Bi 9824rkaw

Bi 9824rkaw

Uploaded by

poojavarsha798Copyright:

Available Formats

Bi 9824rkaw

Bi 9824rkaw

Uploaded by

poojavarsha798Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Bi 9824rkaw

Bi 9824rkaw

Uploaded by

poojavarsha798Copyright:

Available Formats

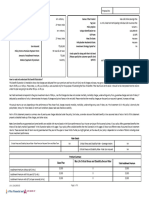

BENEFIT ILLUSTRATION

[Date and Time of Illustration – 30 August 2023, 10:04 AM]

Proposal No:

Name of the Prospect/Policyholder: Mr. Yamanappa Name of the Product: Max Life Flexi Wealth Plus

Tag Line: A Unit-Linked Non-Participating Individual Life Insurance Plan

Age & Gender: 29 Years, Male

Policy Option: NA

Name of the Life Assured: Mr. Yamanappa Unique Identification No: 104L115V02

GST Rate (Base Policy, First Year): 18.00%

GST Rate (Base Policy, Subsequent Year): 18.00%

GST Rate (Rider, First Year): NA

Age & Gender: 29 Years, Male

GST Rate (Rider, Subsequent Year): NA

Max Life State: Haryana

Policyholder Residential State: Haryana

Sum Assured: `1,00,00,000 Investment Strategy Opted for: Self Managed Portfolio Strategy

Policy Term & Premium Payment Term: 36 Years & 36 Years

Funds opted for along with their risk level

Amount of Installment Premium: `3,458 [Please specify the customer specific fund

Mode of payment of premium: Monthly option):

High Growth Fund (Risk Rating-Very High) : 100%

How to read and understand this benefit illustration?

This benefit illustration is intended to show what charges are deducted from your premiums and how the unit fund, net of charges and taxes, may grow over the years of the policy term if the fund earns a gross

return of 8% p.a. or 4% p.a. These rates, i.e., 8% p.a. and 4% p.a. are assumed only for the purpose of illustrating the flow of benefits if the returns are at this level. It should not be interpreted that the returns

under the plan are going to be either 8% p.a. or 4% p.a.

Net Yield mentioned corresponds to the gross investment return of 8% p.a., net of all charges but does not consider mortality, morbidity charges, underwriting extra, if any, guarantee charges and cost of riders, if

deducted by cancellation of units. It demonstrates the impact of charges exclusive of taxes on the net yield. Please note that the mortality charges per thousand sum assured in general, increases with age.

The actual returns can vary depending on the performance of the chosen fund, charges towards mortality, morbidity, underwriting extra, cost of riders, etc. The investment risk in this policy is borne by the

policyholder, hence, for more details on terms and conditions please read sales literature carefully.

Part A of this statement presents a summary view of year-by-year charges deducted under the policy, fund value, surrender value and the death benefit, at two assumed rates of return. Part B of this statement

presents a detailed break-up of the charges, and other values.

Note: Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your insurer carrying on life insurance business. If your policy offers guaranteed benefits then

these will be clearly marked “guaranteed” in the illustration table on this page. If your policy offers variable benefits then the illustration on this page will show two different rates of assumed future investment

returns. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including actual

future investment performance.

Rider Details

Critical Illness and Disability-Secure Rider - Rider Premium Critical Illness and Disability-Secure Rider - Coverage Variant NA

NA

Payment Term and Rider Term Critical Illness and Disability-Secure Rider - Rider Sum Assured NA

Premium Summary

Base Plan Max Life Critical Illness and Disability-Secure Rider Total Installment Premium

Installment Premium without GST (in Rs.) 3,458 0 3,458

Installment Premium with first year GST (in Rs.) 3,458 0 3,458

Installment Premium with GST 2nd year onwards (in Rs.) 3,458 0 3,458

UIN: 104L115V02 Page 1 of 7

Part A

(Amount in Rupees.)

