Employee State Insurance Act 1948: Presented by 1) Mayur Khatri

Employee State Insurance Act 1948: Presented by 1) Mayur Khatri

Uploaded by

Joginder GrewalCopyright:

Available Formats

Employee State Insurance Act 1948: Presented by 1) Mayur Khatri

Employee State Insurance Act 1948: Presented by 1) Mayur Khatri

Uploaded by

Joginder GrewalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Employee State Insurance Act 1948: Presented by 1) Mayur Khatri

Employee State Insurance Act 1948: Presented by 1) Mayur Khatri

Uploaded by

Joginder GrewalCopyright:

Available Formats

EMPLOYEE STATE INSURANCE ACT

1948

Presented by;

1) Mayur Khatri

The employees state insurance act 1948

Pioneering measure in social insurance in india.

Health insurance first discussed in 1927 by indian

legislature.

Originally called workmens state insurance bill 1946.

Came into force on 19

th

april 1948.

OBJECTIVE

The objective of the act is to secure sickness, maternity

and medical benefits to employees of factories and

establishments and dependents benefits to the

dependents of such employees.

APPLICABILITY

ACT APPLIES TO FACTORIES USING POWER not using

AND EMPLOYING 20 OR MORE PERSONS. Gradually

extended to the following:

Smaller power-using factories with 10-19 persons

Non-power factories with 20 or more persons

Shops

Hotels and restaurants

Cinemas including preview theaters

Newspaper establishments

Road motor transport undertakings employing 20 or more

persons

State govt may cover other establishments in consultation

with the esi corporation and with approval of the central

govt.

DEFINITIONS

Employee: employee refers to any person employed on

wages in connection with the work of a factory or

establishment to which this act applies.

Includes technical, manual, clerical and supervisory

functions

No distinction between casual and temporary employees or

technical and non-technical, or time-rate or piece-rate

Covers admin staff and those in purchase

Does not include naval, military or air force personnel.

DEFINITIONS (CONTD.)

Wages: means all remuneration paid in cash, including

payment in period of leave, lockout or strike which is not

illegal. Does not include:

Contribution paid to the provident fund or pension fund

Travelling allowance

Sum paid to defray special expenses

Gratuity payable on discharge

Registration

Registration of a factory/establishment with the

employees state insurance corporation (esi) is a

statutory responsibility of the employer under section 2-

a and 10-b.

Declaration of registration in form 01 to be furnished to

the appropriate regional office within 15 days of the act

becoming applicable.

Employer should get the declaration form filled in by

every employee covered under the scheme.

BENEFITS

1. Sickness and extended sickness benefit

2. Maternity benefit

3. Disablement benefit

4. Dependants benefit

5. Medical benefit

6. Funeral benefit

SICKNESS AND EXTENDED SICKNESS BENEFIT

Represents periodical payments made to an insured

person for the period of certified sickness after completing

9 months in insurable employment.

To qualify, contributions should be for minimum 78 days in

the relevant period.

Maximum duration for benefit is 91 days.

Rates of payment vary from rs.14-125 per day, i.E.

Average of 50% of daily wages.

Insured persons suffering from tb, leprosy, mental and

malignant diseases or other specified long term diseases

are entitled to extended benefits at higher rates, provided

he has been continually employed for at least two years.

MATERNITY BENEFIT

Implies cash payment to an insured woman in case of

confinement or miscarriage or sickness arising out of

pregnancy or premature birth.

Woman should have contributed for minimum 70 days in

the preceding two consecutive contribution periods.

Daily rate of benefits double the standard sickness benefit

rate, i.E. Full wages.

Normally payable for max 12 weeks for confinement and 6

weeks for miscarriage or medical termination of pregnancy.

Payable even in the event of the death of the woman.

DISABLEMENT BENEFIT

In case of temporary disability arising out of

employment injury, this benefit is admissable for the

entire period certified by an insurance medical

officer/practitioner for which the insured person does

not work for wages.

Rate payable not less than 70% of daily wages;

minimum 3 days of incapacity required.

