1008_GPAC_I_233706

1008_GPAC_I_233706

Uploaded by

ssecnwpryjmnpCopyright:

Available Formats

1008_GPAC_I_233706

1008_GPAC_I_233706

Uploaded by

ssecnwpryjmnpCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

1008_GPAC_I_233706

1008_GPAC_I_233706

Uploaded by

ssecnwpryjmnpCopyright:

Available Formats

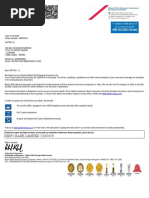

GROUP PERSONAL ACCIDENT INSURANCE POLICY

Certificate of Insurance

Policyholder ID: C000033719 Master Policy No: 27100000001

Mr. Dinesh Singh Certificate No: 016586

House No 443, Ews Neem Sarai, Policy Period: From 10:00 on 31/01/2018 To

Allahabad, Uttar Pradesh, midnight of 30/01/2023

Nr St Vishna School,, Allahabad Policy Type: Individual

Allahabad-211011 UIN of the Product: DHFPAGP18028V011718

Allahabad - Uttar Pradesh

Mobile No: 7525001560

Insurance Agent/Intermediary Details

Insurance Agent/Intermediary Code P020001000

Insurance Agent/Intermediary Name M/s Dewan Housing Finance Corporation Ltd

Insurance Agent/Intermediary Contact No. 180030001919

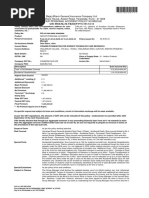

Insured Person’s Details

Member ID Insured Person Name Relationship to Primary Insured Sum Insured

42652/01 Mr. Dinesh Singh Self ` 1,600,000.00

Member ID Date of Birth Age Nominee Name Assignee Name

42652/01 20/01/1984 34 Sumitra SINGH DHFL

Net Premium ` 4,320.40

IGST @ 18% ` 777.60

Total Premium ` 5,098.00

This certificate is subject to master policy terms & conditions issued to M/s Dewan Housing Finance Corporation Ltd

Place: Mumbai For & on behalf of DHFL General Insurance Ltd.

Date: 01/02/2018

Authorized Signatory

Policy Service Office 2nd Floor, DHFL House, 19, Sahar Road, Off Western Express Highway, Vile Parle (East), Mumbai

Mumbai Maharashtra 400099

Stamp Duty The Stamp Duty of ` 80.00 paid vide defaced no: 0002942153201718 dated: 11/09/2017

GST Details

Customer GSTIN Number HSN Number 9971

Place of Supply Allahabad State Code UP00

IRDAI Registration Number: 155 CIN: U66000MH2016PLC283275 GSTIN: 27AAFCD7985H1Z4 Page 1

Note

1. Any GST charged on the said premium will be refunded in accordance with the GST provisions as applicable on the said date. Further,

wherever the GST amount is refunded for which input tax credit was availed by the Customer, the same shall be reversed by the

Customer on receipt of the Credit Note. In case the tax deduction entitled to DHFL-GI on account of such refund is disallowed due to

non-reversal of input tax credit by the customer, the said tax portion should be separately recoverable (along with interest) from the

Customer. Premium refund requests received after September following the financial year in which the policy was issued will be

processed exclusive of GST.

2. This document qualifies as a tax invoice for the purpose of the GST Legislation.

3. Whether GST payable under reverse charge basis: No.

Important Note

This Certificate, Policy terms and conditions and Endorsement shall be read together and word or expression to which a specific meaning

has been attached in any part of this Policy or of the Schedule shall bear the same meaning wherever it may appear. Any

amendments/modifications/alterations made on this system generated policy document is not valid and Company shall not be liable for

any liability whatsoever arising from such changes. Any changes required to be made in the policy once issued, would be valid and

effective, only after written request is made to the Company and Company accepts the requested amendments/modifications/alterations

and records the same through separate endorsement to be issued by the Company. Our grievance redressal procedure and details about

ombudsman is also available in our policy wording. Please note that any misrepresentation, non-disclosure or withholding of material facts

will lead to cancellation of policy ab-initio with forfeiture of premium and non-consideration of claim, if any.

