Chap002 Cost Terms

Chap002 Cost Terms

Uploaded by

Ngái NgủCopyright:

Available Formats

Chap002 Cost Terms

Chap002 Cost Terms

Uploaded by

Ngái NgủCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Chap002 Cost Terms

Chap002 Cost Terms

Uploaded by

Ngái NgủCopyright:

Available Formats

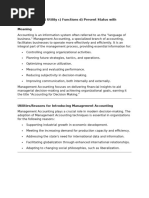

Managerial Accounting and Cost Concepts

Chapter 02

2-2

Users of accounting information

Investors

Board of managements Middle managers

Tax authorities

Creditors

Bottom line managers Company

Public

Employees

2-3

Managerial Accounting vs. Financial Accounting

Managerial accounting provides information for managers inside an organization who direct and control its operations. Financial accounting provides information to stockholders, creditors and others who are outside the organization.

2-4

Financial Accounting vs. Managerial Accounting

Financial Accounting

1. Users 2. Time focus 3. Verifiability versus relevance 4. Precision versus timeliness 5. Subject 6. Rules 7. Requirement External persons who make financial decisions Historical perspective Emphasis on objectivity and verifiability Emphasis on precision Primary focus is on companywide reports Must follow GAAP / IFRS and prescribed formats Mandatory for external reports

Managerial Accounting

Managers who plan for and control an organization Future emphasis Emphasis on relevance Emphasis on timeliness Focus on segment reports Not bound by GAAP / IFRS or any prescribed format Not Mandatory

2-5

Work of Management

Planning

Directing and Motivating

Controlling

2-6 Exh.

1-1

Planning and Control Cycle

Formulating longand short-term plans (Planning) Comparing actual to planned performance (Controlling)

Begin

Decision Making

Implementing plans (Directing and Motivating)

Measuring performance (Controlling)

2-7

Cost classifications by:

Functions

Behaviors

Traceability Relevance

2-8

Cost classification by functions

A. Manufacturing costs (Product costs). B. Non-manufacturing costs (period costs).

2-9

Classifications of Manufacturing Costs

Direct Materials Direct Labor Manufacturing Overhead

The Product

2-10

Direct Materials

Raw materials that become an integral part of the product and that can be conveniently traced directly to it.

Example: A radio installed in an automobile

2-11

Direct Labor

Those labor costs that can be easily traced to individual units of product.

Example: Wages paid to automobile assembly workers

2-12

Manufacturing Overhead

Manufacturing costs that cannot be easily traced directly to specific units produced.

Examples: Indirect materials and indirect labor

Materials used to support the production process.

Examples: lubricants and cleaning supplies used in the automobile assembly plant.

Wages paid to employees who are not directly involved in production work.

Examples: maintenance workers, janitors, and security guards.

2-13

Classifications of Costs

Manufacturing costs are often classified as follows:

Direct Material Direct Labor Manufacturing Overhead

Prime Cost

Conversion Cost

2-14

Nonmanufacturing Costs

Selling Costs Administrative Costs

Costs necessary to secure the order and deliver the product.

All executive, organizational, and clerical costs.

2-15

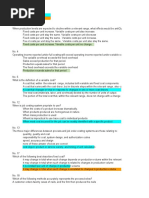

Quick Check

Which of the following costs would be considered manufacturing overhead at Boeing? (More than one answer may be correct.)

A. Depreciation on factory forklift trucks. B. Sales commissions. C. The cost of a flight recorder in a Boeing 767. D. The wages of a production shift supervisor.

2-16

Product Costs Versus Period Costs

Product costs include direct materials, direct labor, and manufacturing overhead.

Inventory Sale

Cost of Good Sold

Period costs include all selling costs and administrative costs.

Expense

Balance Sheet

Income Statement

Income Statement

2-17

Quick Check

Which of the following costs would be considered a period rather than a product cost in a manufacturing company?

A. Manufacturing equipment depreciation. B. Property taxes on corporate headquarters. C. Direct materials costs. D. Electrical costs to light the production facility.

2-18

Manufacturing Cost Flows

Costs

Balance Sheet Inventories

Income Statement Expenses

Material Purchases Direct Labor Manufacturing Overhead

Raw Materials Work in Process

Finished Goods

Period Costs

Cost of Goods Sold

Selling and Administrative

Selling and Administrative

2-19

Quick Check

Which of the following transactions would immediately result in an expense? (There may be more than one correct answer.)

