FINAL NOTES _2024_PRINCIPLES OF BUSINESS ADMINISTRATION-2

FINAL NOTES _2024_PRINCIPLES OF BUSINESS ADMINISTRATION-2

Uploaded by

nakkazi115Copyright:

Available Formats

FINAL NOTES _2024_PRINCIPLES OF BUSINESS ADMINISTRATION-2

FINAL NOTES _2024_PRINCIPLES OF BUSINESS ADMINISTRATION-2

Uploaded by

nakkazi115Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

FINAL NOTES _2024_PRINCIPLES OF BUSINESS ADMINISTRATION-2

FINAL NOTES _2024_PRINCIPLES OF BUSINESS ADMINISTRATION-2

Uploaded by

nakkazi115Copyright:

Available Formats

Page 1 of 190

TOPIC ONE

MEANING AND NATURE OF BUSINESS

A Business is any activity carried out with a view of regular production, purchase and sell of goods and services

with the aim of earning profits and acquiring wealth through the satisfaction of human wants.

There are variations in the definition of a business and industry but information from wholesalers in the medical

supply and equipment channel are used to illustrate that the nature of the firms’ business definition is linked

to the following; the level of the firms’ income statement variables and performance criteria, the significance of

strategic and operational variables in explaining firm performance. (Frazier & Howell 1983).

Though generally from different scholars, a business is an organized entity that provides goods, services, or

both to consumers (Kumar & Sharma, 2022). Businesses exist to fulfill consumer needs and wants, create value,

and generate profit. They can range from small local shops to large multinational corporations.

The activities we refer to are those related to production and exchange of wealth i.e. economic activities. Some

other activities that involve working to create wealth such as occupations or employment do not strictly come

in the scope of the meaning of business referred to above. Because business means different things to different

people, we can be guided by certain characteristics to inform ourselves of whether we are dealing with a business

activity or not.

1.1 Key Characteristics of Business

(i) Production of goods and services: Goods may be consumer or producer goods. Services are essentially

intangible and do not result in ownership of anything by the consumer e.g. services provided by

accountants, doctors, consultants, lawyers, etc.

(ii) Exchange motive (wealth): Business activities are directly or indirectly concerned with the transfer of

goods and services for value. Any form of barter trade (exchange of goods/services for goods/services) or

activities like producing products for home consumption or personal use are not regarded as business.

(iii) Regularity or continuity of dealings: The process of dealing in goods and services must be regular or

continuous. E.g. selling a single item like a phone or shoes occasionally is not business. When activities

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 2 of 190

dealing in exchange of goods and services are regular, then it is likely that these are business activities

aimed at creating wealth.

(iv) Profit motive: Profit has been found to be a major reason (But not with Peter F Drucker) for starting a

business. To make profit a business must earn revenue that exceeds costs which is accomplished through

the effective and efficient production and marketing of goods and services that customers want. Profit is

a reward for entrepreneur or premium for undertaking a risk. Therefore, where the profit motive is readily

apparent in an activity, then this may be a business.

(v) Uncertainty of return: Though profit is the driving reward for any entrepreneur or risk taker, the nature

of the activity may be such that it may result into a loss as a result of factors beyond the entrepreneur’s

control. If such is the case, then there is an element of risk and most businesses have this inherent

characteristic.

1.2 The 21st Century Business Posture

The business posture and dynamics of the yester years have significantly changed as the way business

is conducted today, especially in this era of the fourth industrial revolution and the proliferation of

technological assisted mechanisms has created a new environment for doing business (Molinaro & Orzes,

2022; Kumar & Sharma, 2022).

Comparatively, yesterday’s businesses seemed to have been in the “dark” keeping themselves with in

limited geographical locations, contacts and markets but business today with the technological boom has

created a global village with the advent of the World Wide Web and social media such as; Tiktok, Twitter,

WhatsApp, Instagram and Face book. This has redefined the way business is conducted especially in

product and service development, marketing and publicity, customer attraction and retention, scouting

and recruitment (Vrontis et al; 2022). Additionally technological boom has changed the economic outlook

and climate of today’s business in a much effective and efficient way.

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 3 of 190

1.3 Business Functions

This refers to categories that describe different activities carried out by a business in terms of functions

regardless of their primary economic activity. These are divided into core and support functions, each

playing a crucial role in the overall operation of a business.

1.3.1 Core Functions

(i) Production/Operations Function: This is the process of mixing multiple inputs, both material and

intangibles, such as plans or information, to create output. Furthermore, it can be defined as the process

of using multiple inputs, like land, labor, and capital, to produce outputs in form of goods or services. It

may also be described as the process of creating or manufacturing items and products from raw materials

or components.

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 4 of 190

(ii) Marketing and Sales Function: This involves processes for creating, communicating, delivering and

exchanging offerings that have value for customers and clients. Furthermore, marketing involves

understanding consumer needs and promoting products or services to meet those needs. It includes

market research, advertising, sales promotion, and customer relationship management. Effective

marketing strategies attract and retain customers, driving sales and brand loyalty.

(iii) Finance Function: The finance function manages the organization's financial resources. It involves

budgeting, accounting, financial planning, investment management, and ensuring liquidity and

profitability. Proper financial management ensures that the business can meet its obligations and invest

in growth opportunities.

(iv) Human Resources Function: HR is responsible for recruiting, training, and managing employees. This

function ensures that the organization has the right talent and maintains a productive work environment.

HR also handles employee relations, benefits, and compliance with labor laws.

1.3.2 Support Functions

(i) Information Technology (IT): IT supports the technological needs of the business, including managing

computer systems, networks, and data storage. Effective IT infrastructure enables efficient operations

and supports decision-making processes.

(ii) Customer Care: This function handles customer inquiries, complaints, and feedback, ensuring customer

satisfaction and loyalty. Good customer service enhances the customer experience and can lead to repeat

business and positive word-of-mouth.

(iii) Research and Development (R&D): R&D focuses on innovation and the development of new products

or services to maintain a competitive advantage. Investing in R&D helps businesses stay ahead of

competitors and meet changing market demands.

(iv) Legal: The legal function ensures that the business complies with laws and regulations of a given country,

manages legal risks, and handles contracts and litigation. Legal expertise protects the business from legal

issues and supports ethical operations.

Please note that the above functions work hand in hand, none of the above Functions works separately

from the other.

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 5 of 190

1.4 Types of Business

Businesses are broadly categorized as Industry and commerce

1.4.1 Industry

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 6 of 190

Refers to that part of business that is concerned with the production of goods and services. Typically,

products from industry may be either consumer products (used by final consumers) or producer products

(used by another industrial undertaking to produce other goods).

1.4.1.1 Classification of Industry

Industry manifests itself in the following types best described using the different categories they fall into

three categories:

1. Primary Industry: This sector involves the extraction and harvesting of natural resources. Examples

include agriculture, mining, forestry, and fishing. Primary industries provide raw materials essential for

other industries. It is therefore split into two;

(i) Extraction industries; these are activities geared towards drawing out, extracting or raising various

forms of wealth from the soil, air and water. The goods from such an activity may be used in construction

and manufacturing activities or may be consumed directly like products from fishing and agricultural

products.