At 4% p.a. Gross Investment Return At 8% p.a. Gross Investment Return

Commission

Policy Annualized

payable to

Year Premium Mortality, Morbidity Fund at End Surrender Mortality, Fund at End Surrender

Other Charges* GST Death Benefit Other Charges* GST Death Benefit intermediary

Charges of Year Value Morbidity Charges of Year Value

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

1 41,494 8,586 3,278 2,136 28,088 24,548 1,00,00,000 8,586 3,281 2,136 28,672 25,132 1,00,00,000 -

2 41,494 8,761 3,253 2,162 57,121 54,761 1,00,00,000 8,760 3,271 2,165 59,440 57,080 1,00,00,000 -

3 41,494 8,933 3,447 2,229 86,875 85,105 1,00,00,000 8,930 3,495 2,237 92,187 90,417 1,00,00,000 -

4 41,494 9,302 3,650 2,332 1,17,130 1,15,950 1,00,00,000 9,296 3,746 2,347 1,26,799 1,25,619 1,00,00,000 -

5 41,494 9,668 4,068 2,473 1,47,653 1,47,653 1,00,00,000 9,656 4,228 2,499 1,63,147 1,63,147 1,00,00,000 -

6 41,494 10,130 4,489 2,632 1,78,334 1,78,334 1,00,00,000 10,111 4,733 2,672 2,01,225 2,01,225 1,00,00,000 -

7 41,494 10,589 4,915 2,791 2,09,177 2,09,177 1,00,00,000 10,560 5,263 2,848 2,41,149 2,41,149 1,00,00,000 -

8 41,494 11,240 5,343 2,985 2,39,956 2,39,956 1,00,00,000 11,197 5,817 3,063 2,82,804 2,82,804 1,00,00,000 -

9 41,494 11,886 5,772 3,178 2,70,671 2,70,671 1,00,00,000 11,827 6,396 3,280 3,26,309 3,26,309 1,00,00,000 -

10 41,494 12,723 6,200 3,406 3,01,090 3,01,090 1,00,00,000 12,641 7,000 3,535 3,71,554 3,71,554 1,00,00,000 -

11 41,494 13,552 4,016 3,162 3,34,361 3,34,361 1,00,00,000 13,443 5,017 3,323 4,21,877 4,21,877 1,00,00,000 -

12 41,494 14,567 4,432 3,420 3,67,239 3,67,239 1,00,00,000 14,422 5,664 3,615 4,74,231 4,74,231 1,00,00,000 -

13 41,494 15,672 4,843 3,693 3,99,609 3,99,609 1,00,00,000 15,481 6,337 3,927 5,28,647 5,28,647 1,00,00,000 -

14 41,494 16,961 5,245 3,997 4,31,235 4,31,235 1,00,00,000 16,713 7,035 4,275 5,85,046 5,85,046 1,00,00,000 -

15 41,494 18,434 5,636 4,333 4,61,881 4,61,881 1,00,00,000 18,113 7,758 4,657 6,43,351 6,43,351 1,00,00,000 -

16 41,494 20,090 6,014 4,699 4,91,302 4,91,302 1,00,00,000 19,678 8,504 5,073 7,03,483 7,03,483 1,00,00,000 -

17 41,494 22,023 6,373 5,111 5,19,139 5,19,139 1,00,00,000 21,495 9,272 5,538 7,65,250 7,65,250 1,00,00,000 -

18 41,494 24,327 6,710 5,587 5,44,908 5,44,908 1,00,00,000 23,651 10,059 6,068 8,28,344 8,28,344 1,00,00,000 -

19 41,494 26,907 7,017 6,106 5,68,227 5,68,227 1,00,00,000 26,046 10,860 6,643 8,92,557 8,92,557 1,00,00,000 -

20 41,494 29,953 7,290 6,704 5,88,480 5,88,480 1,00,00,000 28,857 11,673 7,295 9,57,455 9,57,455 1,00,00,000 -

21 41,494 33,466 7,520 7,377 6,05,032 6,05,032 1,00,00,000 32,074 12,492 8,022 10,22,585 10,22,585 1,00,00,000 -

UIN: 104L115V02 Page 2 of 7

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

22 41,494 37,450 7,699 8,127 6,17,228 6,17,228 1,00,00,000 35,689 13,310 8,820 10,87,477 10,87,477 1,00,00,000 -

23 41,494 41,911 7,818 8,951 6,24,392 6,24,392 1,00,00,000 39,694 14,122 9,687 11,51,640 11,51,640 1,00,00,000 -

24 41,494 46,858 7,869 9,851 6,25,817 6,25,817 1,00,00,000 44,082 14,921 10,621 12,14,557 12,14,557 1,00,00,000 -

25 41,494 52,113 7,845 10,793 6,20,993 6,20,993 1,00,00,000 48,673 15,702 11,588 12,75,903 12,75,903 1,00,00,000 -