In case injury results in permanent, partial or total loss

of earning capacity, periodical payments to be made

for life. One-time lumpsum is permissible in certain

cases.

DEPENDANTS BENEFIT

Periodical pension paid to dependants of deceased where

death occurs out of employment injury or disease.

Widows: 3/5

th

of benefit rate for life or until remarriage

Children: 2/5

th

of benefit rate until 18

Total amount distributed not to exceed ceiling of

disablement benefit.

Benefit not paid to married daughters.

In case there is no widow or child, benefit can be paid to

other dependants including parents.

Amount paid is reviewed and increases granted from time to

time to compensate for erosion in real value and cost of

living.

MEDICAL BENEFIT

Insured persons and their families entitled to free, full and

comprehensive medical care.

Extended upto two years for chronic and long-term

diseases.

Treatment continues even if person goes out of coverage,

till sickness ends.

Package covers all aspects of health care from primary to

super-specialist facilities, such as:

1) Out-patient treatment

2) Domiciliary treatment

3) Specialist consultation and diagnostic facilities

MEDICAL BENEFIT (CONTD.)

1) In-patient treatment

2) Free supply of drugs and dressing

3) X-ray and laboratory investigations

4) Vaccination and preventive innoculations

5) Ante-natal, confinement, post-natal care

6) Ambulance service or conveyance charges

7) Free diet during admission in hospitals

8) Free supply of artificial limbs, aids and appliances for

physical rehabilitation

9) Family welfare services and other national health

programme services

10) Medical certification

11) Special provisions including super-speciality treatment.

FUNERAL BENEFIT

Funeral expenses are in the nature of a lump sum

payment upto a maximum of rs.2500 made to defray

the expenditure of the funeral of deceased insured

person.

The amount is paid either to the eldest surviving

member of the family or, in his absence, to the person

who actually incurs the expenditure on the funeral.

ALL BENEFITS UNDER THE ESI SCHEME ARE

PAID IN CASH EXCEPT MEDICAL BENEFIT,

WHICH IS GIVEN IN KIND.

PROTECTION

An employer cannot dismiss or punish an employee under

treatment for sickness of in receipt of any benefit or absent

from work due to illness. Any notice of dismissal, discharge

or reduction is invalid. However, the employer can

discharge or punish the employee if:

He has received temporary disablement benefit and

remained absent for 6 months or more

Is under treatment for sickness other than tb or arising out

of pregnancy and remained absent for 6 months or more

Is under medical treatment for tb or a malignant disease

and has remained absent continuously for 18 months or

more.

MISCELLANEOUS

Cash benefits payable under the esi act are not

liable to attachment or sale in execution of any court

decree or order.

Right to receive benefit is not transferable.

Disputes under the provisions of the act to be

decided by the employees insurance court (eic) and

not by a civil court. Appeals to the high court only by

an order of the eic on a question of law.

Period of limitation for appeal is 60 days.

CASE ON MANIBEN GOVINDBHAI AND ANR. VS EMPLOYEES'

STATE INSURANCE ... ON 17 APRIL, 2000

Shah, the learned Advocate appearing for the respondent-Corporation.

On the facts and in the circumstances of the case, the matter is taken

up for final hearing today itself. The facts of the present petition, in

short, are that the petitioner No. 1-Maniben is the widow of deceased-

Govindbhai Kanabhai Makwana who was an insured person under the

Employees' State Insurance Act, 1948. Petitioner No. 2 is the son of

deceased-Govindbhai Kanabhai Makwana. The petitioners filed ESI

Application No. 7 of 1985 before the Employees' Insurance Court at

Ahmedabad and claimed for dependent benefits for herself and also for

her then minor son which application was allowed by the ESI Court

vide its judgment and order dated 7-1-1992. The petitioners were,

thereafter, intimated by the respondent by its letter dated 12/16th

March, 1992 that they have accepted the verdict of the ESI Court given

in the said ESI Application No. 7 of 1985 and in the same letter, the

petitioner No. 1 was asked to submit Form No. 18 duly filled in and

supported with original death certificate.