(ii) Genetic industries; these engage in reproduction and multiplication of certain species of plants and

animals with the objective of earning profits from their sale. Plant nurseries and Cattle breeding firms are

examples of such industries.

2. Secondary Industry: This sector involves the manufacturing and construction processes that convert

raw materials into finished goods. Examples include factories, construction companies, and textile

manufacturers. Secondary industries add value to raw materials and produce goods for consumers and

businesses. It is therefore split into three;

(i) Capital industries: These are industries which are engaged in the production of heavy machinery like

those producing earth-moving equipment. Companies like CAT are found in such industries.

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 7 of 190

(ii) Manufacturing industries: These are industries that are involved in the conversion or transformation of

raw materials to semi- finished or finished products. These industries normally use products of extractive

industries and examples of their output include soap, sugar, iron sheets, scholastic materials, cloth, and

beverages e. t. c. For example; Riham industry, Steel and tube industry

(iii) Construction industries; these design, manufacture or construct a single substantial asset like a bridge,

a building, a dam and roads. The outputs of such industries remain at a fixed site and they normally use

products of manufacturing industries like cement, nails, paint etc. and extractive industries such as sand,

water, bricks etc. They are distinct from the point of view marketability. They are not marketed in the

ordinary sense of being taken to the market to be sold because these products are built, created or

fabricated at a fixed site for example ROKO construction company

3. Tertiary Industry: This sector provides services rather than goods. Examples include retail, banking,

education, and healthcare. Tertiary industries support the economy by offering services that facilitate

production and consumption for example banking i.e. Stanbic Bank, insurance i.e. Prudential insurance

company, Jubilee, UAP, telecommunication i.e. Airtel, MTN, consultancy etc.

1.4.2 Commerce

This covers all those activities that take place in a community in its efforts to distribute goods and services

produced. It includes trade and aids to trade.

1.4.2.1 Trade

The buying and selling of goods and services. Trade can be domestic (within a country) or international

(between countries). Trade is essential for making products available to consumers and businesses.

Trade can be classified as home trade or foreign trade:

(i) Home trade: This refers to the internal trade of a country which is carried on among the people of a

particular country. Home trade is also divided into:

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 8 of 190

(a) Whole sale trade: This involves a channel between the producer and the retailers who buy in bulk and

selling in relatively smaller quantities e.g. Depos, Agents e. t. c.

(b) Retail trade: This refers to a link between the wholesalers and the final consumer or the public who

normally buy a variety but in smaller quantities

(ii) Foreign trade: This refers to trade across the borders of different countries i.e. trade between two or more

countries. Foreign trade is further divided into:

(a) Export trade: This involves the swelling of goods and services across the boundaries of a given country

(b) Import trade: This involves buying goods and services from another country or other countries.

1.4.2.2 Aids to Trade

These are auxiliary services that allow smooth flow of trade activities. They include the following:

(i) Transportation: Moving goods from producers to consumers. Efficient transportation systems ensure

timely delivery and reduce costs.

(ii) Warehousing: Storing goods until they are needed. Warehousing helps manage supply and demand

fluctuations and ensures product availability.

(iii) Insurance: Protecting against risks associated with trade. Insurance provides financial protection against

losses due to accidents, theft, or natural disasters.

(iv) Banking: Providing financial services to support trade activities. Banks offer loans, credit, and payment

services that facilitate transactions and business operations.

(v) Warehousing: It involves the storage of goods in a designated facility, allowing businesses to manage

their inventory efficiently and meet market demand promptly.

(vi) Communication: This involves sending and receiving of messages from one party to another.

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 9 of 190

1.5 Purpose of Business

The purpose of a business is broadly categorized as:

(i) Economic Objectives

(ii) Social Objectives

Businesses aim at achieving both economic and social objectives.

1.5.1 The economic objectives include:

(i) Creation of a customer: Any product or service brought on the market is intended to satisfy the need of

a customer. Peter Drucker believed that the only valid purpose of a business is to create a customer.

Unless there is a customer to buy the product of a business, it cannot exist to the extent that it is a

customer that determines what a business is by responding to his/her needs through buying the product,

thereby keeping the business in existence.

(ii) Making Profits: If you asked a typical business man what a business is, he is likely to say that it is an

organization to make profit. Even a typical economist is likely to answer like that. Such an observation

would sadly be false and misleading; according to Drucker. This position has been augmented by Urwick

who asserted that earning profits cannot be the objective of a business any more than eating is the

objective of living. In addition, Henry Ford of Ford General Motors declared that mere chasing money is

not business. Never the less, classical economic theory of business enterprise and behaviour argues that

the objective of a firm is profit maximization and although modern economists like Boumol and Joel Dean

believe that profit is not the sole aim of business, they qualify profit maximization as a business objective

in the long run. This leads to an acknowledgement by Drucker that profit maximization is not an

explanation, cause, or rationale of a business; it is a test of the validity of business behaviour and

decisions. Drucker goes on to say that, profit has to functions; first, it the first test of performance, which

is the only effective test, but second, it is the premium for the risk of uncertainty. This gives rise to the

other objectives.

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 10 of 190

(iii) Survival: For businesses to be going concerns in complete agreement with the characteristic of regularity

and continuity of dealings, then profits must be made. A business needs to make sufficient profits in

order to survive in the long run and this make survival an important objective of business.

(iv) Growth: Related to profits, every business wants to grow as an indicator that its profit making. Growth

is natural to all activity and as such, as more money is invested and more and profits are made so does

a firm grow.

1.5.2 Social Objectives

(i) Dividends/fair returns to investors: Paying fair dividends to investors rewards them for their

investment and encourages continued or increased investment in the company. Fair returns on

investment attract more investors, providing the company with the capital needed for expansion and

innovation. It also signals the company's financial health and profitability.

(ii) Employment generation: Providing employment opportunities is a fundamental responsibility of

businesses. Employment not only generates income for individuals, allowing them to support themselves

and their families, but also stimulates economic growth. A stable job market reduces poverty and

improves living standards, contributing to social stability and economic development.

(iii) Ethical practices: Adhering to fair trade practices, maintaining transparency, and operating with

integrity. Ethical behavior builds trust and loyalty among customers, employees, and stakeholders.

(iv) Fair deal to labour: Treating employees fairly and ethically is crucial for maintaining a motivated and

productive workforce. This includes offering fair wages, safe working conditions, and opportunities for

career development. Fair treatment of labor reduces turnover, increases employee satisfaction, and

enhances the company’s reputation as a responsible employer.

(v) Timely payments of loans and advances to financial institutions: Meeting financial obligations on

time, including loans and advances, is essential for maintaining a good credit rating and avoiding

penalties. Timely payments ensure the business remains in good standing with financial institutions.

(vi) Timely payments of taxes to government: Paying taxes promptly supports government services and

infrastructure development, contributing to a stable business environment.

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 11 of 190

(vii) Protection of environment: Protecting the environment involves adopting sustainable practices that

minimize harm to natural resources and ecosystems. Businesses can achieve this by reducing waste,

lowering emissions, conserving energy, and using eco-friendly materials. Environmental protection

ensures the health and safety of communities, preserves biodiversity, and enhances the company’s

reputation.

