0 ratings0% found this document useful (0 votes)

2 viewsf1040s1

f1040s1

Uploaded by

5pbw5b7ghdCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

f1040s1

f1040s1

Uploaded by

5pbw5b7ghd0 ratings0% found this document useful (0 votes)

2 views3 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views3 pagesf1040s1

f1040s1

Uploaded by

5pbw5b7ghdCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

Free Forms Courtesy of FreeTaxUSA.

com

Prepare, Print, and E-File

Your Federal Tax Return for

FREE!!

Go to www.FreeTaxUSA.com to start your free return today!

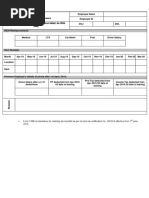

SCHEDULE 1 OMB No. 1545-0074

Additional Income and Adjustments to Income

(Form 1040)

Department of the Treasury

a Attach to Form 1040, 1040-SR, or 1040-NR. 2021

Attachment

Internal Revenue Service a Go to www.irs.gov/Form1040 for instructions and the latest information. Sequence No. 01

Name(s) shown on Form 1040, 1040-SR, or 1040-NR Your social security number

Part I Additional Income

1 Taxable refunds, credits, or offsets of state and local income taxes . . . . . . . 1

2a Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a

b Date of original divorce or separation agreement (see instructions) a

3 Business income or (loss). Attach Schedule C . . . . . . . . . . . . . . . 3

4 Other gains or (losses). Attach Form 4797 . . . . . . . . . . . . . . . . . 4

5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach

Schedule E . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Farm income or (loss). Attach Schedule F . . . . . . . . . . . . . . . . . 6

7 Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . 7

8 Other income:

a Net operating loss . . . . . . . . . . . . . . . . . . 8a ( )

b Gambling income . . . . . . . . . . . . . . . . . . . 8b

c Cancellation of debt . . . . . . . . . . . . . . . . . . 8c

d Foreign earned income exclusion from Form 2555 . . . . . 8d ( )

e Taxable Health Savings Account distribution . . . . . . . . 8e

f Alaska Permanent Fund dividends . . . . . . . . . . . . 8f

g Jury duty pay . . . . . . . . . . . . . . . . . . . . 8g

h Prizes and awards . . . . . . . . . . . . . . . . . . 8h

i Activity not engaged in for profit income . . . . . . . . . 8i

j Stock options . . . . . . . . . . . . . . . . . . . . 8j

k Income from the rental of personal property if you engaged in

the rental for profit but were not in the business of renting such

property . . . . . . . . . . . . . . . . . . . . . . 8k

l Olympic and Paralympic medals and USOC prize money (see

instructions) . . . . . . . . . . . . . . . . . . . . . 8l

m Section 951(a) inclusion (see instructions) . . . . . . . . . 8m

n Section 951A(a) inclusion (see instructions) . . . . . . . . 8n

o Section 461(l) excess business loss adjustment . . . . . . . 8o

p Taxable distributions from an ABLE account (see instructions) . 8p

z Other income. List type and amount a

8z

9 Total other income. Add lines 8a through 8z . . . . . . . . . . . . . . . . 9

10 Combine lines 1 through 7 and 9. Enter here and on Form 1040, 1040-SR, or

1040-NR, line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71479F Schedule 1 (Form 1040) 2021

Schedule 1 (Form 1040) 2021 Page 2

Part II Adjustments to Income

11 Educator expenses . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Certain business expenses of reservists, performing artists, and fee-basis government

officials. Attach Form 2106 . . . . . . . . . . . . . . . . . . . . . . . 12

13 Health savings account deduction. Attach Form 8889 . . . . . . . . . . . . 13

14 Moving expenses for members of the Armed Forces. Attach Form 3903 . . . . . 14

15 Deductible part of self-employment tax. Attach Schedule SE . . . . . . . . . 15

16 Self-employed SEP, SIMPLE, and qualified plans . . . . . . . . . . . . . . 16

17 Self-employed health insurance deduction . . . . . . . . . . . . . . . . . 17

18 Penalty on early withdrawal of savings . . . . . . . . . . . . . . . . . . 18

19a Alimony paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19a

b Recipient’s SSN . . . . . . . . . . . . . . . . . . . . a

c Date of original divorce or separation agreement (see instructions) a

20 IRA deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21 Student loan interest deduction . . . . . . . . . . . . . . . . . . . . . 21

