0 ratings0% found this document useful (0 votes)

63 viewsCPD Faqs V3 080817 - JMS

CPD Faqs V3 080817 - JMS

Uploaded by

KatherineThe document describes several key components of the Philippines' e2m Customs system:

1) The e2m system was implemented in 2004 to computerize customs transactions. It allows for online registration, submissions, payments, and linkages between government agencies.

2) The Client Profile Registration System (CPRS) requires all stakeholders to register and obtain a Customs Client Number in order to access e2m.

3) The Import Assessment System (IAS) automates import procedures, payments, permits and clearances using components like the Payment Application Secure System (PASS5) and linkage to the National Single Window (NSW).

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

CPD Faqs V3 080817 - JMS

CPD Faqs V3 080817 - JMS

Uploaded by

Katherine0 ratings0% found this document useful (0 votes)

63 views21 pagesThe document describes several key components of the Philippines' e2m Customs system:

1) The e2m system was implemented in 2004 to computerize customs transactions. It allows for online registration, submissions, payments, and linkages between government agencies.

2) The Client Profile Registration System (CPRS) requires all stakeholders to register and obtain a Customs Client Number in order to access e2m.

3) The Import Assessment System (IAS) automates import procedures, payments, permits and clearances using components like the Payment Application Secure System (PASS5) and linkage to the National Single Window (NSW).

Original Description:

E2m

Original Title

CPD-FAQS-V3-080817_JMS

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

The document describes several key components of the Philippines' e2m Customs system:

1) The e2m system was implemented in 2004 to computerize customs transactions. It allows for online registration, submissions, payments, and linkages between government agencies.

2) The Client Profile Registration System (CPRS) requires all stakeholders to register and obtain a Customs Client Number in order to access e2m.

3) The Import Assessment System (IAS) automates import procedures, payments, permits and clearances using components like the Payment Application Secure System (PASS5) and linkage to the National Single Window (NSW).

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

63 views21 pagesCPD Faqs V3 080817 - JMS

CPD Faqs V3 080817 - JMS

Uploaded by

KatherineThe document describes several key components of the Philippines' e2m Customs system:

1) The e2m system was implemented in 2004 to computerize customs transactions. It allows for online registration, submissions, payments, and linkages between government agencies.

2) The Client Profile Registration System (CPRS) requires all stakeholders to register and obtain a Customs Client Number in order to access e2m.

3) The Import Assessment System (IAS) automates import procedures, payments, permits and clearances using components like the Payment Application Secure System (PASS5) and linkage to the National Single Window (NSW).

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 21

THE E2M CUSTOMS SYSTEM

What is e2m system?

Started in 2004 as a replacement of

ASYCUDA++ upon creation of E.O.

463 in order to augment the

computerization program of BOC.

Enhancements in the system:

Engagement of VASP as independent web-based

portal for all customs transactions.

Online registration of stakeholders into the system.

Online submission of manifest by carriers.

Automated payment modules and settlements.

Online submission of import entries and export

declaration.

Automated linkage to other government agencies.

Real time updates on the submitted online

transactions with BOC or other government

agencies.

ACCREDITATION OF VASP

(CAO 2-2007)

Conditions for Accreditation

Selected VASPs shall sign Service Level Undertaking (SLU)

and Non-Disclosure Undertaking (NDU).

Security bond of Php 50,000.00 shall be imposed (second

year onwards)

Post Performance Bond to BOC-accredited Surety Company

amounting to Php 5 Million.

Accredited VASP shall undergo a six-month probationary

period.

Selected VASP shall be given accreditation status for a

period of 3 years inclusive of probationary period.

o Renewable yearly thereafter

Pre-termination of Services

Violation of the provisions of regulations,

including SLU and NDU.

Violation of CMTA, e-Commerce Act, and

other related laws,

Actions inimical to the security and integrity

of BOC e-Customs operations.

Other violations as may be determined by

the Commissioner of Customs.

CLIENT PROFILE

REGISTRATION SYSTEM (CPRS)

What is CPRS?

An online registration of all BOC and Other

Government Agencies stakeholders in

order to use the e2m Customs System.

Includes submission of relevant data and

capturing of references which will be

necessary in using a particular transaction

with BOC.