You might also like

- ESICDocument30 pagesESICpraveen singh Bhim100% (1)

- Human Relation ApproachDocument11 pagesHuman Relation ApproachJoginder Grewal100% (1)

- Narrative ReportDocument9 pagesNarrative ReportJohn Paul de Guzman100% (2)

- On ESI & PFDocument31 pagesOn ESI & PFvipin H50% (4)

- Chapter 6 Models and Technique of MP Demand and Supply Forecasting by Shahid ElimsDocument18 pagesChapter 6 Models and Technique of MP Demand and Supply Forecasting by Shahid ElimsJoginder GrewalNo ratings yet

- Ra 7431Document12 pagesRa 7431Ricardo EdanoNo ratings yet

- Employee State Insurance Act 1948: Presented by Sharique Siddique Ashish Kumar Mohit PoddarDocument18 pagesEmployee State Insurance Act 1948: Presented by Sharique Siddique Ashish Kumar Mohit PoddarEKTA AGARWALNo ratings yet

- Esi Act 1948-1Document53 pagesEsi Act 1948-1Takshi BatraNo ratings yet

- Community II - Other AgenciesDocument42 pagesCommunity II - Other AgenciesAnitha AniNo ratings yet

- Esi Act 1948Document16 pagesEsi Act 1948Ravi NarayanaNo ratings yet

- Esi & PF inDocument30 pagesEsi & PF inkuttyboyNo ratings yet

- Esi Act 1948Document11 pagesEsi Act 1948vinodkumarsajjanNo ratings yet

- THE Employee'S State Insurance ACT 1948Document31 pagesTHE Employee'S State Insurance ACT 1948Megha KenchareddiNo ratings yet

- ESI, EPF and MB, ActsDocument62 pagesESI, EPF and MB, ActsGautam PareekNo ratings yet

- The Employees' State Insurance ACT, 1948Document19 pagesThe Employees' State Insurance ACT, 1948Prithviraj MathurNo ratings yet

- ESIC IntroductionDocument10 pagesESIC IntroductionBHAVIK MODINo ratings yet

- Project Wca 1923 SmsDocument7 pagesProject Wca 1923 Smstanmaya_purohitNo ratings yet

- Employees' State Insurance Act, 1948: HighlightsDocument11 pagesEmployees' State Insurance Act, 1948: HighlightsBidyashree PatnaikNo ratings yet

- Esi Act 1948Document31 pagesEsi Act 1948reema88bhardwajNo ratings yet

- Note On ESI - BenefitsDocument10 pagesNote On ESI - BenefitsRaees ShaikhNo ratings yet

- Esi ActDocument29 pagesEsi ActAbhi GowdaNo ratings yet

- B U E S I A: Enefits Nder Mployees Tate Nsurance CTDocument7 pagesB U E S I A: Enefits Nder Mployees Tate Nsurance CTtanmaya_purohitNo ratings yet

- The Employees State Insurance Act, 1948Document24 pagesThe Employees State Insurance Act, 1948Pawan KumarNo ratings yet

- ESICDocument34 pagesESICAanchal Mehta100% (1)

- ESI ACT, 1948-Implications, Benefits and ProcedureDocument29 pagesESI ACT, 1948-Implications, Benefits and ProceduremmleelaasNo ratings yet

- Institute of Management and Computer Studies. (Imcost)Document23 pagesInstitute of Management and Computer Studies. (Imcost)24utsavNo ratings yet

- The Employee'S State Insurance ACT, 1948Document34 pagesThe Employee'S State Insurance ACT, 1948NehaChaudharyNo ratings yet

- Product BrochureDocument10 pagesProduct BrochuresmshekarsapNo ratings yet

- What Is E.S.I. Scheme ?Document23 pagesWhat Is E.S.I. Scheme ?pashya_hrNo ratings yet