22 Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . . 22

23 Archer MSA deduction . . . . . . . . . . . . . . . . . . . . . . . . . 23

24 Other adjustments:

a Jury duty pay (see instructions) . . . . . . . . . . . . . 24a

b Deductible expenses related to income reported on line 8k from

the rental of personal property engaged in for profit . . . . . 24b

c Nontaxable amount of the value of Olympic and Paralympic

medals and USOC prize money reported on line 8l . . . . . 24c

d Reforestation amortization and expenses . . . . . . . . . 24d

e Repayment of supplemental unemployment benefits under the

Trade Act of 1974 . . . . . . . . . . . . . . . . . . . 24e

f Contributions to section 501(c)(18)(D) pension plans . . . . . 24f

g Contributions by certain chaplains to section 403(b) plans . . 24g

h Attorney fees and court costs for actions involving certain

unlawful discrimination claims (see instructions) . . . . . . 24h

i Attorney fees and court costs you paid in connection with an

award from the IRS for information you provided that helped the

IRS detect tax law violations . . . . . . . . . . . . . . 24i

j Housing deduction from Form 2555 . . . . . . . . . . . 24j

k Excess deductions of section 67(e) expenses from Schedule K-1

(Form 1041) . . . . . . . . . . . . . . . . . . . . . 24k

z Other adjustments. List type and amount a

24z

25 Total other adjustments. Add lines 24a through 24z . . . . . . . . . . . . . 25

26 Add lines 11 through 23 and 25. These are your adjustments to income. Enter

here and on Form 1040 or 1040-SR, line 10, or Form 1040-NR, line 10a . . . . . 26

Schedule 1 (Form 1040) 2021

You might also like

- Assignment - Chapter 3 - Kingfisher Corporation Form 1120 Tax Return (Due 09.27.20)Document7 pagesAssignment - Chapter 3 - Kingfisher Corporation Form 1120 Tax Return (Due 09.27.20)Tenaj Kram100% (3)

- Offer LetterDocument10 pagesOffer LetterFarhan Abbasi100% (1)

- Pet Kingdom IncDocument20 pagesPet Kingdom Incjessica67% (3)

- Retirement PlanDocument11 pagesRetirement PlanAlvino YaraNo ratings yet

- 2019 TaxreturnDocument6 pages2019 TaxreturnMARC ANDREWS WOLFFNo ratings yet

- 2015 Tax Return Documents (US Auto Motors LLC) Revised PDFDocument20 pages2015 Tax Return Documents (US Auto Motors LLC) Revised PDFzlNo ratings yet

- BriteSol Inc IRS 1120 Corporation Tax Return 2012Document5 pagesBriteSol Inc IRS 1120 Corporation Tax Return 2012how3935No ratings yet

- Benefits What We OfferDocument5 pagesBenefits What We OfferdhawandhruvNo ratings yet

- 2023 Schedule 1 - Form 1040 - Additional Income andDocument2 pages2023 Schedule 1 - Form 1040 - Additional Income andpatovoidNo ratings yet

- 2022 Draft Schedule 1Document3 pages2022 Draft Schedule 1Riley CareNo ratings yet

- Additional Income and Adjustments To IncomeDocument2 pagesAdditional Income and Adjustments To IncomeConner BeckerNo ratings yet

- Schedule 1 For 2019 Form 1040Document1 pageSchedule 1 For 2019 Form 1040CNBC.comNo ratings yet