Stakeholders who are subject to direct accreditation

with BOC aside from CPRS Enrollment:

Stakeholders Accredited By BOC Accrediting Office

Importer BOC – AMO

Customs Broker BOC – AMO

CBW Operator BOC – AMO (after securing

recommendation from BWC)

PEZA/Freeport Locator BOC – AMO (after securing approval

from respective Freeport Authorities)

Off-Dock CY-CFS District Collector of the Port and

concurrence of Dep Comm AOCG

and Commissioner of Customs

Surety Company Bonds Division

Stakeholders who are subject to accreditation of

government agencies prior to CPRS Enrollment:

Stakeholders Accredited By Accrediting Government Agency

Government Agencies

Authorized Agent Banks BSP and Bankers Association of the

Philippines

Sea Freight Forwarder, NVOCC DTI – FTEB

Air Freight Forwarder CAB

Arrastre Operator Philippine Ports Authority

Exporters registered under BOI, SBMA, CDC, AFAB, PEZA

Investment Promotions Plan (whichever is applicable)

Other regular exporters PhilExport

Shipping Lines MARINA

General Provisions of CPRS

(CMO 39-2008)

General Provisions of CPRS:

All stakeholders shall apply for registration

to CPRS in order to access the e2m

system.

Registrants shall register in CPRS for every

role they will assume in their transactions

with BOC.

Electronic Identifications:

Customs Client Number (CCN)

o Stakeholder’s unique identifier in CPRS for every role that the

stakeholder acquires in the CPRS registration.

o Issued in the form of Certificate of Registration (COR)

Digital Signature

o All transactions in e2m are required to be electronically signed.

Validity of registration is 365 days reckoned from date of

approval of registration.

Operational Procedures of CPRS

Messages through e2m registration of CRPS:

o STORED – the electronic application is accepted by CPRS

o APPROVED – the CPRS application has undergone

verification and has been approved already

o ERROR – stakeholder should resolve the error through

VASPs and re-file as soon as the error is resolved.

Upon approval of CPRS application, the stakeholder

shall:

Receive and email message with attached COR

IMPORT ASSESSMENT SYSTEM

(IAS)

CAO 8-2008

Imports Assessments System

A set of system, as component of e2m

containing:

o Automated procedures on importation

o Payment of duties and taxes

o Securing permits and clearances

System Components of IAS

(CMO 27-2009)

CPRS

EMS

FES

WES

PASS5

Other Settlement Modes

o Tax Exemption Certificates (for shipments availing duty & tax

free importations)

o Import Entry Declaration (for advance duties under L/C)

o Tax Debit Memo

OLRS

Licenses and Clearances System (connected to NSW)

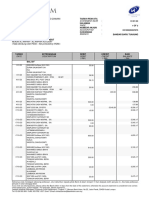

PASS 5 (Payment Application

Secure System)

Reference: CAO 10-2008

Duties, taxes and fees payable (both

advance and final) will be transmitted to

AAB via a payment gateway through a

secured communication channel and

collected by debit from designated bank

accounts.

The National Single Window (NSW)

Facilitates trade through efficiencies in

Customs and authorization process.

Mandated for implementation via E.O. 482

Allows single submission and accelerated

processing of applications for licenses,

permits, prior to undertaking a trade

transaction.

ONLINE RELEASE SYSTEM

An electronic system of sending release

instructions to the Port Operator or Off-

Dock CY CFS or Airport Transit Facility for

the release of goods.

AUTOMATED EXPORT

DECLARATION SYSTEM

Reference CMO 54-2-10

Replaces Manual Export Declaration Form

Only Customs Brokers and Exporters

registered with CPRS per CMO 39-2008

shall be allowed to submit Export

Declaration in the e2m system

Exporters are directed to open and

maintain debit account at any AAB

pursuant to PASS5 as to the payment of

Export Documentary Stamps Fee

You might also like

- MPS 2 The Fashion Rack 14eDocument5 pagesMPS 2 The Fashion Rack 14eLeian Barbosa67% (3)

- Assignment #1 (With Answers)Document9 pagesAssignment #1 (With Answers)南玖No ratings yet

- 1 RR 7-2009Document5 pages1 RR 7-2009JoyceNo ratings yet

- Draft BOC Order On Export Cargo Clearance Formalities and Issuance of Proof of OriginDocument9 pagesDraft BOC Order On Export Cargo Clearance Formalities and Issuance of Proof of OriginPortCallsNo ratings yet

- FAR-AMT 2021: Federal Aviation Regulations for Aviation Maintenance TechniciansFrom EverandFAR-AMT 2021: Federal Aviation Regulations for Aviation Maintenance TechniciansRating: 5 out of 5 stars5/5 (2)

