W2 (2)

W2 (2)

Uploaded by

fedex01246Copyright:

Available Formats

W2 (2)

W2 (2)

Uploaded by

fedex01246Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

W2 (2)

W2 (2)

Uploaded by

fedex01246Copyright:

Available Formats

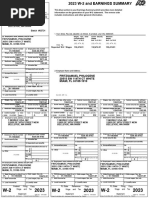

a. Employee's Social Security Number OMB No.

1545-0008

245-67-7624

b. Employer's Identification Number (EIN) d. Control number 1 Wages, Tips, and other compensation 2 Federal Income Tax withheld

35-9990000 28891.68 2816.64

c. Employer's Name, Address, and ZIP Code 3 Social Security Wages 4 Social Security Tax withheld

DFAS ATTN:DFASIN/JAREA 29077.60 1802.81

8899 EAST 56TH STREET 5 Medicare Wages and Tips 6 Medicare Tax withheld

INDIANAPOLIS IN 46249-2410 29077.60 421.63

7 Social Security tips 8 Allocated Tips

e/f. Employee's Name, Address, and ZIP Code 9 10 Dependent Care Benefits

RACHELLE S FOREHAND

TP10VF1K 3891 12 See instructions for box 12 14 See instructions for box 14

D 19 145.92

13

Statutory Retirement Third-party

Employee Plan sick pay

15 State Employer's State ID Number 16 State Wages, Tips, etc 17 State Income Tax 18 Local wages, tips, etc 19 Local Income Tax 20 Locality name

NY 359990000 28891.68 1103.95

15 State Employer's State ID Number 16 State Wages, Tips, etc 17 State Income Tax 18 Local wages, tips, etc 19 Local Income Tax 20 Locality name

Wage and Tax Department of the Treasury - Internal Revenue Service

Form

W-2 Statement 2019 Copy B To Be Filed With Employee's FEDERAL Tax Return

This information is being furnished to the Internal Revenue Service

a. Employee's Social Security Number OMB No. 1545-0008 This information is being furnished to the Internal Revenue Service. If you are required to file a tax

245-67-7624 return, a negligence penalty or other sanction may be imposed on you if this income is taxable and you fail to report it.

b. Employer's Identification Number (EIN) d. Control Number 1 Wages, Tips, other compensation 2 Federal Income Tax withheld

35-9990000 28891.68 2816.64

c. Employer's Name, Address, and ZIP Code 3 Social Security Wages 4 Social Security Tax withheld

DFAS ATTN:DFASIN/JAREA 29077.60 1802.81

8899 EAST 56TH STREET 5 Medicare Wages and Tips 6 Medicare Tax withheld

INDIANAPOLIS IN 46249-2410 29077.60 421.63

7 Social Security tips 8 Allocated Tips

e/f. Employee's Name, Address, and ZIP Code 9 10 Dependent Care Benefits

RACHELLE S FOREHAND

TP10VF1K 3891 12 See instructions for box 12 14 See instructions for box 14

D 19 145.92

13

Statutory Retirement Third-party

Employee Plan sick pay

15 State Employer's State ID Number 16 State Wages, Tips, etc 17 State Income Tax 18 Local wages, tips, etc 19 Local Income Tax 20 Locality name

NY 359990000 28891.68 1103.95

15 State Employer's State ID Number 16 State Wages, Tips, etc 17 State Income Tax 18 Local wages, tips, etc 19 Local Income Tax 20 Locality name

Department of the Treasury - Internal Revenue Service

Wage and Tax

Form

W-2 Statement

2019 Copy C For EMPLOYEE'S RECORDS (See Notice to Employee on Back of Copy B)

a. Employee's Social Security Number OMB No. 1545-0008

245-67-7624

b. Employer's Identification Number (EIN) d. Control number 1 Wages, Tips, and other compensation 2 Federal Income Tax withheld

35-9990000 28891.68 2816.64

c. Employer's Name, Address, and ZIP Code 3 Social Security Wages 4 Social Security Tax withheld

DFAS ATTN:DFASIN/JAREA 29077.60 1802.81

8899 EAST 56TH STREET 5 Medicare Wages and Tips 6 Medicare Tax withheld

INDIANAPOLIS IN 46249-2410 29077.60 421.63

7 Social Security tips 8 Allocated Tips

e/f. Employee's Name, Address, and ZIP Code 9 10 Dependent Care Benefits

RACHELLE S FOREHAND

TP10VF1K 3891 12 See instructions for box 12 14 See instructions for box 14

D 19 145.92

13 Statutory Retirement Third-party

Employee Plan sick pay

15 State Employer's State ID Number 16 State Wages, Tips, etc 17 State Income Tax 18 Local wages, tips, etc 19 Local Income Tax 20 Locality name

