0 ratings0% found this document useful (0 votes)

270 viewsTax Vat

Tax Vat

Uploaded by

kmabcdeValue Added Tax (VAT) is a form of indirect tax levied on the sale of goods and services and imports in the Philippines. Those required to file VAT returns include any person or entity with actual gross sales over 1.9 million pesos in a 12-month period, those who failed to register as required, importers, and professional practitioners with over 1.5 million pesos in annual fees. Professional practitioners subject to VAT include certified public accountants, insurance agents, and those who passed government exams like lawyers, doctors, and engineers.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Tax Vat

Tax Vat

Uploaded by

kmabcde0 ratings0% found this document useful (0 votes)

270 views67 pagesValue Added Tax (VAT) is a form of indirect tax levied on the sale of goods and services and imports in the Philippines. Those required to file VAT returns include any person or entity with actual gross sales over 1.9 million pesos in a 12-month period, those who failed to register as required, importers, and professional practitioners with over 1.5 million pesos in annual fees. Professional practitioners subject to VAT include certified public accountants, insurance agents, and those who passed government exams like lawyers, doctors, and engineers.

Original Description:

tax

Original Title

TAX-VAT

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Value Added Tax (VAT) is a form of indirect tax levied on the sale of goods and services and imports in the Philippines. Those required to file VAT returns include any person or entity with actual gross sales over 1.9 million pesos in a 12-month period, those who failed to register as required, importers, and professional practitioners with over 1.5 million pesos in annual fees. Professional practitioners subject to VAT include certified public accountants, insurance agents, and those who passed government exams like lawyers, doctors, and engineers.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

270 views67 pagesTax Vat

Tax Vat

Uploaded by

kmabcdeValue Added Tax (VAT) is a form of indirect tax levied on the sale of goods and services and imports in the Philippines. Those required to file VAT returns include any person or entity with actual gross sales over 1.9 million pesos in a 12-month period, those who failed to register as required, importers, and professional practitioners with over 1.5 million pesos in annual fees. Professional practitioners subject to VAT include certified public accountants, insurance agents, and those who passed government exams like lawyers, doctors, and engineers.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 67

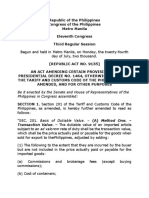

Value Added Tax (VAT)

Value-Added Tax (VAT) is a form of

sales tax. It is a tax on consumption

levied on the sale of goods and services

and on the imports of goods into the

Philippines. It is an indirect tax, which

can be passed on to the buyer.

Value Added Tax (VAT)

Who Are Required To File VAT Returns

Every person or entity who in the course of his trade or

business, sells or leases goods, properties and services

subject to VAT, if the aggregate amount of actual gross

sales or receipts exceed One Million Nine Hundred

Nineteen thousand Five Hundred Pesos (P 1,919,500.00)

for any twelve month period

A person required to register as VAT taxpayer but failed

to register

Value Added Tax (VAT)

Who Are Required To File VAT Returns

A person who imports goods

Professional practitioners

Professional Practitioners (PPs) are formerly classified as non-VAT taxpayers

and were exempt from the VAT and Percentage taxes under Section 109 of the

Tax Code until December 31, 2002.

Prior to this date, they were subject only to Income Tax. Effective January 1,

2003, however, by virtue of RA 7716 and 9010, services of Professional

Practitioners are also subject to either VAT or 3% Percentage Tax.

Starting 2005 services of Professional Practitioners are subject to VAT if gross

professional fees exceed P1.5 million for a 12-month period and subject to 3%

Percentage Tax if gross professional fees total P1.5 million and below for a 12month

Value Added Tax (VAT)

Who Are Considered Professional Practitioners?

"Professional Practitioners" include the following:

Certified Public Accountants

Insurance Agents (Life & Non-life)

Other Professional Practitioners required to pass the

government examination (Lawyers, Doctors, Engineers,

Architects, etc.)

Others (Professional entertainers, Professional Athletes,

Licensed Customs Brokers, etc.)

Value Added Tax (VAT)

Frequently Asked Questions about the VAT

1) What is Output Tax"?

Output tax means the VAT due on the sale,

lease or exchange of taxable goods or properties

or services by any person registered or required

to register under section 236 of the Tax Code.

Value Added Tax (VAT)

Frequently Asked Questions about the VAT

2) What is Input Tax"?

Input tax means the VAT paid by a VATregistered person in the course of his trade or

business on importation of goods or local

purchase of goods or services, including lease or

use of property, from a VAT-registered person.

It shall also include the transitional input tax

determined in accordance with Section 111 of the

Tax Code

Value Added Tax (VAT)

Frequently Asked Questions about the VAT

3) What comprises Goods or Properties?

The term "goods or properties" shall mean all

tangible and intangible objects, which are

capable of pecuniary estimation and shall

include:

a. Real properties held primarily for sale to

customers or held for lease in the ordinary

course of trade or business

Value Added Tax (VAT)

b. The right or the privilege to use patent,

copyright, design or model, plan, secret

formula or process, goodwill, trademark,

trade brand or other like property or right

c. The right or the privilege to use in the

Philippines any industrial, commercial or

scientific equipment

Value Added Tax (VAT)

d. The right or the privilege to use motion

picture film, films, tapes and discs

e. Radio, television, satellite transmission and

cable television time

Value Added Tax (VAT)

4) What comprises "sale or exchange of services"?

