Quiet Title

Quiet Title

Uploaded by

boathookCopyright:

Available Formats

Quiet Title

Quiet Title

Uploaded by

boathookOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Quiet Title

Quiet Title

Uploaded by

boathookCopyright:

Available Formats

Percy Newby c/o 12924 E Marginal Way S Tukwila, Washington

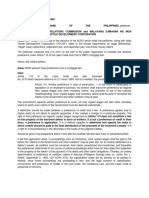

SUPERIOR COURT OF THE STATE OF WASHINGTON FOR THE COUNTY OF KING

Percy Newby, as Trustee for 13001 41st ) ) Avenue South Trust ) ) Plaintiff, ) ) v. ) ) AZTEC FORECLOSURE CORPORATION OF ) WASHINGTON, ) ) HSBC BANK USA, NA ) ) MORTGAGE ELECTRONIC REGISTRATION ) SYSTEMS, INC, ) RENAISSANCE HOME EQUITY LOAN ) TRUST 2006-4, ) ) OCWEN LOAN SERVICING, LLC, ) ) DELTA FUNDING CORPORATION, ) ) GARYS PROCESS SERVICE, ) Defendants ) ) _________________________________

CASE NO. 12-2-07994-3 KNT

AMENDED COMPLAINT TO QUIET TITLE TO REAL PROPERTY.

Plaintiff is proceeding without assistance of counsel unschooled in law, Page 1 of 35

Complaint

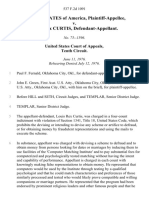

pro se, requesting the court accept direction from Haines v. Kerner, 404 U.S. 519 (1972), Boag v. MacDougall, 545 US 360 (1982), Puckett v. Cox 456 F2d 233 (1972 Sixth Circuit USCA), and Conely v. Gibson, 355 US 41 at 48(1957), ESTELLE, CORRECTIONS DIRECTOR, ET AL. v. GAMBLE 29 U.S. 97, 97 S. Ct. 285, 50 L. Ed. 2d 251, WILLIAM MCNEIL, PETITIONER v. UNITED STATES 113 S. Ct. 1980, 124 L. Ed. 2d 21, 61 U.S.L.W. 4468, BALDWIN COUNTY WELCOME CENTER v. BROWN 466 U.S. 147, 104 S. Ct. 1723, 80 L. Ed. 2d 196, 52 U.S.L.W. 3751, wherein the court has directed those who are unschooled in law making pleadings shall have the court look to the substance of the pleadings rather than the form. Pro se pleadings are to be considered without regard to technicality; pro se litigants' pleadings are not to be held to the same high standards of perfection as lawyers. Maty v. Grasselli Chemical Co., 303 U.S. 197 (1938), B. Platsky v. CIA, 953 F.2d 25, 26 28 (2nd Cir. 1991), "Court errs if court dismisses pro se litigant without instruction of how pleadings are deficient and how to repair pleadings." 2. Plaintiff reserves the right to amend this complaint as new evidence

comes to light and complains and for causes of action alleges as follows: NATURE AND SUMMARY OF THIS ACTION 3. This is a dispute over defendants right to claim a valid foreclosure sale

under the applicable laws of the State of Washington and to Quiet Title and enjoin Defendants, from claiming any estate, right, title or interest in the subject property located at 13001 41st Avenue South Tukwila, Washington 98168 and to hold Defendants accountable for their unfair and deceptive trade practices. 2.2 Defendants contention is that they had a right to foreclose on the property in question and the Plaintiffs contention is that Defendants inter alia intentionally constructed, operated and participated together in a fraudulent scheme to unjustly enrich themselves and to steal the estate described below. 4. Upon information and belief, Aztec Foreclosure Corporation of

Washington, HSBC Bank USA, N.A., Mortgage Electronic Registration Systems, Inc., Renaissance Home Equity Loan Trust 2006-4, Ocwen Loan Servicing, LLC, Delta Funding Corporation and Garys Process Service, (hereinafter

Complaint

Page 2 of 35

Defendants,) have conspired and acted both in concert and individually to maliciously and fraudulently proceed against Plaintiffs real property, causing a Notice of default, Notice of Foreclosure and their intent to sell the property at auction to be posted on the property and their subsequent alleged auction and alleged transfer to occur. 5. Defendants have caused and continue to cause Plaintiff to suffer damages

in an amount to be determined by the Trier of fact herein. 6. Plaintiff is informed and believes and thereupon alleges that Defendants,

and each of them, claim an interest in the property adverse to plaintiff herein. However, the claims of said Defendants are without any right whatsoever, and said defendants have no legal or equitable right, claim, or interest in said property as they have violated the Unfair business practices, breached their Trust and subsequently have lost the chain of Title to the aforesaid property. 7. On April 13, 2011 the Federal Reserve Board signed and published twelve consent orders (the Federal Reserve Consent Orders), which found that the named entities; (Bank of America, N.A., Citibank, N.A., HSBC Bank USA, N.A. (a Plaintiff herein), JPMorgan Chase Bank, N.A., MetLife Bank, N.A., PNC Bank, N.A., U.S. Bank National Association, and Wells Fargo Bank, N.A.) engaged in unsafe or unsound practices. In addition, the United States Comptroller of the Currency entered into consent orders with eight servicers as well as LPS, DocX, MERSCORP, and MERS Inc., (a Plaintiff herein). (The OCC Consent Orders). In the OCC Consent Orders the government found that each of the servicers: a. Filed or caused to be filed in state courts and federal courts affidavits

executed by its employees or employees of third-party service providers making various assertions, such as the ownership of the mortgage note and mortgage, the amount of principal and interest due, and the fees and expenses chargeable to the borrower, in which the affiant represented that the assertions in the affidavit were made based on personal knowledge or based on a review by the affiant of the relevant books and records, when, in many cases, they were not based on such knowledge or review; b. Filed or caused to be filed in state and federal courts or in the local land Page 3 of 35

Complaint

record offices, numerous affidavits and other mortgage-related documents that were not properly notarized, including those not signed or affirmed in the presence of a notary; c. Litigated foreclosure proceedings and initiated non-judicial foreclosure

proceedings without always ensuring that either the promissory note or the mortgage document were properly endorsed or assigned and, if necessary, in the possession of the appropriate party at the appropriate time; d. Failed to devote sufficient financial, staffing and managerial resources to

ensure proper administration of its foreclosure processes; e. Failed to devote to its foreclosure processes adequate oversight, internal

controls, policies, and procedures, compliance risk management, internal audit, third-party management, and training; and f. Failed to sufficiently oversee outside counsel and other third-party

providers handling foreclosure-related services.

7.

8.

Defendants have conspired to defraud the Plaintiff of interest in said

property contrary to due process of law. Plaintiff has incurred Court costs and fees in this matter in order to defend against the Defendants foreclosure action. 9. Defendants caused to have filed with the King County Recorder: (1) altered, forged, and/or fraudulently executed mortgage-related

falsified,

documents through a practice called robo-signing; which is the practice of signing mortgage assignments, satisfactions and other mortgage-related documents in assembly-line fashion, often with a name other than the affiants own, and swearing to personal knowledge of facts of which the affiant has no knowledge. 8. Defendants scheme, inter alia, failed to disclose ownership of the Note

and the mortgage accurately, was manifested in a private electronic registry some of the Defendants may have created or are members of, called the Mortgage Electronic Registration System (MERS). Through MERS, Defendants effectively privatized the public property recording system so that the Plaintiff is effectively unable to discover who held interest in the subject property. Complaint Page 4 of 35

9.

Defendants systematic schemes have confused, misled, and deceived

the borrower, and the Plaintiff who rely on the validity of publicly filed property records. 10. The Plaintiff recently discovered discrepancies on the Deed of Trust, the

signature of the Notary on the Assignment of Deed of Trust, the date on the Assignment of Deed of Trust, the Appointment of Successor Trustee, the status of the signatory and the date of the Notarizations, which are filed in the King County Recorders Office by the Defendants. 11. At least one of the Defendants herein, HSBC is known to have hired

companies like Lender Process Services. LPS is one of the largest companies that provided home foreclosure services to lenders across the nation. The unfair and deceptive trade practices employed by LPS and DocX have been the subject of widespread media attention. For example, on April 3, 2011, the television show 60 Minutes aired a report on the fraudulent robo-signing practices at DocX. Two former DocX employees appeared on the program and explained the scheme at DocX, pursuant to which they forged thousands of documents on behalf of mortgage companies on whose behalf they did not have authority to act. LPSs subsidiary DocX, has been under investigation by the FBI and all fifty state attorneys and have been indicted and charged with criminal forgery and other crimes as a result of its execution of forged mortgage documents. DocX has been found to have committed forgery on an enormous scale. From at least 2006 through 2010, DocX executed various mortgage-related documents on behalf of its mortgage company clients. These documents include fake executives who signed false mortgage assignments, satisfactions, lien releases, and other documents filed with County Recorders across the nation. LPS employees systematically and efficiently composed and signed thousands of documents each day. The employees who signed the documents were not placed under oath, did not sign in the presence of notaries, and/or did not have personal knowledge of the information to which they attested. This practice, which has received widespread media attention and which also has been the subject of numerous civil and criminal complaints, is known as robo-signing. Complaint Page 5 of 35

12.