(viii) Fair deal to customers: this involves maintaining a good relationship with your customers, producing

quality products and services to customers, disclosing all vital Information regarding products, good

customer care, etc.

(ix) Contribution to research/donations: Contributing to research and making donations demonstrate a

company’s commitment to innovation and social responsibility. Supporting research can lead to new

products and services, driving industry progress. Donations to community causes, charities, and

educational institutions enhance the company’s image, build goodwill, and create positive social impact.

Sample Questions

1. “The sole purpose of my business is to make profits” commented by a young business man in

Mbarara As a business administration student. Explain to him why you think he is wrong.

2. Using AIRTEL as an organization of your choice, discuss how creation of a large customer base has

enabled it to achieve all its other business objectives.

3. Despite the fact that businesses are started with many objectives, sometimes they are unable to achieve

all. Why do some businesses find it so hard to achieve their intended objectives?

4. Which of the following industries is a style of secondary industry?

A. Genetic Industry

B. Construction Industry

C. Extraction Industry

D. Service

5. The following are examples of Aids to trade except:

A. Banking

B. Manufacturing

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 12 of 190

C. Insurance

D. Warehousing.

6. The following are economic objectives of the business except:

A. Growth

B. Survival

C. Continuity

D. Profit Motive

7. Which of the following best describes the primary objective of a business?

A) To provide employment

B) To offer charity services

C) To generate profits

D) To support government initiatives

8. Which of the following statements best defines the term "business"?

A) A non-profit organization providing services to the public

B) An entity engaged in the production or distribution of goods or services for profit

C) A government agency regulating market activities

D) A social group focused on cultural activities

9. Which of the following is NOT a characteristic of business?

A) Profit motive

B) Risk and uncertainty

C) Government ownership

D) Production of goods and services

10. Which of the following is NOT considered a characteristic of a business?

A) Regularity in transactions.

B) Profit motive.

C) Involvement in production and distribution.

D) Solely relying on donations for revenue.

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 13 of 190

Reference Material

Books

1. Modern Business Administration (6th Ed) by Robert C Appleby

2. Adom, K., Hinson, R. E., Mintah, E. O., & Obuobisa-Darko, T. (2023). Business Administration: An

Introduction for Managers and Business Professionals. CRC Press.

3. Business Administration, a fresh approach by Roger Carter

4. Parsons Carl Copeland (2008). Business Administration, Lightning Source Inc. Publishers

5. Business Administration Hand Book by L. Hall

6. Business Administration and Management (4th Ed) by Deverell

7. Business Administration (4th Ed) by Waswa Balunywa

8. Bagire Vincent (2013). A Revision Guide for Business Administration

9. Linda K. Trevino and Katherine A. Nelson (2010).Managing Business Ethics, 5th Edition, Wiley Publishers

Online Video Resources

Meaning of Company Stocks: https://www.youtube.com/watch?v=o4jfBC0AgIM&list=PPSVE-tivities

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 14 of 190

TOPIC TWO

FORMS OF BUSINESS ORGANIZATIONS

In the present-day, complex and dynamic business landscape, the structure of a business plays a key role in

determining its operational efficiency, compliance with legal obligations and strategic flexibility. Business

organizations are in various forms, each tailored to varying needs, goals and contexts. These structures range

from simple, individually owned enterprises to complex, multi-owned corporations. Understanding the

characteristics, advantages, and disadvantages of each form is crucial for business administrators to inform

decisions. The primary forms of business organizations include sole proprietorships, partnerships, joint stock

companies and cooperatives. Each of these forms offers unique benefits and challenges, influencing factors

such as liability, taxation, control, and regulatory requirements.

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 15 of 190

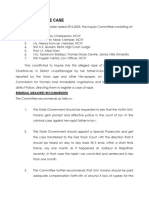

2.0 Summary of Forms of Business Organizations (Should be on land scape and 1 page)

Organization Type Registration /Incorporation Membershi Limited Separate Transferability of

p Liability Legal shares

Entity

Sole Proprietorship License/Permit from LC Single No No Yes

Partnership Ordinary 2 – 20 No No No

Professional 2 – 50 No/Exce Yes/No No

pt LLP

Private 1. M & A of Association 1 - 100 Yes/ No Yes Restricted

Ltd. 2. Certification of Transfer to the 1 –

Liab. Co Incorporation 100 members

Public M & A of Association

Joint Ltd.

Stock Co. Ltd. Liab. Co 1. Certification of

Companie by Shares Incorporation

s 2. Certificate of 2 to Infinity Yes/ No Yes YES

Commencement

3. Prospectus

4. Hold a Statutory Meeting

within 30 days of

commencement

Co. Ltd. by Guarantee Charity M & A of Association 1 - 100 Yes/ No Yes No

Government Established by an Act of 100% /51% Yes/ No Yes YES

Companies Parliament minimum

Cooperatives Register the Rules and Minimum of Yes SACCO is

Regulation + Application 30 Limited

YES YES

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 16 of 190

TOPIC TWO (A)

SOLE PROPRIETORSHIP

A sole proprietorship is a business entity owned and operated by a single individual. There is no legal distinction

between the owner and the business. This form of business is noted for its simplicity and direct control by the

owner over all aspects of operations. It is the oldest, most common, and simplest form of business organization.

Examples of sole proprietorships include small local businesses such as a neighbourhood bakery, freelance

graphic designer, independent consultants, floral shops, bookstores, saloons farms, retail shops, restaurants,

butchers, secretarial bureaus, etc.

2.1.1 Characteristics/Features

(i) Simplicity: Sole proprietorships are easy to establish and manage with minimal legal requirements.

Unlike corporations, Sole proprietorships do not require formal incorporation procedures or extensive

documentation.

(ii) Ownership: These businesses are owned entirely by one individual, who retains full control and decision-

making authority over the business operations. For instance, a local café can be owned by a single person

who also manages its daily operations, finances, and marketing.

(iii) Liability: The owner has unlimited personal liability for all debts and obligations incurred by the business.

Creditors can seek recourse against the owner's assets in the case of business liabilities. For example, if

a sole proprietor's catering business incurs debt, creditors can claim the owner's savings or property to

settle the debt.

(iv) Taxation: Income generated by the sole proprietorship is computed against the business owner's personal

income. This process is known as pass-through taxation Revenues are taxed only on individuals, not on

the entity itself. It simplifies tax compliance compared to corporate taxation.

(v) Decision Making: Sole proprietors make decisions independently, allowing for quick responsiveness to

market changes and customer needs without needing to consult partners or shareholders. A sole fashion

designer, for instance, can decide on new collections without consulting anyone else.

(vi) Duration: The lifespan of a sole proprietorship is directly tied to the owner's lifespan and willingness to

continue operating the business. Upon the owner's death, the business may cease to exist unless

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 17 of 190

provisions for succession are in place. For example, a family-owned bookstore may close if the owner

retires or passes away without a successor.

(vii) Limited source of capital: Sole proprietors often rely on personal savings, loans from family or friends,

or small business loans to fund their ventures. Access to external capital may be limited compared to

larger corporations. For instance, a home-based craft business might be initially funded by the owner's

personal savings and small loans from family members.