- The Employee's State Insurance Act 1948Document37 pagesThe Employee's State Insurance Act 1948Sanjeev Prasad67% (3)

- TMB UNI Family Health Care PolicyDocument24 pagesTMB UNI Family Health Care Policysubu_devasena6782100% (1)

- Obligation of The Employer: E) Obligation of Employee & Employers Under Employment State Insurance Act, 1948Document4 pagesObligation of The Employer: E) Obligation of Employee & Employers Under Employment State Insurance Act, 1948Sujay Vikram SinghNo ratings yet

- THE Employee'S State Insurance ACT 1948: Industrial Relations & Labour LawsDocument13 pagesTHE Employee'S State Insurance ACT 1948: Industrial Relations & Labour LawsWeena Yancey M MominNo ratings yet

- The Employees' State Insurance ACT, 1948Document17 pagesThe Employees' State Insurance ACT, 1948Nisar Ahmad SiddiquiNo ratings yet

- Letter of Demand Outstanding PaymentDocument12 pagesLetter of Demand Outstanding PaymentKushagra GuptaNo ratings yet

- Project Report of Labour Laws On Benefits of The Employees' State Insurance Act, 1948Document10 pagesProject Report of Labour Laws On Benefits of The Employees' State Insurance Act, 1948aggarwalbhaveshNo ratings yet

- ESICDocument23 pagesESICHarini Saripella100% (1)

- Sickness, Ec, MaternityDocument145 pagesSickness, Ec, MaternityJhodie Anne IsorenaNo ratings yet

- The Employees' State Insurance (ESI) ACT, 1948Document17 pagesThe Employees' State Insurance (ESI) ACT, 1948goldberg13No ratings yet

- Employees' State Insurance Act, 1948Document6 pagesEmployees' State Insurance Act, 1948Ronan GomezNo ratings yet

- Digit Illness Group Insurance FinalDocument25 pagesDigit Illness Group Insurance FinalRaghu Vamsi PNo ratings yet

- Star Comprehensive Insurance PolicyDocument4 pagesStar Comprehensive Insurance Policynarumanu1120No ratings yet

- Health Companion 12 - 2011an-02Document2 pagesHealth Companion 12 - 2011an-02sprashant5No ratings yet

- ESI BenefitsDocument19 pagesESI Benefitsrashmi_shantikumar67% (3)

- 449 1Document39 pages449 1raghuvanshiswati1989No ratings yet

- THE Employee S State Insurance ACT 1948Document31 pagesTHE Employee S State Insurance ACT 1948Deepika PatelNo ratings yet

- Task 23Document4 pagesTask 23ANUBHNo ratings yet

- Health Ensure: Bajaj AllianzDocument18 pagesHealth Ensure: Bajaj Allianzgrr.homeNo ratings yet

- Employees State Insurance SchemeDocument8 pagesEmployees State Insurance SchemeKrishnaveni MurugeshNo ratings yet

- ESICDocument24 pagesESICIsha Sushil Bhambi100% (1)

- THE Employee'S State Insurance ACT 1948Document34 pagesTHE Employee'S State Insurance ACT 1948Deepa SudheeshNo ratings yet

- Esi Scheme and CGHS: Mrs. Namita Batra Guin Associate Professor Deptt. of Community Health NursingDocument19 pagesEsi Scheme and CGHS: Mrs. Namita Batra Guin Associate Professor Deptt. of Community Health NursinglivelinamiNo ratings yet

- Employees' Compensation Commission (P.D. 626 As Amended)Document24 pagesEmployees' Compensation Commission (P.D. 626 As Amended)Angelica laroyaNo ratings yet

- PPT On ESI PFDocument32 pagesPPT On ESI PFVinit KannanNo ratings yet

- 1.11 The ESI Act, 1948Document34 pages1.11 The ESI Act, 1948Palak DawarNo ratings yet

- Employees State InsuranceDocument19 pagesEmployees State InsurancerajanrengarNo ratings yet

- Types of Esi BenefitsDocument8 pagesTypes of Esi Benefitsbruce1990batmanNo ratings yet

