Chapter 7

Chapter 7

Uploaded by

Mary Rose AmolarCopyright:

Available Formats

Chapter 7

Chapter 7

Uploaded by

Mary Rose AmolarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Chapter 7

Chapter 7

Uploaded by

Mary Rose AmolarCopyright:

Available Formats

INTEGRATED ACCOUNTING

MID TERM PERIOD

LEARNING MODULE ATTACHMENT (DO NOT COPY)

LEARNING OBJECTVES

ACCOUNTING CYCLE

1. Identification of events to be recorded. Finished

2. Journalizing the transaction.

3. Posting from the Journals to General Ledger.

4. Preparing the Unadjusted Trial Balance. Now

5. Recording Adjusting Entries.

6. Preparing the Adjusted Trial Balance.

7. Preparing Financial Statements.

8. Recording Closing Entries. Later

9. Preparing a Closing Trial Balance.

10. Recording Reversing Entries.

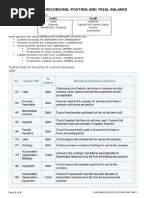

POSTING

• Process of transferring data (debit and credit) from the journal to appropriate accounts in the ledger.

• Purpose of posting is to classify the effects of transactions on five major accounts specifically asset,

liability, equity, income and expense accounts in order to provide more meaningful information.

Illust ration :

THIS FORM IS FOR INSTITUTIONAL PURPOSES ONLY!

LEDGER ACCOUNTS AFTER POSTING

• The debit or credit balance of each amount must be determined to enable us to come up with a trial balance.

• Each account balance is determined by adding all the debits and credits.

• If the sum of an account’s debits is greater than the sum of its credits, that account has a debit balance.

• If the sum of it’s credits is greater, that account has a debit balance.

Illustration: The ledger accounts of Weddings “R” Us after posting are shown below. The account numbers and journal

reference columns are purposely omitted. The balance of each account has been determined.

TRIAL BALANCE

• Trial balance is a list of all accounts with their respective debit or credit balances.

• Prepared to verify the equality of debits and credits in the ledger at the end of each accounting period.

• A control that helps minimize accounting errors.

• When the totals are equal, the trial balance is in balance

THIS FORM IS FOR INSTITUTIONAL PURPOSES ONLY!

LOCATING ERRORS

An inequality in the totals of the debits and credits would automatically signal the presence of an error. These errors

include:

1. Error in posting a transaction to the ledger:

• an erroneous amount was posted to the account.

• a debit entry was posted as a credit or vice versa.

• a debit or credit posting was omitted.

2. Error in determining the account balances:

• a balance was incorrectly computed.

• a balance was entered in the wrong balance column.

3. Error in preparing the trial balance:

• one of the columns of the trial balance was incorrectly added.

• the amount of an account balance was incorrectly recorded on the trial balance.

• A debit balance was recorded on the trial balance as a credit or vice versa, or a balance was omitted entirely.

Approach in locating error

1. Prove the addition of the trial balance

2. If the error does not lie in addition, determine the exact amount by which the trial balance is out of balance. If the

discrepancy is divisible by 9, this suggests:

• Transposition- reversing the order of numbers

• Slide- moving of the decimal point

3. Compare the accounts and amount in the trial balance with that in ledger

4. Recompute the balance of each ledger account.

5. Trace all postings from the journal to the ledger accounts.

A balanced trial balance simply proves that, as recorded, debits equal credits. The following errors are not detected by a

trial balance:

1. Failure to record or post a transaction.

2. Recording the same transaction more than once.

3. Recording an entry but with the same erroneous debit and credit amounts.

4. Posting a part of a transaction correctly as a debit or credit but to the wrong account.

THIS FORM IS FOR INSTITUTIONAL PURPOSES ONLY!

LEARNING ACTIVITY #0 5

Name: Score:

Program / Course: Class Schedule:

Year & Section: Contact No. / FB Account:

Residential Address:

Type of Activity (check or choose from below)

Concept Notes Laboratory Report Portfolio

Skills: Exercise / Drill Illustration Others:___________________

Activity Title : Recording Transactions in T-accounts and Preparing a Trial Balance

Learning Target : To analyze the transaction and post the journal entries in ledger using T-accounts and prepare

unadjusted Trial Balance.

References (Author, Title, and Pages) :_______________________________________________

I. Problem Solving : POSTING

Lily Santos opened a servicing business name on September 2022, The business DTI Registered name “Mind Your

Own Business”. MYOB had the following transactions for the month of September.