NY 359990000 28891.68 1103.95

15 State Employer's State ID Number 16 State Wages, Tips, etc 17 State Income Tax 18 Local wages, tips, etc 19 Local Income Tax 20 Locality name

Wage and Tax Department of the Treasury - Internal Revenue Service

Form

W-2 Statement 2019 Copy 2 To Be Filed With Employee's State, City, or Local Income Tax Return

a. Employee's Social Security Number OMB No. 1545-0008

245-67-7624

b. Employer's Identification Number (EIN) d. Control Number 1 Wages, Tips, other compensation 2 Federal Income Tax withheld

35-9990000 28891.68 2816.64

c. Employer's Name, Address, and ZIP Code 3 Social Security Wages 4 Social Security Tax withheld

DFAS ATTN:DFASIN/JAREA 29077.60 1802.81

8899 EAST 56TH STREET 5 Medicare Wages and Tips 6 Medicare Tax withheld

INDIANAPOLIS IN 46249-2410 29077.60 421.63

7 Social Security tips 8 Allocated Tips

e/f. Employee's Name, Address, and ZIP Code 9 10 Dependent Care Benefits

RACHELLE S FOREHAND

TP10VF1K 3891 12 See instructions for box 12 14 See instructions for box 14

D 19 145.92

13 Statutory Retirement Third-party

Employee Plan sick pay

15 State Employer's State ID Number 16 State Wages, Tips, etc 17 State Income Tax 18 Local wages, tips, etc 19 Local Income Tax 20 Locality name

NY 359990000 28891.68 1103.95

15 State Employer's State ID Number 16 State Wages, Tips, etc 17 State Income Tax 18 Local wages, tips, etc 19 Local Income Tax 20 Locality name

Department of the Treasury - Internal Revenue Service

Wage and Tax

Form

W-2 Statement

2019 Copy 2 To Be Filed With Employee's State, City, or Local Income Tax Return

Notice to Employee

Do you have to file? Refer to the Form 1040 Instructions Be sure to get your copies of Form W-2c from your

to determine if you are required to file a tax return. Even if employer for all corrections made so you may file them

you do not have to file a tax return, you may be eligible for with your tax return. If your name and SSN are correct but

a refund if box 2 shows an amount or if you are eligible for are not the same as shown on your social security card,

any credit. you should ask for a new card that displays your correct

name at any SSA office or by calling 1-800-772-1213. You

Earned income credit (EIC). You may be able to take the

EIC for 2018 if your adjusted gross income (AGI) is less also may visit the SSA at www.SSA.gov.

than a certain amount. The amount of the credit is based Cost of employer-sponsored health coverage (if such

on income and family size. Workers without children could cost is provided by the employer). The reporting in box

qualify for a smaller credit. You and any qualifying children 12, using code DD, of the cost of employer-sponsored

must have valid social security numbers (SSNs). You health coverage is for your information only. The amount

cannot take the EIC if your investment income is more than reported with code DD is not taxable.

the specified amount for 2018 or if income is earned for

Credit for excess taxes. If you had more than one

services provided while you were an inmate at a penal

employer in 2018 and more than $7,960.80 in social

institution. For 2018 income limits and more information,

security and/or Tier 1 railroad retirement (RRTA) taxes

visit www.irs.gov/eitc. Also see Pub. 596, Earned Income

were withheld, you may be able to claim a credit for the

Credit. Any EIC that is more than your tax liability is

excess against your federal income tax. If you had more

refunded to you, but only if you file a tax return.

than one railroad employer and more than $4,674.60 in

Corrections. If your name, SSN, or address is incorrect, Tier 2 RRTA tax was withheld, you also may be able to

correct Copies B, C, and 2 and ask your employer to claim a credit. See your Form 1040 or Form 1040A

correct your employment record. Be sure to ask the instructions and Pub. 505, Tax Withholding and Estimated

employer to file Form W-2c, Corrected Wage and Tax Tax.

Statement, with the Social Security Administration (SSA) (Also see Instructions for Employee on the back of Copy C.)

to correct any name, SSN, or money amount error

reported to the SSA on Form W-2.