26 41,494 57,692 7,738 11,777 6,09,380 6,09,380 1,00,00,000 53,467 16,462 12,587 13,35,329 13,35,329 1,00,00,000 -

27 41,494 63,515 7,543 12,790 5,90,518 5,90,518 1,00,00,000 58,375 17,195 13,603 13,92,573 13,92,573 1,00,00,000 -

28 41,494 69,600 7,253 13,834 5,63,914 5,63,914 1,00,00,000 63,400 17,899 14,634 14,47,352 14,47,352 1,00,00,000 -

29 41,494 75,871 6,863 14,892 5,29,156 5,29,156 1,00,00,000 68,461 18,570 15,666 14,99,464 14,99,464 1,00,00,000 -

30 41,494 82,444 6,366 15,986 4,85,682 4,85,682 1,00,00,000 73,647 19,206 16,713 15,48,587 15,48,587 1,00,00,000 -

31 41,494 89,150 5,757 17,083 4,33,116 4,33,116 1,00,00,000 78,794 19,803 17,747 15,94,574 15,94,574 1,00,00,000 -

32 41,494 96,399 5,028 18,257 3,70,586 3,70,586 1,00,00,000 84,248 20,357 18,829 16,36,852 16,36,852 1,00,00,000 -

33 41,494 1,04,030 4,169 19,476 2,97,388 2,97,388 1,00,00,000 89,848 20,861 19,928 16,75,004 16,75,004 1,00,00,000 -

34 41,494 1,12,473 3,167 20,815 2,12,290 2,12,290 1,00,00,000 95,941 21,308 21,105 17,08,165 17,08,165 1,00,00,000 -

35 41,494 1,21,781 2,006 22,282 1,13,962 1,13,962 1,00,00,000 1,02,541 21,685 22,361 17,35,395 17,35,395 1,00,00,000 -

36 41,494 1,32,223 667 23,920 15,22,004 15,22,004 1,00,00,000 1,09,835 21,980 23,727 31,33,698 31,33,698 1,00,00,000 -

*Other Charges includes all charges except Mortality, Morbidity Charges on the policy. See Part B for details

IN THIS POLICY, THE INVESTMENT RISK IS BORNE BY THE POLICYHOLDER AND THE ABOVE INTEREST RATES ARE ONLY FOR ILLUSTRATIVE PURPOSE.

I, ……………………………………………. (name), have explained the premiums, charges and I, Yamanappa (name), having received the information with respect to the above, have

benefits under the policy fully to the prospect / policyholder. understood the above statement before entering into the contract.

Place:

Date: 8/30/23 Signature / OTP Confirmation Date / Thumb Impression / Date:8/30/23 Signature / OTP Confirmation Date / Thumb Impression /

Electronic Signature of Agent/ Intermediary / Official Electronic Signature of Prospect/ Policyholder

This system generated benefit illustration shall be treated as signed by me.

UIN: 104L115V02 Page 3 of 7

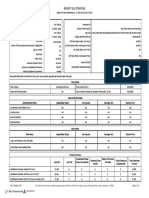

Part B Gross Yield 8% p.a. Net Yield 6.50% Amount in Rupees

Premium Annualized Premium - Policy

Policy Annualized Mortality Guarantee Other Additions to the Fund before Fund at End of Surrender Death

Allocation Premium Allocation GST Admin. FMC

Year Premium (AP) Charge Charge Charges* fund* FMC the Year Value Benefit

Charge (PAC) Charges - GST on PAC Charge

1 41,494 2,490 38,556 8,586 2,136 598 - - - 28,708 194 28,672 25,132 1,00,00,000

2 41,494 2,075 39,046 8,760 2,165 627 - - - 59,514 569 59,440 57,080 1,00,00,000

3 41,494 1,867 39,290 8,930 2,237 659 - - - 92,301 969 92,187 90,417 1,00,00,000

4 41,494 1,660 39,535 9,296 2,347 692 - - - 1,26,956 1,394 1,26,799 1,25,619 1,00,00,000

5 41,494 1,660 39,535 9,656 2,499 726 - - - 1,63,348 1,842 1,63,147 1,63,147 1,00,00,000

6 41,494 1,660 39,535 10,111 2,672 763 - - - 2,01,474 2,311 2,01,225 2,01,225 1,00,00,000