Coverage Details

Coverage Sum Insured & Limits

Accidental Death ` 1,600,000.00

Accidental Permanent Total Disability ` 1,600,000.00

Child Tuition Benefit ` 20,000.00

Claim Payout Option: 100% Lumpsum

Claim Procedure

1. Notify the claim to Us either at Call Centre toll free no. 1800 123 0004 or in email within 7 days of claim occurrence at

mycare@dhflinsurance.com

2. Submit the documents within 30 days of date of occurrence of an accident.

3. Documents to be submitted are - (1) Duly filled & signed claim form (2) Copy of FIR/ Panchnama /Police Inquest Report (if conducted)

(3) Copy of Death Certificate (4) Copy of Post Mortem, if conducted (5) Disability Certificate (6) Any other document as requested by

Claims official.

4. Claim shall be settled/rejected within 30 days of the receipt of the last “necessary” documents or 45 days in case where We have

initiated investigation.

5. In case of delay in the payment beyond the stipulated timelines, We shall be liable to pay interest at a rate of two percent (2%) above

the Bank Rate from the receipt of the last relevant document from the insured /claimant by insurer till the date of actual payment.

Important Exclusions/Conditions

1. We will not make any payment under this policy howsoever attributable to -

• any Pre-existing Condition(s) / disability, any complication arising from it

• suicide or attempted suicide, intentionally self inflicted Injury or Illness, acts of self-destruction whether the Insured Person is

medically sane or insane

• being under the influence of drugs, alcohol, or other intoxicants or hallucinogens

• participation in an actual or attempted felony, riot, crime, misdemeanor, or civil commotion

• ionizing radiation or contamination by radioactivity from any nuclear fuel or from any nuclear waste from burning nuclear fuel.

2. The Certificate of Insurance shall be void and all premium paid shall be forfeited to Us, in the event of misrepresentation, mis-

description or non-disclosure of any material fact, fraud or non cooperation of the insured.

3. The Certificate of insurance is renewable subject to the renewal premium being paid and the Group Policy is in force, on or before the

renewal due date. On renewal the benefits provided under the policy and/or terms and conditions of the policy including premium rate

may be subject to change. Grace period of 30 days is allowed for renewal of the policy.

4. The insured covered under this Group Personal Accident Insurance Policy can opt to migrate to a suitable Individual Personal Accident

Policy offered by Us. The member shall apply for portability at least 45 days before the premium renewal date.

5. Product will be withdrawn after approval from IRDAI. In such a case, we will inform the Group Organiser/ Administrator.

For policies which fall due for renewal within 15 days from the date of withdrawal – There will be one time option for the Group

Administrator to renew the existing policy with Us or migrate to modified or new similar health insurance policy with Us.

IRDAI Registration Number: 155 CIN: U66000MH2016PLC283275 GSTIN: 27AAFCD7985H1Z4 Page 2

For policies which fall due for renewal after fifteen (15) days from the date of withdrawal – The only option will be to migrate to modified

or new similar health insurance policy with Us.

You will have an option to opt for similar health insurance policy with Us subject to Portability norms in vogue.

6. You may request to cancel this Certificate of Insurance by sending 15 days notice in writing to Us. We shall refund the amount post

retention of the premium (as per the short period table) for the period the policy has been in force. However, in case of claim in the

policy, there will be no refund of premium.

IRDAI Registration Number: 155 CIN: U66000MH2016PLC283275 GSTIN: 27AAFCD7985H1Z4 Page 3

You might also like

- Auto Insurance Policy Amended Declarations: Named Insured VehiclesDocument2 pagesAuto Insurance Policy Amended Declarations: Named Insured VehiclesSMART CHOICE AUTO GROUPNo ratings yet

- PDF Task 1.CS243 Credit Card Authorization Form - Vaug2024Document2 pagesPDF Task 1.CS243 Credit Card Authorization Form - Vaug2024keshiahorNo ratings yet

- Inspection ReportsDocument9 pagesInspection Reportsratnesh811100% (1)

- Continuing Care Advisory Council (CCAC) Meeting MaterialsDocument100 pagesContinuing Care Advisory Council (CCAC) Meeting MaterialsPhil AmmannNo ratings yet

- Consolidated Shipping Line-Shipping CompanyDocument23 pagesConsolidated Shipping Line-Shipping CompanyConsolidated Shipping LineNo ratings yet

- 2865100829755704000Document11 pages2865100829755704000balakrishnan.soundararajanNo ratings yet

- Policy 85769629 27062024Document4 pagesPolicy 85769629 27062024faisalshaikh91422No ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance PolicyNerissa JainNo ratings yet