- Account StatementDocument6 pagesAccount StatementDeepaBabukumarNo ratings yet

- Eblr Switch Over FormatDocument2 pagesEblr Switch Over FormatMontu Bhai59% (17)

- Information On The: BOC - Client Profile Registration System (CPRS)Document7 pagesInformation On The: BOC - Client Profile Registration System (CPRS)Jen CastroNo ratings yet

- Border ManagementDocument48 pagesBorder ManagementRoebie Marie DimacaliNo ratings yet

- Cmo 39 - 2008Document11 pagesCmo 39 - 2008Otis MelbournNo ratings yet

- (Note) Customs5Document8 pages(Note) Customs5reivisteNo ratings yet

- Import & Export Procedures - EACDocument15 pagesImport & Export Procedures - EACrodgerlutaloNo ratings yet

- Draft CAO On Accreditation, Establishment and Operation of E2M Value-Added Service Providers (VASPs)Document7 pagesDraft CAO On Accreditation, Establishment and Operation of E2M Value-Added Service Providers (VASPs)PortCallsNo ratings yet

- Frequently Asked Question On: (Customs Modermization Project)Document41 pagesFrequently Asked Question On: (Customs Modermization Project)RiaNo ratings yet

- CMO 7-2012 Supplemental Guidelines Automated Export Documentation System Implementation Under E2mDocument9 pagesCMO 7-2012 Supplemental Guidelines Automated Export Documentation System Implementation Under E2mMichael Joseph IgnacioNo ratings yet

- Public Notice 59Document16 pagesPublic Notice 59Shreyansh ShreyNo ratings yet

- Cmo No 5-2012Document23 pagesCmo No 5-2012Euxine Albis100% (1)

- The Basics On The Bureau of Customs E2m-CustomsDocument89 pagesThe Basics On The Bureau of Customs E2m-CustomsEuxine Albis88% (8)

- Research On Bureau of Customs IssuancesDocument4 pagesResearch On Bureau of Customs IssuancesArya PadrinoNo ratings yet

- Customs Memorandum Order No. 004-14: February 21, 2014Document6 pagesCustoms Memorandum Order No. 004-14: February 21, 2014cardingdelarosaNo ratings yet

- Universal FreightDocument4 pagesUniversal FreightJoanna BaileyNo ratings yet

- The Philippines Department of Finance Bureau of Internal Revenue Quezon CityDocument8 pagesThe Philippines Department of Finance Bureau of Internal Revenue Quezon CityJhenny Ann P. SalemNo ratings yet

- Duty Drawback SchemeDocument3 pagesDuty Drawback SchemeganariNo ratings yet

- Registration Guidelines For CPRSDocument2 pagesRegistration Guidelines For CPRSP Dg Reyes100% (1)

- Mandatory Use of An Automated Inventory Management System (Ims) For Off-Dock and Off-Terminal Customs Facilities and WarehousesDocument16 pagesMandatory Use of An Automated Inventory Management System (Ims) For Off-Dock and Off-Terminal Customs Facilities and WarehousesDreiron CastilloNo ratings yet

- 2022 CDP Tut Day 4 - The E2m Customs System, E-Commerce Act and Ease of Doing Business ActDocument8 pages2022 CDP Tut Day 4 - The E2m Customs System, E-Commerce Act and Ease of Doing Business Actjanna.barbasaNo ratings yet

- Leveraging Technology For Serving TaxpayersDocument4 pagesLeveraging Technology For Serving TaxpayerssrinivaskirankumarNo ratings yet

- Cmo 39 2015 Guidelines On The Pilot Implementation of The Electronic Application and Issuance of Preferential and Non Preferential Certificate of Origin e CODocument6 pagesCmo 39 2015 Guidelines On The Pilot Implementation of The Electronic Application and Issuance of Preferential and Non Preferential Certificate of Origin e COmick_15No ratings yet

- Draft Bureau of Customs Memo On Submission of E-ManifestDocument9 pagesDraft Bureau of Customs Memo On Submission of E-ManifestPortCallsNo ratings yet

- Cmo-18-2021-Revised Rules and Regulation On The Opening and Utilization of Prepayment AccountsDocument7 pagesCmo-18-2021-Revised Rules and Regulation On The Opening and Utilization of Prepayment AccountsKim Emmanuel AlajidNo ratings yet

