direct-import-bills-form

direct-import-bills-form

Uploaded by

Michael MarandiCopyright:

Available Formats

direct-import-bills-form

direct-import-bills-form

Uploaded by

Michael MarandiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

direct-import-bills-form

direct-import-bills-form

Uploaded by

Michael MarandiCopyright:

Available Formats

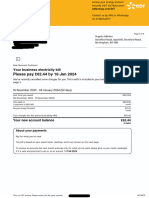

APPLICATION FOR PAYMENT OF DIRECT IMPORT BILLS

(To be completed by the applicant in block letters using black ink pen) Branch Name:

We have imported following commodity/goods and request you to remit as per details given below towards the import of goods:

Date:

Commodity: HS Code:

Purpose of import : Type of Goods : Capital Non-Capital

Foreign Currency FC

Amount

FC Amt in Figures In Words

Value Date of Remittance : Foreign Bank Charges : SHA OUR BEN

Country of Origin of Goods: Country from which goods shipped:

Remitter’s Name

IEC No. PAN No.

Address of Remitter

Name of contact Person

Mobile No E-mail id

Beneficiary name

Beneficiary Address

Country of Beneficiary:

Beneficiary’s Bank

(Name and Address)

Beneficiary’s Bank Account or IBAN Number

SWIFT & SORT Code details of beneficiary Bank (In case of TT)

IBAN for remittancemade to UK, Transit Code for remittance

Europe, Bahrain Saudi Arabia & UAE made to Canada

Sort Code for remittance to UK (or) SWIFT code (or) routing

BSB Code for remittance to Australia Number of beneficiary bank

DATE D D M M Y Y Y Y

(Authorised Signatory with Company/Firm seal)

Enclose necessary supporting documents as per Annexure-1. Page 1/3

1/4

APPLICATION FOR PAYMENT OF DIRECT IMPORT BILLS

Purpose of import:

The details to be mentioned in Swift

message for beneficiary information

Part Payment of Total Shipment Yes No

Is the Beneficiary same as the Overseas Supplier Yes No

Is the remittance being made for Merchanting Trade Transaction Yes No

Authority to debit bank account

Account Type Account Number Currency

EEFC

CA/ CC/ OD

Authority to debit charges( if different from above account )

CA/ CC/ OD

Forward contract details :

Contract Number: Date:

Contract Amount: Due Date of Contract:

Amount to be utilized for remittance

Reasons for delayed payment (Applicable if payment is being made after stipulated time as per FEMA guidelines; i.e. after 90days/180 days from the date

of shipment): ________________________________________________________________________________________________________(Please

submit documentary evidences)

DATE

D D M M Y Y Y Y

(Authorised Signatory with Company/Firm seal)

GENERAL DECLARATION

I/We confirm that the goods being imported by me/us are not covered under Negative list of imports as per the latest Foreign Trade Policy (as

amended till date) notified by Government of India, Ministry of Commerce & Industry, Department of Commerce, Directorate General of Foreign Trade,

New Delhi. I/We are eligible to import the above mentioned goods under the current Export and Import Policy in place. I/We confirm that said goods

imported/being imported by me/us are not restricted for import through specific licensing under the above mentioned policy and amendments.

OR

Original Exchange control copy of the License number ______________ dated_________ for the amount of ____________ is enclosed. I/We declare

that the license is valid and have not been cancelled by the DGFT. (In case item is under Negative List of import).

I/We declare that the goods to which the application relates are/will be imported into India on my/our account. I/We declare that the import is on behalf

of ___________________________ .

I/We declare that the invoice value of the goods imported/being imported into India is the real value of the goods

I/We enclose the custom stamped Exchange Control Copy of Bill of Entry/Copy of Bill of Entry (in case of IDPMS)/ Courier wrapper/ Postal Appraisal

Form/ Custom Assessment Certificate/ CA certificate (in case of Service Export/Import) as an evidence of import of the said goods.