(viii) No Separate Legal Entity: Legally, the business and its owner are considered the same entity. Business

assets are not considered legally separate from the assets of the owner. This means the owner assumes

all legal and financial responsibilities associated with the business. For example, a sole proprietor running

a taxi car service is personally responsible for any liabilities or debts incurred.

2.1.2 Formation of a Sole Proprietorship

The formation of a sole proprietorship involves straightforward steps:

(i) Licenses and Permits: Depending on the nature of the business, obtaining licenses or permits from local,

state, or federal authorities may be required. This ensures compliance with regulations governing specific

industries or activities. For example, a home bakery might need health department permits.

(ii) Business Name Registration: In some jurisdictions, sole proprietors may need to register a business

name. For instance, Jane Smith might register bakery name as "Smith's Sweet Treats".

2.1.3 Advantages of Sole Proprietorship

(i) Ease of Formation: Starting a sole proprietorship involves minimal legal paperwork and costs, making

it straightforward and inexpensive compared to other business forms. For example, setting up a pet

grooming service might only require a business license and minimal initial investment.

(ii) Complete Control: Sole proprietors have full autonomy over business decisions, allowing for quick

decision-making and adaptation to market changes. For instance, a freelance web developer can quickly

change their service offerings based on client demands.

(iii) Tax Benefits: Pass-through taxation can result in lower overall tax liability, as business profits are taxed

at the owner's individual income tax rate. An example is an independent real estate agent who reports

earnings on their tax return.

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 18 of 190

(iv) Profit Retention: Owners retain all profits generated by the business, providing direct financial

incentives for business growth and success. For example, a single-owner coffee shop keeps all profits

without sharing with partners.

(v) Flexibility: Sole proprietors can easily pivot business strategies, change operations, or adjust to new

market conditions without needing to consult partners or shareholders. For instance, a solo artist can

switch from painting to sculpture based on market trends.

(vi) Direct Motivation: The owner's personal financial well-being is directly tied to the success of the

business, fostering strong motivation and commitment. For example, an independent tutor is highly

motivated to attract and retain students to ensure a steady income.

2.1.4 Disadvantages of Sole Proprietorship

(i) Unlimited Liability: The owner is personally liable for all business debts and legal obligations. Personal

assets, such as homes or savings, can be at risk in the event of business-related lawsuits or financial

difficulties. For example, a sole proprietor of a small construction business risks personal assets if sued

for faulty workmanship.

(ii) Limited Resources: Sole proprietors may face challenges in accessing capital compared to larger

businesses. This can restrict growth opportunities and limit the ability to expand operations. For instance,

an independent retailer might struggle to secure financing for a larger storefront.

(iii) Limited Continuity: The business may cease to exist upon the owner's death or incapacity unless

provisions for succession or transfer of ownership are in place. For example, a local flower shop may close

if the owner retires without a successor.

(iv) Limited Expertise: Sole proprietors must manage all aspects of the business, requiring a broad range of

skills. This can be demanding and may limit the business’s ability to operate efficiently. For example, a

sole proprietor running an IT consulting firm needs expertise in both technical skills and business

management.

(v) Limited Growth Potential: Due to resource constraints and the owner's capacity, sole proprietorships

may face challenges in scaling operations or competing with larger firms. For instance, a single-owner

bakery might struggle to expand to multiple locations.

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 19 of 190

(vi) Risk Burden: Owners bear all risks associated with the business, including economic downturns,

industry changes, and competitive pressures, without the support of partners or shareholders. For

example, a sole proprietor in the travel industry may face significant losses during economic recessions.

2.1.5 New Trends in Sole Proprietorship

The evolving business landscape has seen significant changes with the rise of the gig economy. These

trends have had a profound impact on the structure and operations of sole proprietorships. This write-

up explores the characteristics, advantages, and challenges associated with these phenomena and how

they shape the experience of sole proprietors.

A Gig Sole proprietor is characterized by short-term contracts or freelance work, often facilitated through

digital platforms. This model of work contrasts with traditional employment, where individuals hold long-

term, stable positions within a single organization.

Characteristics of Gig Sole Proprietorship

(i) Short-term Contracts: Gig work is typically project-based or on-demand, with engagements lasting from

a few hours to several months.

(ii) Freelance Work: Individuals offer their services independently rather than being long-term employees.

(iii) Digital Platforms: Online platforms such as Uber, Fiverr, and Upwork connect gig workers with clients,

providing a marketplace for services.

(iv) Prevalence: Many gig workers, such as ride-share drivers, freelance graphic designers, and consultants,

choose to operate as sole proprietors.

(v) Flexibility: Sole proprietors in the gig economy enjoy the freedom to set their own schedules and select

clients, tailoring their work to fit their personal and professional goals.

(vi) Autonomy: This structure allows individuals complete control over business decisions and operations,

fostering a sense of independence.

Advantages of Gig Sole Proprietorship

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 20 of 190

(i) Flexibility: The ability to determine one's own work hours and client base is a significant draw. This

flexibility can lead to a better work-life balance and the opportunity to pursue multiple interests.

(ii) Potential for Higher Income: Sole proprietors can potentially earn more based on the demand for their

services and their ability to negotiate rates. High-demand skills or services can command premium prices.

(iii) Diverse Opportunities: The gig economy allows individuals to explore various fields and projects,

contributing to a diverse portfolio of experience.

Disadvantages of Gig Sole Proprietorship

(i) Irregular Income: Earnings in the gig economy can be unpredictable, fluctuating based on market

demand and the availability of work. This instability can make financial planning challenging.

(ii) Lack of Employment Benefits: Unlike traditional employees, gig workers do not receive benefits such

as health insurance, retirement plans, or paid leave. They must independently secure and finance these

necessities.

(iii) Self-Management: Sole proprietors are responsible for all aspects of their business, including marketing,

accounting, client relations, and regulatory compliance. This can be overwhelming, especially for those

without a business background.

Conclusion

Sole proprietorships offer a straightforward and flexible way for individuals to start and run their own

businesses. It is perfect where capital requirements are small and risk isn’t too high, where quickness of

decision making is very important, where customers need personal attention via taste and fashion. However,

they come with significant risks, especially regarding personal liability.

REFERENCE MATERIALS

Books

1. Modern Business Administration (6th Ed) by Robert C Appleby

2. Business Administration, a fresh approach by Roger Carter

3. Parsons Carl Copeland (2008). Business Administration, Lightning Source Inc. Publishers

4. Business Administration Hand Book by L. Hall

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 21 of 190

5. Business Administration and Management (4th Ed) by Deverell

6. Business Administration (4th Ed) by Waswa Balunywa

7. Bagire Vincent (2013). A Revision Guide for Business Administration

8. Linda K. Trevino and Katherine A. Nelson (2010).Managing Business Ethics, 5th Edition, Wiley Publishers

9. Published articles

Online Video Resources

1. https://www.youtube.com/watch?v=Qp9teuaKcyc

2. https://www.youtube.com/watch?v=Qp9teuaKcyc

3. Sole Proprietorships Explained: How They Work and Why They're Popular

SAMPLE QUESTIONS

1. Identify and discuss the key characteristics that make a business well-suited for a sole proprietorship

structure. Provide examples of businesses that typically thrive as sole proprietorships

2. Discuss the main advantages and disadvantages of operating a business as a sole proprietorship.

3. Evaluate the types of support and resources available for sole proprietors. How can these resources aid in

the success and growth of a sole proprietorship?