In April 2011, MERSCORP and MERS Inc. executed a Stipulation and

Consent to the Issuance of a Consent Order with the Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, the Office of Thrift Supervision, and the Federal Housing Finance Agency (the Federal Regulators), in which both entities agreed to the terms of a comprehensive Consent Cease and Desist Order. 13. The Consent Cease and Desist Order is based upon the result of the Federal Regulators examination of MERS, which identified certain deficiencies and unsafe or unsound practices by MERS [Inc.] and MERSCORP that present financial, operation, compliance, legal and reputation risks to MERSCORP and MERS [Inc.], and to participating Members. In regard to tracking, registering, and foreclosing upon mortgages, the Federal Regulators specifically found that MERSCORP and MERS Inc.: a. Failed to exercise appropriate oversight,

management supervision and corporate governance, and have failed to devote adequate financial, staffing, training and legal resources to ensure proper administration and delivery of services to Examined Members; and b. Failed to establish and maintain adequate internal controls, policies and procedures, compliance risk management, and internal audit and reporting requirements with respect to the administration and delivery of services to Examined Members. 14. The Federal Regulators directed MERSCORP and MERS Inc. to develop

and implement a series of reforms. None of these reforms, however, involves repairing the damage Defendants caused to the accuracy, reliability, and availability of public records to the Plaintiff. 15. State Attorneys General, including the New York and Delaware Attorneys

General, have filed civil complaints against MERSCORP and MERS Inc. alleging that the conduct of MERSCORP and MERS Inc. described in this Complaint violates numerous laws, including state unfair trade practices statutes. 16. Even the Washington Attorney General Amicus brief before the

Washington Supreme Court in case No. 10-5523-JCC states that MERS conceals the true owner of a home loan, damages a free, fair and transparent Complaint Page 6 of 35

mortgage marketplace, commits a classic violation of consumer protection laws, fails to reveal the note holders and the chain of transfers remains one of its most important legal failings. He also states that separating the note and deed has become a systematic and unmanageable problem. 17. Plaintiff pursuant to RCW Title 62A, and specifically 62A 3-501(B)(2)(ii),

hereby, and before the foreclosure questioned the authenticity, validity and authority of all recorded and/or notarized signatures of all parties and documents filed against the property in question, therefore requiring any and all said parties to provide evidence of authenticity and validity for any and all signatures on any and all original documents and/or pleadings. See Indymac Bank v. Boyd, 880 N.Y.S.2d 224 (2009). To establish a prima facie authority in an action to foreclose a mortgage, the Defendants must establish the existence of the Deed of Trust and the Promissory Note. A bank must also provide the original signature Note when demanded. Such Note has been previously demanded and the demand was ignored. Plaintiff further demanded a request for accounting and request regarding list of collateral or statement of account pursuant to RCW 62A.9A-210 prior to foreclosure and was also ignored. Plaintiff still demands such. See also State Street Bank and Trust Company v. Harley Lord 851 SO. 2nd 790 (2003), W.H. Downing v. First National Bank of Lake City 81 SO. 2nd 586 (1955), National Loan Investors, L. P. v. Joymar Associates 767 SO. 2ND 549,551 (2000), Dasma Investments, LLC v. Realty Associates Fund III 459 F. Supp. 2d 1294 (2006), Shelter Development Group, INC. v. MMA of Georgia 50 BR 588, 590 Bankruptcy Court (1985), Universal Postal Union - Pages 73, 74, 80, 96, 103, 186, 195, TITLE 18 USC Section 7, Jackson v. Magnolia - 20 HOW 296, 315, 342 US F. Supplemental Rules of Admiralty - found in 28 USC - Rule 55, and 56 - Default and Summary Judgments, Menominee River Co. v. Augustus Spies L & C Co.147 Wis. 559 at p. 572. 18. Upon information and belief, Defendants had no lawful right to enforce the

instrument that they claim they were enforcing, as there is no evidence that they possessed the original instrument. Because it is negotiable, the promissory note must be surrendered in a foreclosure proceeding so that it does not remain in the Complaint Page 7 of 35

stream of commerce. Defendants allegedly foreclosed on the property but failed to surrender the Promissory Note after they allegedly foreclosed on the mortgage so it would not remain in the stream of commerce. See: Perry v. Fairbanks Capital Corp., 888 So. 2d 725, 726 (Fla. 5th DCA 2004) and JAMES F. JOHNSTON and SANDRA JOHNSTON, Appellants v. JEANNE HUDLETT N0. 4D08-4636 (Fla. 2010). 19. As a direct and proximate cause of Defendants actions, Plaintiff has

suffered harm, including, but not limited to, the following: a. Legal uncertainty concerning title; b. Difficulty or inability to discover and remedy title defects; c. The loss of property due to illegal foreclosure; d. Difficulty or inability to buy and sell property; e. Decrease in real estate value; f. loss of credit score; g. The cost of identifying and repairing the issues identified in this Complaint.

JURISDICTION AND VENUE

20. In Washington, a Quiet Title action is an equitable action. It allows a party in peaceful possession of real property to compel others who assert a hostile claim to assert that claim and submit it to judicial determination. Plaintiff is asserting the right to require Defendants to produce any and all original documentation to prove that their claimed rights to foreclose on the property exist. Plaintiff is a trustee for the 13001 41st Avenue South Trust and as such has authority to bring this action with exclusive possessory rights, having a paramount security interest over the below described Subject Property. This court has jurisdiction over this matter pursuant to RCW 7.28, RCW 61.24.030, RCW 62A 3-501, and venue lies in the Washington Superior Court, as the subject property is located in King County Washington. National Banking Associations are not exempt from State laws, unless specifically exempted.

PARTIES

21. At all times material hereto, AZTEC FORECLOSURE CORPORATION OF WASHINGTON, Defendant, is a domestic Washington corporation, whos Registered Agent is DAVID C TINGSTAD and whos address is: 145 THIRD AVE S #200 EDMONDS WA. AZTEC FORECLOSURE CORPORATION OF Complaint Page 8 of 35

WASHINGTON claims to be a trustee and claims some ownership rights in the below described property, claims to represent Ocwen Loan Servicing, LLC and also claims to be a debt collector. 22. HSBC BANK USA, NA, Defendant, is a foreign New York corporation that

is neither registered nor authorized to do business within the state of Washington, as set forth in the records of the Washington Secretary of State and, who claims to be a Trustee for Renaissance Home Equity Loan Trust 2006-4, and, has its principal place of business in Wilmington, Delaware and, is the principal subsidiary of HSBC USA Inc. HSBC BANK USA claims to hold beneficial interest to the Deed of Trust dated October 27, 2006. 23. MORTGAGE ELECTRONIC REGISTRATION SYSTEMS, INC, Defendant,

claims to be a Nominee for Delta Funding Corporation, Defendant, while at the same time claiming to be the beneficiary on the Deed of Trust and was holding it separate from the Note and, whos address is 1818 Library Street, Suite 300, Reston, VA 20190. MERS is a foreign Delaware corporation that is neither registered nor authorized to do business within the state of Washington, as set forth in the records of the Washington Secretary of State. MERS has no interest in the Note or the property and is a tax evasion broker and because the relevant Note was assigned to one party while the Deed of Trust was assigned to MERS, a split of the Note and Deed has occurred and therefore the latter is a nullity and, 24. Renaissance Home Equity Loan Trust 2006-4, Defendant, is a foreign

corporation/Trust that is neither registered nor authorized to do business within the state of Washington, as set forth in the records of the Washington Secretary of State, whos address is: 3121 Michelson Drive Suite 200, Irvine, CA 92612. Renaissance Home Equity Loan Trust 2006-4 claims a representative capacity ownership rights in the Note described in the Deed of Trust dated October 27, 2006, on behalf of the Note holders of the trust. 25. Ocwen Loan Servicing, LLC is a Delaware corporation authorized to do business in Washington, whos Registered Agent is: CORPORATION SERVICE COMPANY, whos address is: 300 DESCHUTES WAY SW STE 304 TUMWATER WA 98501. Ocwen claims to be a creditor on the Deed of Trust Complaint Page 9 of 35

dated October 27, 2006 although without any evidence that they loaned any money to the alleged debtor in violation of RCW 9A.82.010(3) and at the same time Ocwen claims to be a Beneficiary to the Deed of Trust dated October 27, 2006. 26. DELTA FUNDING CORPORATION, Defendant, is a foreign New York

corporation that is neither registered nor authorized to do business within the state of Washington, as set forth in the records of the Washington Secretary of State and also claims to be a beneficiary on the Deed of Trust dated October 27, 2006. DELTA FUNDING CORPORATION filed for bankruptcy on December 17 of 2007 and is state supervised and a subsidiary of Delta Financial Corporation. DELTA FUNDING CORPORATIONs address is: 1000 WOODBURY ROAD WOODBURY, NY. 27. GARYS PROCESS SERVICE, INC Defendant, is a Washington Corporation whos Registered Agents address is: PAUL G TURPEN 14973 INTERURBAN AVE S #201 TUKWILA WA 98168. GARYS PROCESS SERVICE, INC, auctioned off the subject property on March 9, 2012 in full knowledge of the filed Lis Pendens, Lawsuit and Cease & Desist Notice. 28. The subject property is located in King County, Washington and is legally