The term "sale or exchange of services" means

the performance of all kinds of services in the

Philippines for others for a fee, remuneration

or consideration, including those performed or

rendered by the following:

a. Construction and service contractors

b. Stock, real estate, commercial, customs

and immigration brokers

Value Added Tax (VAT)

c. Lessors of property, (personal or real)

d. Warehousing services

e. Lessors or distributors of cinematographic

films

f. Persons engaged in milling, processing,

manufacturing or repacking goods for

others

Value Added Tax (VAT)

g. Proprietors, operators or keepers of hotels,

motels, resthouses, pension houses, inns,

resorts

h. Proprietors or operators of restaurants,

refreshment parlors, cafes and other

eating places, including clubs and caterers

i. Dealers in securities

j. Lending investors

Value Added Tax (VAT)

k. Transportation contractors on their

transport of goods or cargoes, including

persons who transport goods or cargoes

for hire and other domestic common

carriers by land, air and water relative to

their transport of goods or cargoes

l. Services of franchise grantees of telephone

and telegraph, radio and television

broadcasting and all other franchise

grantees except those under Section 119 of

the Tax Code

Value Added Tax (VAT)

m. Services of non-life insurance companies

(except their crop insurances), including

surety, fidelity, indemnity and bonding

companies

n. Similar services regardless of whether or

not the performance thereof calls for the

exercise or use of the physical or mental

faculties

Value Added Tax (VAT)

5) What is included in the phrase Sale or

Exchange of Services"

The phrase "sale or exchange of services shall

include: shall include:

a. The lease or the use of or the right or

privilege to use any copyright, patent, design

or model, plan, secret formula or process,

goodwill, trademark, trade brand or other

like property or right

Value Added Tax (VAT)

b. The lease or the use of, or the right to use

of any industrial, commercial or scientific

equipment

c. The supply of scientific, technical, industrial

or commercial knowledge or information

d. The supply of any assistance that is ancillary

and subsidiary to and is furnished as a means

of enabling the application or enjoyment of

any such property, or right or any such

knowledge or information

Value Added Tax (VAT)

e. The supply of services by a nonresident

person or his employee in connection with the

use of property or rights belonging to, or the

installation or operation of any brand,

machinery or other apparatus purchased

from such non-resident person

f. The supply of technical advice, assistance or

services rendered in connection with

technical management or administration of

any scientific, industrial or commercial

undertaking, venture, project or scheme

Value Added Tax (VAT)

g. The lease of motion picture films, films, tapes

and discs

h. The lease or the use of or the right to use

radio, television, satellite transmission and

cable television time

Value Added Tax (VAT)

6) What is a zero-rated sale?

It is a sale, barter or exchange of goods,

properties and/or services subject to 0%

VAT pursuant to Sections 106 (A) (2) and

108 (B) of the Tax Code.

Value Added Tax (VAT)

7) What transactions are considered as zero-rated

sales?

The following services performed in the Philippines by VAT-registered persons shall be

subject to zero percent (0%) rate:

Value Added Tax (VAT)

a. Processing, manufacturing or repacking

goods for other persons doing business

outside the Philippines which goods are

subsequently exported where the services are

paid for in acceptable foreign currency and

accounted for in accordance with the rules

and regulations of the Bangko Sentral ng

Pilipinas (BSP)

Value Added Tax (VAT)

b. Services other than those mentioned in the

preceding paragraph, the consideration for

which is paid for in acceptable foreign

currency and accounted for in accordance

with the rules and regulations of the Bangko

Sentral ng Pilipinas (BSP)

c. Services rendered to persons or entities whose

exemption under special laws or international

agreements to which the Philippines is a

signatory effectively subjects the supply of

such services to zero percent (0%) rate

Value Added Tax (VAT)

d. Services rendered to vessels engaged exclusively in international shipping

e. Services performed by subcontractors and/or

contractors in processing, converting, or

manufacturing goods for an enterprise

whose export sales exceeds seventy

percent (70%) of total annual

production

Value Added Tax (VAT)

8) What Sales by a VAT-Registered Persons are

subject to 0% rate?

The following sales by VAT-registered persons

shall be subject to zero percent (0%) rate:

a. Sale of goods which are directly shipped by

a VAT-registered resident to a place outside

the Philippines

Value Added Tax (VAT)

b. Sale of goods which are considered as

"deemed" export sales by a VAT-registered

person to certain entities who are also

residents of the Philippines:

Sales to export-oriented enterprises which the Code

considers as export sales at the level of the supplier

of raw materials

Sales of gold to the Bangko Sentral ng Pilipinas

Sales considered as exportation of goods under a

special law such as Executive Order No. 226

(Omnibus Investments Code of 1987) and Republic

Act No. 7916 (PEZA Law)

Value Added Tax (VAT)

c. Foreign currency denominated sales of goods

d. Sales to entities, the exemption of which,

under a special law or an international

agreement with the Government of the

Philippines, effectively zero rates such sales

Value Added Tax (VAT)

9) What transactions are considered as

Transaction Deemed Sales?