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 22 of 190

TOPIC TWO (B)

PARTNERSHIPS

A partnership is a business arrangement where two or more individuals agree to share the profits and losses of

a business operated by all or some of them on behalf of others. It is essentially a relationship that exists between

persons with a common goal of making a profit. This type of business structure is characterized by shared

ownership, responsibilities, and decision-making.

Where a partnership is formed to carry out a profession service, the number of professionals, which constitutes

the partnership shall start from two and not exceed fifty (2 to 50). Examples of professionals include lawyers

(law firms), Accountants (accounting firms), etc. For other businesses, their membership starts from two and

not exceeding twenty (1 to 20). In Uganda, partnerships are registered under the partnership ACT 2013.

2.3.1 Characteristics of Partnerships

(i) Non-transferability of Interest: Partners cannot transfer their partnership interest to others without the

consent of the remaining partners. This ensures that new partners are accepted only with the agreement

of the existing partners. For instance, if Partner A wants to sell his share to an outsider, he must get

approval from Partners B and C.

(ii) Plurality of Persons: A partnership must have at least two partners. For banking businesses, the

maximum number is usually 50, while for other types of businesses, it is typically 20.

(iii) Partnership Deed: Partnerships are usually governed by a written agreement known as the partnership

deed, which outlines the rights, responsibilities, and profit-sharing ratios among partners. For instance,

a partnership deed might specify that Partner A receives 40% of the profits while Partner B and C each

receive 30%.

(iv) Principal-Agent Relationship: Each partner acts as both a principal and an agent of the partnership.

This means Partner “A” can make decisions and enter into contracts that will bind partners “B” and “C”.

For example, Partner “A” can negotiate a lease for office space, which all partners are then obligated to

honour.

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 23 of 190

(v) Unlimited Liability: Partners have unlimited personal liability for the debts and obligations of the

partnership. Their personal assets can be used to settle business debts if the partnership assets are not

sufficient to pay for all the partnership debts at the time of dissolution of the partnership. For example,

if the partnership owes $100,000, and the partnership business assets cover only $70,000, the partners

must cover the remaining $30,000 from their assets.

2.2.2 Formation of a partnership

2.2.2.1 Procedure of forming a partnership

(i) Reservation of business name (URSB): This is mandatory.

(ii) Register business name (business names registration act.

(iii) Statement of particulars.

(iv) Partnership Deed (not mandatory but prudent practice).

(v) Acquisition of a Certificate of registration- Sec 4 BNRA (business name registration Act).

(vi) Acquisition of a trading license.

(vii) Gazetting.

2.2.2.2 Who can be a partner?

Anyone who is legally capable of entering into a contract can be a partner. This includes individuals who are

sane and financially sound. For instance, an 18-year-old entrepreneur in Uganda accountant can form a

partnership.

Partnerships are created through a partnership agreement (Deed)or by the operation of law, such as the

Partnership Act. In Uganda, partnerships are registered under the Partnership Act of 2010.

2.2.3 Partnership Deed/Agreement

A partnership deed is an agreement that spells out the rights and obligations of each of the partners made out

by partners and witnessed by a solicitor. It is not a must to sign an agreement but it is desirable for clarity and

permanence. If it is absent, the Partnership Act prevails.

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 24 of 190

Partnership agreements can be established through various means:

(a) By Word of Mouth: An oral agreement among partners.

(b) By Writing: A formal written agreement, known as a partnership deed.

(c) By Implication: An implied agreement based on the conduct of the parties.

(d) By Holding Out: When someone represents themselves as a partner, they may be held liable as if they

were a partner.

Contents of a Partnership Deed

(i) Mode of sharing the profits.

(ii) Names and signatures of partners

(iii) Interest on capital and drawings.

(iv) Winding up/changes and dissolution.

(v) Nature of business.

(vi) Capital contribution per partner.

(vii) Preparation and auditing of accounts.

(viii) The ratios in which profits/losses will be shared.

(ix) Amounts, if any, partners may draw in advance before ascertainment of profits.

(x) Partners’ salaries if any.

(xi) Admission of new members.

(xii) Duration of the partnership.

2.2.4 Types of Partnerships

(i) General partnership: This is a partnership where all partners participate in the management of the

business and each partner is liable for all business debts/losses. All partners participate in management

and are jointly liable for business debts. For example, a group of doctors opening a clinic where each one

of them has a daily task in the operations

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 25 of 190

(ii) Limited partnerships: Partnership in which some partners are not actively involved in the day-to-day

running of the business while others are actively involved in the management of the business. The inactive

partners have limited liability for instance, a real estate investment firm with silent investors who provide

capital but do not manage properties.

(iii) Limited liability partnership (LLP): This s a partnership where all partners have limited liability i.e.,

they are not responsible for the debts and liabilities of the partnership. Not all businesses can register as

LLP’s. LLPs usually include medical partnerships, Law firms, and accounting firms. For example, an

accounting firm where partners are protected from the debts incurred by the firm.

2.2.5. Types of Partners

(i) Active partners: These contribute capital to the business, participate actively in the management of

businesses and are liable to third parties. They are sometimes referred to as “ordinary”, “regular”, 'actual

‘, or 'ostensible partners. For example, partners in a law firm who manage cases and clients.

(ii) Dormant/Sleeping Partners: This is one who does not take any active part in the management of the

business. He contributes capital and shares the profit which is usually less than that of the active

partners. He is liable for all the debts of the firm but his relationship with the firm is not disclosed to the

general public.

(iv) Nominal/Quasi Partners: He/she neither contributes any capital nor shares in the profits nor takes part

in the management of the business. But he is liable to third parties like other partners. He/she is known

to outsiders and earns goodwill for using his name as a partner.

(v) Minor partner: This is a partner below the contracting age. Enjoys limited liability and his decisions are

not legally binding. However, on attaining majority (contracting age), if he continues as a partner, his

liability will become unlimited with effect from the date of his original admission into the firm.

(vi) Partner in profits only: This is a partner who shares in the profits only without being liable of the losses.

He does not take part in the active management of the business.

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 26 of 190

(vii) Sub partners: This is a stranger sharing the profits derived from the firm. He/ she shares profits with

one of the partners and has no rights against the firm. For instance, a spouse who shares in a partner's

business profits

(viii) Partner by Holding out: This is one who, without being a partner, conducts himself in such a manner

as to lead third parties (outside world) to believe he is a partner. He is stopped or prevented from denying

he is a partner. He is considered as a partner in the eyes of the law and is liable to third parties.

(ix) Partner by Estoppel: This is one who if declared to be a partner by a partnership firm remains silent

without denying it. He is also considered a partner by holding out and is liable to third parties.

2.2.6 Advantages of Partnerships

(i) Survival Capacity: Partnerships can continue even if there are changes in partners. For example, if a

partner retires, the remaining partners can continue the business.

(ii) Increased Capital: More partners mean more potential for capital investment. For instance, a partnership

of five people can pool more resources than a sole proprietor.

