Unit I A Introduction Accouting

Uploaded by

Gopal KrishnanUnit I A Introduction Accouting

Uploaded by

Gopal KrishnanUNIT I

INTRODUCTION TO

ACCOUNTING

NEED AND IMPORTANCE

What has happened to the investment?

What is the result of the business transactions?

What are the earnings and expenses?

How much amount is receivable /Payable from/

to customers

From/To whom goods have been Purchased/ sold on

credit?

What are the nature and value of assets & Liabilities

possessed by the business concern?

BOOK-KEEPING

Is the science and art of correctly recording in the

books of account all those business transactions that

result in the transfer of money or moneys worth.

The branch of knowledge which tells us how to keep a record

of business transactions.

Advantages:

Permanent, Reliable & Arithmetical accuracy

Net Results & Ascertainment of Financial Position & Progress

Calculation of Dues, Taxation and Mgt. Decision making

Control over Assets and borrowings

Fixing the selling price & Legality issues

Identifying Dos and Donts

ACCOUNTING

American Accounting Association defines

accounting as the process of identifying,

measuring and communicating economic

information to permit informed judgements and

decision by users of the information

The systematic and comprehensive recording of

financial transactions pertaining to a business.

The process of summarizing, analyzing and

reporting these transactions.

4

OBJECTIVES

The main objectives of accounting are:

1. To maintain accounting records

2. To calculate the result of operations

3. To ascertain the financial position

4. To communicate the information to users

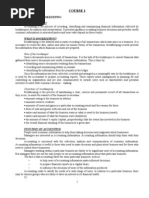

Business

transaction

s

(monetary

value)

Identifying

Recording

Classifying

Summarizing

Analyzing

Interpreting

Communicating

Process

Information to

Users

Output Input

PROCESS OF ACCOUNTING

USERS ACCOUNTING INFORMATION

Owners & Management

Employees & Trade Unions

Creditors, Banks & Lending Institutions

Potential Investors & Present Investors

Government & Tax Authorities

Regulatory Agencies &

Researchers

8

BRANCHES OF ACCOUNTING

Financial accounting

Recording business transactions in the books of accounts

to found the operating result(FP) for a particular period

Cost accounting

Collection, classification and ascertainment of the cost of

production or job undertaken by the firm

Management accounting

For the purpose of policy formulation, planning, control

and decision making by the management

9

BASIC ACCOUNTING TERMS

1. Cash transaction

Cash receipt or payment

2. Credit transaction

Where cash is not involved immediately but will be paid

or received later

3. Proprietor

A person who owns a business

4. Capital

Amount invested by the proprietor in the business

5. Assets

Properties belongings to the business

CONT

6. Liabilities

Financial obligations of a business.

The amounts which a business owes to

others.

7. Drawings

The amount of cash or value of goods

withdrawn from the business by the

proprietor for his personal use

CONT

8. Debtors

A person who receives a benefit without giving

money , but liable to pay in future or in due

course of time is debtor

9. creditors

A person who gives a benefit without receiving

money , but to claim in future is a creditor

CONT

10. Purchases

The amount of goods bought by a business

for resale or for use in the production.

11. Purchases return or returns outward

When goods are returned to the suppliers

due to defective quality or not as per the

terms of purchase

12.SALES

The amount of goods sold that are already

bought or manufactured by the company.

CASH SALES

Sold for Cash

CREDIT SALE

Sold but payment are not received at that time

TOTAL SALES

= Cash Sales + Credit Sales

13.SALES RETURN

14. STOCK

15. REVENUE

Amount receivables or realized from sale of

goods

Earnings from Interest, Commission, Dividend

etc.

16.EXPENSES

Amount spent in order to produce and sell the

goods and services

17. INCOME

Difference between Revenue and Expenses

= Revenue Expenses.

18. VOUCHER

19. INVOICE

20. RECEIPT

ACCOUNTING EQUATION

Fundamental Accounting Equation:

Assets = Liabilities + Owners Equity

This equation is always in balance

In order for this equation to remain in balance,

double-entry bookkeeping is employed.

That is, the recording of every transaction or event must

have at least two parts

Either an equal impact (increase or decrease) to both sides of

the equation or equal and opposite impact to one side.

The recording of every transaction must keep this equation

in balance

21

You might also like

- Current Account 29 August 2020 To 29 September 2020No ratings yetCurrent Account 29 August 2020 To 29 September 20205 pages

- Module 2 - The Risk-Based Financial Statement Audit - Client Acceptance, Audit Planning, Supervision and Monitoring100% (1)Module 2 - The Risk-Based Financial Statement Audit - Client Acceptance, Audit Planning, Supervision and Monitoring19 pages

- AUDITING PROBLEMS (CPAR First Preboards 2018) - AnswersNo ratings yetAUDITING PROBLEMS (CPAR First Preboards 2018) - Answers10 pages

- Introduction To Accounting, Journal, Ledger, Trial BalanceNo ratings yetIntroduction To Accounting, Journal, Ledger, Trial Balance74 pages