A. Work in process is completed. B. Finished goods are sold. C. Raw materials are placed into production. D. Administrative salaries are accrued and paid.

2-20

Example 1

AQUAS is a bottled water producer. It was established on Oct. 1, 2013. Clever Man the companys accountant is required to prepare an income statement to report on the first quarter performance.

AQUAS Income Statement For the quarter ended Dec. 31, 2013 (in VND mil.) 1. Sales 800 2. Expenses Materials purchased 200 Wages for workers 100 Wages for marketing staff 50 Salaries for office clerks 60 Payment for Advertising 150 Plant rent 55 Office rent 65 Payment for office utility 120 Payment for plant utility 180 Total expenses 980 20 3. Loss (180)

2-21

Cost Classifications by Behaviors

Behavior of Cost (within the relevant range)

Cost Variable In Total Total variable cost changes as activity level changes. Total fixed cost remains the same even when the activity level changes. Per Unit Variable cost per unit remains the same over wide ranges of activity. Fixed cost per unit goes down as activity level goes up.

Fixed

2-22

Variable Cost

Your total texting bill is based on how many texts you send.

Total Texting Bill Number of Texts Sent

2-23

Variable Cost Per Unit

The cost per text sent is constant at 5 cents per text message.

Cost Per Text Sent Number of Texts Sent

2-24

Fixed Cost

Your monthly contract fee for your cell phone is fixed for the number of monthly minutes in your contract. The monthly contract fee does not change based on the number of calls you make.

Monthly Cell Phone Contract Fee Number of Minutes Used Within Monthly Plan

2-25

Fixed Cost Per Unit

Within the monthly contract allotment, the average fixed cost per cell phone call made decreases as more calls are made.

Monthly Cell Phone Contract Fee Number of Minutes Used Within Monthly Plan

2-26

Types of Fixed Costs

Committed

Long-term, cannot be significantly reduced in the short term.

Discretionary

May be altered in the short-term by current managerial decisions

Examples

Depreciation on Buildings and Equipment and Real Estate Taxes

Examples

Advertising and Research and Development

2-27

The Linearity Assumption and the Relevant Range

Economists Curvilinear Cost Function

Relevant Range

A straight line closely approximates a curvilinear variable cost line within the relevant range.

Total Cost

Accountants Straight-Line Approximation (constant unit variable cost) Activity

2-28

Mixed Costs

The total mixed cost line can be expressed as an equation: Y = a + bX

Where: Y a b X = The total mixed cost. = The total fixed cost (the vertical intercept of the line). = The variable cost per unit of activity (the slope of the line). = The level of activity.

Y Total Utility Cost

Variable Cost per KW

X Activity (Kilowatt Hours)

Fixed Monthly

Utility Charge

2-29

Quick Check

Which of the following costs would be variable with respect to the number of cones sold at a Baskins & Robbins shop? (There may be more than one correct answer.)

A. The cost of lighting the store. B. The wages of the store manager. C. The cost of ice cream. D. The cost of napkins for customers.

2-30

Quick Check

Which of the following costs would be variable with respect to the number of people who buy a ticket for a show at a movie theater? (There may be more than one correct answer.)

A. The cost of renting the film. B. Royalties on ticket sales. C. Wage and salary costs of theater employees. D. The cost of cleaning up after the show.

2-31

Income statement under contribution format

2-32

Income statement under contribution format

Total $ 100,000 60,000 $ 40,000 30,000 $ 10,000 per unit $ 50 30 $ 20

Sales Variable costs Contribution margin Fixed costs Net Income

The contribution format focuses on the relationship between costs and activity level. Contribution margin will cover fixed costs and generate income.

2-33

Cost classification by traceability

Direct costs

Costs that can be easily and conveniently traced to a unit of product or other cost objective. Examples: direct material and direct labor

Indirect costs

Costs cannot be easily and conveniently traced to a unit of product or other cost object. Example: manufacturing overhead

2-34

Cost classification by relevance

1. Differential cost. 2. Sunk cost. 3. Opportunity cost.

2-35

Differential cost

Costs and revenues that differ among alternatives.

In 2013, Honda Vietnam established Asimo robots used for assembling motobikes. Their costs are VND 2.1 billions and their estimated useful life is 6 years.

There is a new Asimo version which is much better than the old ones: if Honda Vietnam uses the new version, the company will save 70% annual operating expenses.