Instructions for Employee (Also see Notice to Employee M - Uncollected Social Security or RRTA tax on taxable cost of group-term life

insurance over $50,000 (former employees only). See “Other Taxes” in the Form

on the back of Copy B.) 1040 instructions.

Box 1. Enter this amount on the wages line of your tax return. N - Uncollected Medicare tax on taxable cost of group-term life insurance over

Box 2. Enter this amount on the federal income tax withheld line of your tax $50,000 (former employees only). See “Other Taxes” in the Form 1040

return. instructions.

Box 5. You may be required to report this amount on Form 8959, Additional P - Excludable moving expense reimbursements paid directly to member of

Medicare Tax. See Form 1040 instructions to determine if you are required to Armed Forces (not included in boxes 1, 3, or 5).

complete Form 8959. Q - Nontaxable combat pay. See the instructions for Form 1040 or Form 1040A

Box 6. This amount includes the 1.45% Medicare Tax withheld on all Medicare for details on reporting this amount.

wages and tips shown in box 5, as well as the 0.9% Additional Medicare Tax on R - Employer contributions to your Archer MSA. Report on Form 8853, Archer

any of those Medicare wages and tips above $200,000. MSAs and Long-Term Care Insurance Contracts.

Box 8. This amount is not included in boxes 1, 3, 5, or 7. For information on S - Employee salary reduction contributions under a section 408(p) SIMPLE

how to report tips on your tax return, see your Form 1040 instructions. plan (not included in box 1).

You must file Form 4137, Social Security and Medicare Tax on Unreported Tip T - Adoption benefits (not included in box 1). Complete Form 8839, Qualified

Income, with your income tax return to report at least the allocated tip amount Adoption Expenses, to compute any taxable and nontaxable amounts.

unless you can prove that you received a smaller amount. If you have records W - Employer contributions (including amounts the employee elected to

that show the actual amount of tips you received, report that amount even if it is contribute using a section 125 (cafeteria) plan) to your health savings account.

more or less than the allocated tips. On Form 4137 you will calculate the social Report on Form 8889, Health Savings Accounts (HSAs).

security and Medicare tax owed on the allocated tips shown on your Form(s)

AA - Designated Roth contributions under a section 401(k) plan.

W-2 that you must report as income and on other tips you did not report to your

employer. By filing Form 4137, your social security tips will be credited to your BB - Designated Roth contributions under a section 403(b) plan.

social security record (used to figure your benefits). DD - Cost of employer-sponsored health coverage. The amount reported with

Box 10. This amount includes the total dependent care benefits that your Code DD is not taxable.

employer paid to you or incurred on your behalf (including amounts from a EE - Designated Roth contributions under a governmental section 457(b) plan.

section 125 (cafeteria) plan). Any amount over $5,000 is also included in box 1. This amount does not apply to contributions under a tax-exempt organization

Complete Form 2441, Child and Dependent Care Expenses, to compute any section 457(b) plan.

taxable and nontaxable amounts. Box 13. If the “Retirement plan” box is checked, special limits may apply to the

Box 12. The following list explains the codes shown in box 12. You may need amount of traditional IRA contributions you may deduct. See Pub. 590-A,

this information to complete your tax return. Elective deferrals (codes D, E, F Contributions to Individual Retirement Arrangements (IRAs).

and S) and designated Roth contributions (codes AA, BB and EE) under all Box 14. Any amount in box 14 should be coded. The following explains the

plans are generally limited to a total of $18,500 ($12,500 if you only have codes.

SIMPLE plans, $21,500 for section 403(b) plans, if you qualify for the 15-year C - Taxable reimbursements for Permanent Change of Station (Included in Box 1)

rule explained in Pub. 571). E - Military TSP Contribution (Tax Exempt)

However, if you were at least age 50 in 2018, your employer may have allowed F - TIAA/CREF and Fidelity Retirement Contributions

an additional deferral of up to $6,000 ($3,000 for section 401(k)(11) and 408(p) G - Pre-Tax Transportation Equity Act Benefits

SIMPLE plans). This additional deferral amount is not subject to the overall limit

H - Home to Work Transportation Fringe Benefits. (Included in Box 1)

on elective deferrals. Contact your plan administrator for more information.