DATE

D D M M Y Y Y Y

(Authorised Signatory with Company/Firm seal)

Enclose necessary supporting documents as per Annexure-1.

Page 2/3 2/3

Page 2/4

APPLICATION FOR PAYMENT OF DIRECT IMPORT BILLS

OR

I/We declare that we will submit within 90 days from the date of remittance the custom stamped Exchange Control copy of Bill of Entry/Copy of Bill of

Entry(in case of IDPMS)/Post parcel wrapper(for imports by post)/Courier Bill of Entry(for imports through courier)/ CA certificate (in case of Service

Export/Import) to Bank of Baroda .

I/We further declare that we have not made payment against the same invoice/contract through any other AD Bank.

I/We agree that in the event of transaction could not be executed/debited to my/ our account after submitting the request for processing to the bank on

account of insufficient/ unclear balance at the same time of execution of the transaction in my/ our account any exchange losses incurred in this

connection due to reversal of the Forex deal can be charged to my/our Bank of Baroda account.

I/We agree that in the event the transaction is cancelled or revoked by me/us after submitting the request for processing to the bank any exchange

losses incurred in this connection can be charged to my/our Bank of Baroda account. I/We further agree that once the funds remitted by me/us have

been transmitted by Bank of Baroda to the correspondent and/or beneficiary banks, Bank of Baroda shall not be responsible for any delays in the

disbursement of such funds including the withholding of such funds by the correspondent and/or beneficiary banks. I/We further agree that once the

funds remitted by me / us have been transmitted by Bank of Baroda, intermediary Bank charges may be levied by Correspondent and / or Beneficiary

Banks, which may vary from bank to bank.

I/We agree that in the event the transaction being rejected by the beneficiary bank because of incorrect information submitted by me, any charges levied

by the beneficiary bank or exchange losses incurred in this connection can be charged to my Bank of Baroda account.

I/We also understand that if I/we refuse to comply with any such requirement or make only unsatisfactory compliance therewith, the bank shall refuse in

writing to undertake the transaction and shall, if it has reason to believe that any contravention/evasion in contemplated by me/us, report that matter to

the RBI.

I/We also agree that the exchange rate will be applicable at the time of deal booking and may vary from the rate prevailing when the request is submitted.

I/we also understand that the rate communicated to us (if any) is an indicative rate and the actual rate may be different from the same.

FEMA DECLARATION

(Under Section10 (5), Chapter III of The Foreign Exchange Management Act, 1999)

I/We hereby declare that the transaction, the details of which are specifically mentioned in this letter does not involve, and is not designed for the purpose

of any contravention or evasion of the provisions of the aforesaid act of any rule, regulation, notification, direction or order made there under. I/ We also

hereby agree and undertake to give such information/ documents as will reasonably satisfy you about this transaction in terms of the above declaration.

I/We also undertake that if I/ We refuse to comply with any such requirements or make only unsatisfactory compliance therewith, the bank shall refuse in

writing to undertake the transaction and shall if it has reason to believe that any contravention /evasion is contemplated by me /us report the matter to

Reserve Bank Of India.

I/We further declare that the undersigned has/have the authority to give the above debit authority, declaration and undertaking on behalf of the

firm/company.

Place

Date DD M M Y Y Y Y

(Authorised Signatory with Company/Firm seal)

Annexure I : Documents enclosed (please tick all that are relevant)

Self Attested copy of Commercial Invoice

Transportation Document (self Attested copy of Airway Bill/Bill of Lading/Courier receipt)

Triplicate Exchange Control copy of Bill of Entry in original/ Copy of Bill of Entry( in case of IDPMS)/ Courier wrapper/

Postal Appraisal Form/ Custom Assessment Certificate/ CA certificate (in case of Service Export/Import)

Supportive documents in case of delayed payment

Other documents

Enclose necessary supporting documents as per Annexure-1. Page 3/3

3/4

You might also like

- Revised Request Letter Format For Import Remittance (Advance & Direct)Document3 pagesRevised Request Letter Format For Import Remittance (Advance & Direct)SALE EXECUTIVES75% (4)