The following transactions are considered as

deemed sales:

a. Transfer, use or consumption, not in the

course of business, of goods or properties

originally intended for sale or for use in the

course of business

Value Added Tax (VAT)

b. Distribution or transfer to:

- Shareholders or investors as share in the

profits of the VAT-registered person; or

- Creditors in payment of debt

c. Consignment of goods if actual sale is not

made within sixty (60) days following the

date such goods were consigned

d. Retirement from or cessation of business,

with respect to inventories of taxable goods

existing as of such retirement or cessation

Value Added Tax (VAT)

10) What is VAT-exempt sale?

It is a sale of goods, properties or service and

the use or lease of properties which is not

subject to output tax and whereby the buyer

is not allowed any tax credit or input tax

related to such exempt sale.

Value Added Tax (VAT)

11) What are the VAT-exempt transactions?

a. Sale of non-food agricultural, marine and

forest products in their original state by the

primary producer or owner of the land

where the same were produced

b. Sale of cotton and cotton seeds in their

original state and copra

Value Added Tax (VAT)

c. Sale or importation of agricultural and

marine food products in their original state,

livestock and poultry of a kind generally

used as, or yielding or producing foods for

human consumption and breeding stock and

genetic materials thereof

Value Added Tax (VAT)

d. Sale or importation of fertilizers; seeds,

seedlings and fingerlings; fish, prawn, livestock and poultry feeds, including ingredients

whether locally produced or imported, used

in the manufacture of finished feeds (except

specialty feeds for race horses, fighting cocks,

aquarium fish, zoo animals and other animals

generally considered as pets)

Value Added Tax (VAT)

e. Sale, Importation or lease of passenger and/or

cargo vessels and aircraft, including engine,

equipment and spare parts of said vessel to be

used by the importer himself as operator thereof

Value Added Tax (VAT)

f. Importation of personal and household effects

belonging to residents of the Philippines

returning from abroad and nonresident

citizens coming to resettle in the Philippines;

Provided, that such goods are exempt from

customs duties under the Tariff and Customs

Code of the Philippines

Value Added Tax (VAT)

g. Importation of professional instruments and implements,

wearing apparel, domestic animals, personal household

effects (except any vehicle, vessel, aircraft, machinery,

other goods for use in the manufacture and merchandise

of any kind in commercial quantity) belonging to persons

coming to settle in the Philippines, for their own use and

not for sale, barter or exchange, accompanying such

persons, or arriving within ninety (90) days before or

after their arrival, upon the production of evidence

satisfactory to the CIR, that such persons are actually

coming to settle in the Philippines and that the change

of residence is bona fide

Value Added Tax (VAT)

h. Services subject to percentage tax

i. Services by the agricultural contract growers

and milling for others of palay into rice, corn

into grits, and sugar cane into raw cane sugar

j. Medical, dental, hospital and veterinary services except those rendered by professionals

Value Added Tax (VAT)

k. Educational services rendered by private

educational institutions, duly accredited by

the Dept. of Education Culture and Sports

(DECS), and Commission on Higher Education (CHED), and those rendered by the

government educational institutions

Value Added Tax (VAT)

l. Services rendered by individuals pursuant

to an employer-employee relationship

m. Services rendered by regional or area headquarters established in the Philippines by

multinational corporations which act as

supervisory communications and coordinating

centers for their affiliates, subsidiaries or

branches in the Asia-Pacific Region and do

not earn or derive income from the Phils.

Value Added Tax (VAT)

n. Transactions which are exempt under

international agreements to which the

Philippines is a signatory, or under special

laws, except those under the following laws:

P.D. No. 66 - Export Processing Zone Authority

(EPZA) registered firms

P.D. No. 529 - Petroleum Exploration

Concessionaires under the Petroleum Act of 1949

P.D. No. 1590 - Philippine Airlines (PAL) relative to

domestic transport of goods or cargoes

Value Added Tax (VAT)

o. Sales by agricultural cooperatives duly

registered with the Cooperative Development

Authority (CDA) to their members as well as

sale of their produce, whether in its original

state or processed form, to non-members;

their importation of direct farm inputs,

machineries and equipment, including spare

parts thereof, to be used directly and

exclusively in the production and/or

processing of their produce

Value Added Tax (VAT)

p. Gross receipts from lending activities by credit or

multi-purpose cooperatives duly registered with the

Cooperative Development Authority (CDA) whose

lending operation is limited to their members

q. Sales by non-agricultural, non-electric and non-credit

cooperatives duly registered with the Cooperative

Development Authority: Provided, that the share

capital contribution of each member does not exceed

Fifteen Thousand Pesos (P 15,000) and regardless of

the aggregate capital and net surplus ratably distributed among the members

r. Export sales by persons who are not VAT-registered

Value Added Tax (VAT)

s. Sale of real properties utilized for low-cost

housing as defined by R.A. No. 7979,

otherwise

known as the Urban Development Housing Act of

1992 and other related laws, such as R.A. No. 7835

and R.A. No. 8763

wherein the price ceiling per

unit is

P1,500,000.00 or as may from time

to time be determined by the Housing and Urban

Development Coordinating Council (HUDCC)

and the National Economic Development

Authority (NEDA);

Value Added Tax (VAT)

i. Sale of real properties utilized for socialized

housing defined under R.A. No. 8763, wherein the

price ceiling per unit is P225,000.00 or as may from

time to time be determined by the HUDCC and the

NEDA and other related laws;

ii. Sale by real estate dealers and/or lessors of house

and lot and other residential dwellings valued at

P1,500,000.00 and below the amount shall be

adjusted to its present value using the Consumer Price

Index as published by the National Statistics

Office

(NSO).

