0 ratings0% found this document useful (0 votes)

Teleperformance Global Services Private Limited: Payslip For The Month of July 2023

Uploaded by

ayushmishra8765079704Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

Teleperformance Global Services Private Limited: Payslip For The Month of July 2023

Uploaded by

ayushmishra87650797040 ratings0% found this document useful (0 votes)

Original Title

2000000000391408b176914-5608-4cf9-8f34-fbf6572a6b35 (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

Teleperformance Global Services Private Limited: Payslip For The Month of July 2023

Uploaded by

ayushmishra8765079704Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1/ 1

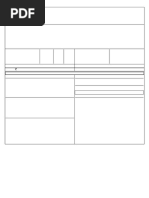

TELEPERFORMANCE GLOBAL SERVICES PRIVATE LIMITED

Intelenet House,Plot CST No 1406-A/28,Mindspace,Malad(West),Mumbai-400090,India

Payslip for the month of July 2023

Employee Code 200000000039140 PF Account Number GNGGN00252970000299936

Employee Name Ayush Mishra Location Gurgaon

Bank Name HDFC BANK LTD Grade Grade I

Payment Mode Bank Transfer Designation Senior Customer Care Executive

Bank Account Number 50100452906101 Days Worked 31

Date of Joining 21 Jul 2022 Previous Monthly LOP 0

Date of Birth 12 Jul 2001 Paid Leave 0

UAN Number 101730215739 LOP 0

Esic Account Number IFSC Code HDFC0000240

Earnings Monthly Rate Current Month Arrears Total Deductions Amount

Basic Salary 17263.00 17263.00 0.00 17263.00 Provident Fund 2,072.00

House Rent Allowance 10358.00 10358.00 0.00 10358.00 LWF Deduction 31.00

FBP Allowance 4692.00 4692.00 0.00 4692.00 Mediclaim 400.00

Advance Statutory Bonus 2212.00 2212.00 0.00 2212.00

Incentive 0.00 1000.00 0.00 1000.00

Gross Earnings 35,525.00 Total Deductions 2,503.00

In words ( ) : Thirty Three Thousand Twenty Two Only Net Salary : 33,022.00

Income Tax Calculation for the financial Year 2023-2024

Particular Cumulative Projected Current Annual Details Of Exemption U/S 10

Basic Salary 50675.00 138104.00 17263.00 206042.00 No Exemption 0

House Rent 30406.00 82864.00 10358.00 123628.00

Allowance

FBP Allowance 13834.00 37536.00 4692.00 56062.00

Advance Statutory 6432.00 17696.00 2212.00 26340.00 Monthly Tax deducted in Salary

Bonus

Month One Time Tax Monthly Tax Total Tax

Over Time 4119.00 0.00 0.00 4119.00

Incentive 6450.00 0.00 1000.00 7450.00 July 52 -52 0

Salary For The Year 423641.00

Gross Salary 423641.00

Gross Taxable Income 423641.00

Less : Standard Deduction 50000.00

Net Taxable Income (Rounded Off) 373650.00

Income Tax Deduction

87A 3683.00

Income Tax Payable 0.00

Surcharge 0.00

Education Cess 0.00

Total Income Tax & Surcharge Payable 0.00

Esop Tax to be Recovered in this Month 0.00

Esop Tax Already Deducted 0.00

Less Tax Deducted at source till current month 0.00

Less Tax Deducted by Previous Employer 0.00

Balance Tax Payable/Refundable 0.00

Average Tax Payable per Month 0.00

You might also like

- 150 Accounting Interview Questions and Answers PDFNo ratings yet150 Accounting Interview Questions and Answers PDF13 pages

- Accounting and Payroll Specialist Study TestNo ratings yetAccounting and Payroll Specialist Study Test1 page

- Teleperformance Global Services Private Limited: Payslip For The Month of January 202267% (3)Teleperformance Global Services Private Limited: Payslip For The Month of January 20221 page

- Payslip For The Month of January 2023: CRM Services India Private LimitedNo ratings yetPayslip For The Month of January 2023: CRM Services India Private Limited1 page

- Payslip 2023 2024 5 200000000029454 IGSLNo ratings yetPayslip 2023 2024 5 200000000029454 IGSL2 pages

- Payslip 2023 2024 5 100000000546055 IGSL PDFNo ratings yetPayslip 2023 2024 5 100000000546055 IGSL PDF1 page

- Teleperformance Global Services Private Limited: Payslip For The Month of December 2021No ratings yetTeleperformance Global Services Private Limited: Payslip For The Month of December 20211 page