- Introduction To Accounting: Accounting The Language of BusinessNo ratings yetIntroduction To Accounting: Accounting The Language of Business34 pages

- Financial Accounting: Accounting Basics: Branches of AccountingNo ratings yetFinancial Accounting: Accounting Basics: Branches of Accounting7 pages

- LECTURE 1 - WEEK 1 - CHAP 1, 2, 4 EditedNo ratings yetLECTURE 1 - WEEK 1 - CHAP 1, 2, 4 Edited27 pages

- Introduction To Accounting, Journal, Ledger, Trial Balance: Module - 1No ratings yetIntroduction To Accounting, Journal, Ledger, Trial Balance: Module - 164 pages

- 2.1 2.1. Introduction - Terminologies of Accountancy PDFNo ratings yet2.1 2.1. Introduction - Terminologies of Accountancy PDF14 pages

- The Nature of Accounting and Accounting Equation L175% (4)The Nature of Accounting and Accounting Equation L123 pages

- Introduction To Accounting, Journal, Ledger, Trial BalanceNo ratings yetIntroduction To Accounting, Journal, Ledger, Trial Balance74 pages

- Introduction To Accounting Class 11 Notes Accountancy Chapter 1100% (1)Introduction To Accounting Class 11 Notes Accountancy Chapter 16 pages

- Accounts Full_22480960_2025_01_13_20_26No ratings yetAccounts Full_22480960_2025_01_13_20_2669 pages

- Accounting Is A Process of Recording Financial Transactions Pertaining To A BusinessNo ratings yetAccounting Is A Process of Recording Financial Transactions Pertaining To A Business6 pages

- Yummy Ice-Cream!!!!: Offer!!!OFFER!!! FROM 21/12/2017 TILL 27/12/2017No ratings yetYummy Ice-Cream!!!!: Offer!!!OFFER!!! FROM 21/12/2017 TILL 27/12/20173 pages

- Week 1 Theories Concepts of EntrepreneurshipNo ratings yetWeek 1 Theories Concepts of Entrepreneurship21 pages

- Chapter Eight: South African Policy Framework For Start-UpsNo ratings yetChapter Eight: South African Policy Framework For Start-Ups19 pages

- Accounting Concepts and Conventions: Unit - INo ratings yetAccounting Concepts and Conventions: Unit - I30 pages

- Sakthi Institute of Information and Management Studies: (Feb 2011-AUQP)No ratings yetSakthi Institute of Information and Management Studies: (Feb 2011-AUQP)1 page

- Unit I: Accounting For Changes Prices (Inflation Accounting)No ratings yetUnit I: Accounting For Changes Prices (Inflation Accounting)18 pages

- Mergers & Acquisitions: How To Expand Your Business in Today's EnvironmentNo ratings yetMergers & Acquisitions: How To Expand Your Business in Today's Environment15 pages

- Positioning Products and Services in The Market: Unit IvNo ratings yetPositioning Products and Services in The Market: Unit Iv16 pages

- أثر المحاسبة الإبداعية على جودة القوائم المالية دراسة عينة من الاكاديمين والمهنيين في مجال المحاسبة والمراجعةNo ratings yetأثر المحاسبة الإبداعية على جودة القوائم المالية دراسة عينة من الاكاديمين والمهنيين في مجال المحاسبة والمراجعة16 pages

- Mahindra Ugine - List of Unclaimed Dividendholders List - As On 05 08 2014 PDFNo ratings yetMahindra Ugine - List of Unclaimed Dividendholders List - As On 05 08 2014 PDF1,580 pages

- Payment Transaction Report: Stanbic Bank Zimbabwe Limited, Company Registration No. 3387/89No ratings yetPayment Transaction Report: Stanbic Bank Zimbabwe Limited, Company Registration No. 3387/892 pages

- Standard Chartered PLC - Half Year 2013 Press ReleaseNo ratings yetStandard Chartered PLC - Half Year 2013 Press Release187 pages

- Credit Support Pathways For Rooftop Solar Projects in IndiaNo ratings yetCredit Support Pathways For Rooftop Solar Projects in India19 pages

- Chief Duties - Senior Agricultural Specialist: Market AssessmentNo ratings yetChief Duties - Senior Agricultural Specialist: Market Assessment3 pages

- Peabody Energy - Bmo Presentation SubmittedNo ratings yetPeabody Energy - Bmo Presentation Submitted24 pages

- Proforma Invoice: Contract #2812-2021 Dd. 2021.12.28No ratings yetProforma Invoice: Contract #2812-2021 Dd. 2021.12.282 pages

- EcoCash Notice To Shareholders 30 Aug FinalNo ratings yetEcoCash Notice To Shareholders 30 Aug Final1 page

- Justice Reyes: PNB v. Rodriguez GR No. 170325 FactsNo ratings yetJustice Reyes: PNB v. Rodriguez GR No. 170325 Facts2 pages

- Capital Expenditures vs. Operating Expenditures - What's The Difference - InvestopediaNo ratings yetCapital Expenditures vs. Operating Expenditures - What's The Difference - Investopedia3 pages