Value Added Tax (VAT)

t. Lease of a residential unit with a monthly rental per

unit not exceeding Ten Thousand Pesos (P10,000.00),

regardless of the amount of aggregate rentals received

by the lessor during the year: Provided, that the

exemption likewise applies to lease of residential units

where the monthly rental per unit exceeds P 10,000.00

but the aggregate rentals of the lessor during the year

do not exceed P 1,500,000.00: the amount of P10,000.00

shall be adjusted to its present value using the

Consumer Price Index, as published by the NSO;

Value Added Tax (VAT)

u. Sale, importation, printing or publication of

books and any newspaper, magazine, review

or bulletin which appears at regular intervals

with fixed prices for subscription and sale and

which is not devoted principally to the publication of paid advertisements

Value Added Tax (VAT)

v. Sale or lease of goods or properties or the

performance of services other than the transactions mentioned in the preceding paragraphs, the gross annual sales and/or receipts

does not exceed the amount of P1,500,000.00:

w. Services of banks, non-bank financial

intermediaries performing quasi-banking

functions, and other non-bank financial

intermediaries;

Value Added Tax (VAT)

12)

What are the Applicable VAT Rates?

(a) Twelve Percent (12%);

(b) Zero Percent (0%);

(c) Seven Percent (7%)

Value Added Tax (VAT)

13)

What are the Tax Formula for VAT?

The General Formula for VAT Payable is:

Output Tax

P XXX

Less: Input Tax

XXX

VAT Payable

P XXX

=====

Value Added Tax (VAT)

14) Withholding Value Added Tax

The Government or any of its political subdivisions,

instrumentalities or agencies, including governmentowned and controlled corporations shall, before making

payment on account of services rendered or for its

purchase of goods from sellers of services of goods

which are subject to the VAT, deduct and withhold a

Final Withholding VAT at the rate of Seven Percent (7%)

of the gross payment.

The contract price of the services rendered by the

contractor shall no longer be declared in the Monthly

VAT Declaration or Quarterly VAT Return

Value Added Tax (VAT)

15) What are the Deadlines of Filing of the Monthly

VAT Declaration and Quarterly VAT Returns

and the Applicable VAT Forms?

For Monthly VAT Declaration:

20 days after the end of the month

BIR Form 2550M Monthly VAT

Declaration

For Quarterly VAT Return:

25 days after the end of each quarter

BIR Form 2550Q Quarterly VAT Return

Value Added Tax (VAT)

16. The Formula for Sale of Services

Output Tax (Gross Receipts x 12%)

P XXX

Less: Input Taxes

VAT paid on local purchases and importation of goods

For materials, supplied with the sale of service P XXX

For use as supplies in the course of business

XXX

For use in the course of trade or business for

which deduction for depreciation (or

amortization is allowed, except

automobile, aircraft and yachts)

XXX

VAT paid on the purchase of real property

XXX

VAT paid on purchase of services

XXX

Transitional Input Tax

XXX

XXX

VAT Payable

P XXX

======

Value Added Tax (VAT)

17. What does Gross Receipts mean?

The term gross receipts means cash or its cash

equivalent actually or constructively received

(not including the VAT) as:

(a) payment on the contract price, compensation, service fee, rental or royalty;

(b) payment for materials, supplied with the

services; and

(c) Deposits or advanced payments on the

contract for services

Value Added Tax (VAT)

Illustrative Problem - 1

CarCare Shop is a car repair shop furnishing labor only or

both parts and labor. CareCare Shop had the following data

for August 2010 (all information are exclusive of VAT):

Amounts received as advances on

car to be repaired and repainted

P 11,000

Amounts received for cars repaired,

repainted, finished and delivered

to owners:

For Labor

175,000

For Parts (purchased from a

VAT registered supplier)

33,000

Amounts paid to machine shop

44,000

Amount paid to suppliers of paints

55,000

Value Added Tax (VAT)

Solution - 1

OUTPUT TAX

Cash received as advances (P 11,000x 12%)

P 1,320

Cash received for completed jobs for

Labor (P 175,000 x 12%)

21,000

Parts (P 33,000 x 12%)

3,960

Total Output Tax

26,280

Less: INPUT TAX

On Parts purchased (P 33,000 x 12%) P 3,960

On Machine Shop

(P 44,000 x 12%)

5,280

On Paints purchased (P 55,000 x 12%)

6,600 15,840

VAT Payable

P 10,440

Value Added Tax (VAT)

Illustrative Problem - 2

Mr. Q is a CPA in the practice of public accounting and is a VATregistered taxpayer. Data for August 2010 (all information are

exclusive of VAT):