The new versions price is VND 4 billions and its useful life is 5 years. The current robotss disposal value is VND 1 billion. Honda Vietnams current annual operating expenses are VND900 millions. Should Honda Vietnam buy the new version?

2-36

Sunk Costs

Sunk costs inccured in the past and cannot be changed by any decision. They are not differential costs and should be ignored when making decisions.

2-37

Opportunity Costs

The potential benefit that is given up when one alternative is selected over another.

2-38

Example 2

Ennerdale Ltd has been asked to quote a price for a one-off contract. The company's management accountant has asked for your advice on the relevant costs for the contract. The following information is available:

2-39

Materials

The contract requires 3,000 kg of material K, which is a material used regularly by the company in other production. The company has 2,000 kg of material K currently in stock which had been purchased last month for a total cost of 19,600. Since then the price per kilogram for material K has increased by 5%. The contract also requires 200 kg of material L. There are 250 kg of material L in stock which are not required for normal production. This material originally cost a total of 3,125. If not used on this contract, the stock of material L would be sold for 11 per kg.

2-40

Labour

The contract requires 800 hours of skilled labour. Skilled labour is paid 9.50 per hour. There is a shortage of skilled labour and all the available skilled labour is fully employed in the company in the manufacture of product P. The following information relates to product P: per unit Selling price 100 Less Skilled labour 38 Other variable costs 22

2-41

End of Chapter 02

You might also like

- Multiple Choice: Principles of Accounting, Volume 2: Managerial AccountingDocument31 pagesMultiple Choice: Principles of Accounting, Volume 2: Managerial Accountingquanghuymc100% (1)

- Introduction For Business and FinanceDocument35 pagesIntroduction For Business and FinanceazizNo ratings yet

- EXAMDocument41 pagesEXAMJoebet Balbin BonifacioNo ratings yet

- Chapters in Module Chapter 1, 2,7,8,9,11Document13 pagesChapters in Module Chapter 1, 2,7,8,9,11rahimNo ratings yet

- Cost Accounting QuestionsDocument52 pagesCost Accounting QuestionsEych Mendoza67% (9)

- Cost ConceptsDocument43 pagesCost ConceptsProfessorAsim Kumar MishraNo ratings yet

- CH 03Document33 pagesCH 03Sharon ShenNo ratings yet

- Basic Cost Management Concepts: Mcgraw-Hill/IrwinDocument52 pagesBasic Cost Management Concepts: Mcgraw-Hill/IrwinDaMin ZhouNo ratings yet

- Costacctg13 SM ch02Document26 pagesCostacctg13 SM ch02Yenny TorroNo ratings yet

- Costs Terms, Concepts and Classifications: Chapter TwoDocument40 pagesCosts Terms, Concepts and Classifications: Chapter TwoWilliam Masterson ShahNo ratings yet

- Cost Terms, Concepts, and ClassificationsDocument33 pagesCost Terms, Concepts, and ClassificationsKlub Matematika SMANo ratings yet

- Basic Cost Accounting ConceptsDocument53 pagesBasic Cost Accounting ConceptsHassham YousufNo ratings yet

- Managerial AccountingDocument8 pagesManagerial AccountingPaula Cxerna Gacis100% (1)

- Chap. II - Relevant Information 2Document28 pagesChap. II - Relevant Information 2ybegdu100% (1)

- MANAGERIAL ACCOUNTING - Test 1Document5 pagesMANAGERIAL ACCOUNTING - Test 1Saad AhmedNo ratings yet

- Basic Management Accounting ConceptsDocument28 pagesBasic Management Accounting Conceptslita2703No ratings yet

- Costs Terms, Concepts and Classifications: Chapter TwoDocument40 pagesCosts Terms, Concepts and Classifications: Chapter TwokorpseeNo ratings yet

- Acl-II Assignment B CMBCDocument11 pagesAcl-II Assignment B CMBCPrabha GanesanNo ratings yet

- Basic Management Accounting ConceptsDocument33 pagesBasic Management Accounting ConceptsNur Ravita HanunNo ratings yet

- Management Acct AssignmentDocument11 pagesManagement Acct AssignmentYasir ArafatNo ratings yet

- An Introduction To Cost Terms and Purposes 2-1Document33 pagesAn Introduction To Cost Terms and Purposes 2-1Moayad TeimatNo ratings yet