(iii) Management Skills: Combines the expertise and skills of multiple partners. For example, one partner

might be good at marketing while another excels in finance.

(iv) Access to Credit: Easier to secure loans due to combined assets and creditworthiness. For example, a

partnership may obtain a larger loan for expansion than an individual could.

(v) Shared Risks: Losses and risks are spread among partners. For instance, if the business incurs a loss,

it is divided among the partners, reducing the burden on any single individual.

(vi) Flexibility: Relatively easy to form and dissolve. For example, two friends can start a business together

with minimal paperwork and dissolve it if it does not work out.

(vii) Fewer Regulations: Less governmental oversight compared to corporations. For instance, partnerships

generally face fewer regulatory requirements than incorporated businesses.

(viii) Easy Decision Making: Fewer bureaucratic hurdles compared to larger businesses. For example,

decisions can be made quickly in a small partnership without needing board approvals.

(ix) Limited Liability: Some partners can enjoy limited liability, protecting personal assets. For example, in

an LLP, partners are not personally responsible for the firm's debts.

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 27 of 190

2.2.7 Disadvantages of Partnership

(i) Unlimited Liability: Some partners are fully liable for the partnership's debts. For example, if the

partnership cannot pay its debts, partners' personal assets can be used to cover the shortfall.

(ii) Shared Consequences: The actions of one partner can affect all others. For instance, if one partner

incurs debt or legal issues, all partners are responsible.

(iii) Transparency: Less privacy as partnership dealings must be disclosed among partners. For example,

partners must share financial and operational details with each other.

(iv) Limited Resources: Capital and resources can still be limited compared to corporations. For example, a

partnership might struggle to raise as much capital as a corporation with shareholders.

(v) Non-transferability: Partnership interests cannot be easily transferred. For instance, a partner cannot

sell their interest in the partnership without the agreement of the other partners.

(vi) Decision Delays: Agreement among partners may slow decision-making. For example, partners may need

to discuss and agree on major decisions, which can take time.

(vii) Conflict Potential: Disagreements among partners can disrupt business. For example, differing opinions

on business direction can lead to conflicts.

(viii) Continuity Challenges: Partnerships may dissolve with changes in membership. For example, if a

partner leaves or dies, the partnership may need to be reformed or dissolved.

(ix) Motivational Issues: Sharing profits can reduce individual motivation. For example, partners may feel

less motivated if they perceive unequal effort or contribution. When one member leaves for any reason

say death or another person is admitted the partnership dissolves. This does not mean winding up the

business. The dissolution occurs because terms of the new partnership will be different. The relationships

are new e.g. capital contribution, profit and loss sharing ratio etc.

2.2.8 Termination of a Partnership

Partnerships can be terminated under various conditions:

(i) Agreement of partners: Partners may agree to terminate the partnership.

(ii) Departure or admission of partners: A partner may leave or a partner may be added, in which case the

old partnership is terminated and a new one initiated.

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 28 of 190

(iii) Dismissal of a partner: A partnership agreement may provide for the dismissal of partners under certain

circumstances. In case this happens and the legally required membership is not upheld or new partners

are admitted, then a partnership may be dissolved.

(iv) Failure to observe the regulations: The Law also dictates the termination of partnerships under certain

circumstances e.g. engagement in an illegal activity.

Conclusion

A partnership is an improvement of a sole proprietorship and is suited for business activities where investment

is not very large and where application of personal skill and judgement is required.

Reference Material

1. Parsons Carl Copeland (2008). Business Administration, Lightning

2. Linda K. Trevino and Katherine A. Nelson (2010). Managing Business Ethics, 5th Edition, Wiley Publishers.

3. Modern Business Administration (6th Ed) by Robert C Appleby

4. Business Administration, a fresh approach by Roger Carter

5. Parsons Carl Copeland (2008). Business Administration, Lightning Source Inc. Publishers

6. Business Administration Hand Book by L. Hall

7. Business Administration and Management (4th Ed) by Deverell

8. Business Administration (4th Ed) by Waswa Balunywa

9. Bagire Vincent (2013). A Revision Guide for Business Administration

10. Linda K. Trevino and Katherine A. Nelson (2010).Managing Business Ethics, 5th Edition, Wiley Publishers

YOU TUBE VIDEO

https://www.youtube.com/watch?v=s8vXZTB3618: Partnerships Explained: Types and Considerations

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 29 of 190

TOPIC TWO (C)

JOINT-STOCK COMPANIES

2.3.1 Background to the emergence of Joint-Stock Companies

Following the emergence of the industrial revolution, there emerged complex needs that were associated with

the modern industry and commerce that could not be met by sole proprietorship or partnerships. A new form

of business organization which could mobilize more funds and conduct large operations was needed and as

such The JOINT STOCK Companies were born.

Whereas the origins of joint-stock companies can be traced back to medieval Europe, they became particularly

prominent during the Age of Exploration in the 16th and 17th centuries. It enabled investors to purchase shares

in the company, pooling their resources to fund voyages and share in the profits and these set a precedent for

the growth of Joint-stock companies.

2.3.2 Definition of a company

A company is an artificial person created by law having a separate entity with perpetual succession. This means

that a company is separate from its promoters or subscribers. In Uganda, companies are registered and

regulated by Uganda Registration Services Bureau (URSB).

After incorporation/registration

Upon its birth, a company becomes a body corporate distinct from its subscribers/members and is required to

comply with a number of statutory obligations. Failure to comply may attract penalties both civil and criminal

in nature as well as potential striking off from the business register. These obligations include but are not

limited to:

2.3.3 Statutory obligations of a company

(i) Management/Board

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 30 of 190

The Board is critical in keeping the company as a going concern through among others, adopting

corporate governance principles and ensuring compliance with other statutory obligations. Every

company is required to have a director(s) (Sec. 185). In case of a single member company (SMC) in addition

to the sole owner being a director, such an owner shall appoint a nominee and an alternate nominee

director to manage the affairs of the SMC upon the demise of the owner. Action by sole person who acts

as both the director and secretary are prohibited (sec. 188).

(ii) Address

All companies doing business or registered in Uganda are required to have a registered office and a

registered postal address. From the day of commencement of business or 14 days after incorporation,

whichever is earlier, a company shall have an address to which all communications and notices may be

addressed (Secs 115 & 116).

An address is an essential marketing tool for your business and exonerates one from brief case company

syndrome, while at the same time creating a distinction between your professional and private life. For

purposes of the postal address, it may be physical, virtual or even care of (C/O) in cases where an

authorizing document is attached.

Failure to have such an address shall render the company and every officer in default to a fine of twenty-

five currency points (Sec. 115(5)). The registrar of Companies may also elect to deregister the company in

default (Sec. 115(4)).

(iii) Return of allotment

Whenever a Company limited by shares or by guarantee and having share capital, makes any allotment

of its shares to the shareholders, it shall within sixty days thereafter deliver to the registrar of companies

for registration such return of allotment (sec. 61).

Failure to file such a return attracts liability against the officers of the company to the tune of twenty-five

(25) currency points and an additional five currency points for every day during which the default

continues (Sec. 61(3)).