Professional Fees received, net of 10%

withholding income tax

P 180,000

Accounts receivable from clients

300,000

Reimbursements received on advances to clients:

Expenses chargeable to clients, billed to client

20,000

Expenses chargeable to clients, billed to Mr. Q

6,000

Purchase of Computer

70,000

Purchase of Office Supplies

2,500

Payment for Utilities (PLDT/Meralco)

15,000

Payment for Salaries of employees

25,000

Other Expenses:

Paid to VAT taxpayers

3,000

Paid to Non-VAT taxpayers

8,000

Value Added Tax (VAT)

Solution - 2

OUTPUT TAX

On Professional Fees received [(P 180,000/90%) x 12%]

P 24,000

On reimbursement received from clients for expenses

chargeable to Clients, billed to Mr. Q (P 6,000 x 12%)

720

Total Output Tax

24,720

Less: INPUT TAX

On expenses chargeable to client, billed to Mr. Q P 720

Purchase of Computer (P 70,000 x 12%)

8,400

Purchase of Office Supplies (P 2,500 x 12%)

300

Payment for Utilities (P 15,000 x 12%)

1,800

Payment for other expenses of operations paid to

VAT taxpayers (P 3,00 x 12%)

360

11,580

VAT Payable

P 13,140

Value Added Tax (VAT)

18. The Formula for Sale of Goods or Properties is:

Output Tax (Gross Selling Price x 12%)

P XXX

Less: Input Taxes

VAT paid on local purchases and importation of goods

For sale; or

P XXX

For conversion into or intended to form

part of a finished product for sale,

including packaging materials

XXX

For use as supplies in the course of business

XXX

For use in the course of trade or business for

which deduction for depreciation (or

amortization is allowed, except

automobile, aircraft and yachts)

XXX

VAT paid on the purchase of real property

XXX

VAT paid on purchase of services

XXX

Transitional Input Tax

XXX

XXX

VAT Payable

P XXX

======

Value Added Tax (VAT)

Illustrative Problem

Mr. X, a VAT-registered taxpayer, total sales for the month of August

2010 was P 1,500,000 (VAT not included). For the same period,

purchases (VAT not included), were:

Goods for sale from A Co., a VAT taxpayer

P 300,000

Goods for sale, from B Co., a Non-VAT taxpayer

200,000

Supplies, from C Co., a VAT taxpayer

50,000

Services from D Co., a VAT taxpayer

60,000

Office equipment, from E Co., a VAT taxpayer

40,000

Real property for use in business, from F Co.,

a VAT taxpayer

500,000

Rent paid to G Co., a VAT Taxpayer

50,000

Value Added Tax (VAT)

Solution

OUTPUT TAX Sales (P 1,500,000 x 12%)

P 180,000

Less: INPUT TAXES

On goods purchased from A Co. (P 300,000 x 12%)

36,000

On Supplies purchased from C Co. (P 50,000 x 12%)

6,000

On Services purchased from D Co. (P 60,000 x 12%)

7,200

On Office equipment purchased from E Co.

(P 40,000 x 12%)

4,800

On Real Property purchased from F Co.

(P 500,000 x 12%)

60,000

On Rental paid to G Co. (P 50,000 x 12%)

6,000

Total Input Taxes

120,000

VAT Payable

P 60,000

Value Added Tax (VAT)

19. What is a Presumptive Input Tax?

Persons engaged in the processing of sardines, mackerel

and milk, and in the manufacturing of refined sugar,

cooking oil, and packed noodle-based instant meals, shall

be allowed a presumptive input tax, equivalent to four

percent (4%) of the gross value in money of their

purchases of primary agricultural products which are used

as inputs to their production

Value Added Tax (VAT)

Processing shall mean pasteurization, canning and

activities which through physical or chemical process

alters the exterior texture or form or inner substance

of a product in such a manner as to prepare it for

special use to which it could not have been put in its

original from and condition

Value Added Tax (VAT)

Illustrative Example

Dyesebel Foods Corp. purchased sardines from fishermen

and processes them into canned sardines. During the month

of August 2010, the following sales and purchases (VAT not

included) were made:

Sales

P 400,000

Fish from fishermen

100,000

Tin cans from Lata Co.

20,000

Tomato paste (in cans)

5,000

Olive Oil (in bottles)

2,500

Pepper from farmers

1,800

Paper labels from Tatak Co.

500

Value Added Tax (VAT)

Solution

Output Tax (P 400,000 x 12%)

P 48,000

Less: INPUT TAXES

Actual Input Tax on Purchases

On Tin cans (P 20,000 x 12%) P 2,400

On Tomato Paste (P 5,000 x 12%)

600

On Olive Oil (P 2,500 x 12%)

300

On Paper Labels (P 500 x 12%)

60

Presumptive Input Tax

On Pepper ( 1,800 x 4%)

72

3,432

VAT Payable

P 44,566

Value Added Tax (VAT)

20. Transitional Input Tax

A person who becomes liable to VAT or any person who

elects to be a VAT registered person shall, be allowed

input tax on his beginning inventory of goods, materials

and supplies equivalent to two percent (2%) of the value

of such inventory or the actual VAT paid on such goods,

materials and supplies, whichever is higher.