7 41,494 1,660 39,535 10,560 2,848 801 - - - 2,41,447 2,803 2,41,149 2,41,149 1,00,00,000

8 41,494 1,660 39,535 11,197 3,063 841 - - - 2,83,154 3,317 2,82,804 2,82,804 1,00,00,000

9 41,494 1,660 39,535 11,827 3,280 883 - - - 3,26,713 3,854 3,26,309 3,26,309 1,00,00,000

10 41,494 1,660 39,535 12,641 3,535 927 - - - 3,72,014 4,413 3,71,554 3,71,554 1,00,00,000

11 41,494 - 41,494 13,443 3,323 - - - - 4,22,400 5,017 4,21,877 4,21,877 1,00,00,000

12 41,494 - 41,494 14,422 3,615 - - - - 4,74,818 5,664 4,74,231 4,74,231 1,00,00,000

13 41,494 - 41,494 15,481 3,927 - - - - 5,29,301 6,337 5,28,647 5,28,647 1,00,00,000

14 41,494 - 41,494 16,713 4,275 - - - - 5,85,771 7,035 5,85,046 5,85,046 1,00,00,000

15 41,494 - 41,494 18,113 4,657 - - - - 6,44,148 7,758 6,43,351 6,43,351 1,00,00,000

16 41,494 - 41,494 19,678 5,073 - - - - 7,04,354 8,504 7,03,483 7,03,483 1,00,00,000

17 41,494 - 41,494 21,495 5,538 - - - - 7,66,197 9,272 7,65,250 7,65,250 1,00,00,000

18 41,494 - 41,494 23,651 6,068 - - - - 8,29,369 10,059 8,28,344 8,28,344 1,00,00,000

19 41,494 - 41,494 26,046 6,643 - - - - 8,93,662 10,860 8,92,557 8,92,557 1,00,00,000

20 41,494 - 41,494 28,857 7,295 - - - - 9,58,640 11,673 9,57,455 9,57,455 1,00,00,000

21 41,494 - 41,494 32,074 8,022 - - - - 10,23,851 12,492 10,22,585 10,22,585 1,00,00,000

22 41,494 - 41,494 35,689 8,820 - - - - 10,88,823 13,310 10,87,477 10,87,477 1,00,00,000

UIN: 104L115V02 Page 4 of 7

Premium Annualized Premium - Policy

Policy Annualized Mortality Guarantee Other Additions to the Fund before Fund at End of Surrender Death

Allocation Premium Allocation GST Admin. FMC

Year Premium (AP) Charge Charge Charges* fund* FMC the Year Value Benefit

Charge (PAC) Charges - GST on PAC Charge

23 41,494 - 41,494 39,694 9,687 - - - - 11,53,065 14,122 11,51,640 11,51,640 1,00,00,000

24 41,494 - 41,494 44,082 10,621 - - - - 12,16,061 14,921 12,14,557 12,14,557 1,00,00,000

25 41,494 - 41,494 48,673 11,588 - - - - 12,77,482 15,702 12,75,903 12,75,903 1,00,00,000

26 41,494 - 41,494 53,467 12,587 - - - - 13,36,982 16,462 13,35,329 13,35,329 1,00,00,000

27 41,494 - 41,494 58,375 13,603 - - - - 13,94,297 17,195 13,92,573 13,92,573 1,00,00,000

28 41,494 - 41,494 63,400 14,634 - - - - 14,49,143 17,899 14,47,352 14,47,352 1,00,00,000

29 41,494 - 41,494 68,461 15,666 - - - - 15,01,320 18,570 14,99,464 14,99,464 1,00,00,000

30 41,494 - 41,494 73,647 16,713 - - - - 15,50,503 19,206 15,48,587 15,48,587 1,00,00,000

31 41,494 - 41,494 78,794 17,747 - - - - 15,96,548 19,803 15,94,574 15,94,574 1,00,00,000

32 41,494 - 41,494 84,248 18,829 - - - - 16,38,878 20,357 16,36,852 16,36,852 1,00,00,000

33 41,494 - 41,494 89,848 19,928 - - - - 16,77,077 20,861 16,75,004 16,75,004 1,00,00,000

34 41,494 - 41,494 95,941 21,105 - - - - 17,10,279 21,308 17,08,165 17,08,165 1,00,00,000

35 41,494 - 41,494 1,02,541 22,361 - - - - 17,37,543 21,685 17,35,395 17,35,395 1,00,00,000