1 Owner invested P 1,000,000 cash to the busines s

4 Purchas ed equipment wor th P 5 8 0,000 paid in cash

5 Purchas ed off ice supplies worth P 3 00,000 on account (use a s an ass et a cco unt )

15 P aid P100,000 acc ounts payable.

16 Rendered servi ces to various cl ient f or P 5 00,000 on cash basis.

18 Rendered servi ces to various cl ient f or P 8 00,000 on account.

20 Collected P700,000 accounts re ce ivab le.

25 Paid the salar y of employee P70 ,000 .

30 Paid Meralco and Mayni lad f or utiliti es bill total ing P 1 0 ,000

Withdrew P1 0,000 f rom the busine ss f or personal use

Requirements:

1. J ournali ze t he above tr ansactions usi ng t he f ollowing ac count t itl es:

110 Cash , 120 Accounts Receivab le , 130 Notes Receivable , 14 0 Off ice Supplies,

15 0 Equipmen t, 210 Accounts P ayable , 220 Notes P ayable, 310 Lily, Capital,

320 Lily, Withdrawal, 410 Service I ncome, 430 Inte res t Income , 520 Salaries Expenses

530 Utiliti es Expenses , 540 Supplies Expense

2. Post the jour nal ent r ies to the l edger (us e T- Ac counts)

II. Analytica l Skill s: Unadjusted Trial B alance

George Handyman Services, has the f ollowing a ccount bala nce as of December 31, 2020 .

Account Payab le 3 2 ,000

Account Recei vable 320,000

Accumulat ed Depreciation 4 0 0,000

Building 500,000

Cash 970,000

Int ere st Expense 96,000

Land 700,000

Notes Payable 800,000

Owner’s Equit y 920,000

Prepaid Rent 50,000

Sal ari es Ex pense s 240,000

Ser vi ces Fees 796,000

Utiliti es Expenses 7 2,000

Requirements: Prepare unadjus ted tri al bala nce , Ma ke s ure to provide proper he ading f or the

report and prese nt t he account in t hei r correc t sequence.

THIS FORM IS FOR INSTITUTIONAL PURPOSES ONLY!

LEARNING ACTIVITY #0 6

Name: Score:

Program / Course: Class Schedule:

Year & Section: Contact No. / FB Account:

Residential Address:

Type of Activity (check or choose from below)

Concept Notes Laboratory Report Portfolio

Skills: Exercise / Drill Illustration Others:___________________

Activity Title : Recording Transactions in Ledger and Preparing a Trial Balance

Learning Target : _Post Transaction in ledger and Prepare unadjusted Trial Balance

References (Author, Title, and Pages) :_______________________________________________

Problem Solving : Posting & Unadjusted Trial Balance

Mr. Kim Taeyung has st art ed operating a se rvi ce bus ine ss i n 2020. His company, VTS Company is

engaged in providing ser vices to it s c lient. The f ollowing we re VTS Company’s tr ansa ctions in

May 2020.

May 1 Invest ed P700,000 in the busi ne ss

3 Went to various gover nment agencie s to regist er t he bus ine ss a nd paid P10,000.

6 Purchas ed supplies worth P100,000 paid in ca sh

7 Purchas ed supplies worth P20,000 on account

11 Rendered servi ces to various cl ient f or P60,000 received ca sh.

12 Rendered servi ces to various cl ient f or P20,000 on account.

14 Paid salar y of employee f or the f irst half of the month , P4,000.

17 Paid supplier half of the total amount in May 7 tra nsa c

21 Received promissory no te f rom the clie nt on Ma y 12 transa cti on, who wa s not able

to pay within 8 days f rom the date of the t ransa ction. Principal i s P20,000 wit h the

interest of P2,000

25 Recei ved payment on the promissor y note of May 21.

29 Purchas ed equipment wor th P100,000 by issui ng a promissory note

30 Paid the salar y of employee for the se cond half of the month, P4,000

31 Paid Meralco and Mayni lad f or utiliti es bill total ing P 5,000

Withdrew P12,000 f rom the busine ss f or personal use

Requirements :

1. J ournali ze t he above tr ansactions usi ng t he f ollowing ac count t itl es:

110 Cash 410 Servi ce Income

120 Accounts Receivab le 430 Int ere st Income

130 Notes Receivabl e 520 Salar ies Expense s

150 Supplies 530 Taxes and Li ce ns es Expenses

210 Accounts Payable 540 Supplies Expense

220 Notes Payable 55 0 Utilities Expens e

310 V, Capital

320 V, Withdrawal

2. Post the jour nal ent r ies to the l edger

3. Prepare the unadjusted tr ial bal ance.

THIS FORM IS FOR INSTITUTIONAL PURPOSES ONLY!