The amount allowable shall be credited against the

Output Tax.

Value Added Tax (VAT)

21. Example - Transitional Input Tax

Mr. A, owner of a trading firm, initially registered as a non-VAT taxpayer

paying the 3% percentage tax. On the following following year he

registered as a VAT taxpayer because his sales in the previous year

exceeded P 1,500,000. At the beginning of the year he has the following

inventories:

Merchandise inventory. . . . . . . . . . . . . . . . . . . . . . . . .P 450,000

Store and Office supplies inventory. . . . . . . . . . . . . . . 100,000

Actual Input Tax Paid on the Inventories. . . . . . . . . P 66,000

How much is the Allowed Transitional Input Tax?

Value Added Tax (VAT)

22. Solution - Transitional Input Tax

Merchandise inventory. . . . . . . . . . . . . . . . . . . . .P 450,000

Store and Office supplies inventory. . . . . . . . . . . 100,000

Total Inventories of merchandise and supplies P 550,000

Multiply by Transitional Input Tax Rate. . . . .

2%

Transitional Input Tax. . . . . . . . . . . . . . . . . . . . .P 11,000

Actual Input Tax . . . . . . . . . . . . . . . . . . . . . . . . . P 66,000

Allowed. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . P 66,000

=======

Value Added Tax (VAT)

23. Excess Input Tax Carry Over

In cases, where the Total Input Taxes exceed the Total

Output Tax for a given period, only the amount of input

taxes shall be applied to the Total Output Tax.

The Excess Input Tax shall be used and applied in the

succeeding taxable period.

Should there be an excess input tax in the first month of a

quarter, and again an excess input tax in the second month

of the same quarter, while the excess input tax of the first

month is carried over to the second month, the excess input

tax of the second month is not carried over to the third

month.

You might also like

- Ra 9135Document20 pagesRa 9135Daley CatugdaNo ratings yet

- Strategic ManagmenttDocument19 pagesStrategic ManagmenttAsif AliNo ratings yet

- Company Profile GlobeDocument15 pagesCompany Profile GlobekmabcdeNo ratings yet

- Shell Case StudyDocument1 pageShell Case StudykmabcdeNo ratings yet

- Ias 16Document3 pagesIas 16Jhonalyn ZonioNo ratings yet

- Estate and Donors Tax in Re TRAIN LAWDocument8 pagesEstate and Donors Tax in Re TRAIN LAWRona RososNo ratings yet

- Taxn03B: Transfer and Business TaxesDocument18 pagesTaxn03B: Transfer and Business TaxesKerby GripoNo ratings yet

- Exempt Sales - NotesDocument28 pagesExempt Sales - NotesSunny DaeNo ratings yet

- Vat On Sale of Services AND Use or Lease of PropertyDocument67 pagesVat On Sale of Services AND Use or Lease of PropertyZvioule Ma FuentesNo ratings yet

- Explain The Relationship Between Risk and ReturnDocument2 pagesExplain The Relationship Between Risk and ReturnKristine Claire PangandoyonNo ratings yet

- VAT Concepts Tax 321Document28 pagesVAT Concepts Tax 321justineNo ratings yet

- Chapter 2. The Time Value of Money: (Section 2.2)Document35 pagesChapter 2. The Time Value of Money: (Section 2.2)Sai Sriram JNo ratings yet

- Vat On Sales of Goods or PropertiesDocument10 pagesVat On Sales of Goods or Propertiesgoerginamarquez100% (1)

- Rmo 19-2007Document3 pagesRmo 19-2007Jema Abreu50% (2)

- Gross Estate ReviewerDocument9 pagesGross Estate ReviewerMark Noel SanteNo ratings yet

- Omnibus Investment CodeDocument7 pagesOmnibus Investment CodeKimmee LeeNo ratings yet

- Entrepreneurship 2Document51 pagesEntrepreneurship 2Harry Atta-motteNo ratings yet

- Reviewer in Financial MarketDocument6 pagesReviewer in Financial MarketPheobelyn EndingNo ratings yet

- Salient Points of TRAIN LawDocument21 pagesSalient Points of TRAIN LawNani kore100% (1)

- TradeDocument6 pagesTradeLouise CruzNo ratings yet

- Finals - II. Deductions & ExemptionsDocument13 pagesFinals - II. Deductions & ExemptionsJovince Daño DoceNo ratings yet

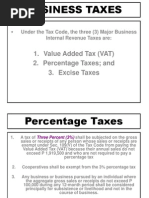

- Introduction To Business Taxes: September 4, 2020Document20 pagesIntroduction To Business Taxes: September 4, 2020Bancas YvonNo ratings yet

- Draft BOC Order On Customs Bonded Warehousing SystemDocument37 pagesDraft BOC Order On Customs Bonded Warehousing SystemPortCallsNo ratings yet

- Individual Income TaxationDocument50 pagesIndividual Income TaxationGab RielNo ratings yet

- Business and Other Transfer Taxes - PrelimDocument47 pagesBusiness and Other Transfer Taxes - PrelimYoseph WooNo ratings yet