- Additional Income and Adjustments To IncomeDocument1 pageAdditional Income and Adjustments To IncomeIshfaq Ali KhanNo ratings yet

- Additional Income and Adjustments To IncomeDocument1 pageAdditional Income and Adjustments To IncomeIshfaq Ali KhanNo ratings yet

- Additional Income and Adjustments To Income: Schedule 1Document1 pageAdditional Income and Adjustments To Income: Schedule 1Betty Ann LegerNo ratings yet

- f1040s1 PDFDocument1 pagef1040s1 PDFCarlosNo ratings yet

- Irs New Form 1040Document2 pagesIrs New Form 1040ForkLogNo ratings yet

- 2022 Schedule 3 (Form 1040)Document2 pages2022 Schedule 3 (Form 1040)Riley CareNo ratings yet

- PDC 2006Document10 pagesPDC 2006NC Policy WatchNo ratings yet

- Additional Credits and PaymentsDocument2 pagesAdditional Credits and PaymentsStuti TiwariNo ratings yet

- 990 Return of Organization Exempt From Income Tax: Use IRS East Carolina Development CO, INC 56-2044953Document10 pages990 Return of Organization Exempt From Income Tax: Use IRS East Carolina Development CO, INC 56-2044953NC Policy WatchNo ratings yet

- f1040s3Document3 pagesf1040s35pbw5b7ghdNo ratings yet

- BNI 1120 ReturnDocument5 pagesBNI 1120 ReturndishaakariaNo ratings yet

- Return of Organization Exempt From Income Tax: See '2 312 Hodges Road (252) 523-7700 Tip. Ki Ns Ton NC 2 8 5 0 4Document19 pagesReturn of Organization Exempt From Income Tax: See '2 312 Hodges Road (252) 523-7700 Tip. Ki Ns Ton NC 2 8 5 0 4NC Policy WatchNo ratings yet

- Short Form Return of Organization Exempt From Income TaxDocument9 pagesShort Form Return of Organization Exempt From Income TaxHalosNo ratings yet

- Scedule 2Document2 pagesScedule 2patovoidNo ratings yet

- Additional Income and Adjustments To IncomeDocument1 pageAdditional Income and Adjustments To IncomeDean RomanNo ratings yet

- Additional Income and Adjustments To IncomeDocument1 pageAdditional Income and Adjustments To IncomeSz. RolandNo ratings yet

- U.S. Income Tax Return For Certain Political Organizations: Sign HereDocument6 pagesU.S. Income Tax Return For Certain Political Organizations: Sign HereManikanta Sai KumarNo ratings yet

- By The Numbers, Inc.Document51 pagesBy The Numbers, Inc.mailfrmajithNo ratings yet

- View Document 2Document23 pagesView Document 2swindellabilene7No ratings yet

- Irs 6251Document2 pagesIrs 6251Lincoln WebberNo ratings yet

- Ivan Incisor CH 3 2014 Tax Return - For - FilingDocument6 pagesIvan Incisor CH 3 2014 Tax Return - For - FilingShakilaMissz-KyutieJenkinsNo ratings yet

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDocument6 pagesCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnStephanie YatesNo ratings yet

- Income Tax On Dollar To InrDocument1 pageIncome Tax On Dollar To InrApki mautNo ratings yet

- Net Investment Income Tax - Individuals, Estates, and TrustsDocument1 pageNet Investment Income Tax - Individuals, Estates, and Trustsapi-252942620No ratings yet

- Net Investment Income Tax - Individuals, Estates, and TrustsDocument1 pageNet Investment Income Tax - Individuals, Estates, and TrustsRishabh TaNo ratings yet

- Profit or Loss From Business: Linda Gercken 156-56-8670Document2 pagesProfit or Loss From Business: Linda Gercken 156-56-8670ROB100% (1)

- Chapter 4 For FilingDocument9 pagesChapter 4 For Filinglagurr100% (1)