36 41,494 - 41,494 1,09,835 23,727 - - - 13,78,231 17,57,641 21,980 31,33,698 31,33,698 1,00,00,000

Gross Yield 4% p.a. Amount in Rupees

Premium Annualized Premium - Policy

Policy Annualized Mortality Guarantee Other Additions to the Fund before Fund at End of Surrender Death

Allocation Premium Allocation GST Admin. FMC

Year Premium (AP) Charge Charge Charges* fund* FMC the Year Value Benefit

Charge (PAC) Charges - GST on PAC Charge

1 41,494 2,490 38,556 8,586 2,136 598 - - - 28,123 191 28,088 24,548 1,00,00,000

2 41,494 2,075 39,046 8,761 2,162 627 - - - 57,192 551 57,121 54,761 1,00,00,000

3 41,494 1,867 39,290 8,933 2,229 659 - - - 86,982 921 86,875 85,105 1,00,00,000

4 41,494 1,660 39,535 9,302 2,332 692 - - - 1,17,275 1,299 1,17,130 1,15,950 1,00,00,000

5 41,494 1,660 39,535 9,668 2,473 726 - - - 1,47,836 1,682 1,47,653 1,47,653 1,00,00,000

6 41,494 1,660 39,535 10,130 2,632 763 - - - 1,78,554 2,067 1,78,334 1,78,334 1,00,00,000

UIN: 104L115V02 Page 5 of 7

Premium Annualized Premium - Policy

Policy Annualized Mortality Guarantee Other Additions to the Fund before Fund at End of Surrender Death

Allocation Premium Allocation GST Admin. FMC

Year Premium (AP) Charge Charge Charges* fund* FMC the Year Value Benefit

Charge (PAC) Charges - GST on PAC Charge

7 41,494 1,660 39,535 10,589 2,791 801 - - - 2,09,436 2,454 2,09,177 2,09,177 1,00,00,000

8 41,494 1,660 39,535 11,240 2,985 841 - - - 2,40,253 2,842 2,39,956 2,39,956 1,00,00,000

9 41,494 1,660 39,535 11,886 3,178 883 - - - 2,71,006 3,229 2,70,671 2,70,671 1,00,00,000

10 41,494 1,660 39,535 12,723 3,406 927 - - - 3,01,462 3,614 3,01,090 3,01,090 1,00,00,000

11 41,494 - 41,494 13,552 3,162 - - - - 3,34,775 4,016 3,34,361 3,34,361 1,00,00,000

12 41,494 - 41,494 14,567 3,420 - - - - 3,67,694 4,432 3,67,239 3,67,239 1,00,00,000

13 41,494 - 41,494 15,672 3,693 - - - - 4,00,103 4,843 3,99,609 3,99,609 1,00,00,000

14 41,494 - 41,494 16,961 3,997 - - - - 4,31,769 5,245 4,31,235 4,31,235 1,00,00,000

15 41,494 - 41,494 18,434 4,333 - - - - 4,62,452 5,636 4,61,881 4,61,881 1,00,00,000

16 41,494 - 41,494 20,090 4,699 - - - - 4,91,910 6,014 4,91,302 4,91,302 1,00,00,000

17 41,494 - 41,494 22,023 5,111 - - - - 5,19,782 6,373 5,19,139 5,19,139 1,00,00,000

18 41,494 - 41,494 24,327 5,587 - - - - 5,45,582 6,710 5,44,908 5,44,908 1,00,00,000

19 41,494 - 41,494 26,907 6,106 - - - - 5,68,930 7,017 5,68,227 5,68,227 1,00,00,000

20 41,494 - 41,494 29,953 6,704 - - - - 5,89,208 7,290 5,88,480 5,88,480 1,00,00,000

21 41,494 - 41,494 33,466 7,377 - - - - 6,05,781 7,520 6,05,032 6,05,032 1,00,00,000

22 41,494 - 41,494 37,450 8,127 - - - - 6,17,992 7,699 6,17,228 6,17,228 1,00,00,000

23 41,494 - 41,494 41,911 8,951 - - - - 6,25,164 7,818 6,24,392 6,24,392 1,00,00,000

24 41,494 - 41,494 46,858 9,851 - - - - 6,26,592 7,869 6,25,817 6,25,817 1,00,00,000

25 41,494 - 41,494 52,113 10,793 - - - - 6,21,762 7,845 6,20,993 6,20,993 1,00,00,000