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 31 of 190

(iv) Register of members

A company is required to keep, at its registered office, a register of its members (119) and shall notify the

registrar of companies of the place where the register is kept and any changes thereto (119(3)). Failure to

keep such a register attracts a daily default fine of twenty-five currency points against officer responsible

for such a default (119(6)).

(v) Annual Returns

All Companies whether limited by shares of Guarantee are required to submit annual returns to the

registrar of companies within forty-two days after the Annual General Meeting of the company in issue

(Secs. 132,133, 134).

Failure to file Annual Returns attracts a penalty of twenty-five (25) currency points against company and

every officer responsible for the default (132 (4) & 133(3)). Further, if for 5 consecutive years no Annual

Returns have been filed by the Company, the registrar of companies may be prompted to strike off the

company from the register (134(5) & (6)).

6. Company Resolutions

Company decisions are derived through board meetings and shareholders meetings. These decisions are

communicated through board resolutions (Sec.150). Resolutions generally fall into two categories, i.e.

(a) Resolutions passed by the board: These relate to daily operations and may not be registered.

(b) Resolutions passed by members/shareholders: These relate to special resolutions and other

resolutions agreed upon by and affecting the members.

The wording or content of a resolution can determine whether it’s a board resolution or members’

resolution. This is because the two have clear cut boundaries on matters of jurisdiction. Applicants are

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 32 of 190

therefore advised to ensure the resolutions are signed by the rightful set of people. A single member may

not sign both as secretary and Director at the same time or on the same application.

2.3.4 Benefits of Registering a Company

When a company is registered, it is said to have been ‘incorporated’ and thereon a certificate of

incorporation is issued. Upon incorporation, the company becomes a body corporate separate from its

owners. In other words, the business entity will be recognized under the law as legal and eligible to

transact in its own name.

This means that the company can, among other things:

1) Own and transfer property;

2) Borrow money and provide security in form of a charge on its assets;

3) Sue (or be sued) in its own name.

The other benefits of formalizing your business include:

1) Identity

2) Corporate status

3) Financial accommodation

4) Corporate rescue

5) Cross border trade

6) Marketing

7) Intellectual Property rights

URSB registers the following types of companies:

1) Single Member Company,

2) Public company,

3) Private company limited by shares,

4) Company limited by guarantee and

5) Foreign company

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 33 of 190

A share represents a unit of ownership in a company or financial asset. When an investor buys shares, they

are purchasing a portion of the company’s equity, entitling them to a share of the profits and assets of the

company

2.3.5 Formation of a Joint-Stock Company

The formation of a joint-stock company involves several stages, including the planning, legal procedures, and

regulatory compliance required to establish and commence business operations. This process ensures that the

company is structured legally and is ready to operate within the regulatory framework of its jurisdiction. Below

is a breakdown of the stages involved in forming a joint-stock company:

1. Preliminary Steps

a. Business Idea and Planning:

(i) Conceptualization: The founders identify a viable business idea and assess its potential for

success.

(ii) Feasibility Study: Conduct market research, financial analysis, and feasibility studies to evaluate

the viability of the business idea.

(iii) Business Plan: Develop a comprehensive business plan outlining the company’s objectives,

strategies, target market, financial projections, and operational plans.

b. Choosing the type of Joint-Stock Company:

Decide whether to form: a private joint-stock company or public joint-stock company

(i) A private joint-stock company (limited number of shareholders, shares not publicly traded) or

(ii) A public joint-stock company (shares offered to the public and traded on a stock exchange).

2. Legal and Regulatory Requirements

a. Name reservation:

(i) Selecting a Name: Choose a unique and appropriate name for the company.

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 34 of 190

(ii) Name Reservation Application: Submit an application to the relevant regulatory authority to

reserve the company name and ensure it is not already in use.

b. Drafting Legal Documents:

(i) Memorandum of Association (MOA): A document outlining the company’s name, registered office,

objectives, and the extent of liability of its members.

(ii) Articles of Association (AOA): A document detailing the internal rules and regulations governing

the company’s management, operations, and the rights and duties of shareholders and directors.

c. Initial Capital:

(i) Share Capital: Determine the initial capital required for the company and the number of shares to

be issued. This involves deciding the nominal value of each share.

(ii) Subscription of Shares: Ensure that the initial shareholders subscribe to the minimum required

share capital.

3. Registration and Incorporation

a. Filing for Incorporation:

(i) Submission of Documents: Submit the MOA, AOA, and other required documents (e.g., name

reservation certificate, shareholder details) to the Registrar of Companies or the relevant regulatory

authority.

(ii) Registration Fees: Pay the necessary registration fees and stamp duties.

b. Issuance of Certificate of Incorporation:

(i) Verification: The Registrar reviews the submitted documents to ensure compliance with legal

requirements.

(ii) Certificate of Incorporation: Upon approval, the Registrar issues a Certificate of Incorporation,

officially recognizing the company as a legal entity.

4. Post-Incorporation Steps

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 35 of 190

a. Commencement of Business:

(i) Public Joint-Stock Companies: If forming a public company, additional steps include issuing a

prospectus, inviting the public to subscribe to shares, and meeting the minimum subscription

requirements.

(ii) Private Joint-Stock Companies: Can commence business immediately upon receiving the

Certificate of Incorporation.

b. Corporate Governance Setup:

(i) Board of Directors: Appoint the initial board of directors as per the AOA. Directors are responsible

for overseeing the company’s management and operations.

(ii) Company Secretary: Appoint a company secretary responsible for ensuring regulatory compliance

and maintaining company records.

c. Regulatory Compliance:

(i) Business Licenses and Permits: Obtain necessary business licenses and permits required for the

company’s operations.

(ii) Tax Registration: Register for taxes, including corporate tax, value-added tax (VAT) and other

applicable taxes.

(iii) Statutory Registers: Maintain statutory registers, including the register of members, register of

directors and register of charges.

d. Bank Account:

Opening a Bank Account: Open a corporate bank account in the company’s name for managing financial

transactions and capital.

e. Annual Compliance:

(i) Annual General Meeting (AGM): Conduct AGMs as required by law, where shareholders can

discuss the company’s performance and make important decisions.

(ii) Financial Statements and Audits: Prepare annual financial statements and conduct audits as

required. Submit annual returns and financial reports to the regulatory authorities.

2.3.6 Characteristics of Joint-Stock Companies

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 36 of 190

Joint-stock companies possess several key characteristics that distinguish them from other forms of business

organizations:

(1) Separate Legal Entity/Legal Person: A joint-stock company is a separate legal entity distinct from its

shareholders. It can own property, enter into contracts, sue, and be sued in its own name. Perpetual

Succession, the company’s existence is not affected by changes in its ownership. It continues to exist

until it is legally dissolved.

(2) Limited Liability: The liability of shareholders is limited to the amount unpaid on their shares. Personal

assets of shareholders are protected and cannot be used to settle the company’s debts and liabilities.

(3) Transferability of Shares: Shares of a joint-stock company can be freely transferred by shareholders i.e.

from person to another, providing liquidity and enabling investors to easily buy and sell shares. In the

case of public joint-stock companies, shares are traded on stock exchanges, facilitating market-driven

price discovery and accessibility to a broad investor base.