- Pre Course Assignment Jan 2014Document80 pagesPre Course Assignment Jan 2014K D100% (2)

- Nigeria Bank StatementDocument2 pagesNigeria Bank StatementДанила Филатов100% (1)

- EDF Bill InvDocument4 pagesEDF Bill Invmoran64800No ratings yet

- Covering Letter For Miscellaneous Remittances - LatestDocument2 pagesCovering Letter For Miscellaneous Remittances - LatestSALE EXECUTIVESNo ratings yet

- Request LetterDocument4 pagesRequest LetterMayur JoshiNo ratings yet

- Application For Import RemittancesDocument1 pageApplication For Import RemittancesRadhakrishnan Rb100% (2)

- SBR - Mock B - QuestionsDocument3 pagesSBR - Mock B - Questionsriya_pramodNo ratings yet

- Acceptance Cum Payment of Import 0304 1Document3 pagesAcceptance Cum Payment of Import 0304 1swapnaNo ratings yet

- BOB-Acceptance-cum-Payment-of-Import-Inland-Bills-Application-Form-20-06-2020Document2 pagesBOB-Acceptance-cum-Payment-of-Import-Inland-Bills-Application-Form-20-06-2020Michael MarandiNo ratings yet

- acceptance-cum-payment-of-import-bills-formDocument2 pagesacceptance-cum-payment-of-import-bills-formMichael MarandiNo ratings yet

- Foreign Outward Remittances FormDocument4 pagesForeign Outward Remittances FormprayankkunjadiyaNo ratings yet

- BOB Foreign Inward Remittances Application Form PDFDocument6 pagesBOB Foreign Inward Remittances Application Form PDFVarun SrivastavaNo ratings yet

- BOB Foreign Inward Remittances Application FormDocument6 pagesBOB Foreign Inward Remittances Application Form5yzftsg9qsNo ratings yet

- Export Advance Payment - ApplicationDocument1 pageExport Advance Payment - ApplicationKumar SwamyNo ratings yet

- Revised Application For Direct Import Bill (New)Document2 pagesRevised Application For Direct Import Bill (New)gautam0% (1)

- Sample in QDocument8 pagesSample in QMOHD SUHAILNo ratings yet

- Advance Import PaymentDocument3 pagesAdvance Import PaymentPalas DattaNo ratings yet

- Wa0008.Document7 pagesWa0008.amyashu22No ratings yet

- Advance Import PaymentDocument8 pagesAdvance Import PaymentAshish GargNo ratings yet

- A1 For Import Goods PaymentsDocument3 pagesA1 For Import Goods PaymentskollarajasekharNo ratings yet

- Disposal Instruction For Foreign Inward RemittanceDocument2 pagesDisposal Instruction For Foreign Inward RemittanceKumar BhaskarNo ratings yet

- Request Letter-2Document3 pagesRequest Letter-2Ankush PadhaNo ratings yet

- Advance Import Covering LetterDocument3 pagesAdvance Import Covering LetterSmita JadhavNo ratings yet

- Direct Import Payment - RL 01.04.2016Document3 pagesDirect Import Payment - RL 01.04.2016Prakash PandeyNo ratings yet

- form-a2-for-corporatesDocument5 pagesform-a2-for-corporateshataxe6043No ratings yet

- FORM A2 Revised FormDocument6 pagesFORM A2 Revised Formcopy catNo ratings yet

- Sample Import Bill For CollectionDocument6 pagesSample Import Bill For CollectionjgaeqNo ratings yet

- Export-bill123Document8 pagesExport-bill123Ananta DuttaNo ratings yet

- Documents ListDocument8 pagesDocuments ListHaresh RajputNo ratings yet

- FL AdvDocument4 pagesFL Advkaif alamNo ratings yet

- Advance Payment FormatsDocument2 pagesAdvance Payment Formatsurartstudio7No ratings yet