- Teleperformance Global Services Private Limited: Payslip For The Month of November 2021100% (2)Teleperformance Global Services Private Limited: Payslip For The Month of November 20211 page

- Payslip 2023 2024 6 200000000029454 IGSLNo ratings yetPayslip 2023 2024 6 200000000029454 IGSL1 page

- payslip-2024-2025-9-100000000751055-TGBPLNo ratings yetpayslip-2024-2025-9-100000000751055-TGBPL1 page

- Payslip 2024 2025 10 300000000129493 TGBPLNo ratings yetPayslip 2024 2025 10 300000000129493 TGBPL1 page

- Teleperformance Global Business Private Limited: Payslip For The Month of March 2024No ratings yetTeleperformance Global Business Private Limited: Payslip For The Month of March 20241 page

- Teleperformance Global Services Private Limited: Payslip For The Month of November 2021No ratings yetTeleperformance Global Services Private Limited: Payslip For The Month of November 20211 page

- Earning For The Month - April 2023: Jubilant Foodworks LTDNo ratings yetEarning For The Month - April 2023: Jubilant Foodworks LTD1 page

- Payslip 2023 2024 5 100000000546055 IGSL PDFNo ratings yetPayslip 2023 2024 5 100000000546055 IGSL PDF1 page

- Payslip 2023 2024 8 100000000701882 IGSLNo ratings yetPayslip 2023 2024 8 100000000701882 IGSL1 page

- payslip-2024-2025-11-kmbl317592-KTKBANKTNo ratings yetpayslip-2024-2025-11-kmbl317592-KTKBANKT1 page

- KS320656a5e6a50-b53b-4da9-9b39-f9cf0b2ba018No ratings yetKS320656a5e6a50-b53b-4da9-9b39-f9cf0b2ba0181 page

- payslip-2024-2025-10-200000000041801-TGBPLNo ratings yetpayslip-2024-2025-10-200000000041801-TGBPL1 page

- KS320659573d711-6bd5-440e-a338-cb0348f54efcNo ratings yetKS320659573d711-6bd5-440e-a338-cb0348f54efc1 page

- KS320652d36de48-53d9-42ad-a930-242a3fdb8679No ratings yetKS320652d36de48-53d9-42ad-a930-242a3fdb86791 page

- Payslip 2020 2021 12 300000000004232 CRMSIPLNo ratings yetPayslip 2020 2021 12 300000000004232 CRMSIPL1 page

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Acc 351 Public Sector Accounting Note1 FinalNo ratings yetAcc 351 Public Sector Accounting Note1 Final67 pages

- Income Tax and Benefit Return For Non-Residents and Deemed Residents of CanadaNo ratings yetIncome Tax and Benefit Return For Non-Residents and Deemed Residents of Canada8 pages

- Fundamentals of Capital Budgeting: From Forecasting Earnings To Project Cash FlowsNo ratings yetFundamentals of Capital Budgeting: From Forecasting Earnings To Project Cash Flows40 pages

- Volume 1 of Direct Tax by CA. Akash SirNo ratings yetVolume 1 of Direct Tax by CA. Akash Sir346 pages

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoNo ratings yetManila Cavite Laguna Cebu Cagayan de Oro Davao8 pages

- Acc 106 - P1 Examination, Pa 1: Your Email Will Be Recorded When You Submit This FormNo ratings yetAcc 106 - P1 Examination, Pa 1: Your Email Will Be Recorded When You Submit This Form18 pages

- Copy of Unit 3 Cornell Notes budet,taxes & Id Theft (KEY).docxNo ratings yetCopy of Unit 3 Cornell Notes budet,taxes & Id Theft (KEY).docx5 pages

- MCQ Bank - Presentation of Published Financial StatementsNo ratings yetMCQ Bank - Presentation of Published Financial Statements19 pages

- Grade 11 Provincial Examination Accounting P2 (English) November 2021 Question PaperNo ratings yetGrade 11 Provincial Examination Accounting P2 (English) November 2021 Question Paper12 pages

- Estimation of Project Cash Flows: RequiredNo ratings yetEstimation of Project Cash Flows: Required4 pages

- SK MC - ANNEX D Sample Register of Cash in Bank RCB and Other Related Financial Transactions SKFPD Policy Template100% (2)SK MC - ANNEX D Sample Register of Cash in Bank RCB and Other Related Financial Transactions SKFPD Policy Template2 pages