- Mediclassic NewDocument2 pagesMediclassic NewPiyush KantNo ratings yet

- StarHealthAssureInsurancePolicy ProspectusDocument32 pagesStarHealthAssureInsurancePolicy ProspectusMahroof Babu MarkasseriNo ratings yet

- Employee State Insurance Act 11.53.58 PMDocument9 pagesEmployee State Insurance Act 11.53.58 PMvaishnav.sNo ratings yet

- Arogyadhan ApplicationDocument6 pagesArogyadhan Applicationksantarao9700No ratings yet

- Prospectus New India Mediclaim PolicyDocument15 pagesProspectus New India Mediclaim PolicyKamlesh KumarNo ratings yet

- On "Employee's State Insurance Act 1948" of India.Document20 pagesOn "Employee's State Insurance Act 1948" of India.Anshu Shekhar SinghNo ratings yet

- Basis of Difference HRM & PMDocument3 pagesBasis of Difference HRM & PMJoginder GrewalNo ratings yet

- CommunicationDocument34 pagesCommunicationJoginder GrewalNo ratings yet

- BBA Business Communication Lecture Notes Ebook PDFDocument332 pagesBBA Business Communication Lecture Notes Ebook PDFJoginder Grewal100% (3)

- Effectiveness Communication SkillsDocument28 pagesEffectiveness Communication SkillsJoginder GrewalNo ratings yet

- Centralization & DecentralizationDocument26 pagesCentralization & DecentralizationJoginder GrewalNo ratings yet

- Materials ManagementDocument12 pagesMaterials ManagementJoginder GrewalNo ratings yet

- Oral and Non-Verbal CommunicationDocument10 pagesOral and Non-Verbal CommunicationJoginder GrewalNo ratings yet

- Organization of Material ManagementDocument18 pagesOrganization of Material ManagementJoginder GrewalNo ratings yet

- Management As Science, Art and ProfessionDocument15 pagesManagement As Science, Art and ProfessionJoginder Grewal100% (6)

- Inventory ManagementDocument45 pagesInventory ManagementJoginder GrewalNo ratings yet

- Centralization & DecentralizationDocument26 pagesCentralization & DecentralizationJoginder GrewalNo ratings yet

- Manpower Training and DevelopmentDocument31 pagesManpower Training and DevelopmentJoginder GrewalNo ratings yet

- Human Resource PlanningDocument40 pagesHuman Resource PlanningJoginder Grewal100% (1)

- Presentation On: Shifali Garg MBA NcceDocument25 pagesPresentation On: Shifali Garg MBA NcceJoginder Grewal100% (2)

- Introducton (HRM)Document33 pagesIntroducton (HRM)Joginder GrewalNo ratings yet

- Chapter-10 C-Quality of Work LifeDocument17 pagesChapter-10 C-Quality of Work LifeJoginder GrewalNo ratings yet

- Logistics PlanningDocument20 pagesLogistics PlanningJoginder GrewalNo ratings yet

- Introduction To Production and Operation Management: Chapter OutlineDocument21 pagesIntroduction To Production and Operation Management: Chapter OutlineJoginder GrewalNo ratings yet

- Communication ProcessDocument12 pagesCommunication ProcessJoginder GrewalNo ratings yet

- Difference Between Product and BrandDocument24 pagesDifference Between Product and BrandJoginder GrewalNo ratings yet

- Difference Between Product and BrandDocument24 pagesDifference Between Product and BrandJoginder GrewalNo ratings yet

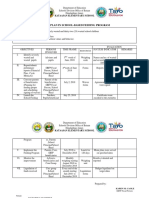

- Action Plan in Feeding ProgramDocument4 pagesAction Plan in Feeding ProgramKaye Mcforest Caole100% (11)

- Eastern Visayas-WPS OfficeDocument3 pagesEastern Visayas-WPS OfficeAubreyNo ratings yet