Amounts in excess of the overall elective deferral limit must be included in K - Pretax Vision and Dental Deduction

income. See the "Wages, Salaries, Tips, etc." line instructions for Form 1040. P - Parking Fringe Benefits/Employer Provided Vehicle. (Included in Box 1)

Note: If a year follows code D through H, S, Y, AA, BB or EE, you made a R - Retirement Deductions. (for Civilian Employees who have wages earned in

make-up pension contribution for a prior year(s) when you were in military Puerto Rico)

service. To figure whether you made excess deferrals, consider these amounts S - Federal Employee Health Benefit employee deduction for Civilian

for the year shown, not the current year. If no year is shown, the contributions Employees who have wages earned in Puerto Rico.

are for the current year. Your employer does not use codes G, H, K, V, Y, Z, FF, T - Cost of Living Allowance not included in box 1 or 16 for Civilian Employees

GG, HH. who have COLA included for wages in Alaska, Hawaii, Guam and the Northern

A - Uncollected social security or RRTA tax on tips. Include this tax on Form Mariana Islands, Puerto Rico and the U.S. Virgin Islands

1040. See "Other Taxes" in the Form 1040 instructions. U - Non-Cash Fringe Benefits (Included in Box 1)

B - Uncollected Medicare tax on tips. Include this tax on Form 1040. See "Other V - Pretax FEHB Incentive

Taxes" in the Form 1040 instructions. X - Occupational Tax/Local Services Tax (CIVILIAN)

C - Taxable cost of group-term life insurance over $50,000 (included in boxes 1, Y - Pretax Flexible Spending Accounts (CIVILIAN) Employee Contributions

3 (up to social security wage base), and 5).

Z - Retirement Deductions for Massachusetts Residents Only

D - Elective deferrals to a section 401(k) cash or deferred arrangement. Also

Note: Keep Copy C of Form W-2 for at least 3 years after the due date for filing

includes deferrals under a SIMPLE retirement account that is part of a section

your income tax return. However, to help protect your social security

401(k) arrangement.

benefits, keep Copy C until you begin receiving social security benefits, just in

E - Elective deferrals under a section 403(b) salary reduction agreement. case there is a question about your work record and/or earnings in a particular

F - Elective deferrals under a section 408(k)(6) salary reduction SEP. year.

J - Nontaxable sick pay (information only, not included in boxes 1, 3, or 5).

L - Substantiated employee business expense reimbursements (nontaxable).

You might also like

- Scan 0001Document5 pagesScan 0001Monica Padilla71% (21)

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnDocument1 pageCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnmaliktaimoorsurahNo ratings yet

- Psav Encore Global W-2Document5 pagesPsav Encore Global W-2Vincent NewsonNo ratings yet

- Wage and Tax Statement Wage and Tax StatementDocument1 pageWage and Tax Statement Wage and Tax StatementFabiola UrgilésNo ratings yet

- Adeccow 215Document2 pagesAdeccow 215ier362No ratings yet

- Devin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptDocument2 pagesDevin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptemtteachNo ratings yet

- UnknownDocument4 pagesUnknownnayla marie santiago cuadradoNo ratings yet

- Resume of Msnetty42Document2 pagesResume of Msnetty42api-25122959No ratings yet

- Wage and Tax StatementDocument4 pagesWage and Tax StatementRich1781No ratings yet

- Wage and Tax StatementDocument4 pagesWage and Tax StatementMark Oasay100% (1)

- Wage and Tax Statement: Page 1 / 4Document4 pagesWage and Tax Statement: Page 1 / 44kbzdsfw8kNo ratings yet

- Morehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsDocument1 pageMorehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsCorey GarrisNo ratings yet

- Uci2011 PDFDocument2 pagesUci2011 PDFAnonymous W2VAMd7xNo ratings yet

- Wage and Tax Statement: Page 1 / 4Document4 pagesWage and Tax Statement: Page 1 / 4blon majorsNo ratings yet

- B0Vihh80429h1914420275227011105202Document2 pagesB0Vihh80429h1914420275227011105202natalia montaño ramirezNo ratings yet

- View W2Document4 pagesView W2fernamedina9No ratings yet

- US Internal Revenue Service: fw2 - 2000Document12 pagesUS Internal Revenue Service: fw2 - 2000IRSNo ratings yet

- Tino Altamirano 23Document1 pageTino Altamirano 23tinosaurio97No ratings yet

- 2023 W2Document2 pages2023 W2Bharath VanathadupulaNo ratings yet

- Omb No. 1545-0008 Omb No. 1545-0008Document2 pagesOmb No. 1545-0008 Omb No. 1545-0008Luke NyeNo ratings yet