- San Beda University: College of Arts and Sciences San Miguel, Mendiola, ManilaDocument8 pagesSan Beda University: College of Arts and Sciences San Miguel, Mendiola, ManilaBlanche PenesaNo ratings yet

- BTR Functions Draft 6-1-15Document16 pagesBTR Functions Draft 6-1-15Hanna PentiñoNo ratings yet

- Tax1 Q1 Summer 17Document3 pagesTax1 Q1 Summer 17Sheena CalderonNo ratings yet

- Advance Taxation Assignment: Name: Muhammad Mohsin O1-112171-016 Bs A&F - 7ADocument3 pagesAdvance Taxation Assignment: Name: Muhammad Mohsin O1-112171-016 Bs A&F - 7AmohsinNo ratings yet

- Tariff-Code-2018 BarDocument39 pagesTariff-Code-2018 Barred_inajNo ratings yet

- Introduction To Business TaxationDocument41 pagesIntroduction To Business TaxationJeane Mae Boo0% (1)

- Case Study (Business Combination)Document23 pagesCase Study (Business Combination)Princes S. RoqueNo ratings yet

- Chapter 2 - Income TaxDocument30 pagesChapter 2 - Income TaxRochelle ChuaNo ratings yet

- RR No. 7-2003Document9 pagesRR No. 7-2003Lorenzo BalmoriNo ratings yet

- General Principles of Taxation - Sample CasesDocument2 pagesGeneral Principles of Taxation - Sample CasesJace Tanaya100% (1)

- Vat On Sale of Services and Use orDocument53 pagesVat On Sale of Services and Use orJohnAllenMarillaNo ratings yet

- Notes in Other Percentage TaxDocument2 pagesNotes in Other Percentage TaxNovie Marie Balbin AnitNo ratings yet

- Taxation 2 - DimodlonDocument291 pagesTaxation 2 - DimodlonFeby OrenaNo ratings yet

- Chapter 4Document4 pagesChapter 4Marinelle DiazNo ratings yet

- RA 8751 Countervailing LawDocument6 pagesRA 8751 Countervailing LawAgnus SiorNo ratings yet

- A. Assessment B. Collection: Remedies of The GovernmentDocument10 pagesA. Assessment B. Collection: Remedies of The GovernmentGianna CantoriaNo ratings yet

- CHAPTER 12 - BOI and PEZA Registered EntitiesDocument19 pagesCHAPTER 12 - BOI and PEZA Registered EntitiesEmerwin Dela PeňaNo ratings yet

- GROUP 10 (Corporation Income Taxation - Regular Corporation)Document16 pagesGROUP 10 (Corporation Income Taxation - Regular Corporation)Denmark David Gaspar NatanNo ratings yet

- Case 9-30 Master Budget With Supporting SchedulesDocument2 pagesCase 9-30 Master Budget With Supporting SchedulesCindy Tran20% (5)

- LABOR LAW REVIEW Project 2Document11 pagesLABOR LAW REVIEW Project 2Van John MagallanesNo ratings yet

- Chapter 3.1 - VAT Exempt Sales PDFDocument10 pagesChapter 3.1 - VAT Exempt Sales PDFJade Berlyn AgcaoiliNo ratings yet

- Tax For Rental Income in The PhilippinesDocument3 pagesTax For Rental Income in The PhilippinesRESIE GALANGNo ratings yet

- CANALISATIONDocument34 pagesCANALISATIONPiyushVarmaNo ratings yet

- Activity On Cost-Benefit Analysis Scenario Benefits Costs AssessmentDocument2 pagesActivity On Cost-Benefit Analysis Scenario Benefits Costs AssessmentDaniel Victor AngNo ratings yet

- Income Tax On CorporationDocument53 pagesIncome Tax On CorporationLyka Mae Palarca IrangNo ratings yet

- Final PPT - VatDocument60 pagesFinal PPT - Vatmd1586No ratings yet

- Original Issuance of Shares of Stocks: Documentary Stamp TaxDocument4 pagesOriginal Issuance of Shares of Stocks: Documentary Stamp TaxJohn Paul EslerNo ratings yet

- Topic 3 - Magna Carta For Disabled PersonsDocument38 pagesTopic 3 - Magna Carta For Disabled PersonsNddejNo ratings yet

- Lesson 2Document17 pagesLesson 2Lyana DagoocNo ratings yet

- Global TradeDocument15 pagesGlobal Tradenatalie clyde matesNo ratings yet

- Subsidies and Counter MeasuresDocument23 pagesSubsidies and Counter MeasuresSeashell LoafingNo ratings yet

- VAT ReviewDocument8 pagesVAT ReviewabbyNo ratings yet

- Income Taxation ModuleDocument52 pagesIncome Taxation ModulePercival CelestinoNo ratings yet

- VatDocument6 pagesVatKenneth Bryan Tegerero TegioNo ratings yet

- Business Taxes (3)Document64 pagesBusiness Taxes (3)Tristan JequintoNo ratings yet

- Value-Added Tax Description: A. B. C. D. eDocument7 pagesValue-Added Tax Description: A. B. C. D. eKasteen ManzanoNo ratings yet