described as: THAT PORTION OF TRACT 55, RIVERSIDE INTERURBAN TRACTS, ACCORDING TO THE PLAT THEREOF RECORDED IN VOLUME 10 OF PLATS, PAGE 74, RECORDS OF KING COUNTY, WASHINGTON, DESCRIBED AS FOLLOWS: BEGINNING AT THE SOUTHEAST CORNER OF SAID TRACT; THENSE WEST ALONG THE SOUTH BOUNARY LINE THEREOF, 132.8 FEET TO THE WEST LINE OF 41ST AVENUE SOUTH; THENCE NORTH, ALONG SAID WEST LINE, 160 FEET TO THE TRUE POINT OF BEGINNING OF THE TRACT HEREIN DESCRIBED; THENCE WEST, PARALLEL TO THE SOUTH BOUNDARY LINE OF SAID TRACT, 53.43 FEET TO THE SOUTHARLY MARGIN OF COUNTY ROAD; THENCE EASTERLY ALONG SAID SOUTHARLY MARGIN OF ROAD, 153.22 FEET TO THE WEST LINE OF SAID 41ST AVENUE SOUTH; THENCE SOUTH, ALONG SAID WEST LINE, 65.8 FEET TO THE TRUE POINT OF BEGINNING; (ALSO KNOWN AS Complaint Page 10 of 35

LOT 10, BLOCK 3, SUBDIVISION OF PART OF TRACTS 55,56 AND 57 OF RIVERTON INTERURBAN TRACTS, AN UNRECORDED PLAT) SITUATE IN THE COUNTY OF KING, STATE OF WASHINGTON. The Subject Property has an Assessors Parcel Number: 734160021501 and is also commonly known as: 13001 41st Avenue South Tukwila, Washington 98168. 29. Defendants have caused events to occur within the jurisdiction of this

Court from which plaintiffs Complaint arises. 30. At all times material hereto, actions by Defendants have caused, and

continue to cause, Plaintiff and the estate to suffer damages in an amount to be determined by the Trier of fact herein.

FIRST CAUSE OF ACTION

(QUIET TITLE) 31. Plaintiff re-alleges and incorporates herein by reference to the preceding

allegations, as though herein fully set forth. Plaintiff is informed and believes and thereon alleges that, at all times herein mentioned, each of the Defendants sued herein was the agent and/or employee of each of the remaining Defendants and was at all times acting within the purpose and scope of such agency and employment, because the conduct constituting the offense was engaged in, authorized, solicited, requested, commanded or knowingly tolerated by a high managerial agent acting within the scope of the agents employment and in behalf of the corporations. Upon information and belief, QUALITY LOAN SERVICE CORP. OF

WASHINGTON had no lawful right to commence foreclosure proceedings on Plaintiffs real property. Plaintiff hereby continues to demand that Defendants present the original instrument pursuant to: RCW 62A 3-501(b)(2)(i),(ii),(iii). Plaintiff specifically rejects all fraudulent counterfeit and/or un-validated signatures in any and all documents pursuant to RCW 62A 3-308(a). The basis of Plaintiffs interest in title is the trust instrument granted by William Schmidt and Sufian Hamad on March 6, 2012. See exhibits A 1 & 2. Because the Schmidt Deed of Trust Dated 10/27/2006 was split from the Note the former is a nullity and should be stricken from the chain of title. Complaint Page 11 of 35

Plaintiff is seeking to quiet title against the claims of Defendants and void the unlawful foreclosure sale as follows: Defendants are seeking to hold themselves out as the fee simple owners of the subject property, when in fact Plaintiff has an interest in such property claimed by Defendants, when Defendants have no rights, title, interest, or estate in the Subject Property, and Plaintiffs interest is adverse to Defendants claims of ownership. Plaintiff seeks to void Defendants foreclosure sale. Plaintiff seeks to quiet title as of March 7, 2012. Plaintiff therefore seeks a judicial declaration that the title in the Subject Property is vested in Plaintiff alone and that Defendants, herein, and each of them be declared to have no estate, right, title, or interest in the Subject Property, adverse to Plaintiff herein.

SECOND CAUSE OF ACTION (OBTAINING A SIGNATURE BY DECEPTION OR DURESS)

32. Plaintiff re-alleges and incorporates herein by reference to the preceding allegations, as though herein fully set forth. Plaintiff complains that Defendants committed the Class C Felony of violation of RCW 9A.60.030 because the conduct constituting the offense was engaged in, authorized, solicited, requested, commanded or knowingly tolerated by a high managerial agent acting within the scope of the agents employment and in behalf of the corporations. (1) A person is guilty of obtaining a signature by deception or duress if by deception or duress and with intent to defraud or deprive he or she causes another person to sign or execute a written instrument. (2) Obtaining a signature by deception or duress is a class C felony. That on 10/27/2006 MERS knew or should have known that they were not legally qualified to be a beneficiary under the Washington Deed of Trust Act, as MERS had no interest in the note and would not hold the Note, when the lender drew up the Deed of Trust. The grantor of the Deed of Trust was deceived by MERS and the lender and believed that MERS had an interest in the Note and was qualified Complaint Page 12 of 35

under Washington Deed of Trust Laws to be the lawful beneficiary on the Deed of Trust when in actuality that was not the case. This deception caused William Schmidt to pass title into the trust as a direct result of the false representation. See: Affidavit of William Schmidt. Exhibit B.

THIRD CAUSE OF ACTION

(FORGERY, FALSE ALTERATION) 33. Plaintiff re-alleges and incorporates herein by reference to the preceding

allegations, as though herein fully set forth. Plaintiff complains that Defendants committed the Class C Felony of Forgery & False Alteration, punishable upon conviction of violation of RCW 9A.60.010, 9A.60.020(3) and RCW 9A.60.030(1) because the conduct constituting the offense was engaged in, authorized, solicited, requested, commanded or knowingly tolerated by a high managerial agent acting within the scope of the agents employment and in behalf of the corporations.

Count 1. RCW 9A.60.010(6) "Forged instrument" means a written instrument which has been falsely made, completed, or altered. That on June 19, 2009 in the County of King, State of Washington, Defendants acted knowingly in concert with its employees, with the purpose to defraud, used as genuine or transferred with the knowledge or belief that it would be used as genuine, a writing, namely Appointment of Successor Trustee recording number 20090707002064, knowing that it had been made or authenticated so that it purported to have been made by another, or that it had been made by authority of one who did not give such authority and did so without authority of law and before the Assignment of Deed of Trust was executed. Kevin M Jackson signed as Manager of Ocwen Loan Servicing, LLC and as Attorney in Fact for HSBC Bank USA, National Association as Indenture Trustee for the registered Noteholders of Renaissance Home Equity Loan Trust 2006-4. Plaintiff disputes that Kevin M Jackson had such authority and that said Appointment was valid. Said document was notarized by a known robosigner and an employee of Ocwen Loan Servicing, LLC (a Plaintiff herein) in Palm Beach Complaint Page 13 of 35

Florida. See Exhibit J. Defendants are liable under sections RCW 9A.60.010, 9A.60.020(3) and RCW 9A.60.030(1). Count 2. Plaintiff complains that Defendants committed the Class C Felony of Forgery punishable upon conviction of violation of RCW 9A.60.020(1),(3) (1) because the conduct constituting the offense was engaged in, authorized, solicited, requested, commanded or knowingly tolerated by a high managerial agent acting within the scope of the agents employment and in behalf of the Defendants. That on July 21, 2009 in the County of King, State of Washington, Defendants acted knowingly in concert with its employees, with the purpose to defraud, used as genuine or transferred with the knowledge or belief that it would be used as genuine, a writing, namely, Kevin M Jackson signed an Assignment of Deed of Trust Recording number 20090721000835 knowing that it had been made or authenticated so that it purported to have been made by another, or that it had been made by authority of one who did not give such authority and that it was also knowingly done after the Appointment of Successor Trustee. See Exhibt G. Kevin M Jackson signed this document as Vice President of Mortgage Electronic Registration Systems, Inc. This document was also notarized by a known robosigner in Palm Beach Florida and also an employee of Ocwen Loan Servicing LLC. Upon information and belief Kevin M Jackson was never appointed as Vice President by the MERS Board Of Directors and thus there was no authority to make the assignment of Deed of Trust nor was he authorized to represent HSBC Bank or in any way represents the registered Noteholders of Renaissance Home Equity Loan Trust 2006-4. A person is guilty, with intent to injure or defraud: (a) He or she falsely makes, completes, or alters a written instrument or; (b) He or she possesses, utters, offers, disposes of, or puts off as true a written instrument which he or she knows to be forged. (2) In a proceeding under this section that is related to an identity theft under RCW 9.35.020, the crime will be considered to have been committed in any locality where the person whose means of identification or financial Complaint Page 14 of 35

information was appropriated resides, or in which any part of the offense took place, regardless of whether the defendant was ever actually in that locality. (3) Forgery is a class C felony. See Exhibits G,J.