- DocumentsPdfDocument2 pagesDocumentsPdfphilaaoicNo ratings yet

- Employee W-2 Report 20230223151717Document1 pageEmployee W-2 Report 20230223151717sarafawwNo ratings yet

- Dennis w2Document5 pagesDennis w2Dennis GieselmanNo ratings yet

- DocumentsPdf-3Document2 pagesDocumentsPdf-3carmenfelix644No ratings yet

- TWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772Document2 pagesTWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772sana shahidNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax ReturnJoshua WagonerNo ratings yet

- Alex Muller W2Document1 pageAlex Muller W2aafmullerNo ratings yet

- W-2 2024Document2 pagesW-2 2024alanisangeles429100% (1)

- Gp Wihh 31473 h 1914120241925141102202Document2 pagesGp Wihh 31473 h 1914120241925141102202FloydNo ratings yet

- 1_494070273116681Document1 page1_494070273116681dingsteehansNo ratings yet

- Kenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. DeptDocument2 pagesKenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. Depttaylorizabella1No ratings yet

- FileDocument2 pagesFilemikejrsotoNo ratings yet

- Howard W2Document2 pagesHoward W2dhhentNo ratings yet

- 6MTihh01388h1914320244903121104202Document2 pages6MTihh01388h1914320244903121104202bb9tsgv6shNo ratings yet

- W2 ExportDocument1 pageW2 ExportenderjosNo ratings yet

- 70558 - 2022 - W2 (1)Document2 pages70558 - 2022 - W2 (1)rodrigueznicolle1212No ratings yet

- James Melvin Anderson W2Document1 pageJames Melvin Anderson W2matheus.alcantara014No ratings yet

- W21225760934 0 PDFDocument2 pagesW21225760934 0 PDFAnonymous czHLQeLPB4No ratings yet

- 0940-14044252 0000009042 - NJ SEC: Copy C, For Employee's RecordsDocument2 pages0940-14044252 0000009042 - NJ SEC: Copy C, For Employee's RecordstaiNo ratings yet

- Employee W-2 Report - 20230119235333Document1 pageEmployee W-2 Report - 20230119235333Diane SausmanNo ratings yet

- W2 2019 VAQazDocument1 pageW2 2019 VAQazconniannf2No ratings yet

- 5 MTihh 4271 H 1914120242901191102202Document2 pages5 MTihh 4271 H 1914120242901191102202elena.69.mxNo ratings yet

- Documents PDFDocument2 pagesDocuments PDFNeena KumarNo ratings yet

- PDF 1Document1 pagePDF 1manolo IamanditaNo ratings yet

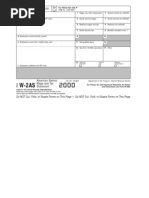

- US Internal Revenue Service: Fw2as - 2000Document10 pagesUS Internal Revenue Service: Fw2as - 2000IRSNo ratings yet

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City, or Local Income Tax Returnlucasortegabrandonarturo24No ratings yet

- W2 Hyatt PLaceDocument5 pagesW2 Hyatt PLaceJuan Diego Velandia DuarteNo ratings yet

- DNSP 0000003971Document2 pagesDNSP 0000003971negrapujolsNo ratings yet

- W2 W2taxdocument 2023Document3 pagesW2 W2taxdocument 2023sywwvpdnp7No ratings yet

- 779 Ihh 403 H 6754020242226102101202Document2 pages779 Ihh 403 H 6754020242226102101202elena.69.mxNo ratings yet

- 0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDocument2 pages0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDeepika RajasekarNo ratings yet

- Employee W-2 Report - 20240115122921Document1 pageEmployee W-2 Report - 20240115122921mcleodfairhavenNo ratings yet

- Paid Loan LetterDocument2 pagesPaid Loan LetterBharath VanathadupulaNo ratings yet

- Print PreviewDocument5 pagesPrint Previewmelidelacruz566No ratings yet

- 2021 Form W-2Document1 page2021 Form W-2jgonzalezruiz94No ratings yet

- Timothy W Janssen 4812 LITTLE Fox Court Imperial MO 63052Document2 pagesTimothy W Janssen 4812 LITTLE Fox Court Imperial MO 63052TJ JanssenNo ratings yet

- Wage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnDocument7 pagesWage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnLovely HeartNo ratings yet