- SHILA CHOUDHARY-HEALTHDocument5 pagesSHILA CHOUDHARY-HEALTHeshwarj002No ratings yet

- PolicyDocument4 pagesPolicyAk RajaNo ratings yet

- Document (2)Document3 pagesDocument (2)austinovilla2No ratings yet

- HEALTHDocument4 pagesHEALTHpj14061986No ratings yet

- Certificate of InsuranceDocument4 pagesCertificate of InsuranceBhoomika MahardaNo ratings yet

- Group Activ Health - Certificate of Insurance: Insured Person DetailDocument12 pagesGroup Activ Health - Certificate of Insurance: Insured Person DetailchovvNo ratings yet

- Policy CertificateDocument5 pagesPolicy CertificateSITESH SINGHNo ratings yet

- Certificate of InsuranceDocument4 pagesCertificate of InsuranceAnilkumar HeggalagiNo ratings yet

- 202411260323362_bdfe7138-fcbb-4c66-b693-6d4b925e4540_dsDocument8 pages202411260323362_bdfe7138-fcbb-4c66-b693-6d4b925e4540_dslokeshp2430No ratings yet

- Shubham Kalbhor HealthDocument5 pagesShubham Kalbhor Healthpj14061986No ratings yet

- JB503916 Bab2c NB 00 20201209164847 1Document10 pagesJB503916 Bab2c NB 00 20201209164847 1SatishSubramanianNo ratings yet

- Saurabh Kumar Singh House No 505, Post Officebasantpur, Near Hanuman Mandir, Basantpur, Ballia, UTTAR PRADESH-277301 MOBILE NUMBER: 8354953469Document33 pagesSaurabh Kumar Singh House No 505, Post Officebasantpur, Near Hanuman Mandir, Basantpur, Ballia, UTTAR PRADESH-277301 MOBILE NUMBER: 8354953469Saurabh Kumar SinghNo ratings yet

- Certificate of InsuranceDocument4 pagesCertificate of InsuranceChandra SekharNo ratings yet

- Personal Loan Policy ScheduleDocument6 pagesPersonal Loan Policy Scheduleakmishra1501No ratings yet

- 29-08-2023 - Registrar Cir - Insurance Details - 443576221 - 1Document3 pages29-08-2023 - Registrar Cir - Insurance Details - 443576221 - 1GALLA SSHNo ratings yet

- ParentsDocument2 pagesParentssameo13No ratings yet

- MN240617070711864Document4 pagesMN240617070711864eshwarj002No ratings yet

- RAM KUMAR GUPTA POLICYDocument6 pagesRAM KUMAR GUPTA POLICYsilverspringventureNo ratings yet

- Sbi Term InsuranceDocument3 pagesSbi Term Insurancevenkat.bathemNo ratings yet

- 101 Math Short Cuts (WWW - Qmaths.in)Document1 page101 Math Short Cuts (WWW - Qmaths.in)moin khanNo ratings yet

- PolicyDocument3 pagesPolicymrkd3633No ratings yet

- HDFCGA0312202100003212Document8 pagesHDFCGA0312202100003212Dhanush Shiva Dollaiah0% (1)

- Reliance Covid-19 Indemnity Policy-Certificate of InsuranceDocument5 pagesReliance Covid-19 Indemnity Policy-Certificate of InsurancePavan Kalyan UngaralaNo ratings yet

- JeevanBeema AkashDocument2 pagesJeevanBeema Akashakashuniversal20No ratings yet

- Intermediary Details Name Code Contact Number Care Health Insurance Ltd. Direct 1800-102-6655Document4 pagesIntermediary Details Name Code Contact Number Care Health Insurance Ltd. Direct 1800-102-6655ajayNo ratings yet

- MN240617070695810Document4 pagesMN240617070695810eshwarj002No ratings yet

- care healthDocument6 pagescare healthsaicool236No ratings yet

- Personal Accidental Insurance CertificateDocument4 pagesPersonal Accidental Insurance CertificateDivy Ayush KumarNo ratings yet

- JeevanBeema9 4 2023Document2 pagesJeevanBeema9 4 2023Mr. PerfectNo ratings yet

- Manindha InsuranceDocument4 pagesManindha InsuranceRevanth RajNo ratings yet

- Certificate of Insurance - 20!06!59Document3 pagesCertificate of Insurance - 20!06!59Patel SunilkumarNo ratings yet