- Independent Study 2Document6 pagesIndependent Study 2Otis MelbournNo ratings yet

- Import Document For PortDocument37 pagesImport Document For PortAbhishekNo ratings yet

- Version 5.0 (PASS5) : November 12, 2008Document5 pagesVersion 5.0 (PASS5) : November 12, 2008Otis MelbournNo ratings yet

- Customs Memorandum ORDER No. 30-2015Document19 pagesCustoms Memorandum ORDER No. 30-2015Otis MelbournNo ratings yet

- CMO 39-2015 E-Processing of Certificate of OriginDocument6 pagesCMO 39-2015 E-Processing of Certificate of OriginPortCallsNo ratings yet

- Jhulaghat FinalDocument108 pagesJhulaghat FinalAltafNo ratings yet

- CM 18-20Document39 pagesCM 18-20Cyke BalabatNo ratings yet

- Trade Notice 03-2017Document133 pagesTrade Notice 03-2017saurabhNo ratings yet

- DU BBA Lecture 13Document51 pagesDU BBA Lecture 13Tafhimul IslamNo ratings yet

- CM NewDocument12 pagesCM NewCyke BalabatNo ratings yet

- Docs For Claiming Exp AssistanceDocument5 pagesDocs For Claiming Exp Assistancejuzerali007No ratings yet

- Republic of The Philippines Bureau of Customs Philippine Economic Zone AuthorityDocument6 pagesRepublic of The Philippines Bureau of Customs Philippine Economic Zone AuthorityPortCallsNo ratings yet

- Eeds Trader GuideDocument39 pagesEeds Trader GuideNagrani PuttaNo ratings yet

- CDA Memorandum Circular No 2020 20Document6 pagesCDA Memorandum Circular No 2020 20Carol DonsolNo ratings yet

- RCMC Registration: Registration-Cum-Membership CertificateDocument12 pagesRCMC Registration: Registration-Cum-Membership Certificateenterslice advisoryNo ratings yet

- 71 2003Document17 pages71 2003api-247793055No ratings yet

- Handbook of Procedures 2023Document212 pagesHandbook of Procedures 2023Doond adminNo ratings yet

- 0 Customs Manual CRBDocument11 pages0 Customs Manual CRBTanujLodhiNo ratings yet

- Electronic To MobileDocument15 pagesElectronic To MobileJoben N. GutierezNo ratings yet

- Information On Authorized Economic Operator (Aeo)Document10 pagesInformation On Authorized Economic Operator (Aeo)n.hidayahsamsuddinNo ratings yet

- 2024MC - SEC MC No. 10 S. of 2024 Electronic SEC Universal Registration Environment ESECUREDocument11 pages2024MC - SEC MC No. 10 S. of 2024 Electronic SEC Universal Registration Environment ESECUREAnn Avis Ng OngNo ratings yet

- Customs Clearance Proceedure - GhanaDocument17 pagesCustoms Clearance Proceedure - Ghanasaisridhar99No ratings yet

- Cmo 3-2015Document33 pagesCmo 3-2015Angel FerreraNo ratings yet

- Presentation Custom ProcedureDocument30 pagesPresentation Custom ProcedureSohail Saahil0% (1)

- CDEC-REGISTRATION-FORMDocument3 pagesCDEC-REGISTRATION-FORMEnok IncursioNo ratings yet

- Dubai Customs Certified Expert - Module 5Document28 pagesDubai Customs Certified Expert - Module 5abuAbduRahmanNo ratings yet

- Kastam ImpotDocument30 pagesKastam ImpotsubrascNo ratings yet

- E ServicesDocument52 pagesE ServicesRheneir MoraNo ratings yet

- CMO 40 2015: Customs Rules and Regulations Implementing BOC PEZA JMO 2 2015 On The Transfer of Goods From The Ecozone Logistics Service Enterprise Else To Its Partner Ecozone LocDocument7 pagesCMO 40 2015: Customs Rules and Regulations Implementing BOC PEZA JMO 2 2015 On The Transfer of Goods From The Ecozone Logistics Service Enterprise Else To Its Partner Ecozone LocPortCallsNo ratings yet

- RR 17-2006 (Taxi Meter)Document28 pagesRR 17-2006 (Taxi Meter)Axel MendozaNo ratings yet

- BOC CMO 7 2016 Rules For The Importation of MVDP Participants Located Inside EcozonesDocument2 pagesBOC CMO 7 2016 Rules For The Importation of MVDP Participants Located Inside EcozonesPortCalls100% (1)