- Frantz Raymond TaxDocument1 pageFrantz Raymond Taxjoseph GRAND-PIERRENo ratings yet

- Partnership FinanceDocument5 pagesPartnership Financeonlyonedeemuneyy4No ratings yet

- Lejean Tax 2019Document1 pageLejean Tax 2019joseph GRAND-PIERRENo ratings yet

- 2022 Draft Schedule ADocument2 pages2022 Draft Schedule ARiley CareNo ratings yet

- BOTEXDocument1 pageBOTEXjoseph GRAND-PIERRENo ratings yet

- F1040SC 2024-02-09 1707521005408Document1 pageF1040SC 2024-02-09 1707521005408ichaucavNo ratings yet

- Ivan Incisor CH 2 Tax Return - For - FilingDocument4 pagesIvan Incisor CH 2 Tax Return - For - FilingShakilaMissz-KyutieJenkins100% (1)

- Please Review The Updated Information Below.: For Begins After This CoversheetDocument6 pagesPlease Review The Updated Information Below.: For Begins After This CoversheetAshutosh Singh ParmarNo ratings yet

- U.S. Income Tax Return For An S Corporation: For Calendar Year 2022 or Tax Year Beginning, 2022, Ending, 20Document5 pagesU.S. Income Tax Return For An S Corporation: For Calendar Year 2022 or Tax Year Beginning, 2022, Ending, 20Benny BerniceNo ratings yet

- f1040 - Schedule - C - 2019-00-00-ED SNIDER YOUTH HOCKEY FOUNDATIONDocument2 pagesf1040 - Schedule - C - 2019-00-00-ED SNIDER YOUTH HOCKEY FOUNDATIONKeller Brown Jnr50% (2)

- U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnDocument3 pagesU.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnCFLA, IncNo ratings yet

- f1120s AccessibleDocument5 pagesf1120s AccessiblebhanuprakashbadriNo ratings yet

- 2022 Instructions For Form 1041 and Schedules A, B, G, J, and K-1 - I1041Document52 pages2022 Instructions For Form 1041 and Schedules A, B, G, J, and K-1 - I1041Mr Cutsforth100% (2)

- Additional Credits and PaymentsDocument1 pageAdditional Credits and PaymentsIshfaq Ali KhanNo ratings yet

- DHHSCDocument2 pagesDHHSClrowland974No ratings yet

- Form - 6251Document2 pagesForm - 6251Anonymous JqimV1ENo ratings yet

- U.S. Return of Partnership Income: Sign HereDocument5 pagesU.S. Return of Partnership Income: Sign HereMarie CaragNo ratings yet

- f990t-1Document2 pagesf990t-1nuhNo ratings yet

- Return of Organization Exempt From Income Tax °'"e"°'5"5-°°"'Document10 pagesReturn of Organization Exempt From Income Tax °'"e"°'5"5-°°"'NC Policy WatchNo ratings yet

- Preview Copy Do Not File: Profit or Loss From BusinessDocument1 pagePreview Copy Do Not File: Profit or Loss From BusinessRon KnightNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09Skip LarsonNo ratings yet

- U.S. Return of Partnership Income: Sign HereDocument6 pagesU.S. Return of Partnership Income: Sign HerelordbippyNo ratings yet

- J.K. Lasser's Your Income Tax 2024, Professional EditionFrom EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNo ratings yet

- Aetna Health assessmentDocument2 pagesAetna Health assessment5pbw5b7ghdNo ratings yet

- Medical Test Results - Created with VisMeDocument1 pageMedical Test Results - Created with VisMe5pbw5b7ghdNo ratings yet

- Turkish_Airlines_Online_Ticket_InformatiDocument3 pagesTurkish_Airlines_Online_Ticket_Informati5pbw5b7ghdNo ratings yet

- healthscreenDocument4 pageshealthscreen5pbw5b7ghdNo ratings yet

- Acco 20233 Income Tax Chapter 5Document18 pagesAcco 20233 Income Tax Chapter 5Kia Mae PALOMARNo ratings yet