- F2 Mock 2Document12 pagesF2 Mock 2Areeba alyNo ratings yet

- Customization Operations Cost Information Toperform Each of These Functions. Aparticular PurposeDocument4 pagesCustomization Operations Cost Information Toperform Each of These Functions. Aparticular PurposeNalynCasNo ratings yet

- Unit 2Document34 pagesUnit 2Abdii DhufeeraNo ratings yet

- CHAPTER 2 Question SolutionsDocument3 pagesCHAPTER 2 Question Solutionscamd1290100% (1)

- Introduction To Cost Accounting Final With PDFDocument19 pagesIntroduction To Cost Accounting Final With PDFLemon EnvoyNo ratings yet

- Blocher - 9e - SM - Ch03-Final - StudentDocument25 pagesBlocher - 9e - SM - Ch03-Final - Studentadamagha703No ratings yet

- MB0041 AccountsDocument10 pagesMB0041 AccountsvermaksatishNo ratings yet

- Chap 002 Garrision PresDocument18 pagesChap 002 Garrision Presee1993No ratings yet

- Cost Concepts: Managerial AccountingDocument72 pagesCost Concepts: Managerial AccountingCianne AlcantaraNo ratings yet

- Unit Five: Relevant Information and Decision MakingDocument39 pagesUnit Five: Relevant Information and Decision MakingEbsa AbdiNo ratings yet

- Ch02, MGMT Acct, HansenDocument28 pagesCh02, MGMT Acct, HansenIlham DoankNo ratings yet

- Cost AccountingDocument12 pagesCost AccountingrehanNo ratings yet

- Chap 2 Basic Cost Management Concepts and Accounting For Mass Customization OperationsDocument15 pagesChap 2 Basic Cost Management Concepts and Accounting For Mass Customization OperationsMarklorenz SumpayNo ratings yet

- Mafs Exam Theory NotesDocument6 pagesMafs Exam Theory NotesPenguin Da Business GooseNo ratings yet

- UntitledDocument65 pagesUntitledGleiza HoNo ratings yet

- Macb A1Document24 pagesMacb A1Luu Nhat HaNo ratings yet

- ACT 5060 MidtermDocument20 pagesACT 5060 MidtermAarti JNo ratings yet

- Chapter 1 - StudentsDocument8 pagesChapter 1 - StudentsLynn NguyenNo ratings yet

- Chapter Two ActivitiesDocument27 pagesChapter Two ActivitiesaishaNo ratings yet

- Cost Cha 1Document39 pagesCost Cha 1Abreham AddNo ratings yet

- ACC102-Chapter1new 002Document18 pagesACC102-Chapter1new 002Logs MutaNo ratings yet

- ACT MID ANSDocument7 pagesACT MID ANSMarjiya Baktyer AhmedNo ratings yet

- Module 1Document26 pagesModule 1Mari TaNo ratings yet

- EA Unit 3Document56 pagesEA Unit 3Nikhil TiruvaipatiNo ratings yet

- Managerial Accounting and Cost ConceptsDocument14 pagesManagerial Accounting and Cost ConceptsWaseem ChaudharyNo ratings yet

- CONSO Managerial Cost Concepts Analysis and BehaviorDocument101 pagesCONSO Managerial Cost Concepts Analysis and BehaviorAaminah BeathNo ratings yet

- ACCCOB3Document87 pagesACCCOB3Lexy SungaNo ratings yet

- BBA 2003 Cost AccountingDocument29 pagesBBA 2003 Cost AccountingUT Chuang ChuangNo ratings yet

- Topic 2 and 3 - Cost Concepts and Behaviour - DR Faruk BhuiyanDocument55 pagesTopic 2 and 3 - Cost Concepts and Behaviour - DR Faruk Bhuiyanfahad.hossain.joyNo ratings yet

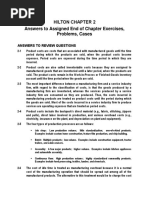

- Hilton Chapter 2 Assigned Homework Exercises 10thDocument9 pagesHilton Chapter 2 Assigned Homework Exercises 10thWynona Gaile PagdonsolanNo ratings yet

- Acc 3200 MidtermDocument5 pagesAcc 3200 MidtermCici ZhouNo ratings yet

- Kinney CH 02Document19 pagesKinney CH 02sweetmangoshakeNo ratings yet

- ACCTG 42 Module 2Document14 pagesACCTG 42 Module 2Hazel Grace PaguiaNo ratings yet