- Philippine Economic Zone Authority (PEZA Registered) Can Avail of 2 TAXDocument6 pagesPhilippine Economic Zone Authority (PEZA Registered) Can Avail of 2 TAXDaryl Noel TejanoNo ratings yet

- VATDocument17 pagesVATnodnel salonNo ratings yet

- Waters PH Interview TallyDocument5 pagesWaters PH Interview TallykmabcdeNo ratings yet

- TAX Percentage TaxDocument19 pagesTAX Percentage TaxkmabcdeNo ratings yet

- St. Scholastica'S College, Manila Junior Marketing AssociationDocument3 pagesSt. Scholastica'S College, Manila Junior Marketing AssociationkmabcdeNo ratings yet

- Juice ChecklistDocument1 pageJuice ChecklistkmabcdeNo ratings yet

- Reasons For Juice Dieting: 6% For Loosing Weight Healthy Living Because It's IN Health ProblemsDocument6 pagesReasons For Juice Dieting: 6% For Loosing Weight Healthy Living Because It's IN Health ProblemskmabcdeNo ratings yet

- Retail PlanDocument18 pagesRetail PlanLeslee JoyNo ratings yet

- Average Annual Family Income and Expenditure by Income ClassDocument2 pagesAverage Annual Family Income and Expenditure by Income ClasskmabcdeNo ratings yet

- Lecture 01 - Cost AccountingDocument56 pagesLecture 01 - Cost Accountingdia_890No ratings yet

- CBSE Class 11 Accountancy Sample Paper 2013 (4) - 0 PDFDocument12 pagesCBSE Class 11 Accountancy Sample Paper 2013 (4) - 0 PDFsivsyadavNo ratings yet

- Introduction To Business Combinations and The Conceptual FrameworkDocument15 pagesIntroduction To Business Combinations and The Conceptual FrameworkAhmed Fahmy100% (1)

- Iiflar2011 12Document106 pagesIiflar2011 12Aisha GuptaNo ratings yet

- Enager Industries3Document5 pagesEnager Industries3pratheek30100% (1)

- RCF Leave Bank - A Unique Social Security ConceptDocument13 pagesRCF Leave Bank - A Unique Social Security ConceptSanjeev Shantkumar DoshiNo ratings yet

- Saxonville SausageDocument15 pagesSaxonville SausageBonno Lipu100% (1)

- Notes To AccountsDocument7 pagesNotes To Accountsamitsharma93228No ratings yet

- Equity Weekly: Equity Research - Monday, November 16, 2009Document4 pagesEquity Weekly: Equity Research - Monday, November 16, 2009naudaslietasNo ratings yet

- Ic 38 Short NotesDocument30 pagesIc 38 Short NotesShubham GoelNo ratings yet

- Indias Top 500 Companies 2019Document454 pagesIndias Top 500 Companies 2019arvindshastry100% (3)

- Financial ModelDocument28 pagesFinancial ModelSlidebooks Consulting100% (5)

- Tugas Studi Kasus AKM1 Kelompok 4Document4 pagesTugas Studi Kasus AKM1 Kelompok 4Marchelino GirothNo ratings yet

- Financial Reporting (International) : Wednesday 5 June 2013Document9 pagesFinancial Reporting (International) : Wednesday 5 June 2013Ruslan LamievNo ratings yet

- Grade 11 Accn June 2023 P2 MGDocument9 pagesGrade 11 Accn June 2023 P2 MGKwakhanya StemelaNo ratings yet

- Bcom 3 Sem Corporate Accounting 1 21100518 Mar 2021Document5 pagesBcom 3 Sem Corporate Accounting 1 21100518 Mar 2021abin.com22No ratings yet

- WalmartDocument10 pagesWalmartNurbergen YeleshovNo ratings yet

- Leverage Analysis-IDocument2 pagesLeverage Analysis-Ipoorna_mpcNo ratings yet

- FinanceDocument42 pagesFinanceankita merchantNo ratings yet

- Coffee Shop Business PlanDocument24 pagesCoffee Shop Business Planبدر الدين زين العابدينNo ratings yet

- Maersk Maya VC Voyage AnalysisDocument1 pageMaersk Maya VC Voyage Analysishackey720No ratings yet

- 1 Partnership-YTDocument7 pages1 Partnership-YTSherwin DueNo ratings yet

- P 1Document8 pagesP 1Ken Mosende TakizawaNo ratings yet

- China Leather Shoes Market ProfileDocument9 pagesChina Leather Shoes Market ProfileAllChinaReports.comNo ratings yet

- Capital Versus Revenue: Some Guidance: Pyott V CIRDocument7 pagesCapital Versus Revenue: Some Guidance: Pyott V CIRAbigail Ruth NawashaNo ratings yet

- 13sg Monopoly OligopolyDocument16 pages13sg Monopoly OligopolyAaron Carter Kennedy100% (1)

- 7115 w05 QP 1Document16 pages7115 w05 QP 1mstudy123456No ratings yet

- REPORT INTERNSHIP - ContohDocument16 pagesREPORT INTERNSHIP - ContohMatthew JohnsonNo ratings yet

- Health Finance AssignmentDocument3 pagesHealth Finance AssignmentGeorge TanarunoNo ratings yet