- SBI Sampoorn SurakshaDocument8 pagesSBI Sampoorn SurakshaRon RoyNo ratings yet

- Certificate of Insurance: Magma HDI General Insurance Company LimitedDocument4 pagesCertificate of Insurance: Magma HDI General Insurance Company Limitedjavid2020shaikhNo ratings yet

- Your Optima Restore Floater Policy: Certificate For The Purpose of Deduction Under Section 80 D of Income Tax Act, 1961Document4 pagesYour Optima Restore Floater Policy: Certificate For The Purpose of Deduction Under Section 80 D of Income Tax Act, 1961dtp3.futuristicNo ratings yet

- Group Medicare Certificate of InsuranceDocument12 pagesGroup Medicare Certificate of InsuranceMallikarjunayya HiremathNo ratings yet

- Features of ICICI Pru Saral Jeevan BimaDocument2 pagesFeatures of ICICI Pru Saral Jeevan BimaAshok GNo ratings yet

- PMJJBY_COIDocument2 pagesPMJJBY_COIakshay jondhaleNo ratings yet

- Insurance Premium Payment Certification: E-Policy ServiceDocument2 pagesInsurance Premium Payment Certification: E-Policy ServiceMuntana TewpaingamNo ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument13 pagesRenewal of Your Optima Restore Floater Insurance Policysiddharth.bangani4294No ratings yet

- Certificate of InsuranceDocument4 pagesCertificate of Insurancekvinoth22No ratings yet

- AckoPolicy-GwUG2UpoPpr2-SFrIXoFagDocument5 pagesAckoPolicy-GwUG2UpoPpr2-SFrIXoFagrktelecom255No ratings yet

- Surya PDFDocument3 pagesSurya PDFBesan LaduNo ratings yet

- Pai Proposal Form-1Document2 pagesPai Proposal Form-1praveenaNo ratings yet

- Yogesh - Self Insurance (1) (1)Document3 pagesYogesh - Self Insurance (1) (1)aishu.riya26No ratings yet

- Group Mediprime Certificate of Insurance: 380-Bsa-Dn188271Document4 pagesGroup Mediprime Certificate of Insurance: 380-Bsa-Dn188271Sangwan ParveshNo ratings yet

- Max Life Group Credit Life Secure Policy Document v1Document19 pagesMax Life Group Credit Life Secure Policy Document v1Amit VermaNo ratings yet

- Personal Accident InsuranceDocument3 pagesPersonal Accident Insuranceramlakhanbaiga8No ratings yet

- GEMI Application Form - Two Wheeler LoansDocument5 pagesGEMI Application Form - Two Wheeler LoansLuckyNo ratings yet

- GurbaniDocument4 pagesGurbanimeetu2102No ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance PolicyShashank SinghNo ratings yet

- 4154_369754690_00_000Document12 pages4154_369754690_00_000S P SpNo ratings yet

- ACFrOgAhxVOA9CreROm9T93sWzO_63zk3MgYT1DV_utr-ItpiTF8ktbf2y3Uh2Yooqpa2QUEINTKSwZDm7Q_RaiDavN5afwSqSJqB07mysh1LvyxDoZryBBSMUUp1hiOhHBkKRgDHBatUgPgbDFH4nxcGux4SYCZNlku7VqOew==-2Document44 pagesACFrOgAhxVOA9CreROm9T93sWzO_63zk3MgYT1DV_utr-ItpiTF8ktbf2y3Uh2Yooqpa2QUEINTKSwZDm7Q_RaiDavN5afwSqSJqB07mysh1LvyxDoZryBBSMUUp1hiOhHBkKRgDHBatUgPgbDFH4nxcGux4SYCZNlku7VqOew==-2Tushar AggarwalNo ratings yet

- 42404461Document5 pages42404461tyagishahroof786No ratings yet

- Policy Contract - Kotak Micro Insurance Plan - June 5 2015Document3 pagesPolicy Contract - Kotak Micro Insurance Plan - June 5 2015Anshu GoelNo ratings yet

- Health insurance copyDocument8 pagesHealth insurance copyvishnu.somanNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- Cofmow compendium 2020-21 (1)Document35 pagesCofmow compendium 2020-21 (1)ssecnwpryjmnp100% (1)