- Cost Accounting Discussion Transcript Part 2Document5 pagesCost Accounting Discussion Transcript Part 2kakimog738No ratings yet

- Chapter 12 - Pricing Decisions and Cost ManagementDocument43 pagesChapter 12 - Pricing Decisions and Cost ManagementBrian Sants50% (2)

- Core 2 CPADocument24 pagesCore 2 CPAobamadexNo ratings yet

- Entrepreneur: Entrepreneur Enterprendre . To Undertake"Document92 pagesEntrepreneur: Entrepreneur Enterprendre . To Undertake"Amar Salunkhe100% (1)

- Multiple Choice AllDocument19 pagesMultiple Choice Alltamii9665No ratings yet

- 12 Digital MarketingDocument28 pages12 Digital MarketingShabNo ratings yet

- 11.software Quality Models and StandardsDocument42 pages11.software Quality Models and StandardsSandy CyrusNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailssidvikventuresNo ratings yet

- EBSR Hotel Investment Guide 01-20-2021Document28 pagesEBSR Hotel Investment Guide 01-20-2021jaimeeNo ratings yet

- Corporate Governance Assignment On CSR by Mayank RajpootDocument13 pagesCorporate Governance Assignment On CSR by Mayank RajpootMayank Rajpoot100% (1)

- Chap 017Document40 pagesChap 017Mário CerqueiraNo ratings yet

- Challenges & Opportunities For Renewable Energy in IndiaDocument90 pagesChallenges & Opportunities For Renewable Energy in Indiasoumyadeepbhunia100% (1)

- QUIZDocument3 pagesQUIZWycliffe Luther RosalesNo ratings yet

- 308 M2L1 SummaryDocument2 pages308 M2L1 Summaryphuong.nm1No ratings yet

- Heinz India: Akanksha Kanojia 32219 Rolika Sharma 32243Document25 pagesHeinz India: Akanksha Kanojia 32219 Rolika Sharma 32243tvalleysNo ratings yet

- Bit WiseDocument11 pagesBit WisemikekvolpeNo ratings yet

- IC Exam Reviewer VUL No AnswerDocument12 pagesIC Exam Reviewer VUL No AnswerRoxanne Reyes-LorillaNo ratings yet

- State Power 7-3Document138 pagesState Power 7-3gauravee1No ratings yet

- 3a Ban MTBF Bangladesh EngDocument17 pages3a Ban MTBF Bangladesh EngShihabHasanNo ratings yet

- Assignment q 1Document7 pagesAssignment q 1abdurezak.mohammed-ugNo ratings yet

- Alasr Construction LLPDocument14 pagesAlasr Construction LLPKalpita DhuriNo ratings yet

- Guidewire Analyst Day Master FINAL PDFDocument132 pagesGuidewire Analyst Day Master FINAL PDFLisa Wheeler0% (1)

- SSA 2020 Public Report PDFDocument518 pagesSSA 2020 Public Report PDFartchambersNo ratings yet

- Pay Slip DecDocument1 pagePay Slip DecMalix EagleNo ratings yet

- Banking Literature ReviewDocument5 pagesBanking Literature Reviewafmzeracmdvbfe100% (1)

- Combining Gann's 50 With VidyaDocument4 pagesCombining Gann's 50 With VidyaOPTIONS TRADING20No ratings yet

- 18CEO302J Modern Civil Engineering EconomicsDocument2 pages18CEO302J Modern Civil Engineering EconomicsmekalaNo ratings yet

- Beta Saham 20181228 enDocument13 pagesBeta Saham 20181228 enArniyanti 11No ratings yet

- Demand and Elasticity WorksheetDocument5 pagesDemand and Elasticity Worksheetmayer abadi siregarNo ratings yet

- Academic-Writing-Handbook-International-Students-3rd-Ed Pages 50-58 - Week 3 - Ma Alejandra Villalobos MDocument10 pagesAcademic-Writing-Handbook-International-Students-3rd-Ed Pages 50-58 - Week 3 - Ma Alejandra Villalobos Mapi-525487811No ratings yet

- Brand MatrixDocument28 pagesBrand MatrixNeetu Gs100% (1)

- Account Statement From 12 Jun 2019 To 12 Dec 2019Document3 pagesAccount Statement From 12 Jun 2019 To 12 Dec 2019Anil vaddiNo ratings yet

- Dpwh-23e00292 Bid FormDocument2 pagesDpwh-23e00292 Bid FormRichard LabroNo ratings yet