26 41,494 - 41,494 57,692 11,777 - - - - 6,10,134 7,738 6,09,380 6,09,380 1,00,00,000

27 41,494 - 41,494 63,515 12,790 - - - - 5,91,249 7,543 5,90,518 5,90,518 1,00,00,000

28 41,494 - 41,494 69,600 13,834 - - - - 5,64,612 7,253 5,63,914 5,63,914 1,00,00,000

29 41,494 - 41,494 75,871 14,892 - - - - 5,29,811 6,863 5,29,156 5,29,156 1,00,00,000

UIN: 104L115V02 Page 6 of 7

Premium Annualized Premium - Policy

Policy Annualized Mortality Guarantee Other Additions to the Fund before Fund at End of Surrender Death

Allocation Premium Allocation GST Admin. FMC

Year Premium (AP) Charge Charge Charges* fund* FMC the Year Value Benefit

Charge (PAC) Charges - GST on PAC Charge

30 41,494 - 41,494 82,444 15,986 - - - - 4,86,283 6,366 4,85,682 4,85,682 1,00,00,000

31 41,494 - 41,494 89,150 17,083 - - - - 4,33,652 5,757 4,33,116 4,33,116 1,00,00,000

32 41,494 - 41,494 96,399 18,257 - - - - 3,71,045 5,028 3,70,586 3,70,586 1,00,00,000

33 41,494 - 41,494 1,04,030 19,476 - - - - 2,97,756 4,169 2,97,388 2,97,388 1,00,00,000

34 41,494 - 41,494 1,12,473 20,815 - - - - 2,12,553 3,167 2,12,290 2,12,290 1,00,00,000

35 41,494 - 41,494 1,21,781 22,282 - - - - 1,14,103 2,006 1,13,962 1,13,962 1,00,00,000

36 41,494 - 41,494 1,32,223 23,920 - - - 15,21,281 725 667 15,22,004 15,22,004 1,00,00,000

*There are no charges included in other charges. Guaranteed Loyalty Additions and Wealth Boosters declared as per the product terms and conditions are included on Additions to the fund.

Notes: 1. Refer the sales literature for explanation of terms used in this illustration.

2. Fund management charge is based on the specific fund option(s) chosen.

3. In case rider charges are collected explicitly through collection of rider premium, and not by way of cancellation of units, then, such charges are not considered in this illustration. In other cases, rider charges are included in

other charges.

I, ……………………………………………. (name), have explained the premiums, charges and I, Yamanappa (name), having received the information with respect to the above, have

benefits under the policy fully to the prospect / policyholder. understood the above statement before entering into the contract.

Place:

Date: 8/30/23 Signature / OTP Confirmation Date / Thumb Impression / Date:8/30/23 Signature / OTP Confirmation Date / Thumb Impression /

Electronic Signature of Agent/ Intermediary / Official Electronic Signature of Prospect/ Policyholder

This system generated benefit illustration shall be treated as signed by me.

UIN: 104L115V02 Page 7 of 7

You might also like

- ICWIM - V5a - Sample Paper Final 1rDocument39 pagesICWIM - V5a - Sample Paper Final 1rAnnabella Petro100% (1)

- DRM SlidesDocument376 pagesDRM Slidesrohit BindNo ratings yet

- Bi 0655kgueDocument9 pagesBi 0655kguevanselimNo ratings yet

- UIN: 104L115V01 Page 1 of 6Document6 pagesUIN: 104L115V01 Page 1 of 6Gobinda SinhaNo ratings yet

- Bi 4299eekbDocument4 pagesBi 4299eekbchigiliseenaNo ratings yet

- Max Life BIDocument8 pagesMax Life BIcambrittvNo ratings yet

- Child Max UlipDocument6 pagesChild Max Ulipjagdevwasson761No ratings yet

- Bi 9351xmteDocument7 pagesBi 9351xmtetoptrendingtoday30No ratings yet

- illustration-7Document4 pagesillustration-7shubhendraagarwal8No ratings yet

- Bi 4258jcbuDocument5 pagesBi 4258jcburayees khanNo ratings yet

- Max Life UlipDocument4 pagesMax Life Ulipjagdevwasson761No ratings yet

- Benefit Illustration: UIN: 104N118V05 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N118V05 Page 1 of 3Mahesh GediyaNo ratings yet