Count 3. RCW 9A.60.030(1) A person is guilty of obtaining a signature by deception or duress if by deception or duress and with intent to defraud or deprive he or she causes another person to sign or execute a written instrument. (2) Obtaining a signature by deception or duress is a class C felony. The Deed of Trust dated October 27, 2006 that Defendants filed or caused to have filed into the King County Recorders Office is a forgery. It is not the same Deed of Trust that William P Schmidt signed. William Schmidt qualified his signature, See Exhibit B, and such qualification does not appear on the altered and recorded Deed of Trust. The recorded Deed of Trust that Defendants mailed through the U.S. Mail to William Schmidt does reflect such qualification and on its face appears genuine, but is not. Also Plaintiff alleges that upon information and belief, the Assignment of Deed of Trust, and Appointment of Successor Trustee filed 7/21/2009 and 7/07/2009 are fraudulent because these documents were executed after the closing date of the Renaissance Home Equity Loan Trust 2006-4 (the supposed owner of the Deed of Trust and Note), in violation of the Trust Pooling and Servicing Agreement. The Plaintiff also alleges that Kevin M Jackson, the purported signatory on the Assignment was not the Vice President for MERS and lacked the requisite corporate and legal authority to effect an actual assignment of the Deed of Trust or Appointment of Successor Trustee. Further MERS claims to be a Nominee for Delta Funding Corporation on the date of signing. (July 10, 2009) However Delta Financial Corporation, and its

operating subsidiary Delta Funding Corporation, filed for Bankruptcy on

December 17, 2007 and that the petitioner (Delta Financial Corporation, et al.) was ordered to transfer their right title and interest in and to the Residual Interest and the Pooling and Servicing Agreement to Citigroup Global Markets, Inc. effective January 1, 2008. Kevin M Jackson knew or should have known (especially as Vice President of MERS as nominee or beneficiary) of the Complaint Page 15 of 35

Bankruptcy filing and did not have authority to transfer or assign assets of Delta Funding Corporation after December 17, 2007 without usurping the Bankruptcy Trustees authority at that time and violating U.S. Bankruptcy laws. See Delta Funding Corporation Bankruptcy filing Case # 07-11881-CSS, See Exhibit D, D1. Defendants filed, or caused to be filed, the altered/forged/fraudulent Deed of Trust and Appointment of Successor Trustee and Assignment of Deed of Trust into the King County Recorders Office that others may rely upon the altered/forged/fraudulent documents to their detriment. Plaintiff has been damaged as a direct result. These altered/forged/fraudulent documents cloud the title and affect Plaintiffs right to property. See: Affidavit of William Schmidt Exhibit B.

FOURTH CAUSE OF ACTION

(FALSE FILING) 34. Plaintiff re-alleges and incorporates herein by reference to the preceding

allegations, as though herein fully set forth. Plaintiff complains that Defendants committed the Class C Felony of offering false instrument for filing or record punishable upon conviction of violation of RCW 40.16.030 because the conduct constituting the offense was engaged in, authorized, solicited, requested, commanded or knowingly tolerated by a high managerial agent acting within the scope of the agents employment and in behalf of the Defendants. Every person who shall knowingly procure or offer any false or forged instrument to be filed, registered, or recorded in any public office, which instrument, if genuine, might be filed, registered or recorded in such office under any law of this state or of the United States, is guilty of a class C felony and shall be punished by imprisonment in a state correctional facility for not more than five years, or by a fine of not more than five thousand dollars, or by both Defendants filed or caused to have filed with the King County Recorder: (1) falsified, forged, and/or fraudulently executed mortgage-related documents as stated above and through a practice called robo-signing; which is the practice of signing mortgage assignments, satisfactions and other mortgage-related Complaint Page 16 of 35

documents in assembly-line fashion, often with a name other than the affiants own, and swearing to personal knowledge of facts of which the affiant has no knowledge. There is no evidence that Defendants hold the instrument that they claim that they are entitled to enforce or legally authorized to enforce, or that the signatories on the documents are legitimate and caused the filing of a Notice of Trustees Sale. Count 1. That on 07/21/2009 in the County of King, State of Washington, Defendants acted knowingly in concert with its employees, with the purpose to defraud and that on the WASHINGTON ASSIGNMENT OF DEED OF TRUST, filed under King County Recorder No. 20090721000835 the signatories have created the illusion that the Assignment of the Deed of Trust was as made and entered into on the 26th day of December, 2006, when in fact the Assignment was not executed until July 10, 2009. (Almost three years later.) The assignment could not have taken place on the date stated in the document, but instead when Kevin M Jackson appeared and executed the document, if indeed the document is at all valid. Upon information and belief Kevin M Jackson, the signatory on the Assignment was not the Vice President for MERS and lacked the requisite corporate and legal authority to effect an actual assignment of the Mortgage. See: Kingman Holdings, LLC v. CitiMortgage, Inc., 2011 WL 1883829 (E.D. Tex. 2011), the court assessed a fraud claim against CitiMortgage in which the plaintiff alleged that MERS appointment of an assistant secretary was invalid because it was not approved by the board of directors. The court upheld the fraud claim and held that if the assistant secretary had no authority to bind MERS, then MERS filed a fraudulent document after he executed the assignment. The Assignment is defective. Upon information and belief Kevin M Jackson was never appointed to Vice President by the MERS board of directors and thus there was no authority to make the assignment of Deed of Trust. Further, the document was prepared by the same Notary, Leticia N. Arias, who is an employee of OCWEN LOAN SERVICING, and had a conflict of interest. (see upper left of document exhibit G) Several courts have recently acknowledged that MERS is not and cannot be the owner of the underlying note and therefore Complaint Page 17 of 35

could not transfer the note, the beneficial interest in the deed of trust, or foreclose upon the property secured by the deed. See In re Foreclosure Cases, In re Vargas, 396 B.R. 511, 520 (Bankr. C.D. Cal. 2008) ; Landmark Natl Bank v. Kelser, 216 p.3d 158 (Kan. 2009) ; Lasalle Bank v. Lamy, 824 N.Y.S2d 769 (N.Y. Sup. Ct. 2006). The Assignment of Deed of Trust, and Appointment of Successor Trustee filed 07/07/2009 and 7/21/2009 are fraudulent because these documents were executed after the closing date of the Renaissance Home Equity Loan Trust 2006-4 (the supposed owner of the Deed of Trust and Note), and upon information and belief, in violation of the Trusts Pooling and Servicing Agreement. Leticia N. Arias (the Notary), Maria Alvarez and OCWEN LOAN SERVICING (Defendant) all are located in Palm Beach Florida. The assignment of Deed of Trust was notarized in Palm Beach Florida. MERS however, is located in Reston Virginia and upon information and belief, has no employees and Dan McLaughlin is listed as Vice President of MERS. In any case Kevin M Jackson has a conflict of interest as he signed as Vice president of MERS, (Defendant) and he also signed the Appointment of Successor Trustee, as Manager of HSBC (also a Defendant). In Washington State, making or creating Legal Documents without being an attorney is considered Practicing Law without a license, a Misdemeanor Crime. An employee of the Servicer (OCWEN) who signed the same document that she created for a co-conspirator (MERS) is a Gross Conflict of Interest, conspiracy to defraud and Malfeasance of Office. See Exhibits G, J. Count 2. The Notarial signature is that of a Leticia N Arias, a known robo-signer. That signature is not the same as on her Certified Application for Notary Public Commission Application from the Secretary of State of Florida and other recordings done by her in other states. See exhibits G, L, M, N, O, P, P1. Count 3. The Deed of Trust dated October 27, 2006 is a forgery. It is not the same Deed of Trust that William P Schmidt signed. The document has been forged. See: Affidavit of William Schmidt, Exhibit B. Any recording based on Robo-Signed documents is void without any legal effect. Forging assignments is illegal because fraud cannot be the basis of an Complaint Page 18 of 35

Assignment of Deed of Trust, lawful recording or clear title. Trustees Deeds following Robo-Signed sales are void as a matter of law. Numerous authorities have established the rule that an instrument wholly void, such as an undelivered deed, a forged instrument, or a deed in blank, cannot be made the foundation of a good title, even under the equitable doctrine of bona fide purchase. Consequently, the fact that purchaser acted in good faith in dealing with persons who apparently held legal title, is not in itself sufficient basis for relief. The Doctrine of Unclean Hands provides: Defendants misconduct in the matter before the court makes their hands unclean and they may not hold with them the pristine remedy of injunctive relief. The unclean hands rule requires that the parties not cheat, and behave fairly. The Defendants must come into court with clean hands, and keep them clean, or they will be denied relief, regardless of the merits of the claim. Count 4. The Appointment of Successor Trustee filed on 07/07/2009 file No.