- Country Presentation Customs KenyaDocument5 pagesCountry Presentation Customs KenyavictormathaiyaNo ratings yet

- Conditions For Customs LicensesDocument5 pagesConditions For Customs Licensescelestinmvungi4No ratings yet

- Best Practices in Inventory Management: by Rafel MayolDocument19 pagesBest Practices in Inventory Management: by Rafel MayolJay J BianzonNo ratings yet

- Business Services Class 11 Notes Business Studies - 7114551Document8 pagesBusiness Services Class 11 Notes Business Studies - 7114551TanishqNo ratings yet

- Account Statement 010122 010122Document1 pageAccount Statement 010122 010122Hari OmNo ratings yet

- D2C - E-Commerce Deck 8 SliderDocument10 pagesD2C - E-Commerce Deck 8 SlidermanujdevNo ratings yet

- Introduce Shortly About The Firm.Document6 pagesIntroduce Shortly About The Firm.Nhiên LýNo ratings yet

- Checkout - La Tulipe FlowersDocument7 pagesCheckout - La Tulipe FlowersGeorge BirgeNo ratings yet

- DeKeersmaeker 73671600 Vandewalle 27901600 2021Document121 pagesDeKeersmaeker 73671600 Vandewalle 27901600 2021Mohd Ismail YusofNo ratings yet

- Report On FinTech Applications in The Asia-Pacific Region and Global MarketsDocument2 pagesReport On FinTech Applications in The Asia-Pacific Region and Global MarketsFahd GhumanNo ratings yet

- RKG Class 11 Accounts Mock 2 SolDocument13 pagesRKG Class 11 Accounts Mock 2 SolSangket MukherjeeNo ratings yet

- IPLOOK IKEPC 500 Series Product InformationDocument4 pagesIPLOOK IKEPC 500 Series Product InformationIPLOOK TechnologiesNo ratings yet

- Spotify Financial Data and MetricsDocument3 pagesSpotify Financial Data and MetricsMurtaza BadriNo ratings yet

- Srinivas Bhukya-2024Document2 pagesSrinivas Bhukya-2024yehitsme4uNo ratings yet

- ASB Platinum Travel Insurance Policy WordingDocument18 pagesASB Platinum Travel Insurance Policy WordingawefaweNo ratings yet

- ALL Available Courses List of CoursiahubDocument7 pagesALL Available Courses List of CoursiahubsmwasimtabNo ratings yet

- Hemlata Order - ID - 5471273808 - 240114 - 153506Document1 pageHemlata Order - ID - 5471273808 - 240114 - 153506ca.astha007No ratings yet

- Declaration Under Section 6 (1) of The U.P. Agricultural Credit Act, 1973Document2 pagesDeclaration Under Section 6 (1) of The U.P. Agricultural Credit Act, 1973shashank srivastava100% (1)

- FareDocument3 pagesFareOn LineddNo ratings yet

- System: Total Solution For Value-Based Healthcare PurchasingDocument17 pagesSystem: Total Solution For Value-Based Healthcare PurchasingmochkurniawanNo ratings yet

- Tuition Fee Details For July2019session IIyear Onwards - Ug and PGDocument6 pagesTuition Fee Details For July2019session IIyear Onwards - Ug and PGCH MANOJNo ratings yet

- Nature of Transaction: AIR FARE TICKETS Nature of Transaction: AIR FARE TICKETSDocument1 pageNature of Transaction: AIR FARE TICKETS Nature of Transaction: AIR FARE TICKETSsarahNo ratings yet

- (Nov 11, 2016) Cash Management Report - Loans From Marek. PDFDocument1 page(Nov 11, 2016) Cash Management Report - Loans From Marek. PDFDavid HundeyinNo ratings yet

- 31.08.2020 - Khan Market Site DocumentationDocument49 pages31.08.2020 - Khan Market Site DocumentationVanshika DograNo ratings yet

- Estatement-202301 20230301121107Document3 pagesEstatement-202301 20230301121107Nazatul Ida BilalNo ratings yet

- OP Case Management For Complex AdultsDocument542 pagesOP Case Management For Complex Adultspfi_jenNo ratings yet

- 2.5 Networking XiiDocument20 pages2.5 Networking XiiSaagar ShetageNo ratings yet

- Bus Ticket From Delhi-1Document2 pagesBus Ticket From Delhi-1Vara Prasad100% (1)