- EH185126150183Document1 pageEH185126150183ssecnwpryjmnpNo ratings yet

- Annexure A condemnationDocument1 pageAnnexure A condemnationssecnwpryjmnpNo ratings yet

- Condemnation policyDocument1 pageCondemnation policyssecnwpryjmnpNo ratings yet

- Specification Hyd Lifting TableDocument1 pageSpecification Hyd Lifting TablessecnwpryjmnpNo ratings yet

- Company Tax - Practice QuestionsDocument7 pagesCompany Tax - Practice Questionstladitebo007No ratings yet

- InsuranceDocument1 pageInsuranceravi shawNo ratings yet

- P.D. No. 1897Document2 pagesP.D. No. 1897ocampo_louieNo ratings yet

- United States Court of Appeals Tenth CircuitDocument5 pagesUnited States Court of Appeals Tenth CircuitScribd Government DocsNo ratings yet

- Vehicle Book3 PDFDocument54 pagesVehicle Book3 PDFAdriya Fellis FurnandaceNo ratings yet

- Cma Inter - Corporate Accounts Marathon NotesDocument50 pagesCma Inter - Corporate Accounts Marathon NotesCreation of MoneyNo ratings yet

- Phil-Am Gen Insurance Co. Vs Ramos GR No. L-20978Document2 pagesPhil-Am Gen Insurance Co. Vs Ramos GR No. L-20978Celver Joy Gaviola TampariaNo ratings yet

- Bi 17ubi305 - Corporate AccountingDocument18 pagesBi 17ubi305 - Corporate AccountingJmzkx SjxxkNo ratings yet

- National Steel Corporation V. Court of Appeals G.R. No. 112287 December 12, 1997 Panganiban, J. DoctrineDocument12 pagesNational Steel Corporation V. Court of Appeals G.R. No. 112287 December 12, 1997 Panganiban, J. DoctrineIt'sRalph MondayNo ratings yet

- The Magnacarta For Public School Teachers v.1Document70 pagesThe Magnacarta For Public School Teachers v.1France BejosaNo ratings yet

- 10 - Mixed Cash Flows and AnnuitiesDocument4 pages10 - Mixed Cash Flows and AnnuitiesAli AfzalNo ratings yet

- Drill On Gross Income Suggested AnswersDocument5 pagesDrill On Gross Income Suggested AnswersAngel HiaviaNo ratings yet

- Invest Ease RegistrationDocument3 pagesInvest Ease Registrationsivasri999No ratings yet

- NYS Comptroller - Wayne Cty. Healthcare EligibilityDocument14 pagesNYS Comptroller - Wayne Cty. Healthcare EligibilityerikvsorensenNo ratings yet

- City of Cleveland Pothole Claim FormDocument5 pagesCity of Cleveland Pothole Claim FormKaylyn ReneeNo ratings yet

- Income Tax June 2023-Dec 2020Document116 pagesIncome Tax June 2023-Dec 2020binuNo ratings yet

- P-6 Aset TetapDocument65 pagesP-6 Aset TetapRaehan RaesaNo ratings yet

- Analysis of Insurance ContractsDocument11 pagesAnalysis of Insurance ContractsSunny SunnyNo ratings yet

- All Products August 2020 Pay Out Structure CAT ADocument21 pagesAll Products August 2020 Pay Out Structure CAT ANiPPUN BHARDWAJNo ratings yet

- Selamat Di Zurich Syariah: BergabungDocument3 pagesSelamat Di Zurich Syariah: BergabungdarningbaturajaNo ratings yet

- Price List 01.07.2023Document2 pagesPrice List 01.07.2023ParakhModyNo ratings yet

- ГрафікиDocument4 pagesГрафікиТетяна Леонідівна МешкоNo ratings yet

- Commission: RS-2023-003 ('Setting CLDocument2 pagesCommission: RS-2023-003 ('Setting CLiccebuNo ratings yet

- Audit Liability 09 Chapter 7Document2 pagesAudit Liability 09 Chapter 7Ma Teresa B. CerezoNo ratings yet

- Request For Proposal (RFP) Owner'S Representation/Project ManagerDocument13 pagesRequest For Proposal (RFP) Owner'S Representation/Project ManagerAnwarNo ratings yet

- J Care Rate Card Revamped - 23Document6 pagesJ Care Rate Card Revamped - 23zemmyNo ratings yet