20090707002064 in the King County Recorders Office is a fraud. Kevin M Jackson signed it as Manager of HSBC Bank USA on 6/19/2009. The same Kevin M Jackson signed the Assignment of Deed of Trust on July 10, 2009 as Vice President of MERS and after the Assignment that he himself signed. The Plaintiff alleges on information and belief that Kevin M Jackson, the signatory on the Assignment was not the Vice President for MERS and lacked the requisite corporate and legal authority to effect an actual assignment of the Mortgage or the Appointment of Successor Trustee. Also because these documents were executed after the closing date of the Renaissance Home Equity Loan Trust 2006-4 (the supposed owner of the Deed of Trust and Note), and upon information and belief, in violation of the Trusts Pooling and Servicing Agreement. The Defendants have unclean hands in this matter. The Notary on the Appointment of Successor Trustee is Maria Alvarez, a known robo-signer who appears to be employed by Ocwen. (see Assignment of Deed of Trust Exhibit G). The documents were notarized in Palm Beach Florida, all apperently by employees of Ocwen. MERS is located in Reston Virginia. All competent jurists should be able to see that it is extremely unlikely that Kevin Complaint Page 19 of 35

Jackson would travel to Palm Beach, Florida from Reston, Virginia to get his signature notarized as Vice President of MERS one week, and then another week travel there again from Buffalo, New York as Manager of HSBC to get another Notary of Ocwen to get his signature notarized again. Plaintiff asks the court to require Kevin M Jackson (if he exists) to describe his employment history from 2008 through 2010 under the penalties of perjury. Plaintiff has been damaged as a result of Defendants reckless negligence, utter carelessness, and blatant fraud and Plaintiffs chain of title has been rendered unmarketable and fatally defective.

FIFTH CAUSE OF ACTION

(FALSE CERTIFICATION) 35. Plaintiff re-alleges and incorporates herein by reference to the preceding

allegations, as though herein fully set forth. Plaintiff complains that Defendants committed a violation of RCW 9A.60.050 because the conduct constituting the offense was engaged in, authorized, solicited, requested, commanded or knowingly tolerated by a high managerial agent acting within the scope of the agents employment and in behalf of the Defendants. (1) A person is guilty of false certification, if, being an officer authorized to take a proof or acknowledgment of an instrument which by law may be recorded, he or she knowingly certifies falsely that the execution of such instrument was acknowledged by any party thereto or that the execution thereof was proved. (2) False certification is a gross misdemeanor. That on July 10, 2009 when Leticia N Arias, a known robosigner certified the Assignment of Deed of Trust, that was filed in King County Washington on July 21, 2009 as true, the Notary knew or should have known that the assignment date was false because, the assignment was claimed to be made and entered into on the 26th day of December, 2006, but the alleged Vice President of MERS (who also claims to be a manager of HSBC Bank) didnt execute the Assignment until three years later, on July 10, 2009 according to the Notary and after the Appointment of Successor Trustee. Such certification is deliberately misleading Complaint Page 20 of 35

and caused the false transfer of the Deed of Trust, directly related to the unlawful foreclosure, rendering Plaintiffs chain of title unmarketable. See exhibit G.

SIXTH CAUSE OF ACTION

(FALSE REPRESENTATION CONCERNING TITLE.) 36. Plaintiff re-alleges and incorporates herein by reference to the preceding

allegations, as though herein fully set forth. Plaintiff complains that Defendants committed the violation of RCW 9.38.020 because the conduct constituting the offense was engaged in, authorized, solicited, requested, commanded or knowingly tolerated by a high managerial agent acting within the scope of the agents employment and in behalf of the Defendants. Every person who shall maliciously or fraudulently execute or file for record any instrument, or put forward any claim, by which the right or title of another to any real or personal property is, or purports to be transferred, encumbered or clouded, shall be guilty of a gross misdemeanor. Defendants have caused to be delivered through the U.S. Mail and recorded in King County Recorders Office, a Notice of Default, Notice of Trustees Sale, and Assignment of Deed Of Trust, all in violation of RCW 9.38.020 and directly affecting the Plaintiffs right to the property, and damaging Plaintiffs title to property. See Exhibits G, Q, Q1, Q2, R.

SEVENTH CAUSE OF ACTION

(Presentment) 37. Plaintiff re-alleges and incorporates herein by reference to the preceding

allegations, as though herein fully set forth. Plaintiff complains that Defendants committed a violation of RCW 62A. 3501(a)(2) because the conduct constituting the offense was engaged in, authorized, solicited, requested, commanded or knowingly tolerated by a high managerial agent acting within the scope of the agents employment and in behalf of the Defendants. RCW 62A. 3-501(a)(2) Upon demand of the person to whom presentment is made, the person making presentment must (i) exhibit the instrument, (ii) give Complaint Page 21 of 35

reasonable identification and, if presentment is made on behalf of another person, reasonable evidence of authority to do so, and (iii) sign a receipt on the instrument for any payment made or surrender the instrument if full payment is made. That upon demand for payment on September 6, 2011 by Defendants, acted knowingly in concert with its employees, with the purpose to defrauding William Schmidt in the County of King, State of Washington. That when William Schmidt demanded that the Defendants produce the instrument pursuant to RCW 62A 3501 and verify the alleged debt, Defendants failed in their duty to produce the instrument. Plaintiff hereby continues to demand that Defendants present the original instrument. To date Defendants have failed to present the instrument or to verify their claim, all contrary to RCW 62A. 3-501(a)(2). Silence can only be equated with fraud where there is a legal or moral duty to speak or when an inquiry left unanswered would be intentionally misleading. U.S. v. Tweel, 550 F.2d 297 (1977). See Exhibit K. William Schmidt offered to pay/discharge/settle the claim as soon as Defendants claim was verified. See Exhibit K. Defendants failed to exhibit the instrument, sign any documentation, give any identification or any evidence that they were acting in any representative capacity, all in violation of RCW 62A.3-501. Upon payment to QUALITY LOAN SERVICE CORP., William Schmidt was entitled to receive the original note so that it may not be re-presented by another alleged debt collector. See: Cf., Perry v. Fairbanks Capital Corp., 888 So. 2d 725, 727, (Fl. 2004) (Because it is negotiable, the promissory note must be surrendered in a foreclosure proceeding so that is does not remain in the stream of commerce.). Silence can only be equated with fraud where there is a legal or moral duty to speak or when an inquiry left unanswered would be intentionally misleading. U.S. v. Tweel, 550 F.2d 297 (1977).

SEVENTH CAUSE OF ACTION

(TENDER OF PAYMENT.) 38. Plaintiff re-alleges and incorporates herein by reference to the preceding

allegations, as though herein fully set forth. Complaint Page 22 of 35

Plaintiff complains that Defendants committed a violation of RCW 62A. 3-603, because the conduct constituting the offense was engaged in, authorized, solicited, requested, commanded or knowingly tolerated by a managerial agent acting within the scope of the agents employment and in behalf of the Defendants. (a) If tender of payment of an obligation to pay an instrument is made to a person entitled to enforce the instrument, the effect of tender is governed by principles of law applicable to tender of payment under a simple contract. (b) If tender of payment of an obligation to pay an instrument is made to a person entitled to enforce the instrument and the tender is refused, there is discharge, to the extent of the amount of the tender, of the obligation of an indorser or accommodation party having a right of recourse with respect to the obligation to which the tender relates. (c) If tender of payment of an amount due on an instrument is made to a person entitled to enforce the instrument, the obligation of the obligor to pay interest after the due date on the amount tendered is discharged. If presentment is required with respect to an instrument and the obligor is able and ready to pay on the due date at every place of payment stated in the instrument, the obligor is deemed to have made tender of payment on the due date to the person entitled to enforce the instrument. That on October 5, 2011, William Schmidt offered to pay/discharge/settle the claim in writing to Defendants. Defendants did not respond to Schmidts offer and dishonored his offer to pay, thus refusing payment and discharging Schmidts obligation pursuant to RCW 62A. 3-603. Silence can only be equated with fraud where there is a legal or moral duty to speak or when an inquiry left unanswered would be intentionally misleading. (1977). See Exhibit K. See: U.S. v. Tweel, 550 F.2d 297

EIGHTH CAUSE OF ACTION

(MOCK AUCTIONS) 39. Plaintiff re-alleges and incorporates herein by reference to the preceding

allegations, as though herein fully set forth. Plaintiff complains that Defendants committed a violation of RCW 9.45.070 because the conduct constituting the offense was engaged in, by an agent of the Complaint Page 23 of 35