You might also like

- Audit of LiabilitiesDocument60 pagesAudit of LiabilitiesIvy Bautista67% (3)

- Sample Financial ENT600Document11 pagesSample Financial ENT600shazril93100% (1)

- Abm 1 Midterm Marlowne Brialle T. GalaponDocument9 pagesAbm 1 Midterm Marlowne Brialle T. GalaponCharles Elquime GalaponNo ratings yet

- FABM 1 - Contextualized LAS - Quarter 2 - Week 1bDocument12 pagesFABM 1 - Contextualized LAS - Quarter 2 - Week 1bSheila Marie Ann Magcalas-GaluraNo ratings yet

- Part 2 Basic Accounting Journalizing LectureDocument11 pagesPart 2 Basic Accounting Journalizing LectureKong Aodian100% (2)

- Chaper 4 Completing The Accounting CycleDocument41 pagesChaper 4 Completing The Accounting CycleAssassin ClassroomNo ratings yet

- 2nd-Quarter-L3-TRIAL-BALANCE_(2)(3)Document21 pages2nd-Quarter-L3-TRIAL-BALANCE_(2)(3)claudetteperez0508No ratings yet

- Fabm1 M7Document19 pagesFabm1 M7jsa.batiancilaNo ratings yet

- Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Firm (Part 1)Document35 pagesBusiness Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Firm (Part 1)Ponsica Romeo50% (2)

- Cash Flow StatementDocument59 pagesCash Flow StatementApple Crissa Mae Rejas100% (1)

- Senior High School Department: Quarter 3 - Module 11: Preparing Trial BalanceDocument8 pagesSenior High School Department: Quarter 3 - Module 11: Preparing Trial BalanceJaye RuantoNo ratings yet

- Management Accounting Versus Financial Accounting.: Takele - Fufa@aau - Edu.et...... orDocument6 pagesManagement Accounting Versus Financial Accounting.: Takele - Fufa@aau - Edu.et...... orDeselagn TefariNo ratings yet

- EOS Use of T AccountsDocument4 pagesEOS Use of T AccountsNoralyn DimnatangNo ratings yet

- Instructional Planning: Detailed Lesson Plan (DLP) FormatDocument6 pagesInstructional Planning: Detailed Lesson Plan (DLP) FormatDaisy PaoNo ratings yet

- ACCCOB1 Quiz 1 Monday Set A Answer Key PDFDocument4 pagesACCCOB1 Quiz 1 Monday Set A Answer Key PDFfanchasticommsNo ratings yet

- Assignment # 2 MBA Financial and Managerial AccountingDocument7 pagesAssignment # 2 MBA Financial and Managerial AccountingSelamawit MekonnenNo ratings yet

- Bookkeeping HandoutDocument10 pagesBookkeeping HandoutGierome Ian BisanaNo ratings yet

- GlobalisationDocument9 pagesGlobalisationMark Joseph TadeoNo ratings yet

- Foundation May 2018Document140 pagesFoundation May 2018multenplanintegratedltdNo ratings yet

- ABM 1 Q1-Week 8 For Teacher1Document14 pagesABM 1 Q1-Week 8 For Teacher1Kassandra Kay De Roxas100% (2)

- # 2 Assignment On Financial and Managerial Accounting For MBA StudentsDocument7 pages# 2 Assignment On Financial and Managerial Accounting For MBA Studentsobsa alemayehuNo ratings yet

- Service Bus - Acctg CycleDocument34 pagesService Bus - Acctg CycleJenniferNo ratings yet

- 1st AccDocument6 pages1st AccChristine PerezNo ratings yet

- Posting-and-Preparing-TBDocument33 pagesPosting-and-Preparing-TBaacunaNo ratings yet

- Analyzing, Recording, Posting and Trial Balance: Normal Balance of AccountsDocument6 pagesAnalyzing, Recording, Posting and Trial Balance: Normal Balance of AccountsMich Binayug100% (1)

- Manage Finances Within The BudgetDocument12 pagesManage Finances Within The BudgetEsteban BuitragoNo ratings yet