- 2024 2025PensionSlipDocument1 page2024 2025PensionSlipdivyansh19122007sharmaNo ratings yet

- Introduction To Insurance: The Wholesale Market Focuses Mainly On The London Insurance Market, WhichDocument5 pagesIntroduction To Insurance: The Wholesale Market Focuses Mainly On The London Insurance Market, Whichprasad pawleNo ratings yet

- Form12BB R539 Proof Submission Form PDFDocument4 pagesForm12BB R539 Proof Submission Form PDFSiva ThotaNo ratings yet

- Summative Test Accounting Concepts PrinciplesDocument2 pagesSummative Test Accounting Concepts PrinciplesMarlyn LotivioNo ratings yet

- English Rating Assessment_Senior Tax Accountant_AU - AnswerDocument4 pagesEnglish Rating Assessment_Senior Tax Accountant_AU - AnswerJagdieshNo ratings yet

- Unemployment Benefit Programs: Start Here!Document1 pageUnemployment Benefit Programs: Start Here!Omsare ResNo ratings yet

- Employee'S Declaration of Emoluments, Deductions and Tax CreditsDocument3 pagesEmployee'S Declaration of Emoluments, Deductions and Tax CreditsLance ShahNo ratings yet

- 2015 AICPA FAR - ModerateDocument51 pages2015 AICPA FAR - ModerateTai D GiangNo ratings yet

- INCOME TAXATION REVIEWERDocument8 pagesINCOME TAXATION REVIEWERmariannchello123No ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument26 pagesCertificate of Compensation Payment/Tax WithheldLalai SaflorNo ratings yet

- تست بانك مالية عامةDocument28 pagesتست بانك مالية عامةsara jaberNo ratings yet

- ITC June 2014 Paper 2 Solution 1Document4 pagesITC June 2014 Paper 2 Solution 1NTNo ratings yet

- (CaseSt1) Balance Sheet, Short 2020 PBDocument11 pages(CaseSt1) Balance Sheet, Short 2020 PBtitu patriciuNo ratings yet

- INCOME TAXATION SyllabusDocument7 pagesINCOME TAXATION SyllabusmarkbagzNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument5 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferenceanshul srivastavaNo ratings yet

- HL Guide Retirement For Under 40s 1018Document18 pagesHL Guide Retirement For Under 40s 1018BenNo ratings yet

- Acturial AnalysisDocument14 pagesActurial AnalysisRISHAB NANGIANo ratings yet

- Lotus 2017Document14 pagesLotus 2017teingnidetioNo ratings yet

- Maurya Shashi Hublal (25) Sem 6 TybmsDocument78 pagesMaurya Shashi Hublal (25) Sem 6 TybmsROHIT MALLAHNo ratings yet

- Flexibly Accessed Pension Lump Sum: Repayment Claim (Tax Year 2021 To 2022)Document9 pagesFlexibly Accessed Pension Lump Sum: Repayment Claim (Tax Year 2021 To 2022)ErmintrudeNo ratings yet

- Presentation SwitzerlandDocument12 pagesPresentation SwitzerlandtheresaNo ratings yet

- Income From Business & ProfessionDocument7 pagesIncome From Business & Profession6804 Anushka GhoshNo ratings yet

- Lumpsum RetirementDocument76 pagesLumpsum RetirementLei BumanlagNo ratings yet

- Nigerian Pension Industry Publication Securing The FutureDocument20 pagesNigerian Pension Industry Publication Securing The FuturesomefunbNo ratings yet

- Introduction and Residential StatusDocument11 pagesIntroduction and Residential Statusc2802661No ratings yet

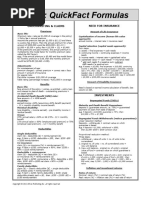

- LLQP Quick FormulasDocument2 pagesLLQP Quick FormulasRenato PuentesNo ratings yet