Defendants while acting within the scope of the agents employment and in behalf of the Defendants. Every person who shall obtain any money or property from another or shall obtain the signature of another to any writing the false making of which would be forgery, by color or aid of any false or fraudulent sale of property or pretended sale of property by auction, or by any of the practices known as mock auction, shall be punished by imprisonment in a state correctional facility for not more than five years or in the county jail for up to three hundred sixty-four days, or by a fine of not more than one thousand dollars, or by both fine and imprisonment. Every person who shall buy or sell or pretend to buy or sell any goods, wares or merchandise, exposed to sale by auction, if an actual sale, purchase and change of ownership therein does not thereupon take place, shall be guilty of a misdemeanor. William Schmidt and Percy Newby, (Plaintiff) on Friday March 9, 2012 went to Aztecs threatened auction at the King County Administrative Building in Seattle, Washington, whereas the auctioneer was served a copy of the Summons, Complaint, Lis Pendens and a Notice to Cease and Desist. The auctioneer was Tara Turpen of Garys Process Service. Tara stated that she had contacted Aztec Foreclosure Corporation and that they intended to continue with the auction. Such action was an attempt to defraud the Plaintiff and potential customers by creating the illusion that the property was the Defendants to sell. Subsequently the property in question allegedly reverted back to the alleged creditor based upon the Mock Auction. The Deed of Trust is a forgery and the filed Assignment of the Deed of Trust is a fraud, thus the alleged sale and transfer of property was in violation of RCW 9.45.070. See affidavit of William Schmidt. Exhibit B. NINETH CAUSE OF ACTION (BREACH OF TRUST) 40. Plaintiff re-alleges and incorporates herein by reference to the preceding

allegations, as though herein fully set forth. Plaintiff complains that Defendants committed the violation of RCW 11.98.085, Complaint Page 24 of 35

and RCW 61.24.005(2). Upon information and belief, the Washington Supreme Court (and others) has ruled that lenders must strictly comply with DEED OF TRUST statutes. Further, the court has ruled that any Trustees Sale, which is held without complying with the notice requirements of statutes, is VOID. It is void because upon information and belief, the trustee (or substitute trustee) on the Deed of Trust never held the Note, only the Deed. Defendants had no authority to auction the property in question, as they breached the Trust. "...the note and mortgage are inseparable..., the assignment of the note carries the mortgage with it, while an assignment of the latter alone is a nullity". The note and mortgage are inseparable; the former as essential, the latter as an incident. See: Carpenter v. Longan (1872). Further MERS is a shell company and could not be a beneficiary pursuant to RCW 61.24.005. There is no evidence that they are or were ever the holder of the instrument or document evidencing the obligations secured by the deed of trust. MERS is not authorized to act in the capacity of a beneficiary, as there is no evidence that they have an interest in, or hold the Note in question. This practice fails the requirement that the true beneficiary be recorded in the county of record. Courts around the nation have held time and again that Deeds of Trust with MERS as a Nominee for the beneficiary are empty and not enforceable. This deception was used in this case to defraud the Borrower and as a means for Defendants to unlawfully obtain and/or convert, to their financial advantage, the borrowers property. Upon information and belief, the Note is held by Renaissance Home Equity Loan Trust 2006-4, a tax exempt Real Estate Mortgage Conduit for the benefit of their investors, not by MERS. Thus if MERS never held the Promissory Note then it is not a lawful beneficiary and cannot assign anything to anyone. MERS violated the statutory language of the Deed of Trust Act, the law of Negotiable Instruments and the common law principals of real property. They therefore breached the Deed of Trust and the Deed of Trust is void. See Amicus Brief of Robert McKenna, Attorney General for Washington in Kristin Bain v. Metropolitan Mortgage Group Inc. et al. No 10-5523-JCC. Upon information and belief, the Complaint Page 25 of 35

DEED OF TRUST and the NOTE are not together nor properly assigned, therefore, breaching and invalidating the DEED OF TRUST. A deed of trust which is not owned by the Note Holder is a nullity. See Merritt v. Bartholick, 36 N.Y. 44, 45, 34 How. Pr. 9129, 1 Transc. App. 63, ("a transfer of the mortgage without the debt is a nullity, and no interest is acquired by it"); Carpenter v. Longan, 83 U.S. (16 Wall.) 271, 274,21 L. Ed. 313 (1872) (an assignment of the mortgage without the note is a nullity, "[a] different doctrine would involve strange anomalies [***]."); US Bank N.A. v. Madero, 80 A.D.3d 751, 752, 915 N.Y.S.2d 612 (2011); U.S. Bank, N.A. v. Collymore, 68 A.D.3d 752, 754; 890 N.Y.S.2d 578 (2009); Kluge v. Fugazy, 145 A.D.2d 537, 538, 536 N.Y.S.2d 92 (1988)(plaintiff, the assignee of a mortgage without the underlying note, could not bring a foreclosure action); Flyer v Sullivan, 284 A.D. 697, 698, 134 N.Y.S.2d 521 (1954)(mortgagee's assignment of the mortgage lien, without assignment of the debt, is a nullity). When the note is split from the deed of trust, the note becomes, as a practical matter, unsecured. RESTATEMENT (THIRD) OF PROPERTY (MORTGAGES) 5.4 cmt. (1997). A person holding only a note lacks the power to foreclose because it lacks the security, and a person holding only a deed of trust suffers no default because only the holder of the note is entitled to payment on it. See RESTATEMENT (THIRD) OF PROPERTY (MORTGAGES) 5.4 cmt. e (1997). Where the mortgagee has transferred only the mortgage, the transaction is a nullity and his assignee, having received no interest in the underlying debt or obligation, has a worthless piece of paper. 4 RICHARD R. POWELL, POWELL ON REAL PROPERTY, 37.27[2] (2000). Upon information and belief Aztec Foreclosure Corporation was also in breach of the Pooling and Servicing agreement (P.S.A.) because there is no evidence that they had ever transferred the Note and the Mortgage to the Renaissance Home Equity Loan Trust 2006-4 for the benefit of their investors as required by the P.S.A. by the closing date of the Trust. The Original Lender failed in their duty to request that the Trustee re-convey the property as required by the Deed of Trust section 23, page 14 when the Original Complaint Page 26 of 35

lender sold the Note and was paid in full and then failed to surrender the Security Instrument and all notes evidencing debt. (See Exhibit C) The Trustee subsequently failed to re-convey to the plaintiff the property after the lender sold the Note to Renaissance Home Equity Loan Trust 2006-4 as required under the subject Deed of Trust section 23, Re-conveyance, which states Upon payment of all sums secured by this Security Instrument, Lender shall request Trustee to reconvey the Property and shall surrender this Security Instrument and all notes evidencing debt secured by this Security Instrument to Trustee. Trustee shall reconvey the Property without warranty to the person or persons legally entitled to it After the Note was sold and the lender was paid, the plaintiffs were entitled to the property but no such transfer took place, in breach of contract. There is also no evidence that the Deed of Trust was attached to the sale of the Note. Upon information and belief, a DEED OF TRUST that is invalid cannot be foreclosed upon. Carpenter v. Longan, 83 U.S. 16 Wall. 271, Wells Fargo,

Litton Loan v. Farmer, 867 N.Y.S.2d, Indymac Bank v. Bethley, 880 N.Y.S.2d 873, Wells Fargo v. Reyes, 867 N.Y.S.2d 21, In re Hwang, 396 B.R. 757, 76667, Mortgage Electronic Registration Systems, Inc. v. Chong, 824 N.Y.S.2d 764, Lasalle Bank v. Ahearn, 875 N.Y.S.2d 595, Novastar Mortgage, Inc v. Snyder 3:07CV480, In Lambert v. Firstar Bank, 83 Ark. App. 259, 127 S.W. 3d

523 (2003), complying with the Statutory Foreclosure Act does not insulate a financial institution from liability and does not prevent a party from timely asserting any claims or defenses it may have concerning a mortgage foreclosure. Fraud destroys the validity of everything into which it enters, Nudd v. Burrows, 91 U.S. 426. Fraud vitiates everything, Boyce v. Grundy, 3 Pet. 210. Fraud vitiates the most solemn contracts, documents and even judgments, U.S. v. Throckmorton, 98 U.S. 61. Therefore (whatever action) should be dismissed for fraud. TENTH CAUSE OF ACTION (LOST CHAIN OF TITLE) Complaint Page 27 of 35

41.

Plaintiff re-alleges and incorporates herein by reference to the preceding

allegations, as though herein fully set forth. The principals of the following judicial foreclosure case necessarily pertain equally to non-judicial foreclosure: In Kluge v. Fugazy, 145 AD2d 537, 536 NYS2d 92 [2nd Dept., 1988] the Court held that the assignment of a mortgage without transfer of the debt is a nullity and a cause of action for foreclosure must fail. In Merritt v. Bartholick, 36 NY 44 [1867] the Court of Appeals held that a mortgage is but an incident to the debt which it is intended to secure (cites omitted), the logical conclusion is that a transfer of the mortgage without the debt is a nullity, and no interest is assigned by it. The security cannot be separated from the debt, and exist independently of it. This is the necessary legal conclusion, and recognized as the rule by a long course of judicial decisions. As a general proposition, a party seeking to foreclose a mortgage must own or control the underlying debt. See Gotlib v. Gotlib, 399 N.J. Super. 295 (App. Div. 2008); Garroch v. Sherman. 6 N.J. Eq. 219 (Ch. 1847); and Bellistri v. Ocwen Loan Servicing, LLC, 248 S.W. 3d. 619 (Mo. 2009), Wells Fargo, Litton Loan v.