- Ticket To Your UC Retirement-UCRP Presentation Fall 2016 FinalDocument42 pagesTicket To Your UC Retirement-UCRP Presentation Fall 2016 FinalkramynotNo ratings yet

- Full Download Naruto Sakura S Story 1st Edition Masashi Kishimoto and Tomohito Ohsaki PDFDocument52 pagesFull Download Naruto Sakura S Story 1st Edition Masashi Kishimoto and Tomohito Ohsaki PDFighormesout39100% (1)

- Batten-White Subdivision LPAT RulingDocument65 pagesBatten-White Subdivision LPAT RulingPeterborough ExaminerNo ratings yet

- Benefits and Drawbacks of Electronic Health Record SystemsDocument12 pagesBenefits and Drawbacks of Electronic Health Record SystemsDesti AriyantiNo ratings yet

- BMF 2011 - 2Document5 pagesBMF 2011 - 2bosmanoldfundNo ratings yet

- 2023年丹麦Document344 pages2023年丹麦wolf wolf wolfNo ratings yet

- DR Bharat Singh GehlotDocument4 pagesDR Bharat Singh GehlotR Pavan SenNo ratings yet

- Child MarriageDocument16 pagesChild MarriageSimran Kaur BhatiaNo ratings yet

- Ramos Vs CA, DLSMCDocument3 pagesRamos Vs CA, DLSMCJewn Kroos100% (1)

- RSA Safety Rules-April 18 2018Document5 pagesRSA Safety Rules-April 18 2018Lydia VinalesNo ratings yet

- TN Dept of Correction AuditDocument234 pagesTN Dept of Correction AuditSlater TeagueNo ratings yet

- Alberto Cairo's MALOFIEJ2016 Presentation SlidesDocument35 pagesAlberto Cairo's MALOFIEJ2016 Presentation Slidesalberto_cairo2290100% (3)

- FinalbillDocument2 pagesFinalbillapi-336679116No ratings yet

- Medical Action - The Way To Make A Difference: How You Can HelpDocument1 pageMedical Action - The Way To Make A Difference: How You Can HelpDaniela BandaNo ratings yet

- Riverhead News-Review Classifieds and Service Directory: Oct. 19, 2017Document11 pagesRiverhead News-Review Classifieds and Service Directory: Oct. 19, 2017TimesreviewNo ratings yet

- Patient'S Rights and Responsibilities: Dr. Eutiquio Ll. Atanacio Jr. Memorial Hospital IncDocument8 pagesPatient'S Rights and Responsibilities: Dr. Eutiquio Ll. Atanacio Jr. Memorial Hospital IncJoeren GonzalesNo ratings yet

- PDFDocument1 pagePDFAnonymous s34Mx8Zfl30% (1)

- Path To Good Governance in Nigeria Challenges and ProspectsDocument6 pagesPath To Good Governance in Nigeria Challenges and ProspectsIJARP Publications0% (1)

- Job Discerption For Cluster Level Federation (CLF) ConsultantDocument3 pagesJob Discerption For Cluster Level Federation (CLF) ConsultantRavi thokalNo ratings yet

- Classroom Property InventoryDocument2 pagesClassroom Property InventorySheila Mae PertimosNo ratings yet

- Position Paper On Maharlika FundDocument9 pagesPosition Paper On Maharlika FundmanuelitofuentescruzNo ratings yet

- VAW Desk Assessment Tool For Best Barangay VAW DeskDocument15 pagesVAW Desk Assessment Tool For Best Barangay VAW DeskAndrea Lizares Si100% (2)

- Labor Law Review Table of Jurisdiction and Remedies DuanoDocument7 pagesLabor Law Review Table of Jurisdiction and Remedies DuanokayeNo ratings yet

- Interview Report FormDocument4 pagesInterview Report FormPEDi Kg GedongNo ratings yet

- 11 Economics Notes ch12 PDFDocument3 pages11 Economics Notes ch12 PDFHackerzillaNo ratings yet

- Troubled WatersDocument70 pagesTroubled WatersDestiny JohnsonNo ratings yet