- BOB Foreign Inward Remittances Application Form 20 06 2020Document6 pagesBOB Foreign Inward Remittances Application Form 20 06 2020Finance Logan MineralsNo ratings yet

- Direct Import Direct Payment FormatDocument1 pageDirect Import Direct Payment FormatRohit ChananaNo ratings yet

- FBFP Application Form With Invoice ReductionDocument3 pagesFBFP Application Form With Invoice Reductiondevjain.unfilteredNo ratings yet

- Advance Import Covering Letter - Above Usd 5000 - July 2015Document3 pagesAdvance Import Covering Letter - Above Usd 5000 - July 2015SG InternationalNo ratings yet

- Export Advance Payment - Branch ProposalDocument2 pagesExport Advance Payment - Branch ProposalKumar SwamyNo ratings yet

- One Time Disposal CorporateDocument3 pagesOne Time Disposal CorporateRishi KumawatNo ratings yet

- Form A2 Cum Application For Foreign Outward RemittanceDocument8 pagesForm A2 Cum Application For Foreign Outward Remittancebhanudurgapal18march2002No ratings yet

- Form A1Document13 pagesForm A1Ben DennisNo ratings yet

- Ankit Majmudar - Module 3 - How To Find Foreign Buyer - AMA PDFDocument21 pagesAnkit Majmudar - Module 3 - How To Find Foreign Buyer - AMA PDFhimanshuNo ratings yet

- Inward Remittance VostroDocument2 pagesInward Remittance VostroApurva LalNo ratings yet

- LetterDocument3 pagesLetteranupam_saha_9No ratings yet

- Appnd 22ADocument3 pagesAppnd 22AHardik AkhaniNo ratings yet

- Disposal Instruction FormatDocument3 pagesDisposal Instruction FormatharpreetkaurNo ratings yet

- Import-Bill-Acceptance-Or-Payment-LetterDocument2 pagesImport-Bill-Acceptance-Or-Payment-LetterMichael MarandiNo ratings yet

- Application For Redemption / No Bond CertificateDocument4 pagesApplication For Redemption / No Bond Certificateakashaggarwal88100% (1)

- Declaration Towards Advance Against ExportsDocument2 pagesDeclaration Towards Advance Against ExportsShiva KumarNo ratings yet

- Declaration Towards Advance Against ExportsDocument2 pagesDeclaration Towards Advance Against ExportsShiva KumarNo ratings yet

- Import Payment Covering Letter and A1 FormatDocument4 pagesImport Payment Covering Letter and A1 Formatgan_muruNo ratings yet

- Export Bill ProcessingDocument5 pagesExport Bill ProcessingSatyanarayan PandaNo ratings yet

- InstructionsDocument6 pagesInstructionsVarun RamchandaniNo ratings yet

- Inward Remittance Disposal Instruction-KotakDocument2 pagesInward Remittance Disposal Instruction-KotakAditya2707910% (1)

- ANF 4 I: (Please See Guidelines (Given at The End) Before Filling The Application)Document4 pagesANF 4 I: (Please See Guidelines (Given at The End) Before Filling The Application)akashaggarwal88No ratings yet

- Application Format For Advance Payment For ImportDocument2 pagesApplication Format For Advance Payment For Importsrinivasan ragothaman50% (2)

- TT Import Letter From PartyDocument2 pagesTT Import Letter From PartyVikki PatelNo ratings yet

- PolicyDocument5 pagesPolicyRichard WijayaNo ratings yet

- Disposal Instruction For Handling Foreign Inward RemittancesDocument3 pagesDisposal Instruction For Handling Foreign Inward RemittancesSelvamuthu KumaranNo ratings yet

- ANF 5B LIC - NoDocument5 pagesANF 5B LIC - Nosuman_gourh100% (2)

- Payment InstructionDocument6 pagesPayment InstructionAstha Suri100% (1)

- Sample Inwward RemittanceDocument5 pagesSample Inwward RemittancejgaeqNo ratings yet