- PDFDocument4 pagesPDFJesús Miguel Peña GenereNo ratings yet

- US Internal Revenue Service: Fw2gu - 2000Document10 pagesUS Internal Revenue Service: Fw2gu - 2000IRSNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Background Check FormsDocument5 pagesBackground Check Formsrami.windowsNo ratings yet

- Claim For Lost, Stolen, or Destroyed United States Savings BondsDocument6 pagesClaim For Lost, Stolen, or Destroyed United States Savings BondsMr McBride100% (1)

- 24PRO Check Reissue Form (2305843009342204871)Document1 page24PRO Check Reissue Form (2305843009342204871)1020ziyziyNo ratings yet

- Register Report James Rickard 020510Document36 pagesRegister Report James Rickard 020510Rosemary Rickard ThorntonNo ratings yet

- Guide Investigator HandbookDocument45 pagesGuide Investigator HandbookCompaq Presario0% (1)

- LAAC LawHelp Developer RFPDocument7 pagesLAAC LawHelp Developer RFPScrib DeeNo ratings yet

- LiftFund Eligibilityand Checklist 2019Document1 pageLiftFund Eligibilityand Checklist 2019corey.rjackson100No ratings yet

- United States TIN PDFDocument2 pagesUnited States TIN PDFAldo Rodrigo Algandona100% (1)

- Attorney General John Cornyn On Open Records M-14Document11 pagesAttorney General John Cornyn On Open Records M-14Shirley Pigott MDNo ratings yet

- South Dakota State Treasurer Unclaimed Property: Claim FormDocument2 pagesSouth Dakota State Treasurer Unclaimed Property: Claim FormMiguel Paz100% (1)

- Tax Form w3Document34 pagesTax Form w3hossain ronyNo ratings yet

- E Verify FaqsDocument4 pagesE Verify FaqsMuhammad Aulia RahmanNo ratings yet

- 2014-01-30 ECF 28-1 - Taitz V Colvin - Memorandum in Support of Defendants MTDDocument17 pages2014-01-30 ECF 28-1 - Taitz V Colvin - Memorandum in Support of Defendants MTDJack RyanNo ratings yet

- Normal 60d36dc7dbb09Document10 pagesNormal 60d36dc7dbb09duserwNo ratings yet

- BlueSnap Merchant Application ShortnfDocument2 pagesBlueSnap Merchant Application ShortnfAmit KhannaNo ratings yet

- Health Benefits Enrollment FormDocument3 pagesHealth Benefits Enrollment FormgururajuNo ratings yet

- GA HuntingDocument72 pagesGA HuntingEnrique HernandezNo ratings yet

- Step 6 FOIA I94 Myeverify & Lexus Nexis InstructionsDocument10 pagesStep 6 FOIA I94 Myeverify & Lexus Nexis InstructionsnickstuhhNo ratings yet

- VA Form 21-526 App For Disability Compensation and PensionDocument12 pagesVA Form 21-526 App For Disability Compensation and PensionthinkcenterNo ratings yet

- KALMAN (Kenneth) H. RYESKY, Esq.: Curriculum VitaeDocument11 pagesKALMAN (Kenneth) H. RYESKY, Esq.: Curriculum VitaeKennethRyeskyNo ratings yet

- Simple Draft PDFDocument2 pagesSimple Draft PDFAnonymous s8exNmNo ratings yet

- How to Apply for Cc With Fullz and CashoutDocument7 pagesHow to Apply for Cc With Fullz and CashoutOgunleye Tolu100% (1)

- Guide To Filing An Unemployment Insurance Claim: Information About YourselfDocument2 pagesGuide To Filing An Unemployment Insurance Claim: Information About YourselfkayNo ratings yet

- US Licensed Business Registration ChecklistDocument4 pagesUS Licensed Business Registration ChecklistYohana LazosNo ratings yet

- DSD A112Document115 pagesDSD A112Kilty ONealNo ratings yet

- PDF StroiesDocument2 pagesPDF StroiesCatherine LanuzaNo ratings yet

- A Guide To Getting Started: Electronic Federal Tax Payment SystemDocument5 pagesA Guide To Getting Started: Electronic Federal Tax Payment SystemJermaine BrownNo ratings yet

- 01-909 Formato TaxsDocument4 pages01-909 Formato Taxsconstructora y representaciones del norteNo ratings yet

- Oddo Brothers Cpas: William & Regina LittleDocument30 pagesOddo Brothers Cpas: William & Regina Littlebill littleNo ratings yet