Jumbo LoanDocument3 pagesCalculator: Terms & Conditions - Insta Jumbo LoanANUDEEP CommunityNo ratings yet

- Cheque Bill of Exchange Promissary NoteDocument2 pagesCheque Bill of Exchange Promissary NoteNeel NaikNo ratings yet

- FINACCREDocument187 pagesFINACCREKendall JennerNo ratings yet

- Practice Quiz M4 2Document4 pagesPractice Quiz M4 2sadiqpmpNo ratings yet

- (Cpar2016) AP-8008 (Audit of Cash)Document10 pages(Cpar2016) AP-8008 (Audit of Cash)Dawson Dela CruzNo ratings yet

- Recovery FinalDocument22 pagesRecovery FinalHamza AhmedNo ratings yet

- 3.1zabidah IsmailDocument21 pages3.1zabidah IsmailRadhiah ZainuddinNo ratings yet

- FM TVM Practice Questions G5jmfcwesn PDFDocument2 pagesFM TVM Practice Questions G5jmfcwesn PDFValiant MixtapesNo ratings yet

- Demandnotice Faiza Hamid 3263626 136350Document6 pagesDemandnotice Faiza Hamid 3263626 136350Sonu VishalNo ratings yet

- HE Ntegrated Eview: Far Eastern Uni Ersity - ManilaDocument11 pagesHE Ntegrated Eview: Far Eastern Uni Ersity - ManilaChanelNo ratings yet

- Inter Corporate LoansDocument2 pagesInter Corporate LoansnamrataNo ratings yet