- Name: Golingan, Christian Jay R. Couse: BSBA 701 International Trade and BusinessDocument6 pagesName: Golingan, Christian Jay R. Couse: BSBA 701 International Trade and BusinessChristian Jay GolinganNo ratings yet

- EmmaDocument45 pagesEmmaleone shikukuNo ratings yet

- COMSATS Institute of Information Technology Registrar Office, Principal Seat, IslamabadDocument4 pagesCOMSATS Institute of Information Technology Registrar Office, Principal Seat, IslamabadHimesh RajNo ratings yet

- 3349 Tax MarDocument1 page3349 Tax MarChiranjeevi ChipurupalliNo ratings yet

- Question 2 FR April 2022 Question 2 CaputDocument6 pagesQuestion 2 FR April 2022 Question 2 CaputLaud ListowellNo ratings yet

- International Marketing Strategies For Global CompetitivenessDocument13 pagesInternational Marketing Strategies For Global CompetitivenessFarwa Muhammad SaleemNo ratings yet

- Joint and SolidaryDocument5 pagesJoint and Solidaryavocado booksNo ratings yet

- Final Accounts of Joint Stock Companies: Selling and Distribution ExpensesDocument6 pagesFinal Accounts of Joint Stock Companies: Selling and Distribution ExpensesbhsujanNo ratings yet

- Logistics Report 1Document53 pagesLogistics Report 1Mukesh BishtNo ratings yet

- INTRODUCTION TO BUS I (Bus 101)Document57 pagesINTRODUCTION TO BUS I (Bus 101)MmaNo ratings yet

- Council For Leather Exports (CLE)Document14 pagesCouncil For Leather Exports (CLE)jayth123No ratings yet

- (ACV-S06) Week 6 - Pre-Task - Quiz - What Do You Do - (PA) - INGLES II (30551)Document5 pages(ACV-S06) Week 6 - Pre-Task - Quiz - What Do You Do - (PA) - INGLES II (30551)Jhony Marcos Alarcón CervantesNo ratings yet

- Unit 14Document25 pagesUnit 14divya kalyaniNo ratings yet

- Modes of EntryDocument9 pagesModes of EntryApurva RamtekeNo ratings yet

- Fundamental Analysys of Steel Sector CompaniesDocument38 pagesFundamental Analysys of Steel Sector Companiesvimee2401384100% (4)

- Talesun Corporate PPT VF FM May2019Document66 pagesTalesun Corporate PPT VF FM May2019api-511578545No ratings yet

- The Role of Finance in Supply Chain Management: Lars StemmlerDocument2 pagesThe Role of Finance in Supply Chain Management: Lars StemmlerHernando100% (1)

- MBS 2nd Sem Production OperationDocument2 pagesMBS 2nd Sem Production OperationShruti BogatiNo ratings yet

- Hedge Fund StrategiesDocument3 pagesHedge Fund StrategiesKen BiiNo ratings yet

- Aat - 01 - Ecn 01 emDocument10 pagesAat - 01 - Ecn 01 emMetro CommunicationNo ratings yet

- IFMIS Telangana DADocument13 pagesIFMIS Telangana DAAskani KurumaiahNo ratings yet

- Commonly Found Errors in Reporting Practices - ICAIDocument166 pagesCommonly Found Errors in Reporting Practices - ICAIKANNAPPAN NAGARAJANNo ratings yet

- Accounting Quiz 1Document2 pagesAccounting Quiz 1Cjhay MarcosNo ratings yet

- Dissolution NotesDocument7 pagesDissolution NotesEstephanie FontanozNo ratings yet

- CO-PA New Funct 1 - General TopicsDocument19 pagesCO-PA New Funct 1 - General Topicsarnavbansal95No ratings yet

- Seabank Statement 20240223Document8 pagesSeabank Statement 20240223awayxixixiNo ratings yet

- Lesson 2 FactsheetDocument6 pagesLesson 2 FactsheetPrecious Mae Cuerquis BarbosaNo ratings yet