- Bi 9434larkDocument8 pagesBi 9434larkharshsirohi1123No ratings yet

- Benefit Illustration: UIN: 104N118V03 Page 1 of 3Document5 pagesBenefit Illustration: UIN: 104N118V03 Page 1 of 3santoshinamdargosaviNo ratings yet

- Benefit Illustration: UIN: 104N135V01 Page 1 of 3Document5 pagesBenefit Illustration: UIN: 104N135V01 Page 1 of 3dinesh14salemNo ratings yet

- 14d3a6f2-36f2-495e-bc68-4b8407ba9c42_max_life_termDocument3 pages14d3a6f2-36f2-495e-bc68-4b8407ba9c42_max_life_termyerrisiddappa KNo ratings yet

- Max Life TermDocument3 pagesMax Life Termchandansharma81305636No ratings yet

- Bi 5774vgsaDocument3 pagesBi 5774vgsaMahesh GediyaNo ratings yet

- 2c04fa23-fa2a-45be-9452-37574ef96005_max_life_termDocument3 pages2c04fa23-fa2a-45be-9452-37574ef96005_max_life_termyerrisiddappa KNo ratings yet

- Benefit IllustrationDocument4 pagesBenefit Illustrationking.dusty3No ratings yet

- Bi PDFDocument3 pagesBi PDFSubham PradhanNo ratings yet

- Benefit Illustration: UIN: 104N118V02 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N118V02 Page 1 of 3Bhim Worf ShankarNo ratings yet

- Benefit Illustration: UIN: 104N135V01 Page 1 of 3Document5 pagesBenefit Illustration: UIN: 104N135V01 Page 1 of 3palashmondal0010No ratings yet

- Bi 1102mgxjDocument12 pagesBi 1102mgxjvasu1996ammaNo ratings yet

- Bi 7313vviwDocument3 pagesBi 7313vviwMahesh GediyaNo ratings yet

- Bi 3677lrfoDocument3 pagesBi 3677lrfosushanta nayakNo ratings yet

- SWP Benefit IllustrationDocument3 pagesSWP Benefit Illustrationax3559677No ratings yet

- swp_benefit_illustrationDocument3 pagesswp_benefit_illustrationer.sk323No ratings yet

- BIDocumentDocument3 pagesBIDocumentPRATEEK DEV SinghNo ratings yet

- Business IllustrationDocument5 pagesBusiness Illustrationjaikaranrautela2No ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionvipin jainNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 2vipinpvNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionamarjeet456No ratings yet

- Benefit Illustration: UIN: 104N120V02 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N120V02 Page 1 of 4Karthik GopalanNo ratings yet

- SWP Benefit IllustrationDocument3 pagesSWP Benefit Illustrationrathore.manish05No ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 2Document4 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 2Onn InternationalNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3GurjitNo ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 2Gurkirt SinghNo ratings yet

- Benefit Illustration: UIN: 104N116V11 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V11 Page 1 of 3Abhimanyu Singh BhatiNo ratings yet

- Benefit Illustration: UIN: 104N116V11 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V11 Page 1 of 2sudithakur2023No ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 3Document5 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 3Revathy SanthanakrishnanNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionAlok .kNo ratings yet

- Benefit Illustration: UIN: 104N118V02 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N118V02 Page 1 of 4Charan ManchikatlaNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument4 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionkundan9200No ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3NagarjunaNo ratings yet

- Illustration - 2022-02-16T110618.998Document3 pagesIllustration - 2022-02-16T110618.998mosarafNo ratings yet

- Business IllustrationDocument6 pagesBusiness Illustrationguchaits24No ratings yet

- Business IllustrationDocument7 pagesBusiness IllustrationLieke MartensNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument4 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionrishitrivedi2176No ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3Bimal DeyNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionKarthik GopalanNo ratings yet

- IllustrationDocument6 pagesIllustrationjbarmeda3113No ratings yet

- Max APE 1 Lac PPT 10 Years PT 25 YearsDocument3 pagesMax APE 1 Lac PPT 10 Years PT 25 YearsSumitt SinghNo ratings yet

- UIN: 104L098V03 Page 1 of 4Document4 pagesUIN: 104L098V03 Page 1 of 4sajeet sahNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Lakhwinder RaundNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionLalit AhirwarNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 2vivek0955158No ratings yet