Farmer, 867 N.Y.S.2d, Wells Fargo v. Reyes, 867 N.Y.S.2d 21, Wells Fargo v. Reyes, 867 N.Y.S.2d 21, In re Hwang, 396 B.R. 757, 766-67, Mortgage Electronic Registration Systems, Inc. v. Chong, 824 N.Y.S.2d 764, Lasalle Bank v. Ahearn, 875 N.Y.S.2d 595, Novastar Mortgage, Inc v. Snyder 3:07CV480, Everhome Mortgage Company v. Rowland, No. 07AP-615,

Since no lawful evidence of MERS ownership of the underlying note has been offered, and other courts have concluded that MERS does not own the underlying notes, this court is convinced that MERS had no interest it could transfer to Citibank. Since MERS did not own the underlying note, it could not transfer the beneficial interest of the Deed of Trust to another. Any attempt to transfer the beneficial interest of a trust deed without ownership of the underlying note is void. This is founded upon the maxim, that 'a person cannot grant a thing which he has not: ille non habet, non dat. ELEVENTH CAUSE OF ACTION Complaint Page 28 of 35

(REQUISITES TO TRUSTEE SALE) 42. Plaintiff re-alleges and incorporates herein by reference to the preceding

allegations, as though herein fully set forth. Plaintiff complains that Defendants committed the violation of RCW 61.24.030 (7)(a) because the conduct constituting the offense was engaged in, authorized, solicited, requested, commanded or knowingly tolerated by a high managerial agent acting within the scope of the agents employment and in behalf of the Defendants. It shall be requisite to a trustee's sale: (7)(a) That, for residential real property, before the notice of trustee's sale is recorded, transmitted, or served, the trustee shall have proof that the beneficiary is the owner of any promissory note or other obligation secured by the deed of trust. A declaration by the beneficiary made under the penalty of perjury stating that the beneficiary is the actual holder of the promissory note or other obligation secured by the deed of trust shall be sufficient proof as required under this subsection. Upon information and belief, there is no such declaration that the beneficiary is the owner of any promissory note or other obligation secured by the deed of trust as Plaintiff was not provided such documentation and is unaware that any public record reflects such a declaration, much less before the notice of trustee sale was recorded, transmitted or served. TWELVETH CAUSE OF ACTION (UNFAIR BUSINESS PRACTICES) 43. Plaintiff re-alleges and incorporates herein by reference to the preceding

allegations, as though herein fully set forth. Plaintiff complains that Defendants committed a violation of RCW 19.86. (Consumer Protection) because the conduct constituting the offense was engaged in, authorized, solicited, requested, commanded or knowingly tolerated by a high managerial agent acting within the scope of the agents employment and in behalf of the Defendants.

Complaint

Page 29 of 35

Defendants actions alleged above constitute statutory violations and unlawful practices and acts of Defendants, and each of them aforementioned in this complaint constitute unfair and/or deceptive acts or practices under RCW 19.86. Defendants together unfairly and deceptively utilized MERS to avoid accurately recording property interests, transfers, and satisfactions and to prevent Plaintiff from accessing property records and deceived the alleged debtor of MERS role in the Deed of Trust. Defendants also unfairly and deceptively created or caused to be created false and inaccurate mortgage documents and filed those documents with the King County Recorders Office, as indicated above. These predicate unlawful business acts and/or practices include defendants failure to comply with the disclosure requirements of Title 15 U.S.C. Title 41 Subchapter V. Section 1692 et seq. (Fair Debt Collections Practices Act) and the Real Estate Settlement Procedures Act (RESPA), 12 U.S.C. Sections 2601 to 2617. Plaintiff alleged that Defendants misconduct, as alleged herein, gave, and have given Defendants an unfair competitive advantage over their competitors, and has damaged the Plaintiff. See exhibit B. As a direct and proximate result of Defendants unlawful conduct alleged herein, defendants have prospered and benefitted from the alleged borrower and Plaintiff by collecting mortgage payments. Plaintiff have lost hundreds of thousands of dollars in equity in the property which is the subject of this suit and Defendants have foreclosed on the subject property, thereby completing their unjust enrichment. Plaintiff seeks the imposition of a constructive trust over, and restitution of, the monies collected and realized by the Defendants. Plaintiff alleges that Plaintiff is entitled to equitable relief, including voiding the Trustee sale, restitution, restitionary disgorgement of all profits accruing to Defendants because of their unlawful and deceptive practices and acts and costs, declaratory relief, and a permanent injunction enjoining Defendants from their unlawful activity. THIRTEENTH CAUSE OF ACTION 44. Plaintiff re-alleges and incorporates herein by reference to the preceding

allegations, as though herein fully set forth. Complaint Page 30 of 35

Plaintiff complains that Defendants committed the violation of RCW 19.108.030 (Unjust enrichment) because the conduct constituting the offense was engaged in, authorized, solicited, requested, commanded or knowingly tolerated by a high managerial agent acting within the scope of the agents employment and in behalf of the Defendants. Defendants have deceived the borrower and the Plaintiff into believing that they were entitled to payments that they were collecting, but they were not legally entitled to, as there is no evidence that they are the holder of the instrument that they are allegedly collecting on. Borrower has demanded that Defendants produce the instrument, and their authority to collect but neither production nor authority has been forthcoming. Defendants threatened to foreclose on Plaintiffs property if continuing payment was not forthcoming and have carried out their threats. Accepting such payments when they were not legally entitled to them has unjustly enriched Defendants. Silence can only be equated with fraud where there is a legal or moral duty to speak or when an inquiry left unanswered would be intentionally misleading. U.S. v. Tweel, 550 F.2d 297 (1977). See the securitization audit performed by Mortgage Securitization Auditor Carlos Perez. attached as Exhibit I. FOURTEENTH CAUSE OF ACTION (FRAUD IN THE FACTUM) 45. Plaintiff re-alleges and incorporates herein by reference to the preceding

allegations, as though herein fully set forth. Upon information and belief; A. Plaintiff complains that Defendants committed Fraud In The Factum. That when the Defendants drew up the Deed of Trust dated October 27, 2006 in the County of King, in the State of Washington, for the property herein mentioned, the lender drew up or provided the Deed of Trust with all the names filled in. Under section E on the Deed of Trust, there is a description of MERS as acting solely as nominee for the lender and lenders successors and assigns, however later in the Deed of Trust MERS is listed as beneficiary under this security instrument which was false, as MERS had no interest in the Note that secures the Deed of Trust, Complaint Page 31 of 35

and theoretically MERS would remain a nominee forever. Therefore the wording violates the intent of the Washington Deed of Trust Act, as the language is both misleading and confusing. B. The lender and MERS knew or should have known that MERS was not in fact qualified to be the beneficiary under the Washington Deed of Trust Act, as MERS was not the note holder nor did MERS have any interest in the Note. C. The statement was made to deceive the Borrower into believing that MERS had rights that it in fact did not. D. The Borrower relied upon the good faith representations of the lender and MERS that all was according to law, as they were the experts in this field and the borrower was not. E. As a result of borrowers reliance upon the good faith representation of the lender in the Deed of Trust, the Chain of Title was lost and the property in question was foreclosed on after MERS falsely assigned the Deed of Trust, when MERS indeed could not be a beneficiary under Washington Deed of Trust Act, as MERS had no interest in the Note that secures the Deed of Trust. Silence can only be equated with fraud where there is a legal or moral duty to speak or when an inquiry left unanswered would be intentionally misleading. U.S. v. Tweel, 550 F.2d 297 (1977). The thing itself, is an impossibility. It may, at once, therefore, be admitted, whenever a party undertakes, by deed or mortgage, to grant property, real or personal, in presenti, which does not belong to him or has no existence, the deed or mortgage, as the case may be, is inoperative and void, and this either in a court of law or equity." Pennock v. Coe (1859), 64 U.S. (23 How.) 117, 127-128, 16 L.Ed. 436. F. The lender, when making the loan, violated Regulation Z of the Federal Truth in Lending Act 15 USC 1601 and the Fair Debt Collections Practices Act 15 USC 1692; "intentionally created fraud in the factum" and withheld from plaintiff "vital information concerning said debt and all

Complaint

Page 32 of 35

of the matrix involved in making the loan" See also, Deutsche Bank v. Peabody, 866 N.Y.S.2d 91 (2008). FIFTEENTH CAUSE OF ACTION (SLANDER OF TITLE) 46. Plaintiff re-alleges and incorporates herein by reference to the preceding

allegations, as though herein fully set forth. At all times material hereto, Defendants have conspired and acted both in concert and individually to maliciously and fraudulently proceed against the Plaintiffs real property, by causing false or fraudulent Notices of Trustee Sale, Appointment of Successor Trustee and Assignments of Deed of Trust, to be posted on the King County Recorders web site, which were derogatory to Plaintiffs title, done with malice and intent to, and causing an alleged sale of Plaintiffs property and damaging Plaintiff, in violation of the Washington Deed of Trust act, RCW 61.24. The securitization audit performed by Mortgage Securitization Auditor Carlos Perez. Is attached as Exhibit I, showing that the Defendants did not own the security instrument that they were foreclosing on.