- Accounting ProcessDocument7 pagesAccounting ProcessLeenNo ratings yet

- Fabm1 M9Document13 pagesFabm1 M9jsa.batiancilaNo ratings yet

- 1 The Accounting Equation Accounting Cycle Steps 1 4Document6 pages1 The Accounting Equation Accounting Cycle Steps 1 4Jerric CristobalNo ratings yet

- CH.2 Part IDocument35 pagesCH.2 Part IthomasNo ratings yet

- Accounting CycleDocument33 pagesAccounting CycleKristelle JoyceNo ratings yet

- The Accounting CycleDocument21 pagesThe Accounting Cycleulquira grimamajowNo ratings yet

- Fabm1 Q3 M7 WK7 9 For DigitizedDocument16 pagesFabm1 Q3 M7 WK7 9 For Digitizedquaresmarenzel715No ratings yet

- AccountingDocument14 pagesAccountingKleint Tadem OcialNo ratings yet

- Fabm2 WK5Document4 pagesFabm2 WK5john lester pangilinanNo ratings yet

- Q3 Module 1Document15 pagesQ3 Module 1shamrockjusayNo ratings yet

- Worksheet 4 CFS Acctg 2Document12 pagesWorksheet 4 CFS Acctg 2Jennifer FabiaNo ratings yet

- Rac 101 - The Trial BalanceDocument12 pagesRac 101 - The Trial BalanceKevin TamboNo ratings yet

- Enclosure 1. Teacher-Made Learner's Home Task (Week 6) : 1. Official Receipt or Cash ReceiptDocument5 pagesEnclosure 1. Teacher-Made Learner's Home Task (Week 6) : 1. Official Receipt or Cash ReceiptKim FloresNo ratings yet

- MAY_23_PATHFINDER-FOUNDATION (1)Document99 pagesMAY_23_PATHFINDER-FOUNDATION (1)johnorunmuyiNo ratings yet

- Accounting Errors and Their CorrectionDocument32 pagesAccounting Errors and Their CorrectionmillzmartoNo ratings yet

- Fabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionDocument16 pagesFabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionJosephine C QuibidoNo ratings yet

- GR 08 Economic and Management Sciences Covid19 14 AugDocument11 pagesGR 08 Economic and Management Sciences Covid19 14 AugseripanafishaNo ratings yet

- Business FInance Week 3 and 4Document75 pagesBusiness FInance Week 3 and 4Hyakkima NasumeNo ratings yet

- ACT2111 - 2024 Chapter 2 LYF PDFDocument88 pagesACT2111 - 2024 Chapter 2 LYF PDFJessica AureliaNo ratings yet

- Anchal-Final SITXFIN008 AT2 ProjectDocument16 pagesAnchal-Final SITXFIN008 AT2 ProjectPrabina BajracharyaNo ratings yet

- Basic Accounting Lesson 7: Worksheet and Financial StatementsDocument33 pagesBasic Accounting Lesson 7: Worksheet and Financial StatementsGutierrez Ronalyn Y.No ratings yet

- Important Question For Class 11 Accountancy Chapter 11 - Accounts From Incomplete RecordsDocument8 pagesImportant Question For Class 11 Accountancy Chapter 11 - Accounts From Incomplete RecordsABHISHEK SINGHNo ratings yet

- Business FInance Week 3 and 4Document68 pagesBusiness FInance Week 3 and 4Jonathan De villa100% (1)

- Business FInance Week 5 and 6Document51 pagesBusiness FInance Week 5 and 6Jonathan De villa100% (1)

- Completing The Accounting CycleDocument9 pagesCompleting The Accounting CycleTikaNo ratings yet

- Week 5 - Sept 26-30 - AcctgDocument13 pagesWeek 5 - Sept 26-30 - Acctgmaria teresa aparreNo ratings yet

- Lesson 5 - Basic Financial Accounting & Reporting: Lesson 5 - 1 Recording Business TransactionsDocument7 pagesLesson 5 - Basic Financial Accounting & Reporting: Lesson 5 - 1 Recording Business TransactionsJulliene Sanchez DamianNo ratings yet

- Intermediate Acc 2201 Notes(4)Document100 pagesIntermediate Acc 2201 Notes(4)NiyonzimaNo ratings yet

- ANA-Module-4Document50 pagesANA-Module-4hrobertjohnNo ratings yet

- Act Module4 Cashflow Fabm 2 5.Document11 pagesAct Module4 Cashflow Fabm 2 5.DOMDOM, NORIEL O.No ratings yet