- A Beginners' Guide To Commodity Market (Spot and Futures)No ratings yetA Beginners' Guide To Commodity Market (Spot and Futures)47 pages

- Lecture Financial Accounting (8 - E) - Appendix E - Robert Libby, Patricia A. Libby, Daniel G. Short - 1130794No ratings yetLecture Financial Accounting (8 - E) - Appendix E - Robert Libby, Patricia A. Libby, Daniel G. Short - 113079418 pages

- Current Account 29 August 2020 To 29 September 2020Current Account 29 August 2020 To 29 September 2020

- Module 2 - The Risk-Based Financial Statement Audit - Client Acceptance, Audit Planning, Supervision and MonitoringModule 2 - The Risk-Based Financial Statement Audit - Client Acceptance, Audit Planning, Supervision and Monitoring

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference Guide

- AUDITING PROBLEMS (CPAR First Preboards 2018) - AnswersAUDITING PROBLEMS (CPAR First Preboards 2018) - Answers

- Introduction To Accounting, Journal, Ledger, Trial BalanceIntroduction To Accounting, Journal, Ledger, Trial Balance

- Introduction To Accounting: Accounting The Language of BusinessIntroduction To Accounting: Accounting The Language of Business

- Financial Accounting: Accounting Basics: Branches of AccountingFinancial Accounting: Accounting Basics: Branches of Accounting

- Introduction To Accounting, Journal, Ledger, Trial Balance: Module - 1Introduction To Accounting, Journal, Ledger, Trial Balance: Module - 1

- 2.1 2.1. Introduction - Terminologies of Accountancy PDF2.1 2.1. Introduction - Terminologies of Accountancy PDF

- The Nature of Accounting and Accounting Equation L1The Nature of Accounting and Accounting Equation L1

- Introduction To Accounting, Journal, Ledger, Trial BalanceIntroduction To Accounting, Journal, Ledger, Trial Balance

- Introduction To Accounting Class 11 Notes Accountancy Chapter 1Introduction To Accounting Class 11 Notes Accountancy Chapter 1

- Accounting Is A Process of Recording Financial Transactions Pertaining To A BusinessAccounting Is A Process of Recording Financial Transactions Pertaining To A Business

- Yummy Ice-Cream!!!!: Offer!!!OFFER!!! FROM 21/12/2017 TILL 27/12/2017Yummy Ice-Cream!!!!: Offer!!!OFFER!!! FROM 21/12/2017 TILL 27/12/2017

- Chapter Eight: South African Policy Framework For Start-UpsChapter Eight: South African Policy Framework For Start-Ups

- Sakthi Institute of Information and Management Studies: (Feb 2011-AUQP)Sakthi Institute of Information and Management Studies: (Feb 2011-AUQP)

- Unit I: Accounting For Changes Prices (Inflation Accounting)Unit I: Accounting For Changes Prices (Inflation Accounting)

- Mergers & Acquisitions: How To Expand Your Business in Today's EnvironmentMergers & Acquisitions: How To Expand Your Business in Today's Environment

- Positioning Products and Services in The Market: Unit IvPositioning Products and Services in The Market: Unit Iv

- أثر المحاسبة الإبداعية على جودة القوائم المالية دراسة عينة من الاكاديمين والمهنيين في مجال المحاسبة والمراجعةأثر المحاسبة الإبداعية على جودة القوائم المالية دراسة عينة من الاكاديمين والمهنيين في مجال المحاسبة والمراجعة

- Mahindra Ugine - List of Unclaimed Dividendholders List - As On 05 08 2014 PDFMahindra Ugine - List of Unclaimed Dividendholders List - As On 05 08 2014 PDF

- Payment Transaction Report: Stanbic Bank Zimbabwe Limited, Company Registration No. 3387/89Payment Transaction Report: Stanbic Bank Zimbabwe Limited, Company Registration No. 3387/89

- Standard Chartered PLC - Half Year 2013 Press ReleaseStandard Chartered PLC - Half Year 2013 Press Release

- Credit Support Pathways For Rooftop Solar Projects in IndiaCredit Support Pathways For Rooftop Solar Projects in India

- Chief Duties - Senior Agricultural Specialist: Market AssessmentChief Duties - Senior Agricultural Specialist: Market Assessment

- Proforma Invoice: Contract #2812-2021 Dd. 2021.12.28Proforma Invoice: Contract #2812-2021 Dd. 2021.12.28

- Justice Reyes: PNB v. Rodriguez GR No. 170325 FactsJustice Reyes: PNB v. Rodriguez GR No. 170325 Facts

- Capital Expenditures vs. Operating Expenditures - What's The Difference - InvestopediaCapital Expenditures vs. Operating Expenditures - What's The Difference - Investopedia

- A Beginners' Guide To Commodity Market (Spot and Futures)A Beginners' Guide To Commodity Market (Spot and Futures)

- Lecture Financial Accounting (8 - E) - Appendix E - Robert Libby, Patricia A. Libby, Daniel G. Short - 1130794Lecture Financial Accounting (8 - E) - Appendix E - Robert Libby, Patricia A. Libby, Daniel G. Short - 1130794