SIXTEENTH CAUSE OF ACTION WRONGFUL FORECLOSURE 47. Plaintiff re-alleges and incorporates herein by reference to the preceding

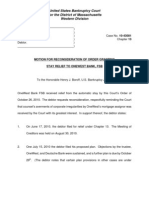

allegations, as though herein fully set forth. Aztec Foreclosure Corporation wrongfully and illegally foreclosed on the Plaintiffs property including but not limited to, in the manner set out in the preceding paragraphs, which are incorporated herein by reference. At all material times hereto, actions by Defendants have caused, and continue to cause, Plaintiff and Plaintiffs estate to suffer damages in an amount to be determined by the Trier of fact herein. RELIEF 48. Plaintiff therefore seeks a declaration that the Title to the subject property is vested in Plaintiff, as Trustee, alone and that the Defendants herein, and each of them, be declared to have no estate, right, title or interest in the subject Complaint Page 33 of 35

property and that said Defendants, and each of them, be forever enjoined from asserting any estate, right, title or interest in the subject property adverse to Plaintiffs herein. In addition to all other remedies allowed by law, Plaintiff is entitled to an order voiding the fraudulent trustee sale by Aztec Foreclosure Corporation and enjoining Defendants, and any agents or parties acting on their behalf from any further pursuit or action against the Plaintiff, and the subject property. Plaintiff is entitled to its reasonable attorneys fees and costs pursuant to RCW 4.84.030.

THEREFORE, Plaintiff prays judgment against Defendants and each of them, as follows: 1. For an Order voiding the fraudulent trustee sale by Aztec Foreclosure Corporation. 2. For an Order reverting the home to the owners or monetary relief equivalent to the value of the home, both structural and land and all appurtenance thereto; 3. For an Order Quieting Title in favor of the Plaintiff; 4. For an Order that the Schmidt Deed of Trust be declared a nullity; 5. For an Order compelling said Defendants, and each of them, to transfer legal title of the subject property to Plaintiff herein; 6. For a declaration and determination that Plaintiff, as Trustee, is the rightful holder of title to the property and that Defendants herein, and each of them, be declared to have no estate, right, title or interest in said property; 7. For a judgment forever enjoining said Defendants, and each of them, from claiming any estate, right, title or interest in the subject property; 8. For costs of suit herein incurred; 9. For an Order that Defendants pay for and correct all filings with the King County Recorders Office; 10. For an Order that a Cancellation of Trustee Sale be immediately recorded in the King County Recorders Office by Defendants post haste; Complaint Page 34 of 35

11. TILA and RESPA Daily Rate plus triple damages; 12. For such other and further relief as the court may deem proper

DATED: _______________

__________________________________________ (Signature)

VERIFICATION

I have read the foregoing and know the contents thereof. The same is true of my own knowledge, except as to those matters, which are therein alleged on information and belief, and as to those matters, I believe to be true. I declare under penalty of perjury under the laws of the People of the state of Washington that the foregoing is true and correct and that this declaration was executed at Tukwila, Washington. BY: ______________________________________ Percy Newby, Trustee, Pro Se, Plaintiff

DATED: _________________

Complaint

Page 35 of 35

You might also like

- Wrongful Foreclosure Complaint With AssignmentDocument28 pagesWrongful Foreclosure Complaint With AssignmentBarry Eskanos100% (6)

- The Quiet Title Workbook 6th EdDocument375 pagesThe Quiet Title Workbook 6th EdGinA100% (11)

- Sample Quiet Title With Adverse PossessionDocument9 pagesSample Quiet Title With Adverse Possessionautumngrace100% (9)

- Complaint To Quiet TitleDocument13 pagesComplaint To Quiet TitleRaoul Clymer100% (7)

- Quiet Title SampleDocument35 pagesQuiet Title SampleRobert McKee100% (7)

- Motion To Cancel SaleDocument16 pagesMotion To Cancel SaleNelson Velardo100% (10)

- Foreclosure Injunction TroDocument16 pagesForeclosure Injunction TroRon Houchins100% (2)

- Foreclosure Injunction TroDocument15 pagesForeclosure Injunction TroAndrey Ybanez80% (10)

- Excellent Quiet Title LawsuitDocument22 pagesExcellent Quiet Title LawsuitKaryl Hawes-Jones97% (30)

- Quiet Title Actions in CaliforniaDocument10 pagesQuiet Title Actions in Californiafilmdude100% (2)

- Quiet Title Actions in CaliforniaDocument7 pagesQuiet Title Actions in Californiadsnetwork100% (3)

- How To File For Quiet TitleDocument2 pagesHow To File For Quiet TitleKNOWLEDGE SOURCE100% (6)

- Quiet Title Actions - Suit For Quiet TitleDocument5 pagesQuiet Title Actions - Suit For Quiet TitleRK Corbes25% (4)

- Motion To DismissDocument13 pagesMotion To Dismissnationalmtghelp100% (2)

- Defendant's Summary Process AnswerDocument175 pagesDefendant's Summary Process AnswerBob100% (1)

- Complaint Illegal Foreclosure by A Scheme Troutman Pepper Hamilton SandersDocument47 pagesComplaint Illegal Foreclosure by A Scheme Troutman Pepper Hamilton SandersJaniceWolkGrenadier86% (7)

- WELLS FARGO BANK, N.A., As Trustee, Respondent, V. SANDRA A. FORD, Appellant.Document13 pagesWELLS FARGO BANK, N.A., As Trustee, Respondent, V. SANDRA A. FORD, Appellant.Foreclosure Fraud100% (3)

- Quiet TitleDocument8 pagesQuiet TitleJOSHUA TASK100% (4)

- 21CV8640 - Complaint or Petition For Quiet TitleDocument7 pages21CV8640 - Complaint or Petition For Quiet TitlenootkabearNo ratings yet

- Quiet Title Actions OutlineDocument8 pagesQuiet Title Actions OutlineScott Schledwitz100% (2)

- Neal, Complaint For Quiet TitleDocument36 pagesNeal, Complaint For Quiet Titleronaldhouchins100% (2)

- Fifth Circuit Appeal AprilDocument38 pagesFifth Circuit Appeal AprilCarolyn DawsonNo ratings yet

- Complaint To Quiet TitleDocument6 pagesComplaint To Quiet TitleFrank D'AmbrosioNo ratings yet

- Post-Foreclosure Complaint Plaintiffs)Document46 pagesPost-Foreclosure Complaint Plaintiffs)tmccand93% (15)

- Killer Foreclosure DiscoveryDocument27 pagesKiller Foreclosure DiscoveryMike Rothermel100% (11)

- The Complete Guide to Preventing Foreclosure on Your Home: Legal Secrets to Beat Foreclosure and Protect Your Home NOWFrom EverandThe Complete Guide to Preventing Foreclosure on Your Home: Legal Secrets to Beat Foreclosure and Protect Your Home NOWRating: 4.5 out of 5 stars4.5/5 (4)

- Quantum of Justice - The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall Street: The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall StreetFrom EverandQuantum of Justice - The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall Street: The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall StreetNo ratings yet

- Complaint Foreclosure With Restitution CoaDocument28 pagesComplaint Foreclosure With Restitution Coajoelacostaesq100% (1)

- HSBC Bank Vs Taher WDocument43 pagesHSBC Bank Vs Taher WDinSFLA100% (1)

- Plaintiff's Reply in Support of Motion To RemandDocument9 pagesPlaintiff's Reply in Support of Motion To RemandBarbara J. Forde100% (2)

- Case File New Jersey Ukpe Plenary Hearing Brief in Re Bank of New York v. Victor Upke Docket No. F-10209-08 4-20-2009Document41 pagesCase File New Jersey Ukpe Plenary Hearing Brief in Re Bank of New York v. Victor Upke Docket No. F-10209-08 4-20-2009Deontos100% (1)

- Foreclosure Quiet Title ComplaintDocument14 pagesForeclosure Quiet Title ComplaintHarry Davidoff100% (7)

- Foreclosure Answer Counter Complaint Third Party + Exhibit A-F IllinoisDocument789 pagesForeclosure Answer Counter Complaint Third Party + Exhibit A-F IllinoisC. Adam Jansen100% (9)

- Florida Quiet Title Complaint by Kathy Ann Garcia-Lawson (KAGL)Document85 pagesFlorida Quiet Title Complaint by Kathy Ann Garcia-Lawson (KAGL)Bob Hurt60% (5)

- MERS, The Unreported Effects of Lost Chain of Title On Real Property Owners and Their NeighborsDocument85 pagesMERS, The Unreported Effects of Lost Chain of Title On Real Property Owners and Their NeighborsForeclosure Fraud100% (1)

- The Florida Foreclosure Judge's Bench BookDocument53 pagesThe Florida Foreclosure Judge's Bench BookForeclosure Fraud100% (4)

- MERS - Show Me The Nomination !!!Document14 pagesMERS - Show Me The Nomination !!!Tim Bryant100% (8)

- California Quiet TitleDocument10 pagesCalifornia Quiet TitleRK Corbes100% (1)

- Dismissed Foreclosure!!Document15 pagesDismissed Foreclosure!!Mortgage Compliance Investigators100% (17)

- Florida Foreclosure Judge's Bench BookDocument53 pagesFlorida Foreclosure Judge's Bench BookJohn Carroll100% (1)

- Answer and Counter Claims in David J. Stern V GMAC MortgageDocument18 pagesAnswer and Counter Claims in David J. Stern V GMAC MortgageForeclosure Fraud67% (3)

- Florida Quiet Title Complaint 20100211 Kagl V Suntrust and Jeff LawsonDocument39 pagesFlorida Quiet Title Complaint 20100211 Kagl V Suntrust and Jeff LawsonBob HurtNo ratings yet

- Lis PendensDocument2 pagesLis PendensGreg Nelson100% (2)