- M8 Correcting Closing Reversing Entries and Financial StatementsDocument10 pagesM8 Correcting Closing Reversing Entries and Financial StatementsMicha AlcainNo ratings yet

- Modyul 1 (Ikatlong Markahan)Document29 pagesModyul 1 (Ikatlong Markahan)delgadojudithNo ratings yet

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursFrom EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNo ratings yet

- LBO BBG ConsensusDocument17 pagesLBO BBG ConsensusGeoff HaireNo ratings yet

- 3Q 2018 KPAL Steadfast+Marine+TbkDocument82 pages3Q 2018 KPAL Steadfast+Marine+Tbkangga andi ardiansyahNo ratings yet

- Measurement Applications: David Chu Richard Persaud Jeffrey Rousset Stephen StoreyDocument46 pagesMeasurement Applications: David Chu Richard Persaud Jeffrey Rousset Stephen Storeyupi julaehaNo ratings yet

- EarningsQuality5 6 22Document530 pagesEarningsQuality5 6 22somigemysteriousNo ratings yet

- Finance ColgateDocument104 pagesFinance ColgatecharvitrivediNo ratings yet

- AA153501 1427378053 BookDocument193 pagesAA153501 1427378053 BooklentinieNo ratings yet

- Financial Accounting, 3e: Weygandt, Kieso, & KimmelDocument47 pagesFinancial Accounting, 3e: Weygandt, Kieso, & KimmelMichelleneChenTadleNo ratings yet

- Sample Construction Company Financial Statement and Supplentary Informantion For The Year Ended December 31, 2011Document26 pagesSample Construction Company Financial Statement and Supplentary Informantion For The Year Ended December 31, 2011Khalid MahmoodNo ratings yet

- Libby 4ce Solutions Manual - Ch03Document69 pagesLibby 4ce Solutions Manual - Ch037595522No ratings yet

- Summative Test For Acc 109Document8 pagesSummative Test For Acc 109mkrisnaharq99No ratings yet

- Corrales AAA CompanyDocument4 pagesCorrales AAA CompanyEthan Michael CorralesNo ratings yet

- FABM ACCOUNTING CYCLE SERVICE - Service BusinessDocument1 pageFABM ACCOUNTING CYCLE SERVICE - Service Businesskerue7000No ratings yet

- Sample Valuation-ModelDocument19 pagesSample Valuation-ModelG Sai KiranNo ratings yet

- The Accounting EquationDocument19 pagesThe Accounting EquationkristinejoycecamposNo ratings yet

- Statement of Comprehensive IncomeDocument8 pagesStatement of Comprehensive IncomeSalvie Angela Clarette UtanaNo ratings yet

- CH 07Document100 pagesCH 07SamiNaserNo ratings yet

- Financial Statements For REPUBLIC CEMENT CORP (RCM)Document10 pagesFinancial Statements For REPUBLIC CEMENT CORP (RCM)Pong BermejoNo ratings yet

- Chapter 2 QuestionsDocument23 pagesChapter 2 QuestionsSaleh AlzahraniNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisJasffer DebolgadoNo ratings yet

- Adjustments in Preparation of Financial StatementsDocument30 pagesAdjustments in Preparation of Financial StatementsAvirup ChakrabortyNo ratings yet

- QTTC KeyDocument20 pagesQTTC KeyThảo Uyên TrầnNo ratings yet

- Par CorDocument11 pagesPar CorIts meh Sushi100% (1)

- International Public Sector Accounting Standards (1)Document4 pagesInternational Public Sector Accounting Standards (1)assenmasudNo ratings yet

- Keppel Corporation - Buy: To Be A True ConglomerateDocument4 pagesKeppel Corporation - Buy: To Be A True ConglomerateJustinTangNo ratings yet

- Chap 3 CF1Document52 pagesChap 3 CF1Trà My PhạmNo ratings yet

- Following Expensess: Accountant CompanyDocument8 pagesFollowing Expensess: Accountant CompanyAravind ShekharNo ratings yet

- ACC101 - Accounting CycleDocument3 pagesACC101 - Accounting CycleJade PielNo ratings yet

- CH 1 Introduction To Financial AccountingDocument14 pagesCH 1 Introduction To Financial AccountingMohammed Abdul MajeedNo ratings yet

- CASE QP -ACCOUNTANCY - modifed 1st option (2)Document12 pagesCASE QP -ACCOUNTANCY - modifed 1st option (2)jaydenshibuuNo ratings yet