- IndiaFirst Life Smart Pay PlanDocument9 pagesIndiaFirst Life Smart Pay PlanVartika TripathiNo ratings yet

- Ankit Early Wealth Insurance PLANDocument4 pagesAnkit Early Wealth Insurance PLANLalit AhirwarNo ratings yet

- Priya Singh (Early Wealth)Document3 pagesPriya Singh (Early Wealth)Lalit AhirwarNo ratings yet

- Benefit IllustrationDocument4 pagesBenefit IllustrationAbhilash KumarNo ratings yet

- Captive Programs Overview FlyerDocument2 pagesCaptive Programs Overview FlyerChristina TrigoNo ratings yet

- HDFC Life Insurance PDFDocument56 pagesHDFC Life Insurance PDFMohammed Fazlullah100% (1)

- Define The Types of Annuities Overdue, Early, Differed, Undefined, Perpetual, General.Document19 pagesDefine The Types of Annuities Overdue, Early, Differed, Undefined, Perpetual, General.Fernando CooperNo ratings yet

- Rudy Wong Investment AdvisorDocument21 pagesRudy Wong Investment AdvisorAzlina Zaine100% (2)

- Pricing - Health Insurance Products: Anuradha Sriram - Anshul Mittal - Ankit KediaDocument31 pagesPricing - Health Insurance Products: Anuradha Sriram - Anshul Mittal - Ankit KediaRonit RayNo ratings yet

- BG Tracker (V1)Document1 pageBG Tracker (V1)Sabneesh ChaveriyaNo ratings yet

- Rohan Sip DocumentDocument67 pagesRohan Sip Documentrpalsingh31No ratings yet

- Harvardian College vs. Country BankersDocument1 pageHarvardian College vs. Country BankersChaNo ratings yet

- Study of Fluctuations in Stock MarketDocument34 pagesStudy of Fluctuations in Stock MarketHeena GuptaNo ratings yet

- Estrada On Downside RiskDocument12 pagesEstrada On Downside RiskArt DesaiNo ratings yet

- Marginal Cost of CapitalDocument26 pagesMarginal Cost of CapitalSaeedNo ratings yet

- CH 2 - T.BDocument25 pagesCH 2 - T.BSAMOIERNo ratings yet

- HDFC Life InsuranceDocument2 pagesHDFC Life Insuranceestrade1112No ratings yet

- Product Summary:: Jeevan Shree-IDocument4 pagesProduct Summary:: Jeevan Shree-IPinakin PatelNo ratings yet

- Var Vs Expected Shortfall (Why VaR Is Not Subadditive, But ES Is) - HullDocument4 pagesVar Vs Expected Shortfall (Why VaR Is Not Subadditive, But ES Is) - HullKaushik NathNo ratings yet

- 07-12-2022 Premium BreakupDocument1 page07-12-2022 Premium BreakupRakesh VermaNo ratings yet

- IRDA and Its Powers and FunctionsDocument3 pagesIRDA and Its Powers and FunctionsSonu AnandNo ratings yet

- Jewellery InsuranceDocument73 pagesJewellery InsuranceSachin Gupta100% (1)

- 595unit 5 Insurance IntermediariesDocument28 pages595unit 5 Insurance IntermediariesBajra VinayaNo ratings yet

- Foreign Exchange Risk - Overview, Types, ExamplesDocument7 pagesForeign Exchange Risk - Overview, Types, Examplesvinaykn53No ratings yet

- Big Inners 2Document17 pagesBig Inners 2Abdullah Al-GhazwaniNo ratings yet

- 73300bos58129 Final P2aDocument14 pages73300bos58129 Final P2aPrasanni RaoNo ratings yet

- Agriculture Insurance New FinalDocument41 pagesAgriculture Insurance New Finalrajthakur04No ratings yet

- BIMA SchoolDocument29 pagesBIMA SchoolsppkathaiNo ratings yet

- Lic Question AnswerDocument8 pagesLic Question AnswergoutamxosNo ratings yet

- Trading Basics Part 4 - Managing Risk and Creating An Exit Strategy - FidelityDocument21 pagesTrading Basics Part 4 - Managing Risk and Creating An Exit Strategy - FidelitycmkkaranNo ratings yet

- Marine InsuranceDocument16 pagesMarine Insurancesxy_sadiNo ratings yet

- My ProjectDocument30 pagesMy ProjectPriyanka satamNo ratings yet