(4) Capital raising/Large-Scale Investment: Joint-stock companies can raise substantial capital by issuing

shares to a large number of investors. This allows them to undertake large projects and expansions that

require significant financial resources. In addition, a variety of Investors are involved and both individual

and institutional investors can buy shares, diversifying the sources of capital.

(5) Professional Management/Board of Directors: The Company is managed by a board of directors elected

by the shareholders. The board makes strategic decisions and oversees the company’s operations.

(6) Separation of Ownership and Management: Shareholders own the company, but professional managers

run the day-to-day operations, allowing for specialized management expertise.

(7) Regulated Entity

(a) Regulatory Compliance: Joint-stock companies must comply with a variety of legal and regulatory

requirements, including company law, securities law, and financial reporting standards.

(b) Transparency: They are required to maintain transparency through regular disclosures, financial

statements, and audits, which protect investors and maintain market confidence.

(8) Profit Sharing:

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 37 of 190

(a) Dividends: Profits are distributed to shareholders in the form of dividends, which are declared by

the board of directors. The amount and frequency of dividends depend on the company’s

profitability and dividend policy.

(b) Capital Gains: Shareholders can also benefit from capital gains if the value of their shares

increases over time.

(9) Ownership Rights

(a) Voting Rights: Shareholders typically have the right to vote on important matters, such as electing

directors, approving mergers or acquisitions, and other significant corporate actions.

(b) Information Rights: Shareholders have the right to receive timely and accurate information about

the company’s performance and activities.

(10) Perpetual Existence/Continuous Existence:

The Company’s existence is independent of its shareholders’ existence. It continues to operate regardless

of changes in ownership or management, providing stability and continuity.

(11) Legal Framework

(a) Incorporation: Joint-stock companies are created through a legal process of incorporation, which

grants them legal status and defines their structure and governance.

(b) Memorandum and Articles of Association: These foundational documents outline the company’s

objectives, the rules governing its operations, and the rights and duties of its members.

2.3.7 Types of Companies

1. Companies incorporated under the companies Act: In Uganda, companies are incorporated under the

Companies Act, which provides the legal framework for the formation, management, and dissolution of

companies. The Companies Act, 2012, which replaced the Companies Act, Cap 110, governs company

incorporation and operations in Uganda. The Act distinguishes between various types of companies, and

there are 3 main types of companies that can be registered under the companies act i.e. companies limited

by shares, companies limited by guarantee and unlimited companies.

2. Companies limited by shares: A company limited by shares is a common type of business structure

where the liability of the shareholders is limited to the amount unpaid on their shares. This structure is

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 38 of 190

popular due to its limited liability protection, which ensures that shareholders' personal assets are not

at risk if the company faces financial difficulties. Here’s an in-depth look at companies limited by shares

Characteristics of Companies Limited by Shares

(i) Limited Liability: Shareholder Protection: The liability of shareholders is limited to the unpaid amount

on their shares. If a shareholder has fully paid for their shares, they have no further financial obligation

towards the company's debt.

(ii) Capital Structure: The capital of the company is divided into shares, which can be issued to investors.

Each share represents a unit of ownership in the company.

(iii) Transferability of Shares: Shares can typically be transferred between individuals, subject to any

restrictions outlined in the company’s Articles of Association.

(iv) Separate Legal Entity: Distinct from Owners, the company is a separate legal entity from its

shareholders, meaning it can own property, enter into contracts, sue, and be sued in its own name.

(v) Perpetual Succession: The company’s existence is not affected by changes in ownership or management.

(vi) Management and Control: Board of Directors: Typically managed by a board of directors elected by the

shareholders. The directors make strategic decisions and oversee the company’s operations.

Types of Companies Limited by Shares

(1) Private Limited Company (Ltd)

Private limited company is a type of business entity that offers limited liability to its shareholders but

places certain restrictions on ownership and transfer of shares. It is one of the most common forms of

incorporation for small and medium-sized enterprises (SMEs) and not exceeding one hundred (100)

members, and also a minimum of 1 (one) member.

Characteristics of Private Limited Companies

(i) Shareholder Restrictions: Typically restricts the number of shareholders and prohibits public

trading of shares.

(ii) Transfer of Shares: Share transfer is usually subject to approval by other shareholders or the

board of directors.

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 39 of 190

(iii) Strict regulatory requirements: Less stringent regulatory and disclosure requirements compared

to public companies.

(2) Public Limited Company (PLC)

Is a type of business entity that offers its shares to the general public and has limited liability for its shareholders.

This structure is commonly used by larger businesses that seek to raise capital through public investment and

is subject to stringent regulatory requirements.

Characteristics of Private Limited Companies

(i) Public Offering: Can offer shares to the public and are often listed on stock exchanges.

(ii) Number of Shareholders: No limit on the number of shareholders.

(iii) Regulatory Compliance: Subject to rigorous regulatory requirements, including regular financial

disclosures, corporate governance standards, and compliance with securities laws.

3. Government companies

Is a company in which the government (central or state) holds a significant portion of the share capital, usually

more than 50%. These companies are registered under the country's Companies Act and operate like private

sector companies but with government oversight and objectives.

Examples of Government Companies in Uganda

(i) Uganda Electricity Generation Company Limited (UEGCL); Role: UEGCL is responsible for electricity

generation. It manages the development, operation, and maintenance of energy generation facilities. Key

projects include the construction and management of hydroelectric power stations such as the Karuma

Hydroelectric Power Station and the Isimba Hydroelectric Power Station.

(ii) Uganda Electricity Transmission Company Limited (UETCL); Role: UETCL is the sole entity responsible for

electricity transmission in Uganda. It operates the high-voltage transmission network and is also the

single buyer of electricity from generators for distribution to electricity distribution companies.

Department of Business Administration (DoBA) 2024 Faculty of Business Administration MUBS

Page 40 of 190

(iii) Uganda National Oil Company (UNOC); Role: Established to manage the country’s commercial interests in

the petroleum sector and ensure the development of the oil and gas resources. UNOC is involved in

exploration, production, refining, and trading of oil and gas.

(iv) National Water and Sewerage Corporation (NWSC); Role: NWSC is responsible for providing water and

sewerage services in urban centers across Uganda. It aims to ensure sustainable water supply and sewage

management.

(v) Uganda Development Corporation (UDC); Role: UDC is tasked with promoting and facilitating industrial

and economic development. It invests in strategic sectors and enterprises to stimulate economic growth.

(vi) Posta Uganda (Uganda Post Limited); Role: Provides postal and courier services throughout Uganda. Posta

Uganda also offers financial services such as money transfers.

(vii) Uganda National Roads Authority (UNRA); Role: Responsible for the development, maintenance, and

management of the national road network. UNRA aims to improve the quality and accessibility of roads

across the country.

(viii) Uganda Broadcasting Corporation (UBC); Role: UBC is the national broadcaster of Uganda, providing radio

and television services. It aims to offer informative, educational, and entertaining content to the Ugandan

public.

4. Companies limited by guarantee

A company limited by guarantee is a type of corporate structure primarily used for non-profit organizations,

charities, clubs, and other entities that aim to promote a particular cause rather than distribute profits. In this

structure, members do not hold shares but guarantee to contribute a nominal amount towards the company’s

debts if it is wound up.

Characteristics of companies limited by guarantee